- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Triple Witching Shocks the Market: Analysis of the Contract "Storm Day" That Traders Cannot Ignore

Image Source: pexels

Triple Witching Day impacts the market, often triggering significant volatility due to the simultaneous expiration of contracts. Data shows that Apple’s stock price can experience an average change of -1.20% around Triple Witching Days. Trading volume and price volatility are also significantly higher than on regular trading days, especially in the final hour when trading activity becomes exceptionally active. Traders face heightened risks and uncertainties during this period, making this ‘storm day’ impossible to ignore.

| Evidence Type | Description |

|---|---|

| Trading Volume | Triple Witching Days typically see increased trading volume as traders adjust their positions. |

| Price Volatility | The simultaneous expiration of contracts can lead to unusual price movements in the underlying assets. |

| Trading Activity | Trading activity significantly increases in the final hour of trading. |

Key Points

- Triple Witching Day occurs on the third Friday of March, June, September, and December each year, when three major types of derivative contracts expire simultaneously, leading to heightened market volatility.

- On Triple Witching Day, trading volume typically increases significantly, especially in the final hour, and traders need to adjust positions in advance to cope with market changes.

- Investors should create detailed trading plans to avoid making impromptu decisions in a high-volatility environment, minimizing potential losses.

- High trading volume does not always mean profitable opportunities; traders need to focus on the risks behind price volatility and assess market conditions rationally.

- Effective risk management strategies are crucial; traders can use options to hedge risks, ensuring timely exits from unfavorable positions during significant market volatility.

Triple Witching Day Overview

Definition

Triple Witching Day is a highly influential trading day in global financial markets. On the third Friday of March, June, September, and December each year, three major types of derivative contracts—stock options, stock index options, and stock index futures—expire on the same day.

On this day, market trading volume typically increases significantly, and price volatility is noticeably amplified.

- Stock options, stock index options, and stock index futures expire on the same day

- Monthly options and index futures contracts also expire on this day

- Approximately $6.5 trillion in options and futures expire, significantly boosting market liquidity

The phenomenon of Triple Witching Day impacting the market is particularly pronounced in the U.S. market, and investors need to closely monitor related changes.

Contract Types

Triple Witching Day involves three major types of contracts, each with distinct handling methods on expiration day. The table below summarizes the basic characteristics of each contract type and their primary actions on Triple Witching Day:

| Contract Type | Description | Action on Triple Witching Day |

|---|---|---|

| Stock Options | Grant the right, but not the obligation, to buy or sell a stock at a predetermined price before expiration | Decide whether to exercise, roll over, or let expire |

| Stock Index Futures | Futures contracts based on stock indices, often used for hedging or speculation | Close or roll over positions |

| Stock Index Options | Options based on market indices, granting the right to buy or sell the index at a set price | Close or roll over positions |

Additionally, settlement mechanisms for different contracts vary:

| Derivative Type | Settlement Mechanism | Delivery Method |

|---|---|---|

| Stock Index Futures | Opening auction | Cash settlement |

| Stock Index Options | Opening auction | Cash settlement |

| Single Stock Options | Closing auction | Physical delivery |

Investors need to adjust their position strategies promptly based on contract types and settlement methods to address the significant changes caused by Triple Witching Day impacting the market.

