- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Price Action Trading: How to Make Informed Investment Decisions by Analyzing Price Trends?

Image Source: pexels

You can make investment decisions by analyzing price movements themselves, which is the core of price action trading. Price fluctuations reflect market participants’ sentiment and supply-demand changes. You don’t need complex indicators; you only need to focus on price changes on the chart. This can help you understand the market more intuitively, improving the scientific nature and success rate of your investment decisions.

Key Points

- Price action trading helps you make investment decisions by observing price movements, simple and direct, suitable for beginners.

- When judging market trends, focus on changes in price highs and lows to identify upward or downward trends, reducing the risk of trading against the trend.

- Support and resistance levels are key tools, helping you determine entry and exit timings, improving trading success rates.

- Develop clear entry and exit strategies, set stop-loss and take-profit points, ensuring every trade has a clear exit plan.

- Emphasize risk management, diversify investments, control emotions, and stay rational to make informed decisions in the market.

Basic Concepts

Definition of Price Action Trading

You can make investment decisions by observing changes in market prices, which is the core idea of price action trading. Price action trading does not rely on complex technical indicators or extensive data analysis. You only need to focus on the performance of prices on the chart. For example, a price increase indicates stronger buying forces, while a price decrease shows sellers dominating. You can judge market trends and sentiment by analyzing price highs, lows, closing prices, and opening prices. Many professional investors in the U.S. market use this method because it is simple and direct, helping you quickly understand market dynamics.

Tip: You can practice identifying price movements on a “naked chart” without any auxiliary tools to better develop your market sensitivity.

Differences from Other Analysis Methods

You may have heard of technical analysis and fundamental analysis. Technical analysis relies on various indicators, such as moving averages, MACD, etc. Fundamental analysis focuses on a company’s financial condition, industry prospects, etc. Price action trading differs from these methods. You only look at the price itself, without relying on other data. This reduces distractions during analysis, allowing you to focus on the market’s true supply-demand changes.

The table below compares the three common analysis methods:

| Analysis Method | Primary Basis | Advantages | Disadvantages |

|---|---|---|---|

| Price Action Trading | Price Movements | Simple, Intuitive | Requires Strong Observation Skills |

| Technical Analysis | Technical Indicators | Diverse Tools | May Be Overly Complex |

| Fundamental Analysis | Financial & Industry Data | Long-Term Reference Value | Information Lag |

You can choose the method that suits your investment style. Price action trading is ideal for investors who prefer a simplified process and high efficiency.

