- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Should You Buy or Sell Options? The Key Depends on Which Range the Implied Volatility Is In

Note: This article is for educational and informational purposes only and does not constitute investment advice or an offer. Options carry high risks; please thoroughly understand the risks and assess your suitability before trading (content based on general market practices as of October 2025).

Core Issue and Preliminary Conclusion

The primary decision of whether to “buy or sell” options often hinges not on direction but on which implied volatility (IV) range—low, medium, or high—the market is in. Intuitively:

- When IV is in a historically low range, lean toward “long volatility” (buying strategies);

- When IV is in a historically high range, lean toward “short volatility” (selling, especially limited-risk credit structures);

- In the middle range, both sides are viable, but prioritize limited-risk structures to control tail risks.

The following sections will use IV Rank/IV Percentile as a benchmark, comparing buying and selling strategies across “low/medium/high IV” scenarios, paired with Greeks (Vega/Theta) and a risk checklist to help you build a one-page decision framework.

1. Clarifying Terms: IV, IV Rank, and IV Percentile

- Implied Volatility (IV): Derived from option prices, it reflects the market’s expectation of future volatility (forward-looking dimension).

- IV Rank: The current IV’s position within a past period (commonly 52 weeks), expressed as 0–100%. For example: IV Rank = (Current IV − Past 52-week Low IV) ÷ (52-week High IV − 52-week Low IV) × 100%

- IV Percentile: The current IV’s percentile in the distribution over a past period. For example, if the current IV is higher than 80% of trading days in the past year, IV Percentile ≈ 80%.

For modern trading definitions and applications of IV Rank and IV Percentile, the industry widely refers to the standardized explanations by the tastylive (formerly tastytrade) team. See their official program for a systematic explanation of “IV Rank and IV Percentile Definitions and Uses” (tastylive, 2021), at “IV Rank and IV Percentile” Official Program Page.

Note: Distributions vary across markets and underlyings, and thresholds are not absolute rules. This article adopts common empirical buckets:

