- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What is ACH Transfer? A Comprehensive Guide to the Process, Fees, and Advantages/Disadvantages

Image Source: unsplash

You can use ACH transfers to conduct electronic fund transfers in the United States. As a mainstream payment method, ACH transfers include credit transfers and debit transfers. You typically use them for payroll, bill payments, or recurring deductions. They are convenient and suitable for both personal and business daily use.

Key Points

- ACH transfers are a secure, low-cost electronic fund transfer method, ideal for personal and business daily use.

- When using ACH transfers, it typically takes 1 to 3 business days for funds to arrive, and planning transfer times in advance can avoid delays.

- Individual users can often use ACH transfers for free, while business users generally face low fees, making it suitable for large transactions.

- When choosing ACH transfers, consider processing time, fees, and transaction limits to ensure they meet your needs.

- Before using ACH transfers, carefully verify recipient information to ensure fund security and avoid common errors.

Introduction to ACH Transfers

Definition

You can use ACH transfers to facilitate electronic fund transfers in the United States. ACH (Automated Clearing House) is an electronic payment network operated by Nacha (National Automated Clearing House Association). You can use it to securely transfer funds between bank accounts. The U.S. Treasury has promoted the full adoption of electronic payments, requiring a reduction in paper check usage by September 30, 2025. You will find that the ACH network processed 33.6 billion payments in 2024, with a total value of $86.2 trillion. More businesses and individuals are choosing ACH transfers, gradually replacing traditional paper checks.

You can think of ACH transfers as the most popular low-cost payment method in the U.S. Whether for personal daily life or business transactions, ACH has become the mainstream choice.

Types

When using ACH transfers, you will encounter two main types: direct deposits and direct payments. The table below helps you quickly understand their differences and common use cases:

| ACH Transfer Type | Description | Examples |

|---|---|---|

| Direct Deposit | Electronically sends funds to a bank account via the ACH network. | Payroll, Social Security, unemployment benefits, tax refunds, etc. |

| Direct Payment | Electronically sends funds from a bank account via the ACH network. | Utility bills, rent, insurance premiums, peer-to-peer transfers, etc. |

You can use direct deposits to receive payroll or use direct payments to pay bills or make peer-to-peer transfers. Both types can meet your diverse fund transfer needs.

Main Applications

In daily life in the U.S., you often use ACH transfers for the following operations:

- Payroll distribution

- Online bill payments

- Unemployment benefits

- Social Security benefits

- Tax refunds or payments

- Inter-account transfers

- One-time and recurring payments

You can use ACH transfers to receive payroll or pay utility bills, rent, or insurance premiums. Businesses use ACH transfers for B2B payments, with transaction volumes growing annually. You will find that more Americans are choosing ACH transfers to manage daily fund flows, improving payment efficiency.

ACH Transfer Process

Image Source: pexels

Operational Steps

When initiating an ACH credit transfer, you can follow these steps:

- Log in to your online banking or mobile banking account and navigate to the payment or transfer page.

- Select the “Pay” or “Bill Pay” function.

- Enter the recipient’s bank information, including name, account number, and routing number.

- Fill in the transfer amount and scheduled transfer date, carefully verifying all information for accuracy.

- Banks typically require you to complete an identity verification step before submitting the transfer request.

If you need to perform an ACH debit transfer (e.g., automatic deductions), you usually need to authorize the recipient to withdraw funds from your account. After signing an authorization agreement, the recipient initiates the deduction request, and the bank processes it automatically.

Tip: When adding a new recipient for the first time, the bank may perform additional verification to ensure account security.

Required Information

When initiating an ACH transfer, you need to prepare the following key information:

| Field | Data Element Name | Definition |

|---|---|---|

| Company Name | Your company name | Never changes |

| Standard Entry Class Code | CCD | Never changes |

| Effective Entry Date | Entry date | Changes with each payment |

| Transaction Code | 22 – Demand Credit | Never changes |

| Receiving DFI Identification | ABA routing number | Never changes |

| DFI Account Number | Recipient account number | Never changes |

| Amount | Payment amount | May change with each payment |

| Identification Number | ID number | Changes with each payment |

| Receiving Company Name | USAC payment | Never changes |

When filling out this information, ensure the account number and routing number are accurate. Incorrect information may lead to transfer failure or delays.

Processing Time

When using ACH transfers, processing time is typically 1 to 3 business days. In most cases, funds arrive within 3 days. The specific processing speed is influenced by the following factors:

- Bank processing deadlines. If you miss the daily cutoff time, the transfer will be processed the next business day.

- Payment type. ACH credit transfers are usually faster than debit transfers.

- First-time transfers. Transfers to new recipients may involve additional verification steps, extending processing time.

- Transaction amount. Large transfers may require extra review, lengthening processing time.