Timing Pattern

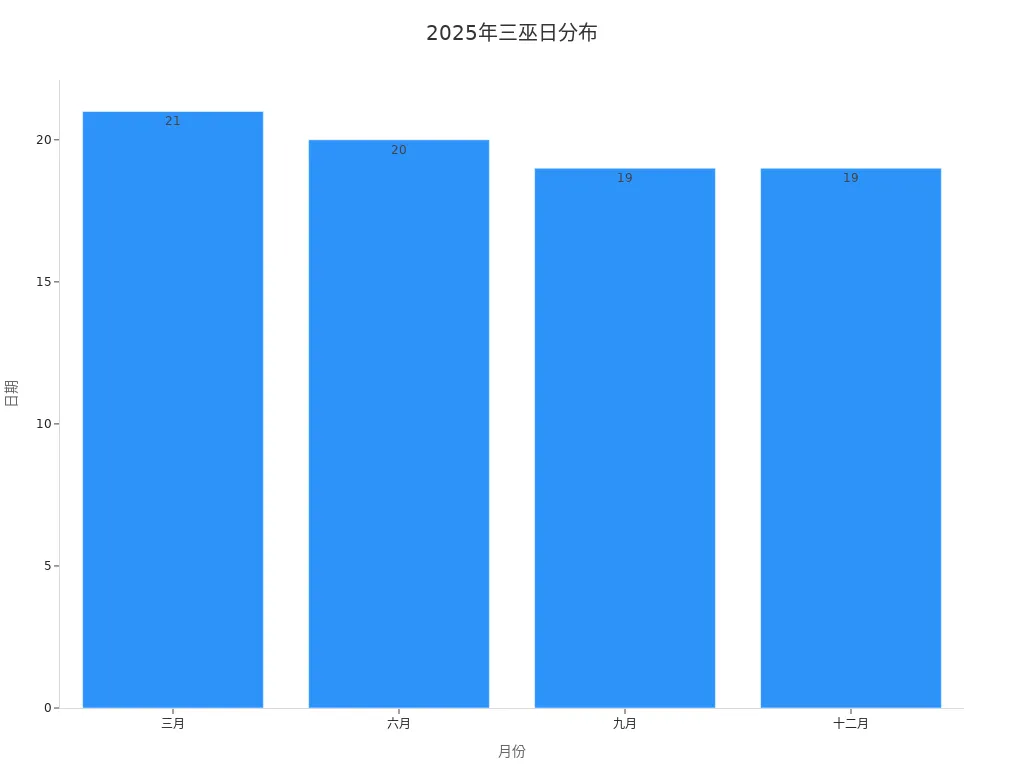

Triple Witching Day follows a strict timing pattern. On the third Friday of March, June, September, and December each year, the three types of contracts expire simultaneously. The table below shows the specific dates for Triple Witching Days in 2025:

| Year | March | June | September | December |

|---|---|---|---|---|

| 2025 | 21st | 20th | 19th | 19th |

This cyclical arrangement allows market participants to plan trading strategies in advance. The phenomenon of Triple Witching Day impacting the market is highly predictable, and investors should leverage this pattern to arrange trading plans rationally.

Triple Witching Day Impacts the Market

Image Source: pexels

Volatility Changes

One of the core manifestations of Triple Witching Day impacting the market is significant changes in volatility. Whenever three major derivative contracts expire simultaneously, market participants adjust or close large positions in a short period. This concentrated activity often leads to significant volatility in individual stocks during the final trading session.

- Studies show that while major indices like the S&P 500 typically fluctuate within a narrow range on Triple Witching Day, individual stocks often experience significant price movements in the last 30 minutes due to option settlements.

- After options expire, the “pinning effect” on prices disappears, making stock prices more susceptible to macroeconomic news or earnings reports, amplifying volatility.

- In the week following Triple Witching Day, overall market volatility often increases further, especially when new market narratives emerge.

The volatility changes caused by Triple Witching Day impacting the market bring more uncertainty for traders while also offering opportunities for some investors to capitalize on short-term fluctuations.

Liquidity and Trading Volume

Triple Witching Day impacting the market is also reflected in dramatic changes in liquidity and trading volume.

- In the U.S. stock market, trading volume typically surges significantly on Triple Witching Day, peaking in the final hour.

- Many traders adjust or close derivative positions before the market closes, leading to a surge in trading volume.

- Market makers manage risks through hedging to ensure they can safely close hedged positions at expiration, further driving active trading.

- Due to increased market volatility, stocks with lower liquidity may face liquidity shortages, with prices easily influenced by large trades.

Notably, while Triple Witching Days typically come with high trading volume, during special periods like post-holiday sessions, trading volume may fall below expectations if many traders are on vacation. Overall, the liquidity changes caused by Triple Witching Day impacting the market create more trading opportunities while increasing uncertainty in price discovery.

Price Anomalies

Another significant feature of Triple Witching Day impacting the market is price anomalies.

- Each quarter, derivative contracts from multiple exchanges expire on the same day, an event market observers call a “triple witching” event. Though it occurs only four times a year, it often leads to unusual price volatility in the market.

