- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Detailed Explanation of Return on Investment (ROI): How to Evaluate Investment Efficiency and Make Decisions Using ROI

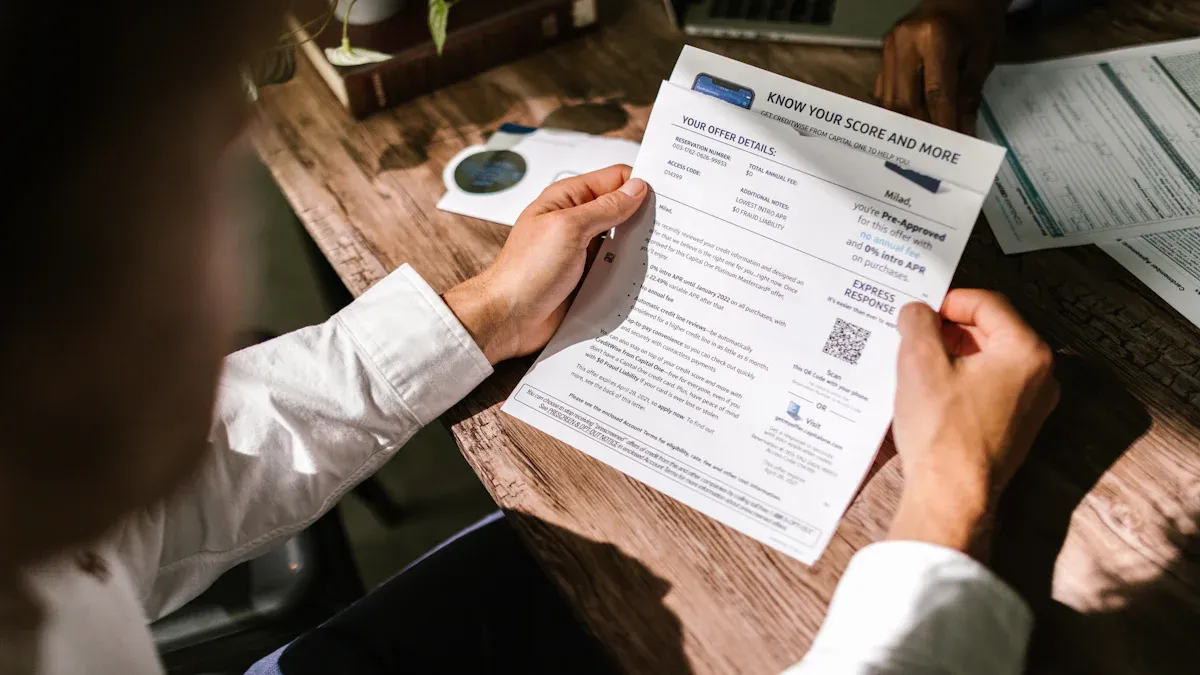

Image Source: pexels

When making investment decisions, you often hear the term Return on Investment. Return on Investment provides you with a simple way to help you quickly compare the returns of different investment projects. Many businesses and individuals like to use it to measure the relationship between inputs and outputs. Although Return on Investment is very popular, other metrics such as Net Present Value (NPV), Internal Rate of Return (IRR), and Return on Invested Capital (ROIC) also have advantages in certain complex or long-term investments. You can choose the appropriate financial metrics based on actual needs to enhance investment judgment.

Key Takeaways

- Return on Investment (ROI) is an important metric for evaluating investment effectiveness, helping you judge the relationship between inputs and outputs.

- When calculating ROI, you need to accurately obtain investment costs and revenue data to ensure the reliability of the evaluation results.

- By comparing the ROI of different projects, you can make wiser choices for investment opportunities and optimize resource allocation.

- When evaluating long-term projects, combining other metrics like Net Present Value (NPV) can provide a more comprehensive judgment.

- Regularly review data and calculation methods to avoid common calculation pitfalls and improve decision quality.

