- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

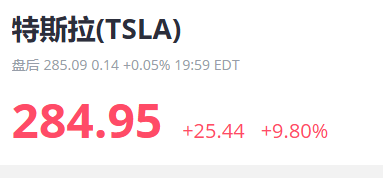

Behind Tesla's 10% surge: the relaxation of autonomous driving policies, how can investors seize the new trend of technology stocks?

Last week, technology stocks led by Tesla rebounded strongly and became an important support for the market. Tesla opened high in the morning and continued to rise, with an intraday increase of nearly 10%. Nvidia also performed well, with an increase of more than 4%. The collective strength of technology stocks not only boosted market confidence, but also released a clear signal: policy dividends are reshaping the industry landscape.

Shocking Reversal: Has Tesla’s “Tightening Curse” Been Lifted?

The surge in Tesla’s stock price is directly due to a heavyweight policy - the Trump administration announced a significant relaxation of regulatory restrictions on autonomous driving. US Transportation Secretary Sean Duffy clearly stated that as long as autonomous vehicles are used for non-commercial purposes such as “testing, demonstration, research”, some compliance procedures will be exempted. US Transportation Secretary Sean Duffy even directly shouted: “We cannot afford to lose this innovation competition, we must cut off all obstacles!” This blow directly hit Tesla’s most painful “lifeline”!

The National Highway Traffic Safety Administration (NHTSA) has also spoken out, promising to “remove unnecessary regulatory barriers that hinder innovation.” This policy shift has cleared a key obstacle for Tesla’s autonomous driving technology monetization. Currently, Tesla has sold more than 2 million vehicles with FSD (fully autonomous driving) function in the US, but its technology iteration has long been limited by cumbersome regulatory processes. This policy relaxation undoubtedly injects a shot in the arm for Musk’s “unmanned taxi” plan.

Undercurrents Surging “The” Bloody Game "Behind Policy Relaxation

Policy loosening is not accidental, but the result of multiple factors working together.

The “nuclear button” of the technology war The US government realizes that the leading position in the field of autonomous driving is related to future technological hegemony. Transportation Secretary Duffy bluntly stated: “We are in an innovation race, and the stakes have never been higher.” Relaxing regulations aims to accelerate the landing of technology and ensure the US’s dominance in the field of autonomous driving.

Corporate lobbying pressure Tesla and other car companies have long complained that regulatory redundancy hinders innovation. Musk has repeatedly called for the establishment of a national unified autonomous driving framework to reduce regional approval differences. This policy adjustment is to some extent the government’s response to industry demands.

Carmakers’ “Tariff Battle Escape” The Trump administration has also loosened its trade policy recently, planning to exempt some auto parts from stacked tariffs. Although vehicle tariffs still exist, this adjustment reflects the government’s attempt to find a balance between protectionism and industry demand.

However, policy loosening is also accompanied by controversy. NHTSA currently has 8 investigations into Tesla’s autonomous driving system, and Musk’s recently led “Government Efficiency Department” has laid off some NHTSA employees, raising questions about regulatory independence. Policy dividends and latent risks coexist, and investors need to remain sober.

Is it still possible for retail investors to get on board now?

Faced with the policy-driven technology stock frenzy, market sentiment has been thoroughly ignited, but calm layout is needed behind the madness. Tesla’s surge is just the beginning, and the real opportunities and risks have just surfaced. If investors want to get a share of this autonomous driving revolution, they must grasp the key points.

Keep an eye on policy trends and bet on the biggest beneficiary. Tesla is undoubtedly the number one winner of this round of regulatory loosening, and the monetization process of the FSD system may usher in an explosive acceleration. But don’t just focus on the leaders - NVIDIA’s computing chips, Luminar’s lidar, and even charging pile operators may become the next targets of crazy capital influx. Once the policy wind blows, the valuation logic of the entire industry chain will be reshaped.

Beware of regulatory changes, beware of bloodshed after the carnival. History has proven countless times that policy dividends are often accompanied by drastic fluctuations. NHTSA still holds eight investigations against Tesla, and any autonomous driving accident could trigger a tsunami of public opinion, leading to a sharp change in regulatory attitudes. Especially pay attention to the landing node of Cybercab in June, which is not only a milestone, but also a fuse that may ignite market sentiment.

We must diversify our layout and find a balance between offense and defense. The violent rise of technology stocks is thrilling, but betting on a single track is no different from gambling. Smart funds have already started to act - you can choose a more credible securities firm for investment. For example, Jiaxin Wealth Management is a globally renowned investment securities firm. By opening an account with Jiaxin Wealth Management, you can get a bank account with the same name. You can deposit digital currency (USDT) into the multi-asset wallet BiyaPay, and then withdraw fiat currency to Jiaxin Securities for investment in US stocks. You can also directly search for its code on the BiyaPay platform to buy. At the same time, investors can monitor stock prices regularly according to their investment strategies and buy or sell stocks at the appropriate time.

Summary: Opportunities and risks coexist, rational layout is the key

The skyrocketing of Tesla is not only a direct reflection of policy dividends, but also reflects the complexity of the game between the technology industry and regulation. For investors, in the short term, they can follow the trend and capture the policy-driven market, but in the medium and long term, they still need to be wary of risks such as technology landing falling short of expectations and regulatory fluctuations. In technology stock investment, maintaining rationality and diversified allocation is the key to standing invincible.::: hljs-center

Center text

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.