- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Pre-Market and After-Hours Trading: A Complete Guide for Beginners

Image Source: unsplash

You can buy and sell stocks outside the regular U.S. stock market trading hours through pre-market and after-hours trading. Many investors use these sessions to capitalize on opportunities driven by news or earnings reports. Data shows that pre-market trading accounts for over 55% of total trading volume, while after-hours trading accounts for 73%. The table below illustrates the percentage of total trading volume for different U.S. market sessions:

| Trading Session | Percentage of Total Trading Volume |

|---|---|

| Pre-Market | Over 55% |

| After-Hours | 73% |

You need to understand the timing, rules, participation methods, and potential risks of these sessions to make informed investment decisions.

Key Highlights

- Pre-market and after-hours trading allow you to trade stocks outside regular hours, seizing market opportunities.

- To participate, choose a broker that supports these sessions and understand the associated rules and fees.

- These sessions have lower liquidity and higher price volatility, requiring careful setting of buy and sell prices.

- Using limit orders helps control transaction prices and mitigate risks from volatility.

- Stay informed, monitor market dynamics, and adjust strategies based on company announcements.

Pre-Market Trading

Image Source: unsplash

Definition

You can trade stocks before the U.S. stock market officially opens, known as pre-market trading. Both the New York Stock Exchange (NYSE) and Nasdaq allow investors to trade before the official opening. The table below provides the official definition of pre-market trading:

| Term | Definition |

|---|---|

| Pre-Market Trading | Trading activity that occurs before the regular market opens. For example, the NYSE and Nasdaq typically open at 9:30 AM ET, so pre-market trading begins a few hours before regular market hours. |

You can use pre-market trading to respond early to significant news or earnings reports that impact the market.

Timeframe

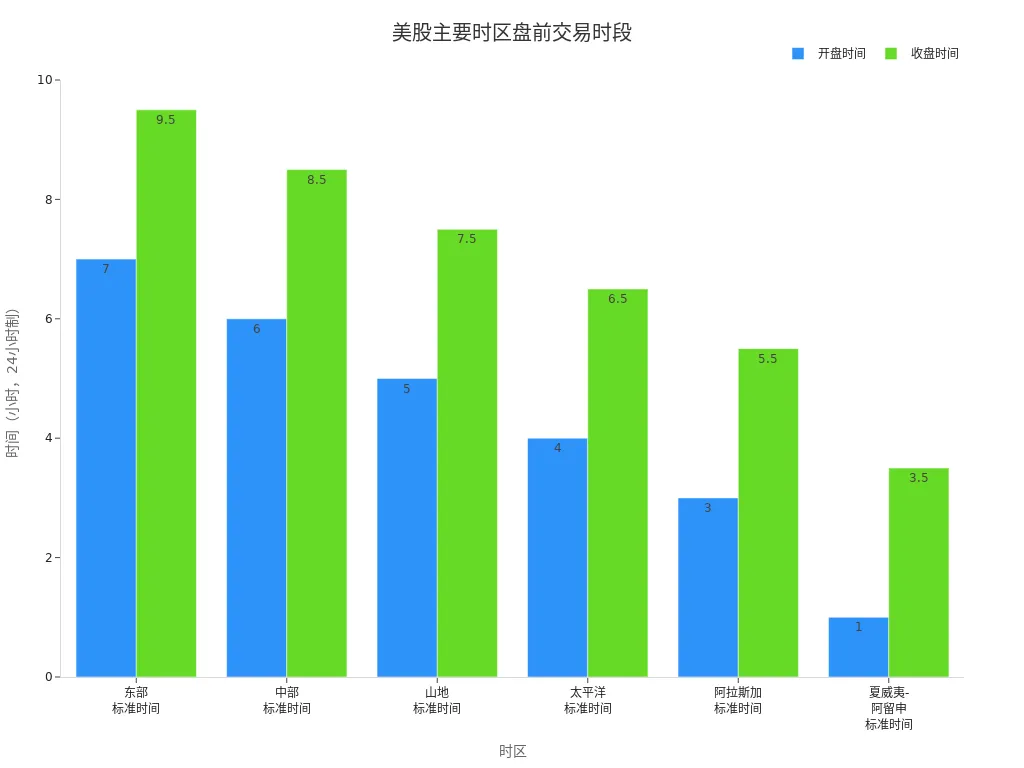

Pre-market trading hours vary by exchange and timezone. You need to select the appropriate trading time based on your timezone. The table below lists pre-market trading hours for different U.S. timezones:

