- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Check the Current Status of an RIA Remittance? Understand the Fees, Security, and Remittance Process

Image Source: unsplash

Do you want to know where your remittance is? Checking the RIA money transfer status is actually very simple. You only need to have the unique order number, PIN code, or reference number provided during the transfer. RIA’s transfer network covers over 190 countries globally, and this tracking number is your key to monitoring fund movements.

Fastest Tracking Method

Visit the “Track a Transfer” page on RIA’s website or use its official mobile app. Simply enter the tracking number to instantly see the latest transfer progress.

Key Points

- You can use the tracking number to check the transfer status via RIA’s website, mobile app, customer service phone, or in-person agent locations.

- RIA transfer fees include a transfer handling fee and exchange rate margin, and you can use official tools to calculate total costs.

- RIA ensures transfer security through data encryption and identity verification, but you should protect personal information and beware of scams.

- Senders provide details and receive a tracking number, while recipients use the tracking number and ID to collect funds.

- Properly safeguarding your order number or PIN code is crucial, as it’s key to tracking and securing funds.

How to Check RIA Money Transfer Status

Image Source: unsplash

Once you complete a transfer, tracking the funds’ progress becomes the top priority. RIA offers multiple convenient tracking channels, whether you prefer using a computer, phone, or direct communication, making it easy to stay updated on your transfer status. Below, we detail four main tracking methods.

Website Online Tracking

For most users, checking via the official website is the most direct and fastest method. You only need an internet-connected computer and your transfer tracking number.

The steps are very simple:

- First, visit the Ria Money Transfer official website.

- On the homepage’s top menu, find and access the “Track a Transfer” page.

- In the designated input field, accurately enter your order number or PIN code.

- Click the “Track Transfer” button, and the system will immediately display detailed transfer information and current status.

Tip 💡 Before starting the check, ensure you have the transfer receipt handy. The tracking number is the sole key to checking RIA money transfer status, so keep it secure.

