- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Exploring Certificates of Deposit (CDs): A Steady Choice for Low - Risk Investments

Image Source: unsplash

Are you looking for a low-risk investment with stable returns? Certificates of Deposit (CDs) provide capital safety and fixed income, making them ideal for short- to medium-term savings goals. The table below shows average annual returns for various low-risk products:

| Investment Product | Average Annual Return |

|---|---|

| 12-Month CD | 1.93% |

| Inflation | 2.56% |

| Bonds | Higher Returns |

While CD returns are slightly below inflation, their minimal risk makes them a strong choice for conservative financial planning.

Key Highlights

- Certificates of Deposit (CDs) are low-risk investments, ideal for investors seeking capital safety and stable returns.

- When choosing a CD, consider the term and amount to ensure funds aren’t needed before maturity.

- CD interest rates are typically higher than savings accounts, helping offset inflation-related value loss.

- Early withdrawal penalties apply, so review terms carefully to avoid unnecessary losses.

- CDs are suitable for short- to medium-term savings goals, such as down payments or education funds, aiding financial planning.

Introduction to Certificates of Deposit

Image Source: pexels

Definition and Features

Think of a Certificate of Deposit as a fixed-term savings product. You deposit funds with a bank, which holds them for an agreed period and pays interest at maturity. CDs typically offer higher interest rates than regular savings accounts. You choose a term, such as 6 months, 12 months, or longer, but withdrawing funds before maturity incurs a penalty. CDs are available through licensed Hong Kong banks or U.S. banks, with principal and interest generally insured by the FDIC up to $250,000.

The table below highlights key differences between CDs and savings accounts:

| Feature | Certificate of Deposit (CD) | Savings Account |

|---|---|---|

| Fixed Term | Specific term, months to years | No fixed term |

| Interest Rate | Typically higher | Lower |

| Early Withdrawal Penalty | Usually applies | Typically none |

| Safety | FDIC-insured up to $250,000 | FDIC-insured up to $250,000 |

How It Works

When selecting a CD, you decide on the deposit amount and term. The bank sets an interest rate based on the term. Your funds are locked until maturity, and early withdrawal incurs a penalty, often a portion of the interest. Interest is typically paid at maturity, though some banks offer monthly or quarterly payments. You can open a CD through Hong Kong or U.S. bank branches, online banking, or apps. The process is simple, ideal for achieving short- or medium-term savings goals.

Tip: CDs are great for planning down payments, education savings, or other goals. Choose terms and amounts based on your needs.

Benefits of CDs

Image Source: unsplash

Capital Safety

Capital safety is often your top concern when choosing a CD. As a low-risk investment, CDs are backed by banks in Hong Kong or the U.S., typically insured by the FDIC.

- The FDIC insures each depositor up to $250,000 per bank, covering principal and interest.

- Even if the bank faces issues, your funds remain secure.

- CDs are ideal for safely allocating funds for short- or medium-term goals without worrying about capital loss.

Tip: Prioritize FDIC-insured institutions to enhance the safety of your funds.

Stable Returns

CDs offer stable returns by locking in a fixed interest rate at the time of deposit.

- Fixed rates ensure predictable interest income throughout the term.

- You’re shielded from market interest rate fluctuations.

- CDs are backed by federal insurance, further reducing risk.

- Compared to savings accounts, CDs offer higher rates, ideal for stable income.

Use CDs for goals like down payments or education savings by selecting appropriate terms and amounts for reliable planning.

Interest Rate Advantage

CDs generally offer higher interest rates than savings accounts, making them attractive for maximizing returns. The table below shows current market rates:

| Item | Value |

|---|---|

| Current CD Rate | 4.40% APY |

| Current Inflation Rate | 2.3% |

| Average CD Rate | 2.04% APY |

CD rates exceed inflation and savings account rates, providing better returns and helping preserve purchasing power. For those aiming to grow funds over the short or medium term, CDs are a prudent choice.

Risks of CDs

Liquidity Restrictions

Liquidity is a key consideration when choosing a CD. Your funds are locked until maturity, limiting access. Early withdrawal typically results in financial penalties.