Return on Investment Definition

Image Source: unsplash

Concept Explanation

When making investment decisions, you often encounter the term Return on Investment. Return on Investment is a financial metric used to analyze investment efficiency. You can use it to measure the relationship between the returns generated by an investment and the costs invested. The standard calculation formula is:

Typically, you express this result as a percentage. For example, you invest $1,000 to build a website, and later the website generates $1,500 in sales. You can calculate the Return on Investment as follows: ($1,500 - $1,000) / $1,000 = 50%. This figure tells you that for every $1 invested, you gain a net return of $0.5. You can use this method to quickly judge whether an investment is worth continuing.

Different financial institutions also use Return on Investment to measure investment returns for each period. You can use it to compare different investment projects and choose the one with a higher return. Nowadays, many businesses also use Social Return on Investment (SROI) to measure environmental and social value, but the standard Return on Investment remains the most commonly used.

Role and Significance

Return on Investment has many important roles in investment analysis. You can use it to evaluate the profitability of an investment or to compare the merits of different investment opportunities. The table below summarizes the main functions of Return on Investment:

| ROI Function | Description |

|---|---|

| Evaluate Investment Profitability | You can use ROI to determine whether the returns from an investment exceed the costs. |

| Compare Different Investment Opportunities | You can compare the ROI of different projects to choose the investment with higher returns. |

| Serve as a Performance Measurement Benchmark | ROI can serve as a standard to help you optimize investment strategies and maximize returns. |

When making business or personal investment decisions, you can use Return on Investment as a reference. By comparing the ROI of different projects, you can allocate resources more wisely and find the most effective investment opportunities. This is crucial for budgeting, planning, and resource utilization. You can also use Return on Investment to support strategic decisions, helping you achieve long-term goals.

Tip: Although Return on Investment is simple to calculate, it sometimes cannot reflect all costs and benefits. In practical applications, you need to combine other metrics and actual conditions to make a comprehensive judgment.

Return on Investment Calculation Method

Formula Explanation

When evaluating an investment, you first need to master the standard calculation formula for Return on Investment. This formula can help you quickly judge the profitability of a project. The common calculation method for Return on Investment is as follows:

| Parameter | Definition |

|---|---|

| ROI | Return on Investment, calculated as (Net Profit - Investment Costs) / Investment Costs × 100 |

| Net Profit | Revenue or benefits obtained from the investment, such as new sales generated through marketing. |

| Investment Costs | All funds spent on the project, including direct and indirect costs. |

You can use the following formula to calculate:

Return on Investment (ROI) = (Net Profit - Investment Costs) ÷ Investment Costs × 100%

Some financial analysts also use net income instead of net profit, and the formula becomes:

Return on Investment (ROI) = Net Income ÷ Investment Costs × 100%

In actual operations, you need to choose the appropriate calculation method based on the specific situation of the project. Regardless of the method, the core is to compare the relationship between inputs and outputs.

Data Acquisition

To accurately calculate Return on Investment, you must obtain authentic and reliable data. You can collect the required information through the following methods:

- Use historical data. You can review historical records of similar projects to ensure data accuracy and completeness.

- Account for all related costs. You need to consider direct costs (such as materials, labor, and marketing expenses) and indirect costs (such as administrative expenses, maintenance, and opportunity costs).

- Choose the appropriate calculation method. You should select the ROI calculation method that best reflects the actual benefits based on the investment type.

In project evaluations by licensed banks in Hong Kong, analysts typically collect all expenditure details of the project, including initial investments, ongoing maintenance, and management costs. You also need to focus on all revenues generated by the project, such as income from new customers or additional profits from service upgrades. Only then can you ensure the reliability of the Return on Investment calculation results.

Examples of Direct and Indirect Costs

- Direct Costs: Initial investment, material procurement, employee wages

- Indirect Costs: Administrative expenses, equipment maintenance, long-term operational expenses

When organizing data, it’s recommended to categorize all costs to avoid omitting any expenses.

Model Building

When building a Return on Investment evaluation model, you need to consider more than just costs and revenues. You also need to focus on the project’s implementation process and long-term impact. A complete ROI model typically includes the following levels:

| Level | Description |

|---|---|

| Reaction | Collect participant feedback on the project through short-term surveys. |

| Learning | Assess participants’ mastery of new knowledge or skills through tests. |

| Application and Implementation | Evaluate the actual application effects and reasons after project implementation. |

| Impact | Analyze the impact of project content and other factors on final performance. |

| Return on Investment | Combine impact data with quantifiable benefits through cost-benefit analysis. |

When building the model, you also need to consider the time value of money. The time value of money means that one dollar today is worth more than one dollar in the future. You need to focus on opportunity costs, inflation, and the uncertainty of future revenues. By calculating the present value of future cash flows, you can more accurately assess the true profitability of the project.

