- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Are Out-of-the-Money Option Contracts Worth Trading? A Detailed Explanation of the Truth behind the Low-Cost High-Leverage Strategy

Straight to the point: Out-of-the-money (OTM) options aren’t “untouchable,” but treating them as a “low-cost, surefire high-leverage” shortcut often leads to premiums evaporating to zero. The Options Clearing Corporation (OCC) in its latest Characteristics and Risks of Standardized Options clearly states that the buyer’s maximum loss is the entire premium, with time value (Theta) constantly eroding; short-term contracts have higher Gamma and are more sensitive to implied volatility (IV), amplifying execution and pricing error costs (see the authoritative disclosure still applicable in 2025: OCC Risk Disclosure PDF). Long-term statistics also warn: Coval and Shumway in The Journal of Finance (2001) note that zero-Beta at-the-money straddles lose about 3% weekly on average, reflecting the negative expected return of long-volatility strategies over time (see their stable paper page: Coval & Shumway 2001).

This article avoids piling up concepts and instead provides a 2024–2025 evidence-based, frontline trading SOP for “when OTM is worth trading, how to trade it, and how to stop losses and review.” You’ll get an actionable checklist to amplify odds when opportunities align and rationally walk away when conditions aren’t met.

Note: If you’re unfamiliar with basic terms like “premium, strike price, expiration, Greeks,” start with this comprehensive guide: 2025 Beginner’s Guide to Options Trading.

1. Why OTM Often Loses: Low Cost ≠ Low Risk, High Leverage Isn’t a “Free Lunch”

- Time works against buyers. Theta erodes premiums daily, especially in short-term contracts. The OCC’s disclosure framework repeatedly emphasizes “time value decay” as a structural disadvantage for buyers (see OCC Risk Disclosure).

- Implied volatility pricing errors. When IV is in a high percentile, buyers often pay a “volatility premium”; if IV later drops, even a correct directional bet can lose. IV methodology can be referenced in Cboe’s official white paper and calculation framework (see Cboe VIX White Paper (PDF)).

- “Lottery-like” return distribution. Deep OTM options often exhibit “small chance of huge gains, high chance of zero,” as evidenced by Coval & Shumway (2001) on the negative expected return of long straddles without clear catalysts or cost control (see Coval & Shumway 2001).

- Trading costs and liquidity. Deep OTM contracts often have wider spreads and thinner order books, with slippage and commissions eating into limited marginal gains; trading near close or during high-impact events can lead to “one more cut.”

Conclusion: OTM isn’t inherently bad, but without the triple constraint of “IV positioning + event catalyst + execution discipline,” it’s more like buying a lottery ticket than trading.

Extended reading: To understand “what is volatility, and the difference between VIX and individual asset IV,” refer to this clear explanation: What Is Market Volatility? From VIX to ATR.

2. When Are OTM Options “Worth Trading”? — Condition-Action-Verification (SOP)

The following thresholds are “good enough” criteria based on practical executability, not dogma.

Condition A: IV Positioning and Path Expectation

- When the underlying’s IV is in a low historical percentile (e.g., self-built percentile <=30%) and a clear catalyst exists (earnings, policy, data release, event window), consider buying slightly OTM (call or put).

- When IV is in a high percentile with expected volatility decline, prefer limited-risk seller structures (e.g., bull/bear spreads) or calendar spreads to avoid naked tail exposure.

- Methodology basis: Cboe’s authoritative explanation of VIX and IV construction helps identify whether volatility is “expensive or cheap” (see Cboe VIX White Paper).

Condition B: Expiration and Gamma/Theta Trade-Off

- Ultra-short (0–3 days): Only attempt small positions with highly certain direction and catalysts, plus stable execution (good liquidity, controllable slippage).

- Short-to-medium term (7–30 days): Better for spreading time and rolling positions to manage event windows.