- Ensure funds allocated to CDs won’t be needed for daily or emergency expenses.

- Use idle funds for CDs to avoid liquidity issues.

Tip: Match CD terms to your savings goals and allocate funds across different terms to improve overall liquidity.

Interest Rate Risk

When you purchase a CD, the interest rate is locked at the outset. Market rate changes can affect your returns.

- Rising market rates make new CDs more attractive, while your locked rate remains unchanged, potentially missing higher yields.

- In 2023, U.S. market rates rose, with some bank CDs offering yields of 5% or more. CDs bought at lower rates may seem less competitive.

- Conversely, declining rates make your locked high-rate CD more valuable.

| Source | Description |

|---|---|

| Why Financial Institutions Offer Higher Interest Rates for CDs | In 2023, rising rates pushed CD yields to 5% or higher, reflecting economic impacts on bank offerings. |

| How to Invest When Interest Rates Are Rising | “Money market accounts and CDs have higher rates than years ago,” making CDs appealing in rising rate environments. |

| How do interest rates work? | Rising rates increase CD and savings account APYs, making CDs more favorable post-rate hikes. |

When facing rate changes, consider these options:

- In falling rate environments, lock in higher-rate CDs early to secure better returns.

- In rising rate environments, wait for higher rates or choose shorter-term CDs for flexibility.

Tip: Spread investments across different CD terms to mitigate interest rate fluctuations.

Early Withdrawal Penalties

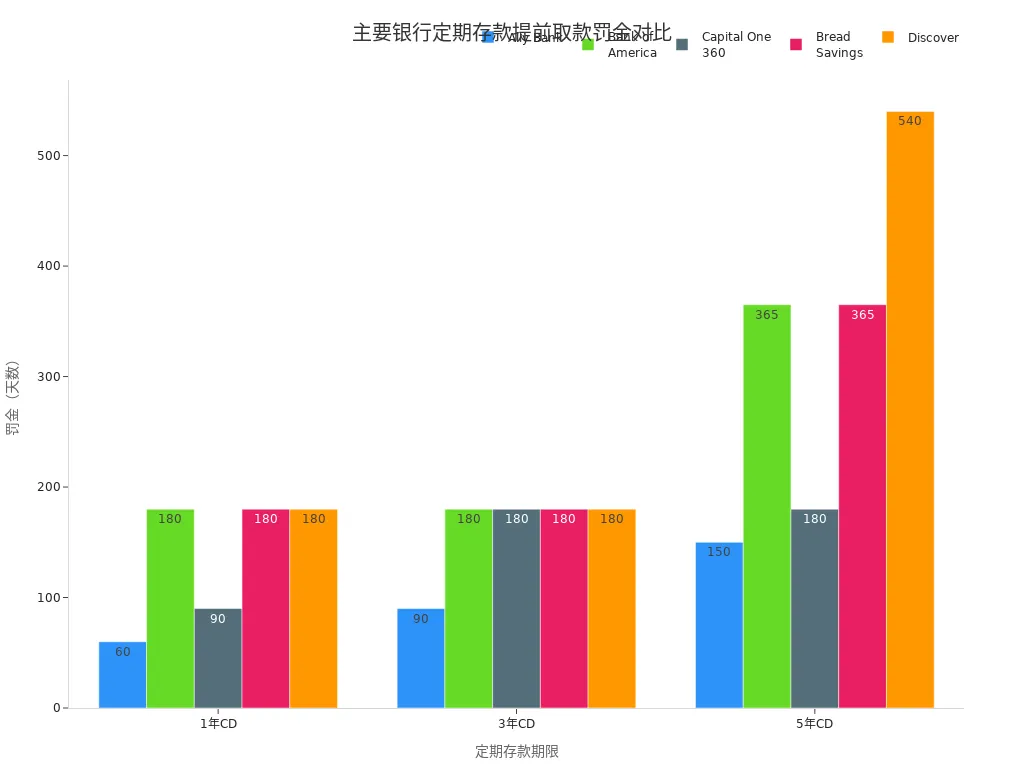

Withdrawing funds from a CD before maturity typically incurs a penalty, varying by institution and term. The table below outlines early withdrawal penalties for major banks:

