- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Understanding Margin Accounts: How to Use Leverage to Increase Investment Returns?

Image Source: unsplash

When investing, you often focus on maximizing returns with limited capital. A margin account lets you use leverage to expand your investment capacity. You can use a portion of your funds as margin to borrow additional capital for trading. This approach can boost profits but also brings higher risks. You need to understand leverage’s role and master safe operational methods to better protect your capital.

Key Points

- Margin accounts allow you to control larger investments with less capital, amplifying returns through leverage.

- When using leverage, monitor initial and maintenance margin requirements to avoid forced liquidation risks.

- Setting stop-loss points and reasonable leverage ratios can effectively reduce investment risk and protect capital.

- Compare borrowing rates across brokers; choosing lower-rate options reduces financing costs.

- Maintain liquidity and reserve cash to handle market volatility, ensuring investment safety.

Margin Account Mechanics

Definition and Mechanism

You can choose to open a margin account for investing. A margin account is a special securities account where you use a portion of your funds as margin to borrow additional capital from a broker for investments. This allows you to control a larger investment scale with less capital. In the U.S. market, investors commonly use margin accounts to trade stocks, ETFs, and other financial products.

When using a margin account, you must adhere to initial and maintenance margin requirements. The initial margin is the minimum percentage of funds you need to invest when opening a position. The maintenance margin is the minimum equity you must maintain during the holding period. If your account balance falls below the maintenance margin, the broker will require you to add funds, or they may force-liquidate your positions.

The table below outlines the basic mechanics of margin accounts:

| Type | Description |

|---|---|

| Initial Margin | Limits the maximum leverage for successful stock investments. For example, a 50% initial margin requirement means a 2:1 leverage ratio at the start. |

| Maintenance Margin | Forces investors to sell (or add funds) before losses escalate, preventing long-term holding of leveraged positions. |

| Leverage Impact | Leverage increases risk during market fluctuations, especially with sharp stock price drops, potentially triggering margin calls. |

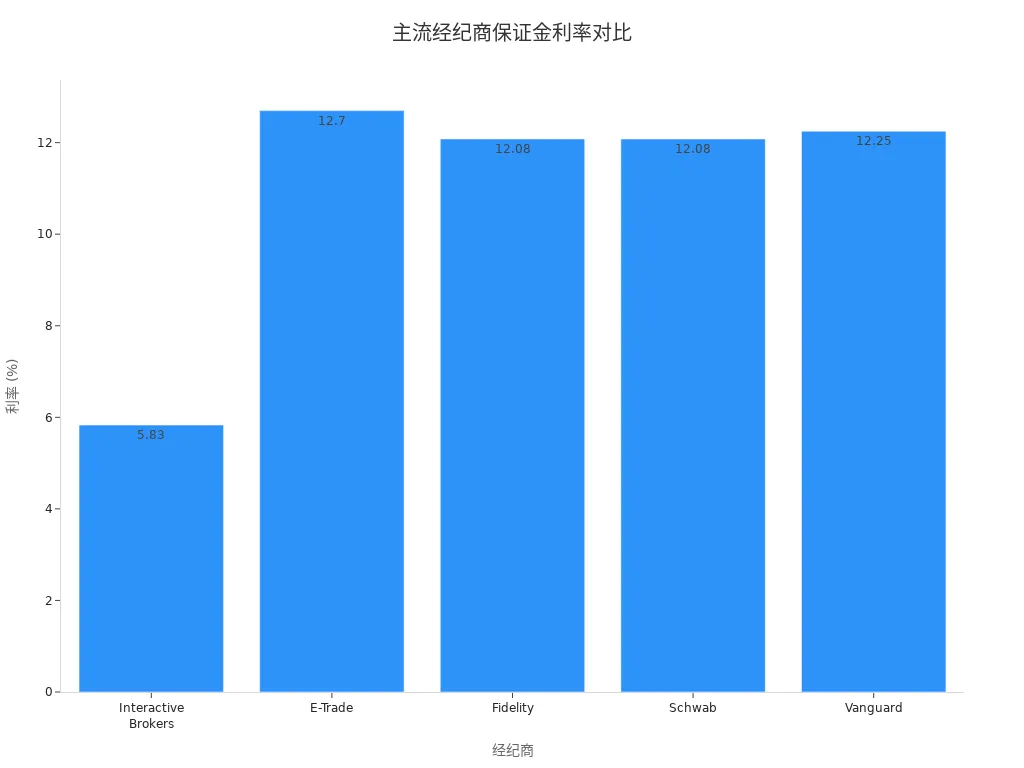

When opening a margin account in the U.S. market, you also need to consider borrowing rates. Margin rates vary significantly among brokers, directly affecting your financing costs. The table below lists margin rates for major U.S. brokers (in USD):

| Broker | Rate |

|---|---|

| Interactive Brokers | 5.83% |

| E-Trade | 12.70% |

| Fidelity | 12.08% |

| Schwab | 12.08% |

| Vanguard | 12.25% |

You can visually compare these rates in the bar chart below:

