- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Complete Guide to the US Stock Market Holidays in 2025

Image Source: pexels

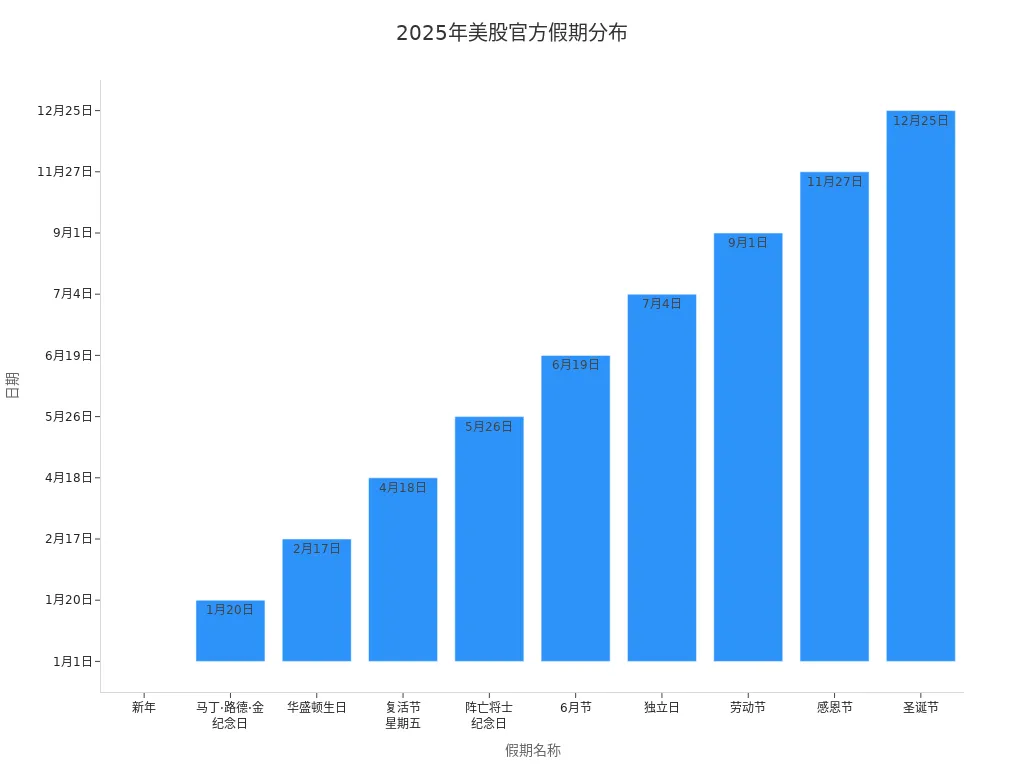

When you formulate a trading plan, it is very important to master the 2025 U.S. stock market holiday closures. The table below lists the main holiday closures officially announced by the New York Stock Exchange and Nasdaq, along with the corresponding dates:

| Holiday | 2025 |

|---|---|

| New Year’s Day | January 1, Wednesday |

| Martin Luther King Jr. Day | January 20, Monday |

| Washington’s Birthday | February 17, Monday |

| Good Friday | April 18, Friday |

| Memorial Day | May 26, Monday |

| Juneteenth | June 19, Thursday |

| Independence Day | July 4, Friday* |

| Labor Day | September 1, Monday |

| Thanksgiving | November 27, Thursday** |

| Christmas Day | December 25, Thursday*** |

You will find that during holidays, the market suspends trading, often leading to changes in trading volume and market sentiment fluctuations. You can pay attention to these dates in advance and arrange your investment strategies rationally.

Key Highlights

- Understanding the 2025 U.S. stock market holiday closures helps you arrange investment plans rationally and avoid missing important trading opportunities.

- Market volatility increases before and after holidays, and investors need to pay attention to changes in market sentiment to avoid blind following.

- During U.S. stock market holidays, futures and forex markets remain open, allowing investors to use these market dynamics to adjust strategies.

- Special events may lead to temporary closures, so stay tuned to official announcements and adjust trading plans in a timely manner.

