- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Say Goodbye to High Commissions! Transfer Stocks Between Brokers and Seamlessly Connect to Your New Investment Platform!

Image Source: pexels

Are you still troubled by high commissions? Now, through simple operations, you can safely transfer stocks from a high-commission broker to a new platform, achieving flexible fund management. The entire process is efficient and convenient, without affecting the continuity of your investments. You only need to prepare the necessary documents according to the steps to easily complete the transfer. Keep reading to learn about the detailed process, say goodbye to high commissions, and enjoy a better investment experience.

Key Highlights

- High commissions can significantly reduce your investment returns; choosing a low-commission platform can save you substantial fees.

- Before transferring stocks, ensure all necessary documents, such as account numbers and stock details, are prepared to smoothly complete the transfer.

- Using the ACATS system allows for efficient and secure stock transfers, avoiding missed profits due to market fluctuations.

- On the new platform, you can enjoy zero or low-commission trading, enhancing investment efficiency and flexibility.

- Regularly check the transfer progress to ensure all assets are received and address any issues promptly.

Reasons to Say Goodbye to High Commissions

Image Source: unsplash

Impact of High Commissions

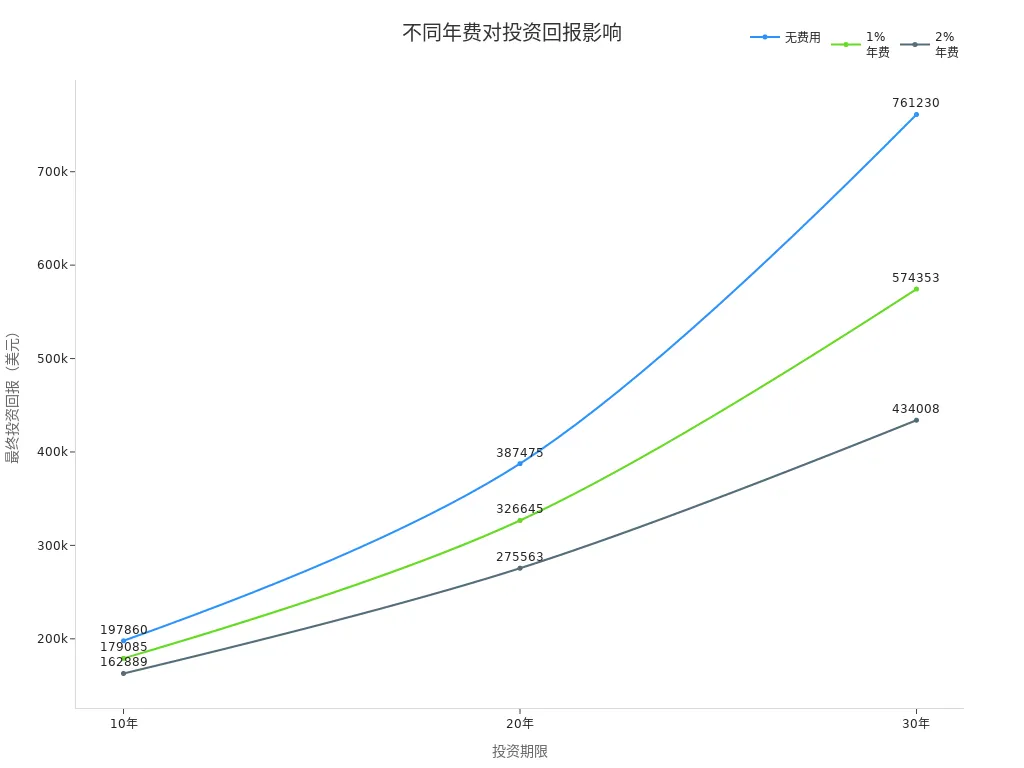

You might think a 1% annual commission fee is low, but in the long term, these fees can significantly reduce your investment returns. Investment fees not only directly reduce your principal but also limit the ability of your principal to grow through compounding. For example, assuming you invest $10,000 with a 7% annual return, the difference in returns after 20 years under different annual fees is as follows:

