- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Which is Better, the Straddle Option or the Strangle Option? Analyzing Advanced Strategies for Two-Way Layouts

For educational purposes only, does not constitute investment advice. Options are complex and high-risk instruments, especially short strategies may face theoretically unlimited losses, please operate only after fully understanding the risks and meeting the appropriateness and permission requirements of the local market.

Why These Two? First, the Framework of the Conclusion

- If you expect “significant volatility, but uncertain direction”, and hope to be “ignited” faster by price or IV changes, often choose Long Straddle (buy call + put with the same expiration and same strike price).

- If you also value “large volatility”, but have a limited budget and can accept farther break-even points, then lean towards Long Strangle (same expiration, different strike prices, usually both legs are out-of-the-money).

- If you judge that the future will maintain range-bound oscillation and IV will fall back somewhat, experienced traders will consider Short Straddle/Strangle with risk control, or simply use limited-risk alternatives (Iron Condor/Iron Butterfly).

Below we follow the path of “definition → Greeks → cost and liquidity → event trading → risk control and margin → parameters and execution → decision checklist”, to provide a practical comparison and selection guide.

At a Glance: Quick View of Core Differences

| Dimension | Straddle | Strangle |

|---|---|---|

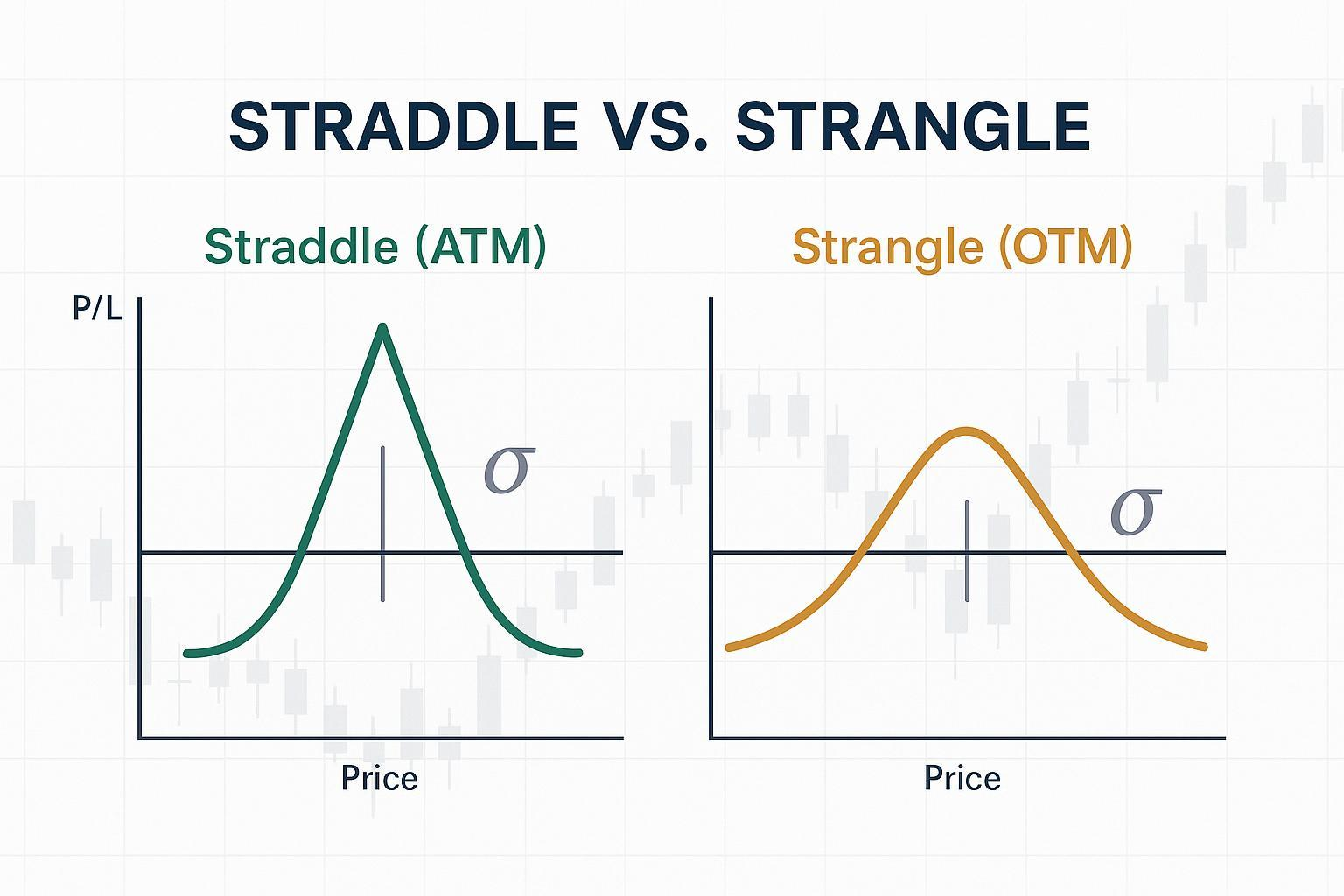

| Composition | Same expiration, same strike price (mostly ATM) | Same expiration, different strike prices (mostly both legs OTM) |

| Cost (Long) | Higher premium | Lower premium |

| Break-even (Long) | Closer to current price, easier to trigger | Farther, requires more significant movement |

| Greeks (Long Initial) | Positive Gamma, positive Vega, negative Theta and values usually higher | Same sign direction but relatively lower sensitivity |

| Liquidity and Spread | More active near ATM, usually narrower spread | OTM more prone to wider spreads and slippage |

| Short Risk | Negative Gamma, negative Vega, positive Theta; potential unlimited loss | Same risk characteristics, but looser at both ends, still with tail risk |

