- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to start retirement finance? Comprehensive analysis of IRA accounts + practical operation guide

Image Source: pexels

The most important step in starting retirement planning is opening an IRA account. You can enjoy tax advantages through an IRA, allowing investment gains to grow tax-free until withdrawal.

- Stock-heavy portfolios have an annual return rate of about 7%-10%, while bond-heavy portfolios average 3%-5% annually.

- Early investment allows funds more time to grow, with more pronounced compounding effects.

- As long as you have income, whether you’re self-employed or a company employee, you can easily open an IRA account.

Key Points

- Opening an IRA account is the first step in retirement planning. Whether you’re self-employed or a company employee, as long as you have income, you can easily open an IRA account.

- IRA accounts offer tax advantages, with investment gains growing tax-free. Choosing the right IRA type can help you optimize retirement fund accumulation.

- Compounding is the key to achieving long-term wealth growth. The earlier you start investing, the more pronounced the compounding effect, and the more secure your future retirement life will be.

- Contribute regularly to your IRA account, taking advantage of annual contribution limits. Flexibly arrange contribution schedules to reduce short-term financial pressure.

- When managing an IRA account, regularly review beneficiary information and tax planning to avoid common mistakes and ensure the safe growth of retirement funds.

Starting Retirement Planning and IRA Accounts

Image Source: unsplash

Role of IRA Accounts

When starting retirement planning, choosing the right savings tool is critical. An IRA account provides a tax-advantaged environment designed specifically for retirement savings. Whether or not you have an employer-sponsored 401(k) plan, as long as you have income, you can open an IRA account. Through an IRA account, you can enjoy tax-deferred or tax-free growth, allowing your funds to accumulate faster than in a regular savings account.

Many studies show that proper use of an IRA account can help optimize withdrawal strategies during retirement. By adopting informed withdrawal strategies, you can not only increase wealth during retirement but also effectively reduce tax burdens. For example, using informed withdrawal strategies over a 30-year retirement period, you could gain an additional $400,000 in wealth while reducing taxes by $225,000.

The table below compares the main advantages of an IRA account versus a regular savings account:

| Account Type | Eligibility | Tax Advantages | Growth Method | Suitable For |

|---|---|---|---|---|

| Traditional IRA | Anyone with income | Tax-deferred | Investment gains defer taxes | Those without 401(k) or seeking supplementation |

| Roth IRA | Income with limits | Tax-free growth | Tax-free withdrawals | Young, fast-growing income |

| Regular Savings Account | No restrictions | None | Interest taxed annually | Short-term savings |

When starting retirement planning, choosing an IRA account can make your retirement funds grow faster, ultimately accumulating more wealth.

Compounding and Tax Advantages

Compounding is the key to achieving long-term wealth growth. By contributing funds to your IRA account annually, your funds not only earn investment returns but also allow those returns to generate further gains. The longer the time horizon, the more significant the snowball effect of compounding.

- Suppose you contribute $5,000 annually to an IRA account for 15 years, with an average annual return of 7%. Your total contribution would be $75,000. Due to compounding, your final account balance could reach $346,659, far exceeding the amount you invested.

- Compounding works for everyone, and you don’t need to time the market precisely. As long as you commit to long-term investing, compounding will continuously amplify your returns.

- In an IRA account, investment gains can grow tax-deferred (Traditional IRA) or tax-free (Roth IRA). This means you don’t have to pay taxes on investment gains annually, allowing the full amount to participate in compounding growth, maximizing your retirement savings.

The longer the investment period, the more significant the compounding effect. The earlier you start retirement planning, the more secure your future retirement life will be.

By leveraging the tax advantages of an IRA account, you can maximize the compounding effect. This is the most valuable opportunity to seize when starting retirement planning.

IRA Account Types

Traditional IRA

You can choose a Traditional IRA account for retirement savings. A Traditional IRA allows you to invest with pre-tax income, reducing your taxable income for the year. Investment gains in the account are tax-deferred, and you only pay income tax upon withdrawal during retirement.

- As long as you have income, you can open a Traditional IRA. Tax deductions for high-income earners may be phased out.

- After reaching age 73, you must begin taking Required Minimum Distributions (RMDs), withdrawing a certain amount annually and paying taxes on it.