| Timezone | Opening Time | Closing Time |

|---|---|---|

| Eastern Standard Time (EST) | 7:00 AM | 9:30 AM |

| Central Standard Time (CST) | 6:00 AM | 8:30 AM |

| Mountain Standard Time (MST) | 5:00 AM | 7:30 AM |

| Pacific Standard Time (PST) | 4:00 AM | 6:30 AM |

| Alaska Standard Time (AKST) | 3:00 AM | 5:30 AM |

| Hawaii-Aleutian Standard Time (HST) | 1:00 AM | 3:30 AM |

You can refer to the chart below for a visual representation of U.S. stock pre-market trading hours across major timezones:

Participation Methods

To participate in pre-market trading, you need to select a U.S. broker that supports this feature, such as Interactive Brokers or Futu. You place orders through the broker’s platform, selecting the “pre-market” or “extended hours” session. Some brokers may restrict order types during pre-market trading, often allowing only limit orders. Additionally, pre-market trading has lower trading volume, so orders may not fully execute.

Tip: Before placing orders, carefully review the broker’s pre-market trading rules and fee disclosures to avoid unnecessary losses.

Pre-Market Trading Characteristics

Pre-market trading has several distinct characteristics:

- You’ll notice lower liquidity, with limited buy and sell orders, resulting in slower transaction speeds.

- Prices are more volatile, heavily influenced by breaking news or earnings reports. Studies show that return volatility during regular trading hours is lower than in after-hours sessions, and pre-market price volatility also tends to exceed regular hours.

- Pre-market high and low prices may differ from regular trading hours, with larger price range fluctuations.

- Pre-market trading volatility is often influenced by the previous trading session, with rapid shifts in market sentiment.

When trading pre-market, closely monitor market dynamics, set reasonable buy and sell prices, and avoid issues from low liquidity, such as unexecuted orders or prices deviating from expectations.

After-Hours Trading

Definition

You can continue trading stocks after the U.S. stock market’s regular hours, known as after-hours trading. Major U.S. exchanges, such as the NYSE and Nasdaq, set regular trading hours from 9:30 AM to 4:00 PM ET. After-hours trading occurs between 4:00 PM and 8:00 PM ET. The table below provides the official definition of after-hours trading:

| Term | Definition |

|---|---|

| After-Hours Trading | Trading stocks outside the standard U.S. exchange hours (9:30 AM to 4:00 PM ET). This extended session typically occurs from 4:00 PM to 8:00 PM ET. |

| After-Hours Trading | Trading securities when major markets are closed. Since 1985, U.S. exchanges have set regular hours from 9:30 AM to 4:00 PM ET, with after-hours trading from 4:00 PM to 8:00 PM ET on regular trading days. |

You can use after-hours trading to respond promptly to market changes driven by earnings reports, major news, or global events.

Timeframe

After-hours trading hours for major U.S. exchanges are as follows:

| Trading Type | Start Time (ET) | End Time (ET) |

|---|---|---|

| After-Hours | 4:00 PM | 8:00 PM |

| Pre-Market | 4:00 AM | 9:30 AM |

You can trade on the NYSE and Nasdaq from 4:00 PM to 8:00 PM ET during after-hours sessions. These sessions typically have lower trading volume, but volume spikes during earnings releases or major news. For example, on January 29, 2025, after Meta, Microsoft, and Tesla released earnings, E-mini S&P 500 futures trading volume surged 53% in the first after-hours hour. On February 26, 2025, after Nvidia earnings, Nasdaq futures volume increased 107% in the same period.

Participation Methods

To participate in after-hours trading, you need to meet these conditions:

- You need a standard brokerage account with a U.S. broker. Some brokers also allow after-hours trading in retirement accounts (e.g., IRAs).

- You may need to apply or agree to after-hours trading services on the broker’s platform, often requiring acknowledgment of risk terms.

