- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

From Beginner to Pro: Enhancing Your Investment IQ with Earnings Calls

Image Source: pexels

You can directly obtain the authentic views of company executives through earnings calls. These meetings not only convey qualitative information that financial statements cannot capture, but also often trigger rapid fluctuations in stock prices, reflecting the market’s immediate reaction to new data. Positive call content can enhance investor confidence and have a long-term impact on a company’s stock price trajectory. The confident expressions of leading companies can also drive overall market sentiment, helping you better identify potential corporate issues and future strategies.

Key Points

- Earnings calls provide authentic executive perspectives, helping you understand the company’s future strategies and potential risks.

- Through the Q&A session, you can gain insights from direct interactions between analysts and management, uncovering deeper information.

- Using AI tools to automatically transcribe and analyze call content improves information acquisition efficiency, aiding in smarter investment decisions.

- Pay attention to changes in management’s tone and wording to promptly identify potential risks and adjust investment strategies.

- Regularly organize and archive earnings call materials to build your own information database for subsequent analysis and decision-making.

Value of Earnings Calls

Basic Concepts

You can directly learn the authentic views of listed company executives through earnings calls. Earnings calls are typically held quarterly, lasting about 45 minutes to 1 hour. The meeting process includes preparation, call structure, and a Q&A session. The call begins with the host introducing the management team members, followed by the investor relations or legal department explaining the call’s details. Management will review the financial report in detail and provide commentary. Finally, analysts and investors participate in the Q&A session, which is the most informative part.

During the call, you can hear executives like the CEO and CFO discuss financial metrics such as revenue, earnings, and expenses, and management will also share factors affecting the company’s performance.

| Participant | Role Description |

|---|---|

| CEO/CFO and other executives | Present the financial statements, including revenue, earnings, expenses, and other relevant financial metrics. |

| Management | Provide insights into factors affecting the company’s financial performance, including positive and negative factors. |

| Company | Offer guidance or forecasts for future performance, including revenue targets, expectations, and strategic plans. |

| Analysts and Investors | Ask questions during the Q&A session, seeking clarification on the company’s financial results, strategies, or other relevant topics. |

Information Advantage

Earnings calls provide unique information that written financial reports cannot convey. Management can express tone and uncertainty through verbal communication, allowing you to sense their confidence or concerns about the future. The call structure and interactive sessions reveal management’s true intentions and the company’s economic condition. During the Q&A session, you can hear analysts and investors ask direct questions about the company’s strategy, market risks, and other key issues, which are often more valuable than the financial report itself.

- You can gain key information on performance drivers, future strategies, and market risks.

- Highly engaged conversations deliver more information, helping you make smarter investment judgments.

Role in Decision-Making

Earnings calls are indispensable in investment decision-making. You can promptly identify potential risks and opportunities through call content. Management’s tone, wording, and interaction style often reveal details not mentioned in written reports. You can adjust your investment strategy based on the information disclosed during the call. For example, investors in the U.S. market often quickly adjust their portfolio structures based on new information from earnings calls. Earnings calls allow you to stay ahead in information acquisition and analysis, enhancing your investment IQ.