Price Action Trading Methods

Image Source: pexels

Trend Identification

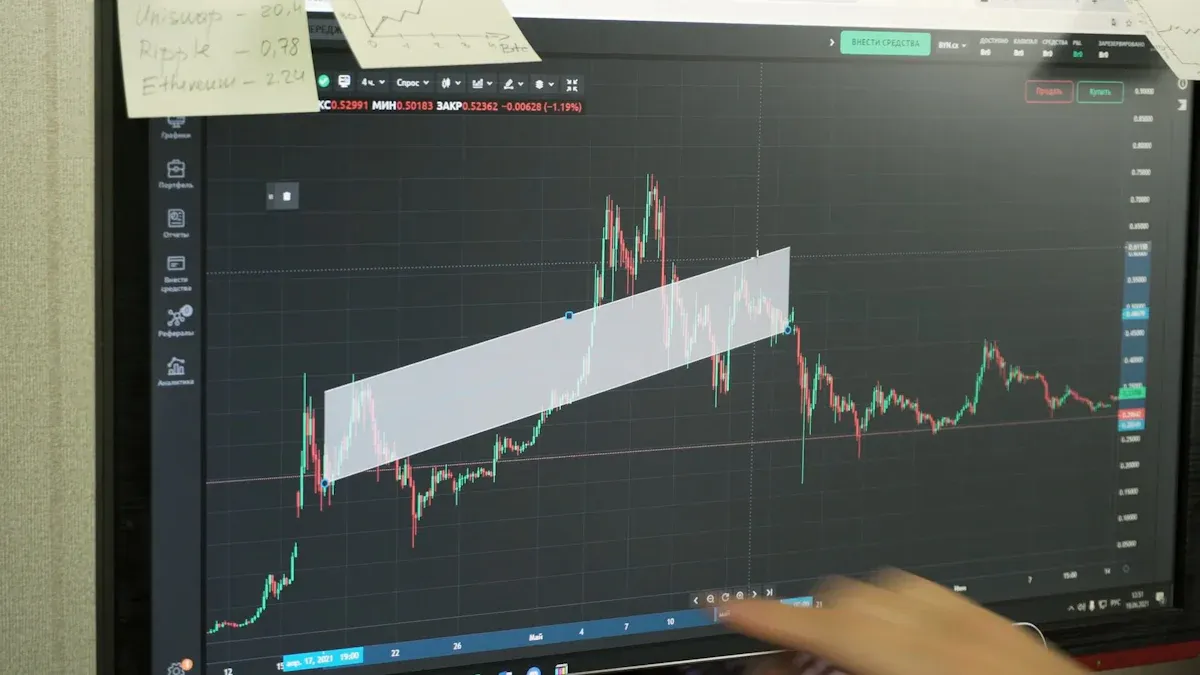

You can judge market trends by observing changes in price highs and lows. In price action trading, trend identification is the most fundamental skill. If you see prices continuously reaching new highs, with pullbacks forming higher lows, this typically indicates an upward trend. Conversely, if prices keep hitting new lows, with rebounds forming lower highs, it signals a downward trend.

For example, in the U.S. stock market, if a stock rises for several consecutive days, with each day’s closing price higher than the previous day, this is a clear upward trend. You can use this trend to trade with the momentum, reducing risks from trading against the trend.

Tip: You can draw straight lines connecting highs and lows on a naked chart to help clearly identify the trend direction.

Support and Resistance

Support and resistance are commonly used tools in price action trading. A support level is an area where prices tend to stop falling and rebound, while a resistance level is where prices often face pressure and pull back during an uptrend. You can identify these levels by observing historical price reversal points.

For instance, in the U.S. market, if a stock repeatedly dips to $50 and rebounds, that area is a support level. If it frequently faces resistance and pulls back around $70, that’s a resistance level. You can use these zones to set buy or sell plans, improving trading success rates.

Candlestick and Chart Patterns

Candlestick charts are a vital tool in price action trading. Each candlestick includes the opening price, closing price, high, and low. You can judge market sentiment by observing candlestick arrangements and combinations. For example, consecutive large bullish candles indicate strong buying pressure; a “hammer” or “engulfing pattern” may signal a trend reversal.

In practice, you can combine candlestick patterns with trend analysis to develop more scientific entry and exit strategies. Naked chart analysis lets you focus on price itself, avoiding over-reliance on technical indicators and simplifying decision-making.

Signals and Timing

Image Source: pexels

Identifying Buy and Sell Signals

You can identify buy and sell signals by observing specific patterns in price movements. In price action trading, common buy signals include “hammer” lines, “engulfing patterns,” and breakouts above key resistance levels. For example, on a daily candlestick chart of a U.S. stock, if you spot a hammer with a long lower shadow after a downtrend, with the closing price above the opening, it often signals strong buying support, suggesting a potential rebound. You can treat this pattern as a potential buy signal.

Sell signals are equally important. For instance, after a sustained uptrend, a “shooting star” or “evening star” pattern may indicate weakening buyer momentum, suggesting a possible pullback. If you see a price break above a prior high on a naked chart but quickly retreat with a closing price below the opening, this could be a short-term sell signal.

Tip: You can confirm signal reliability by combining them with support and resistance levels. A buy signal near a strong support zone is more reliable.

Entry and Exit Strategies

You need clear entry and exit strategies to effectively manage risks in trading. For entry, you can wait for a price to break a key resistance level or enter after a clear reversal signal. For example, if a U.S. tech stock repeatedly faces resistance at $100 but breaks through with high volume and closes high, you can consider buying on the breakout.

Exit strategies are equally critical. You can set take-profit and stop-loss points to ensure every trade has a clear exit plan. For instance, after buying, if the price hits a prior high of $120, you can sell part or all of your position. If it falls below the entry support, say $95, you can stop out to avoid larger losses.

