- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

From the Shopping Basket to the Mortgage: Does CPI Affect Everything in Your Life?

Image Source: unsplash

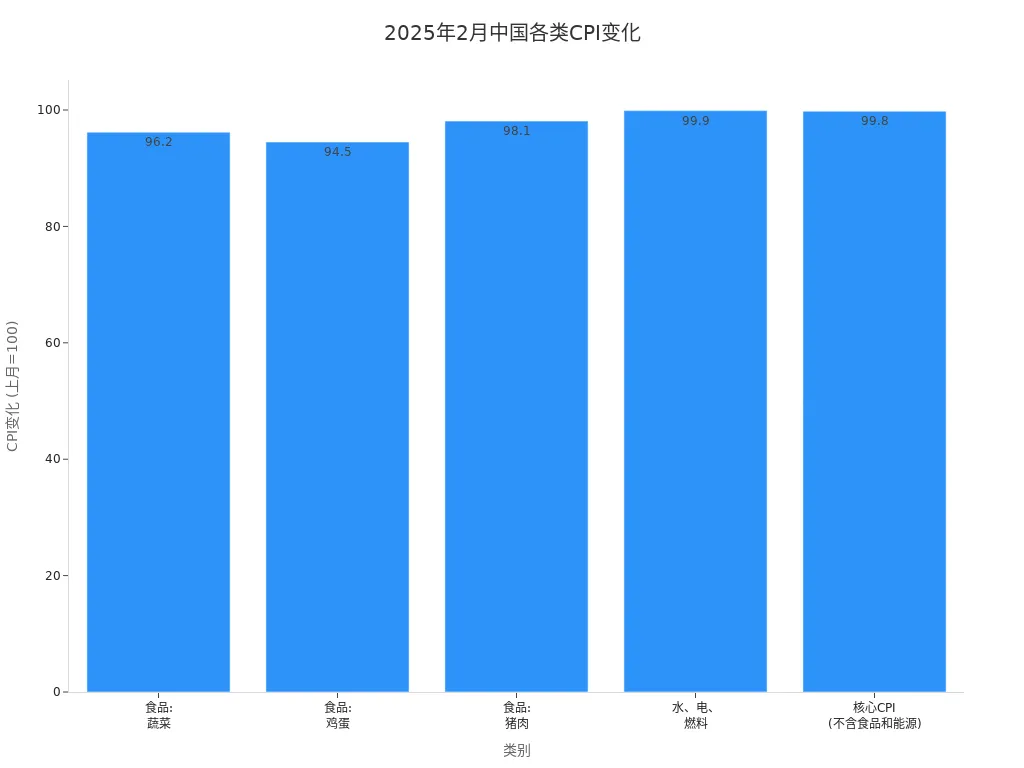

When you go to the market to buy groceries, you will notice that the prices of vegetables and eggs are constantly changing. When you repay your mortgage, the monthly payment amount may also adjust with the economic environment. When you plan your consumption or savings, CPI changes directly affect your budget and choices. The following table shows the latest CPI data for different categories in mainland China for February 2025, giving you an intuitive sense of how grocery basket price fluctuations impact household spending:

| Category | CPI Change (Prev Mth=100) | Date |

|---|---|---|

| Food: Vegetables | 96.200 | February 2025 |

| Food: Eggs | 94.500 | February 2025 |

| Food: Pork | 98.100 | February 2025 |

| Water, Electricity, Fuel | 99.900 | February 2025 |

| Core CPI | 99.800 | February 2025 |

By paying attention to CPI, you can better plan household spending, consumption capacity, and future decisions.

Key Points

- CPI (Consumer Price Index) reflects price changes in daily consumer goods and services, helping you understand fluctuations in the cost of living.

- Monitoring CPI data can help you better plan your household budget, reasonably arrange consumption and savings.

- CPI changes affect banks’ interest rate adjustments, which in turn impact your mortgage monthly payments.

- Food price fluctuations directly affect your grocery basket spending; it’s recommended to regularly track expenses to optimize your budget.

- In a high-inflation environment, choosing investment targets with pricing power can help you protect your wealth.

CPI Overview

Definition and Role

When you select vegetables at the supermarket, you may notice that prices sometimes rise and sometimes fall. You may wonder, what patterns lie behind these changes? In fact, these price changes in daily consumer goods are exactly what CPI (Consumer Price Index) reflects. CPI is the main indicator for measuring price changes in consumer goods and services for residents in mainland China. You can think of CPI as a “grocery basket” containing commonly purchased items in your daily life, such as food, clothing, transportation, and healthcare. Whenever the prices of these items change, CPI fluctuates accordingly.