- Low IV: IV Rank/IV Percentile < 20

- Medium IV: Approximately 20–80

- High IV: > 80

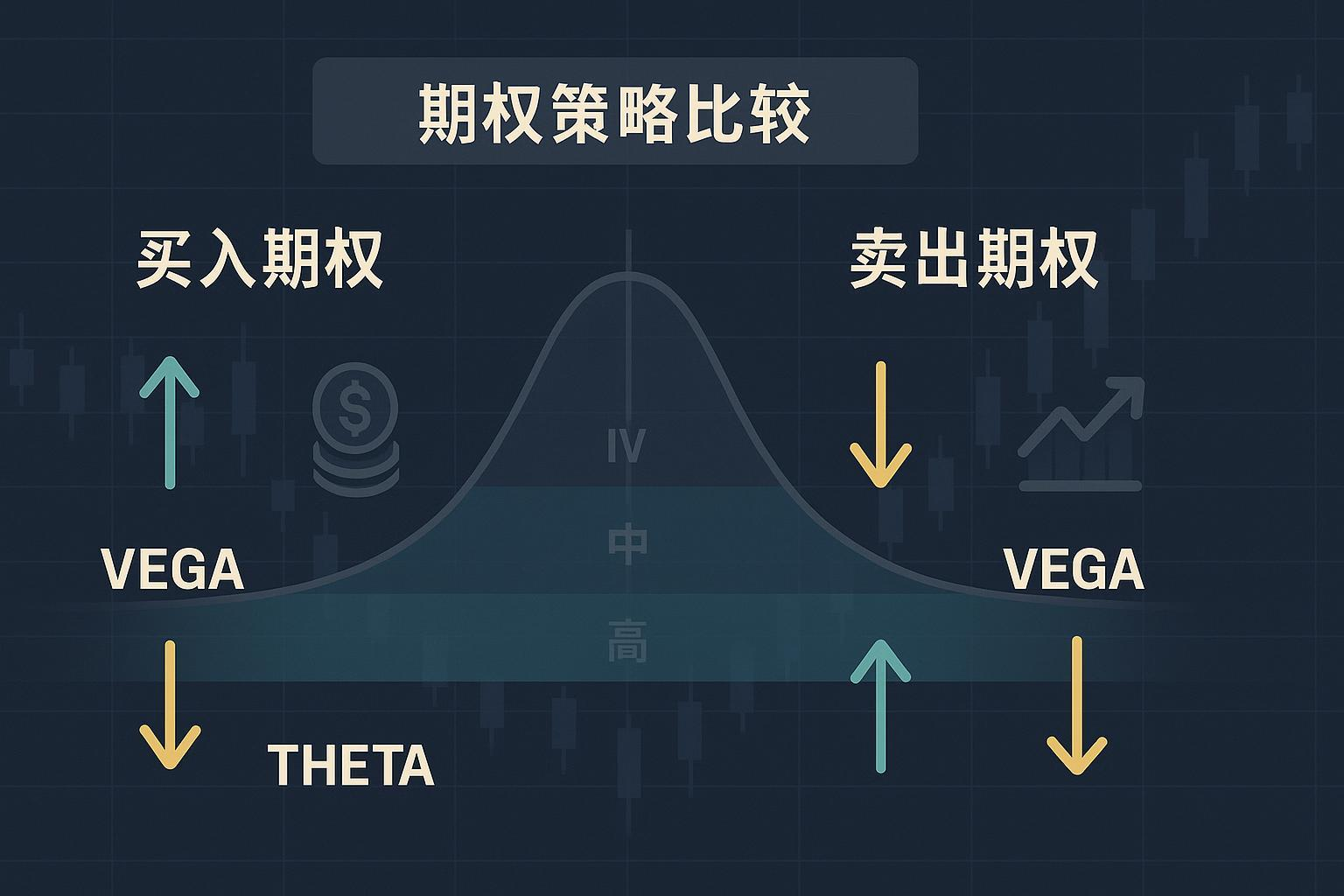

2. Buying vs. Selling: How Vega/Theta Shift the Odds

- Buying Options (Long):

- Vega is positive (benefits from rising IV), Theta is negative (time decay erodes the premium).

- The farther from expiration, the higher Vega typically is and the smaller Theta’s absolute value; closer to expiration, Vega decreases, and Theta accelerates erosion.

- Selling Options (Short):

- Vega is negative (benefits from falling or reverting IV), Theta is positive (time decay favors collecting premiums).

- But beware: Extreme market moves can cause IV to spike and the underlying to jump significantly, rapidly amplifying losses.

This implies:

- When you judge “IV is low and likely to revert to normal or rise,” buying strategies offer better cost-effectiveness;

- When you judge “IV is high and likely to revert,” selling strategies (especially limited-risk structures) have an edge.

3. VRP Perspective: Why Favor “Short Volatility” in High IV?

Extensive research shows that, over the long term, implied volatility often exceeds realized volatility (IV > RV), indicating a “volatility risk premium (VRP).” Classic evidence can be found in Bollerslev, Tauchen, and Zhou’s 2009 study in the Review of Financial Studies, which systematically demonstrates the predictive relationship of VRP, constructed from VIX and realized volatility, for future returns. See “Expected Stock Returns and Variance Risk Premia (RFS 2009)”.

This means: When IV is at a historically high level, the market often pays higher premiums for uncertainty, providing time value and premium sources for “short volatility” seller strategies. However, it must be emphasized that VRP does not guarantee “sure profits”—extreme market tail losses can wipe out years of gains in one event, making risk management the top priority.

4. Strategy Fit by IV Range: Choosing Between Buying and Selling

Below, strategies are listed by “low/medium/high IV” scenarios, with symmetric comparisons of buying and selling. Thresholds and examples are empirical rules, to be adjusted based on the underlying’s characteristics and current market structure (as of October 2025).

4.1 Low IV (IV Rank/Percentile < 20): Prioritize Long Volatility

- Applicable Judgment: Volatility is suppressed and may revert or rise; or you’re uncertain about direction but expect “volatility to pick up.”

- Preferred Strategies (Buying Side):

- Buy ATM straddles/strangles

- Debit spreads (e.g., bull/bear spreads)

- When direction is clear, buy single-leg calls/puts (choose longer expirations to boost Vega and mitigate Theta)

- Advantages: Lower IV component in entry costs; if volatility rises or direction aligns, the risk-reward ratio is attractive; risk is controlled (loss capped at premium).

