- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Choose between Options and Futures? Understanding the Core Differences to Formulate the Right Strategies

Introduction: This article targets readers primarily in the Chinese market, focusing on “how to choose” as the core, systematically comparing the key differences between options and futures in terms of rights and obligations, margin and leverage, profit and risk structures, costs and liquidity, delivery and settlement, and Chinese market regulations. Rules and data have been verified as of 2025-10-14. Derivative trading carries extremely high risks; this article is for general investment education only and does not constitute investment advice. Before trading, thoroughly understand the rules, sign and comprehend risk disclosure documents, and consult licensed professionals if necessary.

Core Difference 1: Rights and Obligations, Execution Methods

- Futures: Both parties to a standardized contract are obligated to perform, using a “daily mark-to-market” and margin system, with breaches triggering measures such as forced liquidation. This mechanism is clearly outlined in the settlement and trading rules of the China Financial Futures Exchange (subject to the latest rules). Refer to the relevant definitions and provisions in the China Financial Futures Exchange’s Trading Rules (2024-02-06).

- Options: The buyer has rights but no performance obligations; the seller bears corresponding obligations. A-share market exchange-traded stocks and ETF options are typically European-style, automatically exercised at expiration (if meeting minimum economic benefit conditions) or abandoned. Key terms such as contract units, last trading day, and exercise date are clearly defined in exchange technical and business documents. Refer to the Shanghai Stock Exchange Market Data File Exchange Interface Specification V2.60 (including options fields).

Key Insights:

- From a “responsibility” perspective, futures involve “bilateral obligations,” while options involve “buyer’s rights, seller’s obligations.”

- From an “execution” perspective, futures at expiration are closer to a “must-execute” contract arrangement; whether options are exercised is decided by the buyer (European-style exercised at expiration), and whether physical delivery or cash settlement follows depends on the specific product and exchange rules (e.g., index options are typically cash-settled).

Core Difference 2: Margin and Leverage, Daily Mark-to-Market, and Margin Calls

- Futures: Require initial/maintenance margin, with contracts settled daily (mark-to-market). Losses are immediately recorded and may trigger additional margin calls; failure to meet these may lead to forced liquidation. These key mechanisms are clearly specified in the China Financial Futures Exchange Settlement Rules (2025-01-07) (subject to the latest exchange rules).

- Options: Buyers do not require margin (the premium paid is the maximum loss); sellers post margin based on risk models, which may increase during heightened volatility or near expiration/delivery months. For risk disclosure and compliance points in derivatives business, refer to the reference templates and explanations in the “Risk Management Business” section of the China Futures Association, see China Futures Association Derivative Trading Risk Disclosure Reference Page (2025-02-21).

Practical Tips:

- Futures’ “daily mark-to-market” means profits and losses are realized daily, with significant capital occupancy and margin call pressure during volatile periods.

- Options buyers have smoother cash flows, but time value continuously decays; options sellers must fully assess additional margin requirements and potential significant losses in extreme market conditions.