- During holidays, trading volume usually declines, liquidity decreases, and investors should operate cautiously and conduct good risk management.

2025 U.S. Stock Market Holiday Closures Overview

Image Source: pexels

Holiday Closures List

When you formulate an investment plan, you need to understand the specific arrangements for U.S. stock market holiday closures in 2025. The New York Stock Exchange (NYSE) and Nasdaq announce official holiday closures each year. In 2025, U.S. stock market holiday closures are distributed relatively evenly, covering major U.S. statutory holidays. You can refer to the table below for a quick lookup of the full-year holiday closures:

| Holiday | Date | NYSE | Nasdaq |

|---|---|---|---|

| New Year’s Day | January 1 | Closed | Closed |

| Martin Luther King Jr. Day | January 20 | Closed | Closed |

| Presidents’ Day | February 17 | Closed | Closed |

| Good Friday | April 18 | Closed | Closed |

| Memorial Day | May 26 | Closed | Closed |

| Juneteenth | June 19 | Closed | Closed |

| Independence Day Eve | July 3 | 1:00 p.m. Close | 1:00 p.m. Close |

| Independence Day | July 4 | Closed | Closed |

| Labor Day | September 1 | Closed | Closed |

| Thanksgiving | November 27 | Closed | Closed |

| Day after Thanksgiving | November 28 | 1:00 p.m. Close | 1:00 p.m. Close |

| Christmas Eve | December 24 | 1:00 p.m. Close | 1:00 p.m. Close |

| Christmas Day | December 25 | Closed | Closed |

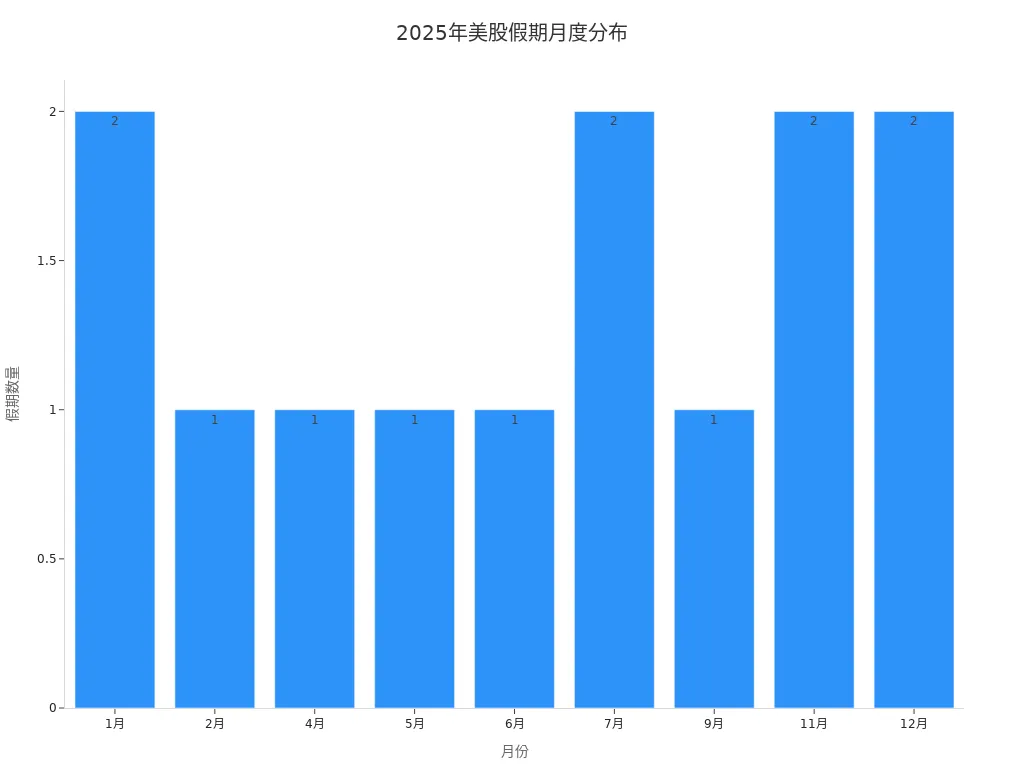

You will find that the number and distribution of U.S. stock market holiday closures in 2025 are basically consistent with previous years. Major holidays like New Year’s Day, Thanksgiving, and Christmas Day are scheduled in different months throughout the year, helping you plan trading time rationally.

