- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Afraid of catching a knife while bottom fishing? Itching to miss the opportunity? Use this trick to collect money first and then bottom fishing, Buffett will give you a thumbs up!

In the past week, the market has been completely disrupted. The sudden tariff policy has once again put pressure on the already fragile sentiment, and many stocks with good fundamentals are also unable to escape the fate of collective decline. From manufacturing to technology stocks, there are many stocks that have fallen by more than 20%. Just before everyone had a chance to respond, the market quietly began to recover in these two days.

Many investors are currently standing at a crossroads.

“Entering now, will it be bottom fishing again?”

Unfortunately, I didn’t dare to buy when it first fell. Now that it has risen back, I feel a little unwilling.

I actually have confidence in some companies and have cash on hand, but if I really want to buy, the signal is still lacking…

This is a typical awkward period of “wanting to buy but afraid to buy, taking money but afraid of missing out” At this time, the truly smart money will not dive into the market, but will do so in a safe and efficient way Waiting for opportunities while earning profits - they adopt the classic strategy widely used by Buffett: Cash-Secured Put .

Many investors don’t know “how to wait”.

The most difficult thing in the stock market is often not “judging the direction”, but “deciding when to take action”. Especially in the current situation.

You don’t want to buy it, but you don’t know how to “wait”.

Let’s see which category you belong to.

| Type | Current mental state | Potential demand |

|---|---|---|

| Conservative type | Afraid to buy halfway up the mountain, would rather wait a little longer | Want to buy high-quality stocks, but hope for a “safety margin”. |

| Opportunistic type | I want to bottom fishing but I’m afraid of falling too hard, so I’ve been hesitating | Taking advantage of the decline to create volatility opportunities, but also wanting to control the pace |

| Value type | I have long-term confidence in some companies, but I haven’t made up my mind to enter yet | Want to build positions at a more cost-effective price, accept slow layout |

| Cash type | I have idle funds in hand, but I still can’t find the signal of “must buy”. | If you want your funds to be useful, at least don’t lie down and earn interest |

These users all have one thing in common:

They all hope to buy their favorite stocks at a price they are willing to accept, while not wasting time and money waiting.

Cash-backed put options just meet this demand.

What is a cash-backed put option?

Don’t be scared by the name, it’s not complicated at all. Let’s put it in one sentence:

“I promise to buy this stock at a price I’m willing to accept, but I can still earn some interest before it falls to the price I want to buy.”

How to do it specifically? You “sell” a put option, which means:

If the stock price falls below a certain level (such as the 90 dollars you set), you are willing to buy; in exchange, you receive a premium now, such as 3 dollars per share.

There are two possible outcomes:

- When the stock falls to your set price, you buy it at 90 dollars and earn an extra 3 dollars, which is equivalent to a cost of 87 dollars.

- The stock didn’t fall to your set price. You didn’t buy anything, but you got 3 dollars/share premium for free.

This premium is your subsidy for “waiting a bit”.

Why is this strategy particularly suitable for use now?

The current market has several key characteristics:

High volatility | Premium prices rise

The more uncertain the market, the more expensive the option price, and the more profit can be made when selling PUT.

High-quality stocks are wrongly killed. Opportunities to build positions emerge

Many good companies have been “wrongly killed”, but their long-term value has not changed. It is a good time to build positions in batches.

Not in a hurry to buy, but don’t want to bear the position

The essence of this strategy is “selective bottom fishing”, rather than chasing highs and selling lows.

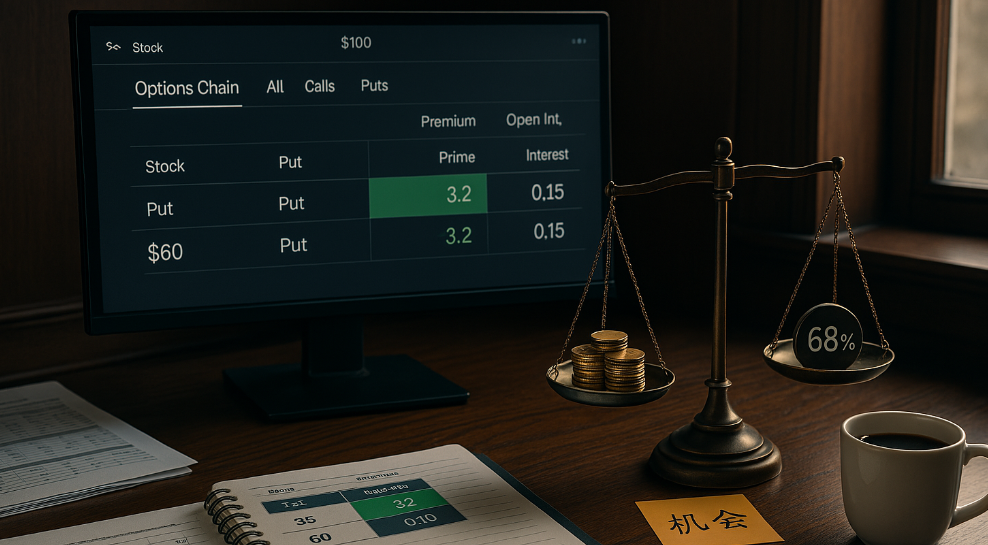

Practical simulation: What would happen if you operate like this now?

Suppose you are following a technology stock that has recently fallen from 120 dollars to 105 dollars and is now slowly rebounding to 110 dollars.