You can also use batch entries and exits to reduce single-decision risks. For example, buy in three stages with equal capital, then sell in batches as the price hits targets. This smooths costs and mitigates market volatility impacts.

Case Study: Suppose you observe a U.S. stock forming strong support at $50, repeatedly holding without breaking, and showing a hammer pattern. You can buy near $51, set a stop-loss at $49, and target $60. As the price hits the target, sell gradually to maximize gains.

By using these methods, you can make more scientific timing decisions, improving trading success. Price action trading emphasizes understanding the market itself, helping you make rational decisions in complex environments.

Risks and Pitfalls

Common Pitfalls

When learning price action trading, you may fall into common pitfalls. Many focus only on single candlestick patterns, ignoring the broader trend. You might assume every hammer or engulfing pattern signals a reversal, but that’s not always true. You need to combine trends, support, and resistance for comprehensive judgment. Some investors overly rely on naked charts, ignoring market news and macro conditions, which reduces analysis accuracy.

Tip: You can build a habit of reviewing trades, identifying and correcting biases in your analysis.

Risk Management

You must prioritize risk management in practice. Before each trade, set a stop-loss point to define your maximum acceptable loss. Don’t invest all your capital in a single asset; diversify to reduce risk. You can use batch entries and exits to lessen market volatility impacts. Capital management is the foundation of long-term stable profits. You can use a table to track each trade’s profit and loss, helping you control risk better.

| Trading Stage | Risk Control Measures |

|---|---|

| Entry | Set Stop-Loss |

| Holding | Diversify Investments |

| Exit | Batch Take-Profit |

Psychological Factors

You’re prone to emotional influences during trading. Market fluctuations can trigger panic or greed, leading to impulsive actions. You need to stay rational and stick to your trading plan. By keeping a trading journal, you can analyze emotional changes and improve self-control. You must understand that price action trading relies on market comprehension, and only by controlling emotions can you make informed decisions.

Suggestion: Before each trade, ask yourself if you’re following risk management principles to avoid emotional deviations.

You can enhance the scientific nature of your decisions through price action analysis. Rational analysis and risk control are vital for long-term success.

- If you focus only on profits, you risk emotional decisions and impulsive trading.

- By adopting a process-driven approach, you maintain consistency and resilience.

- By treating wins and losses as data points, not personal successes or failures, you can respond to market changes more rationally.

You can combine your situation, continuously learn, and practice price action trading methods. Rational investing, avoiding blind trend-following, will steadily improve your investment skills.

FAQ

Is price action trading suitable for beginners?

You can start with price action trading. The method is simple, focusing on observing price movements. You don’t need complex tools. With consistent practice, you can gradually improve your analytical skills.

What software is needed for price action trading?

You can use common charting software. For example, many U.S. market investors choose basic candlestick chart tools. You don’t need advanced indicators, just focus on price changes.

How do you judge the validity of price action signals?

You can combine trends, support, and resistance levels for judgment. Signals near key zones are more reliable. You should review trades often to build experience.

Can price action trading be used in different markets?

You can apply price action trading in U.S. stocks, forex, futures, and other markets. As long as public price data is available, you can analyze movements and develop strategies.

How important is capital management in price action trading?

You must prioritize capital management. Set stop-loss points before each trade and diversify investments. This effectively controls risk and protects your capital.

Price action trading empowers you to make informed investment decisions by analyzing price movements directly, but challenges like high cross-border remittance fees, exchange rate volatility, and platform data delays can hinder trading efficiency or increase costs.

BiyaPay offers a seamless financial platform to overcome these obstacles. Our real-time exchange rate queries provide instant access to fiat and digital currency conversion rates across various currencies, ensuring transparency and efficiency. With remittance fees as low as 0.5%, covering most countries globally and enabling same-day transfers, BiyaPay supports your price action trading with swift fund access. Plus, you can trade US and Hong Kong stocks via our stocks feature without needing an overseas account, integrating price action analysis to optimize trade timing. Sign up with BiyaPay today to enhance your trading efficiency and achieve steadier wealth growth through rational investing!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.