- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Synthetic Options: The Secret Strategy Used by Professional Traders

Image Source: pexels

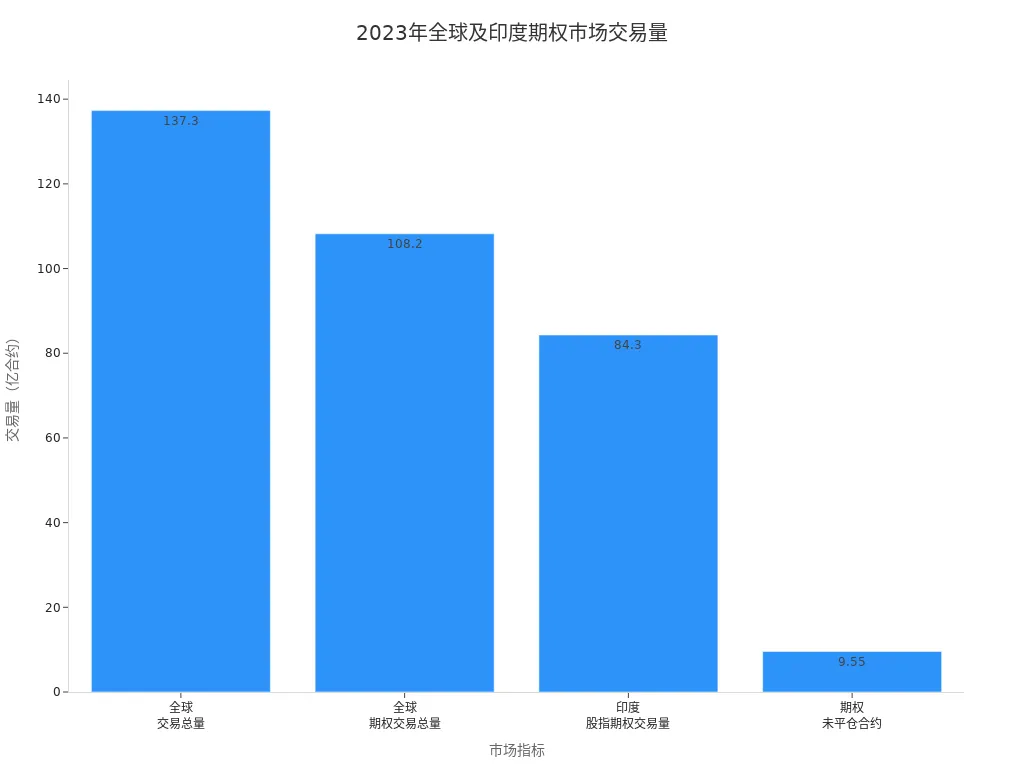

You may have noticed that professional traders widely use synthetic options in global markets. It is a strategy that simulates a target position by combining different option contracts or spot assets. Synthetic options allow you to flexibly respond to market changes and seize trading opportunities. The table below shows the scale of global options trading in 2023, with trading volume continuing to grow, highlighting the immense market potential of synthetic options:

| Metric | Value |

|---|---|

| Total Global Trading Volume in 2023 | 1.373 billion contracts |

| Total Global Options Trading Volume in 2023 | 1.082 billion contracts |

| India Stock Index Options Trading Volume in 2023 | 843 million contracts |

| Growth Rate from 2022 to 2023 | 98% |

| Number of Open Interest Contracts in 2023 | 95.5 million contracts |

| Open Interest Growth from 2022 to 2023 | 18% |

By learning synthetic options, you can master more practical techniques, enhance your trading skills, and effectively manage risks.

Key Points

- Synthetic options help you flexibly respond to market changes and enhance trading opportunities by combining different options and spot assets.

- Using the put-call parity relationship, you can create synthetic positions to simulate the payoff of long or short stocks.

- Synthetic options offer greater flexibility, allowing you to quickly adjust strategies during market volatility and reduce trading costs.

- Through synthetic options, you can replicate target positions in low-liquidity environments, improving investment flexibility and efficiency.

- Beginners can start with simple synthetic long strategies to gradually familiarize themselves with the market and improve trading skills.