Tip: When evaluating long-term projects, it’s recommended to combine metrics like Net Present Value (NPV) to comprehensively judge the reasonableness of Return on Investment.

Calculation Example

Image Source: pexels

Basic Example

You can quickly master the calculation method of Return on Investment through a simple example. Suppose you conduct a promotional campaign in the U.S. market, planning to sell 1,000 products. Each product is sold for $3, with a cost of $2, and you also need to pay $100 in advertising expenses. You can calculate it as follows:

- Calculate expected revenue: 1,000 × $3 = $3,000

- Calculate total expenses: (1,000 × $2) + $100 = $2,100

- Calculate net profit: $3,000 - $2,100 = $900

- Calculate Return on Investment (ROI): ($900 ÷ $2,100) × 100 = 42.9%

You can see that the final Return on Investment is 42.9%. This figure indicates that for every $1 invested, you gain a net return of $0.429. You can use this method to quickly assess whether a project is worth investing in.

Tip: In actual operations, it’s recommended to include all related costs, such as advertising, labor, and materials, to avoid underestimating investment costs.

Industry Differences

When calculating Return on Investment in different industries, you’ll notice significant differences in focus and results. The table below summarizes the ROI focus points for major industries:

| Industry | Focus Points |

|---|---|

| Retail | Revenue growth, customer conversion rates, and customer retention rates |

| Healthcare | Efficiency, cost savings, and improved patient outcomes |

| Manufacturing | Productivity, waste reduction, and supply chain issues |

| Finance | Security, fraud prevention, and operational efficiency |

In the retail industry, you typically focus more on sales growth and customer conversion rates. The healthcare industry emphasizes cost savings and improved patient health. Manufacturing focuses on production efficiency and waste reduction. The finance industry prioritizes security and operational efficiency.

You can also refer to ROI benchmarks for different industries:

| Industry | Return on Investment (ROI) |

|---|---|

| Professional Services | 300-500% (3:1 to 5:1) |

| Service-Based Businesses | 400-600% (4:1 to 6:1) |

| B2B SaaS Companies | 500-800% (5:1 to 8:1) |

| B2C SaaS Companies | 300-500% (3:1 to 5:1) |

When analyzing, you should also note the difference between financial and non-financial returns. Financial returns include sales growth and cost savings. Non-financial returns include user experience and brand reputation, which, although difficult to quantify, are equally important for long-term business development.

Application Scenarios

Project Investment

When evaluating project investments, Return on Investment is one of the most commonly used metrics. Especially in “Exploit” type projects that optimize and expand existing business models or products, you can directly use Return on Investment to measure financial returns, efficiency improvements, and market penetration rates. For example, tech companies in the U.S. market analyze sales growth and cost savings of new products to determine whether to increase investment. In contrast, “Explore” type projects that explore new business models focus more on learning and innovation, typically not using traditional Return on Investment as the primary evaluation metric.

In project evaluations by licensed banks in Hong Kong, analysts use Return on Investment to measure customer growth and operational efficiency after launching new services, helping banks optimize resource allocation.

- You can focus on the following project types:

- Product upgrades and optimization

- Market expansion

- Operational efficiency improvements

Advertising and Marketing

In advertising and marketing, Return on Investment can help you determine which marketing activities truly generate revenue. By calculating Marketing ROI, you can understand the actual returns from each dollar of advertising investment, thereby optimizing budget allocation. Brands adjust future marketing strategies based on the ROI results of different campaigns. For example, when JELLYSUB promoted in the U.S. market, it initially struggled to improve ad performance due to a lack of keyword data. Later, through Amazon’s advertising solutions, JELLYSUB accurately analyzed keyword performance for each ad placement, established a clear baseline, and significantly improved Return on Investment.

You can use ROI to prove the value of marketing activities and secure more support for future budgets.