- You need sufficient USD funds to handle the high volatility and risks of after-hours trading.

- You need a trading platform that supports after-hours trading, typically offering real-time quotes and advanced tools.

- You must understand the specific risks, including lower liquidity, wider bid-ask spreads, and higher price volatility.

Tip: Before placing orders, review the broker’s after-hours trading rules to understand order type restrictions (e.g., limit orders only) and avoid unexecuted orders due to low liquidity.

After-Hours Trading Characteristics

After-hours trading has several notable characteristics:

- Higher liquidity risk. During regular hours, high participation and volume ensure ample liquidity. In after-hours trading, fewer participants reduce volume and liquidity, widening bid-ask spreads and increasing transaction difficulty.

- Significant price volatility. Research shows that price jumps after earnings announcements have over a 90% probability in after-hours trading, compared to 2.95% during regular hours. Non-earnings after-hours trading has a 3.67% jump probability. You may encounter larger price swings, with orders potentially only partially filled or not executed.

- Strong influence from major news. Earnings reports and global events often released after hours can trigger sharp price movements. For example, after-hours trading volume for Meta, Microsoft, Tesla, and Nvidia surged post-earnings, with heightened price volatility.

- Broker service variations. Brokers differ in after-hours trading support, including trading hours, order types, and fees. You need to choose a broker and platform suited to your needs.

During after-hours trading, closely monitor market dynamics, set reasonable buy and sell prices, and fully assess liquidity and volatility risks. Like pre-market trading, after-hours trading is an extended session with both risks and opportunities. Participate rationally based on your investment goals and risk tolerance.

Differences

Comparison with Regular Trading Hours

You can trade in the U.S. stock market during pre-market, after-hours, or regular trading sessions, each with distinct mechanisms, liquidity, and order types. The table below compares them:

| Trading Session | Liquidity Characteristics | Order Type Restrictions |

|---|---|---|

| Pre-Market | Lower liquidity, less favorable prices | Limit orders only |

| Regular Trading Hours | High liquidity, more effective prices | Market, stop, and limit orders |

| After-Hours | Lower liquidity, less favorable prices | Limit orders only |

During regular trading hours (9:30 AM–4:00 PM ET), you benefit from higher liquidity and tighter bid-ask spreads. In pre-market (4:00 AM–9:30 AM) and after-hours (4:00 PM–8:00 PM) sessions, liquidity drops, and price volatility increases. You’re restricted to limit orders, and large orders may struggle to execute. Data shows that in 2021, pre-market and after-hours trading volume increased, with 8:00–9:30 AM accounting for 48% of extended hours volume, while 4:00–5:00 AM contributed only 8%, indicating most trading occurs closer to regular hours.

Advantages and Disadvantages

Pre-market and after-hours trading offer flexibility but come with higher risks. Below is a summary of key advantages and disadvantages:

Advantages:

- You can trade outside standard hours, capitalizing on news or earnings-driven opportunities.

- You have the chance to buy or sell at attractive prices, adjusting positions promptly.

Disadvantages: - You face lower liquidity, making some stocks difficult to trade.

- Wider bid-ask spreads and volatile prices may result in transactions deviating from expectations.

- You’re limited to limit orders, lacking the flexibility of regular hours.

- Information asymmetry may lead to prices not reflecting true market conditions.

When choosing a trading session, weigh convenience against risks and align with your needs.

How to Participate

Account Opening and Broker Selection

To participate in U.S. pre-market or after-hours trading, you first need to open an account with a mainstream U.S. broker, such as Interactive Brokers or Futu. You’ll need valid identification, proof of address, and USD funds. Some licensed Hong Kong banks also offer U.S. stock accounts, streamlining the process. After opening an account, activate it and complete a risk assessment. These steps are typically completed via the broker’s website or app, making the process convenient.

Reminder: When selecting a broker, prioritize those supporting pre-market and after-hours trading. Consider transaction fees, platform stability, and customer service quality.

Operational Process

To trade during pre-market or after-hours sessions, follow the broker’s platform requirements. Using Schwab as an example, here are the steps:

- Log into the Schwab platform, select “Trade,” and navigate to the “All-in-One Trade Ticket” page.