- Recipient bank policies. Some banks release funds immediately, while others delay until the next business day.

- Bank operating hours. ACH transactions are processed only during bank business hours.

- Weekends and holidays. Transfers during weekends or U.S. federal holidays will be deferred.

- Verification process. If the bank requires further verification, the transfer may be delayed.

Reminder: You can plan transfer times in advance to avoid delays due to holidays or bank cutoff times affecting fund arrangements.

ACH Transfer Fees

Image Source: pexels

Fee Types

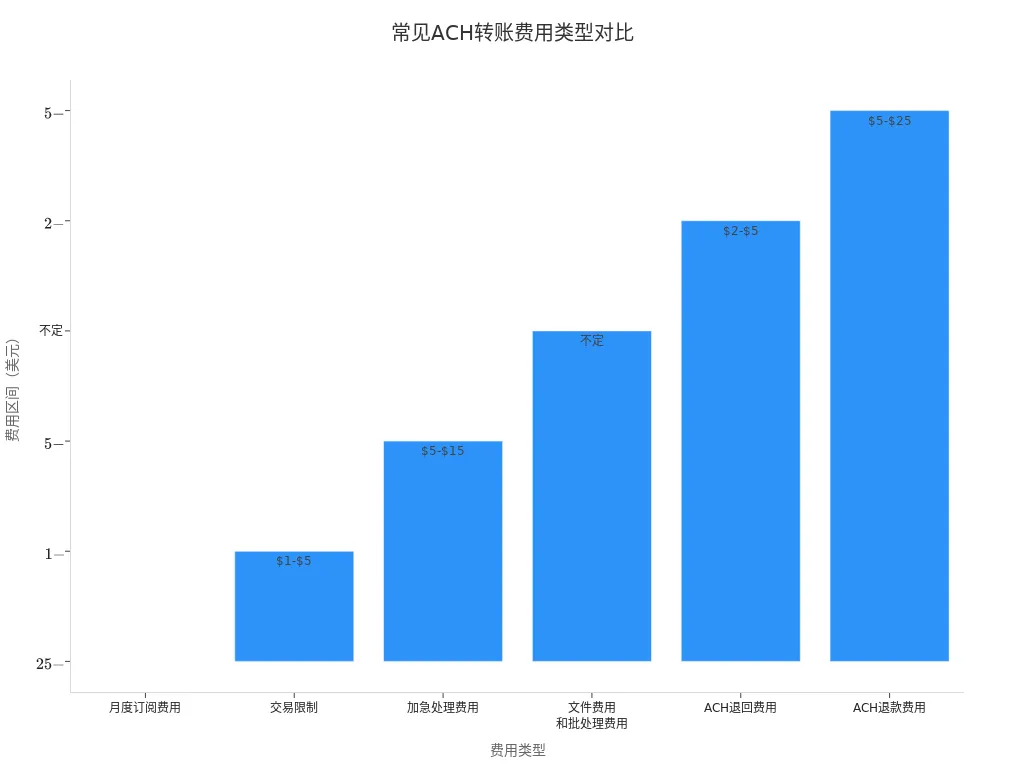

When using ACH transfers, you typically encounter various fees. Fee structures differ for individual and business users. Individual users can often transfer for free, with an average fee of about $0.29 per transaction. Business users face average fees between $0.26 and $0.50, while large businesses may pay as low as $0.11 to $0.25 per transaction. You can refer to the table below to understand common fee types and their descriptions:

| Fee Type | Description |

|---|---|

| Monthly Subscription Fees | Some platforms require a monthly plan subscription, typically costing $25 to $55. |

| Transaction Limits | Exceeding monthly free transfer limits may incur additional fees of $1 to $5 per transaction. |

| Expedited Processing Fees | Same-day ACH typically adds $10 to $15, while next-day ACH usually costs $5 to $10. |

| File and Batch Processing Fees | Some banks and processors charge extra for file and batch processing. |

| ACH Return Fees | Returned ACH transfers typically incur $2 to $5 fees. |

| ACH Refund Fees | Refund disputes usually cost $5 to $25. |

You can visually understand the fee ranges for various types through the chart below:

Compared to wire transfers, ACH transfer fees are significantly lower. You typically pay nothing for ACH transfers, while domestic wire transfers cost $25-$30 per transaction, and international wire transfers can reach $40-$50.

Influencing Factors

In practice, you will find that ACH transfer fees are influenced by multiple factors, including:

| Influencing Factor | Description |

|---|---|

| Transaction Volume | Higher transaction volumes typically reduce per-transaction costs. |

| Business Type | Certain industries deemed high-risk may face higher fees. |

| Risk Level | A business’s credit score and transaction history affect risk levels. |

| High-Risk Processing | Businesses classified as high-risk may incur higher transaction fees. |

If you are a business user, higher transaction volumes lead to lower per-transaction fees. If your business is in a high-risk industry, banks may charge higher service fees. You also need to consider your business’s credit score and transaction history, as these affect the final fee level.