- You can use ROI to evaluate:

- Digital advertising campaigns

- Social media promotions

- Offline event effectiveness

E-commerce Operations

In e-commerce operations, Return on Investment not only focuses on total profits but also on key metrics like customer acquisition costs, customer lifetime value, and average order value. You can use the table below to understand the definitions of these metrics:

| Metric | Definition |

|---|---|

| Customer Acquisition Cost (CAC) | The average cost of attracting new customers, helping you evaluate the effectiveness of marketing and advertising activities. |

| Customer Lifetime Value (CLV) | The estimated total revenue a customer can generate during their relationship with the business, helping you judge the long-term value of customers. |

| Average Order Value (AOV) | The average amount spent per customer order, increasing AOV can boost revenue without increasing customer numbers. |

When operating an e-commerce platform in the U.S. market, you can continuously improve Return on Investment by optimizing ad placements, enhancing customer experience, and increasing order value.

It’s recommended to regularly analyze these metrics and adjust operational strategies in time to ensure every investment yields maximum returns.

Limitations and Pitfalls

Hidden Benefits

When calculating Return on Investment, you often overlook some hard-to-quantify hidden benefits. For example, long-term customer retention can bring sustained value to a business, as these customers generate more revenue over time, helping the business achieve sustainable growth. Enhancing brand equity is also an important intangible return. A successful project can make a brand more influential in the market and increase customer trust. You also need to consider opportunity costs. Whenever you invest time, money, or team resources in one project, other projects may be delayed or abandoned, and these unrealized opportunities are also hidden costs. Additionally, digital transformation projects often improve customer experience, such as more personalized services or more efficient processes, which are hard to reflect directly in ROI figures but are crucial for long-term business development.

Decision Risks

When making investment decisions, risk assessment is critical. Effective risk management can help you identify potential threats, reducing financial losses. You can use advanced risk assessment tools to monitor supply chain and market changes in real-time, obtaining the latest information. These tools typically generate easy-to-read reports to help you make wiser decisions. Only by fully understanding risks can you improve the accuracy of Return on Investment evaluations and avoid misjudgments due to insufficient information.

Calculation Pitfalls

In actual operations, you may encounter some common calculation pitfalls:

- Confusing cash flow with revenue. You might directly compare initial investments with profits without considering actual cash flow.

- Underestimating initial costs. You sometimes overlook certain expenses, leading to underestimated investment costs.

- Ignoring personnel time. You may not account for the time value of yourself or your employees.

- Unclear minimum return requirements. You need to know the minimum ROI requirements of the business.

- Measuring the wrong metrics. For example, some projects may generate attention but fail to increase sales.

- Focusing on too many metrics. You might be distracted by excessive data, overlooking the most critical metrics.

- Ignoring existing resources. You need to leverage existing IT and team resources to reduce costs.

- Lack of team involvement. It’s best to involve business teams in ROI calculations to ensure data is recognized.

- Ignoring the full sales cycle. You need to consider the impact of the entire sales cycle.

- Ignoring market changes. You should regularly evaluate ROI and adjust strategies in time.

Tip: When evaluating Return on Investment, it’s recommended to regularly review data and methods to avoid decision quality being affected by pitfalls.

Optimization Suggestions

Data Collection

To improve the accuracy of Return on Investment evaluations, you first need to prioritize data collection. Reliable data can help you make more scientific decisions. You can adopt the following practices:

- Clearly define the goals for data collection, ensuring each piece of data serves ROI analysis.

- Standardize data entry formats to reduce human errors.

- Automate data collection as much as possible to improve efficiency and accuracy.

- Establish a data governance framework to standardize data management processes.

- Conduct regular data audits to identify and correct data issues.

- Implement data quality tools to continuously monitor data integrity and consistency.

In actual operations, it’s recommended to standardize the data collection process and combine automation tools to reduce manual intervention and enhance data reliability.

