- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

The Federal Reserve Dot Plot: A Key Tool for Understanding Future Interest Rate Movements

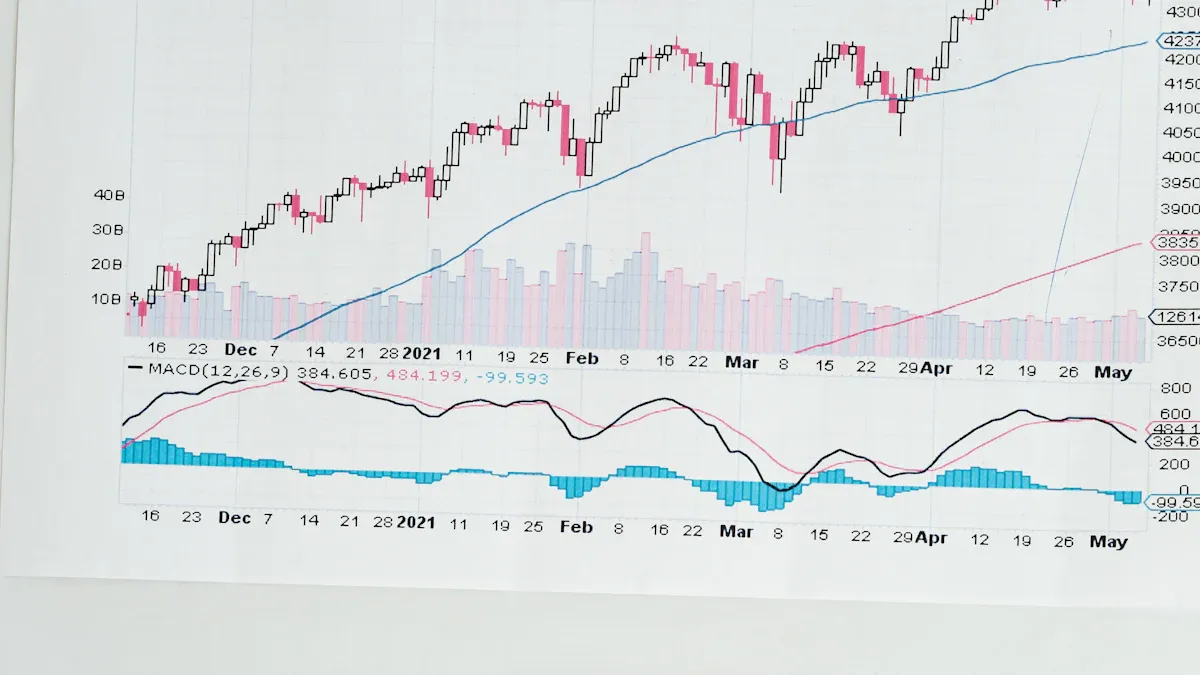

Image Source: pexels

The Federal Reserve dot plot is a chart reflecting Federal Open Market Committee (FOMC) members’ expectations for future interest rates. By analyzing the dot plot, investors can gain clearer insights into market expectations for rate hikes or cuts. Changes in the dot plot often trigger significant volatility in U.S. markets, aiding investors in adjusting asset allocation and risk management strategies.

Key Points

- The Federal Reserve dot plot displays FOMC members’ projections for future interest rates, helping investors understand market expectations.

- Released quarterly, the dot plot requires timely analysis to adjust asset allocations effectively.

- Observing concentrated areas in the dot plot reveals policymakers’ consensus, aiding in risk assessment.

- The dot plot is not an absolute guide; investors should combine it with other economic data for comprehensive analysis.

- Rational interpretation of the dot plot, avoiding sole reliance, enhances the scientific basis of investment decisions.

Introduction to the Federal Reserve Dot Plot

Image Source: pexels

Definition and Structure

The Federal Reserve dot plot is a unique chart showing FOMC members’ forecasts for future federal funds rate levels. Each member marks a dot representing their expectation for the federal funds rate at the end of a specific year. The plot typically uses years as the horizontal axis (X-axis) and interest rate levels as the vertical axis (Y-axis). The distribution of dots across years and rate intervals forms patterns, indicating consensus or divergence among members.