Tip: When choosing a bank or payment platform, you can compare fee structures based on your transaction volume and industry type to select the most suitable service.

ACH transfers are known for their low costs, making them suitable for most personal and business daily fund transfer needs. You can flexibly choose based on your situation to improve fund management efficiency.

Pros and Cons of ACH Transfers

Advantages

When choosing ACH transfers, you can enjoy multiple benefits. The table below summarizes the main advantages and their descriptions:

| Advantage | Description |

|---|---|

| Improved Cash Flow | You can ensure timely fund arrivals, reducing reliance on mailed checks and improving cash flow predictability. |

| Lower Costs | You pay only a few cents per transaction, far less than the processing fees for paper checks and credit cards. |

| Flexibility and Convenience | You can choose one-time payments or set up recurring automatic deductions to avoid missing payment deadlines. |

| Reduced Fraud Risk | You don’t need to worry about lost or stolen checks, as the ACH network uses encryption and account verification to protect your funds. |

| Increased Accuracy | Automated processing reduces human input errors, ensuring accurate payment information. |

When U.S. businesses issue payroll, they typically use ACH transfers. This ensures employees receive wages on time, and businesses can accurately track fund flows. If you have a USD account with a licensed Hong Kong bank, you can also receive payments from U.S. clients via the ACH network, enjoying low costs and high security.

Tip: The ACH network adheres to Nacha standards, ensuring every transaction undergoes strict review. You can confidently make large or high-frequency payments.

Disadvantages

When using ACH transfers, you also need to be aware of some limitations. Common disadvantages include:

- Processing Delays: After initiating a transfer, you typically wait 1 to 3 business days for funds to arrive, which may be inconvenient if you need funds urgently.

- Transaction Reversal Risk: If the account balance is insufficient or information is entered incorrectly, the bank may reverse the transaction, affecting your fund arrangements.

- Associated Fees: Although ACH transfer fees are low, banks charge additional fees for returns or disputes.

- Limited International Capability: You can only transfer within the U.S. or to certain Hong Kong banks that support ACH. For international payments, you may need multiple transactions or alternative methods.

- Single and Daily Transaction Limits: Your per-transaction and daily total amounts are limited, requiring businesses to plan ahead for large international payments.

If you transfer from the U.S. to a licensed Hong Kong bank account, you may encounter single-transaction limits or delays. For large international transactions, you may need to process in batches, increasing management complexity.

Reminder: When arranging critical fund flows, plan ahead to understand the bank’s processing times and limit policies to avoid delays impacting business progress.

Comparison of Transfer Methods

Comparison with Wire Transfers

When choosing a transfer method, you often hesitate between ACH transfers and wire transfers. The biggest advantage of wire transfers is their speed, typically arriving within hours in China/Mainland China or the U.S. ACH transfers take 1 to 3 business days. You can refer to the table below to quickly understand their main differences:

| Transfer Type | Processing Time | Fee Range |

|---|---|---|

| ACH | 1-3 business days | $0-$3 |

| Wire Transfer | Available within hours | $15-$50 |

If you need urgent remittances, such as for real estate or large transactions, wire transfers are more suitable. If you prioritize low costs for payroll, bills, or recurring payments, ACH transfers are more appropriate.

Tip: Wire transfers have high fees and are suitable for one-time large payments. ACH transfers have low fees and are better for daily and recurring operations.

Comparison with Zelle and Others

In the U.S., you can also use instant transfer tools like Zelle. Zelle transfers are very fast, arriving within minutes. When using Zelle, you don’t need to enter bank account or routing numbers, only the recipient’s phone number or email. The table below shows the main differences between ACH transfers and Zelle:

| Type | Transfer Speed | Maximum Transfer Limit | Security and Reversibility |

|---|---|---|---|

| ACH Transfer | 2-5 business days | $3,500-$25,000 (depending on the bank) | Reversible, lower risk |

| Zelle | Minutes | Varies by bank policy | Irreversible, verify recipient information |

If you need to quickly transfer money to friends or family, Zelle is convenient. However, Zelle transfers are irreversible, and funds cannot be recovered if incorrect information is entered. For payroll, bills, or business payments, ACH transfers are safer and more reliable.

Usage Recommendations

When choosing a transfer method, you can make decisions based on the following scenarios:

- For payroll, recurring bills, supplier payments, or automatic savings, ACH transfers are the most suitable.

- For urgent large payments, such as real estate transactions or international trade, prioritize wire transfers.

- For quick transfers to friends or family, instant transfer tools like Zelle are more convenient.

In practice, consider the amount, speed, and security comprehensively to choose the most suitable method. For receiving payments in a licensed Hong Kong bank account, you can also use the ACH network for low-cost fund transfers.

