- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Your Hedging Tool: Master the Correct Way of Gold Investment from Scratch

Image Source: pexels

You can invest in gold through various methods. Common gold investment methods include physical gold, gold ETFs, and paper gold. Each method has distinct characteristics and suits different investors. You can choose the appropriate method based on your needs and risk tolerance.

Physical Gold

Physical gold includes gold bars, coins, and gold jewelry. You directly own tangible assets, independent of the financial system. This method is suitable when you aim for long-term value storage and seek security. You can liquidate gold at any time, as the market has high confidence in gold. Government-minted coins (such as American Gold Eagles) offer the best liquidity, while gold bars allow you to buy the most gold per dollar.

Tip: When choosing physical gold, you can select coins or bars based on your investment goals. Coins have high liquidity, while bars offer better cost-effectiveness.

The advantages and disadvantages of physical gold are as follows:

- Advantages:

- You directly own tangible assets, avoiding financial system risks.

- Suitable for long-term storage and inheritance.

- Gold has a long history and high market recognition.

- Disadvantages:

- Relatively lower liquidity, as selling may involve accepting offers below spot prices.

- You need to consider storage and security issues.

- Transactions may incur additional fees.

You can refer to the table below to understand the liquidity characteristics of physical gold:

| Liquidity Feature | Description |

|---|---|

| High Liquidity | Gold can be converted to cash at any time, with prices published 24/7. |

| Easy to Sell | Gold products like jewelry can be easily sold at high-street jewelers. |

| Sellable Quantity | Gold can be sold in any amount, from a single bar to large quantities. |

| Market Confidence | Gold’s long history of success boosts market confidence. |

| Investment Choice | Buying gold coins is generally more liquid than bars or collectible coins. |

When purchasing physical gold in the U.S. market, you can typically do so through banks, precious metal dealers, or licensed Hong Kong banks. You also need to consider storage and insurance costs.

Gold ETFs

Gold ETFs are funds listed on stock exchanges. You can buy and sell gold ETFs through a brokerage account, as conveniently as trading stocks. Gold ETFs are suitable for those seeking high liquidity and ease of trading. You don’t need to physically hold gold or worry about storage and security issues.

The advantages and disadvantages of gold ETFs are as follows:

- Advantages:

- Convenient trading, high liquidity, suitable for short-term investments.

- You can participate in the gold market with smaller amounts of capital.

- High transparency, with prices closely tied to gold spot prices.

- Disadvantages:

- You need to trust the fund issuer, which involves some systemic risk.

- Management fees may erode returns during long-term holding.

- You cannot directly withdraw physical gold.

You can refer to the table below to compare the main differences between gold ETFs and paper gold:

| Feature | Gold ETF | Paper Gold |

|---|---|---|

| Accessibility | Offers higher accessibility and liquidity | May be lower, depending on market conditions |

| Risk | Market volatility and systemic risk | Storage and theft risk |

| Asset Type | Paper asset | Physical asset |

When investing in gold ETFs in the U.S. market, you only need to open a brokerage account, with low minimum investment thresholds. Some ETFs allow participation with as little as USD 50 per share.

Paper Gold

Paper gold is a book-entry gold investment method. You open an account with a bank or financial institution, buying and selling “shares” based on gold prices, with your holdings recorded in the account. You don’t physically hold gold but can trade flexibly. Licensed Hong Kong banks also offer paper gold services, suitable for those who want to participate in the gold market conveniently without managing physical assets.

Characteristics of paper gold:

- You don’t need to worry about physical storage or transportation.

- Low transaction thresholds, suitable for small investments.

- You cannot withdraw physical gold, and returns depend entirely on account records.

- In some cases, paper gold’s liquidity may be limited, so you should review bank policies.

Note: Both paper gold and gold ETFs are “paper assets,” but paper gold is typically traded only through specific bank channels, while gold ETFs can be freely traded in the securities market.

You can also participate in the gold market through gold stocks, gold funds, or gold futures. Gold stocks allow you to invest in gold mining companies, gold funds provide diversified asset allocation, and gold futures are suitable for experienced investors. You can flexibly choose the appropriate safe-haven tool based on your risk tolerance and investment goals.