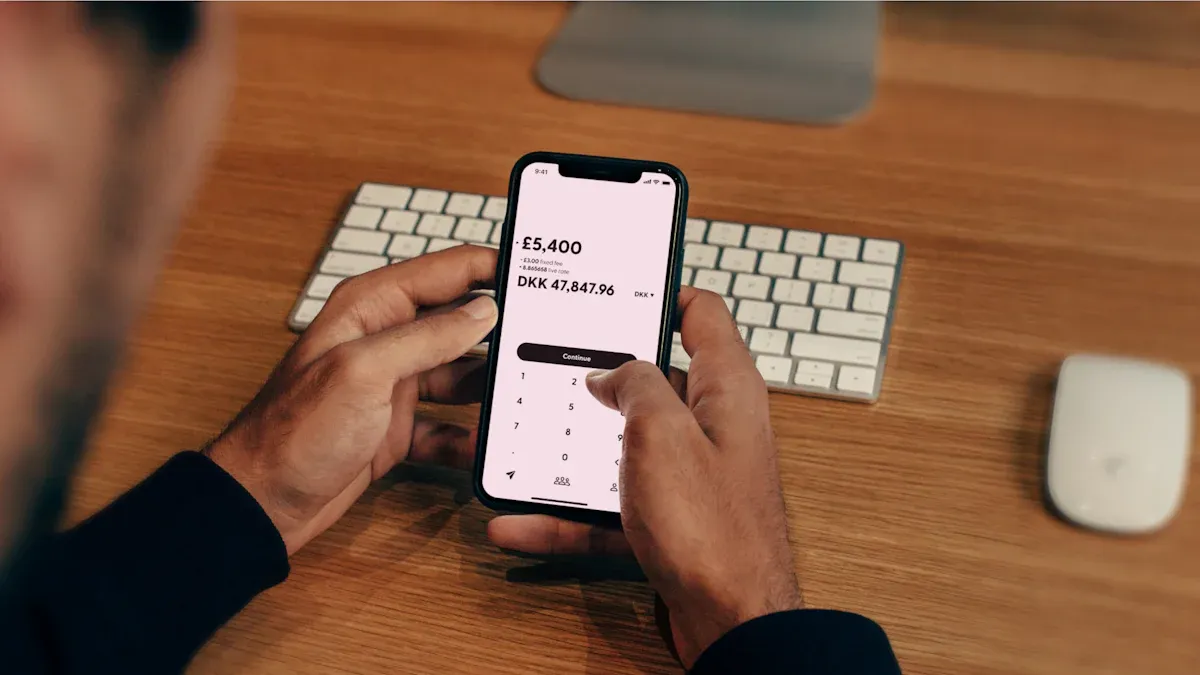

Mobile App Tracking

If you frequently transfer money or want to check progress on the go, RIA’s official mobile app is your best choice. It integrates all functions into the palm of your hand.

- App Name: Ria Money Transfer

- Get the App: Use this universal link to download from your phone’s app store (e.g., App Store or Google Play).

- Android Users Note: The app has over 5 million downloads on Google Play, is about 112MB, and requires Android 8.1.0 or higher.

After downloading and logging into the app, you’ll easily find the “Track Transfer” feature on the main interface. Enter your tracking number to view the RIA money transfer status in real-time, with a process similar to website tracking.

Customer Service Phone Tracking

If you encounter issues with online tracking or prefer speaking with a live representative for detailed answers, calling RIA’s customer service center is a reliable option. To protect your account security, customer service staff will verify your identity before providing information.

Prepare the following details for verification:

- Your full name

- Your address and date of birth

- Government-issued valid ID information

- In some cases, especially for large transfers or first-time users, staff may also request utility bills or bank statements to verify your address.

With these details ready, call RIA’s customer service number for your region, provide the tracking number, and get assistance.

In-Person Agent Location Tracking

If you initiated the transfer at a RIA agent location, you can return to any agent location to check the status. This method is especially suitable for users unfamiliar with online operations.

To find the nearest agent location, follow these steps:

- Visit RIA’s website or open its mobile app.

- Use the “Location Finder” tool on the page.

- Enter your city, state, or zip code in the search box.

- The system will instantly display nearby agent locations on a map, with details like address and operating hours.

When visiting, bring your transfer receipt and personal ID; staff will help you check the specific RIA money transfer status.

RIA Transfer Fees Breakdown

Image Source: unsplash

Before transferring, understanding the total cost is critical. RIA’s transfer fees consist of two main parts: an explicit transfer handling fee and a margin hidden in the exchange rate. Understanding these helps you make informed decisions.

Fee Structure

Your total transfer cost is influenced by several factors, including the destination, amount, and payment method.

- Transfer Handling Fee: The direct fee you pay for the service. Paying via your bank account (e.g., a licensed Hong Kong bank account) typically incurs lower fees, but funds may take about 4 business days to arrive. Using a credit or debit card speeds up the transfer, often within hours, but incurs higher fees.

- Exchange Rate Margin: Many providers profit by offering rates below the mid-market rate (the “true” rate used by banks and institutions), meaning you get a less favorable rate.