The “better” answer depends on your budget, judgment of volatility amplitude, IV environment, and risk tolerance.

Definition and Expiration Profit and Loss: Starting from Mathematics

- Straddle: Call + put combination with the same underlying, same expiration, same strike price, can be long or short. For authoritative definition and profit and loss diagram, see OIC《Options Strategies Quick Guide》PDF(long-term maintenance materials).

- Strangle: Call + put combination with the same underlying, same expiration, different strike prices (usually both legs OTM), can also be long or short. Also refer to the OIC manual above.

Taking long positions as examples (for easy comparison):

- Long Straddle (underlying spot price S ≈ strike price K):

- Upper break-even = K + (total premium of both legs)

- Lower break-even = K − (total premium of both legs)

- Maximum loss = total premium of both legs; profit unlimited on the upside (downside limited by underlying falling to 0)

- Long Strangle (both legs OTM, Kc > S > Kp):

- Upper break-even = Kc + (total premium of both legs)

- Lower break-even = Kp − (total premium of both legs)

- Maximum loss = total premium of both legs; profit theoretically unlimited (downside similarly limited to 0)

Intuitive example (illustrative, not live quotes):

- S=100, Long Straddle: Buy ATM Call 5 + ATM Put 5, total cost 10; break-even: 110 and 90;

- S=100, Long Strangle: Buy Call K=110 (2) + Put K=90 (2), total cost 4; break-even: 114 and 86.

Greeks and Sensitivity: Why ATM is More “Sensitive”

- Long Straddle/Strangle are both: positive Gamma, positive Vega, negative Theta; shorts are the opposite. This is the fundamental basis for these two types of strategies to “long/short volatility”.

- Gamma and Vega of ATM contracts are usually in the peak range, so Straddle (both legs ATM) is more sensitive to changes in price and IV; while Strangle (both legs OTM) has lower initial sensitivity and requires larger price displacement to be “ignited”. Saxo has systematically explained the application, sensitivity, and risks of the two strategies in its learning center, see Saxo Bank《Understanding the straddle option strategy》(access time: 2025).

- Regarding the empirical rule that Vega is higher near ATM, refer to TradingBlock 的Option Greeks Calculator 说明(2025更新).

Key points summary:

- Want to benefit faster from smaller nominal price changes or IV upside, choose Long Straddle;

- Want to reduce upfront cost, but can accept farther trigger thresholds, choose Long Strangle.

Cost, Break-even Thresholds, and Liquidity/Execution Differences

- Cost: Long Straddle is usually more expensive (both legs ATM have higher time value and Vega), long Strangle is cheaper (both legs OTM).

- Break-even thresholds: Correspondingly, Straddle’s break-even is closer and easier to trigger; Strangle’s is farther and harder to trigger.

- Liquidity and bid-ask spread: In practice, contracts near ATM are often more active with narrower spreads; farther OTM are more prone to wider spreads and slippage. Regarding how to evaluate the activity and spread of contracts before placing orders, refer to moomoo’s option chain tutorial (including volume, open interest, spread and other indicators), see moomoo《如何阅读期权链》教学(2025-07更新).

Practical tip: If you adopt Strangle, be sure to check the liquidity of both OTM strike prices in advance, and if necessary, use limit orders and batch transactions to reduce impact costs.

Event Trading and IV Crush: When to Use Long, When to Consider Short

- Before events: Uncertainty rises, IV often increases. Long holders (+Vega) benefit from IV elevation and potential significant volatility. Schwab summarized the matching of the two strategies with different volatility scenarios in its 2023 tutorial, see Charles Schwab《Straddles vs. Strangles Options Strategies》(2023/2025更新).

- After events: Uncertainty dissipates, IV often falls back quickly (IV Crush). This is unfavorable for longs and favorable for shorts; but if price breaks out unilaterally, shorts may suffer accelerated losses. Regarding the tutorial graphics and text on “IV upside before earnings, IV Crush after earnings”, see moomoo《接近财报后的IV Crush与期权》(2025-04-07).

Timing ideas:

- Expect “major event + unclear direction + low IV”: Long Straddle first; when budget is limited, use Long Strangle as alternative.

- After events, significantly high IV and expected oscillation: Only for advanced users to consider protected Short side, or replace with limited-risk structures (Iron Condor/Iron Butterfly).