| Institution | 1-Year CD | 3-Year CD | 5-Year CD |

|---|---|---|---|

| Ally Bank | 60 days’ interest | 90 days’ interest | 150 days’ interest |

| Bank of America | 180 days’ interest | 180 days’ interest | 365 days’ interest |

| Capital One 360 | 3 months’ interest | 6 months’ interest | 6 months’ interest |

| Bread Savings | 180 days’ interest | 180 days’ interest | 365 days’ interest |

| Discover | 6 months’ interest | 6 months’ interest | 18 months’ interest |

Plan your finances to avoid early withdrawals, which can erode interest earnings. Allocate short- and long-term funds separately to minimize penalties.

Note: Review the bank’s terms before opening a CD to understand early withdrawal policies and penalties.

Suitable Investors

Risk-Averse Investors

If you’re highly sensitive to investment risk, CDs offer greater peace of mind. Depositing funds in licensed Hong Kong or U.S. banks typically includes FDIC insurance. Data shows 55+ age groups prefer CDs for their low-risk nature. The table below shows CD investment by age group:

| Age Group | Percentage Investing in CDs |

|---|---|

| Under 35 | 23% |

| 55 and Over | 41% |

Older investors favor CDs for their safety. If you prioritize capital preservation and stable returns, CDs are an excellent fit.

Short- to Medium-Term Savings Goals

CDs help achieve goals like down payments, education, or retirement savings with fixed rates for predictable planning.

- CDs offer fixed rates, ideal for specific financial goals.

- For homebuyers, CDs are more attractive than savings accounts due to higher yields.

- For retirement, IRA CDs provide tax-advantaged savings.

Choose terms aligned with your goals for secure growth.

Portfolio Diversification

Incorporate CDs into your portfolio to balance high-risk assets, reducing overall volatility. CDs provide stable returns during market uncertainty, allowing flexible allocation adjustments for safety and diversification.

Choosing a CD

Term Selection

When selecting a CD, consider your savings goals and when you’ll need the funds. Terms range from months to years, with longer terms often offering higher rates but locking funds longer. Match terms to your needs to avoid early withdrawal penalties.

- Understand your savings goals.

- Monitor the current rate environment.

- Review early withdrawal penalties.

- Choose reputable institutions.

Allocate funds across different terms to enhance liquidity.

Interest Rate Comparison

Interest rates are a key factor in CD selection. Rates vary by bank and term, so compare offerings from Hong Kong or U.S. banks to maximize returns.

- Traditional CDs offer fixed rates, often with minimum deposit requirements.

- Jumbo CDs require higher deposits for potentially higher rates.

- Some CDs allow rate increases during the term, ideal for rising rate environments.

- Flexible CDs permit early withdrawals or additional deposits, suiting those needing liquidity.

Match products to your financial needs and risk tolerance.

Bank Reputation

Prioritize banks with strong reputations to minimize risks. Choose licensed Hong Kong or well-known U.S. banks, checking credit ratings and performance history for reliable service and customer protection.

Tip: Verify a bank’s credentials and insurance through financial regulatory websites to safeguard your interests.

