- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Stay Ahead of the Curve! The Sahm Rule Teaches You to "Read the Room" and Detect Economic Recession!

Image Source: unsplash

Do you want to stay one step ahead in the investment market? The Sahm Rule helps you capture economic recession signals by observing changes in the unemployment rate. You only need to focus on unemployment rate data to quickly “read the signs” and adjust your investment strategy in time. Whether you focus on stocks or digital currencies, mastering the Sahm Rule allows you to stay ahead in investing, effectively reduce risks, and seize market trends.

Key Takeaways

- Monitor unemployment rate data and use the Sahm Rule to identify economic recession signals, adjusting investment strategies in time.

- When the three-month moving average unemployment rate rises 0.5 percentage points above its lowest point in the past year, the Sahm Rule triggers an alert, indicating the economy may be declining.

- Combine Sahm Rule signals to allocate assets reasonably, increasing the proportion of bonds and cash to reduce investment risks.

- Regularly monitor changes in the unemployment rate and flexibly interpret Sahm Rule signals to help you seize opportunities amid market fluctuations.

Introduction to the Sahm Rule

Image Source: pexels

Definition and Principle

You can use the Sahm Rule to quickly determine whether the economy is entering a recession. The Sahm Rule is a heuristic indicator specifically designed to identify early signals of a U.S. economic recession. Its core idea is simple: if the unemployment rate rises significantly, the economy is likely declining. You only need to focus on the national unemployment rate, a single data series, without relying on complex statistical models.

The Sahm Rule was designed to help policymakers take timely fiscal measures to mitigate the impact of economic recessions. A Brookings Institution report emphasizes that automated fiscal assistance can improve small business survival rates, helping people retain jobs and housing. You can see that the Sahm Rule is not only easy to understand but also facilitates rapid responses.

The principles of the Sahm Rule include the following points:

- A significant rise in the unemployment rate usually signals weakening economic activity.

- Through changes in the unemployment rate, policymakers can adjust fiscal policies in time.

- The rule relies on national unemployment rate data, making it easy for you to access and interpret quickly.

Criteria for Judgment

You can use the specific criteria of the Sahm Rule to identify economic recession signals. The judgment method is as follows:

- When the three-month moving average of the national unemployment rate rises 0.5 percentage points or more above its lowest point in the past twelve months, the Sahm Rule is triggered.

- This signal indicates that the economy has entered the early stages of a recession, rather than predicting a recession in advance.

You only need to regularly check the unemployment rate data published by the U.S. Bureau of Labor Statistics, calculate the three-month moving average, and compare it with the lowest point in the past twelve months. If you find an increase exceeding 0.5 percentage points, you should be cautious of the risk of an economic recession. The Sahm Rule allows you to use a simple method to quickly “read the signs” and identify economic downturn trends.

Effectiveness of the Sahm Rule

Economic Logic

You can understand the close relationship between the unemployment rate and economic recessions through the Sahm Rule. Economists have found that changes in the unemployment rate often reflect economic downturn trends earlier than other economic indicators. The Sahm Rule is designed based on the following logic:

- A rise in the unemployment rate usually signals weakening economic activity, with businesses reducing hiring and consumer confidence declining.

- When the three-month moving average unemployment rate rises 0.5 percentage points above its lowest point in the past twelve months, the likelihood of an economic recession significantly increases.

- You only need to focus on the unemployment rate, a single data series, to obtain reliable economic signals without complex models.

This method allows you to quickly assess economic conditions using simple data, avoiding information overload. The Sahm Rule emphasizes the timeliness and sensitivity of the unemployment rate, helping you adjust investment strategies promptly.