Introduction to Synthetic Options

Image Source: pexels

Definition and Theoretical Basis

You can understand synthetic options as a strategy that simulates a target position by combining different financial instruments. The core of synthetic options lies in using option pricing models to flexibly combine call options, put options, and underlying assets to achieve the same risk-reward profile as directly holding a specific asset or option.

Synthetic pricing provides you with the opportunity to compare actual contracts with their synthetic counterparts. You can compare the prices of call and put options with the same strike price and expiration date to determine which approach is more advantageous. Factors such as interest rates and dividends also influence your choice between real and synthetic positions.

The common types of synthetic positions are shown in the table below:

| Synthetic Position Type | Composition |

|---|---|

| Synthetic Long Stock | Buy Call Option + Sell Put Option |

| Synthetic Short Stock | Buy Put Option + Sell Call Option |

You can flexibly choose different synthetic positions based on your market outlook to achieve the effect of simulating long or short stocks.

Put-Call Parity Relationship

The put-call parity relationship is the foundation of synthetic options theory. You can understand the price relationship between call and put options through this mathematical relationship. As long as the strike price and expiration date are the same, there is a strict mathematical relationship between call and put options. This relationship allows you to replicate the payoff of one instrument using another.

- You can use the put-call parity relationship to create synthetic positions. For example, combining a protective put option with a short position in a risk-free bond can effectively simulate the payoff of a European call option.

- This flexibility provides you with multiple ways to achieve financial goals. You can choose synthetic options to replicate target positions when liquidity is low or when certain option prices are unreasonable.

- Under the no-arbitrage principle, two identical portfolios should have the same cost. If the market shows deviations, you can profit through arbitrage operations.

In practice, common synthetic option combinations include:

| Synthetic Option Type | Components |

|---|---|

| Synthetic Long Stock | Long Call Option + Short Put Option |

| Synthetic Long Call Option | Long Put Option + Long Stock |

| Synthetic Long Put Option | Long Call Option + Short Stock |

| Synthetic Short Stock | Long Put Option + Short Call Option |

| Synthetic Short Call Option | Short Put Option + Short Stock |

| Synthetic Short Put Option | Short Call Option + Long Stock |

You will find that synthetic options not only help you replicate target positions in low-liquidity markets but also allow you to flexibly adjust strategies based on market changes. By combining different options and underlying assets, you can simulate various complex investment positions, improving trading flexibility and efficiency.

Implementation Methods

Spot and Option Combinations

You can construct different synthetic option positions by combining spot assets with option contracts. For example, if you hold a stock of a U.S.-listed company and buy a put option on that stock, you can simulate the effect of a synthetic long call option. You can also sell the stock and buy a call option to simulate a synthetic long put option.

This method is suitable for use when the spot market has good liquidity. You need to note that holding spot assets requires attention to margin requirements and trading costs. If you operate in an investment account with a licensed Hong Kong bank, you can usually directly trade U.S. stocks and related options, which is convenient and flexible.

Tip: When operating in practice, be sure to monitor option premiums and trading costs. Synthetic positions involve multiple transactions, and commission expenses will be higher than for a single contract.

Option Contract Combinations

You can also use only option contracts to construct synthetic positions. Common practices include:

- Buying a call option and selling a put option to simulate a long stock position.

- Selling a call option and buying a put option to simulate a short stock position.

- Holding the underlying stock and buying a put option to simulate a long call option.

- Selling the underlying stock and selling a put option to simulate a short call option.

- Selling the underlying stock and buying a call option to simulate a long put option.

- Holding the underlying stock and selling a call option to simulate a short put option.

You can flexibly choose these combinations in the U.S. market. The primary market for synthetic options typically has better liquidity than individual option markets, but when establishing synthetic positions in less liquid options, the bid-ask spread may be larger, affecting your trading price. You also need to monitor margin requirements and commission expenses to ensure the cost-effectiveness of the strategy.

Advantages of Synthetic Options

Flexibility

You often encounter significant market fluctuations in trading. Synthetic options can help you flexibly respond to these changes. You can quickly adjust the direction and risk configuration of your positions based on your judgment.

- Synthetic strategies provide you with effective alternatives, significantly reducing capital requirements and improving win rates.

