- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Trump wields the tariff stick again, which US stocks may become safe havens amidst widespread wailing?

Under Trump’s tariff war, the US may have to pay an economic price of up to $20 trillion for it. So, who will pay for this huge loss?Foreign companies, US domestic companies, or ultimately ordinary consumers? Especially during the tense global economic situation, the reaction of the US stock market is particularly evident.

Today, let’s take a look at the reaction of the US stock market in this tariff storm and which stocks are expected to stand out and become a safe haven in the stock market.

The “crazy” cost of US tariffs

Former US Treasury Secretary Larry Summers warned that the Trump administration’s “reciprocal tariffs” policy could cost the US economy up to $20 trillion, which is equivalent to 70% of the US annual GDP. If you measure it by the wealth of each household in the US, this means that each household has “lost” more than $150,000.

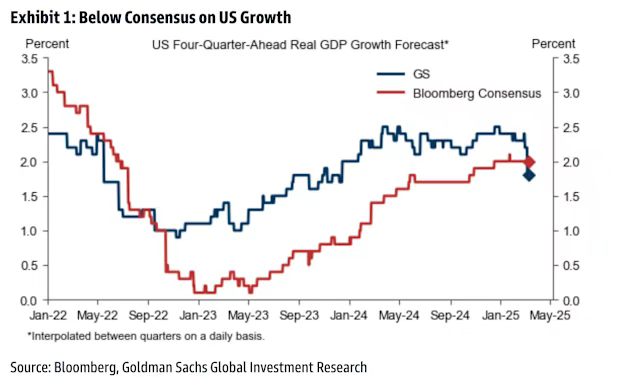

The impact of this policy is not instantaneous, but will gradually intensify through long-term structural downward effects on the economy. In the past US-China trade war, institutions such as the Peterson Institute for International Economics and Goldman Sachs have evaluated similar tariff policies. Research shows that if the US imposes high tariffs on major trading partners, its GDP will decline by 3.5% to 4% in the next 3 to 5 years.

So why is Trump’s proposed “reciprocal tariffs” policy likely to cause greater economic losses than in the past?

The reason is that this tariff hike is more severe, involves a wider range of countries, and lasts longer. This tariff shock may have a “structural downward” effect - that is, a reduction in the long-term economic growth potential of the US.

This estimate is not exaggerated, but is based on the common “long-term output discount model” in economics. Simply put, if $1 trillion of output is lost each year due to tariffs, the long-term cumulative losses will gradually increase over the next 15 to 20 years, and may eventually reach $20 trillion.

In history, after the US implemented the Smoot-Hawley Tariff Act in 1930, global trade shrank, triggering the Great Depression. This historical lesson shows that the intensification of tariff policies may have long-term adverse effects on the economy.

Tariff cost: Who is paying for it?

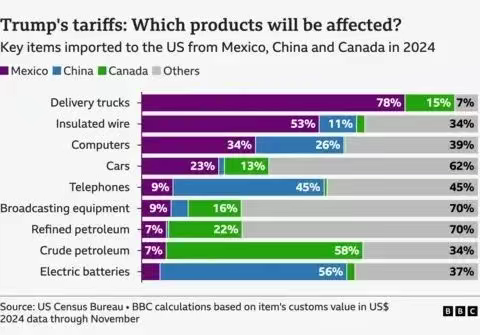

On the surface, tariffs are paid by importers, but companies usually do not easily bear the additional costs, but pass them on to consumers through the supply chain. For consumers, this means that the prices of daily purchases will rise - whether it is supermarket goods, cars, or electronic products.

In industries that rely on global supply chains such as electronics, automobiles, and clothing, the impact of tariffs is particularly significant. For example, a smartphone originally priced at $800 may rise to over $1,000 after tariffs.

This is not speculation. From 2017 to 2020, the Trump administration imposed tariffs on China, the European Union, and others. Although the total import volume of the US did not decrease significantly, the prices paid by consumers generally increased. Research from the Wharton School of the University of Pennsylvania shows that more than 90% of the costs are paid by US companies and consumers.

Yale University predicts that a comprehensive tax increase will raise US prices by 2.1% to 2.6%, which means that families will spend an additional $3,400 to $4,200 per year.

This money may be the miscellaneous fees for a child, the insurance premium for a car, or the deductible for family medical expenses, all of which are real expenses.

In addition, tariffs may have a broader impact on the economy. BlueBay Asset Management, a subsidiary of RBC Global, estimates that the new tariffs may increase inflation by 1 percentage point and reduce economic growth to 1.5%. Although it will not immediately trigger a recession, weak consumption has already appeared, retail and service industry sales have declined, and economic vitality has weakened.

The cost of tariffs is not only the rise in prices, but also the decline in consumer confidence and quality of life. In the end, every household will pay the bill, and the entire economy will also bear the pressure.

US stock market reaction: Tech stocks plummet, who can profit from it?