Historical Performance

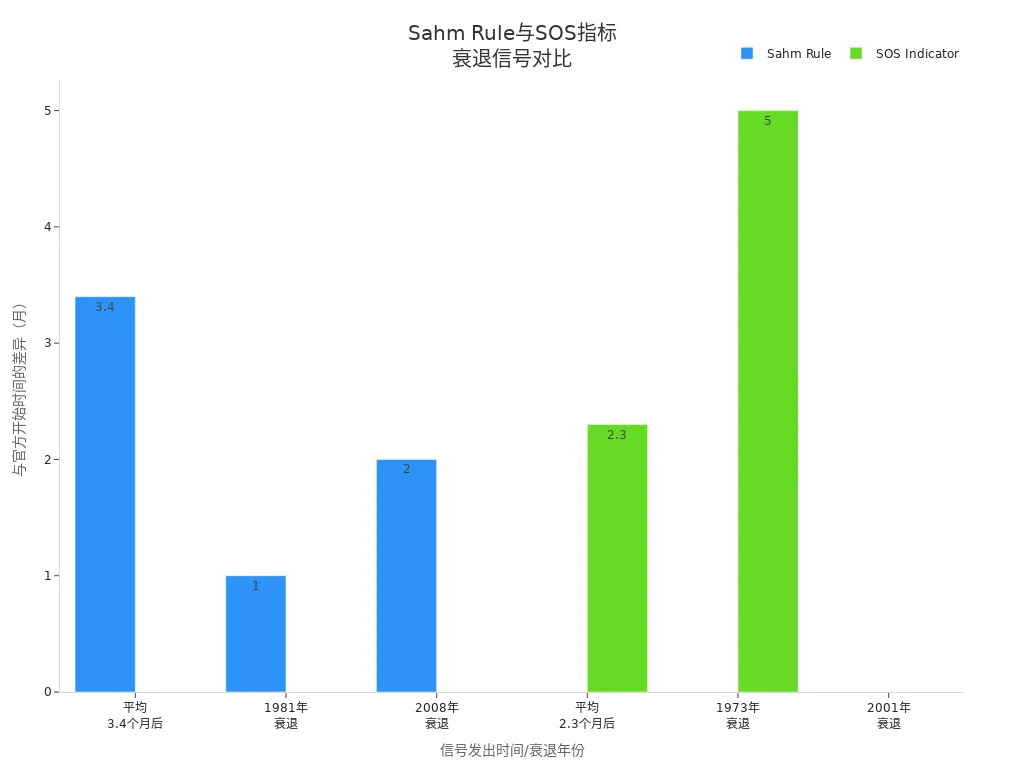

You can understand the actual effectiveness of the Sahm Rule through historical data. Compared to other economic recession indicators, the Sahm Rule performs consistently in the U.S. market, with signal issuance times closely aligned with official recession designations. The table below shows the performance of the Sahm Rule compared to the SOS indicator during different recessions:

| Indicator | Signal Issuance Time | Difference from Official Start Time |

|---|---|---|

| Sahm Rule | Average 3.4 months later | 3.4 months |

| SOS Indicator | Average 2.3 months later | 2.3 months |

| 1973 Recession | SOS 5 months earlier | 5 months |

| 2001 Recession | SOS same month | 0 months |

| 1981 Recession | Sahm 1 month earlier | 1 month |

| 2008 Recession | Sahm 2 months earlier | 2 months |

You can see that the Sahm Rule has consistently provided timely warnings in multiple economic recessions. Compared to indicators like the yield curve, the Sahm Rule relies on real-time unemployment data, reacting faster but sometimes being sensitive to short-term fluctuations. The table below compares the advantages and disadvantages of the Sahm Rule and the yield curve:

| Indicator | Advantages | Disadvantages |

|---|---|---|

| Sahm Rule | Based on real-time unemployment data, reacts quickly | May be overly sensitive to short-term fluctuations |

| Yield Curve | Reflects market expectations of future economic conditions, historically accurate | May lag behind actual conditions during economic changes |

You can combine this information to choose the economic recession identification tool that suits you, better grasping market dynamics.

