- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Set the Annualized Return Target? Peter Lynch Teaches You to Achieve Steady Appreciation

Image Source: pexels

When setting your annualized return target, you should prioritize rationality and realism. U.S. market data shows an average annual return of 9.33% over the past 30 years, 8.87% over 20 years, and 11.01% over 10 years.

| Time Period | Average Annual Return (Including Reinvested Dividends and Inflation) |

|---|---|

| Past 10 Years (2014–2024) | 11.01% |

| Past 20 Years (2004–2024) | 8.87% |

| Past 30 Years (1994–2024) | 9.33% |

You should consider your risk tolerance and avoid blindly chasing high returns. Peter Lynch’s investment philosophy also emphasizes reasonable expectations, which offers important insights for setting targets.

Key Points

- When setting an annualized return target, consider historical market performance and your risk tolerance. A reasonable target can help you achieve life goals.

- Quantify your return target to ensure it is both challenging and achievable. Overly high or low targets can affect investment decisions.

- Diversified investing can reduce risk and increase the likelihood of stable returns. Allocating funds to different asset types can effectively mitigate market volatility.

- Long-term holding of quality assets is key to achieving target returns. Patient investing and avoiding frequent trading can improve success rates.

- Regularly review and adjust investment targets to ensure they align with market conditions and personal circumstances. Flexibility in responding to changes maintains investment stability.

Principles of Annualized Return Target Setting

Target Definition

When setting an annualized return target, you first need to clarify what the target means. The annualized return target is the average annual return you hope your investments will achieve. This target is not just a number but the foundation for achieving your life goals. You can set it based on your needs, such as funding your child’s education, retirement, or purchasing a sailboat. Everyone’s goals differ, so you need to create your own “custom benchmark.”

- You can consider the following aspects to define your target:

- What are your life goals?

- How much cash flow do you need to meet these goals?

- What level of return do you expect from your investments?

Long-term U.S. market data shows that the average annualized return of the stock market is about 10%. Since 1926, the U.S. stock market has returned approximately 10% annually, while global stock portfolios have averaged around 11%. The S&P 500 Index has averaged over 10% annual returns since 1957. These historical data points can serve as a reference for setting your annualized return target.

You also need to quantify your return target. For example, if you aim to cover retirement expenses with an 85% probability, you might set a 9% annual return target. You should also consider your investment amount, time horizon, and target costs to ensure the target is both challenging and achievable. If your target significantly exceeds the market’s average, you need to consider whether you have additional funding sources or adjust the target.

Tip: Quantifying your target helps you better plan your portfolio structure and select appropriate investment products.

Target Risk

When setting an annualized return target, you must fully recognize the risks of setting it too high or too low. If your target is too high, you may choose high-risk investments, increasing the likelihood of losses. Historical data shows that market volatility is significant, with some years yielding below-average returns. You need to understand that market downturns are inevitable, and long-term investors should be mentally prepared.

-

Risks of setting an overly high target:

- You may pursue high-risk assets, leading to increased portfolio volatility.

- During market downturns, you may panic and sell, missing out on long-term returns.

- If the target exceeds realistic market levels, achieving expected returns becomes difficult.

-

Risks of setting an overly low target:

- You may miss out on the power of compounding, limiting long-term asset growth.

- Your life goals, such as retirement funding, may not be met.

- You may be overly conservative, missing opportunities from market upswings.

You also need to consider your risk tolerance. Research shows that risk-averse investors prefer assets with lower volatility to achieve a smoother consumption path. You need to understand your psychological capacity to avoid emotional decisions during market fluctuations. Regularly review and adjust your portfolio to ensure it aligns with your annualized return target and risk tolerance.

Suggestion: Long-term investing, dollar-cost averaging, and diversified asset allocation can help you reduce risk and steadily achieve your annualized return target.

