- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Understanding 403(b): Building Blocks for Your Retirement Life (with Frequently Asked Questions)

Image Source: unsplash

Understanding the 403(b) can help you lay a solid foundation for your retirement. A 403(b) is a retirement savings account designed specifically for employees of educational and nonprofit organizations. You can enjoy tax advantages, with a portion of your salary directly deducted for investment, and the account’s earnings are tax-free until withdrawal.

- According to a 2023 survey, in 2022, 80% of eligible employees chose to participate in a 403(b) plan.

The earlier you start saving, the more secure your future will be.

Key Points

- The 403(b) plan provides tax advantages for employees of educational and nonprofit organizations, helping you accumulate retirement funds faster.

- Employees participating in a 403(b) plan can enjoy pre-tax contributions, reducing taxable income for the year, with funds growing tax-free until retirement.

- Employers may offer matching contributions, increasing your retirement savings; make sure to understand the matching policy to maximize benefits.

- Regularly review your account and understand withdrawal rules to avoid mismanagement that could affect the security of your retirement funds.

- Learn about common 403(b) pitfalls and plan and manage your account scientifically to ensure a more secure retirement.

Understanding 403(b) Basics

Introduction to 403(b)

When considering retirement savings, you may come across the term 403(b). Understanding the 403(b) can help you prepare for your future. A 403(b) is a retirement savings plan designed for employees in specific industries. The IRS officially refers to it as a “tax-sheltered annuity plan.” You can contribute a portion of your income to this account through automatic payroll deductions, and your employer may also contribute on your behalf. The funds in the account are not taxed until you retire, allowing you to accumulate wealth more quickly.

You can refer to the table below for a quick overview of the official definition of a 403(b):

| 403(b) Plan Definition | Description |

|---|---|

| Name | Tax-Sheltered Annuity Plan |

| Eligible Participants | Certain employees of public schools, employees of certain 501©(3) tax-exempt organizations, and certain ministers |

| Features | Allows employees to contribute a portion of their salary to the plan, with employers also able to contribute on their behalf. |

You might confuse a 403(b) with a 401(k). Both are common U.S. retirement savings plans, but they serve different groups. A 401(k) is primarily for private-sector employees, while a 403(b) is designed for employees of educational, healthcare, religious, and nonprofit organizations. You can compare them in the table below:

| Plan Type | Eligible Participants |

|---|---|

| 403(b) | Employees of tax-exempt organizations, such as schools or nonprofits |

| 401(k) | Employees of private companies |

Eligible Participants

If you work at a public school, nonprofit hospital, church, or other 501©(3) tax-exempt organization in the U.S., you are eligible to participate in a 403(b) plan. Understanding the eligible participants for a 403(b) can help you determine if you qualify for this benefit.

Common eligible organization types include:

- Public schools (e.g., K-12 school districts)

- 501©(3) tax-exempt organizations (e.g., hospitals, charities)

- Churches and other religious institutions

You can refer to the table below for further details on organizations that can offer 403(b) plans to employees:

| Organization Type | Description |

|---|---|

| Public Schools | Includes K-12 school districts |

| Churches | Applies to religious institutions |

| 501©(3) Tax-Exempt Organizations | Includes hospitals and nonprofit service providers |

You are also eligible to participate if you fall under the following conditions:

- Employed by a 501©(3) tax-exempt organization

- Working in a public school system

- Employed by a cooperative hospital service organization

- Civilian faculty or staff at the Uniformed Services University

- Certain ministers employed by a 501©(3) organization

If you meet any of the above conditions, you can consider using a 403(b) plan to save for your retirement. Understanding the basics of a 403(b) is an important step toward financial freedom.

Retirement Savings Advantages

Image Source: unsplash

Tax Benefits

By choosing to participate in a 403(b) plan, you can enjoy multiple tax benefits. First, your contributions can be deducted pre-tax directly from your salary, effectively reducing your taxable income for the year. This means you pay less in taxes annually, leaving more disposable income. Second, investment earnings and interest in the account are tax-deferred until you withdraw them at retirement. This tax-deferral mechanism allows your funds to grow more efficiently.

