- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

After-Hours Trading: How to Optimize Your Investment Strategy with Market Gaps

Image Source: pexels

You can leverage after-hours trading to seize market gaps, responding flexibly to sudden information and price movements. Compared to regular trading hours, trading volume at 4:00 a.m. ET accounts for only 0.27% of total volume, primarily driven by retail traders. By the end of 2024, ETF-related trading volume has risen to 20%, with nominal value accounting for 40%-50%. These liquidity shifts offer opportunities for strategy optimization and arbitrage but also require caution due to price volatility and liquidity risks.

Key Points

- After-hours trading occurs from 4:00 p.m. to 8:00 p.m. ET, providing flexible investment opportunities.

- Lower liquidity may prevent orders from being fully executed, so set limit orders carefully to reduce risks.

- Information delays can create arbitrage opportunities, allowing you to capitalize on price differences.

- High price volatility, especially after major news releases, requires close monitoring of market dynamics.

- Combining technical analysis tools and real-time information optimizes your investment strategy for higher returns.

Overview of After-Hours Trading

Definition and Timing

You can engage in after-hours trading outside regular trading hours, offering greater flexibility. In the U.S., major exchanges allow after-hours trading from 4:00 p.m. to 8:00 p.m. ET. Refer to the table below for specific trading session times:

| Exchange | Pre-Market Hours | After-Hours Trading Hours |

|---|---|---|

| U.S. Exchanges | 4:00 a.m. - 9:30 a.m. | 4:00 p.m. - 8:00 p.m. |

After-hours trading is often referred to as extended-hours trading. During this period, you can adjust your investment strategy based on market dynamics and respond promptly to breaking news.

Characteristics of Market Gaps

The market environment during after-hours trading differs significantly from regular hours. You’ll notice that liquidity is typically lower, which may result in orders not being fully executed or only partially filled. Price volatility is also higher, with prices potentially experiencing sharp fluctuations that impact your trading outcomes.

- After-hours trading has limited liquidity, leading to partial or failed order executions.

- Price volatility is greater, increasing slippage risk, where execution prices may deviate from regular hours.

- You need to closely monitor trading volume and price changes, using limit orders to mitigate risks.

You can capitalize on market gaps by combining real-time information and technical analysis to optimize your investment strategy. However, you must also address the challenges posed by liquidity and volatility, crafting your trading plan cautiously.

Advantages of After-Hours Trading

Opportunities from Information Delays

During after-hours trading, you can exploit arbitrage opportunities arising from information delays. Due to varying order processing speeds across exchanges, some investors can capitalize on price discrepancies. For example, you can send buy orders to two exchanges simultaneously, and delays may result in executions at different times, creating price differences. High-frequency traders often use this to buy on one exchange and sell on another for profit.

Refer to the table below to understand how information delays create arbitrage opportunities:

| Example | Description |

|---|---|

| Order Delay | Sending buy orders to two exchanges simultaneously, resulting in different execution times due to delays. |

| High-Frequency Trader Opportunity | High-frequency traders exploit price differences by buying and selling across exchanges. |

| Cost and Profit | London Stock Exchange data shows an average arbitrage cost of about 0.5 basis points per trade. |

During after-hours trading, information disclosure and market reaction speeds are slower. You can act on breaking news or earnings announcements to position yourself in related stocks or ETFs, gaining an edge. Institutional investors often adjust positions after hours, leveraging the less competitive environment to reduce pressure.

Tip: Pay attention to liquidity and bid-ask spreads during after-hours trading. Low liquidity can widen spreads, increasing trading costs. For example, if you want to sell 100 shares at USD 55, but the highest bid is only USD 53.50 due to limited buyers, you may need to accept a lower price or risk an unexecuted limit order.

Price Volatility

After-hours trading exhibits significantly higher price volatility than regular hours. With lower trading volumes, prices are more sensitive to large orders or sudden news.

- During after-hours trading, low trading volume leads to larger price swings.

- Major news releases can cause sharp price movements in stocks, sectors, or ETFs.

- For instance, after U.S. companies release earnings, related stock prices often jump, impacting other companies in the same sector.

