- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Call Option: A Powerful Tool to Leverage Rising Market Trends at Low Cost

Image Source: unsplash

Call options let you capitalize on market uptrends with minimal capital. Their leverage far exceeds other financial instruments, allowing control of large assets with small investments—up to 500:1 in some cases. Compared to stocks, options have lower transaction costs and require less upfront capital. The table below compares costs:

| Evidence Type | Description |

|---|---|

| Transaction Costs | Options have lower trading costs than stocks, attracting liquidity and informed traders. |

| Leverage Effect | Options offer higher leverage, controlling larger assets with lower initial costs. |

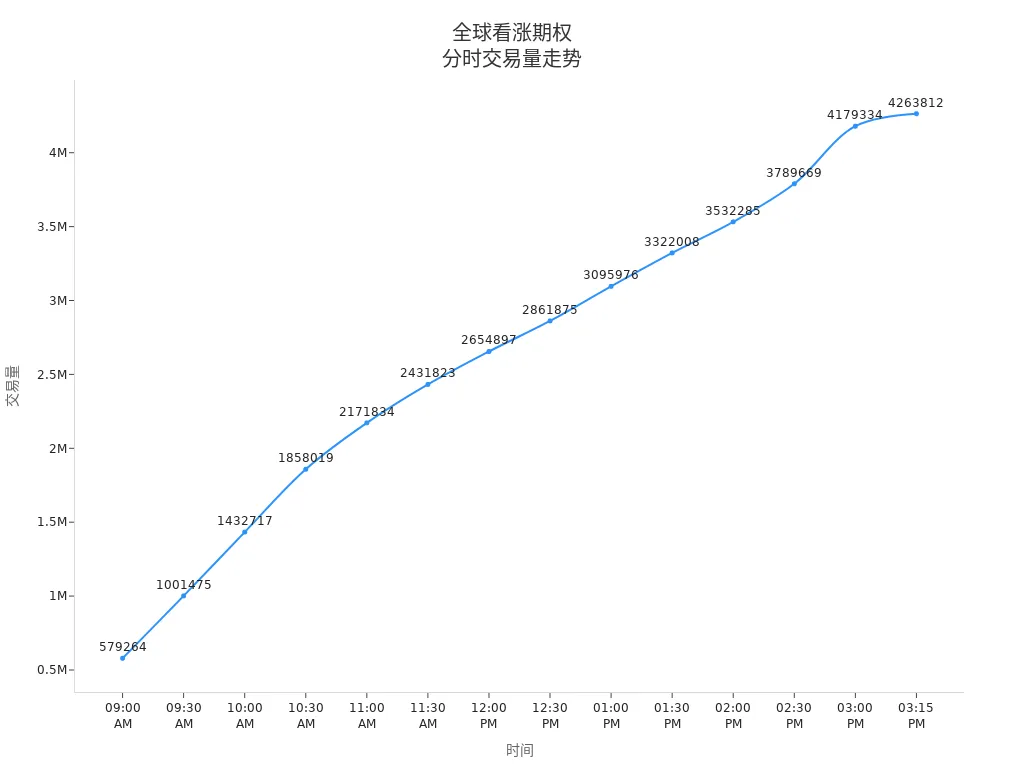

Global demand for call options is strong. This chart shows daily trading volume fluctuations:

Call options maximize capital efficiency while keeping risks within your control.

Key Highlights

- Call options allow control of high-value assets at low cost, with maximum loss limited to the premium paid.

- Selecting appropriate strike prices and expiration dates balances risk and reward effectively.

- Leverage amplifies returns during market uptrends.

- Selling call options generates premiums, cushioning losses from stock price declines.

- Call options suit investors seeking high capital efficiency and manageable risk, enhancing portfolio flexibility.

Low-Cost Leverage

Image Source: pexels

Leverage Effect

Call options enable you to leverage small investments for significant market exposure. You pay a modest premium to control high-value assets. For example, a small premium grants the right to buy stocks at a set price. Leverage is calculated as follows:

| Formula | Description |

|---|---|

| (Delta × Stock Price) / Option Price = Leverage | Uses the option’s delta to compute leverage. |

| Example | Delta of 0.6, stock price $10, option price $1 yields leverage of 6. |

Steps to calculate:

- Determine the option’s delta.

- Multiply delta by the stock price.