If you opt for the Roth 403(b) option, you pay taxes on contributions upfront, but as long as certain conditions are met, both the principal and earnings can be withdrawn tax-free during retirement. This allows you to flexibly choose the tax strategy that best suits your needs.

You can refer to the table below for a quick overview of the main tax advantages of a 403(b) plan:

| Tax Advantage Type | Description |

|---|---|

| Pre-Tax Contributions | Employees can contribute pre-tax, reducing taxable income for the year. |

| Tax Deferral | Contributions and earnings are not subject to income tax until distribution, maximizing the compounding effect. |

| Roth Option | If specific requirements are met, contributions and earnings from a Roth 403(b) are tax-free upon distribution. |

By paying less in taxes annually, the funds in your account can grow faster. Tax deferral allows you to harness the power of compounding, resulting in more savings at retirement.

Common tax benefits include:

- Contributions can be made pre-tax, reducing taxable income for the year.

- Funds grow tax-free until retirement.

- Roth 403(b) contributions and earnings are tax-free upon distribution if conditions are met.

Wealth Accumulation

By saving long-term through a 403(b) plan, you can significantly improve your quality of life in retirement. Your contributions and investment earnings grow tax-free, meaning every dollar can fully leverage the power of compounding. Compounding allows your interest to generate additional interest, resulting in wealth growth far exceeding that of regular savings.

Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

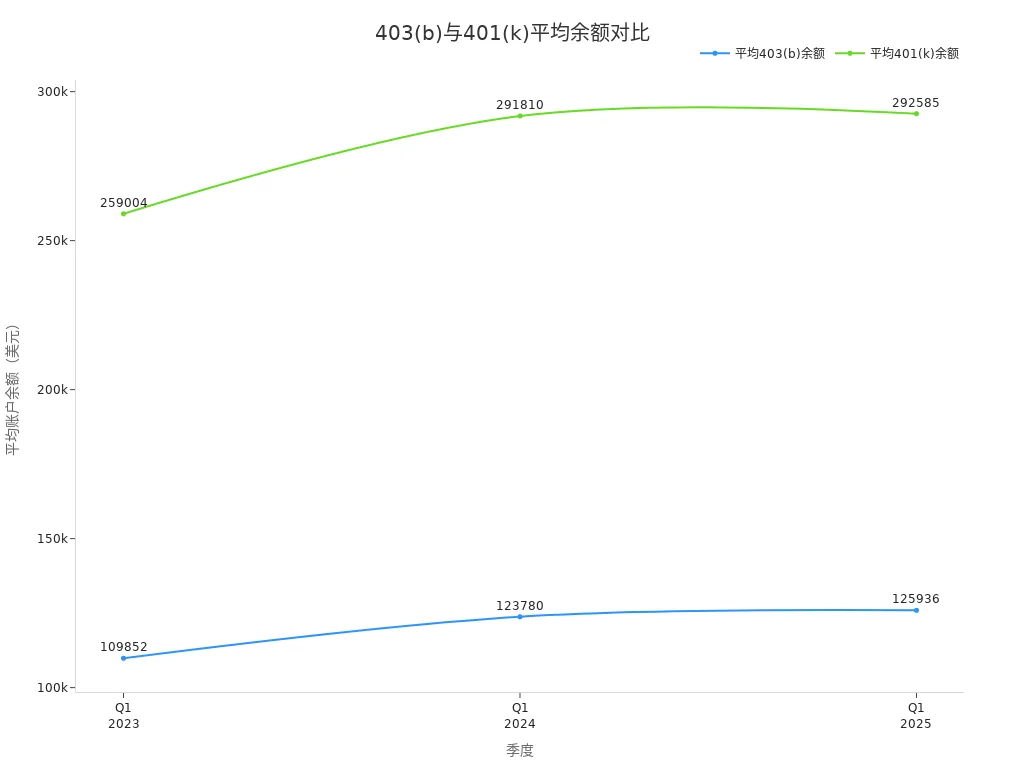

By consistently contributing each year, your account balance will grow steadily. The chart below compares the average account balances of 403(b) and 401(k) plans across different quarters. Although the average balance of a 403(b) is slightly lower than a 401(k), with long-term accumulation, you can still achieve substantial retirement funds.