Refer to the table below for the impact of major news events on after-hours trading prices:

| Evidence Type | Description |

|---|---|

| Price Jumps | Earnings announcements almost always cause price jumps in the announcing company, with significant volatility in related companies. |

| Market Efficiency | Markets process earnings information efficiently, with prices reacting within milliseconds. |

| Spillover Effect | When large companies like Qualcomm release earnings, related companies like Intel and AMD are also affected. |

| Trading Volume | After-hours trading volume and price volatility are significantly higher on earnings announcement days. |

| Price Reaction | Price jumps occur with over 90% probability post-earnings announcements. |

| Sector Impact | Earnings announcements impact not only the announcing company but also other companies in the same sector and the broader market. |

You need to closely monitor trading volume and price changes during after-hours trading. Low liquidity can widen bid-ask spreads, increasing trading costs. Using limit orders can help mitigate risks and avoid losses from sharp price fluctuations.

Institutional investors typically have more resources and capital, enabling them to manage risks more effectively. They capitalize on after-hours price volatility, gaining an advantage over retail investors. You can adopt their strategies, combining technical analysis and real-time information to optimize your decisions.

After-Hours Trading Operations

Image Source: unsplash

Stock Selection Methods

During after-hours trading, your stock selection strategy needs to be more cautious. In a low-liquidity environment, prioritize U.S. stocks or ETFs with high trading volume and moderate volatility. Consider the following:

- Select companies with major news releases during after-hours, such as earnings reports or merger announcements, to leverage information advantages.

- Focus on industry leaders or large ETFs, which typically have higher trading volumes and smaller bid-ask spreads during after-hours.

- Use technical analysis tools to screen for stocks showing breakout signals, combining these with after-hours news for informed decisions.

You can use screening tools on major investment platforms to quickly identify active after-hours trading targets. Platforms like Interactive Brokers and E-Trade provide real-time after-hours trading volume and price movement data to support smarter decision-making.

Order Placement Methods

During after-hours trading, prioritize limit orders. Limit orders allow you to control the execution price, reducing risks from low liquidity. Keep the following in mind:

- Limit orders ensure you get your desired price but do not guarantee execution. If no buyers or sellers meet your price, the order may not execute.

- After-hours trading liquidity is typically lower than regular hours. Monitor bid-ask depth closely to avoid slippage.

- You can place limit orders during pre-market, regular, and after-hours sessions. After-hours limit orders are only valid during specific electronic trading sessions and will expire if not executed or canceled.

Pro Tip: Avoid using market orders during after-hours trading. Market orders may result in execution prices far from your expectations, increasing costs. Limit orders, while not guaranteeing execution, effectively control risk.

You also need to choose an appropriate investment platform. Different platforms offer varying after-hours trading hours and available securities. The table below shows after-hours trading support for major U.S. platforms:

| Investment Platform | Trading Hours | Number of Tradable Securities |

|---|---|---|

| Interactive Brokers | 4:00 a.m. - 8:00 p.m. ET | Over 10,000 stocks and ETFs |

| Charles Schwab | 4:00 p.m. - 8:00 p.m. ET | 23 highly liquid funds |

| E-Trade | 4:00 p.m. - 8:00 p.m. ET | Over 20 large ETFs |

| Fidelity Investments | 7:00 a.m. - 9:30 a.m. ET | N/A |

| Merrill Edge | 7:00 a.m. - 9:30 a.m. ET | N/A |

| Webull | 4:00 a.m. - 9:30 a.m. ET | N/A |

| Tastytrade | 8:00 a.m. - 9:30 a.m. ET | N/A |

| Ally Invest | 8:00 a.m. - 9:30 a.m. ET | N/A |

| Firstrade | 8:00 a.m. - 9:30 a.m. ET | N/A |

Choose a platform with longer after-hours trading windows and a broader range of tradable securities based on your needs. For example, Interactive Brokers supports full-day after-hours trading, ideal for investors needing flexibility.

Technical Analysis

In after-hours trading, technical analysis remains a critical decision-making tool. Due to higher market volatility, certain technical indicators are more valuable. Focus on the following:

- Moving Averages: Identify price trends and support/resistance levels.

- Relative Strength Index (RSI): Gauge whether a stock is overbought or oversold to time trades.

- Stochastic Oscillator: Analyze price momentum to capture short-term reversal signals.

- Average Directional Index (ADX): Assess trend strength to determine if the market favors trend-following strategies.

- Bollinger Bands: Monitor price volatility ranges to identify breakout or pullback opportunities.

Combine these indicators with after-hours news and trading volume changes to develop more informed trading strategies. Professional investors often use multiple indicators to enhance decision accuracy.