Importance of Rational Target Setting

Dangers of Overly High Targets

When setting an annualized return target, if the target is too high, you may overlook the market’s actual risks. Peter Lynch emphasized that rational investors do not blindly chase high returns but set reasonable expectations based on market history and personal circumstances. Overly high targets may lead you to select high-risk assets, increasing portfolio volatility. You may panic during market downturns, making poor decisions. Over time, such behavior can undermine stable asset growth.

Costs of Overly Low Targets

If you set an annualized return target too low, you may miss out on market upswings. You might be overly conservative, choosing low-risk, low-return products, which slows asset growth. As a result, your life goals, such as retirement funds or children’s education expenses, may be unattainable. A reasonable target helps you balance risk and reward, achieving sustained asset growth.

Impact of Investment Psychology

During the investment process, psychological factors significantly influence decisions. According to Fisher (2014), financial advisors can help you stay rational, disciplined, and objective during market turbulence, countering emotions like fear, greed, and regret. The following table summarizes the impact of irrational annualized return targets on investor psychology and behavior:

| Emotional Driver | Potential Consequences | Advisor Suggestions |

|---|---|---|

| Fear | Panic selling during market downturns | Stay rational, follow long-term plans |

| Greed | Blindly chasing high returns, ignoring risks | Set realistic targets, diversify investments |

| Regret | Regretting missed opportunities, frequently adjusting strategies | Stay disciplined, avoid emotional decisions |

You need to recognize that a reasonable annualized return target helps maintain investment stability and consistency. Rational target setting can help you withstand psychological pressures from market volatility and focus on long-term growth.

Peter Lynch’s Strategy for Steady Growth

Image Source: unsplash

Return Expectations

When setting an annualized return target, you need to establish realistic return expectations. Peter Lynch believed that understanding the fundamentals of the companies you invest in is critical. You should be clear about a company’s business model and growth potential to reasonably estimate future returns. Lynch advised staying calm during market fluctuations and not altering long-term judgments due to short-term ups and downs. He also noted that market corrections are common and can provide opportunities to buy quality companies at a discount.

- You can refer to Lynch’s insights:

- Understand the company’s business to set realistic return expectations.

- Maintain emotional discipline to avoid impulsive actions.

- View market corrections as investment opportunities.

During his tenure managing the Fidelity Magellan Fund, Lynch achieved an average annual return of 29.2%, compared to 15.8% for the S&P 500 Index. While Lynch’s performance was exceptional, he emphasized that ordinary investors should use the market’s long-term average as a reference and avoid chasing extremely high returns.

| Investor | Average Annual Return |

|---|---|

| Peter Lynch | 29.2% |

| S&P 500 Index | 15.8% |

Diversified Investing

Lynch advocated diversified investing to reduce risks from single assets. You can allocate funds to different asset types, such as stocks, bonds, gold, and farmland. Data shows that 10-year U.S. Treasury notes have consistently delivered positive returns over the past 30 years and are negatively correlated with stocks. Gold has also performed well, with zero correlation to stocks. Farmland and timberland can yield positive returns during high inflation and are less affected by economic cycles.

- Benefits of diversified investing include:

- Reducing overall volatility

- Increasing the likelihood of stable returns

- Mitigating single-market risks

Long-Term Holding

Lynch emphasized that long-term holding of quality assets is key to achieving target returns. Historical data shows that since the 1920s, investors holding the S&P 500 Index for 20 years have almost never incurred losses. Even during major market downturns, long-term holding can still yield positive returns. You should be patient in your investments and avoid frequent trading. Long-term investing not only reduces emotional decisions but also increases the likelihood of achieving your annualized return target.

| Evidence Type | Description |

|---|---|

| Benefits of Long-Term Stock Holding | Holding the S&P 500 for 20 years results in almost no losses |

| Investment Time vs. Timing | Holding for 5 or 10 years significantly increases the probability of positive returns |

Insights from Lynch’s Philosophy

Lynch’s investment philosophy provides key insights for setting your annualized return target:

- You should deeply understand the companies you invest in and choose businesses that are simple to comprehend.