Stay Ahead in Investing: Applying the Sahm Rule

Operational Process

To stay ahead in investing, you must master the specific operational process of the Sahm Rule. You can follow these steps to quickly identify economic recession signals:

- Obtain the latest national unemployment rate (U3) data. The U.S. Bureau of Labor Statistics publishes unemployment rates monthly, and you can directly visit its official website or use mainstream financial data platforms.

- Calculate the average unemployment rate for the most recent three months. For example, if the unemployment rates for the past three months are 3.8%, 4.0%, and 4.2%, you need to add these three months’ data and divide by three to get the three-month moving average.

- Find the lowest three-month unemployment rate average in the past 12 months. You can review historical data to identify the lowest point.

- Compare these two numbers. If the latest three-month unemployment rate average is at least 0.50% higher than the lowest point in the past year, the Sahm Rule triggers an alert, indicating the economy may be entering a recession.

You can refer to the table below to select reliable data sources to ensure accurate analysis results:

| Data Source | Update Frequency | Reliability |

|---|---|---|

| State Unemployment Insurance Claims Administrative Data | Weekly | High |

| Survey-Based Unemployment Rate | Monthly | Medium |

| Employment Data from Payroll Processors | N/A | Under Exploration |

You can prioritize official data from the U.S. Bureau of Labor Statistics, combined with state unemployment insurance claims administrative data, to improve the timeliness and accuracy of your judgments. This way, you can stay ahead in investing and identify market risks early.

Signal Identification

How do you interpret the signals issued by the Sahm Rule in actual investment processes? You can focus on the following key points:

- The Sahm Rule issues signals by observing the three-month moving average of the unemployment rate relative to its lowest point in the past 12 months.

- When the three-month moving average rises more than 0.5 percentage points above this low point, the Sahm Rule alert is triggered, indicating the risk of an economic recession.

- The Sahm Rule typically issues signals 2 to 8 months after an economic recession begins, showing some lag.

You can combine stock and digital currency markets to understand the practical reference value of the Sahm Rule:

- Changes in unemployment data can signal an impending economic recession, and you should remain vigilant to stay ahead in investing.

- Economic recessions typically lead to monetary policy easing, which may affect the performance of stock and cryptocurrency markets. For example, in August 2024, the U.S. unemployment rate rose, triggering many recession indicators, leading to significant pullbacks in crypto and traditional financial assets.

- Implementing the Sahm Rule during market volatility may make it challenging to accurately time market entries and exits. You need to develop a thorough risk management strategy to avoid selling at lows due to panic and missing rebound opportunities.

Tip: You can combine Sahm Rule signals to periodically adjust your portfolio, monitor U.S. market monetary policy changes, and use USD-based financial products from licensed Hong Kong banks to diversify risks and stay ahead in investing.

You only need to consistently monitor unemployment rate data and flexibly interpret Sahm Rule signals to stay ahead in investing in U.S. stocks and digital currency markets, seizing market rhythms and reducing risks.

Case Studies

Image Source: pexels

Historical Performance

You can understand the accuracy of the Sahm Rule through historical data. Since 1970, the Sahm Rule has performed exceptionally well in identifying U.S. economic recessions. You only need to focus on changes in the unemployment rate to capture signals of economic downturns. The following are the main performances of the Sahm Rule in history:

- Over the past fifty years, the Sahm Rule has almost always accurately signaled the start of an economic recession when the unemployment rate rises by 0.5 percentage points.

- When the Sahm Rule value reaches 0.20 or higher, the probability of a recession occurring within the next three months significantly increases, more than doubling the normal level.

- Compared to other economic indicators, the Sahm Rule performs better in terms of timeliness and accuracy, helping you stay ahead in investing.

You can see that the Sahm Rule was widely followed during the 2008 financial crisis and the COVID-19 recession. Although the unemployment rate rose rapidly in these two crises, the Sahm Rule’s signals can sometimes lag, particularly in the first three months of a recession, when signal reliability is lower. Therefore, in practical applications, you need to combine other economic data to avoid relying on a single judgment.