Information Acquisition

Image Source: pexels

Channels and Tools

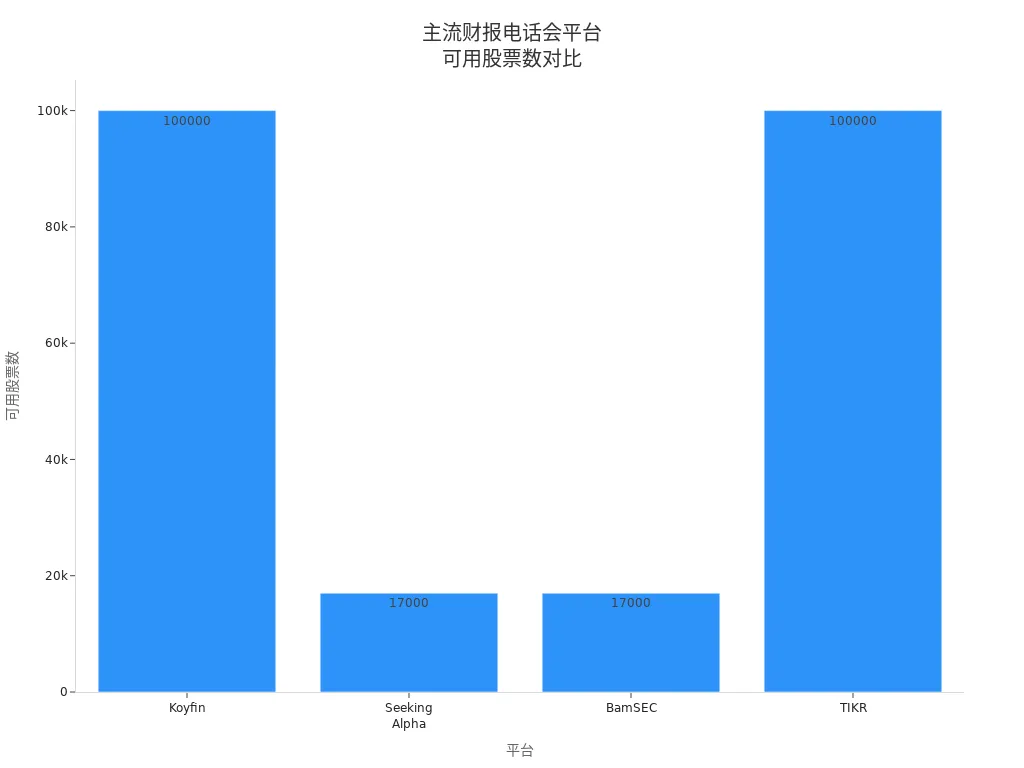

You can access earnings call information through various platforms. Mainstream tools like Koyfin, Seeking Alpha, BamSEC, and TIKR support stock coverage for global or U.S. markets, with fees priced in USD. The table below shows the main features of these platforms:

| Platform | Cost | Stock Coverage | Number of Available Stocks |

|---|---|---|---|

| Koyfin | $0 - $39/month | Global | ~100,000 |

| Seeking Alpha | $239/year | U.S. | ~17,000 |

| BamSEC | $69/month | U.S. | ~17,000 |

| TIKR | $0 - $40/month | Global | ~100,000 |

You can choose the appropriate platform based on your investment targets and budget to quickly access earnings call recordings, transcripts, and related analyses for your target companies.

Call Screening

When screening high-quality earnings calls, you should focus on the following aspects:

- Whether the financial report content is clear and easy to understand for assessing company performance.

- Whether the call includes a Q&A session, allowing you to hear direct exchanges between analysts and management.

- Whether the call participation strategy is effective, helping you obtain key information.

- Whether the company builds a narrative and vision through the call, enhancing investor trust.

- Whether management clearly communicates strategies and quarterly performance.

- Whether the company reiterates its vision, helping you understand its goals.

You can combine these criteria to select the most noteworthy calls, improving information acquisition efficiency.

Data Organization

After collecting earnings call information, you need to efficiently organize and archive the materials. Common methods are as follows:

| Method | Description |

|---|---|

| Transcribe Calls | Convert recordings to text for easy review and analysis. |

| Archive on Investor Relations Websites | Store recordings and transcripts on the company’s investor relations page for anytime access. |

| Maintain Historical Records | Company websites retain past call materials, allowing you to review and compare. |

You can build your own database, regularly organizing and archiving materials for subsequent analysis and review of investment decisions.

Analysis Methods

Image Source: pexels

Sentiment and Wording

When analyzing earnings calls, you should first focus on management’s sentiment and wording. Management’s tone often reveals their confidence or concerns about the company’s future. Researchers typically analyze call text data, labeling management’s vocabulary as positive, negative, or neutral. You can compare tone differences between management’s formal statements and their interactions with analysts to determine if they are avoiding sensitive issues.

- You can use language query and word count software to remove irrelevant words, count high-frequency terms, and identify key points management repeatedly emphasizes.

- Natural language processing technology can help you generate lists of core vocabulary used by analysts and management during the call. These methods make it easier to capture management’s true attitude and promptly identify potential risks or opportunities.

Key Information

You need to be adept at extracting key information from earnings calls. Call content includes not only financial data but also company strategies, market conditions, and future plans. By focusing on changes in call themes, you can determine if the company is adjusting its strategic direction. For example, if management suddenly emphasizes a new business, it may indicate a company transformation or response to new risks.

The table below shows important signals that changes in call themes may convey:

| Evidence Point | Description |

|---|---|

| European Commission Investigation | The European Commission investigated whether tire manufacturers used earnings calls to convey pricing strategies to competitors, potentially violating antitrust laws. |

| Concept of Price Signals | Price signals often reflect a company’s public stance on future strategies or market behavior, potentially affecting industry dynamics. |

| Timing of Public Statements | Management’s choice to make statements when competitors might be listening often carries special significance. |

You can also use AI tools to efficiently analyze call transcripts, generating sentiment analysis reports, creating editable financial result files, and building personalized information feeds. These tools help you quickly pinpoint information valuable to investment decisions.