The Truth About Shorts: Margin, Permissions, and Tail Risks

- Common points of Short Straddle/Strangle: Maximum gain is only net received premium, potential loss theoretically unlimited; negative Gamma, negative Vega, positive Theta, sensitive to unilateral fast markets and IV surges.

- Margin and permissions (taking US stocks as example):

- Portfolio Margin (PM) will assess margin occupancy through scenario-based stress tests, usually closer to actual risks than Reg-T. Refer to Charles Schwab《Understanding Portfolio Margin》(2024-03-08).

- Selling naked strategies without protective legs (such as Short Straddle/Strangle) usually requires higher option trading permission levels; different brokers have slightly different gradings, refer to IBKR《Options Levels 1–4》(2024-11-11).

Risk control suggestions (principled):

- If not a professional trader, prioritize limited-risk alternatives (such as Iron Condor/Iron Butterfly), limit maximum loss to acceptable range by buying protective legs;

- Control position size and leverage, do not “average down” losses;

- Formulate emergency plans for extreme markets (including forced liquidation, hedging trigger conditions).

How to Set Parameters: Strike Prices, Expirations, and Position Management

- Long Straddle:

- Strike price: Bias towards ATM (or the symmetric strike price closest to spot);

- Expiration: Short-term has higher Gamma, faster Theta erosion; farther months have less Theta pressure but higher cost. Match expiration around events, avoid crossing too many irrelevant periods.

- Long Strangle:

- Strike prices: Both legs often choose OTM. Can use “expected volatility/Expected Move” or near-end ATR to estimate the distance of upper and lower legs, so that break-even roughly covers the expected range;

- Expiration: Match with event window, if IV is low, can build in batches, or use slightly farther months to reduce Theta pressure.

- Position management (long):

- Set stop-profit rules triggered by price or IV (such as batch profit-taking when breakthrough leads Gamma to expand Delta);

- If price doesn’t move, IV doesn’t rise and Theta is eroding, consider time stop-loss and timely retreat.

- Position management (short, only for advanced):

- Preset protective legs/use spread structures as alternatives;

- When volatility accelerates, respond with rolling or hedging (such as Gamma scalping), but related techniques belong to advanced content, not priority for beginners.

Decision Checklist: Which One Should You Choose?

- I expect a big market, unclear direction:

- Sufficient budget, hope to be triggered faster → Long Straddle

- Limited budget, can accept farther break-even → Long Strangle

- I expect oscillation, IV may fall back (after events):

- Only when having experience and risk control tools, consider protected Short Strangle/Straddle, or replace with Iron Condor/Iron Butterfly

- I care about execution and slippage:

- More biased towards Straddle (ATM more active); if doing Strangle, be sure to evaluate the liquidity and spread of both OTM legs

- I am sensitive to margin occupancy:

- Avoid naked shorts; if really need to short volatility, prioritize limited-risk structures, or use portfolio margin accounts and strictly control risks

Conclusion: No “Absolutely Better”, Only “More Suitable Now”

The essential difference between Straddle and Strangle lies in the trade-off of “cost—trigger threshold—sensitivity”: the former has higher cost and easier trigger, the latter has lower cost and harder trigger. Base the choice on the assessment of “expected volatility amplitude, IV level, and time window”, and put risk control first. For most non-directional traders who hope to conduct event-driven trading:

- Before events, IV not high and sufficient budget → Mainly Long Straddle;

- Limited budget, but still value large volatility → Long Strangle;

- Short volatility after events → Please prioritize limited-risk structures, and meet account permissions and margin requirements.

References and Extended Reading (in order of first appearance):

- OIC(long-term maintenance materials):Options Strategies Quick Guide PDF

- Saxo Bank(2025 access):Understanding the straddle option strategy

- TradingBlock(2025-10 update):Option Greeks Calculator 说明

- Charles Schwab(2023/2025 update):Straddles vs. Strangles Options Strategies

- moomoo(2025-04-07):接近财报后的IV Crush与期权

- Charles Schwab(2024-03-08):Understanding Portfolio Margin

- IBKR(2024-11-11):Options Levels 1–4

Regardless of the higher-cost Straddle or the more leveraged Strangle, the profitability of these dual-direction strategies is directly impacted by transaction friction. Every two-legged entry and exit, and the management of slippage in OTM Strangles, requires an extremely low-cost trading environment. A platform that minimizes trading friction while enabling highly efficient global capital flow is a reliable foundation for your advanced option strategies.

BiyaPay is committed to providing an efficient execution environment for your global trading strategies. You can trade US and Hong Kong stocks on one platform without the need for complex foreign accounts. The advantage of zero commission on contract order placement helps you significantly reduce friction costs when constructing and dissolving multi-leg option combinations.

For capital flow, BiyaPay offers real-time exchange rate checks and conversion services, supporting seamless exchange between 30+ fiat currencies and 200+ cryptocurrencies, with remittance fees as low as 0.5%, ensuring same-day transfer and arrival of funds.

Register quickly with BiyaPay today to focus your efforts on the analysis of volatility, Gamma, and Theta, while keeping execution costs at a minimum.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.