- Do not invest in areas you don’t understand.

- Focus on the company’s growth potential and management’s stake in the business.

- Avoid trying to predict market movements or making emotional decisions.

- Stay humble and set realistic return expectations.

- Diversify investments and be prepared to handle market volatility.

You can draw on Lynch’s experience, combine it with your circumstances, set a reasonable annualized return target, and persist long-term to achieve steady asset growth.

Steps to Set an Annualized Return Target

Image Source: unsplash

Risk Assessment

When setting an annualized return target, you first need to conduct a comprehensive risk assessment. This helps you understand how much volatility and loss you can tolerate. You can follow these steps to assess your risk tolerance:

- Clarify your financial goals, such as retirement, children’s education, or home purchase.

- Determine the time horizon needed to achieve these goals.

- Identify your behavioral biases, such as whether you panic during market fluctuations.

- Assess your psychological capacity to handle losses.

- Understand the trade-off between risk and return.

- Document your risk discussions and decision-making process.

- Periodically reassess your risk tolerance to ensure it aligns with your circumstances.

You can use a risk tolerance questionnaire to assist in the assessment. These questionnaires typically include 10 or fewer questions to quickly gauge your investment knowledge and comfort with risk. You can adjust the questionnaire content based on your needs to ensure accurate and effective results.

Tip: Risk assessment is not a one-time task. You should periodically reassess your risk tolerance as your life stage and market conditions change.

Referencing Historical Returns

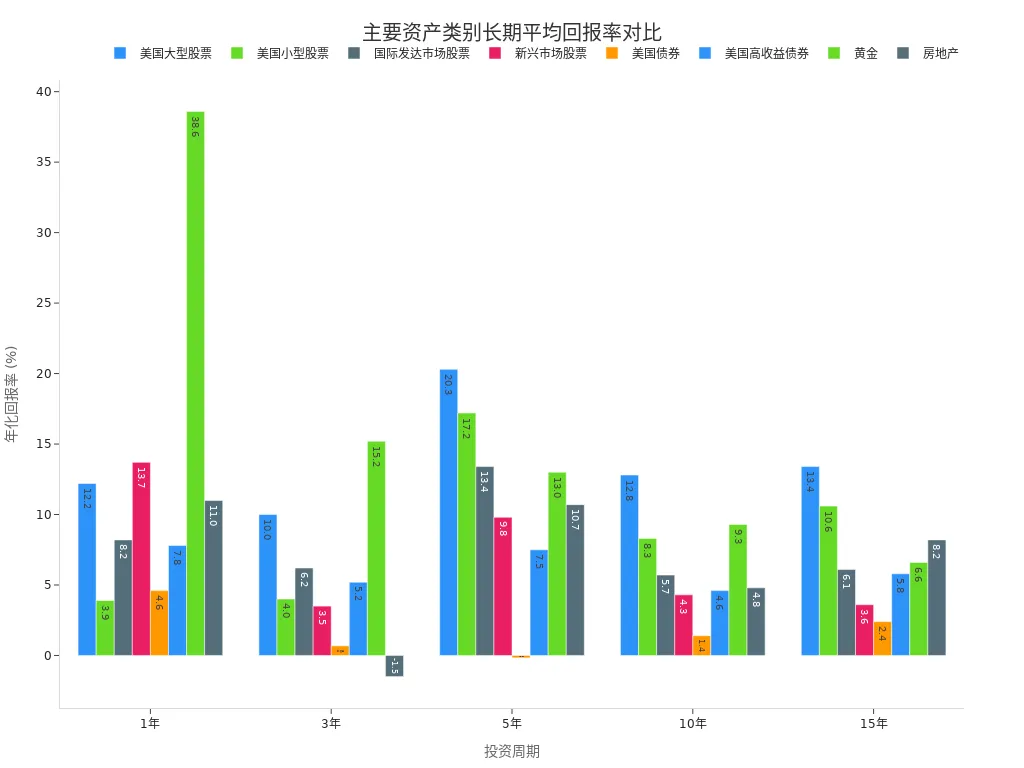

When setting an annualized return target, you need to reference the historical average returns of different assets. U.S. market long-term data provides a valuable reference. The following table shows the average returns of major asset classes over different investment periods:

