- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Tracking Smart Money with SEC 13F: The Ordinary Investor's "Copy Homework" Guide

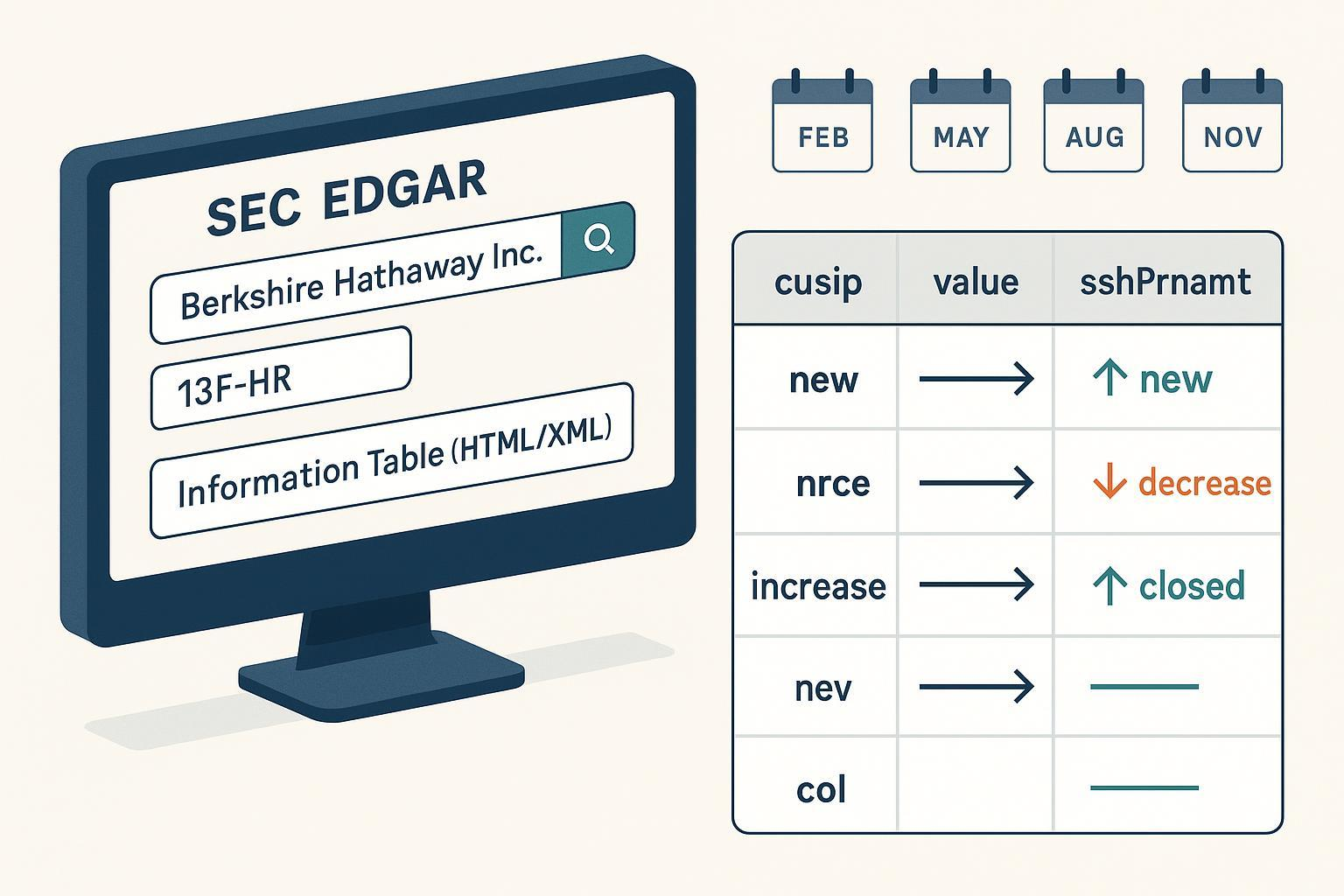

Want to learn how to “review institutional holdings and create an actionable watchlist” without blindly following trades? This guide takes you through the most authoritative path—SEC EDGAR’s Form 13F—to complete a full process from search to comparative analysis. The first complete operation takes about 30–45 minutes; subsequent quarterly updates can be done in 10–15 minutes.

Important Note: This article is for educational and informational purposes only and does not constitute investment advice. 13F filings have delays and coverage limitations; do not use them for short-term trading decisions.

What You Will Learn

- How to precisely locate any institution’s 13F filings on EDGAR (including 13F-HR, 13F-HR/A, 13F-NT)

- How to download and identify the “Information Table” in HTML/XML versions

- How to compare two periods’ information tables to identify “new positions, increased holdings, reduced holdings, and exited positions”

- How to create an actionable “watch and track list” based on changes and establish a quarterly review rhythm

Why 13F: Under Section 13(f) of the U.S. Securities Exchange Act of 1934, institutional investment managers meeting the threshold must disclose long positions in specific securities quarterly. For authoritative background and details, refer to the SEC’s Division of Investment Management Form 13F FAQs (2025).