Practical Demonstration

You can experience the role of the Sahm Rule in investment decisions through practical operations. Suppose you monitor unemployment rate data published by the U.S. Bureau of Labor Statistics and find that the three-month moving average unemployment rate is 4.2%, while the lowest point in the past twelve months was 3.5%. After calculation, you find the difference is 0.7 percentage points, exceeding the 0.5 percentage point threshold.

- At this point, the Sahm Rule issues an economic recession signal. You can consider adjusting your portfolio, focusing on USD-based financial products from licensed Hong Kong banks to diversify risks.

- Recent market data shows that although the Sahm Rule conditions are met, the labor market remains robust, with discrepancies between rising unemployment rates and job creation. This indicates complex market conditions, and the Sahm Rule signal may not necessarily indicate an imminent recession.

- In practice, you should continuously track the difference between the three-month moving average unemployment rate and the twelve-month low, combining other economic indicators to improve judgment accuracy.

Tip: You can regularly record unemployment rate data and use spreadsheet tools for calculations and comparisons to help you more scientifically seize market rhythms and stay ahead in investing.

Practical Strategies to Stay Ahead in Investing

Asset Allocation

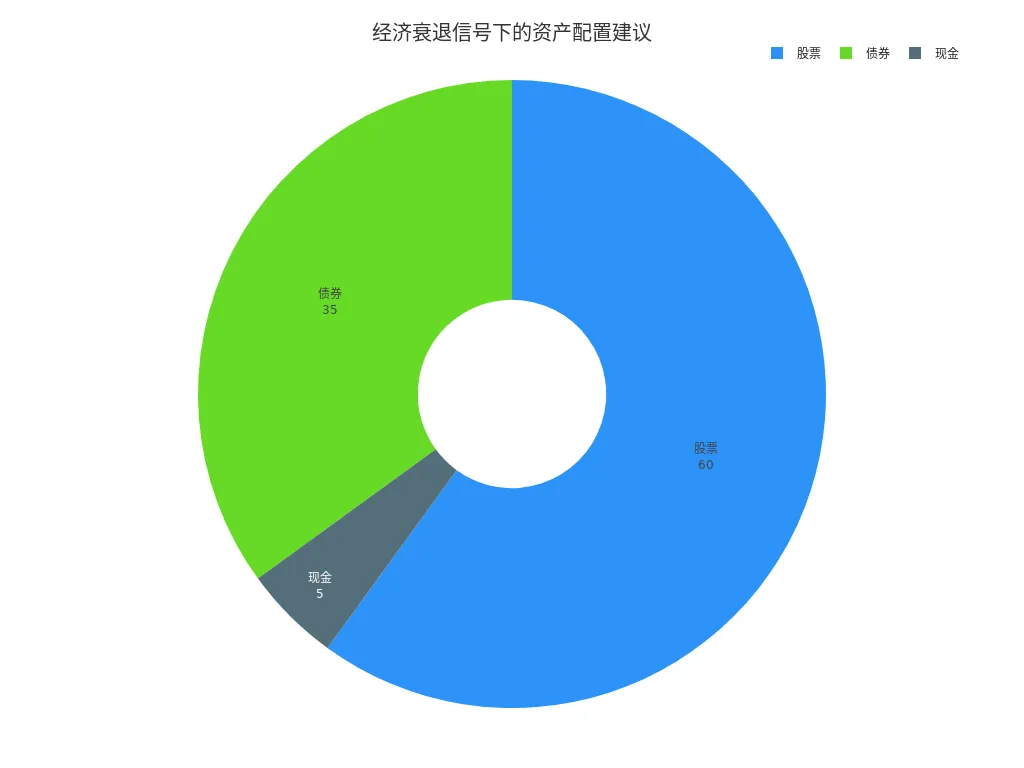

After identifying an economic recession signal issued by the Sahm Rule, you should adjust your asset allocation promptly. Reasonable asset allocation can help you reduce risks and stabilize returns. Professional investors and institutions often use the Sahm Rule as an important tool for early recession detection, incorporating it into macroeconomic analysis frameworks to enhance forecasting capabilities. You can refer to the following asset allocation suggestions:

| Asset Class | Allocation Proportion |

|---|---|

| Stocks | 60% |

| Bonds | 35% |

| Cash | 5% |

You can shift a portion of your portfolio’s stocks toward bonds and cash. Bonds typically perform more stably during economic recessions, while cash provides liquidity for handling unexpected situations. In the U.S. market, many investors choose USD-denominated bonds or gold as safe-haven assets. You can also purchase USD-based financial products through licensed Hong Kong banks to further diversify risks.