| Asset Class | 1-Year Return | 3-Year Return | 5-Year Return | 10-Year Return | 15-Year Return |

|---|---|---|---|---|---|

| U.S. Large-Cap Stocks | 12.2% | 10.0% | 20.3% | 12.8% | 13.4% |

| U.S. Small-Cap Stocks | 3.9% | 4.0% | 17.2% | 8.3% | 10.6% |

| International Developed Market Stocks | 8.2% | 6.2% | 13.4% | 5.7% | 6.1% |

| Emerging Market Stocks | 13.7% | 3.5% | 9.8% | 4.3% | 3.6% |

| U.S. Bonds | 4.6% | 0.68% | -0.17% | 1.4% | 2.4% |

| U.S. High-Yield Bonds | 7.8% | 5.2% | 7.5% | 4.6% | 5.8% |

| Gold | 38.6% | 15.2% | 13.0% | 9.3% | 6.6% |

| Real Estate | 11.0% | -1.5% | 10.7% | 4.8% | 8.2% |

You can use this data, combined with your risk preferences and funding needs, to set a reasonable annualized return target. Different assets have varying returns and volatility, and diversified investing helps balance risk and reward.

Suggestion: You can set your target near the long-term average of U.S. large-cap stocks or a diversified portfolio, avoiding the pursuit of extremely high returns.

Investment Time Horizon

The investment time horizon significantly affects the likelihood of achieving your annualized return target. The longer you invest, the higher the probability of achieving positive returns. Long-term investing helps smooth out market volatility and reduces the risk of short-term losses. Research shows:

- The longer the investment horizon, the higher the probability of failing to meet specific profit targets.

- If the investment horizon is short, market volatility may increase the likelihood of losses.

- The specific allocation of your portfolio also affects the likelihood of achieving your target.

When setting your target, you need to consider your funding needs and future plans. For example, if you plan to retire in 10 years, you can allocate a higher proportion to stocks. If you need funds in 3 years, you can increase allocations to bonds or cash-like assets.

Tip: You can consult with a licensed financial advisor in Hong Kong to develop a more scientific investment plan based on your time horizon and risk tolerance.

Target Adjustment

Market conditions and personal circumstances change, so you need to periodically review and dynamically adjust your annualized return target. Factors like economic cycles, interest rate changes, and personal income fluctuations can affect your return expectations. You can reassess your target annually or biennially to ensure it aligns with current conditions.

- During significant market volatility, you can lower your target to reduce risk exposure.

- When your risk tolerance increases or funding needs decrease, you can raise your target to pursue higher returns.

- Document the reasons and process for each target adjustment to maintain investment rationality and discipline.

Suggestion: Dynamic target adjustment is not about frequently changing investment directions but making scientific adjustments based on circumstances to maintain long-term investment stability.

Pitfalls and Suggestions

High-Return Pitfalls

When setting an annualized return target, you may fall into the trap of chasing high returns. Many investors choose funds that performed exceptionally well in the past year, assuming high returns will continue. However, markets are cyclical, and past performance does not guarantee future results. You may also try to time the market, buying low and selling high. In reality, this strategy often leads to missed opportunities for long-term growth. Holding quality assets long-term is generally more effective for achieving targets.

Suggestion: Focus on long-term average returns and avoid being swayed by short-term high returns. A reasonable target supports steady asset growth.

Ignoring Risk

When setting targets, you may overlook volatility and downside risks. Many investors focus only on returns without assessing potential losses. Downside deviation and the Sortino ratio can help you identify specific risk sources in your portfolio and quantify negative return fluctuations. These tools provide a clearer picture of potential losses, helping you make more rational decisions.