- You can more easily modify directional exposure and risk configuration compared to traditional stock holdings.

- Flexibility in managing positions is crucial for adapting to market changes and maximizing profits.

You will find that the flexibility of synthetic options allows you to react promptly when new market opportunities arise. You can adjust your strategy based on market trends to enhance returns.

Strategy Adjustment

During actual trading, you often need to quickly adjust strategies based on market changes. Synthetic options allow you to modify positions without closing existing trades. This flexibility enables you to respond swiftly to market changes, reducing the number of transactions required to adjust positions and thus lowering trading costs.

- You can quickly switch positions when market conditions change without closing old positions.

- Synthetic options can reduce the number of transactions needed to adjust positions, lowering trading costs.

Professional traders often use synthetic futures and other option-based strategies as substitutes for futures contracts when price restrictions are in place. This approach not only enhances strategic flexibility but also effectively controls costs.

You can refer to the following common strategy adjustment scenarios:

- Rolling involves closing one set of option legs and opening another set with different strike prices or expiration dates to fine-tune risk and reward.

- Rolling down a long call option can reduce the cost basis when the stock declines but also reduces maximum profit potential.

- If the stock appears likely to continue falling, you can close the position early.

- If the stock nears the strike price of a short call option, close the entire position to lock in profits.

- Rolling up a short call option can increase profit potential and bring in more premium.

- When implied volatility rises significantly, close the short call option to capture the inflated premium and shift the position to holding only the long call option.

- If volatility declines, roll the short call option to a new strike price, collect more premium, and maintain the strategy.

You can flexibly choose different strategy adjustment methods based on your risk appetite and market judgment.

Simulating Positions

When trading, you may encounter situations where certain assets have low liquidity or unreasonable prices. Synthetic options can help you simulate the return and risk characteristics of target securities. By combining underlying assets with different options, you can achieve performance similar to directly holding the asset.

- Synthetic options adhere to the option parity principle, where the value of a long call option and a short put option with the same strike price and expiration date is equivalent to holding a long position in the underlying asset.

- Through synthetic positions, you can implement complex trading strategies, effectively reduce risks, and promote market growth and liquidity.

You can refer to the table below to understand the performance of synthetic positions in different market environments:

| Market Environment | Synthetic Strategy Performance | Direct Holding Performance |

|---|---|---|

| XAU/USD | Better | Average |

| EUR/USD | Better | Average |

When operating in practice, you need to be aware of the limitations of synthetic options. Increased complexity, execution and liquidity risks, potential losses, regulatory and margin requirements, and counterparty risks are all factors you need to evaluate in advance.

By learning and practicing, you can gradually master the ability to simulate positions with synthetic options, enhancing your trading skills.

Application Scenarios

Long Strategies

You can use synthetic options to implement long strategies, especially when you are bullish on a stock’s rise. You don’t need to directly buy the stock to achieve similar returns. Many institutional investors choose synthetic options in the following scenarios:

- When you want to diversify investments across multiple assets, you can save significant capital.

- You expect a stock price to rise but don’t want to bear high margin requirements or the capital pressure of directly buying the stock.

- You want to avoid capital-intensive requirements and improve capital utilization.

Synthetic options provide flexibility and cost-effectiveness. You can participate in bullish strategies with less capital, replicating the profit and loss potential of actual stock holdings. When the market turns downward, you can also mitigate losses promptly. In an investment account with a licensed Hong Kong bank, you can easily build these long strategies through the U.S. options market.

Short Strategies

You can also use synthetic options to implement short strategies. Compared to traditional short selling, synthetic options typically require less initial capital. You can refer to the table below to understand the main differences between the two:

| Feature | Synthetic Options | Traditional Short Selling |

|---|---|---|

| Capital Efficiency | Typically requires less initial capital due to option premiums offsetting costs. | Requires higher initial capital to purchase the stock. |

| Risk Exposure | May face unlimited losses and early exercise risks. | Risks mainly stem from stock price increases. |

| Cost Management | Avoids fees associated with hard-to-borrow stocks. | May incur borrowing fees. |

| Leverage | Offers relatively high return potential but increases risk. | Lower leverage effect with relatively manageable risks. |

When using a synthetic short stock strategy, the maximum loss can be unlimited. If the stock price rises significantly, you may incur substantial losses. The Bearish Split-Strike Synthetic strategy carries similar risks, with the short call option also having unlimited risk. You need to pay special attention to risk management and set reasonable stop-loss points during operations.

