- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Want to Send Money via RIA? Here's Everything You Need to Know

Image Source: unsplash

Want to use RIA for money transfers? It is a global money transfer service that offers multiple receiving options, such as cash pickup, bank deposits, and mobile wallets. Its network spans the globe, covering nearly 200 countries and regions with over 600,000 service points. This extensive offline network makes it highly convenient for recipients to collect cash worldwide.

Key Takeaways

- RIA Money Transfer has a long history and a vast global network, covering nearly 200 countries with over 600,000 service points.

- RIA transfers are straightforward, allowing you to send money online, via the mobile app, or through offline agent locations, with support for transfers to mainland China bank accounts.

- Transfer fees and exchange rates affect the total cost; credit card payments incur higher fees, while bank account payments are cheaper. RIA’s exchange rates typically include a 3% to 6% margin.

- Transfer speed depends on payment and receiving methods; cash pickup is the fastest, while bank deposits take longer. You can track transfer status using a PIN.

- RIA’s strengths include its extensive cash pickup network, fast transfers, and simple process. Its drawbacks are less competitive exchange rates and occasional service delays.

RIA Money Transfer Basics

Image Source: unsplash

Before deciding whether to use RIA for money transfers, let’s dive into its basic information. This will help you determine if it meets your needs.

Introduction to RIA Money Transfer

Ria Money Transfer is not a new company; it has a long history. The company was established in 1987 and has grown significantly over the decades. Here are some key milestones in its development:

- 2006: Acquired by Euronet Worldwide, Inc., a global electronic payment giant, becoming a key part of its money transfer business.

- 2014: Partnered with Walmart to launch the Walmart-2-Walmart transfer service in the U.S., significantly expanding its U.S. service network.

- 2020: Its network covered over 159 countries with hundreds of thousands of service points, offering convenient online and mobile app services.

Did You Know? Ria’s parent company, Euronet Worldwide, is a NASDAQ-listed company, providing additional assurance of operational stability and transparency.

RIA’s Security and Compliance

The safety of your funds is likely your top concern when transferring money. Ria takes stringent measures to protect your transactions and personal information. First, it strictly complies with the laws and regulations of the regions where it operates, including U.S. financial regulations, and adheres to all EU and UN sanctions. It holds a Nationwide Multistate Licensing System (NMLS) ID number 920968 in the U.S., confirming its status as a compliant financial service provider.

To safeguard your data, Ria employs multiple technical protections:

- Data Encryption: Uses advanced encryption technologies like SSL and TLS to ensure your online transaction information remains secure during transmission.

- Identity Verification: Implements multi-factor authentication (MFA), requiring multiple steps to verify your identity during login or transactions.

- Real-Time Monitoring: A dedicated security team monitors transaction activities in real time to detect and prevent suspicious behavior promptly.

RIA’s Services in China

Ria supports transfers to mainland China. Typically, you can choose to send funds directly to the recipient’s bank account. You’ll need to provide the recipient’s name, bank name, bank account number, and other details.

Additionally, Ria’s extensive global network gives it an advantage when handling transfers involving different regional financial systems. For example, if your recipient holds an account with a licensed Hong Kong bank, they can conveniently receive funds sent via Ria, with the entire process being clear and transparent.