Tip: After-hours trading environments are unique, and technical signals may be affected by liquidity. Adjust analysis parameters dynamically based on actual trading volume and order book depth to avoid misleading signals from single indicators.

Risks of After-Hours Trading

Liquidity Risk

During after-hours trading, you’ll encounter liquidity shortages. Lower trading volumes make it harder to convert stocks to cash quickly. Some platforms only allow you to view quotes from a single trading system, limiting your options. You may notice wider bid-ask spreads, leading to less favorable execution prices. Many electronic trading systems only accept limit orders, which may result in unexecuted orders.

- You cannot access or act on all quotes.

- Liquidity shortages hinder trade execution.

- Wider bid-ask spreads impact execution prices.

- Increased price volatility heightens risks.

- Order execution may be delayed or fail.

- After-hours traders are often professionals with information advantages.

You can mitigate risks by setting stop-loss and limit orders. Monitor trading volume and order book depth closely, and choose high-liquidity periods for trading.

Price Gaps

After-hours trading markets are highly volatile, with frequent price gaps. After major news or events, stock prices may jump significantly without intermediate trades. Low liquidity exacerbates price movements, exposing you to unexpected losses.

- Major news impacts market sentiment, causing frequent price gaps.

- Low liquidity leads to larger price gaps.

- After-hours price changes reflect market reactions to new information.

- The next day’s opening price may differ significantly from the previous close.

- After-hours price movements may not predict the next day’s opening price.

Closely monitor after-hours market dynamics and adjust positions promptly. Setting price alerts helps you stay informed of changes even when offline.

Regulatory Restrictions

During after-hours trading, you must comply with strict regulatory requirements. Extended trading hours reduce liquidity, increasing price volatility. Some platforms only accept limit orders, and trading systems must adapt to extended hours. You may face wider bid-ask spreads and increased execution challenges.

- Extended hours reduce liquidity.

- Price volatility and bid-ask spreads are larger.

- Enhanced compliance measures are needed for varying market dynamics.

- Trading systems must adapt to after-hours sessions.

- Investors need compliant workarounds.

Choose platforms with robust compliance mechanisms to ensure trading safety. Stay informed about global news and market policies to adjust strategies and reduce risks.

Strategy Optimization Suggestions

Image Source: unsplash

Case Study Analysis

You can analyze historical data to uncover the potential of after-hours trading for boosting returns. Studies show that overnight trading often yields higher returns than daytime trading, with some stocks exhibiting significant positive deviations. Investing in these stocks can generate twice the market’s average annual return with only one-third of the market’s beta risk.