| Initial Investment | Annual Return | 0.5% Annual Fee | 1.5% Annual Fee |

|---|---|---|---|

| $10,000 | 7% | $34,719 | $28,466 |

You can see that a mere 1% difference in annual fees results in a return gap of over $6,000 after 20 years. Over a longer period, the impact of fees becomes even more pronounced:

| Investment Period | No Fees | 1% Annual Fee | 2% Annual Fee |

|---|---|---|---|

| 10 Years | $197,860 | $179,085 | $162,889 |

| 20 Years | $387,475 | $326,645 | $275,563 |

| 30 Years | $761,230 | $574,353 | $434,008 |

High commissions and additional fees can significantly reduce your investment returns, causing you to lose substantial potential profits in the long term. Every cent in fees reduces your future wealth growth. Choosing to say goodbye to high commissions creates more room for your wealth to grow.

Advantages of the New Platform

The new investment platform offers greater convenience and cost-effectiveness. You can enjoy zero or low commissions, reducing investment costs. New platforms typically have user-friendly interfaces, suitable for beginners, and support mobile access, allowing trading anytime, anywhere. Below is a comparison between new platforms and traditional brokers:

| Feature | New Investment Platform | Traditional Broker |

|---|---|---|

| Commission | Zero or low commission | $5-50 per trade |

| User Interface | User-friendly, easy navigation | Steep learning curve |

| Accessibility | 24/7, mobile-friendly | Business hours only |

| Trading Tools | Basic tools and analysis | Broader research capabilities |

| Minimum Deposit | Lower | Higher |

Many new platforms also provide high-quality services. For example, Platform A and Platform C offer 0% commissions and high-quality services. By choosing these platforms, you can easily say goodbye to high commissions and enhance your investment experience.

Transfer Process

Image Source: pexels

Pre-Transfer Preparation

Before officially transferring stocks, you need to make thorough preparations. The ACATS system (Automated Customer Account Transfer Service) provides an efficient and automated transfer method. It allows you to transfer securities and cash between brokers without selling assets, avoiding taxable events. This way, you can avoid missing profits due to market fluctuations, ensuring investment continuity.

You need to prepare the following documents in advance:

- Account numbers for both the current and new brokers

- Details of the stocks to be transferred, including stock codes and quantities

- Personal identification documents (e.g., passport or ID)

- Bank account information (if funds transfer is involved)

Tip: You should record all transfer-related communications and documents, including transfer applications, broker confirmations, and payment receipts. This allows you to quickly retrieve information if issues arise.

If your stocks involve board or shareholder approvals or require third-party consent (e.g., from lenders), ensure all approvals are completed in advance. After the transfer, remember to update relevant registration information and keep all documents safe.

Application Steps

You can complete the stock transfer application by following these steps:

- Understand the ACATS transfer process. ACATS allows you to transfer cash and full stock shares from one broker to another, with the process being automated and efficient.

- Initiate the transfer application on the new broker’s platform. Typically, you need to log into the new broker’s account, go to the “Transfers and Payments” menu, and select “Transfer Positions.”

- Choose the transfer type. You can opt for a full or partial transfer, depending on your investment needs.

- Fill in the required information. Enter the account details for both the current and new brokers, provide stock details, and confirm whether to transfer all assets.

- Be aware of fees. Some brokers charge ACATS transfer fees (e.g., USD 100), which will be deducted from your cash balance.

- After submitting the application, the brokers will process the transfer request through the DTCC system. You don’t need to perform manual operations, as the system automates most of the process.

Note: If you have lent securities, you must exit the securities lending program before initiating the transfer application.

Progress Tracking

You can track the stock transfer progress online at any time. Most brokers provide status tracking tools. For example, in the U.S. market, you can log into your broker account and use the status tracker to check the transfer status. Electronic transfers typically take 5 business days, while mail transfers may take 2 to 4 weeks.