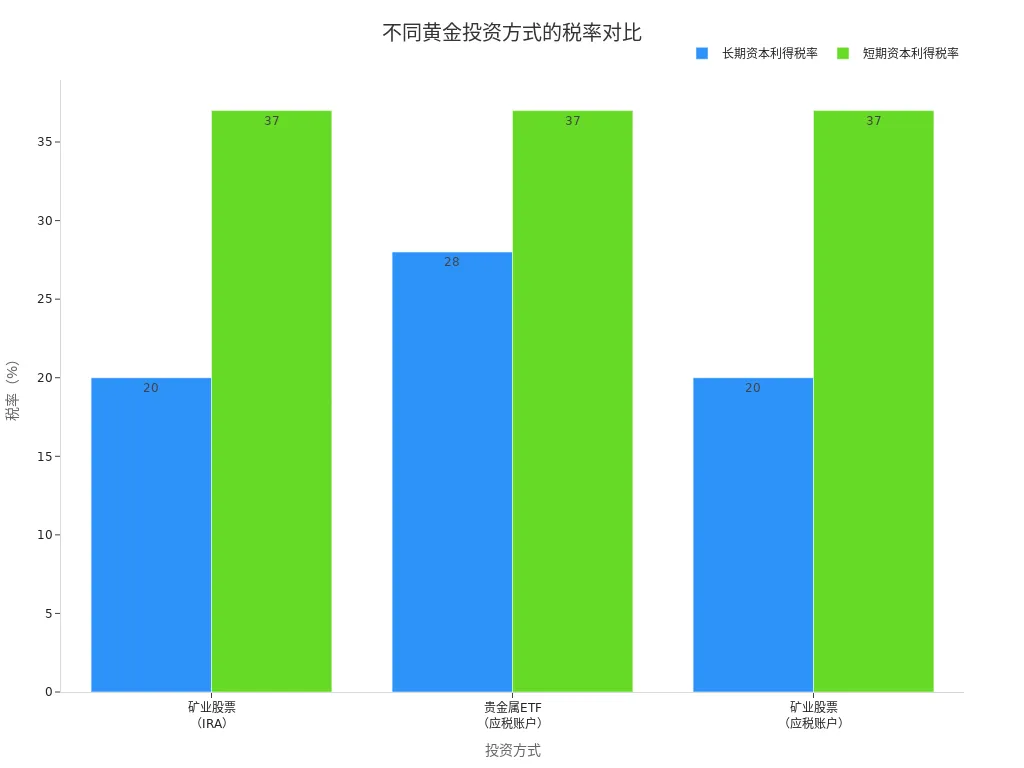

When choosing a gold investment method, you also need to consider tax policies. Tax rates vary significantly across different investment methods. The chart below shows a comparison of long-term and short-term capital gains tax rates for different gold investment methods:

You can see that gold ETFs and gold stocks have different tax rates in taxable accounts, so it’s advisable to thoroughly understand relevant policies before investing.

Investment Process

Investment Channels

When choosing gold investment channels, you can consider multiple options. Licensed Hong Kong banks provide convenient gold investment services. You can buy and sell gold through bank counters, online banking, or mobile apps. In addition to banks, investment firms and gold jewelry companies also offer physical gold and related products. In recent years, gold-backed ETFs have gained popularity among investors due to their low cost and convenience. You can trade gold ETFs directly through a brokerage account without holding physical gold.

The table below summarizes common gold investment channels and their characteristics:

| Investment Channel | Description |

|---|---|

| Commercial Banks | Primarily sell investment gold products, with prices slightly higher than gold exchange quotes. |

| Investment Firms | Offer a variety of investment gold products to meet different investment needs. |

| Gold Jewelry Companies | Sell gold through jewelry, suitable for consumption and collection. |

| Gold-Backed ETFs | Low-cost, convenient trading, with growing holdings, suitable for those seeking flexible asset allocation. |

You can choose the appropriate investment channel based on your needs and risk tolerance. Gold ETFs are suitable for those prioritizing liquidity and convenience, while physical gold suits those valuing security and long-term storage.

Account Opening Process

When opening an account with a licensed Hong Kong bank or U.S. brokerage firm to invest in gold, you need to complete a series of steps. The general process is as follows:

- Choose a reputable financial institution or brokerage firm.