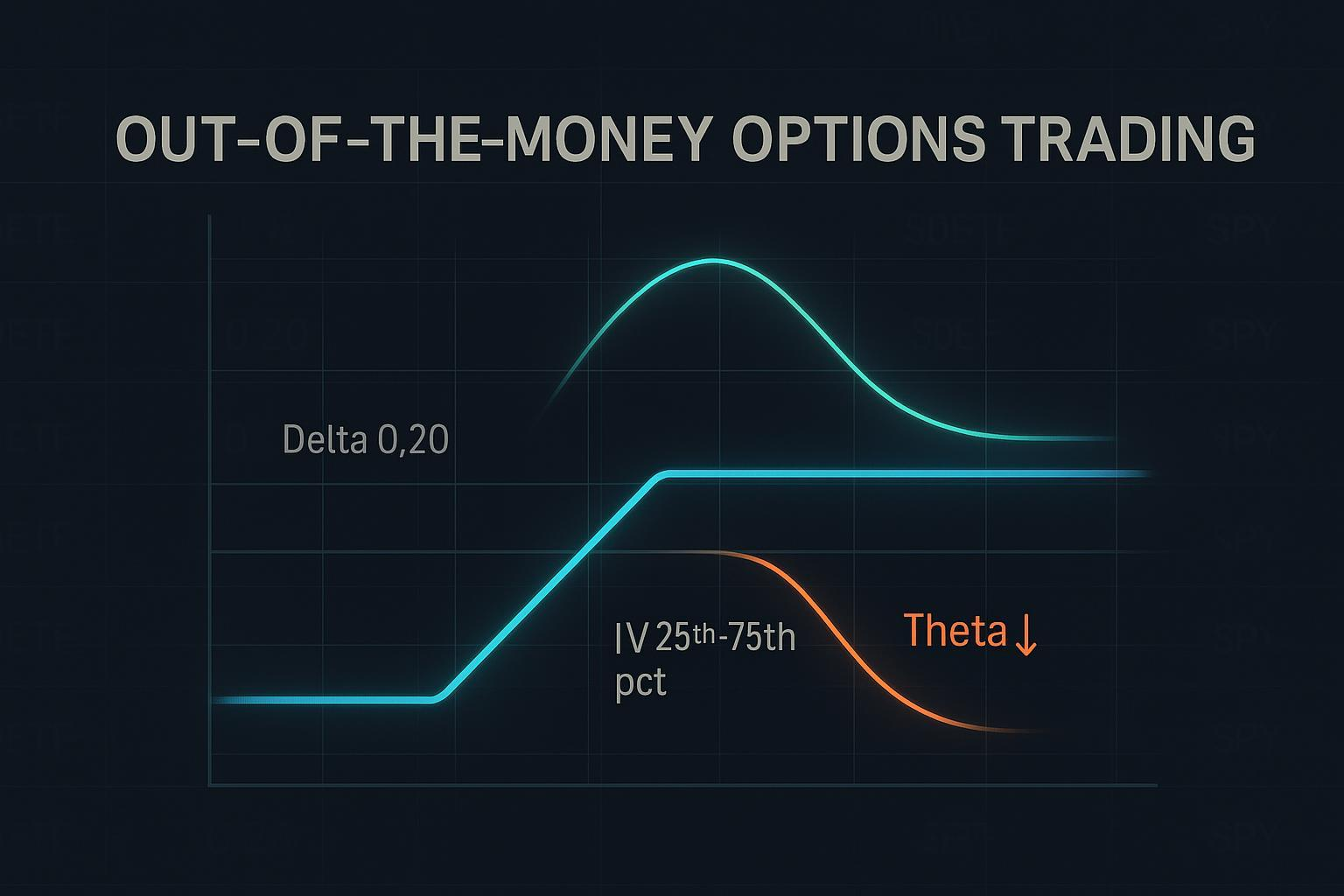

- Tool guidance: Prioritize “slightly OTM” over “deep OTM.” A practical filter is Delta ≈ 0.15–0.30, balancing the probability of reaching the strike with leverage efficiency.