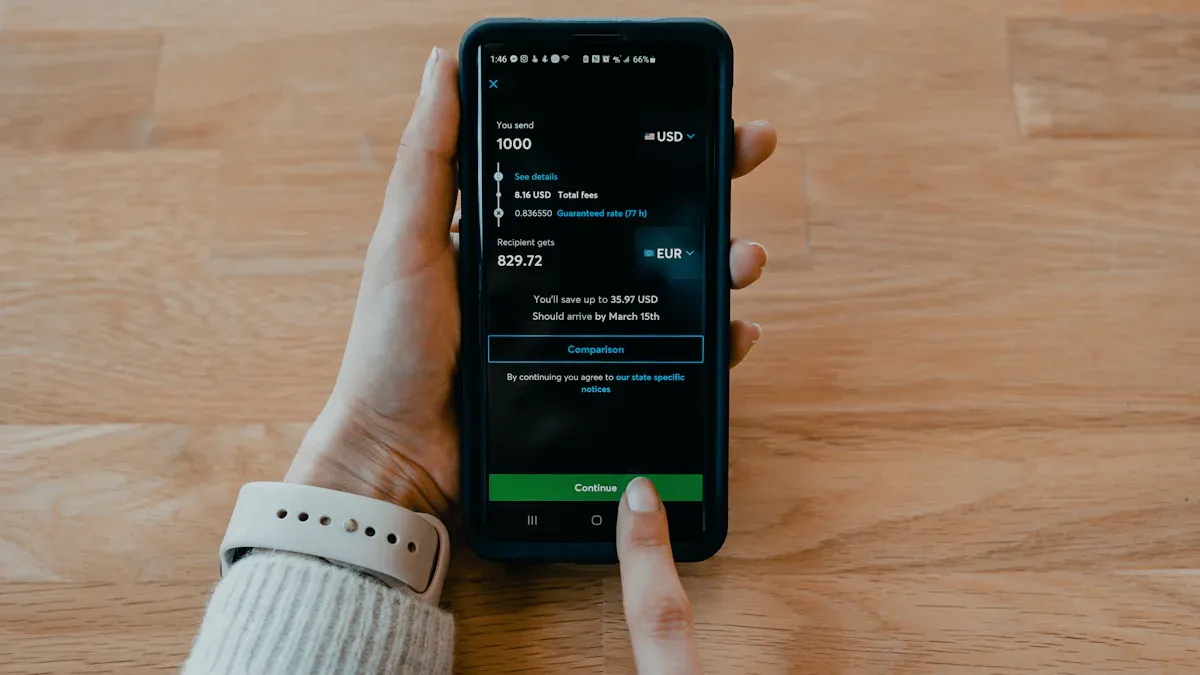

Want to Use RIA Money Transfer? Step-by-Step Guide

Image Source: unsplash

Now that you understand RIA’s basics, you’re likely ready to start your first transfer. If you want to use RIA for money transfers, the process is very straightforward. Ria offers three main methods: online website, mobile app, and offline agent locations, allowing you to choose based on convenience. Below, we break down each process.

Online Transfer Process

Using Ria’s official website or mobile app for online transfers lets you complete transactions without leaving home. The process is clear and typically takes just a few minutes.

- Create or Log In to Your Account: You need to register a free account on the Ria website or app. If you already have an account, simply log in.

- Enter Transfer Details: In the transfer calculator, input the amount you want to send and the recipient’s country (e.g., mainland China). The system will automatically calculate the transfer fee, exchange rate, and show the amount the recipient will receive.

- Provide Recipient Information: This is a critical step. You need to accurately provide the recipient’s details, including:

- The recipient’s full name as it appears on their ID

- Address and contact phone number

- Receiving method (e.g., bank deposit or cash pickup)

- For bank deposits, provide the bank name, account number, and other account details.

- Choose Payment Method: Next, select how you’ll pay for the transfer. Ria supports multiple flexible payment options.

Available Payment Options Include:

- Debit Card

- Credit Card

- Bank Account Direct Transfer

- Cash - Note that this option is typically only available in the U.S. through specific partner locations.

- Review and Confirm Transfer: In the final step, the system displays a summary of all details, including the amount, fees, exchange rate, and recipient information. Double-check everything to ensure accuracy. After confirmation, you’ll receive a transaction receipt and a PIN for tracking.

Offline Agent Location Transfer Process

If you prefer face-to-face service or need to use cash for the transfer, Ria’s extensive offline agent network is an excellent choice.

- Find the Nearest Agent Location: Before heading out, locate the closest Ria agent location.

- Visit the Ria website or open the Ria app.

- Use the “Location Finder” feature on the page.

- Enter your city, state, or postal code.

- The system will list nearby agent locations with their addresses and operating hours.

- Prepare Necessary Documents and Information: When visiting the agent location, bring a valid government-issued ID (e.g., driver’s license or passport) and the funds for the transfer.

- Complete the Transfer Form: At the agent location, the staff will provide a transfer form. Fill in the recipient’s details. Then, submit the form, your ID, and the transfer funds to the staff, who will handle the remaining steps and assist you in completing the transfer.