- Enter the stock code and action type, ensuring you select a limit order.

- Under “Timing,” choose “Extended Hours (Afternoon).”

- Review the order and verify all details.

- If correct, click “Place Order” to complete the transaction.

- Note that during extended hours, electronic markets automatically match buy and sell orders, but execution may be slower.

When trading, carefully verify order details, set reasonable prices, and avoid unexecuted orders due to low liquidity.

Platform Overview

You can choose from several U.S. brokers supporting pre-market and after-hours trading. The table below details extended hours for select platforms:

| Broker | Extended Hours Access |

|---|---|

| Fidelity Investments | 7:00 AM–9:30 AM, 4:00 PM–8:00 PM |

| Merrill Edge | 7:00 AM–9:30 AM, 4:00 PM–8:00 PM |

| Webull | 4:00 AM–9:30 AM, 4:00 PM–8:00 PM |

| Tastytrade | 8:00 AM–9:30 AM, 4:00 PM–8:00 PM |

| Ally Invest | 8:00 AM–9:30 AM, 4:00 PM–5:00 PM |

| Firstrade | 8:00 AM–9:30 AM, 4:00 PM–8:00 PM |

Select a platform based on your trading needs and schedule. Brokers vary in extended hours support, so review their rules and service details in advance.

Risks and Precautions

Image Source: pexels

Liquidity Risk

The most common risk in pre-market and after-hours trading is low liquidity. Fewer market participants result in sparse buy and sell orders, leading to partial or unexecuted orders. The table below summarizes common liquidity-related risks:

| Risk Type | Description |

|---|---|

| Market Liquidity Risk | Low liquidity in pre-market or after-hours may lead to partial or no trades. |

| Volatility Risk | High volatility may result in partial or unexecuted orders. |

| Market Disconnection Risk | Different trading systems may show varying prices for the same stock, leading to execution price discrepancies. |

| Price Volatility Risk | Pre-market or after-hours prices may differ from regular opening prices, resulting in unfavorable executions. |

| Major News Announcement Risk | Significant news often released outside trading hours can cause sharp price swings in low liquidity. |

Be aware that low liquidity can make large orders particularly difficult to execute.

Price Volatility

Price volatility in pre-market and after-hours trading is significantly higher than during regular hours. Small trading volumes can trigger large price swings. Key observations include:

- Low liquidity and fewer participants lead to sharper price fluctuations.

- Small trading volumes can disproportionately impact prices, causing significant swings.

- Wider bid-ask spreads increase the risk of sudden price changes and unexpected volatility.

When placing orders in extended hours, set reasonable limit prices to avoid losses from sharp price fluctuations.

Information Asymmetry

During pre-market and after-hours trading, information asymmetry risks are higher. Institutional investors often have faster, more comprehensive information channels. The table below shows information asymmetry levels across different periods:

| Period | Information Asymmetry Level | Trading Type Impacting Price | Notes |

|---|---|---|---|

| Pre-Open | High | Informed Trading | Stronger information discovery in the morning |

| Regular Trading Hours | Medium | Uninformed Trading | Less price discovery |

| Post-Close | Low | Uninformed Trading | Higher liquidity costs |

| Overnight Trading | Medium | Informed Trading | Smaller price changes but notable discovery |

| Monday | High | Informed Trading | High information processing post-weekend |

| Macro Announcement Days | High | Informed Trading | More pronounced asymmetry post-announcements |

During these sessions, you often rely on public news, while professional institutions access deeper analysis, putting you at a disadvantage.

Common Misconceptions

Many beginners have misconceptions about pre-market and after-hours trading. Be cautious of these common errors:

- Assuming all investors are suited for extended hours trading, which isn’t true.

- Believing early buying guarantees better prices, when prices often reverse at market open.

- Thinking you have the same information as professional traders, despite significant information channel disparities.

- Assuming extended hours price trends predict regular hours direction, which is often incorrect.

- Believing platform features match regular hours, when many order types and protections are unavailable.

- Blindly assuming extended hours trading is always profitable, ignoring high risks and volatility.

When participating, rationally assess your capabilities and risk tolerance to avoid losses from misconceptions.