- If you withdraw funds before age 59½, you’ll typically face a penalty.

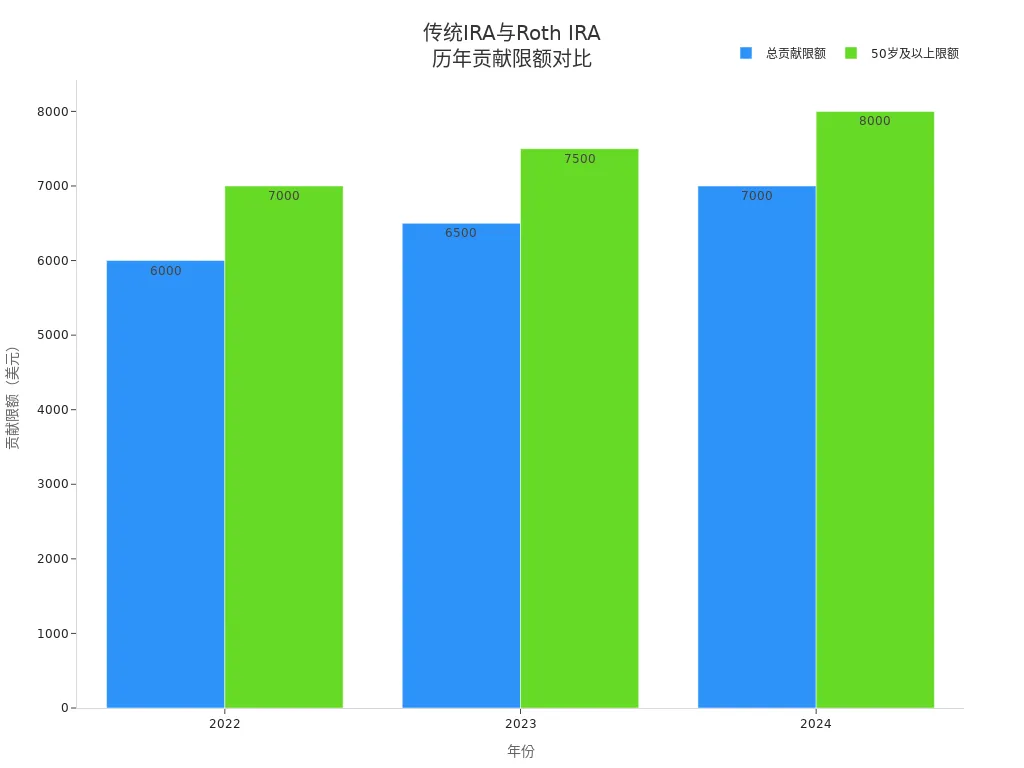

- The contribution limit for a Traditional IRA adjusts annually. The table below shows contribution limit changes from 2022 to 2024:

| Year | Total Contribution Limit for Traditional and Roth IRA | Limit for Age 50 and Over |

|---|---|---|

| 2024 | $7,000 | $8,000 |

| 2023 | $6,500 | $7,500 |

| 2022 | $6,000 | $7,000 |

Roth IRA

A Roth IRA account is suitable for those who want tax-free withdrawals in the future. You invest with after-tax income, and both investment gains and qualified withdrawals are tax-free.

- You must have income and stay within specified income limits.

- For single filers in 2025, income must be between $150,000-$165,000, and for married couples filing jointly, between $236,000-$246,000.

- A Roth IRA has no mandatory distribution requirements, allowing funds to continue growing.

- You can withdraw contributions tax-free at any time, but earnings require specific conditions to be withdrawn tax-free.

- A Roth IRA is suitable for those expecting higher tax rates in retirement or seeking flexible retirement fund management.

| Feature | Roth IRA | Traditional IRA |

|---|---|---|

| Tax Treatment | After-tax funds, tax-free growth | Pre-tax funds, taxed on withdrawal |

| Withdrawals | Contributions withdrawn tax-free anytime, earnings tax-free with conditions | Taxed on withdrawal |

| Required Distribution | No mandatory distributions | Mandatory distributions after age 73 |

| Beneficiary Withdrawals | Tax-free under conditions | Taxed |

Type Selection Tips

When choosing an IRA account type, you need to consider your income, tax situation, and future plans.