CPI is not just a number. Through CPI, you can understand the pace of inflation. If CPI keeps rising, it indicates that the overall price level is increasing, and your cost of living will also rise. Conversely, if CPI falls, your living pressures may ease. When planning your household budget, consumption, and savings, CPI data can serve as a reference. Governments and banks also adjust interest rates and related policies based on CPI changes, affecting your mortgage and loan costs.

Calculation Method

You may be curious about how CPI is calculated. In fact, the CPI calculation process is very detailed. Mainland China uses the chained Laspeyres price index to ensure data accuracy and representativeness. Specific practices include:

- Covering approximately 500 regions nationwide, including about 200 counties and 300 cities, ensuring prices from different regions are included.

- Building a “grocery basket” sample based on representative goods and services consumed by households.

- High frequency of price collection, with perishable goods like fruits, vegetables, and meat collected six times a month, and other goods collected twice a month.

- The CPI base period is adjusted based on changes in economic and consumption structures, for example, since January 2016, 2015 became the new base period.

Through these data, you can more accurately understand the real price changes in mainland China. The scientific calculation method of CPI helps you and all sectors of society better grasp economic trends and make reasonable life and investment decisions.

Grocery Basket Price Changes

Image Source: pexels

Food Prices and CPI

When you select vegetables and meat at the supermarket, you often notice significant price fluctuations. Over the past five years, food prices in mainland China have experienced multiple ups and downs, directly affecting CPI trends. You can understand the relationship between food prices and CPI through the following table:

| Time | Food Price Change (%) | CPI Change (%) | Notes |

|---|---|---|---|

| January 2018 | N/A | N/A | Data starting point |

| May 2023 | 7.7% (year-on-year increase) | -0.1% | Driven by rising prices of fruits, vegetables, and pork |

| May 2023 | -0.4% (year-on-year decrease) | N/A | Food prices declined |

| Before 2016 | ~30% | N/A | Food weight in CPI |

| After 2016 | 19.9% | N/A | Food weight in CPI decreased |

You can see that in May 2023, the year-on-year food price increase reached 7.7%, mainly driven by rising prices of fruits, vegetables, and pork. Meanwhile, CPI slightly declined, indicating that other categories’ prices also affect overall CPI. The weight of food in CPI dropped from about 30% before 2016 to 19.9%, but the grocery basket remains a significant component of CPI.

You may also be concerned about specific food price changes. The following table shows price fluctuations for some food categories in recent years:

| Food Category | Price Change (%) |

|---|---|

| Meat and Poultry | 73% |

| Eggs | 39% |

| Seafood | 25% |

| Spinach | 9-58% |

| Cabbage | 9-58% |

| Lettuce | 33% |

| Eggplant | 23-44% |

| Onions | Over 100% |

| Cooking Oil (Hunan) | 31% |

| Cooking Oil (Gansu) | 21% |

In your daily life, you often notice significant price fluctuations for vegetables like onions, spinach, and cabbage. Onion prices have even risen by over 100%. These changes directly affect your grocery basket spending and are reflected in CPI data.

Household Budget Impact

When you make your monthly household budget, grocery basket price changes are the most direct influencing factor. When food prices rise, you need to spend more money to buy the same amount of vegetables and meat. For rural residents in mainland China, food demand is highly sensitive to price changes, especially for fruits and vegetables. When your income increases, food consumption also rises. Households with a lower proportion of working-age members have higher income elasticity for food demand, meaning you need to pay more attention to grocery basket spending when allocating your budget.

Tip: You can track monthly grocery basket spending to adjust your budget structure in time. Studies show that households at different income levels react similarly to food price changes, but rural households are more affected. When planning household consumption, it’s advisable to prioritize grocery basket price trends and reasonably arrange monthly expenses.

If you live in a city, rising food prices also affect your consumption choices. You may reduce dining out and increase home cooking frequency. You may also choose more economical ingredients to optimize your grocery basket structure. Whether in urban or rural areas, grocery basket price changes directly impact your quality of life and consumption capacity.

By paying attention to CPI and grocery basket prices, you can not only plan your household budget effectively but also make wiser consumption decisions when facing price fluctuations.