- Electronic transfers: Approximately 5 business days

- Mail transfers: 2–4 weeks

It’s recommended to regularly log into your account to monitor transfer progress. If any issues arise, contact the broker’s customer service promptly.

Asset Confirmation

After the transfer is complete, you need to confirm whether all assets have been received. You can check the stock and cash balances in your new broker account, verifying that the stock codes and quantities match those in the original account. Some brokers will notify you of transfer completion via email or SMS.

| Transfer Method | Processing Time |

|---|---|

| Electronic Funds to Bank | 1–3 business days |

| Bank Wire to Bank | Same day |

| Paper Check | 5–6 days |

| Intra-Broker Account Transfer | Within minutes |

If you find discrepancies in stock quantities or funds, contact the new broker’s customer service immediately, providing relevant transfer records and receipts to resolve the issue quickly.

After confirming asset receipt, you can continue investing on the new platform, achieving the goal of saying goodbye to high commissions.

Fees and Timing

Fee Types

When transferring stocks between brokers, you may encounter various fees. Fee structures vary across brokers, so you need to understand these fees in advance to avoid unnecessary expenses. Below is a comparison of transfer fees for several major brokers:

| Broker | Fee Description |

|---|---|

| Merrill Edge | Account transfer and processing fees, not explicitly specified. |

| Vanguard | $100 processing fee for account closure and full asset transfer. |

| Robinhood | Up to $75 reimbursement for transfers of $7,500 or more. |

You should also note that some brokers charge higher fees for IRA (Individual Retirement Account) transfers. Some firms also impose proportional IRA custodial fees. For partial transfers, some brokers may not charge fees. For example, some brokers charge $50 for full account transfers but waive fees for partial transfers.

Tip: Look out for promotional policies on the new platform. Some brokers offer transfer fee reimbursements or cash bonuses for new clients. For instance, Robinhood provides up to $75 fee reimbursement for large transfers, while E*TRADE offers cash bonuses for new clients based on deposit amounts.

Timeframe

The timeframe for stock transfers varies depending on the broker and transfer method. You need to plan ahead to avoid delays impacting your investment strategy. Generally, electronic transfers are faster than paper-based transfers. Below is a comparison of typical transfer timeframes:

| Source | Average Time |

|---|---|

| Public FAQ | 7–10 business days |

| Fidelity | 3–5 weeks |

In most cases, you can complete the transfer within 7 to 10 business days. If documents are incomplete or special assets are involved, the process may extend to 3 to 5 weeks. Before initiating the transfer, confirm with the broker that all documents are complete to minimize waiting time.

- Electronic transfers: Typically 7–10 business days

- Paper transfers or special assets: Up to 3–5 weeks

It’s recommended to initiate transfers during periods of low market volatility to avoid missing investment opportunities due to prolonged transfer times.

Cost Reduction

You can reduce costs during the stock transfer process through various strategies. First, proactively analyze your account structure and choose the optimal transfer timing. You can use portfolio data to predict future funding needs and plan transfers in advance. Second, maintain communication with the broker to ensure all documents are accurate, avoiding repeated fees or delays due to errors.

- Choose a new platform with fee reimbursement policies. For example, some brokers offer up to $75 reimbursement for large transfers.

- Take advantage of new platform signup bonuses. Some brokers offer cash rewards for new clients, with amounts tied to deposit sizes.

- Opt for partial transfers, as some brokers do not charge fees for partial transfers.

- Keep account information updated in real-time to ensure every step is traceable, reducing additional costs due to information discrepancies.

- Facilitate team collaboration. If you have multiple accounts or involve family members in transfers, plan and execute them collectively to improve efficiency.

Before transferring, thoroughly understand each broker’s fee structure and promotional policies, and choose the optimal timing for the transfer. This way, you can minimize transfer costs and truly say goodbye to high commissions.

Common Issues

Transfer Failures

You may encounter transfer failures when transferring stocks. Common reasons include incorrect account information, restrictions on stocks, or incomplete documents. You should carefully verify account numbers and personal information to ensure accuracy. If a transfer fails, contact the customer service of both the old and new brokers immediately, explain the situation, and submit any required documents. Some brokers will notify you of the failure reason via email or SMS. Keep all communication records for future reference and resolution.