Tip: When choosing a margin account, always compare brokers’ rates and terms. Lower rates reduce your financing costs, boosting returns.

Leverage Basics

In a margin account, leverage allows you to control larger positions with less capital. The leverage ratio is determined by the initial margin. For example, a 50% initial margin lets you invest USD 20,000 in stocks with USD 10,000 capital, yielding a 2:1 leverage ratio. A 25% initial margin allows USD 40,000 in stocks with USD 10,000, a 4:1 leverage ratio.

You need to understand how leverage works:

- Leverage amplifies your profits. If a stock rises 10%, your actual return exceeds that of a non-leveraged position.

- Leverage also magnifies losses. A 10% drop results in a larger loss, potentially triggering a margin call or forced liquidation.

- Higher leverage ratios increase risk. You should select a leverage ratio based on your risk tolerance in practice.

When using a margin account in the U.S. market, you must constantly monitor your account balance and market fluctuations. Controlling leverage ratios and promptly adding margin can effectively reduce the risk of forced liquidation.

Tip: When using leverage, set stop-loss points to avoid significant capital losses from sharp market swings.

Leverage Impact

Image Source: pexels

Profit Amplification

When using leverage, you can control a larger investment amount with less capital, increasing potential profits in a rising market. For example, with USD 10,000 as margin, you buy USD 20,000 in stocks via a margin account. If the stock rises 10%, your profit isn’t USD 1,000 but USD 2,000, yielding a 20% return on your capital.

The table below illustrates profit changes under different leverage ratios:

| Leverage Ratio | Capital (USD) | Total Position (USD) | Stock Gain | Actual Profit (USD) | Capital Return |

|---|---|---|---|---|---|

| 1:1 | 10,000 | 10,000 | 10% | 1,000 | 10% |

| 2:1 | 10,000 | 20,000 | 10% | 2,000 | 20% |

| 4:1 | 10,000 | 40,000 | 10% | 4,000 | 40% |

You can see that higher leverage ratios significantly amplify profits. In a bull market, leverage can accelerate wealth growth.

Tip: While chasing high returns, remember that leverage’s amplification applies to both profits and losses.

Risk Amplification

While enjoying higher returns, you face greater risks. Leverage amplifies not only profits but also losses. If the market declines, your losses scale up proportionally.

Suppose you use USD 10,000 to buy USD 20,000 in stocks via a margin account. A 10% drop results in a USD 2,000 loss, not USD 1,000, yielding a -20% return on capital.

The table below shows loss scenarios under different leverage ratios:

| Leverage Ratio | Capital (USD) | Total Position (USD) | Stock Decline | Actual Loss (USD) | Capital Return |

|---|---|---|---|---|---|

| 1:1 | 10,000 | 10,000 | -10% | -1,000 | -10% |

| 2:1 | 10,000 | 20,000 | -10% | -2,000 | -20% |

| 4:1 | 10,000 | 40,000 | -10% | -4,000 | -40% |

In a declining market, losses accumulate quickly. If losses push your account below the maintenance margin, the broker will issue a margin call, requiring additional funds. Failure to comply may lead to forced liquidation, selling your stocks to prevent further losses.

Note: When using leverage, monitor market fluctuations and account balances closely. Setting stop-loss points and adding margin promptly are key to risk control.

Margin Account Risks

Image Source: unsplash

Primary Risks

When using a margin account, you must be aware of multiple risks. First, leverage amplifies losses. A market downturn results in larger losses than non-leveraged positions. You may also face forced liquidation. If your account falls below the maintenance margin, the broker will demand additional funds. If you can’t comply, they will sell your holdings to limit further losses.