- Limitations and Risks: Theta erosion persists; if IV drops further or prices stay flat, time value loss is significant.

- Management Tips:

- Choose slightly longer expirations to increase Vega and allow time for market “fermentation”;

- Enter in batches and take profits in batches as IV rises;

- If direction doesn’t materialize and uncertainty (e.g., earnings) increases, consider reducing positions or using calendar spreads to optimize Theta.

- Selling Side in Low IV:

- If selling, use “limited-risk credit spreads” and avoid naked selling;

- The reward/risk ratio is typically unattractive, and negative Vega is unfavorable in rising IV scenarios.

4.2 Medium IV (Approximately 20–80): Both Sides Viable, Prioritize Limited-Risk Structures

- Applicable Judgment: IV is in a normal range, neither extremely cheap nor expensive.

- Buying Side:

- Directional: Debit spreads, calendar/diagonal spreads (leveraging term structure and smile/skew);

- Neutral: Moderately wide strangles, controlling premium costs;

- Selling Side:

- Credit spreads (bear call/bull put), small-scale iron condors/iron butterflies, with boundary selection balancing Theta and tail risks;

- Advantages: Flexible choices, allowing both directional bets and premium collection;

- Limitations and Risks: Multi-leg structures require higher execution and liquidity; neutral setups are vulnerable to sudden events breaking ranges.

- Management Tips:

- Prioritize “limited-risk” structures;

- Reduce leverage around event days (earnings, major data releases);

- Use skew information: sell the expensive side, buy the cheap side to optimize risk-reward.

4.3 High IV (>80): Prioritize Short Volatility, but Control Tail Risks

- Applicable Judgment: IV is significantly elevated, with the market pricing uncertainty expensively; reversion or mean regression is more likely.

- Preferred Strategies (Selling Side):

- Iron condors/iron butterflies

- Limited-risk credit spreads (bull/bear credit spreads), paired with deep out-of-the-money “insurance legs” if needed

- Covered calls (holding underlying and selling calls) or protective puts for defense

- Advantages: Positive Theta and falling IV/negative Vega provide tailwinds; in high IV, “farther strikes still yield good premiums.”

- Limitations and Risks: Gaps or trend continuations in extreme markets can rapidly amplify losses; naked selling has steep risks, unsuitable for most investors.

- Management Tips:

- Use “limited-risk” structures whenever possible;

- Diversify underlyings and expirations to reduce single-point tail risks;

- Set predefined exit/hedge triggers (e.g., close positions after capturing 50–70% of credit spread premiums).

- Buying Side in High IV (Special Use):

- If you believe “high IV will go higher” or expect a “large one-sided move,” allocate small positions to directional buys or “debit reverse spreads,” but accept higher premium costs and stricter payoff conditions.

5. Event-Driven and Exceptions: Earnings, Macro Data, and “IV Crush”

A common observation is that short-term option IV rises before earnings, and after uncertainty is resolved post-announcement, short-term IV drops rapidly (IV crush), especially impacting out-of-the-money premiums. Therefore:

- Selling straddles/strangles directly in “pre-earnings high IV” without hedging risks directional gap tail losses;

- A more prudent approach is:

- For short volatility, favor “limited-risk credit structures” with small positions and far boundaries;

- For long volatility, manage expiration and Theta carefully, avoiding heavy positions in extremely expensive near-term premiums.

Additionally, term structure inversions and changes in volatility smile/skew alter “which side is expensive, which is cheap,” affecting the cost-effectiveness of buying or selling. In practice, adjust based on current option chain quotes.

6. 0DTE and Ultra-Short-Term Options: Approach with Caution

0DTE and ultra-short-term contracts are extremely sensitive to Theta, highly leveraged, and vulnerable to small price movements and liquidity shocks. For most investors:

- Avoid naked selling or “unlimited risk” exposures;

- Use small positions, strict stop-loss/stop-profit, and limited-risk structures as prerequisites;

- Reduce or avoid such exposures during major data or event periods.

7. Risk and Compliance Essentials (Must Read)

- Naked selling options has theoretically unlimited loss potential (especially naked call selling), with significant margin calls and forced liquidation risks. For basic disclosures and suitability requirements, see the Options Clearing Corporation’s official document “Characteristics and Risks of Standardized Options” (ODD, September 2023 Revision).