Stock Freezes

Sometimes, you may find that stocks are frozen during the transfer process. This typically occurs in the following situations:

- Stocks are pledged or lent and the related agreements have not been terminated.

- Stocks are in a special period, such as dividend distribution or rights issues.

- The account has outstanding fees or disputes.

You should confirm the stock status with the broker in advance to ensure no pending operations. If stocks are frozen, the transfer process will be paused until the issue is resolved. Proactively communicate with the broker to understand the steps needed to unfreeze the stocks and avoid transfer delays.

Tax Implications

When transferring stocks between brokers, it typically does not trigger a taxable event because it is a transfer of ownership, not a sale. You should note the following:

- Transferring stocks does not incur capital gains tax.

- Cost basis information should be transferred with the stocks, but it’s best to keep your own detailed records.

- In some cases, cost basis may not transfer correctly, especially for older stocks or those involving dividend reinvestment, which could cause issues later.

It’s recommended to consult a professional tax advisor before transferring to ensure all information is accurate and avoid issues during future tax filings.

Retirement Accounts

If you need to transfer an IRA or other retirement account, the process differs significantly from regular accounts. The table below outlines the differences between two common transfer methods:

| Feature | IRA Transfer | IRA Rollover Transfer |

|---|---|---|

| Fund Movement | Direct transfer between custodians | Account holder temporarily holds funds, must deposit in new account within 60 days |

| Tax Withholding | Typically no tax withholding | May have 20% tax withholding |

| Time Limit | No time limit | Must complete within 60 days |

| Reporting Requirements | No need to report on tax forms | Must be reported on tax forms |

- When choosing an IRA transfer, opt for a direct custodian-to-custodian transfer to avoid tax withholding and additional reporting, ensuring smoother fund transfers.

- If you choose an IRA rollover transfer, complete it within 60 days to avoid tax penalties.

When transferring retirement accounts, pay special attention to relevant regulations. If in doubt, consult a professional to ensure compliance and protect your retirement funds.

Seamless Integration with the New Platform

Account Activation

After completing the stock transfer, you need to activate your new platform account. You can log in to the account via the new platform’s website or mobile app. The system will prompt you to set a secure password and complete identity verification. You need to upload identification documents, such as a passport or ID. Some platforms may require you to link a bank account; it’s recommended to prioritize linking to a licensed Hong Kong bank for fund transfers. Once the account is activated, you can immediately view all transferred stocks and cash balances. The new platform typically sends an email notification confirming account activation, reminding you to check asset details promptly.

Fund Management

On the new platform, you can efficiently manage your funds. The platform offers various asset allocation tools to help optimize your investment portfolio. You can utilize Section 351 exchanges to pool multiple investors’ portfolios into a newly created ETF. This allows you to reallocate assets without triggering capital gains tax, achieving tax deferral. The platform automatically checks whether your portfolio meets diversification tests to ensure tax deferral eligibility. You can adjust your holdings at any time, and the system will update asset allocations in real-time. Below are common fund management methods:

- Automatic asset aggregation for unified management

- ETF portfolio restructuring to optimize tax structure

- Diversification tests to ensure tax deferral eligibility

Through the platform’s fund management interface, you can view the real-time market value and historical performance of each asset, enabling more informed investment strategies.

Quick Investing

After activating your account on the new platform, you can immediately start investing. The platform provides various trading tools, including U.S. stocks, ETFs, bonds, and more. You can place buy or sell orders directly, and the system will automatically match the best price. The platform supports 24-hour trading, allowing you to adjust your investment plan flexibly based on market conditions. You can also set up automatic investment plans to regularly purchase specified assets, improving investment efficiency. The new platform typically offers real-time market analysis and investment recommendations to help you make quick decisions. You can use the mobile app to monitor market trends anytime, seizing every investment opportunity.