- If your current tax rate is high, a Traditional IRA can help you gain tax deductions.

- If you expect higher tax rates in retirement, a Roth IRA’s long-term tax-free advantage is more significant.

- A Roth IRA has income restrictions, while a Traditional IRA is more flexible.

- You should also consider mandatory distribution requirements and withdrawal flexibility.

- Common mistakes include focusing only on short-term tax benefits, ignoring future tax rate changes. You should weigh short-term and long-term benefits based on your situation to make the best choice.

Account Opening Channels

Channel Comparison

When choosing a channel to open an IRA account, you can consider discount brokers, traditional brokers, banks, and trust companies. Each channel has distinct service and fee structures. The table below helps you quickly understand the main differences:

| Type | Service Features | Fee Structure |

|---|---|---|

| Discount Brokers | Offer self-directed investment accounts, supporting independent research and decisions. | Typically charge lower transaction fees. |

| Traditional Brokers | Provide personalized services, usually requiring higher initial investment amounts. | Higher fees, charged as a percentage of assets. |

| Banks | Offer self-directed accounts, some provide research analysis, not charging based on investment advice. | Fees may be a percentage of assets. |

| Trust Companies | Offer self-directed IRAs, managing various assets, including non-exchange-traded assets. | Fee structures vary based on services. |

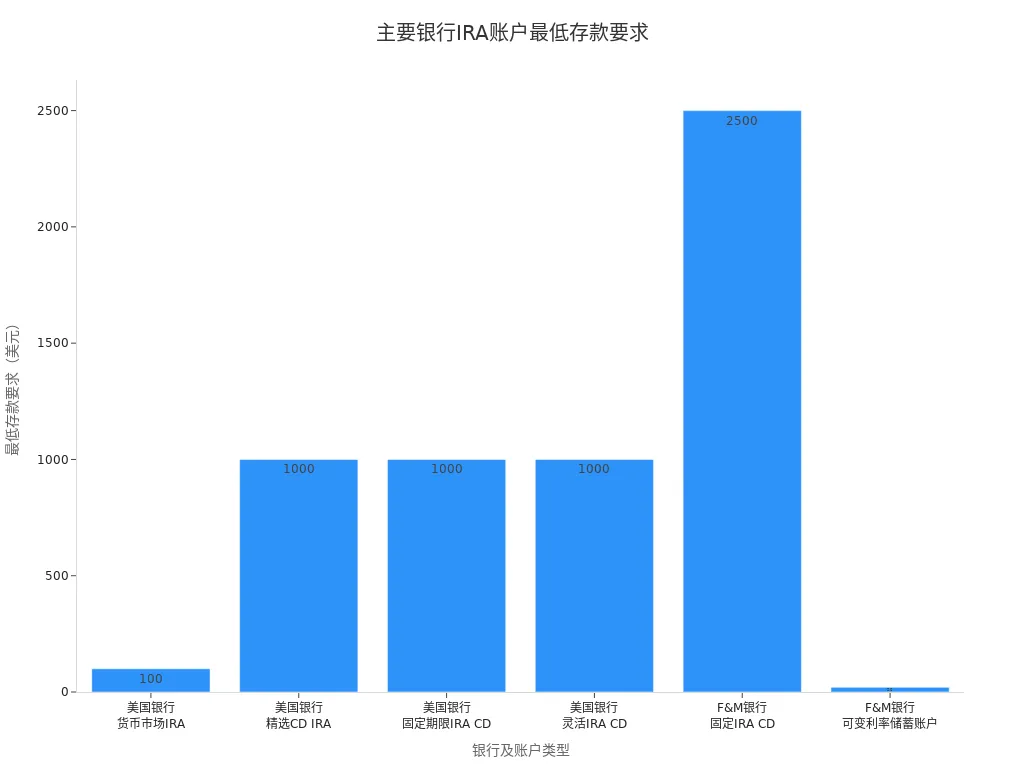

When opening an IRA account at a bank, minimum deposit requirements vary by account type. Some banks’ money market IRAs require only $100, while some certificate of deposit IRAs require $1,000 or more. You can refer to the chart below to understand minimum deposit thresholds for different accounts:

Selection Tips

When choosing an account opening channel, you should consider your needs and investment experience. If you prefer self-directed operations, discount brokers and some banks’ self-directed accounts are more suitable. These channels have simple opening processes, typically requiring only $50-$100 to activate an account. You just need to fill out information online, upload identification, and complete the process in minutes.