This structure allows investors to visually assess policymakers’ expectations for future rates.

Release Process

The Federal Reserve releases the dot plot quarterly alongside its monetary policy statement. After FOMC meetings, the Fed publishes the latest dot plot on its official website. Investors and analysts promptly interpret the chart to identify signals of interest rate changes.

-

The release process includes:

- FOMC members submit individual forecasts.

- The Fed compiles and creates the dot plot.

- The plot is publicly released on the Fed’s website.

The dot plot is anonymous, with no member names attached, preventing excessive scrutiny of individual views.

Role and Significance

The Federal Reserve dot plot holds significant reference value in financial markets. It reflects policymakers’ views on economic prospects and monetary policy. U.S. market participants use the dot plot to adjust allocations in bonds, stocks, and other assets. Changes in the dot plot often drive fluctuations in market rates and USD exchange rates.

| Role | Significance |

|---|---|

| Rate Forecasting | Guides investment decisions |

| Divergence Analysis | Assesses policy risks |

| Trend Tracking | Captures market expectations |

The dot plot has become a critical tool for investors and analysts to interpret future interest rate trends.

Interpreting the Federal Reserve Dot Plot

X-Axis and Y-Axis Meaning

The dot plot’s horizontal axis (X-axis) represents years, with each year corresponding to FOMC members’ rate forecasts. The vertical axis (Y-axis) shows federal funds rate percentages. By observing forecasts for different years, investors can understand policymakers’ expectations for the rate path. For example, projections for 2024, 2025, and beyond reflect members’ expectations for those years’ rates.

This coordinate system allows market participants to compare rate expectations across years intuitively.

Significance of Each Dot

Each dot in the Federal Reserve dot plot represents one FOMC member’s forecast for the federal funds rate in a specific year. Members base their predictions on individual assessments of economic growth, inflation, and employment. The number of dots corresponds to the number of participating members.

Dots are anonymous, ensuring no member’s identity is linked to a specific forecast. Investors cannot attribute views to individuals but can analyze dot distribution to gauge consensus or divergence.

For instance, if most dots cluster around a specific rate, it indicates strong consensus among members. A scattered distribution suggests greater disagreement, increasing market uncertainty.

Trends and Distribution

The dot plot reveals not only individual views but also overall trends. Investors focus on concentrated dot areas and distribution patterns. Clustered areas typically indicate the mainstream expectation for future rates among FOMC members.

- If the dot plot shows rising rates over the coming years, markets may expect a sustained tightening cycle.

- If dots cluster in lower rate ranges, investors may anticipate continued loose policy.

- Significant changes in dot distribution signal shifts in policy expectations, often increasing market volatility.

By analyzing these trends and distributions, the dot plot helps market participants understand FOMC members’ collective outlook on future rates. U.S. investors use this to adjust bond and stock allocations, addressing risks and opportunities from rate changes.

Investment Applications

Image Source: pexels

Rate Forecasting

Investors frequently use the Federal Reserve dot plot to predict future rate trends. Upon its release, markets quickly analyze FOMC members’ projections for the coming years. For example, in 2023, the dot plot showed most members expected rates to remain high in 2024, prompting a rise in U.S. Treasury yields. Investors interpreted this as a signal of an extended tightening cycle, adjusting bond and stock holdings accordingly. The dot plot reflects policymakers’ attitudes and provides critical forward-looking signals.

Market Reactions

The dot plot’s release often triggers notable market movements. If it indicates higher-than-expected rate forecasts, the USD exchange rate and short-term Treasury yields typically rise, while stocks may face pressure. Conversely, hints of future rate cuts boost risk appetite, lifting stock and high-yield bond prices. After a 2022 dot plot release, when members broadly raised rate expectations, 30-year U.S. Treasury prices fell sharply, prompting investors to adjust allocations.

Strategy Adjustments

Asset managers use the dot plot as a key reference in shaping investment strategies but avoid relying on it alone.