Selection Recommendations

Assessing Needs

When choosing a transfer method, you need to comprehensively assess your situation. Different transfer methods vary in amount limits, processing speed, fees, and applicability. The table below summarizes common evaluation criteria to help you quickly determine if ACH transfers suit your needs:

| Evaluation Criterion | Description |

|---|---|

| Transfer Limits | Different financial institutions have varying rules for ACH transfer amounts and timing. You should review the account agreement for specific rules. |

| Time Considerations | ACH transfers typically take 1-3 business days, with potential delays during weekends or holidays. Plan transfer times in advance. |

| Potential Fees | Most banks don’t charge for ACH transfers, but insufficient account balances may incur additional fees. |

| International Transaction Limits | ACH transfers generally don’t support international remittances. For cross-border transfers, consider wire transfers, which have higher fees. |

You should also consider the following:

- Understand fees for different transfer types, including inbound, outbound, and intermediary fees.

- Compare fee differences between banks and non-bank channels.

- Consider exchange rate fluctuations affecting the actual received amount, and perform currency conversions if necessary.

- If timing isn’t urgent, prioritize ACH transfers to save costs.

Tip: When receiving U.S. client payments in a licensed Hong Kong bank account, you can use the ACH network for low-cost fund transfers, but confirm the bank’s limits and processing cycles in advance.

User Recommendations

You can maximize the benefits of ACH transfers and avoid common errors by following these methods:

- Choose a reliable ACH payment processing service with robust security measures and customer support.

- Before setting up a transfer, accurately collect the recipient’s bank routing and account numbers.

- Sign a written authorization agreement with counterparties to ensure compliant operations.

- Conduct a small test transfer before large-scale use to verify the process and information accuracy.

- Use automation features to set up recurring payments, simplifying the process.

- Regularly reconcile and verify to ensure each transfer is accurate.

- Maintain communication with counterparties to promptly address exceptions or change notifications.

- Periodically review the transfer process to identify and optimize potential issues.

In practice, you should also avoid these common mistakes:

- Failing to notify the recipient in advance, leading to deduction failures.

- Choosing the cheapest service while ignoring security and compliance.

- Forgetting to periodically verify account information, increasing fund risks.

- Not promptly addressing return or change notifications, affecting subsequent transfers.

It’s recommended to carefully verify all information before each transfer, stay updated on bank announcements and policy changes to ensure fund security and smooth processes. This improves fund management efficiency and reduces unnecessary losses.

You can use ACH transfers to enhance the efficiency of daily and business payments. They have low fees, suitable for large and recurring transactions. You can enjoy security and convenience but need to consider processing times and limits. Combine your needs, amount, and speed to rationally choose the most suitable transfer method. Flexible use of different tools can make your fund management more efficient.

FAQ

Can ACH transfers be used for international remittances?

You cannot directly use ACH transfers for international remittances. You can only transfer between bank accounts within the U.S. For cross-border remittances, consider wire transfers or services offered by licensed Hong Kong banks.

What are common reasons for ACH transfer failures?

You may experience transfer failures due to insufficient account balances, incorrect account information, bank system maintenance, or exceeding transfer limits. Carefully verify information and ensure sufficient funds.

Are ACH transfers secure?

When using ACH transfers, banks employ encryption and multi-factor verification. As long as you protect your account information, funds are generally secure. Avoid operating in insecure network environments.

Are there amount limits for ACH transfers?

When using ACH transfers, banks typically set single-transaction and daily limits. Consult your bank or review the account agreement for specific limits.

Can licensed Hong Kong banks receive ACH payments from U.S. clients?

You can receive ACH payments from U.S. clients through some licensed Hong Kong bank accounts. Confirm in advance if the bank supports this service and understand the processing cycle and fees.

By mastering ACH transfers’ pros, cons, and operations, you’re equipped to manage funds efficiently, but high cross-border fees, currency volatility, and offshore account complexities can limit your U.S. market payments or investments, especially for swift payroll or bill deductions. Imagine a platform with 0.5% remittance fees, same-day global transfers, and zero-fee contract limit orders, enabling seamless operations via one account?

BiyaPay is tailored for ACH users, offering instant fiat-to-digital conversions to meet U.S. payment demands nimbly. With real-time exchange rate query, monitor USD trends and transfer at optimal moments to cut costs. Covering most regions with instant arrivals, it powers rapid supplier payments or investment account funding. Crucially, trade U.S. and Hong Kong markets through a single account, leveraging zero-fee contract limit orders for budget-driven fund management.

Whether streamlining payments or dodging data entry errors, BiyaPay fuels your efficiency. Sign up now, visit stocks for U.S. prospects—quick setup unlocks cost-effective, data-driven financial management. Join global users and excel in 2025 markets!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.