Operation Tip When filling out the form at the agent location, use clear, legible handwriting. Before submitting, double-check that the recipient’s name matches their ID exactly to avoid unnecessary delays.

Required Information and Documents for Transfers

Whether you choose online or offline methods, preparing the correct information is key to a successful transfer. If you want to use RIA for money transfers, you’ll need to prepare the following two categories of information:

| Information Category | Required Documents and Information |

|---|---|

| Your Information (Sender) | • Valid government-issued ID (e.g., passport, driver’s license) • Your full name, address, and phone number • Funds for the transfer and payment method for fees |

| Recipient’s Information | • Recipient’s legal full name (must match their ID) • Recipient’s address and phone number • Depending on the receiving method: - Bank Deposit: Bank name, account number/IBAN/SWIFT - Cash Pickup: No bank details required, but the recipient needs a valid ID and PIN to collect funds |

Having all this information ready ensures a smooth transfer process, allowing funds to reach the recipient quickly and accurately.

RIA Transfer Fees, Exchange Rates, and Limits

Before deciding to transfer, fees, exchange rates, and limits are the three core factors you need to consider. They directly determine your total cost and the amount you can send. Below, we break down Ria’s specifics in these areas.

How Fees Are Calculated

Ria’s fees are not fixed and vary based on several key factors:

- Transfer Destination: Fees may differ depending on the recipient’s country.

- Transfer Amount: Typically, the higher the amount, the fee percentage may vary.

- Payment Method: This is the primary factor affecting fees.

Ria’s hallmark is its “low fee” strategy, especially when paying via bank account. Using a credit card, while faster, typically incurs higher fees.

To give you a clearer picture, here’s an example of transferring $1,000 USD from the U.S. to Mexico:

| Payment Method | Fee | Delivery Time |

|---|---|---|

| Bank Account | Typically $0 USD | 3-5 business days |

| Credit Card | Higher fees, plus possible additional charges | Usually within 15 minutes |

Special Note Ria officially does not recommend using credit cards for payment. Card issuers often treat transfer transactions as “cash advances,” triggering high interest rates and extra fees, significantly increasing your transfer costs.

How to Get the Best Exchange Rate

The total cost of a transfer includes not only fees but also the exchange rate. Like most transfer companies, Ria’s exchange rates include a margin (typically 3% to 6%) added to the real-time mid-market rate, which is a source of their profit.

Based on market analysis, Ria’s exchange rate margin varies depending on the destination country and currency. This means the rate you get will be slightly lower than the real-time rate you find online.

Money-Saving Tip Before confirming your transfer, check the current mid-market rate on Google or XE.com. Compare it with the rate shown on the Ria app or website. This way, you can clearly see the exchange rate margin and determine if the total cost is within your acceptable range.

Transfer Limits Explained

Due to security and anti-money laundering regulations, Ria imposes limits on transfer amounts. These limits differ for online and offline transfers.

For online transfers via Ria’s website or app, U.S. users typically face the following limits:

| Transaction Type | Daily Limit | 30-Day Rolling Limit |

|---|---|---|

| Domestic Transfers (U.S.) | $1,000 USD | Not applicable |

| International Transfers | Not applicable | $14,999 USD |

What if you need to send more than the online limit? Ria offers solutions:

- Online limits cannot be increased: You cannot request a higher online transfer limit through the app or website.

- Visit an Offline Agent Location: You’ll need to go to a Ria agent location in person, where staff will guide you through transferring higher amounts.

- Provide Additional Documents: For large transfers, you may need to provide additional identification, Social Security Number (SSN), and proof of funds.

Thus, if you want to use RIA for a large transfer, plan ahead and contact an agent location directly for the best approach.

RIA Transfer Speed and Tracking

After sending a transfer, your biggest concerns are likely: When will the money arrive? And how can I track its progress? Ria provides clear delivery time estimates and convenient tracking tools to keep you informed.

How Long Does a Transfer Take?

The time it takes for your transfer to arrive depends on the payment and receiving methods. Different combinations result in varying speeds.

For speed, cash pickup is the best option. When paying with a debit card, recipients can collect cash in as little as about 15 minutes, ideal for urgent situations.

If you choose a bank account deposit, expect a bit more patience.

- Bank Account Transfers: Funds typically take up to 4 business days to reach the recipient’s account.