- The dot plot signals potential rate directions, but investors should also monitor economic growth, inflation, and other fundamentals.

- Forecasts carry uncertainty, with historical data showing actual rate paths often diverging from predictions.

- In Q2 2024, markets widely expected a U.S. economic slowdown, with easing inflation pressures suggesting looser policy. Investors increased long-term bond allocations and reduced high-risk assets.

Professional firms recommend combining the dot plot with other economic indicators to dynamically adjust portfolios and enhance risk management.

Considerations

Limitations

While the Federal Reserve dot plot provides valuable insights into rate expectations, it has clear limitations. First, it reflects only FOMC members’ individual views at a specific time, not final policy decisions. Second, rapidly changing economic conditions can prompt members to revise forecasts. The dot plot lacks detailed economic assumptions, making it hard for investors to discern the reasoning behind predictions.

For example, in 2022, significant U.S. economic data volatility led to notable deviations between dot plot forecasts and actual rate paths. Investors should view the dot plot as a dynamic reference, not an absolute guide.

Expectation Discrepancies

FOMC members’ forecasts are influenced by subjective judgments, leading to potential discrepancies between the dot plot and actual rate movements. Historical data shows members often diverge on key variables like inflation and employment.

- In 2018, the dot plot projected faster rate hikes, but slowing U.S. growth led to fewer hikes than expected.

- Post-2020 pandemic, the dot plot quickly adjusted downward, reflecting limited responsiveness to sudden events.

Investors should be cautious of these discrepancies, integrating additional market and economic data into their analyses.

Interpretation Tips

Professional firms recommend a rational approach to interpreting the dot plot:

- Focus on concentrated dot areas to identify FOMC members’ mainstream views.

- Combine with U.S. inflation, employment, and other macroeconomic data to analyze rate trends comprehensively.

- Avoid treating the dot plot as the sole decision-making basis; integrate it with policy statements and economic forecasts.

A multi-angle analysis enhances understanding of market changes and improves investment decision-making.

The Federal Reserve dot plot offers forward-looking insights into rate trends. By analyzing it, market participants can better grasp policy directions and optimize asset allocations. Rational interpretation, combined with diverse economic data, enhances the scientific basis of investment decisions. Professional firms advise using the dot plot as a supplementary tool while staying attuned to U.S. market dynamics.

FAQ

How often is the Federal Reserve dot plot released?

The Fed releases the dot plot quarterly, synchronized with FOMC meeting conclusions, and publishes it on its official website.

Can the dot plot directly determine future rates?

The dot plot reflects individual FOMC member forecasts. Actual rate decisions depend on economic data and market conditions, determined collectively by the Fed.

How can investors use the dot plot to adjust strategies?

By analyzing dot plot trends, investors can gauge future rate directions and adjust U.S. market bond and stock allocations accordingly.

How does the dot plot differ from Fed statements?

The dot plot shows members’ rate expectations, while Fed statements summarize current economic conditions and policy stances, complementing each other.

Is the dot plot suitable for all investors?

The dot plot is ideal for those tracking U.S. markets. Beginners can combine it with other economic data to better understand trends and enhance decision-making.

The Fed Dot Plot serves as a critical tool for investors to anticipate interest rate trends, enhancing asset allocation and risk management, but challenges like high cross-border remittance fees, exchange rate volatility, and platform data delays can increase costs or reduce trading efficiency.

BiyaPay offers a seamless financial platform to address these obstacles. Our real-time exchange rate queries provide instant access to fiat and digital currency conversion rates across various currencies, ensuring transparency and efficiency. With remittance fees as low as 0.5%, covering most countries globally and enabling same-day transfers, BiyaPay supports your rate-sensitive investments with swift fund access. Plus, you can trade US and Hong Kong stocks via our stocks feature without needing an overseas account, leveraging Dot Plot insights to refine your strategies. Sign up with BiyaPay today to boost your trading efficiency, navigate rate fluctuations confidently, and achieve steady wealth growth!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.