Arbitrage Strategies

You can use synthetic options for arbitrage operations to profit from market price discrepancies. Common arbitrage strategies include conversion arbitrage and reversal arbitrage. The table below shows two typical arbitrage strategies:

| Strategy | Synthetic Position Construction | Market Expectation | Profit Mechanism |

|---|---|---|---|

| Conversion Arbitrage | Synthetic Short Position | Neutral to Bearish | Exploits overvaluation of call options |

| Reversal Arbitrage | Synthetic Long Position | Neutral to Bullish | Exploits undervaluation of put options |

When operating in practice, you need to be aware of the limitations of arbitrage strategies. Market volatility may amplify the impact of price fluctuations, and the profit potential of synthetic positions is limited. You also need to bear higher trading costs and margin requirements. When option liquidity is low, entering and exiting synthetic positions can be challenging. Before executing arbitrage strategies, it’s advisable to assess the market environment and your risk tolerance.

Getting Started for Investors

Operating Process

If you want to start trading with synthetic options, you can follow these steps:

- Choose a suitable broker or trading platform. You need to ensure the platform is reliable, supports various synthetic option strategies, and has a user-friendly interface. For example, platforms like TD Ameritrade and Interactive Brokers in the U.S. market offer robust options tools.

- Develop a trading plan. You need to clarify your investment goals, risk tolerance, and entry/exit strategies. A plan helps you stay calm during market fluctuations.

- Practice with a demo account. You can open a demo account on the platform to familiarize yourself with the trading environment, test your strategies, and avoid real capital losses.

Tip: When practicing, pay attention to the costs and margin requirements of each trade. A demo account can help you gain experience and reduce mistakes in actual operations.

Simple Strategies

As a beginner, you can choose simple and effective synthetic option strategies. Here are common approaches suitable for novices:

- Synthetic Long Strategy: You can simulate the returns of directly holding a stock by buying a call option and selling a put option. This approach requires less cash since the premium from the sold put option can cover most or all of the cost of the call option.

- Cost Efficiency: You only need to prepare a small amount of USD as margin, lowering the capital threshold.

- Risk Management: If the stock price falls, you need sufficient cash or margin capacity to buy the stock at the strike price.

You can practice synthetic long strategies with highly liquid stocks like Apple or Microsoft in the U.S. market.

Tool Selection

When choosing trading tools, you can refer to the table below:

| Tool Name | Applicable Market | Main Features | Currency Unit |

|---|---|---|---|

| TD Ameritrade | U.S. | Options simulation and live trading | USD |

| Interactive Brokers | U.S. | Multi-asset option combinations | USD |

| E*TRADE | U.S. | User-friendly interface and educational resources | USD |

You can prioritize platforms that support demo accounts and synthetic option strategies. The platform’s educational resources can also help you quickly improve your trading skills.

Note: When operating in practice, avoid common beginner mistakes, such as not researching the market, lacking a trading plan, failing to set stop-losses, or overexposing to a single position. Support every decision with evidence and market research, allocate funds reasonably, set stop-loss points, and avoid single-position risks.

Risks of Synthetic Options

Image Source: unsplash

Market Volatility

When using synthetic options, market volatility can introduce multiple risks. During high volatility periods, the price of the underlying asset may change dramatically, causing rapid losses in your synthetic positions. You may also face assignment risk, where short options are exercised at any time, resulting in unexpected positions. Execution complexity increases because synthetic options involve multiple transactions, and partial fills or delayed execution may alter your risk exposure. Margin requirements are typically higher than for single-leg options, and losses can accelerate during market volatility. In low-liquidity or highly volatile markets, mispricing or slippage may erode your profits. The table below summarizes the main risk factors:

| Risk Factor | Description |

|---|---|

| Assignment Risk | Short options may be exercised at any time, leading to unexpected positions. |

| Execution Complexity | Synthetic options require multiple transactions, and partial fills or delayed execution may alter the expected risk exposure. |

| Margin Requirements | Typically higher than single-leg options, reflecting higher risk and the potential for rapid losses during market volatility. |

| Mispricing or Slippage | In low-liquidity or volatile markets, mispricing between synthetic and actual positions may erode profits or cause losses. |

| Market Volatility Impact | If the underlying asset fluctuates sharply, synthetic options can incur rapid losses, similar to the real positions they replicate. |