Risk Identification

When analyzing earnings calls, you must pay attention to potential risk signals. Many stock price crashes are accompanied by company-specific news, such as expansion, management changes, or acquisition announcements. Changes in management’s tone often reflect private information they hold.

The table below summarizes common risk identification signals:

| Indicator Type | Description |

|---|---|

| Performance or Operational News | Common company news during stock price crash weeks includes expansion, distributor or management changes, and acquisition announcements. |

| Tone Changes | A sudden shift to cautious or evasive tone by management may indicate significant risks. |

| Topic Shifts | Frequent topic shifts during the call may suggest management is trying to downplay negative information. |

You can combine these signals to adjust your investment strategy promptly and avoid significant losses.

Pitfalls of Earnings Calls

When interpreting earnings call content, you may easily fall into some common pitfalls.

- Many investors focus too much on past performance, ignoring future market opportunities.

- Unclear communication or insufficient content from management can lead to misjudgments about the company’s prospects.

- If you are unprepared, complex issues during the call may confuse you, affecting your judgment.

It’s recommended to focus on both historical data and management’s outlook for the future when analyzing call content. You should also prepare questions in advance to improve information acquisition efficiency and avoid being misled by surface-level information.

Investment Applications

Case Studies

You can understand how to apply earnings call analysis to investment decisions through specific case studies. The table below shows key points from the earnings calls of three major U.S. tech companies and their implications for investors:

| Company | Key Points | Investment Implications |

|---|---|---|

| Microsoft | Provided optimistic double-digit revenue and operating income growth guidance but expected a 1 percentage point decline in operating margin. | You should focus on potential growth opportunities while understanding that investment returns may have a time lag. |

| Amazon | Emphasized $75 billion in capital expenditure to expand AWS and AI infrastructure, but short-term profitability may be pressured. | You need to balance long-term growth commitments with short-term profitability risks, avoiding a focus solely on short-term profits. |

| Meta | Set a revenue target of $45 billion to $48 billion, planning significant investments in AI and the metaverse. | You can use AI tools to analyze complex financial information, quickly understand key points, and adjust investment strategies. |

When analyzing these cases, you can see that the information conveyed by management during earnings calls directly affects investors’ judgments about the company’s future. You should not only focus on financial data but also combine management’s strategic statements and industry trends to form a comprehensive investment perspective.

Decision-Making Practices

In actual investment processes, you can integrate earnings call analysis into your decision-making system. You can improve decision quality through the following aspects:

| Evidence Point | Description |

|---|---|

| Real-Time Insights | You can directly hear management’s interpretation of company performance, strategies, and future outlook. |

| Forward-Looking Guidance | Companies provide forecasts for future quarters during calls, helping you assess potential growth opportunities. |

| Q&A Session | Analysts’ questions often reveal deep insights into company operations or risks, allowing you to identify risk points. |

| Financial Data Context | Executives explain financial results, helping you understand the business logic behind the numbers. |

| Competitive Insights | You gain perspectives on industry trends and competitor performance, understanding broader market conditions. |

| Market Reaction | Call information may trigger stock price fluctuations, allowing you to adjust portfolio structures accordingly. |

You can combine this information to develop more scientific investment strategies. For example, when you find management is optimistic about the future with clear growth plans, you might consider increasing your holdings. If you notice management avoiding key questions during the Q&A session, you should be cautious of potential risks.

Path to Improving Investment IQ

To continuously improve your investment IQ, you need to integrate earnings call analysis into your daily investment process. You can refer to the following suggestions:

- Ensure information transparency, avoid focusing only on selectively disclosed data by management, and build trust in the company.

- Focus on key metrics like net income, EBITDA, and price-to-earnings ratio, understanding their impact on company value.

- Use interactive platforms like webinars to gain more firsthand information.

- Prepare questions in advance to ensure you obtain the most relevant data and perspectives during the call.

- After the call, actively summarize and review to continuously optimize your analysis methods.

Through continuous practice and summarization, you can gradually build your own investment analysis system. Earnings calls provide a unique information channel, allowing you to maintain an information advantage in investment decisions.

Advanced Techniques and Trends

Technology Applications

You can use artificial intelligence technology to significantly improve the efficiency of earnings call analysis. AI can automatically transcribe call content, helping you capture time-sensitive investment opportunities. You can quickly review transcribed text to gain a more comprehensive market landscape. AI can also incorporate call signals into systematic strategies, such as earnings intelligence and stock factor investing. You can identify emerging signals in a company’s outlook, promptly adjust global portfolios, and protect cross-border assets.

AI, through text analysis technology, can read large volumes of reports and news, identifying company sentiment, financial risks, and market trends. Generative AI tools, such as large language models, are widely used to analyze unstructured data, including call transcripts and financial documents.