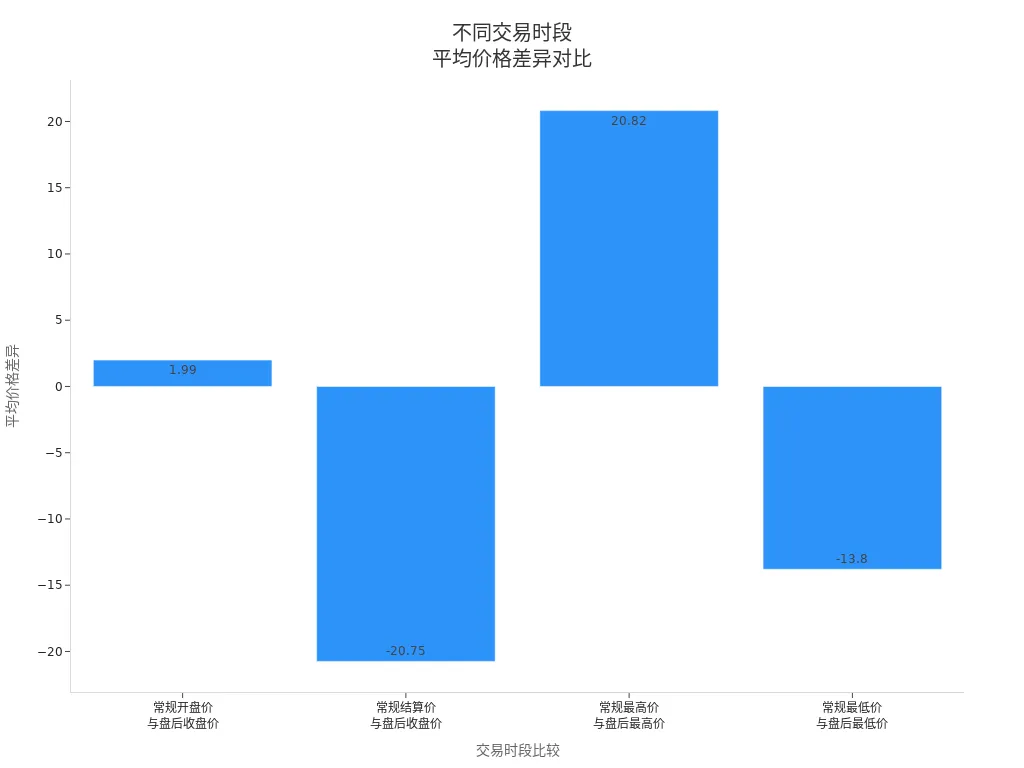

The table below shows price differences across trading sessions:

| Trading Session Comparison | Average Price Difference | Significance |

|---|---|---|

| Regular Open vs. After-Hours Close | 1.99 | Not Significant |

| Regular Close vs. After-Hours Close | -20.75 | Significant |

| Regular High vs. After-Hours High | 20.82 | Significant |

| Regular Low vs. After-Hours Low | -13.80 | Significant |

These price differences demonstrate significant profit potential for investors during after-hours trading.

Data-Driven Decisions

You can use data analysis tools to optimize after-hours trading strategies:

- Time-series analysis provides granular insights into trades, uncovering hidden market patterns and inefficiencies, enabling informed decisions in fast-changing environments.

- Data analysis allows you to adjust strategies based on market trends, predict future changes, and gain a competitive edge.

- Analyzing historical trading activity ensures compliance and continuous performance optimization.

Complementing Daytime and After-Hours Trading

You can combine daytime and after-hours trading strategies to enhance overall investment flexibility:

- Use higher Intraday Buying Power (IBP) for quick trades to capture short-term opportunities.

- Utilize Overnight Buying Power (OBP) to hold positions, balancing risk and reward.

- Adjust trading strategies based on market conditions and personal risk tolerance to maximize returns.

You can flexibly adjust your investment strategy during after-hours trading to capitalize on market gaps. Properly leveraging this period can enhance overall returns. Focus on liquidity and price volatility while continuously refining your trading methods.

- Stay updated on market trends and new tools to adjust strategies promptly.

- Continuously learn technical and fundamental analysis to improve trading skills.

- Monitor relevant news to identify key market events and optimize risk management.

Continuous learning and adapting to market changes will give you a greater advantage in U.S. after-hours trading.

FAQ

What is the minimum capital requirement for after-hours trading?

There is no universal minimum capital requirement for after-hours trading in the U.S. market. Some brokers may impose account balance requirements. Check platform rules in advance.

Are after-hours trading fees different from regular hours?

Some platforms may charge higher fees for after-hours trading. Review the platform’s fee structure to assess trading costs.

Which securities can be traded after hours?

You can typically trade U.S. stocks and select ETFs. Some platforms support additional securities. Check the platform’s list of tradable securities.

How fast are order executions during after-hours trading?

Order execution speeds are generally slower during after-hours trading due to low liquidity. Executions may be delayed. Monitor order status closely.

What are the main risks of after-hours trading?

You face risks like low liquidity, high price volatility, and information asymmetry. Use limit orders wisely to control risks.

By mastering after-hours trading and its strategies, you’re equipped to seize market gaps for investment opportunities, but high cross-border fees, currency volatility, and offshore account complexities can hinder engaging in U.S. after-hours markets, especially for swift responses to earnings jumps or position tweaks. Picture a platform with 0.5% remittance fees, same-day global transfers, and contract limit orders with zero fees, enabling seamless after-hours strategies via one account?

BiyaPay is tailored for after-hours traders, offering instant fiat-to-digital conversions to act on price swings nimbly. With real-time exchange rate query, monitor USD trends and transfer at optimal moments to cut costs. Covering most regions with instant arrivals, it powers rapid allocations to S&P 500 ETFs (like SPY) or high-volatility stocks. Crucially, trade U.S. and Hong Kong markets through a single account, leveraging contract limit orders with zero fees for RSI or Bollinger Band-based limit strategies.

Whether chasing after-hours arbitrage or mitigating liquidity risks, BiyaPay fuels your precision. Sign up now, visit stocks for U.S. prospects—quick setup unlocks cost-effective, data-driven trading. Join global investors and triumph in 2025 market gaps!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.