If you want personalized advice, traditional brokers and trust companies offer more comprehensive services but charge higher fees and require larger initial investments. Some platforms like Interactive Brokers have more complex opening processes, suitable for experienced active investors.

Before opening an account, you can compare the services and fee structures of different channels to choose the option that best fits your needs. As long as you have income, regardless of the channel, you can easily open your IRA account and take the first step in retirement planning.

Account Opening Process

Preparation for Opening

Before formally opening an IRA account, you need to prepare thoroughly. Choosing the right financial institution and account type is a critical step in starting retirement planning. You can consider major U.S. financial institutions, licensed Hong Kong banks, or other reputable channels. Before opening, it’s recommended to complete the following preparations:

- Choose a broker or robo-advisor. You can select a platform based on your investment experience and service needs.

- Open an account with the chosen company. You need to understand the services and fee structures of different institutions.

- Fund the IRA account. Some institutions require only $50-$100 to activate an account.

- Purchase investments within the IRA. You can choose from stocks, bonds, funds, and other products.

When opening an account, financial institutions typically require the following documents:

- Government-issued photo ID (e.g., passport or driver’s license)

- Social Security Number

- Proof of address (e.g., utility bill, if different from ID)

- Beneficiary information (designating account beneficiaries)

- Employment details (e.g., employer name, position)

Tip: Preparing all documents in advance can greatly improve account opening efficiency and avoid delays due to incomplete information.

Operational Steps

The process of opening an IRA account online is very convenient, with an experience similar to online shopping. Most major U.S. financial institutions and licensed Hong Kong banks support online account opening. The typical steps are as follows:

| Step | Description |

|---|---|

| Select Account Type | Choose the desired IRA account type (Traditional or Roth IRA) |

| Provide Personal Information | Enter your personal, employment, and financial information |

| Select Account Features | Choose specific account features (e.g., automatic investing, recurring transfers) |

| Create Login Credentials | Set up account username and password, provide contact information |

| Verify Identity | Upload identification documents to complete verification |

| Specify Funding Source | Choose the method to fund the account (e.g., bank transfer, check) |

| Total Time | Approximately 10 minutes |

You simply follow the on-screen prompts to fill in information and upload required documents. Most platforms complete the opening process within 10 minutes. Some institutions also provide online customer service to assist with any issues during the process.

Notes

When opening an IRA account, you need to pay attention to several key points to avoid common pitfalls:

- Even if you have a 401(k) plan, you can contribute to an IRA account, but you must consider the annual total contribution limit.

- If your income is too high, you may not be eligible to contribute to a Roth IRA. Check income limits in advance.

- The tax deduction amount for a Traditional IRA may be limited if you participate in an employer-sponsored retirement plan.

- Roth IRA contributions are not tax-deductible, but qualified future withdrawals are tax-free.

- If you have multiple IRA accounts, the total annual contribution must not exceed the statutory limit.

- Early withdrawals before age 59½ typically incur a 10% penalty, though certain exceptions apply.

- You can designate beneficiaries to ensure smooth inheritance of the account.

- A Traditional IRA requires mandatory withdrawals starting at age 73, while a Roth IRA has no such requirement.

Common opening challenges include compliance errors, missing documents, inaccurate IRS reporting, failed deductions, and incorrect beneficiary information. When filling out information, carefully verify to ensure all details are accurate and complete. Missing documents may result in a $50 fine per document, and incorrect reporting could trigger compliance risks and audits.

Tip: If you encounter any issues during the opening process, you can consult the financial institution’s customer service. Understanding the relevant rules in advance helps you smoothly complete the retirement planning start and avoid unnecessary trouble later.

IRA Account Management

Image Source: unsplash

Funding Contributions

When managing an IRA account, consistent funding contributions are crucial. Contributing a fixed amount annually helps you fully utilize the annual contribution limit. You can choose to make a lump-sum contribution or set up automatic transfers to contribute monthly in installments. This not only reduces short-term financial pressure but also smooths out the impact of market fluctuations. In the U.S. market, many investors contribute the full annual limit at the beginning of the year to allow funds to participate in compounding growth earlier. You can also flexibly arrange contribution schedules based on your income and expenses.

