- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Revealing Nancy Pelosi's Investment Portfolio: Strategies, Performance and Insights

Nancy Pelosi, a prominent figure in American politics, is not only of great significance on the political stage but also attracts numerous attentions with her personal wealth and investment choices. As the former Speaker of the United States House of Representatives, her financial activities, especially stock investments, always stir up hot discussions.

Many people are curious: how does she invest? What are the “treasures” in her investment portfolio? Does her strategy have reference value? What about past returns? Can ordinary people keep up with her pace? This article will discuss these questions, see how she plays with Capital Markets, and give us some inspiration.

What are the main assets in Nancy Pelosi’s investment portfolio?

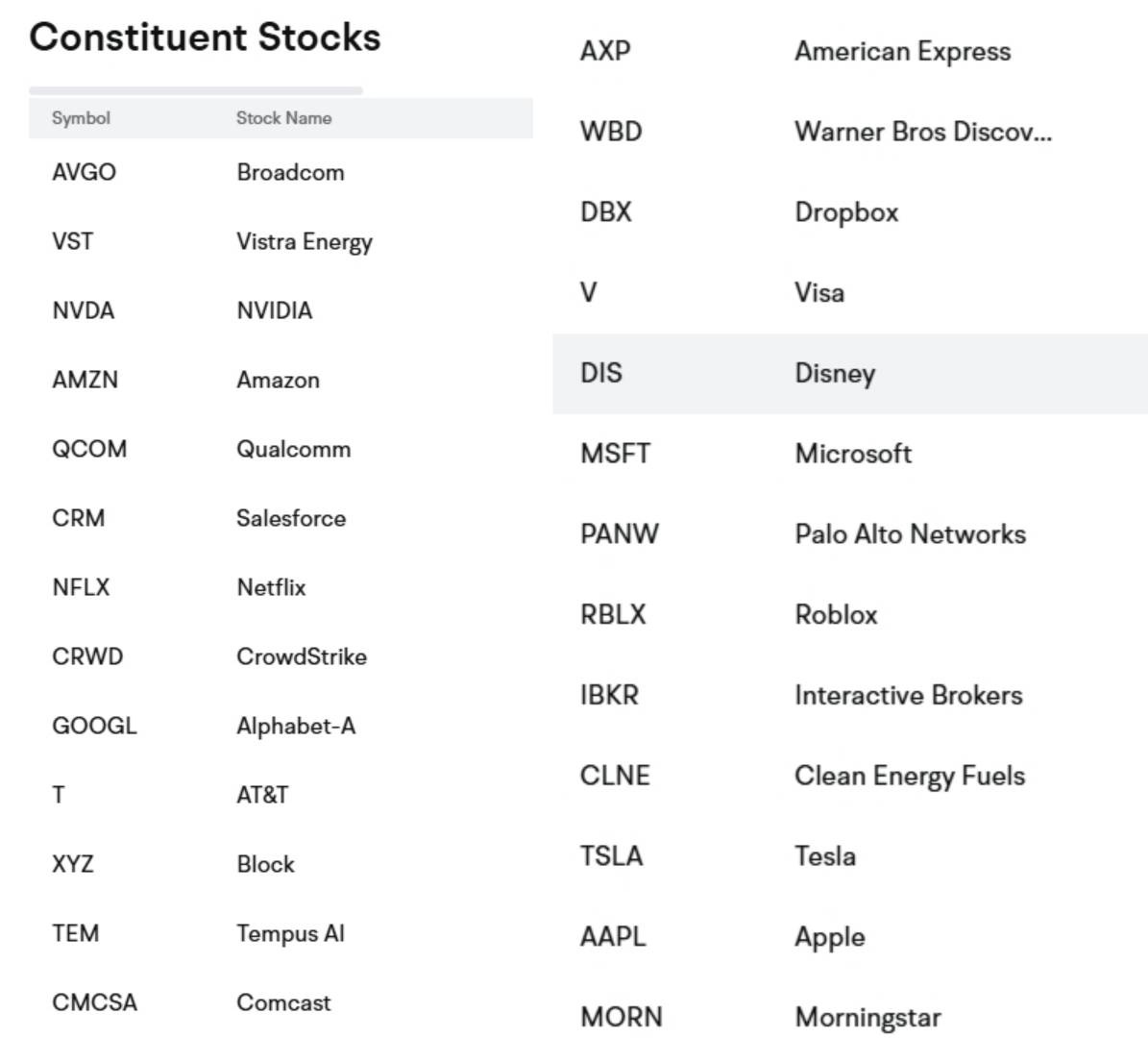

When it comes to Pelosi’s investment portfolio, technology stocks are definitely the “protagonists”. She has long served as a member of Congress in California, which is the “headquarters” of the US technology industry. Therefore, it is not surprising that she has a soft spot for technology companies. According to her public financial reports, her holdings include big names such as Apple, Microsoft, Nvidia and Alphabet, the parent company of Google.

These companies are not only the “leaders” in the technology industry but also the most profitable star stocks in the US stock market in recent years.