Tip: Holidays affect market trading volume and investor sentiment. You need to pay special attention to market volatility before and after holidays to avoid risks due to reduced liquidity.

Early Closure Arrangements

U.S. stock market holiday closures not only include full-day closures but also early closures before certain holidays. In 2025, the New York Stock Exchange and Nasdaq will close early at 1:00 p.m. (Eastern Time) on the following dates:

| Holiday | Date | Closure Time |

|---|---|---|

| Independence Day Eve | July 3, 2025 | 1:00 p.m. ET |

| Day after Thanksgiving | November 28, 2025 | 1:00 p.m. ET |

| Christmas Eve | December 24, 2025 | 1:00 p.m. ET |

On these early closure days, you need to pay attention to changes in trading hours. The early closure arrangements are mainly to give market participants more time to spend holidays with family. Historically, during special periods like the 1907 Panic, exchanges also considered early closures to address market liquidity shortages.

- During the 1907 Panic, the New York Stock Exchange discussed early closure due to market crash risks.

- When bank liquidity is tight, early closures help stabilize market sentiment.

- Before major holidays, early closures have become a convention, helping you better arrange trading.

Special Closure Explanations

In addition to statutory U.S. stock market holiday closures and early closures, the market may temporarily close due to special events. For example, during national major events or former president funerals, exchanges will temporarily close. In January 2025, it is expected that due to the Jimmy Carter Presidential Funeral, the U.S. stock market will temporarily close for one day. This arrangement reflects respect for national leaders and also helps maintain market order.

| Exchange | Status | Notes |

|---|---|---|

| NYSE | Closed | Expected Carter funeral day |

| NASDAQ | Closed | Expected Carter funeral day |

| CBOE | Closed | Expected Carter funeral day |

When you encounter special closures, you need to pay timely attention to official announcements and adjust trading plans. Historically, in December 2018, due to President George H.W. Bush’s state funeral, the U.S. stock market also temporarily closed. You can stay informed on the latest closure information by following news and exchange notifications.

Reminder: Changes in U.S. stock market holiday closures are infrequent, but special events may lead to temporary closures. You need to stay attentive to avoid impacts on investment decisions due to sudden closures.

Open Markets

Futures Markets

During U.S. stock market holiday closures, you can still pay attention to the U.S. futures markets. Some futures products on exchanges like the Chicago Mercantile Exchange (CME) will continue to operate. The table below shows the main futures market trading hours (Central Time):

| Futures Market Type | Trading Hours (CT) |

|---|---|

| Equity and Interest Rate Futures | Sunday 5:00 p.m. to Friday 4:00 p.m. |

| Cryptocurrency and Currency Futures | Sunday 5:00 p.m. to Friday 4:00 p.m. |

| Metals Futures | Sunday 5:00 p.m. to Friday 4:00 p.m. |

| Agricultural Futures | Sunday 7:00 p.m. to Friday 1:20 p.m. |

| Livestock Futures | Monday to Friday 8:30 a.m. to 1:05 p.m. |

You will find that although the U.S. stock market is closed, parts of the futures markets remain active. During holidays, trading volume usually declines, but volatility may increase. You can use these periods to pay attention to market dynamics and seek short-term opportunities.

| Observation Period | Trading Volume Changes | Volatility Changes |

|---|---|---|

| Before and after Christmas | Trading volume declines, holiday participation decreases | May surge due to liquidity constraints |

| New Year period | Liquidity recovers, trading volume stabilizes | Influenced by central bank decisions, etc. |

| End of December | Trading volume slightly increases due to fiscal policy debates | May fluctuate due to market events |

Global Stock Markets

During U.S. stock market holiday closures, other major global stock markets like Europe and Asia mostly continue trading as usual. You can pay attention to market changes in London, Frankfurt, Tokyo, and other places. Fluctuations in global markets sometimes affect the opening of the U.S. stock market the next trading day. During holidays, major news and policy changes in international markets are also worth your close attention.