Mortgage Changes

Image Source: unsplash

Interest Rate Adjustments

When repaying your mortgage, you are most concerned about how much interest you need to pay each month. CPI changes affect banks’ interest rate adjustments. Banks typically adjust loan rates based on inflation levels. If CPI keeps rising, banks may increase mortgage rates. Your monthly repayment amount will also increase accordingly. Conversely, if CPI falls, banks may lower rates, reducing your monthly payment pressure.

You may have heard of the Generalized CPI (GCPI). GCPI not only includes daily consumer goods prices but also incorporates housing prices. GCPI can more accurately reflect the inflation pressure you actually face. Over the past 24 years, GCPI shows that real interest rates in mainland China were negative in most years. This means that when you buy a house with a loan, the actual interest burden may be lower than the nominal figures. As the real estate market gradually cools, GCPI values are even lower than traditional CPI, further indicating the significant impact of housing prices on inflation and rate adjustments.

- Studies indicate that official CPI fails to truly reflect inflation, especially not accounting for the rapid rise in housing prices.

- The introduced Generalized CPI (GCPI) includes housing prices, significantly affecting real interest rate calculations.

- Over the past 24 years, when using GCPI as a proxy for inflation, China’s real interest rates were negative in most years.

- Due to the cooling real estate market, GCPI values show a trend lower than CPI, further validating GCPI’s accuracy as an inflation indicator.

When choosing mortgage products, you can pay attention to banks’ announced interest rate adjustment policies. Hong Kong-licensed banks typically adjust mortgage rates based on mainland China’s inflation data and market trends. You can compare rates from different banks to choose a loan plan that suits you best. You can also monitor CPI and GCPI changes to predict future rate trends and plan your budget in advance.

Tip: When signing a mortgage contract, it’s advisable to carefully read the interest rate adjustment terms. Monitoring the latest CPI and GCPI data can help you predict future changes in monthly payments and avoid repayment pressure due to rising rates.

Home Purchase Decisions

When considering buying a home, CPI changes affect your decisions. Rising CPI typically means overall price increases, raising the cost of home purchases. You need to invest more funds to buy a property of the same size. When CPI falls, housing prices may stabilize or decline, allowing you to achieve your home purchase goal at a lower cost.

Real estate market price fluctuations are not only influenced by CPI but also by macroeconomic conditions, industry policies, and speculative behavior. These factors indirectly affect housing prices through trading volume. When observing the market, you can pay attention to changes in trading volume. If trading volume increases, housing prices may rise; if it decreases, prices may stabilize or fall.

- Studies show that macroeconomic, industry-specific, policy, and speculation-related variables impact real estate price fluctuations.

- These variables indirectly affect prices through trading volume.

- Related literature supports this view, including studies on Hong Kong and Singapore, indicating similar indirect impacts in mainland China’s real estate market.

When making home purchase decisions, you can combine CPI trends and market trading volume to judge future housing price trends. You can also pay attention to government real estate regulation policies, which often affect market supply and demand, thereby influencing prices. If you plan to hold a property long-term, you can monitor inflation levels and interest rate changes to reasonably arrange the timing and loan method for your purchase.

Advice: Before buying a home, you can collect more market information, focusing on CPI, GCPI, and trading volume data. Reasonably assess your repayment capacity and home purchase budget to avoid financial pressure from market fluctuations.

Consumer Spending Impact

Transportation and Healthcare

When you travel daily, you often notice that public transportation fares and fuel prices adjust with CPI changes. When CPI rises, transportation companies typically adjust fares based on a fare adjustment mechanism. For example, Hong Kong-licensed metro companies reference CPI and the Nominal Wage Index (NWI(T)) to determine fare changes. You can understand the impact of CPI on transportation spending through the following points:

- Changes in CPI and NWI(T) directly affect public transportation fare adjustments.

- The fare adjustment mechanism sets a cap related to household income changes to prevent excessive increases.

- In 2023, CPI rose by 2.4%, and NWI(T) rose by 5.2%, leading to a 5.05% fare adjustment rate for 2024.

- The actual fare increase was 3.09%, with the remainder deferred to the following year.

- Frequent fare increases can cause public dissatisfaction, with some believing the current mechanism fails to fairly reflect economic realities.