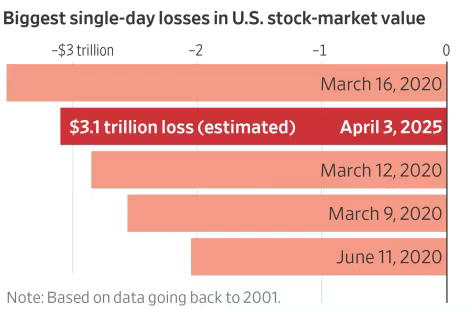

The fierce tariff storm has completely plunged the US stock market into panic. Last Thursday, the market value of the US stock market evaporated by about $3.10 trillion in one day, marking the largest drop since March 2020.

Technology stocks have almost all collapsed, with Apple plummeting more than 9%, Amazon and Meta falling nearly 9%, and Nvidia and Tesla also experiencing significant declines.

The main reason for this round of sharp decline is the deep integration of technology stocks with the global supply chain, especially with China.

For example, Apple’s production network is highly dependent on China. Once tariffs increase, Apple’s production costs and profit margins will be directly impacted. Amazon also relies on the Chinese supply chain, and Meta’s revenue is also affected by Chinese advertising. Tariff policies may put greater revenue pressure on it.

However, Trump’s tariff policy is not entirely negative. In fact, in some cases, tariffs have provided competitive advantages for some US domestic companies. Here are several industries and stocks that may benefit from the current tariff environment.

Which industries may benefit from tariffs?

1. Manufacturing: US local companies usher in a comeback

Under the influence of tariff policy, the US domestic manufacturing industry is expected to usher in an opportunity to rise against the trend.

Due to the imposition of tariffs, the cost of some enterprises that rely on imports has increased, which enables the US domestic manufacturing industry to gain more market share in market competition. Especially for companies that focus on domestic production, they may become the focus of investors’ attention. For example, US domestic steel companies such as Nucor Corporation may benefit from the Trump administration’s tariff policy. The increase in US tariffs on imported steel allows these local steel producers to increase prices and profit margins.

2. Energy industry: US shale oil benefits

The Trump administration’s tariffs may also have indirectly boosted the growth of the US energy industry, particularly shale oil.

The US has provided more market opportunities for domestic oil companies by reducing regulation on the domestic oil industry and increasing taxes on imported oil through tariffs. Large energy companies such as ExxonMobil and Chevron may gain more market share in this policy environment, thereby driving up stock prices.

3. Agriculture: Some agricultural exports are affected, and local demand has surged

The impact of Trump’s tariffs on US agriculture is also complex.

On the one hand, some products of US farmers are facing blockade or reduced demand in overseas markets; on the other hand, due to the increase in tariffs, the demand in the domestic market has increased. Especially for some major agricultural products, such as soybeans, corn, beef, etc., the prices of these products are affected by tariff policies, and local demand may increase. Therefore, some agricultural companies with large capacity in the US, such as ADM (Archer Daniels Midland Company) and Cargill Company, may benefit from this.

Industry leader: may usher in a counter-trend rise in turbulence

In addition to some industries directly affected by tariff policies, there are also some industry leaders who can still demonstrate strong resilience even in the context of overall market decline. These companies usually have strong market leadership positions, stable financial conditions, and the ability to cope with market uncertainty. Although Trump’s tariff policy has increased market uncertainty, it has also provided more growth space for these industry leaders.

For example, in the US financial industry, banks such as JPMorgan Chase can still operate stably when the overall market is declining. With its global business layout and strong market share, JPMorgan Chase has shown a stable performance in short-term market fluctuations. Moreover, with the uncertainty brought by tariff policies, JPMorgan Chase and other large banks may become “safe havens” in the market due to their strong balance sheet and flexible response to market changes.

In addition, although the aviation industry has been affected by fluctuations in fuel prices and tariff policies, some airlines, such as Delta Air Lines, may still rebound during the market downturn. Delta Air Lines may continue to dominate the US domestic aviation market in the coming years by optimizing its cost structure and enhancing its Client Server.

How do ordinary investors conduct transactions?

Trading is inevitably risky, especially in the current situation where the risk of the US stock market is increasing. For the related stocks mentioned above, interested friends can monitor their market trends through BiyaPay, a multi-asset trading platform, and choose the appropriate time to trade.

In addition, BiyaPay also provides convenient deposit and withdrawal services for US and Hong Kong stocks. After recharging digital currency and exchanging it for US dollars or Hong Kong dollars, you can quickly withdraw the funds to your bank account and then transfer them to your brokerage account for investment. This efficient way of fund flow can ensure that you will not miss market opportunities due to fund problems, making Asset Allocation more flexible and convenient.

Overall, under the impact of Trump’s tariff policies, although the stock market has generally been impacted, some industries and companies have been able to rise against the trend, especially some industry leaders and companies that benefit from local production. Investors should pay attention to the dynamics of these industries and companies and choose stocks that can benefit from tariff policies for investment.

At the same time, it is worth noting that although tariff policies have brought market uncertainty, some Financial Institutions, energy companies, and agricultural giants can still find room for survival and development in such a market. By analyzing the dynamics of various industries in depth, you may be able to seize investment opportunities in market fluctuations and achieve long-term stable returns.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.