As shown, in Q1 2024, the average balance for a 403(b) account reached $123,780. By consistently contributing and leveraging tax deferral and compounding, you can accumulate more substantial funds for retirement.

Advantages of wealth accumulation include:

- Your contributions are made pre-tax, reducing taxable income.

- Account funds grow tax-free until distribution, allowing more capital to be reinvested.

- Without immediate tax burdens, funds can compound, significantly boosting long-term retirement savings growth.

- Traditional 403(b) contributions, interest, and dividends grow tax-free, with a noticeable compounding effect.

By understanding the tax benefits and wealth accumulation mechanisms of a 403(b), you can better prepare for your future. As long as you commit to long-term savings, your retirement will be more secure and fulfilling.

How the Account Works

Image Source: unsplash

Contribution Methods

When participating in a 403(b) plan, you can choose from multiple contribution methods. The most common is payroll deduction contributions. Each time you receive a paycheck, a specified amount is automatically deducted and deposited into your 403(b) account. This allows you to save regularly with ease. You can also opt for Roth contributions, where you contribute after-tax income, and both the principal and earnings are tax-free upon withdrawal. Employers may also provide matching or voluntary contributions to help you accumulate retirement funds faster.

Common contribution methods include:

- Payroll deduction contributions

- Roth contributions

- Employer contributions (including matching and voluntary)