You are also indirectly affected by CPI in terms of healthcare spending. Changes in healthcare service price levels affect your medical expenses and insurance premiums. The following table summarizes related research findings:

| Evidence Type | Content |

|---|---|

| Research Finding | There is a long-term equilibrium relationship between healthcare service price levels and healthcare spending, but changes in healthcare service price levels do not significantly affect CPI or average wages. |

| Research Finding | Changes in healthcare service price levels are a Granger cause of healthcare spending but do not affect CPI or average wages. |

| Research Finding | As healthcare costs rise, insurance companies typically increase premiums to cover the higher costs of providing services. |

When facing rising healthcare service prices, you may notice that insurance companies have increased premiums. You need to choose medical insurance products based on your needs to avoid increased financial burdens due to rising medical costs.

Wages and Savings

When you receive your monthly salary, CPI changes directly affect your real purchasing power. If CPI rises while your wage growth is slow, the goods and services you can buy decrease. You need to pay attention to whether wage adjustments can keep up with price increases. Some companies adjust employee wages based on CPI changes to help you offset inflation pressures.

When saving, you also need to consider CPI’s impact. When CPI rises, the real value of money declines, reducing your savings’ purchasing power. You can regularly monitor CPI data to plan your savings reasonably. For example, you can choose savings or investment products with yields higher than CPI to maintain the real value of your assets. You can also optimize your consumption structure, reduce unnecessary spending, and improve savings efficiency.

By paying attention to CPI changes, you can better manage wages and savings, enhancing your household’s financial stability and risk resilience.

Financial Decision Impact

Investment Strategy

When formulating investment strategies in a high-inflation environment, you need to pay attention to CPI changes. Sustained CPI increases lead to declining purchasing power, and you can choose consumer goods companies with pricing power. For example, Kweichow Moutai and Wuliangye perform well during inflation because they can pass on cost increases to consumers. You can also consider export-oriented manufacturers, especially when China’s inflation is lower than global levels, as companies in electronics and textiles are more likely to benefit. Tech companies like Hikvision and iFlytek focus on automation, helping businesses cope with rising labor costs, giving them an advantage in high-inflation periods.

When selecting investment targets, it’s advisable to avoid highly indebted companies. Rising interest rates increase these companies’ financing costs, affecting profitability. For real estate investments, you can focus on high-quality properties in first-tier cities like Beijing and Shanghai, which are more likely to retain value during inflation. You can also consider Real Estate Investment Trusts (REITs), which provide liquid investment options in commercial properties.

Tip: When investing, focus on companies’ pricing power and debt levels, prioritizing assets that can withstand inflation pressures.

Asset Allocation

When allocating assets, rapid CPI increases affect your choices. In a high-inflation environment, the importance of fixed-income assets significantly increases. Sovereign wealth funds typically rank fixed-income assets as the second most popular asset class after infrastructure. You can use fixed-income assets for liquidity management while gaining flexible return sources, enhancing portfolio resilience.

You can also focus on private credit. During high interest rate and high inflation periods, the proportion of private credit in portfolios continues to rise. It provides a return structure with low correlation to public markets, helping diversify risks. When allocating assets, you can combine fixed-income and private credit to enhance overall risk resilience.

- Fixed-Income Assets: Strong liquidity, stable returns, suitable for addressing inflation.

- Private Credit: Low correlation, risk diversification, suitable for high-inflation environments.

Through reasonable asset allocation, you can protect wealth safety during CPI increases and achieve long-term financial goals.

Related Economic Indicators

PPI and GDP

When understanding the economy of mainland China, you often hear about the Producer Price Index (PPI) and Gross Domestic Product (GDP). PPI reflects price changes in the production process, while GDP measures the total economic output. You can judge future price trends by observing the relationship between PPI and CPI. Studies show that PPI changes often precede CPI, indicating that price changes in production affect consumption. The following table summarizes related research findings:

| Researcher | Result Description |

|---|---|

| Chiwei Su et al. | Studies show a one-way causal relationship between PPI and CPI, with PPI changes potentially preceding CPI changes. |

| Fan et al. (2009) | Studies find that CPI has a Granger causal relationship with PPI, indicating the role of demand-side factors in inflation. |

You can see that the interaction between PPI and CPI not only affects prices but also reflects changes in economic demand. As a core macroeconomic indicator, GDP, combined with PPI and CPI data, helps you assess the health of mainland China’s economy.