Risk Assessment

You can assess the risks of synthetic options using various quantitative methods. Monte Carlo simulations can help you analyze tail risks under different market scenarios, while scenario detection analysis identifies common patterns in significant tail scenarios to determine key risk scenarios. The Cox-Ingersoll-Ross (CIR) process is used to model return dynamics, simulating the impact of spread and interest rate changes on portfolio returns. The table below shows commonly used risk assessment methods:

| Quantitative Method | Description |

|---|---|

| Monte Carlo Simulation | Used to assess tail risks of synthetic GICs by simulating different market scenarios to analyze risks. |

| Scenario Detection Analysis | Identifies common patterns in significant tail scenarios generated by Monte Carlo simulations to determine key risk scenarios. |

| Cox-Ingersoll-Ross (CIR) Process | Used to model return dynamics, simulating the impact of spread and interest rate dynamics on portfolio returns. |

When operating in the U.S. market, you can combine these methods to regularly assess the risks of your synthetic option portfolio.

Risk Mitigation

You can adopt various strategies to mitigate synthetic option risks:

- Synthetic Put Option: Combine short stock and a long call option to hedge losses while maintaining upside potential.

- Synthetic Covered Call: Hold the stock and sell a call option to earn premium income while retaining stock ownership.

- Synthetic Protective Collar: Own the stock, buy a protective put option, and sell a covered call option to protect gains while limiting downside risk.

When operating in practice, it’s advisable to adjust positions promptly based on market volatility and set reasonable stop-loss points. You can also use demo accounts to test different risk mitigation strategies to enhance your risk management skills.

You can improve trading flexibility and profit potential through synthetic options. Long-term studies show that synthetic option strategies can replicate the economic effects of futures positions. You need to understand the impact of option premiums, break-even points, and Greeks on option value.

- Conduct comprehensive market analysis

- Strategically select options

- Effectively manage risks

Continuous learning and practice can help you better seize trading opportunities and enhance your investment skills.

FAQ

What is the difference between synthetic options and regular options?

Synthetic options use a combination of multiple financial instruments to simulate a target position. Regular options involve directly buying or selling a single call or put option. You can achieve greater flexibility with synthetic options.

Can I trade synthetic options without holding the spot asset?

You can. By combining different option contracts, you can simulate long or short positions without holding the spot asset.

Are synthetic options suitable for beginner investors?

You can try simple synthetic strategies. It’s recommended to practice with a demo account first to familiarize yourself with the process and gradually improve your trading skills.

What is the biggest risk of synthetic options?

You may face losses due to sharp market fluctuations. Some strategies have unlimited loss potential. You need to set stop-losses and reasonably control position sizes.

Are the trading costs of synthetic options high?

Synthetic options involve multiple transactions. You need to pay multiple commissions and margin costs. It’s advisable to calculate the total cost before placing orders and choose a low-fee platform.

Synthetic options empower you to manage risk and capital requirements like a pro. Whether you’re leveraging the put-call parity for arbitrage or simulating a stock position with less capital, the success of your strategy relies on swift funding and cost-effective trade execution. When the market offers a fleeting opportunity, a slow transaction or high commission can negate your strategic edge.

With BiyaPay, you get the speed and low cost advanced trading demands. We offer zero commission for contract limit orders, significantly reducing the burden of multi-leg synthetic options constructions. Furthermore, our support for quick conversion between fiat and digital assets like USDT ensures your margin capital is deployed instantly, bypassing complex banking routes. You can register fast—in just 3 minutes without needing a foreign bank account—and gain instant access to US and Hong Kong Stocks. Use our real-time exchange rate checks to maintain transparent control over your funding costs. Open your account today and gain the financial agility necessary to master synthetic options trading.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.