Key Information Before Starting (1-Minute Overview)

- Disclosure Frequency and Deadline: Submitted within 45 days after each calendar quarter ends (rule basis: see eCFR’s 17 CFR 240.13f-1). In practice, common disclosure windows are around 2/15, 5/15, 8/15, and 11/15 (typically postponed to the next business day for holidays, a market convention).

- Coverage: Only includes long positions in the “Section 13(f) securities list,” excluding short positions; the list is updated quarterly, see the SEC’s 2024 Fiscal Year Q3 13(f) Securities List (PDF).

- Form Types:

- 13F-HR: Complete quarterly report

- 13F-HR/A: Amended report (correcting prior filings)

- 13F-NT: Notification filing (may involve consolidated filings or filings by others, typically without a complete information table)

- Tools Needed: A browser and a spreadsheet tool (Excel, Google Sheets, etc.).

Checkpoint: Can you confirm that “13F discloses long positions quarterly within 45 days; coverage is limited to the official list and excludes short positions”? If unsure, review the points above or consult the SEC’s 13F FAQs (2025).

Step 1: Locate the Target Institution on EDGAR

- Open the EDGAR search portal: SEC EDGAR Search Portal.

- Enter the institution’s name or CIK in the search bar (e.g., Berkshire Hathaway or the CIK number directly).

- In the results page, enter “13F-HR” in the “Filing Type/Form” filter. To include amendments or notifications, add “13F-HR/A” or “13F-NT” as needed.

- Click “Documents” next to the target record to access the filing index page.

Checkpoint: The index page’s “Document Format Files” section should display the “FORM 13F INFORMATION TABLE,” typically available in HTML and XML formats.

Common Errors and Solutions:

- Only see a cover page without an information table: Likely a 13F-NT (notification). Go back and select a “13F-HR” from the same quarter.

- Can’t find the institution: Verify spelling, try the CIK, or search using the parent company/investment advisor’s full name.

Example Reference: You can compare with an official index page structure containing an information table (e.g., the “FORM 13F INFORMATION TABLE” link position): SEC Filing Index Example (with HTML/XML Information Table).

Step 2: Download and Review the Information Table

- On the index page, click the “FORM 13F INFORMATION TABLE” HTML or XML link:

- HTML: Viewable directly in the browser and copyable to a spreadsheet tool.

- XML: Suitable for structured processing and comparison.

- Key Field Identification:

- nameOfIssuer (issuer name)

- titleOfClass (security type)

- cusip (9-digit CUSIP identifier)

- value (holding value, in USD)

- sshPrnamt / sshPrnamtType (share quantity/unit)

- putCall (marked as PUT/CALL for options)

- investmentDiscretion, votingAuthority (voting rights breakdown: sole/shared/none)

Checkpoint: Can locate the above column names in the information table; XML can be parsed correctly by a spreadsheet or script; CUSIP is 9 digits long.

Pro Tip: If you prefer parsing XML with Excel, the SEC provides illustrated steps and mapping templates, see SEC “How Do I” Guide: Creating a 13F XML Information Table Using Excel.

Common Errors and Solutions:

- XML displays as garbled: View the source in the browser, save as a file, then import into Excel or a script (e.g., Python’s xmltodict/pandas); otherwise, revert to HTML table copying.

- Fields don’t match: Check if you accessed the wrong attachment, if it’s a 13F-NT, or if an amended (/A) version was mixed with the original.

Step 3: Compare Two Periods to Create a “Change List”

Goal: Combine the current and previous periods’ information tables into one spreadsheet, generating four change categories: new positions, increased holdings, reduced holdings, and exited positions, while observing portfolio weight changes.

Process (using CUSIP as the primary key):

- Import both periods’ data: Label them “current” and “previous.” Standardize field names and units (value in USD; align sshPrnamt with sshPrnamtType).

- Match primary key: Use cusip as the key, with nameOfIssuer and titleOfClass as secondary validation.

- Calculate changes:

- New Position: Present in current period, absent in previous.

- Exited Position: Present in previous period, absent in current.

- Increased/Reduced Holdings: Compare changes in sshPrnamt and value.

- Portfolio Weight: Calculate value ÷ total portfolio value for the current period as weight; compare with previous period’s weight.

- Flag Options: If the putCall field appears, group separately (PUT/CALL) and interpret net exposure cautiously (13F excludes short positions).

Checkpoint:

- Comparing the same entity and reporting period;

- Not mixing amended (/A) and original versions;

- Key fields (cusip, value, sshPrnamt) are correctly mapped.

Pro Tip: Prioritize “absolute change amount (value difference) + relative weight change (weight difference)” as dual metrics, then aggregate by industry/theme (e.g., AI, semiconductors, Bitcoin spot ETFs).