Condition C: Execution and Costs

- Liquidity: Check 5-level order book depth and spread stability; one-sided spread ideally ≤ 0.5%–1.0% of the underlying price.

- Trading costs: Include commissions, slippage, and capital lockup (if hedged) in your win-rate model.

- Order and risk control: Use limit orders primarily, split execution if needed; avoid chasing prices passively near close.

3. How to Trade: Key Points for Three Structures

1) Improved Single-Leg OTM (Slightly OTM Preferred)

- Select Delta 0.15–0.30 slightly OTM, paired with clear catalysts and low-percentile IV.

- Disciplined exit:

- Stop-loss: Trigger at 50%–70% premium loss.

- Take-profit: Reduce positions at 100%–200% floating profit, prioritizing Vega (IV spike) gains.

- Time stop: Exit T–1 if the event doesn’t materialize, avoiding “zero acceleration” at expiration.

- Error management: If the catalyst materializes but IV drops, lock in profits per plan even if the price target isn’t met.

2) Vertical Spread (Bull/Bear)

- Purpose: Lower net premium, cap maximum loss, improve the “probability of success × risk-reward ratio” cost-effectiveness.

- Method: Buy near, sell far in the same direction; spread cap = maximum profit; net cost = maximum loss.

- Applicability: For scenarios with directional confidence but uncertainty about IV’s future path.

3) Calendar Spread

- Purpose: Use the Vega and slower Theta of longer-term longs to offset near-term time decay; profit from upward IV structure shifts.

- Risks: Errors in term structure judgment, high execution costs; requires regular assessment of cross-term IV changes.

Advanced tip: Gamma management in extreme markets (for experienced traders only)—long volatility strategies can try Delta-neutral or semi-neutral “Gamma plays,” while seller structures must include small tail protection legs and strictly adhere to margin and position reduction thresholds.

4. Risk Control Checklist (Ready to Apply)

- Before opening

- Ensure “suitable IV positioning + clear catalyst/or use spread structures to hedge IV uncertainty.”

- Check order book and spreads: At least 5-level quote depth, stable spreads; estimate slippage.

- Prioritize slightly OTM; deep OTM only for small speculative positions, not core strategies.

- During holding

- Track Greeks: Theta decay pace and Gamma sensitivity thresholds.

- Conditional orders: Stop-loss (-50%–70% premium), take-profit (+100%–200% in batches).

- Reduce positions after IV expansion profits; cut losses swiftly if direction doesn’t materialize.

- Before expiration

- Avoid chasing orders near close.

- Close T–1 if the event doesn’t materialize to reduce gap or assignment risks.

- Seller structures: Verify margin and tail protection integrity.

- Black swan response

- Buyers: Lock profits quickly, narrow Delta exposure.

- Sellers: Reduce nominal exposure first, then widen protection bands.

- Unified threshold: When underlying volatility exceeds preset multiples (e.g., ATR × 2–3), initiate “reduce—hedge—exit.”

For exposure differences and Greeks impacts for buyers vs. sellers, read this advanced overview: What Is Options Exposure Risk? From Buyer-Seller Risks to Greeks.

5. Implementing in the Chinese Market: Data Sources and Regulatory Differences

- Monitor official statistics to validate trading assumptions and liquidity judgments:

- OCC monthly statistics (global structure and activity insights, updated through 2025): OCC Monthly Statistics

- SSE stock options statistics (view volume/open interest, call/put ratios, etc.): SSE Options Statistics Page

- CFFEX market data—statistics (index options data): CFFEX Statistics Reports

- Practical notes:

- Price limit restrictions and expiration settlement mechanisms affect 0DTE and short-term contracts’ zeroing risk and execution difficulty.

- Varying market-making quality leads to wider deep OTM spreads and thinner order books, with significant impact costs.

- Broker risk control parameters (margin, position caps, risk thresholds) differ from overseas; backtests must be parameterized, not copied.