- Divide by the option price to get the leverage ratio.

Research confirms leverage’s impact. Studies on Chinese and German markets show leverage affects implied volatility. Geske et al. note that capital structure changes influence option prices and volatility. Monitor trading volume and market cap shifts to understand leverage in practice.

Capital Efficiency

Call options optimize capital use, controlling more shares with less money than direct stock purchases. Strategies include:

- Buying deep in-the-money call options with high intrinsic value for significant leverage and lower capital outlay.

- Using covered call strategies, selling calls on owned stocks to lock in sale prices and earn premiums.

These approaches maximize capital efficiency, letting you diversify across opportunities. Leverage and strategic allocation boost returns while managing risk.

Call Option Basics

Definition

A call option is a contract granting the right, but not obligation, to buy an asset at a set price by a specific date. You pay a premium for this right.

- Call options grant the holder the right to buy the underlying asset at a specified strike price.

- The contract is valid until its expiration, allowing exercise beforehand.

- The issuer must fulfill the transaction if exercised.

Focus on strike price and expiration to grasp option mechanics quickly.

Structural Components

Key components influence option pricing and decisions:

| Component | Description |

|---|---|

| Strike Price | Price at which the underlying asset can be bought. |

| Time Value | Portion of the premium tied to time until expiration. |

| Volatility | Measure of the underlying asset’s price fluctuations, typically annualized standard deviation. |

| Theta | Rate of option value decline as expiration nears. |

Learn more via resources like:

- Video on call vs. put option basics.

- Guide on call/put option risks and rewards.

- Details on long/short calls, exercise, and assignment.

- Beginner’s guide to option basics.

Master these to apply call options effectively.

Call Option Mechanics

Buyer Operations

As a call option buyer, follow these steps:

- Pay the premium to gain the right to buy the asset at the strike price.

- If the asset’s price exceeds the strike before expiration, exercise to buy at the strike price.

- Calculate profit: Sale proceeds minus strike price, premium, and fees.

- If the price doesn’t exceed the strike, don’t exercise; maximum loss is the premium.

In scenarios like trading through Hong Kong licensed banks, banks facilitate fund transfers and contract execution, ensuring secure transactions.

Buyers bet on price rises to profit from leveraged exposure.

Seller Strategies

Selling call options involves risk management strategies:

- Hedging: Hold stocks and sell calls to earn premiums, offsetting stock price drops.

- Market Neutral: Minimize directional risk for stable income.

- Covered Calls: Sell calls on owned stocks for premium income.

- Call Spreads: Buy and sell calls on the same asset to limit risk/reward.

- Rolling Calls: Close current positions and open new ones with different expirations/strikes.

- Delta-Based Strike Selection: Use delta to gauge likelihood of in-the-money expiration.

Sellers expect stable or slightly rising prices, profiting from premiums.

Expiration and Strike Price

Expiration and strike price impact profitability:

| Factor | Description |

|---|---|

| Expiration Date | Longer expirations reduce theta’s impact, ideal in uncertain or volatile markets. |

| Strike Price | Balances risk, cost, and profit potential; out-of-the-money strikes are cheaper but riskier, in-the-money safer but costlier. |

Choose expiration and strike based on risk tolerance and market outlook to optimize efficiency and control losses.

Case Studies

Image Source: pexels

Leveraged Returns

Call options amplify returns with low capital. In 2020, U.S. investors used bull call spreads on Apple stock, leveraging price swings for high returns. Small premiums controlled large positions, offering higher returns than stock purchases. Capital was spread across multiple opportunities, boosting efficiency.

Profit-Loss Structure

Call options’ risk-reward profile differs from stocks:

- Buyers’ risk is limited to the premium, with theoretically unlimited upside.

- Stock purchases require more capital, with greater downside risk.

- Sellers face unlimited downside if prices soar beyond the strike.

Options offer controlled risk and high return potential, ideal for leveraging uptrends with defined losses.

Advantages and Risks of Call Options

Advantages

Call options offer:

- Low upfront costs, controlling high-value assets via premiums.

- High leverage, amplifying returns in uptrends.

- Defined maximum loss, limited to the premium.

- Actively managed covered calls excel in volatile stocks, retaining upside while earning premiums.

- Downside protection in bear markets via premium income.

- Dynamic strategies optimize income for concentrated portfolios.

Adjust strategies to capture uptrends while managing risk.