- Downside deviation focuses on downside risk, revealing portfolio weaknesses.

- The Sortino ratio analyzes negative return fluctuations, suitable for investors aiming to minimize losses.

- Quantifying negative return fluctuations provides a more accurate risk profile.

Lack of Flexibility

If you set a target and fail to adjust it, your portfolio may become misaligned with your actual needs. Investors often overlook the importance of periodically reviewing their portfolios. Market conditions and personal circumstances change, and targets should be adjusted accordingly. A lack of flexibility can prevent your investment plan from adapting to new challenges.

- Neglecting portfolio reviews may cause your asset allocation to misalign with your financial situation.

- Over-diversification can increase management complexity and reduce efficiency.

Optimization Suggestions

You can optimize your annualized return target with the following methods:

- Set a reasonable target based on your risk aversion and maximum possible loss.

- Allocate a proportion of your wealth to risky assets, matching your risk tolerance.

- Dynamically adjust investment allocations to simplify decision-making.

- Regularly consult with a licensed financial advisor in Hong Kong for professional advice.

You should avoid emotional decisions, focus on long-term goals, and periodically review and adjust your portfolio. This increases the likelihood of achieving your annualized return target and steadily growing your assets.

When setting your annualized return target, you need to rationally analyze your circumstances. Peter Lynch emphasized that only long-term persistence and diversified investing lead to steady asset growth. You can refer to the following table to understand the risk and return performance of different assets in long-term investing:

| Asset Class | Long-Term Risk-Return Ratio | Suitable Investor Type |

|---|---|---|

| Stocks | Higher | Growth-oriented investors |

| Corporate Bonds | More Favorable | Long-term stable investors |

You should periodically adjust your portfolio to maintain a reasonable risk-return ratio. Continuously learning investment principles and avoiding common pitfalls will help your assets grow steadily over the long term.

FAQ

How often should you adjust your annualized return target?

You can review your target annually or biennially. If your funding needs or market conditions change, adjust it promptly.

What if your annualized return target doesn’t match actual returns?

Don’t worry. Market fluctuations are normal. You can periodically review your portfolio and adjust asset allocations to maintain long-term goals.

What factors should you consider when setting a target?

You need to consider risk tolerance, investment time horizon, historical average returns, and future funding needs. Tailor the target to your circumstances.

What risks come with setting an overly high annualized return target?

You may choose high-risk assets, increasing the likelihood of losses. Market volatility may also cause emotional fluctuations, affecting investment decisions.

Can you achieve your target by investing in a single asset?

It’s best not to invest in just one asset. Diversified investing reduces risk and increases the likelihood of achieving your target. You can consult a licensed financial advisor in Hong Kong for advice.

When setting annualized return targets, Peter Lynch’s prudent philosophy underscores that rational expectations and long-term discipline form the bedrock of asset growth. By drawing on historical data, evaluating your risk tolerance, and making periodic adjustments, you can craft an investment approach tailored to your unique needs, steering clear of impulsive choices that might erode gains.

Picture this: staying ahead of exchange rate shifts to sidestep hidden costs; enjoying remittance fees as low as 0.5%, which can cut expenses by up to 90% compared to traditional banks for smoother fund transfers; seamless conversions between fiat and digital currencies like USDT, bypassing convoluted routes for swift deposits. With global remittance support enabling same-day transfers, you stay agile without missing market windows. A single account lets you trade both US and Hong Kong stocks, eliminating the hassle of juggling platforms for streamlined global portfolio oversight and quicker reactions. The zero-fee contract order placement, favored by seasoned traders, offers an efficient way to position at minimal cost.

Quick signup in just 3 minutes—no overseas account required—opens the door to worldwide investing with zero barriers. Take the next step today: use the real-time exchange rate checker to refine your strategy. Head over to BiyaPay to get started, and explore stocks for broader global options. Embrace disciplined investing to steadily build toward your financial goals.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.