6. Common Pitfalls and Quick Fixes

- Chasing deep OTM “10x myths”: Shift to slightly OTM or spread structures; replace “lottery fantasies” with “probability of success × risk-reward” optimization.

- Overtrading 0DTE: Only try small positions with strong catalysts, stable execution, and clear exit scripts; otherwise, focus on 7–30-day terms.

- Ignoring costs and slippage: Include “spread width, slippage, commissions” in decision tables; abandon trades if thresholds are exceeded.

- Focusing only on direction, not IV: Answer “Is IV expensive or cheap?” before entry; use calendar/vertical spreads to neutralize Vega uncertainty if needed.

7. Review Template (Diagnose a Past Trade with This Process)

- Record initial parameters: Underlying price, strike price, expiration, Delta, IV percentile, expected catalyst, net premium, target, and risk control lines.

- Attribution breakdown:

- Directional contribution (underlying price movement)

- IV change contribution (Vega gains/losses)

- Time decay (Theta)

- Execution costs (slippage + commissions)

- Decision consistency: Did you strictly follow “stop-loss 50%–70%/take-profit 100%–200% in batches”? Did you exit T–1 to avoid gaps?

- Areas for improvement: If IV judgment was wrong, would a spread structure work better next time? If liquidity was insufficient, would you switch to a more active contract or delay?

- Data backfill: Summarize key metrics in your strategy log and compare with exchange/clearinghouse monthly structural data to verify if your assumptions align with market conditions (reference sources: OCC Monthly Statistics, SSE Options Statistics Page, CFFEX Statistics Reports).

8. Essential Authoritative Knowledge Anchors (For Verification and Extension)

- Risks and fundamentals: OCC’s Characteristics and Risks of Standardized Options, a long-standing authoritative text still relevant in 2025 (links above and in text).

- Volatility methodology: Cboe’s VIX white paper, useful for judging IV “expensive/cheap” and term structure impacts (link above).

- Long-term distribution evidence: Coval & Shumway (2001), a representative study on the negative expected return of long-volatility strategies (link above).

If you need to fill gaps in basics and terminology, read this concise guide: What Are Options Contracts? Understanding Strike Prices, Premiums, and Common Strategies.

Conclusion: Turn “Worth Doing” into “Replicable”

The real answer to “Are OTM options worth trading?” isn’t “yes/no” but “under what conditions.” When IV positioning, event catalysts, and execution discipline align, slightly OTM and spread/calendar structures can turn limited costs into controlled leverage efficiency; otherwise, rational restraint is the better trade. Start today by building your IV percentile dashboard, scripting stop-loss/take-profit rules, and consistently reviewing trades with the above template. This way, you’ll be ready when opportunities arise and gracefully “do nothing” when they don’t.

Compliance Note: This article is for educational and research purposes, not investment advice or profit guarantees. Trading options may lead to loss of the entire premium or higher risk exposure; participate prudently based on your risk tolerance and regulatory requirements.

The philosophy behind Out-of-the-Money (OTM) options trading is to capture high odds with discipline, but the core pitfalls remain Theta decay and transaction friction. On OTM contracts with wide bid-ask spreads and high slippage, commissions and fees can become your fiercest enemy. To truly execute a “low-cost, high-leverage” strategy, you need an integrated platform that minimizes trading costs while ensuring efficient global capital flow.

BiyaPay provides the robust backend support your leveraged strategies require. Not only can you simultaneously participate in both US and Hong Kong stock trading on one platform, but you also benefit from zero commission on contract order placement, drastically reducing transaction friction and slippage costs on OTM or vertical spread structures. On the capital management front, BiyaPay offers real-time exchange rate checks and conversion services, supporting over 30 fiat currencies and 200+ cryptocurrencies, with wire transfer fees as low as 0.5%, ensuring same-day transfer and arrival of your funds. Register quickly with BiyaPay today to eliminate execution barriers with FinTech and focus solely on strategy discipline and post-trade analysis.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.