- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Don't Fear Market Volatility! OTE Helps You Dynamically Adjust Positions for Steady Profits!

Image Source: pexels

Do you also feel nervous during market volatility? Many investors, like you, tend to experience emotional fluctuations when facing price swings.

- Over half (51%) of Americans worry about potential market crashes.

In fact, the root of risk is often not market uncertainty but position management. If you can learn to use the OTE tool to dynamically adjust your holdings, market volatility is nothing to fear; instead, it can offer more profit opportunities. OTE helps you make rational decisions, avoiding emotional impacts on investments.

Key Points

- Mastering the OTE tool to dynamically adjust positions can effectively handle market volatility and seize profit opportunities.

- Dynamic position management, through parameter setting and real-time adjustments, helps you control risks and enhance the scientific nature of investment decisions.

- Emotional management is key to successful investing; using the OTE tool can reduce emotional interference and maintain rational operations.

- In different market environments, the OTE tool provides flexible strategies to help you achieve steady profits.

- Regularly reviewing and optimizing trading records can enhance your investment capabilities and ensure long-term success.

Introduction to the OTE Tool

Basic Principles

You often encounter sharp price fluctuations during investing. Market volatility is nothing to fear; the key lies in how you manage positions. The core principle of the OTE tool is to utilize Fibonacci retracement levels to help you find better entry points in trending markets.

- The OTE strategy analyzes market structure, combining timing and liquidity to improve trading precision.

- You can identify areas where prices are likely to reverse through key Fibonacci levels, allowing better timing for buying and selling. This method enables you to adjust positions based on evidence during market volatility, rather than relying on gut feelings.

Main Functions

The OTE tool is more than just a calculator. You can use it to achieve various position management goals:

- You can dynamically adjust holding ratios based on target profits, reducing risk in a single direction.

- OTE stands for On-Target Earnings, which is the total expected compensation when performance targets are met. It typically includes a combination of base salary, commissions, and bonuses.

- In the investment field, the OTE tool helps you set reasonable profit targets, attract and retain top talent, and improve overall team performance.

- You can also use the OTE tool to monitor market changes in real-time, adjust strategies promptly, and avoid making wrong decisions due to emotional fluctuations.

You will find that market volatility is actually a source of profit. As long as you master the OTE tool, risks primarily stem from position management, not the market itself.

Don’t Fear Market Volatility: Key Points of Position Management

Image Source: unsplash

Dynamic Adjustment Principles

During investing, you often encounter significant price fluctuations. Market volatility is nothing to fear, as long as you master the principles of dynamic position management, you can better control risks. The core idea of dynamic position adjustment is to flexibly adjust the size of each trade’s position based on account balance changes and market conditions. This way, you can expand profit potential during market uptrends and effectively control losses during downturns.

Dynamic position management typically includes the following key steps:

| Key Steps | Description |

|---|---|

| Set Parameters | You need to set leverage ratios and maximum position sizes as constraints. |

| Calculate Base Position | Divide account equity by the leverage ratio to determine the base position. |

| Compare Position Sizes | Compare the base position with the maximum position and take the smaller value. |

| Adjust Position Size | Adjust the position size based on actual calculations when opening a trade. |

| Real-Time Adjustments | Position sizes are adjusted in real-time as profits, losses, and account equity change. |

This method has several clear advantages:

- Dynamic adjustments can be automated, requiring minimal manual intervention from you.

- Position sizes are tied to account equity, enabling a compounding effect.

- You can limit risk exposure by setting leverage and maximum position sizes.

- The logic is simple, easy to understand, and customizable for different investment strategies.

- This approach is highly scalable and can be combined with other strategies.

You should note during actual operations that increasing positions may amplify losses, and frequent adjustments in extreme market conditions may lead to instability. Improperly setting maximum positions could also result in excessive leverage, amplifying risks. You can mitigate these risks by cautiously setting parameters and maintaining a capital buffer.

Dynamic asset allocation is not only applicable to stocks but also to bonds, options, currency forwards, and futures. Flexibility and dynamism allow you to adjust your portfolio promptly during market cycles, valuations, and sentiment changes. This enables you to better handle uncertain market environments.

Research shows that strategies using dynamic position management can effectively reduce investment risks. For example, momentum strategies have a correlation as high as 0.99, with a Sharpe ratio of 1.23, and both volatility and maximum drawdown remain at low levels. These data demonstrate that scientific dynamic adjustments help you achieve steady profits.

Market volatility is nothing to fear; in fact, market fluctuations are opportunities for profit. The development of algorithmic trading also proves that proper position management can reduce price volatility, mitigate the impact of investor emotions, reduce herd behavior, and make your investments more rational.