Safety and Precautions

Fund Security

When transferring stocks, fund security is paramount. You should choose a reputable broker and ensure the platform uses encryption technology to protect your account information. Set a strong password and update it regularly. You can also enable two-factor authentication to enhance account security.

Tip: When transferring or withdrawing funds, prioritize using accounts linked to licensed Hong Kong banks to reduce the risk of fund theft. Regularly check your account balance and transaction records, and contact the broker’s customer service immediately if you notice any anomalies.

Avoiding Pitfalls

During the process, you may encounter common pitfalls. Stay vigilant to avoid falling victim to scams.

- Do not trust transfer links or QR codes sent by strangers.

- Avoid downloading broker apps from unofficial channels.

- Do not disclose account passwords or verification codes.

- Be wary of “zero-risk, high-return” investment promises.

You can verify all processes through the broker’s official website or customer service. If you encounter suspicious information, stop operations immediately and consult a professional.

Choosing a Reputable Broker

When selecting a new platform, prioritize brokers with legitimate financial licenses. You can check broker credentials on the websites of the Financial Industry Regulatory Authority (FINRA) or the Securities Investor Protection Corporation (SIPC). Reputable brokers provide insurance coverage for your securities account. For example, SIPC offers up to USD 500,000 in coverage per account (including up to USD 250,000 for cash).

| Coverage Type | Coverage Amount (USD) |

|---|---|

| Total Securities Account Coverage | 500,000 |

| Maximum Cash Coverage | 250,000 |

Avoid choosing unlicensed or unregulated platforms. Reputable brokers disclose fee structures and service terms, protecting your legal rights. Research broker reputations through multiple channels to select a safe and reliable platform for investing.

Through simple operations, you can safely transfer stocks to a new platform, enjoying the tangible benefits of low commissions. The process is efficient and convenient, ensuring the safety of your funds. By focusing on account information and document preparation, you can smoothly complete the transfer. Act now to start a better investment experience and seize every opportunity for wealth growth.

FAQ

What should I do if I enter incorrect account information during the transfer?

You should immediately contact the customer service of both the old and new brokers, explain the error, and submit the correct documents. Most brokers will assist you in resubmitting the application to ensure a smooth transfer.

Can I trade stocks during the transfer process?

You typically cannot trade stocks being transferred during the process. Plan your trading strategy in advance to avoid disruptions to your investment decisions.

Will stock transfers affect dividends?

Dividends earned during the transfer period will be automatically credited to the new account. You can check dividend receipt status on the new broker’s platform. Contact customer service if you have any questions.

Can I transfer only part of my stocks?

You can choose to transfer only specific stocks. Specify the stock codes and quantities in the application. Some brokers do not charge fees for partial transfers.

How do I confirm stock receipt after the transfer?

Log into the new broker’s account to verify stock codes and quantities. You can also check the transfer completion notification email. If there are discrepancies, contact customer service promptly for resolution.

After navigating the stock transfer process, you might ponder how steep commissions and convoluted cross-border fund handling erode your long-term gains, particularly with international holdings where currency swings and remittance charges amplify expenses, stalling your market moves. Picture a dependable platform that streamlines it all: no need for offshore accounts, instant U.S. stock access, and remittances at a mere 0.5% fee, sidestepping tax pitfalls and asset freezes. It’s not just cost-cutting—it’s empowering your portfolio mobility.

BiyaPay stands as your perfect ally, enabling effortless swaps between fiat and crypto for fluid capital management. Use the real-time exchange rate query to pinpoint optimal rates in real time, shielding against volatility. Spanning most global regions, it ensures same-day transfers, so post-transfer assets are deployable without delay. Crucially, trade U.S. and Hong Kong stocks on one unified dashboard with zero fees on limit orders, facilitating a smooth shift to advanced tactics.

From handling ACATS delays to fine-tuning retirement plans, BiyaPay offers expert backing. Act now for boundless potential—sign up swiftly and check out stocks to launch into an era of minimal costs and maximal agility. Thousands have thrived; it’s your turn to excel!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.