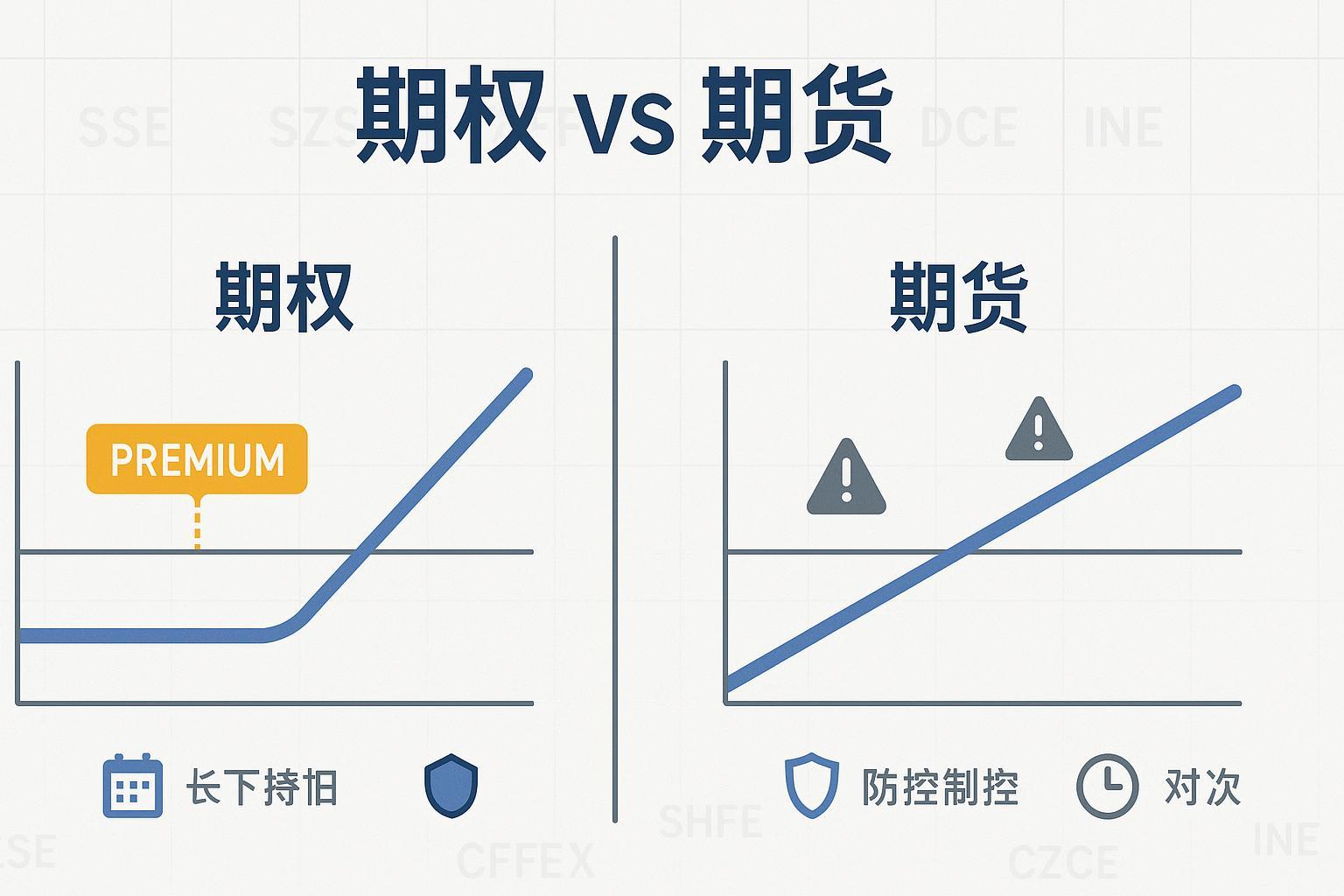

Core Difference 3: Profit/Loss Structure and Risk Boundaries

- Futures (Long Position)

- Profit Structure: For every minimum price movement upward, profits and losses amplify symmetrically.

- Risk Boundary: Theoretically unlimited (significant downward moves may lead to margin blowout risk).

- Options (Buyer)

- Profit Structure: Call options exhibit a “kinked” pattern (slope of 1 above the strike price).

- Risk Boundary: Maximum loss is fixed at the “premium,” with potential upside unlimited (for calls) or downside unlimited (for puts).

- Options (Seller)

- Profit Structure: Maximum profit is limited to the “premium received,” with potential losses unlimited (calls) or unbounded downward (puts).

- Risk Boundary: Must rely on margin, risk control parameters, and self-imposed protection strategies to limit extreme risks.

For a more intuitive understanding, the “symmetric vs. asymmetric” fundamental difference is often depicted in international investor education materials, which can be referenced for clarity, see CME Group Chinese Education Page on Conceptual Differences Between Futures and Options (Note: This page is for general education and not based on Chinese regulations).

Simplified Text Illustration (using call options and long futures as examples):

Underlying price rises → Futures: Linear profit/loss; Options buyer: Kinked line with slope=1 above strike price;

Underlying price falls → Futures: Linear loss; Options buyer: Loss capped at paid premium;

Costs and Liquidity: Explicit/Implicit Costs and Market-Making Quality

- Options Explicit Costs: Premium, commissions, and delivery/exercise fees.

- Options Implicit Costs: Time value (Theta) decay, bid-ask spread, short-term volatility mismatch.

- Futures Costs: Opportunity cost of margin capital, commissions, slippage, and roll-over costs (for cross-period position adjustments).