- Suitability Reminder: Not all investors are suitable for selling options or complex multi-leg strategies. Complete the appropriate risk disclosure and approval at your broker, and choose prudently based on your financial situation and experience.

- Capital and Leverage: Margin requirements for selling strategies vary dynamically with underlying price, volatility, and expiration; insufficient funds may trigger margin calls or forced liquidation.

- Diversification and Hedging: Over-concentrated single underlying or expiration positions carry high risks; reduce tail risks through diversification and insurance legs.

8. One-Page Decision Matrix (By IV Range)

| IV Range | Preferred Action | Representative Strategies | Advantages | Key Risks/Limitations | Management Tips |

|---|---|---|---|---|---|

| Low IV (<20) | Long Volatility | Buy straddles/strangles, debit spreads, single-leg buys | Cheap IV, positive Vega, benefits from direction or volatility rise | Theta erosion, losses if IV drops further or prices stay flat | Longer expirations, batch entry/exit, use calendar spreads to mitigate Theta |

| Medium IV (20–80) | Both Viable | Debit/credit spreads, calendar/diagonal spreads, moderate iron condors | High flexibility, controlled risk | Complex multi-leg execution, vulnerable to event-driven breakouts | Prioritize limited-risk structures, reduce leverage before events, adjust with skew |

| High IV (>80) | Short Volatility | Iron condors/butterflies, limited-risk credit spreads, covered/protective combos | Positive Theta, benefits from IV reversion, good premiums at far strikes | Tail gaps, naked selling extremely risky | Use limited-risk structures, small positions, diversify and hedge, exit at 50–70% premium |

9. Common “Don’ts” (Red Lines)

- Beginners should avoid naked selling (calls/puts) and unlimited-risk strategies;

- Don’t use large positions to sell straddles/strangles before major events to bet on IV crush;

- Don’t treat 0DTE as a “Theta cash machine”;

- Don’t ignore margin and liquidity: Rising volatility increases margin needs, and spreads may not close at ideal prices;

- Don’t treat empirical thresholds as ironclad rules: IV distributions and smile structures vary greatly by underlying and require dynamic calibration.

10. Quick FAQ

- Q: What’s the difference between IV Rank and IV Percentile?

- A: IV Rank focuses on “where the current IV sits within the past year’s high-low range,” while IV Percentile focuses on “the percentage of days in the past period that the current IV exceeds.” They are often used together; practical definitions and calculations are clearly explained in tastylive’s materials, see link above.

- Q: Why are seller strategies favored in high IV?

- A: Long-term statistics show a VRP (IV often exceeds realized volatility), allowing sellers to capture time value from elevated premiums, but tail risks must not be ignored. See the RFS 2009 study linked above.

- Q: Am I suitable for selling options?

- A: It depends on your risk tolerance, experience, and financial situation. Read the OCC’s ODD disclosure first and pass the relevant approval level at your broker; beginners should start with “limited-risk spreads.”

Conclusion

There’s no eternal winner between “buying or selling.” The real key lies in: which IV range, what event environment, and what risk structure. By placing IV Rank/IV Percentile, Vega/Theta, and VRP knowledge on the same “scenario map,” you can switch between buying and selling more systematically. Remember: prioritize position sizing and risk control before profits.

The key to option strategy selection lies in the IV range. Whether you choose to “Buy Low IV” or “Sell High IV,” the success of your strategy relies on minimal transaction costs. Especially when executing multi-leg spreads or facing IV collapse requiring rapid exits, commissions and slippage on bilateral contracts can directly erode your VRP gain or Theta premium.

BiyaPay offers the perfect execution environment for your global option strategies. You can trade US and Hong Kong stocks on one platform without a foreign account, benefiting from zero commission on contract order placement. This significantly reduces transaction friction in your complex strategies. Furthermore, BiyaPay offers real-time exchange rate checks and conversion services, supporting seamless exchange between 30+ fiat currencies and 200+ cryptocurrencies, with remittance fees as low as 0.5%, ensuring same-day transfer and arrival of funds. Register quickly with BiyaPay today to leverage FinTech to translate your deep insight into volatility into highly efficient global asset allocation returns.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.