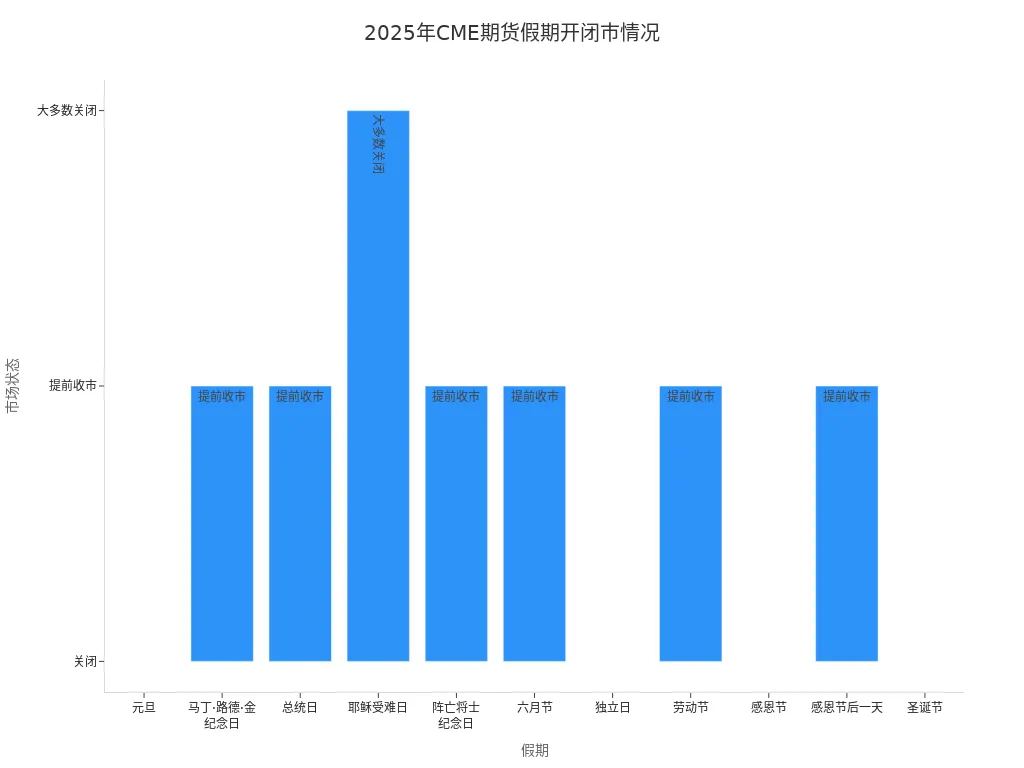

Forex and Commodities

The forex and commodities markets usually remain open during U.S. stock market holiday closures, but some holidays may have early closures or full-day closures. You can refer to the table below for the opening and closing arrangements of the CME futures markets during major holidays in 2025:

| Holiday | Date (2025) | Typical Impact on CME Futures |

|---|---|---|

| New Year’s Day | January 1, Wednesday | Markets closed |

| Martin Luther King Jr. Day | January 20, Monday | Equity index, interest rate, and forex futures: Close at 12:00 p.m. CT Energy and metals: Normal closure Agricultural: Closed |

| Presidents’ Day | February 17, Monday | Equity index and forex futures: Close at 12:00 p.m. CT Interest rate: Close at 12:00 p.m. CT Energy and metals: Normal closure Agricultural: Closed |

| Good Friday | April 18, Friday | Most markets closed (possible exceptions) |

| Memorial Day | May 26, Monday | Most markets close at 12:00 p.m. CT (possible exceptions) |

| Juneteenth | June 19, Thursday | Equity index and forex futures: Close at 12:00 p.m. CT Interest rate: Close at 12:00 p.m. CT Energy and metals: Normal closure Agricultural: Closed |

| Independence Day | July 4, Friday | Markets closed |

| Labor Day | September 1, Monday | Most markets close at 12:00 p.m. CT (possible exceptions) |

| Thanksgiving | November 27, Thursday | Markets closed |

| Day after Thanksgiving | November 28, Friday | Equity index and forex futures: Close at 12:15 p.m. CT Interest rate: Close at 12:00 p.m. CT Energy and metals: Close at 1:45 p.m. CT Agricultural: Close at 12:00 p.m. CT |

| Christmas Day | December 25, Thursday | Markets closed |

During U.S. stock market holiday closures, you can pay attention to futures, forex, and commodities markets to grasp global market dynamics in a timely manner and adjust investment strategies.