- Submit an account opening application and provide personal information.

- Provide valid identification (e.g., ID card, passport, or driver’s license).

- Provide proof of address (e.g., utility bill, bank statement, or lease agreement).

- After account approval, deposit funds.

- Select the gold product or ETF you wish to purchase.

- After completing the transaction, set up storage or account management methods.

Note: For large transactions, financial institutions may report to relevant authorities as required by regulations. When purchasing gold as a professional, you may also need to provide company-related documents.

During the account opening process, ensure all information is accurate and valid. Banks and brokerage firms will strictly verify your identity and source of funds to ensure transaction security.

Fund Management

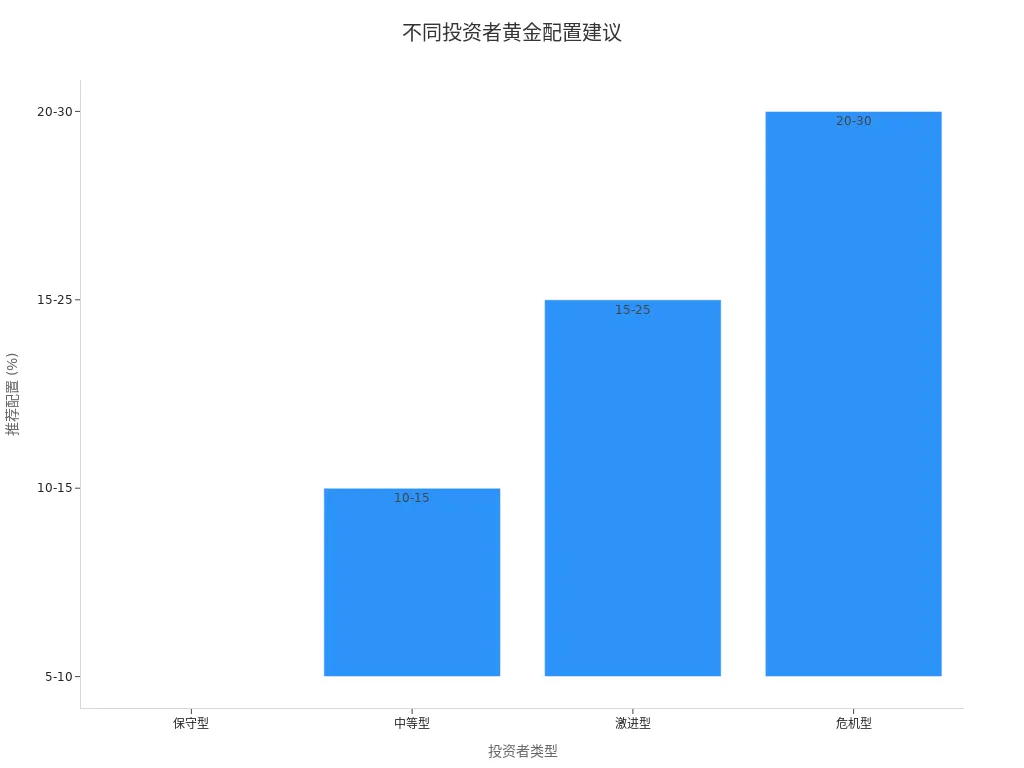

In gold investment, proper fund allocation is crucial. Different investor types correspond to different gold allocation ratios. You can choose the appropriate allocation plan based on your risk tolerance and investment goals.

The table below shows recommended gold investment allocations for different investor types:

| Investor Type | Recommended Allocation | Risk Level | Main Objective |

|---|---|---|---|

| Conservative | 5-10% | Low Risk | Portfolio Insurance |

| Moderate | 10-15% | Medium Risk | Diversification + Growth |

| Aggressive | 15-25% | Higher Risk | Inflation Hedge + Speculation |

| Crisis-Oriented | 20-30% | Situational | Protection Against Economic Uncertainty |

You can adopt a dollar-cost averaging strategy, investing a fixed amount monthly in gold regardless of market price fluctuations. This approach can smooth out the impact of short-term price volatility and reduce the risks of lump-sum investments. You should also monitor macroeconomic factors such as inflation rates, interest rate decisions, and international situations, adjusting your investment allocation as needed.