Tool Selection

When analyzing Return on Investment, choosing the right tools is crucial. Different tools are suitable for different scenarios. The table below summarizes commonly used data analysis and ROI measurement tools:

| Tool Name | Feature Description | Use Case Description |

|---|---|---|

| Tableau | Data visualization tool that helps create interactive dashboards for ROI analysis and reporting. | Suitable for businesses needing data visualization. |

| Datorama | Marketing intelligence platform that centralizes marketing data and provides AI-driven ROI optimization insights. | Ideal for large marketing teams. |

| Bizible | B2B marketing attribution and planning software that aligns marketing and sales data for accurate ROI measurement. | Suitable for B2B businesses. |

| CoSchedule | Provides content-specific analytics and ROI measurement features. | Best choice for content marketing. |

| Sprout Social | Offers detailed social media performance metrics and ROI analysis. | Ideal tool for social media marketing. |

| Mailchimp | Provides built-in email campaign ROI tracking features. | Commonly used tool for email marketing. |

| AdEspresso | Helps measure and optimize ROI for PPC advertising campaigns. | Effective tool for PPC advertising. |

| Traackr | Provides features for tracking and measuring ROI of influencer marketing campaigns. | Dedicated platform for influencer marketing. |

You can also combine general data analysis tools like Microsoft Excel, Google Sheets, or use specialized financial and marketing software like QuickBooks and HubSpot ROI Calculator to meet different business needs.

Continuous Optimization

To make Return on Investment analysis more aligned with actual business changes, you need to continuously optimize the ROI model. You can take the following measures:

- Regularly revise the ROI calculation formula to adapt to changes in the economic environment.

- Align key metrics with business goals to ensure analysis results guide actual decisions.

- Integrate multi-channel attribution models to comprehensively analyze customer behavior paths.

- Prioritize dynamic budget allocation, flexibly adjusting resources based on the performance of different channels.

- Pay attention to market changes and adjust analysis models and budget strategies in time.

Studies show that flexible budget allocation can significantly improve a company’s ROI performance. By dynamically adjusting budgets and metrics, you can help businesses better respond to market changes and achieve higher investment returns.

You can use Return on Investment as a quantitative tool to help you evaluate the effectiveness of investments. The table below summarizes its main features:

| Feature | Description |

|---|---|

| Simple and Powerful | A basic metric for potential investment returns |

| Wide Applicability | Can be used in various financial analysis scenarios |

When analyzing, you should note that ROI only reflects financial returns, and it’s easy to overlook risks and long-term impacts. You can combine quantitative and qualitative data, regularly adjust investment strategies, and continuously optimize decisions.

FAQ

What is Return on Investment (ROI)?

Return on Investment (ROI) is a metric you use to measure the relationship between the returns and costs of an investment project. You can use it to judge whether a project is worth investing in.

How do you quickly calculate ROI?

You simply subtract the investment costs from the net returns, divide by the investment costs, and multiply by 100%. This gives you the ROI percentage.

Is a higher ROI always better?

A high ROI usually indicates good investment performance. However, you also need to consider risks, project duration, and other potential benefits. You can’t rely solely on the ROI figure.

What should you pay attention to when using ROI in the U.S. market?

You need to ensure all costs and revenues are accounted for, including advertising, labor, and maintenance. You should also monitor market changes and regularly review data.

In which scenarios can ROI be used?

You can use ROI to evaluate project investments, advertising campaigns, e-commerce operations, and more. It applies to various business decisions, helping you optimize resource allocation.

By mastering Return on Investment (ROI) analysis, you’ve learned to evaluate investment efficiency and optimize resource allocation, but high cross-border fees, currency volatility, and complex offshore account setups can limit your ability to act on U.S. market opportunities, especially when adjusting portfolios swiftly. Imagine a platform offering 0.5% remittance fees, same-day global transfers, and zero-fee contract limit orders, enabling seamless ROI-driven strategies through a single account?

BiyaPay is tailored for ROI-focused investors, providing instant fiat-to-digital conversions to seize market opportunities nimbly. With real-time exchange rate query, monitor USD trends and transfer at optimal moments to cut costs. Covering most regions with instant arrivals, it powers rapid allocations to S&P 500 ETFs (like SPY) or high-ROI stocks. Crucially, trade U.S. and Hong Kong markets via one account, leveraging zero-fee contract limit orders for ROI-based limit strategies.

Whether optimizing project investments or chasing high-return opportunities, BiyaPay fuels your edge. Sign up now, visit stocks for U.S. prospects—quick setup unlocks cost-effective, data-driven investing. Join the global investment community and thrive in 2025’s markets!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.