Besides technology stocks, Pelosi has not missed any other opportunities. For example, she bought a lot of options in the energy company Vistra Corp (stock code VST), indicating that she is also optimistic about the energy sector. Some people speculate that she may invest in some emerging companies, such as the electric vehicle field. Although specific trading records have not been seen yet, the market always has an imaginative view of her.

In addition, Pelosi’s husband, Paul Pelosi, is a venture - capital expert. His success in technology and real estate has also added a lot to the family’s wealth. Therefore, Pelosi’s investment portfolio not only focuses on technology but also has a flavor of “spreading widely”, which is quite interesting.

Does Nancy Pelosi have any investment strategies?

Pelosi’s investment strategies have two characteristics: one is that she likes to hold potential stocks for a long time, and the other is that she is particularly good at timing.

She likes to invest in those technology companies that can outperform the market and will use tools such as options to “amplify” the returns. For example, in November 2023, she bought 50 call options of Nvidia with an exercise price of $120 and a maturity date of December 20, 2024. At that time, no one might have thought it was particularly special, but later Nvidia’s performance in artificial intelligence and chips was so amazing that the stock price soared. It is estimated that this investment will bring her a return of $5 million.

Her ability to “time the market” is also very strong, and she can often make moves at the turning point of the market. However, this has also made some people suspect: Does she get some “inside information” by virtue of her convenience as the Speaker? Pelosi herself firmly denies it, but anyway, her performance is indeed more eye - catching than ordinary people.

Can ordinary people learn from her? There are some things that can be learned from her. For example, focusing on the technology industry, especially those companies with strong technology and stable market position, is a good direction. You can also try using stock options, which can not only earn more but also manage risks. However, we ordinary people do not have the resources and information like her, so we should think more about our own risk bottom line and not blindly follow her.

How has her investment portfolio performed in the past?

Pelosi’s investment performance can be described as “eye - catching”. In 2023, the return rate of her investment portfolio reached 65%, while the S&P 500 index only rose 29.6% in the same period. She defeated the market average level. 2024 is also not bad. From January to February alone, her investment earned $12 million, and her net worth directly soared to $257 million. Technology stocks such as Nvidia are her great heroes.

Of course, everyone makes mistakes. Her investment is not all smooth sailing. In July 2022, her husband Paul sold 25, 000 shares of Nvidia at $164.05 per share, worth between $1 million and $5 million, resulting in a loss of $340, 000. At that time, many people criticized her for misjudging, but in the long run, her overall return is still considerable.

Generally speaking, Pelosi’s investment portfolio has outperformed the market in the past few years by accurately betting on technology stocks. No wonder everyone is paying attention to her.

Can we track Nancy Pelosi’s investment dynamics in real time?

Want to know what Pelosi has bought and sold? There are several ways to help you keep up with her rhythm:

- Check financial reports: Members of the US Congress have to submit financial disclosure reports regularly, which contain the investment details of her and her family. These reports can be found on the official website of the Congress or government platforms. By looking through them, you can see her latest trends.

- Use professional platforms: Financial websites such as Dataroma and Quiver Quantitative will specifically track the transactions of members of Congress and analyze their positions. The information is updated quickly, which is quite suitable for people who want to “copy homework”.

- Browse social media: Many financial bloggers on X (formerly Twitter) will break the news of Pelosi’s transactions at the first time, and news reports often mention her investments. Paying attention to these can make you know first - hand.

- Try ETFs: Now there are ETFs such as NANC and KRUZ that specifically imitate the investments of members of Congress. NANC follows the Democratic members of Congress, and KRUZ follows the Republican members. Buying these funds can indirectly follow Pelosi’s train of thought.

Are there any ETFs that specifically track the investments of political figures?

There are indeed such ETFs! There are some funds in the market that specifically focus on the investment portfolios of political figures. By analyzing their financial reports and imitating their operations, ordinary people can also “benefit” from the vision of members of Congress.

For example, the NANC ETF (code NANC) tracks the Democratic members of Congress, and its name also has a bit of Pelosi’s shadow, which shows her influence in the investment circle. The return rate of this fund in the past year is about 30%, which is higher than the market average level. Another KRUS ETF (code KRUS) follows the investments of Republican members of Congress and also performs well.

These ETFs are quite interesting. They are both investment tools and make people start to discuss the transparency of political figures’ investments. Investors who want to try need to look at the strategies and risks of these funds and choose the one that suits them.

Conclusion

Nancy Pelosi’s investment portfolio and strategy are impressive. She prefers technology stocks and also invests in energy and emerging industries. Her performance in the past few years has been far ahead of the market. To keep up with her, you can check financial reports, browse financial platforms and social media, or directly buy ETFs like NANC to “copy homework”. Her investment ideas are valuable for ordinary people, especially focusing on technology and precise timing, which are worth pondering.

Speaking of investment, the platform is also very important. For example, BiyaPay, a multi-asset wallet, can handle US stocks, Hong Kong stocks, and digital currencies with just one platform. Withdrawals and deposits are also very fast, and the funds can be credited almost at any time. Whether you want to invest in popular US stocks or switch flexibly between Hong Kong stocks and digital currencies, BiyaPay can help you save a lot of trouble. With smooth fund flow, it is more convenient to seize opportunities. For ordinary people like us, using more convenient tools may also make investment more convenient. Give it a try!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.