Emotions and Decision-Making

During investing, emotions often affect decision-making. Market volatility is nothing to fear, but if you let fear, greed, or overconfidence dominate your actions, it often leads to mistakes. Market psychology research shows that emotions are one of the most common pitfalls in investing. Fear may lead you to panic and stop losses during downturns, greed may cause you to over-leverage during uptrends, and overconfidence may make you overlook risks.

You need to learn to recognize and manage these psychological biases:

- Fear, greed, anxiety, and overconfidence can lead to common investment mistakes.

- Emotion-driven decisions may cause you to frequently enter and exit the market, missing long-term profit opportunities.

- Loss aversion and herd mentality can also affect your judgment, leading to irrational actions.

The OTE tool can help you reduce emotional interference. By setting clear position adjustment rules and profit targets, every operation is evidence-based. This allows you to avoid impulsive decisions due to short-term fluctuations, maintaining rationality and patience.

You should remember that market volatility is normal, and emotional reactions are part of investing. Only by focusing on scientific position management and combining it with the OTE tool can you progress steadily in volatile markets and achieve long-term profits.

OTE Operation Process

Image Source: pexels

Step-by-Step Breakdown

When using the OTE tool in practice, you can follow these steps. Each step is clear and easy to grasp, even for beginners, allowing you to quickly master the core of dynamic position management.

- Confirm Market Context

You first need to analyze the market structure. Determine whether the current market is trending upward, downward, or consolidating. Operations are more reliable only when your trading ideas align with the market structure. - Wait for Price to Reach OTE

You need to be patient and wait for the price to retrace to the OTE zone. Avoid rushing to enter; only when the price enters the key zone will you have a higher probability of success. - Look for Confirmation Signals

Within the OTE zone, you can combine technical indicators or price action to find additional confirmation signals, such as observing candlestick patterns or volume changes. - Set Entry Orders

You can place limit orders within the OTE zone to ensure entry at ideal prices, avoiding chasing highs or selling into lows. - Manage Risks

You need to set stop-losses below key structural levels to effectively control losses even if your judgment is incorrect. - Define Profit Levels

You can set multiple profit targets based on key resistance or support levels. Partial profit-taking helps lock in gains. - Plan Trade Management

You should decide in advance how to manage positions, such as whether to partially close positions after reaching the first target or move stop-losses to protect profits. - Record the Process

You need to meticulously record each OTE trade, including entry reasons, stop-loss settings, and profit/loss outcomes, to facilitate review and experience accumulation. - Review and Improve

You can periodically review your trading log to identify common patterns and areas for improvement, continuously optimizing your process to enhance long-term profitability.

The OTE tool has a simple and clear interface with straightforward operation steps. You can quickly understand each step’s significance through tables and charts. The tool has undergone multiple rounds of expert reviews and practical testing, ensuring usability and practicality. You will find during use that the information display is intuitive, saving significant time.

Common Pitfalls

When using the OTE tool, you may encounter some common pitfalls. Understanding these issues can help you avoid risks and achieve more stable profits.

- Entering Trades Too Early

You may be tempted to enter before the price reaches the OTE zone, which can lead to losses. You need to wait patiently for the price to enter the key zone and show reversal signs before acting. - Ignoring Market Context

If you use OTE when the market structure is unclear or highly volatile, success rates drop significantly. You should only apply the tool when market trends are clear. - Overlooking Key Levels

You may focus solely on the OTE zone while ignoring alignment with important structures (like order blocks). Ensure the OTE zone aligns with key ICT markers to improve success rates. - Unrealistic OTE Levels

Setting OTE levels too high or too low can affect trading outcomes. You should set reasonable OTE zones based on historical data and market trends. - Unclear Communication and Records

If you don’t clearly record each operation or if team communication is poor, execution errors may occur. You should maintain transparency and honesty and summarize and provide feedback promptly. - Complex Commission Structures

If you use OTE in team management, overly complex commission structures can confuse members. You should simplify payment formulas to ensure everyone understands their goals and rewards.

You can avoid pitfalls by:

- Staying patient and waiting for prices to enter reasonable OTE zones.

- Accurately assessing market conditions to ensure operations align with trends.

- Simplifying processes and maintaining clear communication and records.

- Using historical data to set achievable goals, avoiding overly optimistic or pessimistic expectations.

Market volatility is nothing to fear; as long as you follow the scientific OTE operation process and avoid common pitfalls, you can achieve steady profits in various market environments.

Application Scenarios and Effects

You will face different challenges in various market environments. The OTE tool can help you respond flexibly, finding suitable profit methods whether the market is rising, falling, or consolidating. Market volatility is nothing to fear; with the right strategies, you can achieve steady profits.