Simple Formula Example (Excel logic):

- Match previous period quantity: =XLOOKUP(cusip, previous!cusip_column, previous!sshPrnamt_column, “”)

- Change amount: =current_sshPrnamt - previous_matched_value

- Weight: =current_value / SUMIF(current_flag, all_current_values)

Interpretation Boundaries and Risk Control (Must-Read)

- Lag: 13F is a “quarter-end long position snapshot,” not a transaction log; short-term prices may have already changed.

- Coverage Limits: Only discloses long positions in the official list; excludes short positions, most bonds/swaps/OTC derivatives; options are partially represented.

- Confidential Treatment: Approved confidentiality requests may delay some holdings’ disclosure, later supplemented via amendments.

- Entity Differences: A single group may have multiple sub-advisors filing separately; ensure you’re comparing the same reporting entity.

Compliance Backing: Disclosure timing and scope are governed by SEC rules, see eCFR’s 17 CFR 240.13f-1 (Permanent Regulation Page) and the SEC’s Form 13F FAQs (2025).

Don’t Confuse Short Position Disclosures with 13F (2025 Updates)

- 13F discloses long positions; short position transparency comes from a separate rule (Rule 13f-2 and Form SHO). In October 2023, the SEC adopted short position disclosure rules, see SEC Press Release 2023-221 (Adopting Rule 13f-2).

- On February 7, 2025, the SEC issued Press Release 2025-37 (Interim Exemption and Delayed Compliance), postponing the initial Form SHO reporting date (and thus the first public aggregated data release). This means you still cannot see individual institutions’ “short position details” publicly; the SEC plans to release “per-stock, anonymized” monthly data. Clearly distinguish this from 13F (quarterly, disclosed at the manager level).

Common Questions and Troubleshooting

- Can’t find Information Table: Likely a 13F-NT or missing attachment. Return to the same quarter’s list and find “13F-HR”; check for an amended (/A) version.

- XML parsing fails: Open in browser, save as a file, then import; or switch to HTML and copy to a spreadsheet for cleaning.

- Data doesn’t match: Verify the entity (check for separate sub-advisor filings); ensure no mixing of amended and original versions; confirm correct field mapping.

- No updates: Note the 45-day window after quarter-end and holiday postponements; filings may not yet be disclosed or may await amendments.

Practice and Expansion

Try practicing with these common institutions (for operational demonstration only, not as stock or strategy recommendations):

- Berkshire Hathaway (Buffett)

- Bridgewater Associates (Bridgewater)

- ARK Invest

- Tiger Global

- Renaissance Technologies

Method: Create a “quarterly comparison table” for each institution, recording “new/increased/reduced/exited” positions and weight changes in the top ten holdings; tag by industry/theme of interest.

Establish Your Quarterly Routine (5-Step Review)

- Calendar Reminder: Set alerts around 2/15, 5/15, 8/15, and 11/15 (postponed for holidays).

- Batch Download: Download the current and previous quarter’s Information Tables for tracked institutions (XML preferred).

- Semi-Automated Comparison: Use a standardized template to mark the four change categories and weight shifts.

- Watchlist: Add “new positions + significant increases + rising weights” to the watchlist, tagging by industry and setting trigger conditions.

- Cross-Validation: Combine with company announcements, earnings, and fundamentals for further screening, avoiding conclusions based solely on 13F.

References and Further Reading (Authoritative Sources):

- SEC EDGAR Search Portal (Permanent): SEC EDGAR Search Portal

- 13F Rules and FAQ (2025): SEC Form 13F FAQs

- Disclosure Timing Rule Text (Permanent): eCFR 17 CFR 240.13f-1

- XML Information Table Creation and Parsing Guide: SEC “How Do I” Guide: Creating a 13F XML Information Table Using Excel

- Short Position Disclosure Adoption (2023): SEC Press Release 2023-221 (Rule 13f-2 Adoption)

- Short Position Disclosure Delay and Exemption (2025): SEC Press Release 2025-37 (Interim Exemption)

- Official Example Index Structure (with Information Table Links): SEC Filing Index Example (with HTML/XML)

Disclaimer: This article does not constitute investment advice, nor does it guarantee that any method suits your risk tolerance or goals. Make independent judgments and bear risks at your own discretion; key rules and timelines are subject to the latest SEC announcements.

The SEC 13F filing offers invaluable clues regarding institutional capital allocation at the end of each quarter. Whether you are cross-validating “new positions” or tracking “increased stakes,” you ultimately need a highly efficient, low-cost trading environment to execute these strategies. After accounting for the data lag, transaction friction should not be the factor that compromises the final return.

BiyaPay is designed to provide you with a convenient and low-cost execution channel for your global asset allocation. You can trade US and Hong Kong stocks on one platform without the need for complex foreign accounts. The advantage of zero commission on contract order placement helps you reduce the friction costs associated with establishing and adjusting positions.

For capital management, BiyaPay offers real-time exchange rate checks and conversion services, supporting seamless exchange between 30+ fiat currencies and 200+ cryptocurrencies, with remittance fees as low as 0.5%, ensuring same-day transfer and arrival of funds.

Register quickly with BiyaPay today, allowing your rigorous 13F analysis to be efficiently complemented by a smooth global trading and funding process.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.