Risks

Consider:

- Time decay (theta) erodes option value as expiration nears.

- Complex structures require understanding strikes, expirations, and volatility.

- Expiration risk: If the asset price doesn’t exceed the strike, the premium is lost.

- High volatility amplifies price swings, requiring active monitoring.

Combine risk tolerance with strategic adjustments to mitigate losses.

Price Influencing Factors

Underlying Asset Price

The underlying asset’s price drives option value:

- Rising asset prices increase intrinsic value and premiums.

- Time value reflects remaining expiration time.

- Higher volatility boosts prices due to greater profit potential.

Track asset price trends to optimize call option investments.

Volatility and Time

Volatility and time are critical:

- Theta measures time decay, accelerating near expiration.

- High volatility increases extrinsic value, offsetting decay.

- Volatile assets have slower decay; stable assets decay faster.

- Time decay is a key pricing factor.

Balance volatility and time to select optimal contracts.

Market Environment

Market sentiment and information asymmetry impact pricing. Studies show sentiment influences option prices:

| Study | Finding |

|---|---|

| Zghal et al. (2020) | Black-Scholes model with sentiment improves accuracy. |

| Dammak et al. (2022) | G-K model with dynamic information costs yields reliable results. |

| Boutouria et al. (2021) | Sentiment-enhanced Black-Scholes improves pricing. |

| Wang et al. (2022) | Investor sentiment significantly correlates with option prices. |

Monitor market conditions to refine pricing and decisions.

Practical Recommendations

Suitable Investors

Call options suit those seeking low-cost exposure to uptrends with limited capital. They’re ideal if you have basic financial knowledge and are willing to learn option mechanics. In U.S. markets, they enhance portfolio flexibility for risk-tolerant investors aiming for leveraged returns.

Strike Price Selection

Choose strikes based on:

- Trading strategy: Align with your goals.

- Market outlook: Match expected asset price movements.

- Expiration: Longer expirations suit uncertain markets.

- Risk tolerance: Out-of-the-money for high risk/reward; in-the-money for safety.

Adjust strikes to balance goals and market conditions.

Risk Management

Protect capital with:

- Stop-loss orders to limit losses.

- Position sizing based on risk tolerance.

- Hedging via diversified portfolios to reduce market-specific risks.

Monitor markets and adjust strategies to safeguard capital.

Call options offer low-cost leverage for market uptrends. Maximum loss is defined, limited to the premium.

- Balance risk and reward with strategic strike and expiration choices.

- Selling calls generates premiums, offsetting stock declines.

- Ideal for investors seeking efficiency and risk control.

Align call options with your goals and risk profile for optimal portfolio performance.

FAQ

How do call options differ from buying stocks?

Call options require only a premium to control more shares, unlike stocks needing full capital. Options offer higher leverage.

What’s the maximum loss with call options?

Maximum loss is the premium paid, regardless of market swings.

What happens when options expire?

If the asset price exceeds the strike, exercise for profit. If below, don’t exercise; lose the premium.

How do I choose the right strike price?

Select based on risk tolerance and market outlook. Out-of-the-money strikes are riskier but cheaper; in-the-money are safer but costlier.

Who should use call options?

Investors seeking low-cost upside exposure with defined risk, comfortable with potential premium loss, find call options appealing.

By mastering call options’ leverage and mechanics, you’re equipped to seize market upswings with minimal capital, but high cross-border fees, currency volatility, and offshore account complexities can hinder trading U.S. options, especially for swift responses to market swings or position tweaks. Picture a platform with 0.5% remittance fees, same-day global transfers, and contract limit orders with zero fees, enabling seamless option strategies via one account?

BiyaPay is tailored for options traders, offering instant fiat-to-digital conversions to act on bullish signals nimbly. With real-time exchange rate query, monitor USD trends and transfer at optimal moments to cut costs. Covering most regions with instant arrivals, it powers rapid allocations to S&P 500 index options (like SPY) or individual stock calls. Crucially, trade U.S. and Hong Kong markets through a single account, leveraging contract limit orders with zero fees for volatility or Delta-based limit strategies.

Whether chasing leveraged gains or managing risks, BiyaPay fuels your precision. Sign up now, visit stocks for U.S. prospects—quick setup unlocks cost-effective, data-driven trading. Join global investors and conquer 2025 uptrends!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.