- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

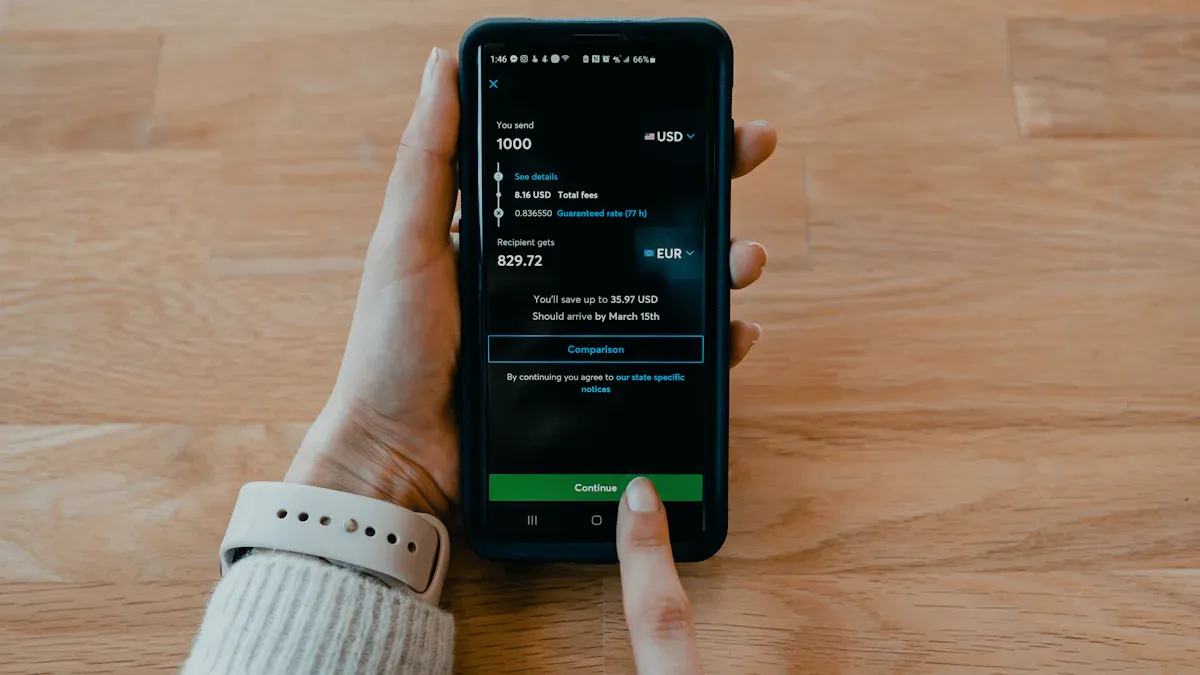

Is the Remitly Exchange Rate Cost-effective? In-depth Analysis of the Remittance Mechanism and Hidden Costs

Image Source: unsplash

For the question “Is Remitly’s exchange rate worth it?”, the answer is “it depends.” The global remittance market is massive and continues to grow, highlighting the importance of making informed choices.

| Attribute | Details |

|---|---|

| 2022 Market Value | $784.25 billion |

| 2032 Projected Market Value | $1,329.92 billion |

| Growth Rate (2023-2032) | 5.8% compound annual growth rate |

When evaluating any remittance service, do not focus solely on advertised low fees or promotional exchange rates. The only criterion for judgment is the “final amount received.”

Key Takeaways

- Whether Remitly’s exchange rate is worth it depends on the specific situation and cannot be generalized.

- Remitly offers promotional rates for new users, but long-term users switch to regular rates that include exchange rate markups.

- When remitting money, in addition to fees, pay attention to exchange rate markups and potential extra costs from credit card payments.

- To calculate the true cost, subtract the platform’s rate from the mid-market rate, multiply by the remittance amount, and add the fee.

- Remitly typically has an advantage in scenarios involving first-time remittances, large remittances, or non-urgent transfers.

Is Remitly’s Exchange Rate Worth It?

Image Source: unsplash

To answer the question of whether Remitly’s exchange rate is worth it, users must understand that its rate is not fixed. It is composed of multiple factors, including user status, market conditions, and the platform’s own profit model.

Promotional Rate vs. Regular Rate

One of Remitly’s main strategies to attract new users is offering highly competitive “promotional rates.” This rate is usually only applicable to the user’s first remittance and may have an amount cap.

- New User Promotion: First-time remittance users can enjoy a lower exchange rate markup. This is a limited-time offer designed to provide an attractive initial experience.

- Regular Rate: After completing the first remittance, users switch to Remitly’s regular rate. This rate includes a higher markup, typically between 0.4% and 1.4%, depending on market conditions and the remittance destination.

Therefore, long-term users cannot continuously enjoy the initial promotional rate.