Bull Market Strategies

In a bull market, prices continue to rise. You can use the OTE tool to set tiered targets, gradually increase positions, and lock in profits. For example, in U.S. companies, a senior sales representative’s OTE is $200,000, including $100,000 base salary and $100,000 in potential commissions and bonuses. Companies use tiered commission structures to incentivize exceeding targets. You can apply a similar staged target-setting approach in investing to achieve profits gradually.

| Market Environment | OTE Example |

|---|---|

| Established Companies | Senior sales representative OTE is $200,000, including $100,000 base salary and $100,000 in commissions and bonuses. Tiered commission structures incentivize exceeding targets. |

| Retail Sales | Store manager OTE is $80,000, including $50,000 base salary and $30,000 in bonuses tied to sales growth metrics. |

You can dynamically adjust positions based on the pace of market uptrends, taking partial profits to reduce drawdown risks.

Bear Market Strategies

In a bear market, prices continue to fall. You can use the OTE tool to set stop-loss lines, reduce positions promptly, and protect capital. You can also combine long straddles and straddle strategies to capitalize on opportunities from significant price fluctuations. For example, Tesla experienced significant volatility in 2020, and traders achieved notable returns through volatility strategies. You don’t need to fear downturns; with proper use of OTE, you can still find profit opportunities.

- Long straddles and straddle strategies are suitable for volatile markets, capturing opportunities from sharp price movements.

- You can set clear stop-losses and targets to avoid emotional trading.

Range-Bound Market Strategies

In a range-bound market, prices fluctuate within a specific range. You can use the OTE tool in combination with the following methods:

- Reversal trading: Enter early or late when prices approach range boundaries.

- Volume analysis: Use volume tools to identify price levels with high trading activity.

- Breakout preparation: Monitor volume surges and range narrowing to predict potential breakouts.

You can also employ iron condor and iron butterfly strategies, which perform well in low-volatility markets. Google’s long straddle strategy allows you to profit from significant fluctuations without predicting price direction. Through scientific position management and strategy combinations, you can achieve steady profits in various market environments.

As long as you master the OTE tool, market volatility is nothing to fear. No matter how the market changes, you can find a profit method that suits you.

Target Audience and Advantages

Suitable Investors

If you seek scientific position management and aim to improve the quality of investment decisions, the OTE tool is highly suitable for you. Whether you are an individual investor, professional trader, or team manager, you can benefit from it.

- If you prioritize risk control and want to set clear investment goals, the OTE tool can help you establish reasonable positions and stop-loss lines.

- If you aim to communicate efficiently with financial advisors, the OTE tool makes your investment profile clearer, leading to more tailored advice.

- If you focus on long-term steady profits, the OTE tool can help you create a personalized investment plan, reducing unnecessary risks.

After completing an investor profile, you gain legal protection when working with advisors, who must recommend investment plans based on your risk profile.

Main Advantages

The OTE tool has multiple advantages over traditional position management methods. You can see them clearly in the table below:

| Advantage | Description |

|---|---|

| Improved Risk Management | You can set clear boundaries based on risk tolerance, avoiding excessive exposure to high-risk investments. |

| Enhanced Confidence and Discipline | Understanding your investor type helps you stay calm and resolute during market volatility. |

| Better Communication | A clear investor profile makes discussions with advisors more constructive, yielding more suitable advice. |

| Long-Term Success | A reasonable investment plan increases the likelihood of achieving financial goals while reducing unnecessary risks. |

You can also experience the following benefits:

- The OTE model integrates closely with performance evaluation, letting you see how your actions impact returns.

- OTE includes performance-based compensation, ideal for those who thrive on earning rewards through effort.

- A transparent income structure gives you clear expectations for future earnings, boosting motivation and engagement.