Practical Tips

Recommended Tools

During pre-market and after-hours trading, professional tools can help monitor market dynamics. The table below lists tools recommended by financial experts and their key functions:

| Tool Name | Function |

|---|---|

| Trade Ideas Scanner | Monitors unusual volume patterns, short squeeze candidates, and pre-market/after-hours activity |

| Volume-Based Gap Scanner | Identifies stocks with price gaps over 1% and high pre-market volume |

| Price Level Breakout Scanner | Tracks stocks breaking key support or resistance levels |

| Market News Impact Scanner | Finds stocks fluctuating due to news or announcements |

| RSI and MACD Combined Scanner | Uses technical indicators to confirm trends and reversals |

| Industry Group Momentum Scanner | Highlights pre-market activity within industry groups |

Choose tools based on your needs to enhance trading efficiency.

Trading Tips

When trading in pre-market and after-hours sessions, consider these practical tips:

- Understand the risks. Pre-market and after-hours trading have higher volatility and lower liquidity.

- Use limit orders to control buy or sell prices and reduce adverse volatility risks.

- Stay informed by monitoring news and earnings to adjust strategies promptly.

- Start small, especially as a beginner, to familiarize yourself with market dynamics.

- Choose the right broker, as platforms vary in extended hours policies and fees.

Mastering these tips can improve risk management and trading experience.

Common Questions

You may encounter these questions during pre-market and after-hours trading:

- What is after-hours trading?

- Who can participate in after-hours trading?

- What are the main benefits of after-hours trading?

- What are the risks of after-hours trading?

- What order types can I use in after-hours trading?

If you have additional questions, consult your broker’s help center or contact customer service for clarity on extended hours rules and processes.

In pre-market and after-hours trading, rationally assess liquidity and transaction costs. Research shows extended hours trading costs are significantly higher than regular hours, and retail investors often face suboptimal quotes. Reduce risks by analyzing pre-market news, using technical indicators, and setting realistic goals. Financial platforms offer weekly videos and insights to support continuous learning. Stay updated on regulatory changes, maintain a diversified portfolio, and select appropriate tools and sessions to enhance your investment capabilities.

FAQ

What are pre-market and after-hours trading?

You can trade stocks outside regular U.S. market hours. Pre-market trading occurs from 4:00 AM to 9:30 AM ET, and after-hours trading from 4:00 PM to 8:00 PM ET.

Who can participate in pre-market and after-hours trading?

You can participate if you have a U.S. broker account supporting extended hours. Some platforms may have eligibility or risk assessment requirements.

What are the risks of pre-market and after-hours trading?

You face low liquidity, high price volatility, and information asymmetry risks. Orders may not fully execute, and prices may deviate from expectations.

What order types can I use in pre-market and after-hours trading?

You can only use limit orders. Market and stop orders are typically unavailable during extended hours. Limit orders help control transaction prices.

Are fees and costs higher for pre-market and after-hours trading?

Some brokers charge additional fees for extended hours trading. Wider bid-ask spreads can also increase effective transaction costs compared to regular hours.

Having unraveled the nuances of pre-market and after-hours trading, you may see the allure of seizing opportunities from earnings or news, yet grapple with steep transaction fees, complex cross-border transfers, and currency volatility eating into your gains. In low-liquidity extended hours, swift capital movement and cost efficiency are critical to staying ahead. Picture a platform that simplifies it all: remittances at just 0.5%, zero fees on limit order contracts, and seamless U.S. stock access without an offshore account. This isn’t just savings—it’s your edge in fast-moving markets.

BiyaPay offers a streamlined financial hub, enabling instant fiat-to-crypto conversions to keep your funds ready. With the real-time exchange rate query, track USD movements closely and initiate transfers at optimal moments, minimizing currency-related losses. Spanning most global regions with same-day transfers, it ensures your capital is deployable when markets shift. Best yet, trade U.S. and Hong Kong stocks on one platform, executing precise limit orders to navigate extended-hours volatility.

Whether you’re a beginner testing pre-market waters or a seasoned trader refining after-hours strategies, BiyaPay empowers your moves. Sign up now, explore stocks, and launch into cost-effective, agile U.S. investing. Join a global investor community and make every trade count!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.