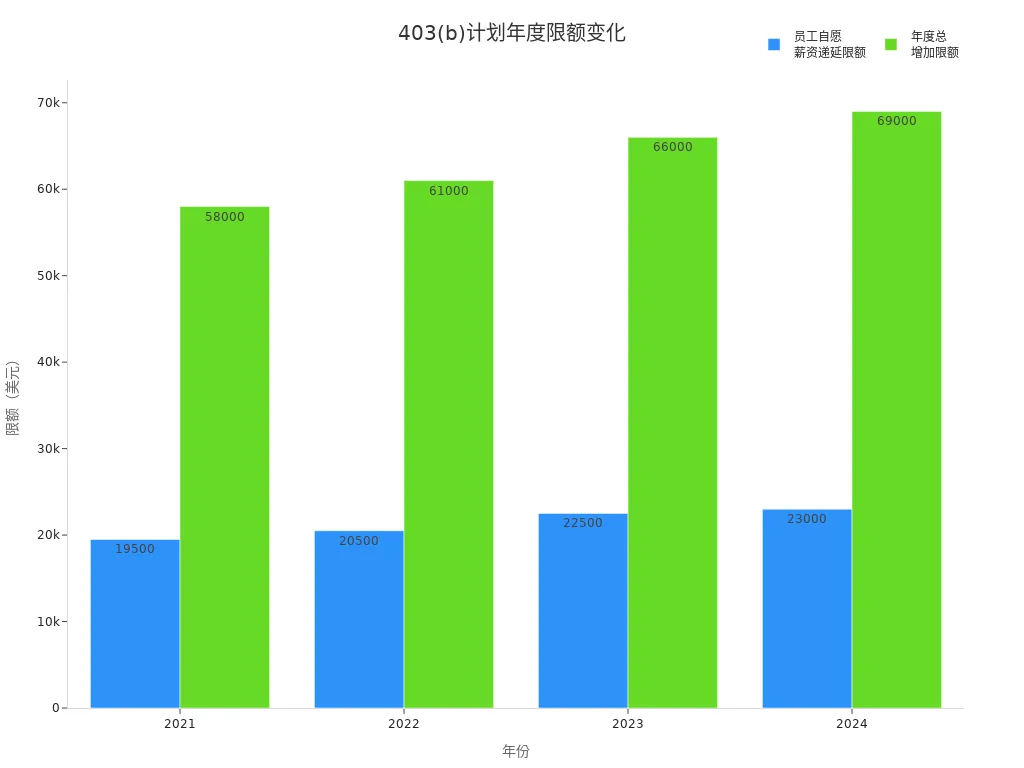

You need to pay attention to annual contribution limits. The IRS adjusts these limits annually. In 2024, the employee elective deferral limit is $23,000, and the total annual addition limit is $69,000. You can refer to the table below for recent limit changes:

| Year | Employee Elective Deferral Limit | Total Annual Addition Limit |

|---|---|---|

| 2024 | $23,000 | $69,000 |

| 2023 | $22,500 | $66,000 |

| 2022 | $20,500 | $61,000 |

| 2021 | $19,500 | $58,000 |

Investment Options

In a 403(b) account, you can choose from various investment products. Common options include mutual funds, annuities, target-date funds, and stable value investments. Most 403(b) plans offer fewer investment choices than 401(k) plans, typically limited to annuities and mutual funds. This setup simplifies choices but may limit your investment diversity.

| Plan Type | Investment Options | Description |

|---|---|---|

| 401(k) | Multiple investment options | Includes stocks, bonds, mutual funds, exchange-traded funds (ETFs), etc., offering greater flexibility. |

| 403(b) | Limited investment options | Typically limited to annuities and mutual funds, with lower investment diversity. |

You can allocate your investments based on your risk tolerance and retirement goals. Understanding the investment options of a 403(b) helps you plan for your future more effectively.

Management Tips

You need to follow some key rules to manage your 403(b) account effectively. Employers must provide elective deferral opportunities to all eligible employees (with few exceptions). You can only withdraw funds under specific circumstances (e.g., separation from service, death, disability, or reaching age 59½). Employers must also establish a written plan and promptly deposit your contributions into the account.

| Rule/Regulation | Description |

|---|---|

| Universal Availability Rule | If any employee is allowed to defer, all employees must be given the opportunity (with limited exceptions). |

| Distribution Restrictions | Funds can only be distributed upon separation from service, death, disability, or reaching age 59½. |

| Written Plan Requirement | Employers must have a written plan and promptly deposit employee deferrals. |

| Plan Termination Distribution | Upon plan termination, participants must be 100% vested, but distributions may not be allowed in some cases. |

You should regularly review your account to ensure timely contributions and a balanced investment portfolio. Understanding the rules can help you avoid common management mistakes and improve the security and efficiency of your retirement savings.

Eligibility and Account Opening Process

Participation Requirements

To participate in a 403(b) plan, you need to meet certain eligibility requirements. Most employees of public schools, nonprofit hospitals, and religious institutions in the U.S. can join. Employers must follow the “universal availability rule,” meaning if one employee is allowed to defer salary, all employees must be given the same opportunity, except in specific cases. After December 31, 2024, long-term part-time employees are also eligible to participate. As long as you are at least 21 years old and have worked at least 500 hours per year for two consecutive years, your employer must allow you to participate in a salary deferral agreement.

You can refer to the table below for a quick overview of the main eligibility requirements:

| Eligibility Requirement | Description |

|---|---|

| Universal Availability Rule | If any employee is allowed to defer salary, all employees should have the opportunity to participate (with limited exceptions). |

| Long-Term Part-Time Employees | After 2024, long-term part-time employees must also be allowed to participate. |

| Effective Opportunity | Employees must have at least one opportunity per year to change deferral amounts. |

As long as you meet the above conditions, you can proactively apply to join a 403(b) plan to save for your retirement.