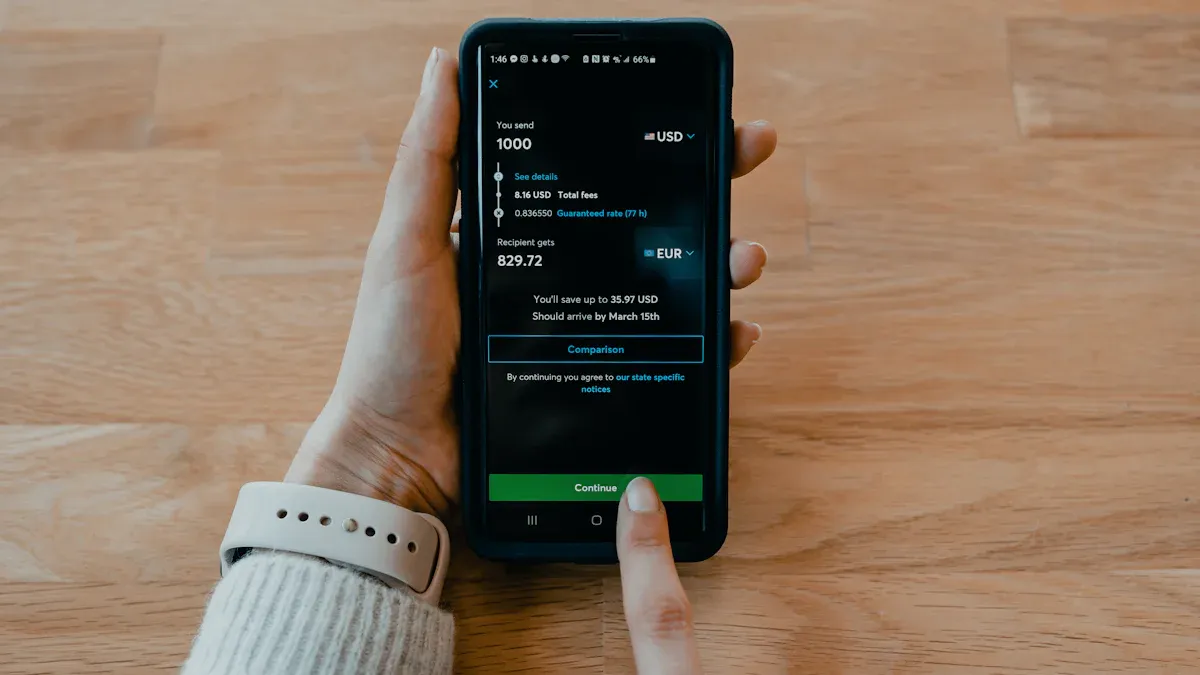

Rate Comparison Example 📊 Assuming you send $1,000 from the US to Germany, the amounts received may vary as follows:

As shown above, even with zero-fee offers, a better rate can mean more money for the recipient.

Fee Calculation Method

For the most accurate fee information, use RIA’s official tools.

RIA’s website or app offers a “Price Calculator” or online calculator. Enter:

- The country/region you’re sending from.

- The recipient’s country/region.

- The amount you plan to send.

- Your chosen payment method (bank account, credit card, etc.).

The system instantly calculates the total cost, including fees and rates, showing the exact amount the recipient will receive.

Here’s a fee reference for sending $500 from the US:

| Receiving Country/Region | RIA International Transfer Fee ($500, Bank Transfer) |

|---|---|

| Mexico | No upfront fee (but rate margin applies) |

| India | $1 + rate margin |

| Philippines | Use price calculator for accurate details |

Important Note Rates and fees fluctuate in real-time. Always use the official calculator to verify final costs just before confirming the transfer.

RIA Transfer Security Analysis

When sending money internationally online, fund safety is the top concern. As a global transfer provider, RIA employs multiple measures to protect your funds and personal information. You also need basic security knowledge to protect yourself.

Official Security Measures

RIA ensures a secure transfer environment through technical safeguards and strict compliance operations, offering multi-layered protection.

- Advanced Data Encryption: RIA uses advanced encryption like SSL (Secure Sockets Layer) and TLS (Transport Layer Security). When your information is transmitted online, it’s encrypted, keeping sensitive data like bank account and identity details confidential and safe from unauthorized access.

- Strict Identity Verification: Every transaction verifies the sender’s and recipient’s identities to prevent fraud and money laundering.

- Real-Time Transaction Monitoring: The system automatically monitors all transactions for suspicious patterns, flagging anomalies for manual review to further secure your funds.