Risk Warnings

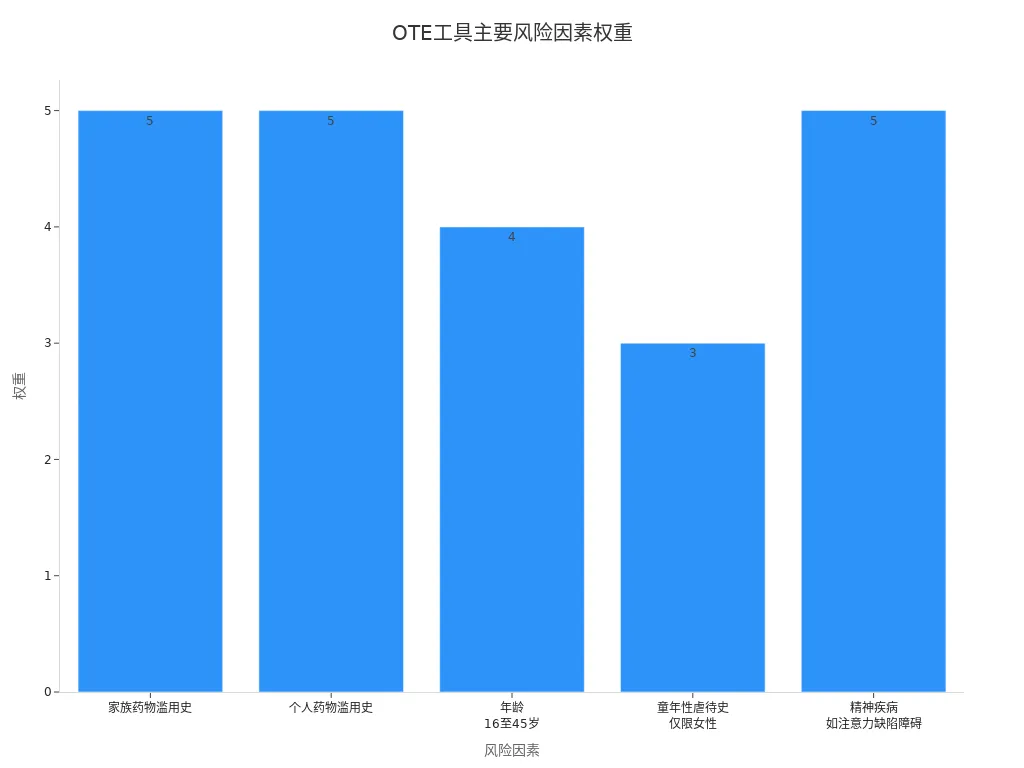

When using the OTE tool, you should also be aware of potential risks. Some risk factors are related to personal background. The chart below shows the main risk factors and their weights:

You need to pay attention to the following points:

- A family or personal history of substance abuse may affect the stability of investment decisions.

- Mental health issues (such as attention deficit disorder, depression, etc.) can increase decision-making risks.

- Investors aged 16 to 45 may have greater risk tolerance and behavioral volatility.

When using the OTE tool, it’s recommended to regularly self-assess and monitor psychological and behavioral changes. If relevant risk factors exist, seek professional advice to ensure more rational and stable investment decisions.

Through the OTE tool, you can scientifically manage positions during market volatility and achieve steady profits. Continuous learning and effective risk management are equally important.

- Continuous learning helps you identify new risks, adopt innovative methods, and stay proactive.

- Effective risk management allows you to better assess and mitigate losses.

It’s recommended to flexibly apply OTE based on your style, follow practical sharing, and continuously improve your investment capabilities.

FAQ

Is the OTE Tool Suitable for Beginners?

You can easily get started with the OTE tool. The operation process is simple, and the interface is intuitive. Even without investment experience, you can quickly understand and apply it.

How Does the OTE Tool Help You Control Risks?

You can set stop-losses and targets to adjust positions promptly. The OTE tool ensures every operation is evidence-based, helping you minimize losses.

Do You Need to Adjust Positions Daily?

You don’t need to adjust positions frequently every day. You can periodically check and adjust positions based on market changes and account conditions.

Which Asset Types Does the OTE Tool Support?

You can use the OTE tool for stocks, bonds, options, futures, and other assets. It’s suitable for managing diversified investment portfolios.

Does Using the OTE Tool Increase Investment Costs?

You won’t incur additional fees for using the OTE tool. You only need to consider the normal transaction fees and commissions associated with trading.

For investors, market volatility is less a risk and more an opportunity for profit, provided you master dynamic position sizing using frameworks like OTE. The success of any dynamic strategy—which involves frequent adjustments, scaling in, and scaling out—hinges entirely on minimal transaction costs. High trading fees will quickly neutralize the gains achieved through sophisticated OTE-based trading.

To ensure your OTE-driven strategy maximizes net returns, integrate the financial precision of BiyaPay. We offer zero commission for contract limit orders, a crucial advantage that drastically cuts the expense of executing the frequent trades necessary for dynamic position management. Furthermore, our platform supports the swift, mutual conversion between fiat and digital assets like USDT, providing you with the fastest, most reliable pathway to fund your brokerage accounts for time-sensitive global investment. You can register quickly—in just 3 minutes without requiring an overseas bank account—and gain immediate access to US and Hong Kong Stocks. Leverage our real-time exchange rate checks to maintain transparent control over your funding costs. Open your BiyaPay account today and translate your dynamic OTE analysis into maximized global trading profits.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.