- AlphaSense’s intelligent summarization feature can generate AI summaries covering all key themes for each call.

- You can use generative search functions to ask questions in natural language and quickly obtain instant answers from relevant documents.

- Generative grid technology allows you to quickly extract insights from multiple transcripts, improving analysis efficiency.

Skill Enhancement

In earnings call analysis, you can leverage the latest technological trends to continuously improve your skills. The table below summarizes current mainstream technologies and their advantages:

| Technology Trend | Description |

|---|---|

| AI-Driven Platforms | Integrated interfaces simplify call processes, enhancing company management flexibility. |

| Automatic Summarization | Automatically generate call summaries, helping you quickly obtain key information. |

| Interactive PDFs | Support analyst and investor questions, provide podcast-style summaries, and enhance interactive experiences. |

| Tools for Generating Potential Q&A Questions | Generate potential questions based on real-time transcripts, improving call interaction quality. |

| Real-Time Analysis and Feedback | Real-time data analysis helps companies communicate efficiently with investors, increasing transparency. |

You can use these tools to reduce information acquisition time and deepen analysis. You can also leverage AI to assist in decision-making, building a more scientific investment system.

Future Directions

You will see continuous innovation in the format and accessibility of earnings calls. More companies are adopting video conferences to enhance interactions between management and investors. In the U.S. market, T-Mobile uses video to showcase products and services, improving customer engagement. Netflix livestreams earnings calls on YouTube, enhancing transparency and interactivity. Zoom uses its own software for its first public earnings call, demonstrating technical strength. Other companies also use video conferences to improve the quality of discussions between management and analysts.

You can anticipate that future earnings calls will become more open and intelligent. You need to continuously learn new technologies and stay updated on industry trends to maintain a lead in investment analysis.

You can boost your investment IQ through earnings calls, gaining the latest management perspectives and industry trends. The table below shows that in Q2 2023, 210 U.S. companies mentioned “AI” during earnings calls, far exceeding the past decade’s average, reflecting the growing value of information.

| Period | Number of Companies Mentioning “AI” | 5-Year Average | 10-Year Average |

|---|---|---|---|

| Q2 2023 | 210 | 88 | 55 |

| Highest Record | 211 (Q1 2024) | N/A | N/A |

You can continue to accumulate experience and follow these suggestions:

- Create a preparation schedule to analyze key information in advance.

- Focus on industry hotspots and prepare expected questions.

- Participate in investor communities and learn AI analysis tools.

You need to keep learning and use professional resources to continuously optimize investment decisions.

FAQ

How can I access earnings call materials for U.S. listed companies?

You can visit the investor relations section of the company’s website or use platforms like Koyfin and Seeking Alpha to access recordings and transcripts. Most platforms offer free trials, with paid plans priced in USD.

Which tools are suitable for analyzing call content?

You can choose AI-driven tools like AlphaSense and BamSEC. These platforms support automatic transcription, sentiment analysis, and call summaries, helping you efficiently extract key information.

How can I judge management’s true attitude during earnings calls?

You can focus on changes in management’s tone and wording. Be cautious of potential risks when they avoid sensitive questions or frequently shift topics.

How do earnings calls directly help with investment decisions?

You can promptly identify strategic adjustments, performance drivers, and market risks through call content. Combining Q&A session information, you can optimize portfolio structures.

Do I need to listen to the entire earnings call every time?

You can prioritize reading call summaries and key Q&A sections. Using AI tools to screen critical information saves time and improves analysis efficiency.

By mastering earnings call analysis, you’ve learned to extract critical insights from executive commentary and Q&A, sharpening your investment decisions, but high cross-border fees, currency volatility, and offshore account complexities can limit reacting to U.S. earnings season signals, especially for swift portfolio adjustments or sentiment plays. Imagine a platform with 0.5% remittance fees, same-day global transfers, and contract limit orders with zero fees, enabling seamless earnings-driven strategies via one account?

BiyaPay is tailored for earnings-focused investors, offering instant fiat-to-digital conversions to act on call signals nimbly. With real-time exchange rate query, monitor USD trends and transfer at optimal moments to cut costs. Covering most regions with instant arrivals, it powers rapid allocations to S&P 500 ETFs (like SPY) or high-growth tech stocks. Crucially, trade U.S. and Hong Kong markets through a single account, leveraging contract limit orders with zero fees for management guidance-based limit strategies.

Whether chasing earnings upside or dodging hidden risks, BiyaPay fuels your edge. Sign up now, visit stocks for U.S. prospects—quick setup unlocks cost-effective, data-driven investing. Join global investors and profit in 2025’s earnings seasons!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.