In terms of liquidity, China’s exchange-traded ETF/stock options have a market-maker system to enhance quote continuity and predictable spreads. Market-maker lists and business guidelines can be found in relevant announcements and regulatory documents, see Shanghai Stock Exchange Stock Options Announcement Index (Market Makers/Business Guidelines).

Rule of Thumb:

- High-frequency traders or those with large transaction needs should prefer main futures contracts or high-volume options contract months.

- Options buyers leaning toward “hold-to-expiration/event-driven” strategies should focus on Theta and liquidity erosion, reasonably selecting expiration months and strike prices.

Delivery, Settlement, and Last Trading Day Differences

- Futures: Include both cash and physical delivery (e.g., commodity futures often involve physical delivery); daily mark-to-market and no-liability settlement. Specific arrangements depend on exchange and product settlement rules.

- Options:

- Stock/ETF options typically involve physical delivery (requiring sufficient underlying assets or funds).

- Index options are usually cash-settled (settled based on the price difference).

- Last Trading Day is not a “universal fixed day”:

- ETF/stock options are typically the “4th Wednesday of the expiration month” (subject to the exchange’s announcement for the period).

- Index options are often the “3rd Friday of the expiration month” (postponed for holidays, subject to the monthly announcement).

These details are reflected in domestic exchange rules/interface documents and monthly expiration announcements, cross-referenced with the previously provided Shanghai Stock Exchange interface specifications and China Financial Futures Exchange rules.

Chinese Market Highlights (Products, Trading Hours, Risk Control)

- Major Exchanges and Products:

- Futures: Index (CSI 300, CSI 500, CSI 1000, SSE 50), treasury bonds, metals, energy, agricultural products, chemicals, and new energy materials (e.g., polysilicon).

- Options: SSE/SZSE ETF and single stock options, CFFEX index options, and commodity options from SHFE, DCE, ZCE, and INE.

- Trading Hours: Day session (typically 09:00–11:30, 13:30–15:00) + night session (for some products, typically starting around 21:00), with possible adjustments before holidays or during delivery months; subject to exchange announcements.

- Risk Control: Position limits, price change limits, dynamic margin adjustments, abnormal trading monitoring, and market-maker assessments, which may tighten during high volatility or holidays; always monitor announcements.

Market Scale Observation: Media in July 2025 cited the China Futures Association, stating that “the national futures and options market saw a trading volume of approximately 4.076 billion contracts in the first half of 2025, up 17.82% year-on-year.” Official statistics should be verified with the association, see Sina Finance’s Analysis of First Half 2025 Trading and Open Interest (2025-07-18).

Scenario-Based Selection Guide: Which Suits You Better?

- If you “fear blowouts and want clear loss limits”:

- Options buying is more suitable (maximum loss = premium).

- Note time value decay, choose expiration months matching your event window, and strictly budget total premium costs.

- If you “need efficient, linear hedging or exposure control”:

- Futures are often more direct and cost-controllable (especially index/treasury futures).

- Suggest pairing with stop-loss, position sizing, and margin call contingency plans.

- If you “have a strong directional view but uncertain timing”:

- Futures allow staggered position building + moving stop-loss.

- Or choose longer-term call/put options to reduce Theta pressure and reserve event windows.

- If you “have a limited budget and want to bet on event-driven outcomes”:

- Small-scale options buying (e.g., straddles or wide straddles) can lock losses to the premium.

- Watch for sharp Theta increases near expiration and volatility mismatch risks.

- If you are “a business/institution hedging”:

- For linear exposures (e.g., raw material costs or index Beta), futures are more common.

- For tail risk concerns (extreme market conditions), consider options or “collar” strategies.

Risk Control and Self-Check List (Review Each Item Carefully)

- Margin and Call Mechanisms: Are you prepared for cash flow fluctuations and margin calls from daily mark-to-market? What’s your contingency plan? Refer to the key points in the CFFEX settlement rules mentioned earlier.

- Maximum Potential Loss: Have you set clear stop-loss and forced liquidation lines for futures? Are options buyers prepared for premiums potentially going to zero?

- Capital Occupancy and Opportunity Cost: Are margin, premium, and reserve fund allocations reasonable?