Buying and Selling Timing

In gold investment, choosing the right buying and selling timing can enhance returns. Commonly used analytical tools include Relative Strength Index (RSI), Moving Averages (MA), and Bollinger Bands. These tools can help you identify market trends and price fluctuation ranges.

The table below summarizes common tools for determining gold buying and selling timing:

| Indicator Name | Function Description |

|---|---|

| Relative Strength Index (RSI) | Identifies overbought (above 70) and oversold (below 30) conditions in gold, helping you confirm buying or selling opportunities. |

| Moving Average (MA) | Determines market direction, with gold prices crossing above or below the moving average often serving as buy or sell signals. |

| Bollinger Bands | Visualizes price fluctuation ranges, with prices touching outer bands often indicating potential reversals or breakouts. |

You can combine these technical indicators to develop your buying and selling strategies. For example, when RSI falls below 30, you can consider buying in batches; when prices break through the upper Bollinger Band, you can consider taking profits gradually. You should also monitor macroeconomic factors such as Federal Reserve interest rate decisions, international conflicts, and trade policy changes, as these can impact gold price trends.

Tip: In practice, you can combine technical analysis with dollar-cost averaging to seize market opportunities, diversify risks, and enhance your overall investment experience.

Risks and Pitfalls

Price Volatility

When investing in gold, you cannot ignore the risk of price volatility. Although gold is considered relatively stable, its prices have historically experienced significant rises followed by notable declines. Gold prices are influenced by economic, geopolitical, and other factors, which may cause fluctuations in your investment returns. Gold itself does not generate interest or dividends, and long-term holding may affect your cash flow.

| Risk Factor | Description |

|---|---|

| Price Volatility | Gold prices may experience significant fluctuations, affecting investment returns. |

| Economic and Geopolitical Factors | Economic and political uncertainties can impact gold prices. |

| Lack of Income Generation | Gold does not produce interest or dividends, potentially causing cash flow issues. |

You should also note that government and central bank gold sales, hedging activities by gold producers, and speculative sentiment may trigger price declines.

Channel Safety

When choosing gold investment channels, safety is paramount. You can take the following measures to protect your assets:

- Choose bank vaults, professional gold storage companies, or high-quality home safes for secure storage.

- Purchase specialized precious metal insurance, carefully reviewing policy terms and coverage.

- Understand reporting obligations when selling gold to avoid financial penalties for non-compliance.

You should prioritize regulated financial institutions and investment channels to reduce the risk of asset theft or loss.

Herd Mentality Traps

Many beginners make common mistakes when investing in gold. You should be cautious of the following behaviors:

- Blindly following trends without understanding gold investment types.

- Ignoring gold purity and certification, leading to purchases of substandard products.

- Overlooking storage and security costs, underestimating actual expenses.

- Failing to research market conditions, making emotional buy or sell decisions.

- Investing all funds in gold, neglecting asset diversification.

- Ignoring taxes and hidden costs, resulting in reduced actual returns.

You should develop a clear investment plan, analyze the market rationally, and avoid emotional decisions.

Anti-Fraud Essentials

The gold investment sector has various scams. You need to stay vigilant and recognize common fraud tactics:

- Fake gold coins and bars: Scammers sell items that appear authentic but are worthless.

- Overpriced gold investments: Selling gold at above-market prices using high-pressure sales tactics.

- Non-existent gold: Promising gold storage without actual physical assets.

- Ponzi schemes: Using new investors’ funds to pay returns to earlier investors, leading to losses for most.

Be wary of unrealistic high-return promises, sales pressure, lack of transparency, and unsolicited investment advice. You should choose qualified institutions, verify product authenticity, and protect your funds.

Advanced Tips

Information Acquisition

When investing in gold, obtaining authoritative and timely information is crucial. You can follow these platforms to stay updated on gold prices and market trends in real-time:

| Source | Description |

|---|---|

| World Gold Council | Provides gold price performance and data, including spot prices and historical data. |

| Bloomberg Precious Metals | Industry-standard platform offering comprehensive gold market data and professional analysis. |

| Kitco | A website focused on precious metals, providing real-time gold prices and industry news. |

These platforms can help you grasp market trends and make more informed investment decisions. You can regularly check these websites to monitor gold price fluctuations and global economic changes.