In stock and digital currency markets, after a Sahm Rule signal appears, you can adopt the following strategies:

| Market Reaction | Investment Strategy |

|---|---|

| Economic Recession Signal | Move to safer investments, such as bonds or gold |

| Increased Market Volatility | May be seen as a buying opportunity, assuming the market has priced in the recession |

- You can consider shifting from higher-risk assets (such as U.S. tech stocks or cryptocurrencies) to safer investments (such as U.S. Treasuries or gold).

- Some investors believe the market has already reflected recession signals and will buy high-quality assets at low prices, awaiting economic recovery.

Tip: You can regularly evaluate your portfolio structure, combine Sahm Rule signals, and flexibly adjust the proportions of stocks, bonds, and cash to stay ahead in investing.

Risk Control

After an economic recession signal appears, you must strengthen risk management. Effective risk control can help you minimize losses and protect asset safety. Professional traders closely monitor unemployment rate data, promptly identify Sahm Rule signals, and develop corresponding forex trading strategies. You can refer to the following risk management techniques:

- You can consider shorting the Australian Dollar (AUD), as this currency tends to depreciate during economic recessions.

- You can short the Brazilian Real (BRL), capitalizing on its downward trend during recessions.

- You can short the Canadian Dollar (CAD), which typically weakens when commodity demand falls.

- You should continuously monitor U.S. unemployment rate data and adjust investment strategies promptly.

- Once the Sahm Rule signal is confirmed, you can select currency pairs heavily affected by recessions and develop forex trading plans.

Note: When adjusting your portfolio, you need to consider your own risk tolerance and avoid over-concentration in a single asset. You can use USD-based financial products from licensed Hong Kong banks to diversify investments and reduce overall risk.

Professional investors and institutions incorporate the Sahm Rule as a key part of macroeconomic analysis, leveraging its historical accuracy and empirical foundation to enhance the rigor of investment decisions. You can also adopt this approach, combining market dynamics and personal needs to develop tailored risk control strategies.

You only need to consistently monitor unemployment rate data, flexibly adjust asset allocation and risk management plans, to stay ahead in investing in U.S. stock and digital currency markets, seizing economic cycle changes and protecting your wealth.

Considerations

Scope of Application

When using the Sahm Rule, you need to understand its applicable environment. The Sahm Rule is primarily suitable for economies with relatively stable labor markets or declining labor supply. You can refer to the following situations:

- The Sahm Rule performs best in markets with static or declining labor supply. For example, when the U.S. labor market experiences no significant immigration or sudden return of unemployed workers, changes in the unemployment rate better reflect economic trends.

- If the labor supply changes significantly, such as during immigration waves or when discouraged workers re-enter the job market, the Sahm Rule’s accuracy decreases.

- Only when the labor market experiences no drastic fluctuations does a rise in the unemployment rate truly represent an economic recession signal.

When analyzing the U.S. market, you can prioritize monitoring changes in labor supply and combine the Sahm Rule to assess economic cycles. When engaging in USD-based financial products through licensed Hong Kong banks, you can also use the Sahm Rule to assist in judging the macroeconomic environment, but you need to consider differences in market structures.

Limitations

In actual investments, you cannot rely solely on the Sahm Rule. It has some clear limitations:

- The Sahm Rule can only detect signals after an economic recession has already begun, and it cannot predict future recessions in advance.