Exchange Rate Markup and Mid-Market Rate

The exchange rates offered by almost all remittance providers differ from the “mid-market rate.” The mid-market rate is the “real” exchange rate for currency transactions between banks and large financial institutions, without any markup. Users can check real-time mid-market rates using free tools on platforms like Wise or Xe.

One of Remitly’s profit models is adding a spread to the mid-market rate, known as the “exchange rate markup” or “profit margin.” This markup typically ranges from 0.5% to 3.0% and is a hidden cost that must be considered when evaluating whether Remitly’s exchange rate is worth it.

Horizontal Comparison: Remitly vs. Wise

Comparing Remitly with other platforms provides a clearer view of its positioning. Take Wise as an example:

- Wise: Typically uses the mid-market rate and charges a separate transparent service fee (usually starting from 0.43%). Users can clearly see the breakdown of the exchange rate and fees.

- Remitly: Incorporates part of the fees into the exchange rate, forming a rate that includes a markup. Although it advertises low or zero fees, the costs are shifted to the exchange rate spread.

On certain remittance routes, such as to some developing countries, Remitly may have an advantage due to its extensive cash pickup network. However, in other scenarios, like remittances to Hong Kong, China, its rate may not be as competitive as Wise.

Rate Lock Feature: A Tool to Mitigate Risk An important feature offered by Remitly is “rate lock.” When a user initiates a remittance, the system locks in the exchange rate at that moment. This means that regardless of subsequent market fluctuations, the amount received by the recipient will be fixed. This feature provides users with financial certainty and peace of mind, effectively avoiding the risks of exchange rate volatility.

Fee Structure and Potential Cost Analysis

Image Source: pexels

The exchange rate is not the only factor determining remittance costs. Remitly’s fee structure and payment methods also contain key details that affect the final amount received. When evaluating whether Remitly’s exchange rate is worth it, users must include these potential costs in their considerations.

Remittance Speed and Fees

Remitly offers users two different remittance speed options, each with corresponding fee standards. This design allows users to balance speed and cost based on the urgency of the funds.

| Service Type | Typical Delivery Time | Fee Example |

|---|---|---|

| Express (Fast) | Usually within minutes | $2.99 or higher |

| Economy | Usually takes 3-5 business days | $0 - $2.99 |

Express service is prioritized, with funds arriving almost instantly, but the fee is relatively higher. In contrast, Economy service is slower but has very low fees, sometimes even free.

Hidden Costs of Payment Methods

Choosing different payment methods directly affects the total cost, with credit card payments being the largest potential cost source.

Note: Additional Fees for Credit Card Payments When users pay for remittances with a credit card, in addition to the 3% processing fee that Remitly may charge, the card-issuing bank may also impose extra fees. Some banks in Hong Kong may treat international remittance transactions as “cash advances.” This means the bank will charge a high fee for the transaction (for example, 5% of the transaction amount or a fixed $10, whichever is higher), and interest will accrue from the transaction date with no grace period.

This hidden cost is very high, and users should avoid using credit cards for remittances whenever possible.

Remittance Amount and Fee Waivers

The remittance amount is another important variable affecting fees. Remitly has tiered pricing for different amounts and offers an important promotional policy.

- Small Remittances: Usually incur a fixed fee, such as $3.99.

- Large Remittances: When a single remittance amount reaches a certain threshold (for example, $1,000 or more), Remitly typically waives the fee.

This fee waiver policy makes Remitly highly competitive for large remittances. For users needing to transfer large sums, the saved fees can significantly improve the overall efficiency of the remittance.

How to Calculate and Choose the Optimal Solution

After theoretical analysis, users need to master a practical method to calculate the true cost and ultimately choose the remittance solution that best fits their needs. This section provides a clear calculation formula and a simple three-step method to help users make informed decisions among numerous options.

True Cost Calculation Formula

To see through the fog of marketing promotions, users must learn to calculate the “true cost” of a remittance. This cost consists of two parts: explicit fees and hidden exchange rate markups.

True Cost = Remittance Fee + Exchange Rate Markup Cost

Among them, the “exchange rate markup cost” is the part most easily overlooked by users. The calculation method is as follows:

Exchange Rate Markup Cost = (Mid-Market Rate - Platform Provided Rate) × Remittance Amount

For example, a user plans to remit $1,000 from the United States to mainland China.

- The mid-market rate is 1 USD = 7.30 CNY.

- Remitly’s provided rate is 1 USD = 7.25 CNY, with a fee of $2.99.

The user’s true cost is calculated as follows:

- Remittance Fee = $2.99

- Exchange Rate Markup Cost = (7.30 - 7.25) × $1,000 = 0.05 × 1000 = 50 CNY. Converted at the mid-market rate, approximately $6.85.