Holding Strategy

When developing a gold holding strategy, you need to align it with your goals and risk tolerance. Effective strategies include:

- Understanding gold’s role in your portfolio and allocating funds reasonably to avoid over-concentration.

- Diversifying investments to spread risk, such as holding both physical gold and gold ETFs.

- Monitoring market trends and using dollar-cost averaging to mitigate the impact of price volatility.

- Ensuring secure storage for physical gold, prioritizing bank vaults or professional storage services.

- Continuously tracking global economic developments and adjusting your holdings as needed.

You can flexibly adjust your holding strategy based on your circumstances to ensure asset safety and enhance long-term returns.

Beginner Tips

As a gold investment beginner, you can follow these tips to avoid common pitfalls:

- Conduct thorough market research and choose reputable dealers or platforms.

- Adopt a long-term investment mindset to avoid high costs and risks from frequent trading.

- Diversify your allocation, avoiding investing all funds in a single gold product, and consider combining bars, coins, and ETFs.

- Pay attention to investment-related tax policies and fees, planning ahead.

By persisting in rational analysis and continuous learning, you can better seize gold investment opportunities and build a robust asset portfolio.

Incorporating gold into your portfolio can effectively diversify risk. The table below shows that gold’s negative correlation with stocks and bonds makes it an ideal safe-haven tool:

| Research Source | Key Findings |

|---|---|

| Diversification evidence of bitcoin and gold from wavelet analysis | Portfolios including gold can reduce risk and protect investments during economic crises. Gold’s negative correlation with stocks and bonds makes it an effective diversification tool. |

| Is gold good for portfolio diversification? A stochastic dominance analysis of the Paris stock exchange | Stock portfolios including gold outperform those without gold among risk-averse investors, especially during unstable periods. |

| The dynamics of gold: Performance across different market scenarios | Gold’s performance in various market environments shows it can enhance returns and hedge risks of other asset classes. |

When investing in gold, you should clarify your goals and choose the method that suits you. While gold offers protection, its price volatility requires continuous learning and rational judgment. Long-term planning is essential for achieving stable asset growth.

FAQ

What is the minimum amount needed to invest in gold?

You can start investing in gold with minimal funds. Gold ETFs and paper gold typically allow participation with as little as USD 50. Physical gold has a higher threshold, depending on the product chosen.

What taxes apply to gold investments?

In the U.S. market, you need to consider capital gains taxes when investing in gold. Tax rates vary based on holding periods. Gold ETFs and gold stocks have different tax rates, so it’s advisable to understand relevant policies in advance.

Is gold investment safe?

Investing in gold through regulated channels can effectively ensure safety. Physical gold requires proper storage, and bank vaults are recommended. For gold ETFs and paper gold, choose regulated financial institutions.

What factors influence gold prices?

You’ll find that gold prices are affected by global economic conditions, U.S. dollar exchange rates, interest rates, geopolitical factors, and more. Market supply and demand changes also cause price fluctuations.

How should beginners choose the right gold investment method?

You can choose based on your capital size, risk tolerance, and investment goals. For liquidity, opt for gold ETFs; for security, choose physical gold; for convenience, select paper gold.

Gold’s power as your defensive asset is clear: it hedges against inflation and geopolitical risk. But to truly leverage its protective qualities, you need seamless, low-cost access to the market and the agility to move capital instantly. When global events dictate an urgent need to increase your gold exposure, being bottlenecked by slow, high-fee traditional banking services is simply not an option.

To ensure your defensive strategy is executed flawlessly, integrate the financial speed of BiyaPay into your investing. Our platform supports the swift, mutual conversion between fiat and digital assets like USDT, providing you with the fastest, lowest-cost pathway to fund your brokerage accounts for buying gold ETFs or related Stocks. You can register quickly—in just 3 minutes without requiring an overseas bank account—and gain instant access to global markets. Use our real-time exchange rate checks to minimize currency conversion costs and maximize your investment capital. Open your BiyaPay account today and ensure your golden shield is always ready and backed by efficient global funding.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.