- If the unemployment rate rises rapidly in the short term, the Sahm Rule may issue false signals while the overall economy remains healthy.

- The rule primarily focuses on the unemployment rate, easily overlooking non-labor market shocks, such as financial crises or supply chain issues.

- Relying solely on the Sahm Rule may cause you to miss changes in other important economic indicators.

You can refer to the table below to understand the Sahm Rule’s false signal instances in history:

| Period | False Signal | Consistency with Economic Recession |

|---|---|---|

| 1970-2024 | No | High |

When investing in U.S. stocks or digital currencies, it’s recommended to combine multiple economic indicators to comprehensively assess market risks. Although the Sahm Rule is reliable, it cannot replace comprehensive macroeconomic analysis. You need to continuously monitor the U.S. labor market and other economic data to enhance the rigor of investment decisions.

You can use the Sahm Rule as an early warning tool for economic recessions, helping you adjust investment strategies promptly. The table below shows that if the three-month moving average unemployment rate, compared to the lowest point in the past 12 months, has a difference exceeding 0.5 percentage points, the economy may be entering a recession, and current data is close to the threshold, with evident labor market pressure.

| Indicator | Description |

|---|---|

| Three-Month Moving Average Unemployment Rate | Compared to the lowest unemployment rate in the past 12 months |

| Threshold | A difference exceeding 0.5 percentage points indicates the economy may enter a recession |

| Current Status | Recent data shows the Sahm statistic is close to the threshold |

You should note that the Sahm Rule is not a natural law, but an empirical rule. The unemployment rate is a lagging variable, and the Sahm Rule typically issues signals after an economic recession has begun. You should use it flexibly in combination with your own goals and continuously monitor U.S. market dynamics.

FAQ

Can the Sahm Rule Predict Economic Recessions in Advance?

You cannot use the Sahm Rule to predict economic recessions in advance. It only issues signals after a recession has begun, helping you adjust investment strategies promptly.

Where Can I Obtain U.S. Unemployment Rate Data?

You can visit the U.S. Bureau of Labor Statistics official website or use mainstream financial data platforms to obtain the latest unemployment rate data. Licensed Hong Kong banks also commonly use these data to analyze markets.

Is the Sahm Rule Applicable to the Digital Currency Market?

You can use the Sahm Rule to assist in judging the macroeconomic environment. The digital currency market is heavily influenced by global economic conditions, and changes in the unemployment rate indirectly affect asset prices.

Is the Probability of False Signals High for the Sahm Rule?

You are unlikely to encounter false signals. Historical data shows that the Sahm Rule performs consistently in the U.S. market, but you should combine other economic indicators for comprehensive judgment.

Can I Use the Sahm Rule to Guide Asset Allocation?

You can refer to Sahm Rule signals to adjust the proportions of U.S. stocks, bonds, and cash. Many investors increase bond and cash allocations after a signal appears to reduce risks.

The Sahm Rule empowers you to be “one step ahead” by providing a reliable, simple indicator for confirming economic recession. But the real advantage lies in the speed and efficiency of your asset reallocation—the move from riskier assets (stocks, crypto) to safer havens (cash, bonds). When the unemployment signal hits, the time it takes to shift funds across asset classes and international borders directly impacts the success of your risk-reduction strategy.

To ensure your recession-proofing strategy is executed with market-leading speed, integrate the financial agility of BiyaPay. We offer zero commission for contract limit orders, a crucial advantage that minimizes the transaction costs associated with rapidly selling off equities and buying up defensive assets when fear spikes. Furthermore, our platform supports the swift, mutual conversion between fiat and digital assets like USDT, providing you with the fastest, most reliable pathway to move capital from your crypto holdings into your brokerage account for safe-haven investments. You can register quickly—in just 3 minutes without requiring an overseas bank account—and gain immediate access to US and Hong Kong Stocks. Leverage our real-time exchange rate checks to maintain transparent control over your funding costs. Open your BiyaPay account today and translate the Sahm Rule’s foresight into decisive, protective action.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.