You also face risks from market volatility. Sudden events can cause sharp price swings, rapidly depleting your margin account’s funds. Additionally, changes in borrowing rates affect total costs. If you open a margin account with a licensed Hong Kong bank, the bank may adjust financing rates based on market conditions, impacting your returns. Liquidity risk is another concern—if market volume is low, you may struggle to sell at favorable prices, exacerbating losses.

Tip: When operating a margin account, monitor account balances and market dynamics to avoid uncontrollable losses from sudden events.

Risk Management

You can reduce risks and protect capital through various strategies. Professional traders suggest:

- Set appropriate stop-loss levels. Predefine stop-loss prices to prevent excessive losses.

- Closely monitor margin levels. Regularly check account funds to ensure they exceed maintenance requirements.

- Avoid excessive leverage. Choose a leverage ratio based on your risk tolerance to avoid liquidation.

- Track changes in financing rates. When opening a margin account with a licensed Hong Kong bank or similar institution, compare rates periodically to select optimal options.

- Maintain liquidity. Reserve some cash to cover unexpected margin calls.

In practice, stay cautious. Diversify investments to avoid concentrating funds in a single asset, further reducing overall risk.

Investment Advantages and Safety Tips

Leverage Advantages

When using a margin account, you can flexibly adjust strategies. Leverage lets you control larger positions with less capital, improving capital efficiency. You can diversify by allocating funds across different stocks or ETFs, reducing the impact of single-asset volatility. To hedge market risks, you can use a margin account for long-short strategies, holding positions that benefit from both rises and falls to minimize overall volatility.

Tax-wise, losses from margin trading can offset capital gains from other investments, lowering your tax burden. Borrowing interest is often deductible as investment interest, subject to regulations. You must meticulously record and report all margin trading activities to ensure accurate, compliant tax filings.

Tip: When planning investments, combine diversification and hedging to enhance return stability.

Safe Operations

When operating a margin account, prioritize risk control. Set stop-loss points to exit trades promptly and limit losses. Choose a reasonable leverage ratio based on your risk tolerance. Regularly check account balances to ensure they meet maintenance margin requirements.

When opening a margin account with a licensed Hong Kong bank or similar institution, leverage their risk alerts and capital management tools. Reserve cash to handle unexpected margin calls. Monitor changes in borrowing rates and select lower-cost financing options to reduce investment pressure.

In practice, adopt these capital management methods:

- Use only a portion of funds for leveraged investments, keeping ample reserves.

- Periodically evaluate your portfolio and adjust holdings as needed.

- Record every trade for tax reporting and risk review.

Note: While pursuing high returns, always prioritize capital safety, manage funds scientifically, and use leverage rationally.

With a margin account, you can amplify investment returns but face higher risks. Use leverage scientifically, set stop-loss points, and monitor account changes closely. Balance returns and risks, follow safety tips, and maintain a rational investment mindset. Only then can you protect capital and achieve steady long-term growth.

FAQ

What’s the difference between a margin account and a regular cash account?

With a margin account, you can borrow funds to invest. A cash account only uses your own funds for trading stocks. Margin accounts amplify returns but increase risk.

Can I adjust the leverage ratio anytime?

You can adjust leverage by increasing or decreasing positions or adding margin. Choose a leverage ratio based on your risk tolerance.

What happens if stock prices drop significantly?

Your account may fall below the maintenance margin, triggering a margin call. If you can’t add funds promptly, the broker will sell your stocks.

How do margin account borrowing rates affect returns?

Borrowed funds accrue interest. Higher rates increase financing costs. Choose brokers with lower rates to reduce investment pressure.

What fees are involved in margin account investing?

You pay borrowing interest and trading fees. Fees vary by broker. Understand all costs upfront to plan investment expenses effectively.

Margin accounts amplify your investment returns through leverage, offering small-capital investors access to larger markets, but challenges like high cross-border remittance fees, exchange rate volatility, and platform complexities can increase costs or reduce trading efficiency.

BiyaPay provides a seamless financial platform to address these hurdles. Our real-time exchange rate queries give you instant access to fiat and digital currency conversion rates across various currencies, ensuring transparency and efficiency. With remittance fees as low as 0.5%, covering most countries globally and enabling same-day transfers, BiyaPay supports your margin trading with swift fund access. Plus, you can trade US and Hong Kong stocks via our stocks feature without needing an overseas account, optimizing your leverage strategies. Sign up with BiyaPay today to enhance your fund efficiency, use leverage wisely, and achieve steady wealth growth!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.