- Regulatory Compliance: RIA operates legally worldwide, adhering to local financial regulations. In the US, it complies with federal laws like the Gramm-Leach-Bliley Act (GLBA) for protecting personal information and is regulated by entities like the Office of Foreign Assets Control (OFAC).

Personal Security Tips for Users

Beyond RIA’s official safeguards, your personal security awareness is equally critical. Protecting your information is the first line of defense against fraud.

Important Safety Tip

Your transfer PIN code, username, and password are confidential. Never share them with anyone, even those claiming to be RIA staff. Official RIA personnel will never ask for this information.

Be sure to:

- Send only to trusted individuals: Beware of strangers requesting funds for “emergencies” or “prize taxes.”

- Protect your tracking number: It’s your sole proof for tracking and receiving funds.

- Avoid phishing scams: Don’t click links in unsolicited emails or texts. Always log in via the official website or app.

- Report suspicious activity immediately: If you notice unauthorized transactions or suspect a data breach, contact RIA’s customer service center promptly.

Complete RIA Transfer Process

Understanding the full transfer steps builds confidence in handling each transaction. From initiating the transfer to the recipient collecting funds, the process is clear. Below are the steps for senders and recipients.

Sender Process Steps

As the sender, your actions start the process. You can initiate transfers via RIA’s website, app, or agent locations.

- Provide Transfer Details: First, provide the recipient’s full name, address, and the exact amount you wish to send.

- Choose Payment and Receiving Method: Decide how to pay (e.g., bank account, credit card) and how the recipient will receive funds.

- Complete Identity Verification: For in-person transfers, present valid ID.

Documents Needed for In-Person Transfers

- Primary ID: A government-issued photo ID, such as a passport, ID card, or driver’s license.

- Proof of Residence: Depending on local regulations, RIA may request utility bills or bank statements.

- Proof for Large Transfers: For significant amounts, you may need to provide proof of fund source, like pay stubs or bank statements.

- Receive Tracking Number: After payment, you’ll receive a unique order number or PIN code. Share this securely with your recipient immediately.

Recipient Collection Steps

The recipient’s process is simple, centered on using the tracking number you provide to access funds.

Recipients have flexible options depending on the country/region:

- Cash Pickup: Recipients visit any RIA agent location with the PIN code and valid ID to collect cash.

- Bank Deposit: Funds are deposited directly into the recipient’s specified bank account, requiring no extra action.

- Mobile Wallet: In over 50 supported countries, funds can go directly to the recipient’s mobile wallet account.

- Home Delivery: In select countries (e.g., Vietnam, Philippines), RIA offers cash delivery to the recipient’s home.

For cash pickup, recipients must ensure the name on their ID matches the sender’s provided details exactly. For other methods, funds arrive automatically, and recipients just need to check receipt.

You now know multiple methods to check RIA money transfer status. You can use the website, the highly-rated mobile app (4.9 on App Store, 4.7 on Google Play), or contact customer service.

Above all, remember that safeguarding your order number or PIN code is the most critical step. It’s not only the key to tracking but also vital for securing funds.

With this guide, you can easily track your RIA money transfer status, ensuring every fund reaches its destination safely.

FAQ

What if I lose my tracking number (PIN code)?

Contact RIA customer service immediately. For fund safety, staff will verify your identity before assisting. Prepare your ID and detailed transaction information.

How long does an RIA transfer take?

Transfer speed depends on the payment method. Credit or debit card payments typically arrive in minutes. Bank account payments may take up to 4 business days.

Can I cancel a transfer already sent?

As long as the recipient hasn’t collected the funds, you can request cancellation. Log into your account or contact customer service promptly. Some fees may not be fully refundable depending on the situation.

What documents does the recipient need to collect funds?

Recipients need a government-issued photo ID (e.g., passport, ID card) and the transfer PIN code you provide. The ID name must match the recipient name you entered exactly.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.