You want to open a position around 95 dollars, but you don’t want to buy it right away.

You can operate like this:

- Sell a 95 dollars put option with an expiration date of 30 days.

- Received a premium of 3 dollars per share, totaling 300 dollars (each option corresponds to 100 shares).

- You prepare 9500 dollars in cash as collateral (cash guarantee);

There are only two possible outcomes:

- If the stock falls below 95 dollars, you will be called over and buy 100 shares, with a total cost of 9500 dollars - 300 dollars = 9200 dollars .

- The stock didn’t fall to 95 dollars, you didn’t buy anything, but you made 300 dollars for nothing.

This is the power of waiting.

If I set a low price, can I get the premium for free?

Many friends who are new to options will ask this question:

I sell a put option. If I set a particularly low price, can I get the premium for free? Will the platform distribute it to me proportionally? Or who has the final say on this price?

The answer is: The premium is not determined by you or the platform, but by the market.

Pricing mechanism = mathematical model + market supply and demand

Simply put, the price of the premium comes from two parts:

| Source | Explanation |

|---|---|

| Theoretical value | A “reasonable valuation” calculated by option pricing models (such as Black-Scholes). |

| Actual transaction price | Buyers and sellers in the market match transactions through pending orders, ultimately forming the true premium price |

The platform does not specify how much money you can earn by selling one PUT. It only displays the theoretical value calculated by the model and matches the final price with the market.

The key factor in determining how much royalties you can receive

We can understand it using the’six core variables’.

| Variable | Explanation |

|---|---|

| Current stock price (S) | The closer the current market price of the stock is to the exercise price, the higher the option value |

| Exercise price (K) | The closer the purchase price you set is to the current price, the higher the premium |

| Expiration time (T) | The further away from the expiration date, the greater the uncertainty and the more expensive the premium |

| Volatility (σ) | The more volatile the stock, the greater the future variables, and buyers are willing to pay higher prices to “buy insurance”. |

| Interest rate ® | Generally, the impact is small, and high interest rates will slightly increase the value of options |

| Dividend (D) | Bullish options are mainly affected, and put options generally have little impact |

Simply put, it means: 'The easier it is for you to’trigger ’ the options you sell, the more money you will receive; thefarther away and safer you sell, the market is only willing to give you symbolic money. ’

For example, suppose the current price of a stock is 120 dollars and you consider selling put options at different exercise prices:

| 行权价 | 到期时间 | 收到的权利金(大概) | 被行权概率 | 实际年化收益(估算) |

|---|---|---|---|---|

| $95 | 1周 | $0.80 | 较低 | 0.8% x 52 ≈ 41.6% |

| $90 | 1周 | $0.35 | 很低 | 0.4% x 52 ≈ 18% |

| $60 | 1周 | $0.01 - $0.02 | 几乎为零 | 0.01% x 52 ≈ 0.52% |

The lower you set, the safer it is, but the market will say, “I basically won’t use this insurance, so I’ll just give you one cent.”

Does setting it low guarantee a profit without loss?

This is also a misconception that many people have at the beginning: ‘If I set it super low, for example, if the stock is 100 dollars and I set it at 60 dollars to buy, isn’t it a guaranteed profit?’

But it doesn’t work, there are two reasons:

- No one will buy your contract. You won’t receive the premium at all

- The premium is very low. Even if the transaction is completed, the profit is almost negligible

The market is not a fool. The “safer” you are, the lower the insurance premium others give you. This is the equivalence of risk and return.

One sentence summary

The premium is the insurance premium "given to you by the market buyer, and the amount depends on how much protection you provide, that is, how much obligation you undertake.

- The closer to the current price, the easier it is to be triggered, and the more you receive.

- The safer and harder it is to trigger, the less money you will receive.

- The platform only provides a trading venue, and the price is determined by market matching.

You might as well think about this strategy from a different perspective.

“I’m not here to make money from this, but to buy good assets at a reasonable price and collect some tolls at the same time.”

If you understand this logic, you have already taken a more stable step than most retail investors who are still “betting on ups and downs”.

Where can I use this strategy? BiyaPay gives you the complete solution

BiyaPay is a global financial platform that integrates trading of US stocks, Hong Kong stocks, digital currencies, and options. Recently, it has supported options trading strategy operations, including “cash-backed put options”.

Why choose BiyaPay?

- Available U or other digital assets quickly exchange dollars and other fiat currencies , flexible use of funds;

- No need to open an offshore bank account to participate in the US stock market.

- Support option Sell to Open operation, clear and intuitive trading interface;

- Hold SEC RIA registration qualification and Canadian MSB compliance license, legitimate and reliable.

Who is suitable for use?

- Individual investors who are optimistic about the value of certain companies in the medium to long term but are not in a hurry to buy immediately.

- Users who have idle USDT or cash assets and want to obtain higher “waiting income”.

- Freelancers, small traders, cross-border digital asset users, etc.

Instead of chasing the rise and fall, it’s better to use rules to “wait for opportunities”.

In the current situation of increasing market uncertainty, we don’t need to use “all-in” and “stop-loss” to gamble mood swing. Instead, we can use rational trading rules , set a “price I am willing to buy” for ourselves, and harvest stable profits in the process of waiting.

A “cash-backed put option” is a strategy for waiting for assignment .

You don’t need to predict the market, you just need to know - how much money are you willing to spend to buy the company you believe in.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.