- Additional Security Reviews: In some cases, if your transaction requires extra security checks, processing may take an additional 24 banking hours.

- Delays in Specific Countries: Bank deposits to certain countries (e.g., India) may face additional processing delays.

Note If a transfer is canceled, refunds to your bank account typically take 2 to 10 business days. Understanding these timelines helps you plan your funds better.

How to Track Your Transfer

After completing the transfer, Ria provides a unique PIN or order number. You can use this number to check the transfer’s status at any time.

You can track your transfer in two main ways:

- Visit the Ria Website:

- Go to

www.riamoneytransfer.com. - Find and access the “Track a Transfer” page from the top menu.

- Enter your order number or PIN.

- Click the “Track Transfer” button to view the status.

- Go to

- Use the Ria Mobile App:

- Open the app and log into your account.

- Tap the “Track” option at the bottom of the screen.

- Enter your order number or PIN to check the status.

To help you understand transfer progress, the table below explains common tracking statuses:

| Tracking Status | Meaning |

|---|---|

| In Process | Ria is processing your transfer request. |

| Ready for Pickup | Funds are available, and the recipient can collect cash with their ID and PIN. |

| Paid | The recipient has successfully collected the cash or funds have been deposited into their bank account. |

Pros and Cons of RIA Money Transfer

Every transfer service has unique strengths and areas to watch out for. Understanding RIA’s advantages and limitations helps you decide if it’s the best choice for you.

Three Key Advantages of Choosing RIA

When considering RIA, you’ll find it excels in the following areas:

- Extensive Cash Pickup Network: This is RIA’s core strength. With over 500,000 pickup locations worldwide, recipients can likely collect cash near their home, ideal for those without bank accounts or needing cash urgently.

- Fast Cash Delivery Service: For urgent transfers, RIA’s cash pickup service is remarkably quick. With debit card payments, funds can be ready for pickup in just minutes.

- Simplified Process: Whether online or at an agent location, RIA’s transfer process is designed to be intuitive. Clear instructions minimize the chance of errors.

Potential Drawbacks of Using RIA

Of course, RIA isn’t flawless. Before deciding, consider these potential shortcomings:

- Exchange Rates Not Optimal: RIA’s rates typically include a 3% to 6% margin, meaning they’re not the real-time mid-market rate you see online. This margin is a profit source but increases your total transfer cost. In contrast, services like Wise use the mid-market rate with a more transparent fee structure.

- Possible Service Delays: While cash transfers are usually fast, some users report delays with urgent or large transfers, possibly due to extra security reviews or bank processing times.

Cost Comparison: RIA vs. Wise To illustrate the impact of exchange rate differences, consider an example of transferring £500 from the UK to the Eurozone. The costs may look like this:

Provider Transfer Fee Exchange Rate Recipient Receives Ria Money Transfer £0 (new customer offer) 1.13 €564.15 EUR Wise £4.43 1.14916 (mid-market rate) €569.49 EUR Data based on October 2023 research.

The table shows that even with Ria’s zero-fee offer, the recipient receives less due to the exchange rate margin. For large or cost-sensitive transfers, compare RIA with services like Wise or Remitly to find the most cost-effective option.

Overall, RIA Money Transfer is particularly suitable for scenarios where recipients need quick and convenient cash pickup. Its vast global agent network is a core strength.

Weigh your needs: If speed and cash accessibility are priorities, RIA is a solid choice. However, if cost is a concern, be mindful of its exchange rate margin.

Final Tip: Before finalizing, always check the latest fees and real-time exchange rates on the RIA website or mobile app for the most accurate cost information.

FAQ

What If I Entered the Wrong Recipient Information?

You must contact Ria customer service immediately. If the transfer hasn’t been paid or deposited, they may be able to help you amend it. To avoid issues, double-check all details before sending.

Can I Cancel a Transfer?

Yes, but only if the funds haven’t been collected or deposited into the recipient’s bank account. You can:

- Log into your online account to cancel.

- Contact Ria customer service for assistance.

Does the Recipient Need a Ria Account?

No, absolutely not. For cash pickup, recipients only need the transfer order number (PIN) and a valid ID. For bank deposits, funds are sent directly to their specified bank account.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.