- Time Sensitivity: Does the event window align with contract expiration?

- Liquidity and Slippage: Are the chosen products/contract months sufficiently active? How’s the market-making quality?

- Compliance and Documentation: Have you fully understood account opening documents and risk disclosures? Revisit the China Futures Association’s risk disclosure reference page (linked earlier).

Common Questions (2025)

- Q: Can options buyers face margin calls?

- A: Generally not. The buyer’s maximum loss is the paid premium; sellers, however, require margin and face margin call risks.

- Q: How do index options and ETF options differ in delivery?

- A: Index options are typically cash-settled; ETF/stock options are usually physically delivered. Refer to the exchange’s current announcements and rules (cross-reference SSE interface documents and CFFEX rules).

- Q: What exactly is the last trading day? Why does it vary?

- A: There’s no universal date. ETF/stock options are typically the 4th Wednesday of the expiration month, while index options are often the 3rd Friday (postponed for holidays). Refer to monthly announcements.

- Q: Is night trading riskier?

- A: Night sessions are influenced by overseas markets, with different liquidity and slippage characteristics and higher sensitivity to sudden news. Check night trading rules and risk parameters based on product characteristics and announcements.

- Q: Are there authoritative materials for systematically learning rule details?

- A: Start with the China Financial Futures Exchange Settlement Rules (2025-01-07) and Trading Rules (2024-02-06), combined with the Shanghai Stock Exchange Interface Specification V2.60 (options fields) to understand key dates and fields; for risk disclosures, refer to the China Futures Association Risk Management Business Page. These links are official resources from the respective institutions.

Summary: How to Turn “Choices” into Action

- Clarify your goals and constraints: Is it “linear hedging/exposure control” or “tail risk protection/event speculation”?

- Document risk boundaries: For futures, set stop-loss and margin call plans; for options, lock in maximum loss and plan expiration months and strike prices.

- Align funding plans: Budget for margin, premiums, reserve liquidity, fees, and slippage.

- Respect the rules: Always refer to the exchange’s current announcements for key parameters and dates, and seek licensed professional advice if needed.

- Combining isn’t contradictory: Many professional traders use futures and options simultaneously in different scenarios, with the key being “clear goals, transparent risks, and precise execution.”

References and Further Reading (cited as anchor text in the main content):

- China Financial Futures Exchange Trading Rules (2024-02-06)

- China Financial Futures Exchange Settlement Rules (2025-01-07)

- Shanghai Stock Exchange Market Data File Exchange Interface Specification V2.60 (including options fields)

- Shanghai Stock Exchange Stock Options Announcement Index (Market Makers/Business Guidelines)

- China Futures Association Risk Management Business Page (2025-02-21)

- CME Group Chinese Education Materials (Futures/Options Conceptual Differences)

- Sina Finance Analysis of First Half 2025 Trading and Open Interest (citing China Futures Association)

Important Reminder: Derivatives carry high leverage and risk, potentially leading to losses exceeding the initial capital (especially in extreme market conditions, futures, and options selling). Make decisions only after fully understanding the rules and conducting stress tests.

Deciding between options and futures hinges on understanding their core differences, but implementation often falters on seamless global capital flows and hedging efficiency. Traders frequently encounter issues like high remittance fees devouring premiums or margin gains amid volatility, exchange swings magnifying leverage exposures, time-consuming foreign account setups, and funding delays during settlements or calls—these undermine structured payoff curves, particularly in cross-market arbitrages involving indices or commodities where platform agility is vital.

BiyaPay delivers a tailored fix: enabling conversions across 30+ fiat currencies and 200+ cryptos, with remittance fees as low as 0.5%, and same-day transfers to most worldwide regions. Effortless signup eliminates overseas accounts, allowing direct US and Hong Kong stock trades on one platform with zero-fee contract orders—ideally suiting futures’ daily mark-to-market or options’ theta decay strategies for asymmetric returns.

Curious? Register at BiyaPay to unlock the Real-time Exchange Rates tool, tracking USD and key currencies to shield against swings eroding your edge. Then, delve into the Stocks section, layering options or futures for broader exposures. With robust compliance and security, BiyaPay keeps your capital resilient across varied markets. Don’t let remittance barriers limit your picks—sign up now, convert differences into gains, starting with modest trials.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.