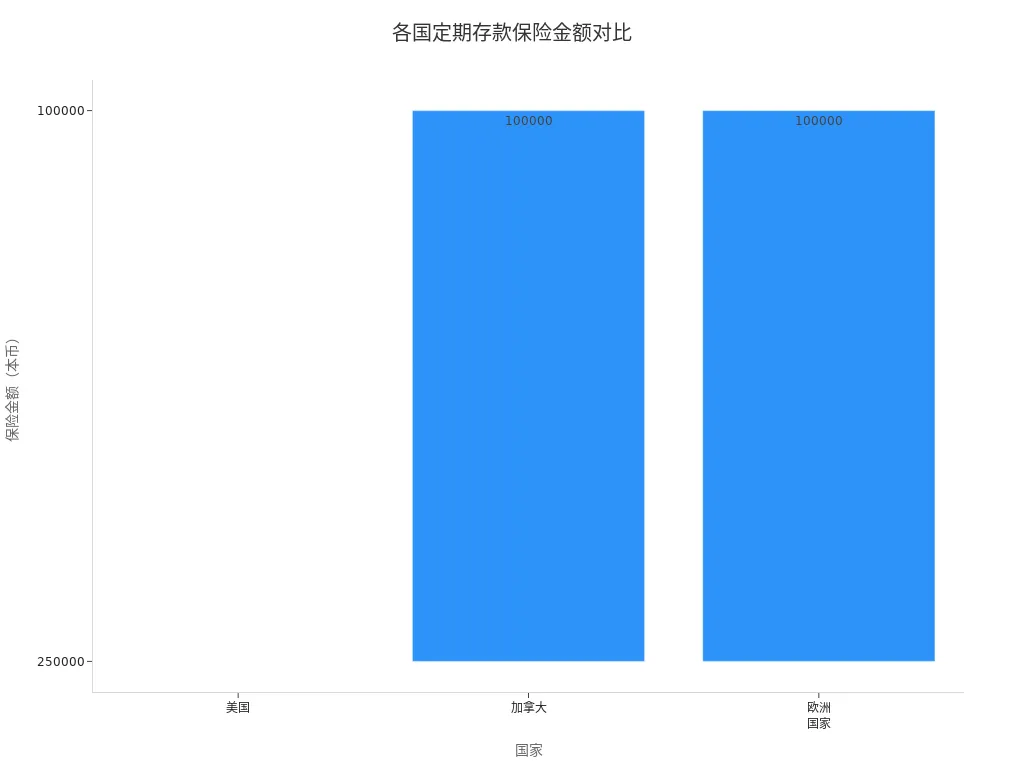

Insurance Coverage

Ensure your CD is covered by deposit insurance. In the U.S., the FDIC insures up to $250,000 per depositor per bank. Canada and Europe offer similar protections. The table below outlines deposit insurance by region:

| Country/Region | Insurance Agency | Coverage Amount | Applicable Accounts |

|---|---|---|---|

| USA | FDIC | $250,000 per bank | Deposit accounts, including CDs |

| Canada | CDIC | $100,000 per bank | Savings, foreign currency, GICs |

| Europe | European Deposit Insurance | €100,000 per bank | Deposit accounts |

Choose insured products to ensure principal and interest safety.

Comparative Analysis

Savings Accounts

Savings accounts offer high liquidity, allowing anytime access for daily or emergency needs. CDs lock funds until maturity, with penalties for early withdrawal. The table below compares their features:

| Feature | Certificate of Deposit (CD) | Savings Account |

|---|---|---|

| Interest Rate | Typically higher | Lower |

| Liquidity | Limited, locked for term | High, funds accessible |

| Risk | Low in stable rate environments | Subject to rate fluctuations |

| Returns | Suited for long-term strategies | Ideal for short-term needs |

For flexibility, savings accounts suit daily use. For higher interest, consider CDs.

Money Market Funds

Money market funds offer high liquidity, allowing purchases or redemptions without penalties. Their yields fluctuate with market conditions, often lower than CDs. Choose money market funds for accessibility or CDs for fixed returns.

| Feature | Certificate of Deposit (CD) | Money Market Fund |

|---|---|---|

| Liquidity | Limited, penalties for early withdrawal | High, penalty-free access |

| Returns | Fixed, often higher than money market funds | Variable, may fluctuate |

- Money market funds offer flexibility but unstable returns.

- CDs provide fixed rates with limited liquidity.

Treasury Securities

Treasury securities, backed by the U.S. government, are extremely low-risk with terms ranging from short to long. Some can be sold in secondary markets, offering liquidity. CDs and treasuries are both low-risk, but differ in returns, terms, and taxation. The table below highlights key differences:

| Feature | Certificate of Deposit (CD) | Treasury Securities |

|---|---|---|

| Risk | Low, FDIC-insured | Low, backed by U.S. government |

| Returns | Potentially higher in some markets | Historically strong with stock-bond portfolios |

| Term | Typically 3 months to 5 years | Up to 20 or 30 years |

| Liquidity | Lower, penalties for early withdrawal | Sellable in active secondary markets |

| Taxation | Interest taxed as ordinary income | Interest exempt from state taxes |

- CD interest is taxed as ordinary income.