Investment Options

You have a variety of investment options within an IRA account. Common investment products include:

- Mutual Funds

- Exchange-Traded Funds (ETFs)

- Target-Date Funds

- Individual Stocks

- Treasuries

- Bonds

- Money Market Funds

- Alternative Investments

You can allocate assets based on your risk tolerance and investment goals. For example, younger investors typically choose more stock-based funds to pursue long-term growth. As retirement approaches, you can gradually increase the proportion of bonds and money market funds to reduce volatility risk. Target-date funds automatically adjust asset allocation for you, suitable for investors who prefer simplified management.

Common Mistakes

When managing an IRA account, you may encounter some common mistakes. The following issues deserve special attention:

- Incorrect or missing beneficiary information may prevent assets from being smoothly inherited.

- Ignoring tax planning for inherited IRAs may lead to additional tax burdens.

- Failing to evaluate the best options for spousal IRA transfers, affecting overall tax efficiency.

- Not using direct transfers for fund rollovers, leading to unnecessary tax consequences.

- Overlooking special tax treatments for company stock, missing tax-saving opportunities.

- Not fully utilizing the tax-free advantages of a Roth IRA, impacting post-retirement fund flexibility.

When managing your account, it’s recommended to regularly review beneficiary information, understand relevant tax regulations, and consult professionals if you have questions. This helps you mitigate risks and ensure the safe growth of retirement funds.

When starting retirement planning, choosing and consistently managing an IRA account is critical. An IRA account not only provides tax advantages but also allows your funds to achieve long-term compounding growth. The table below shows that modern workers’ retirement security increasingly relies on 401(k) and IRA accounts, with Social Security playing a diminishing role, making personal management of retirement accounts more important. You should act early based on your situation, regularly monitor account management and investment strategies to ensure the quality of your future retirement life.

| Evidence Content | Description |

|---|---|

| 401(k) and IRA are key to modern workers’ retirement security | As Social Security’s role diminishes in the future, consistently managing an IRA account becomes especially important. |

| Employer-sponsored plans have almost entirely shifted to 401(k) | This indicates individuals need to actively manage their retirement accounts to ensure financial security. |

FAQ

What are the requirements for opening an IRA account?

As long as you have income, you can open an IRA account. Mainland China residents can apply through licensed Hong Kong banks or major U.S. financial institutions. You need to prepare identification and a Social Security Number.

What products can an IRA account invest in?

You can invest in U.S. market stocks, bonds, mutual funds, ETFs, and target-date funds within an IRA account. You can also choose money market funds or treasuries, flexibly allocating assets.

How much can you contribute to an IRA account annually?

You can contribute up to $7,000 annually. If you are 50 or older, you can contribute $8,000. This limit applies to the combined total of Traditional and Roth IRAs.

What are the consequences of early withdrawals?

Withdrawing funds before age 59½ typically incurs a 10% penalty and income taxes. Certain exceptions, such as first-time home purchases or significant medical expenses, may waive the penalty.

Can an IRA account designate beneficiaries?

You can designate beneficiaries when opening the account. This ensures your retirement funds can be smoothly inherited, avoiding legal disputes. It’s recommended to regularly review and update beneficiary information.

Understanding the power of IRA accounts and the magic of compounding is just the start. The real challenge for many global investors is finding a platform that offers the necessary efficiency, low cost, and accessibility to effectively manage their long-term retirement savings. With BiyaPay, you can overcome these hurdles today. You can get set up in just 3 minutes without the prerequisite of an overseas bank account, enabling immediate action on your investment plans.

Our platform is designed for the modern global investor, facilitating the rapid conversion between fiat currencies and digital assets like USDT, ensuring your retirement contributions are deployed swiftly. This quick turnaround is crucial for maximizing the compounding effect. Furthermore, you can manage your exposure to US and Hong Kong Stocks within a single, integrated account, simplifying your global portfolio management.

Take advantage of our low remittance fees—as low as 0.5%—and utilize our real-time exchange rate checks for transparent and cost-effective fund transfers. Don’t let traditional banking friction slow down your future; open your account today and ensure your retirement funds are growing with maximum speed and minimal cost.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.