Market Volatility Analysis

Image Source: pexels

Pre-Holiday Performance

Before U.S. stock market holidays, you will find that the market often exhibits some unique changes. Many investors become more optimistic before holidays, with increased buying willingness. On the last trading day before a holiday, market returns are often higher than usual.

- Before holidays, retail investors are more active due to year-end bonuses and other factors, with noticeable fluctuations in trading volume.

- At year-end, some investors adopt tax-loss harvesting strategies, selling losing stocks to optimize taxes, which exerts downward pressure on certain securities prices.

- You will also notice that the pre-holiday effect makes market performance before holidays usually better than regular trading days.

Tip: Before holidays, you should pay attention to changes in market sentiment to avoid blind following due to excessive optimism.

Post-Holiday Volatility

After U.S. stock market holidays, market volatility usually increases. You will see that investors need to digest accumulated news and global events during the holiday, leading to a surge in trading volume and fluctuations in stock prices.

- After holidays, many investors rebalance their portfolios, and the market may experience brief declines.

- On the first trading day after a holiday, you need to pay special attention to the market opening performance, as prices may gap or fluctuate sharply.

Note: Market reactions after holidays are rapid, and accumulated information can easily trigger significant price fluctuations.

Coping Strategies

You can borrow professional investors’ strategies to rationally cope with market volatility during U.S. stock market holidays.

- Short-term traders usually buy one to two days before the holiday and sell one to two days after, utilizing the pre-holiday effect and post-holiday volatility.

- Long-term investors can choose to buy target stocks in batches at pre-holiday lows, waiting for the market to warm up.

- After holidays, you can consider buying at the close and selling at the next day’s close to capture short-term opportunities.

- At year-end, some investors adopt the “Santa Claus rally” strategy, holding stocks in the last few days of the year and selling in early January.

When operating, you need to avoid common mistakes:

- Emotional trading: The holiday atmosphere can easily make you overly optimistic, affecting rational judgment.

- Ignoring low trading volume: During holidays, liquidity declines, order execution time lengthens, and trading costs increase.

- Overtrading: The large amount of holiday information can easily lead you to trade frequently, increasing risks.

Recommendation: Before and after holidays, stay calm, conduct good risk management, and arrange trading plans rationally to avoid impacts from market volatility on investment decisions.

Investor Attention Checklist

Market and Trends

During U.S. stock market holiday closures, you can still follow global financial market dynamics through various channels. Although U.S. major exchanges suspend trading, other major global markets like Europe and Asia remain open. You can closely monitor stock index performance in London, Frankfurt, Tokyo, and other places; fluctuations in these markets often affect the U.S. stock market opening on the next trading day.

Futures markets have some products still trading during U.S. stock market closures. You can pay attention to equity index, interest rate, energy, and metals futures under the Chicago Mercantile Exchange (CME). The forex market operates almost year-round without rest, and fluctuations in major currency pairs like USD/EUR and USD/JPY often reflect global capital flows. Commodities like gold, crude oil, and agricultural products also trade continuously worldwide. For the bond market, U.S. Treasury futures and some international bond markets have different opening arrangements, and you can obtain real-time quotes through professional financial platforms.

Recommendation: During closures, use financial news websites or broker platforms to continuously track price changes and trading volumes in major global markets, adjusting investment strategies in a timely manner.

News and Policies

During U.S. stock market holidays, global economic and policy news continues unabated. You can grasp important dynamics affecting the market through the following information sources:

- Economic Calendar: You can check the economic calendar to understand the release times of major U.S. and global economic data, such as GDP, unemployment rate, and inflation.