CPI’s Economic Role

When paying attention to mainland China’s economic policies, CPI is an indispensable key indicator. The government adjusts interest rates, fiscal spending, and industrial policies based on CPI changes. The following table shows CPI’s role in policy formulation:

| Evidence Type | Description |

|---|---|

| CPI and PPI Relationship | CPI is a key indicator for effective macroeconomic regulation, and its relationship with PPI is crucial for understanding inflation and guiding policy decisions. |

| Impact of Economic Policy Uncertainty (EPU) | EPU has a nonlinear impact on CPI and PPI, affecting corporate investment demand and household consumption demand, thus influencing policymakers’ decisions. |

| Persistence of Price Differentials | Price differences between CPI and PPI may be permanent rather than temporary anomalies, suggesting potential adjustments to monetary policy foundations. |

You can use CPI data to determine whether the economy is in an inflationary or deflationary phase. Economists use CPI to assess the overall health of mainland China’s economy. You can refer to the following points:

- The Consumer Price Index (CPI) rose by only 0.4% last year, mainly driven by rising fresh vegetable prices.

- Core CPI rose by only 0.1% in September, the lowest since February 2021.

- Producer prices have been declining for 24 consecutive months, falling 2.8% year-on-year in September.

- Overall economic prices have been declining for the past five quarters, indicating weak domestic demand.

- Beijing has lowered interest rates and strengthened support for real estate and stock markets to stimulate the economy.

By paying attention to indicators like CPI, PPI, and GDP, you can better understand the operational mechanisms of mainland China’s economy, helping you make more informed household and investment decisions.

You have seen that CPI affects your grocery basket, mortgage, transportation, healthcare, and investment decisions. Mainland China has introduced several consumption stimulus measures this year, such as providing interest subsidies for personal consumption loans and issuing consumption vouchers covering dining, tourism, and sports services. By monitoring CPI data, you can adjust your household budget and optimize your consumption structure in time. You can also follow financial experts’ advice to enhance consumption capacity and financial literacy:

| Key Measure | Description |

|---|---|

| Enhance Consumption Capacity | Support employment and income growth to boost consumption capacity |

| Innovate Financial Products | Develop new products for consumption scenarios to meet diverse needs |

| Optimize Payment Services | Improve payment experiences to facilitate daily consumption |

| Improve Credit Systems | Protect financial rights and enhance consumer confidence |

By paying attention to CPI and reasonably planning spending and investments, you can better cope with price increases. CPI indeed affects every aspect of your life, and it’s advisable to continuously monitor relevant data to make informed choices.

FAQ

How often is CPI data released?

Mainland China releases CPI data monthly. You can check the latest data on the National Bureau of Statistics website to understand price change trends.

What is the difference between CPI and PPI?

CPI reflects price changes in your daily consumer goods and services. PPI reflects price changes in the production process. By comparing the two, you can better judge economic trends.

What impact does CPI increase have on your life?

When CPI rises, your daily expenses for groceries, transportation, and healthcare increase. You need to adjust your household budget reasonably and monitor price changes to avoid increased living pressures.

Is a CPI decline a good thing?

A CPI decline may mean falling prices. Your short-term expenses may decrease, but long-term declines could affect economic vitality. You need to consider the overall economic environment and view CPI changes rationally.

How can CPI data optimize household finances?

You can adjust savings and consumption plans based on CPI trends. When CPI rises, prioritize investment products with returns higher than inflation to protect asset value.

From your grocery bill to mortgage payments, the CPI is indeed a vital metric for gauging your actual purchasing power and informing family financial decisions. It directly influences your daily spending, savings plans, and even the future direction of your loan interest rates. In today’s volatile pricing environment, mastering the CPI trend and managing global assets efficiently are crucial steps to protecting your wealth from being eroded by inflation.

In this context, BiyaPay offers an ideal all-in-one solution for investors prioritizing efficiency and low cost. We facilitate seamless conversion between fiat and digital currencies (like USDT), enabling fast funding that bypasses complex channels. Deposits can arrive as quickly as the same day, ensuring you never miss a trading opportunity. When dealing with investments like US and HK stock options, our stocks platform allows you to benefit from zero fees on contract limit orders for low-cost position building and the convenience of managing global assets through a single account. Furthermore, our Real-Time Exchange Rate Query tool helps you stay on top of currency dynamics and avoid hidden losses. With remittance fees as low as 0.5%, you can save up to 90% compared to traditional banks.

Ready to open an account in 3 minutes for zero barriers to global investment, and meet the challenge of inflation with lower costs and higher efficiency? Click to register with BiyaPay and begin your journey into global asset allocation.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.