- True Total Cost ≈ $2.99 + $6.85 = $9.84.

This formula reveals that even if the fee is low, small differences in the exchange rate can accumulate into a significant cost for large remittances.

Three Steps to Lock in the Best Choice

By following these three steps, users can systematically find the remittance solution with the lowest cost and highest efficiency.

- Clarify Core Needs First, users need to determine their core needs: remittance amount, destination, and the urgency of the funds. If the funds are not urgent, choosing Remitly’s “Economy” service is usually a wiser financial decision. Although it is a few days slower than the “Express” service, the fees are lower, effectively saving costs.

- Collect Information Comprehensively Second, users should actively gather key information.

- Check Mid-Market Rate: Use independent tools like Wise or Xe to obtain real-time mid-market rates without any markup. These tools also provide historical rate charts and rate alert functions to help users remit at the best time.

- Find Platform Promotions: Before initiating a remittance, visit the official websites of Remitly and other alternative platforms. Some platforms have dedicated “promotions” links where users can find fee waivers or referral bonuses for new users. Note that these promotions may vary by country/region.

- Calculate and Compare “Final Amount Received” The final step is horizontal comparison. Users should plug the data obtained from different platforms (fees, exchange rates) into the true cost formula or directly compare the “recipient’s actual received amount” displayed by each platform. This is the most intuitive criterion.

| Platform | Remittance Amount (USD) | Fee (USD) | Platform Rate (CNY) | Recipient Received Amount (CNY) |

|---|---|---|---|---|

| Remitly (New User) | $1,000 | $0 | 7.28 | 7,280 |

| Remitly (Regular) | $1,000 | $2.99 | 7.25 | 7,250 |

| Wise | $1,000 | $12.50 | 7.30 | 7,208.75* |

| A Certain Bank | $1,000 | $25 | 7.22 | 7,220 |

*Note: Wise’s calculation is ($1,000 - $12.50) × 7.30 = 7,208.75 CNY. The table data is for example only.

Through this table, users can clearly see at a glance which option allows the recipient to receive the most money under specific conditions.

Summary of Remitly’s Advantage Scenarios

Based on the above analysis, Remitly is not the most cost-effective choice in all situations, but it demonstrates strong competitiveness in the following specific scenarios. In these scenarios, the answer to the question of whether Remitly’s exchange rate is worth it is often affirmative.

- First-Time Remittance Users: Remitly’s promotional rates or fee waivers for new users make their first remittance highly cost-effective.

- Large Remittances: When the remittance amount exceeds a certain threshold (such as $1,000), Remitly typically waives the fee, which is a huge advantage for users transferring large sums.

- Non-Urgent Transfers: For time-insensitive remittances, choosing Remitly’s “Economy” service can trade longer waiting times for lower fees.

- Pursuing Cost Predictability: Remitly’s “rate lock” feature ensures the certainty of the final received amount, helping users avoid unexpected losses due to market fluctuations.

Before remitting, users should assess whether their situation fits the above scenarios to determine if Remitly is the current optimal solution.

Remitly is not an absolute “most cost-effective” choice, but under specific conditions, such as enjoying new user promotions or fee-free large remittances, it demonstrates strong competitiveness.

Final Action Recommendation: Users should abandon blind loyalty to a single platform and develop the habit of spending one minute comparing the “final amount received” before each remittance.

In addition, cost is not the only consideration. The platform ensures fund security through bank-level encryption, strict account verification processes, and compliance with financial regulations in multiple countries. Its transaction tracking feature provides real-time updates, allowing users to confidently monitor fund movements; these conveniences and peace of mind are equally important.

FAQ

Is Remitly Remittance Safe?

Remitly is a legitimate remittance service provider regulated by financial institutions in multiple countries. It uses bank-level data encryption technology to protect user information and has strict account verification processes. Users can track the status of each remittance in real time through the platform to ensure fund security.

What Are Remitly’s Remittance Limits?

Remittance limits vary depending on the user’s account level, remittance destination, and receipt method. New users typically have lower initial limits. Users can apply to increase their 24-hour, 30-day, or 180-day remittance limits by submitting additional identity verification documents.

Can I Cancel After Initiating a Remittance?

Users can usually cancel before the remittance transaction is completed.

- Log in to your Remitly account and go to “Transfer History.”

- Select the transaction you need to cancel.

- If the transaction has not been completed, the page will display the “Cancel Transfer” option.

Please note: Once the recipient has received the funds, the transaction cannot be canceled.

Can New User Promotions Be Used Indefinitely?

New user promotions are typically limited to the first remittance. After completing the first transaction, users switch to Remitly’s regular rates and fee standards. This promotion is designed to provide an attractive initial experience and is not valid long-term.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.