- Earnings Reports: Many U.S. stock companies release quarterly or annual earnings reports before or after holidays. You can view key companies’ performance in the earnings reports section.

- IPO and SPO Calendar: New stock issuances and follow-on offerings affect market sentiment. You can learn about the latest developments through the IPO calendar and SPO calendar.

- Dividend Calendar: Pay attention to the dividend calendar to seize dividend opportunities.

- Holiday Schedule: You can check the holiday schedule at any time to avoid missing important trading days.

- Daily Market Statistics: Through daily market statistics, understand key data like market trading volume and price changes.

You can also pay attention to policy statements from institutions like the U.S. Treasury Department and the Federal Reserve; these announcements are often released during holidays and have profound market impacts. It is recommended that you regularly browse authoritative financial media and official announcements to ensure you do not miss any important news that may affect investment decisions.

You can bookmark the 2025 U.S. stock market holiday table below to plan trading plans rationally and reduce risks from holidays:

| Date | Holiday Name |

|---|---|

| January 20, 2025 | Martin Luther King Jr. Day |

| February 17, 2025 | Presidents’ Day |

| April 18, 2025 | Good Friday |

| May 26, 2025 | Memorial Day |

| June 19, 2025 | Juneteenth National Independence Day |

| July 4, 2025 | Independence Day |

| September 1, 2025 | Labor Day |

| November 27, 2025 | Thanksgiving |

| December 25, 2025 | Christmas Day |

| July 3, 2025 | Day before Independence Day |

| November 28, 2025 | Day after Thanksgiving |

| December 24, 2025 | Christmas Eve |

During holidays, you can pay attention to the following points:

- Trading volume decreases during holidays, and volatility may increase

- Prices may gap

- Pay attention to earnings release times

- Seize short-term trading opportunities

- Avoid trading on major holidays

Regularly paying attention to global market dynamics helps you optimize investment decisions.

FAQ

Can I place orders on U.S. stock market holiday closures?

You cannot conduct U.S. stock spot trading on holiday closures. The broker system will suspend order placement functions. You can arrange orders in advance for execution on the next trading day.

Do U.S. stock market holidays affect futures and forex trading?

During U.S. stock market holidays, parts of futures and forex markets remain open. Major futures contracts and forex pairs usually trade as usual, but liquidity may decline.

How do I check the latest U.S. stock market holiday arrangements?

You can visit the New York Stock Exchange or Nasdaq official websites to view the official holiday calendar. Mainstream financial information platforms will also update the information synchronously.

Will fund settlements be delayed during U.S. stock market holidays?

Trade instructions submitted during holidays will have fund settlements postponed to the next trading day. Please arrange funds in advance to avoid impacting investment plans.

Do U.S. stock market holiday closures affect U.S. stock ETF trading in other markets?

During U.S. stock market holidays, some U.S. stock ETFs can still trade in European or Asian markets. Prices may fluctuate due to liquidity and information delays. Please pay attention to risks.

Grasping the 2025 U.S. stock market holiday schedule equips you to dodge liquidity dips and heightened volatility around closures, yet high cross-border fees, currency uncertainty, and offshore account hurdles often sideline investors from futures or global plays during these gaps—especially when swift adjustments are key. Envision a platform with 0.5% remittance fees, same-day global transfers, instant fiat swaps, and zero fees on contract limit orders, enabling seamless U.S. stock access via one account?

BiyaPay is built for worldwide investors, facilitating swift fiat-to-digital conversions to match market rhythms. With real-time exchange rate query, monitor USD trends and transfer at optimal moments to trim costs. Spanning most regions with instant arrivals, it bridges holidays to futures or forex. Standout: trade U.S. and Hong Kong stocks through a single account, leveraging zero-fee contract limit orders for precise executions.

From pre-Independence Day early closes to post-Thanksgiving swings, BiyaPay backs your moves. Sign up now, visit stocks for U.S. prospects—quick setup unlocks affordable, agile global investing. Join savvy traders and turn holidays into strategy boosters!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.