- Treasury interest is exempt from state taxes.

Both CDs and treasuries offer stable income, but differ in liquidity, safety, and tax treatment. Choose based on your liquidity needs and tax planning.

Investment Recommendations

Avoiding Pitfalls

Common mistakes when choosing CDs include:

- Ignoring early withdrawal penalties. Early access can reduce or eliminate interest earnings.

- Overlooking rates and terms. Variations across banks can lead to missed opportunities for higher returns.

- Neglecting inflation. CD rates may fall below inflation, impacting long-term purchasing power.

- Ignoring changing needs. Failing to review your portfolio may misalign CDs with your goals.

Avoid selecting the first CD offered without comparing rates, choosing unsuitable terms, or missing maturity dates, which can lead to automatic renewals at less favorable rates.

Operational Process

To open and manage a CD account, follow these steps:

- Choose the right CD based on your timeline, opting for short- or long-term products.

- Understand early withdrawal penalties by reviewing terms before opening.

- Consider laddering by spreading funds across different terms for better liquidity.

CDs lock funds for a fixed term in exchange for guaranteed rates, ideal for goals like saving for a down payment in two years.

Key Considerations

Before purchasing a CD, carefully review terms:

- Most CDs impose early withdrawal fees to discourage premature access.

- Some banks require advance notice or set minimum balances, limiting withdrawal amounts or frequency.

- Interest accumulates annually and is taxable as income, requiring annual tax payments.

Ensure CD terms align with your financial needs. Regularly review your portfolio to adjust strategies, ensuring safety and maximizing returns.

CDs stabilize portfolios and reduce risk with fixed rates and capital safety, ideal for short- to medium-term goals. Allocate funds to CDs during market volatility to protect assets. The table below summarizes CDs’ role in portfolio management:

| Benefit | Description |

|---|---|

| Stability | Fixed rates and capital safety for conservative investors |

| Risk Balance | Offsets high-risk assets, reducing market volatility impact |

| Flexibility | Adjust strategies based on rate changes |

Choose CDs based on your needs and risk tolerance, monitoring market rates to optimize your financial plan.

FAQ

What is a Certificate of Deposit (CD)?

You deposit funds with a bank for a fixed term, and the bank pays interest at maturity. Funds cannot be accessed freely until the term ends.

How is CD interest calculated?

The bank sets a fixed rate based on your term and amount. You receive principal and interest at maturity.

What happens if I withdraw a CD early?

Early withdrawal incurs a penalty, typically a portion of interest, which may reduce your earnings.

Are CDs safe?

CDs from licensed Hong Kong or U.S. banks are typically FDIC-insured up to $250,000, covering principal and interest.

What savings goals can CDs help achieve?

CDs are ideal for down payments, education, or retirement savings. Choose terms that align with your timeline for effective planning.

Unveiling the low-risk allure of certificates of deposit (CDs), you may see how high cross-border transfer fees, currency volatility, and complex offshore account setups can chip away at your steady returns—critical when funding goals like down payments or education savings. Picture a platform with 0.5% remittance fees, same-day global transfers, and instant fiat conversions, enabling U.S. CD investments without extra accounts?

BiyaPay is designed for cautious investors, offering seamless fiat-to-digital asset swaps for agile capital flow. Use real-time exchange rate query to monitor USD shifts and remit at optimal moments, cutting losses. Spanning most regions with instant transfers, it ensures your funds are ready fast. Best of all, access U.S. and Hong Kong stock trading through a single account, blending CD stability with equity growth.

Whether building retirement reserves or short-term savings, BiyaPay empowers your strategy. Sign up now, visit stocks for U.S. opportunities—quick setup unlocks cost-effective global finance. Join prudent investors and achieve your financial vision!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.