Account Opening Process

When preparing to open an account, you need to understand the specific process. First, confirm whether your employer has established a written plan document. This document details eligibility, benefits, restrictions, and fund distribution. You need to prepare relevant personal information and follow your employer’s instructions to complete the account opening forms.

The account opening process generally includes the following steps:

- Review the 403(b) plan documents provided by your employer to understand the specific terms.

- Complete and submit the account opening application form, providing personal identification and contact information.

- Choose a contribution method and investment options, determining the deferral amount per period.

- Your employer submits your information to the plan administrator to complete the account setup.

- Regularly check account information to ensure contributions and investment arrangements are correct.

During the account opening process, you will typically encounter the following documents:

| Document Type | Description |

|---|---|

| Written Plan Document | Details the plan rules to ensure compliance. |

| Plan Terms and Conditions | Includes eligibility, benefits, restrictions, available contracts, and distribution timing and forms. |

By following the process, you can smoothly open a 403(b) account and start preparing for your retirement.

Advantages and Limitations

Employer Matching

When you participate in a 403(b) plan, employer matching is a significant advantage. Employer matching in 403(b) plans is becoming increasingly common. Many employers encourage active participation in retirement savings through automatic enrollment, improved communication, and matching contributions. Common matching methods include:

- $1-for-$1 matching: Employers match your contribution amount, typically up to a certain percentage of your salary.

- Partial matching: Employers match 50% of your contributions up to the first 6%.

- Tiered matching: Employers apply different matching rates for different contribution levels.

With employer matching, your retirement account grows faster. However, matching policies vary by employer, so check the specific percentages and caps in your employer’s plan description.

Withdrawal Rules

When managing your 403(b) account, you must understand the withdrawal rules. Generally, you can withdraw funds without penalty after reaching age 59½. Early withdrawals incur a 10% IRS penalty plus regular income tax. In special cases, such as disability or certain medical expenses, the penalty may be waived. By age 73, you must begin taking required minimum distributions (RMDs). The table below summarizes the main withdrawal rules:

| Condition | Age Requirement | Penalty |

|---|---|---|

| Normal Retirement Age | 59½ | No penalty |

| Early Withdrawal | Before 59½ | 10% penalty + regular income tax |

| Special Circumstances | N/A | Penalty may be waived |

| Required Minimum Distribution (RMD) | 73 | N/A |

You should also note that traditional 403(b) withdrawals are taxed as ordinary income, while Roth 403(b) withdrawals have different tax rules.

Fee Structure

When selecting and managing a 403(b) account, you must pay attention to the fee structure. The average annual fee for 403(b) products is 1.78%, but the range varies from 0.56% to 4.58%. Over 60% of products charge early withdrawal fees, and 70% include sales commissions. Common fee types include:

- Front-end or back-end loads

- Commissions

- Early withdrawal fees

- Asset-based management fees

- Recordkeeping fees

- Expense ratios

- Distribution processing fees

- Miscellaneous fees

The table below shows the average fees for different investment products:

| Fee Type | Percentage |

|---|---|

| Variable Annuity | 2.25% |

| Fixed Annuity | 1.15% |

| Mutual Fund | 0.97% |

When comparing to 401(k) plans, 403(b) average fees range from 0.01% to 2.37%, while 401(k) fees range from 0.02% to 0.08%. You should regularly review fee details and choose cost-effective products to avoid unnecessary costs eroding your retirement savings.

Common 403(b) Pitfalls

Investment Pitfalls

When understanding a 403(b), you may encounter some investment-related pitfalls. Many assume that 403(b) plans can use prototype documents or must include all IRS-allowed features. In reality, each plan’s specifics are determined by the employer and may not be identical. You might also mistakenly believe that plans can arbitrarily restrict participants, such as setting minimum age or service requirements. In fact, legal regulations clearly define these restrictions.

In terms of investment choices, many misunderstand risk and diversification. You might think a single security is safer than a market index or invest heavily in stocks of companies with strong short-term performance. This can lead to an imbalanced asset allocation, increasing risk. Asset allocation is a critical factor in long-term investment performance. You may also overlook the order of supplemental contributions or assume all contracts require funding authorization.

Common investment pitfalls include:

- Assuming 403(b) plans must include all IRS-allowed features

- Underestimating the importance of asset allocation and diversification

- Over-concentrating investments in one asset class or company stock

- Ignoring the impact of supplemental contribution order

Management Pitfalls

When managing a 403(b) account, you may also make common mistakes. Many fail to regularly review account statements, leading to discrepancies between actual and expected balances. You should regularly review all retirement account statements, comparing balances with your contributions, investment performance, and authorized distributions.

Some lack sufficient understanding of plan rules, potentially missing opportunities to adjust contributions or investment options. You may also overlook the fee structure, leading to unnecessary costs eroding returns. Only by actively managing your account can you better ensure the security of your retirement funds.

Common management pitfalls include:

- Ignoring regular account statement reviews

- Not understanding plan rules, missing adjustment opportunities

- Overlooking fee structures, increasing unnecessary expenses

By understanding the common pitfalls of a 403(b), you can plan and manage your retirement account more scientifically, avoiding unnecessary losses.

Choosing a 403(b) plan lays a solid foundation for your retirement. Early savings and consistent management allow you to enjoy more benefits:

- Enjoy tax advantages and high contribution limits

- Employers may offer matching with shorter vesting periods

- After 15 years of service, you can make additional catch-up contributions, with new policy catch-up amounts available from ages 60 to 63

Retirement policies are constantly changing, and contribution limits and withdrawal terms may be adjusted. You should actively stay informed about policies, plan flexibly, and avoid common pitfalls to secure a brighter future.

FAQ

1. Can you have both a 403(b) and a 401(k) account at the same time?

You can have both a 403(b) and a 401(k) account simultaneously. You need to ensure that the total annual contributions do not exceed the IRS limits. You can allocate contributions based on your actual needs.

2. How do you access funds from a 403(b) account after retirement?

You can start accessing funds from a 403(b) account after reaching age 59½. Withdrawals are subject to regular income tax. Early withdrawals incur a 10% penalty unless special conditions are met.

3. Can you change your contribution amount at any time?

You have one or more opportunities each year to adjust your contribution amount. You need to contact your employer or plan administrator and follow the process to modify the deferral amount. You should regularly check if contributions align with your needs.

4. What happens to your 403(b) account after you leave your job?

After leaving your job, you can keep your 403(b) account or roll the funds into a new retirement account (e.g., an IRA). You are not required to withdraw the funds immediately. You should monitor account management and fee changes.

5. What products can you invest in with a 403(b) account?

You can invest in mutual funds, annuities, and target-date funds. When choosing investment products, consider your risk tolerance and retirement goals. You should periodically adjust your investment portfolio to adapt to market changes.

The 403(b) plan is a powerful vehicle for tax-advantaged retirement savings for employees of non-profits and educational institutions. However, the plan’s limited investment options (often restricted to annuities and high-fee mutual funds) and complex fee structures can constrain your ability to build a robust, globally diversified, and cost-efficient portfolio.

While BiyaPay is not a 403(b) plan administrator, it provides the perfect solution to complement your retirement savings with a flexible, low-cost external investment strategy. We offer zero commission for contract limit orders, drastically lowering the cost of diversifying into individual US and HK Stocks and ETFs, helping you offset potentially high fees within your 403(b). Furthermore, our platform supports the swift, mutual conversion between fiat and digital assets like USDT, providing you with the fastest, most reliable pathway to manage your non-retirement investment funds globally. You can register quickly—in just 3 minutes without requiring an overseas bank account—and gain immediate access to global markets. Leverage our real-time exchange rate checks to maintain transparent control over your funding costs. Open your BiyaPay account today to efficiently manage the assets that are building your wealth outside of your 403(b) plan.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.