- In the final hour of trading, traders focus on adjusting or closing positions in specific stock or index options, which can trigger short-term price anomalies in individual stocks or indices.

- Stocks with lower market capitalization and higher derivative trading volume experience more pronounced price volatility.

- These price anomalies not only provide arbitrage opportunities for some investors but may also lead to pricing irregularities, increasing market risks.

Regulatory authorities closely monitor price anomalies caused by Triple Witching Day impacting the market. The table below summarizes monitoring and response measures by major U.S. regulatory bodies:

| Regulatory Body | Monitoring Measures | Response Measures |

|---|---|---|

| CFTC | Focuses on market anomalies, particularly pricing irregularities related to Triple Witching Day | Conducts targeted reviews to detect market disruptions |

| SEC | Monitors trading activity | Declines to comment on specific studies |

| Cboe | Maintains market integrity, monitors unusual trading activity | Takes tough enforcement actions against violations |

| CME | Continuously monitors trading activity | Pursues enforcement actions after identifying violations |

U.S. market data shows that since 1990, the S&P 500 index has declined approximately 80% of the time in the week following the September Triple Witching Day, with an average pullback of about -1%. Price anomalies caused by Triple Witching Day impacting the market not only affect trading on the day but may also set the stage for market trends in the following week.

Risks and Challenges

Image Source: pexels

Common Risks

When Triple Witching Day impacts the market, traders face multiple risks.

- Derivative contracts expiring simultaneously on the same day significantly increase market volatility.

- Rapid price fluctuations in a short period can lead to significant losses, especially for inexperienced traders.

- Traders need to close or roll over positions before the deadline, with surging trading volume increasing operational pressure.

- Investors without a trading plan are prone to losses in a highly volatile environment.

- In the final trading hour, market volatility is at its peak, further amplifying risks.

Trading Pitfalls

Many traders fall into pitfalls during the period when Triple Witching Day impacts the market. Some investors mistakenly believe high trading volume guarantees profitable opportunities, ignoring the risks behind price volatility.

Traders who focus only on short-term price anomalies and overlook contract expiration mechanisms may make incorrect decisions during significant market volatility.

Some fail to create a trading plan in advance, leading to operational errors when reacting on the spot. Others overly rely on historical data, ignoring changes in market conditions.

Behavioral Biases

During the period when Triple Witching Day impacts the market, behavioral biases also affect trading decisions.

- Investors in a high-volatility environment are prone to panic, trading frequently and increasing transaction costs.

- Some traders are overconfident, believing they can accurately predict market movements, which may amplify losses.

- Market sentiment can be amplified, with herd behavior causing prices to deviate further from fundamentals.

- Traders under pressure may overlook risk management, leading to capital losses.

Practical Strategies

Risk Management

With significant market volatility on Triple Witching Day, traders must prioritize risk management. Professional institutions typically identify potential risks in advance and develop response plans.

- Traders can use options strategies to hedge risks based on expected price volatility, such as buying put options to protect against declines in underlying asset prices.

- Hedging techniques are particularly important during high-volatility periods. By holding assets in opposite directions, traders can reduce overall risk exposure.

- Clear risk management strategies are crucial. Institutional investors use stop-loss orders to limit potential losses, ensuring timely exits from unfavorable positions during significant market volatility.

- Traders should remain vigilant and closely monitor market dynamics. The high volatility of Triple Witching Day brings both opportunities and risks.

- Institutional investors typically conduct thorough research to understand the securities expiring and their impact on portfolios.

- Quantitative teams develop models to predict trading volume changes, dynamically adjusting algorithms to address increased trading volume and volatility.

Professional traders recommend implementing appropriate risk management strategies before and after Triple Witching Day to avoid significant losses due to market anomalies.

Trading Recommendations

Triple Witching Day offers traders diverse trading opportunities. Different strategies suit varying risk tolerances and technical expertise.

- Momentum trading is suitable for high-volatility days, capitalizing on strong upward or downward trends. Traders can focus on mainstream market sectors to capture short-term trends.

- Scalping exploits price differences in high-volume stocks. This strategy requires technical precision and a deep understanding of market microstructure.

- Pair trading performs well during sector imbalances. For example, if the tech sector is under pressure, traders can go long on strong stocks and short weak ones to profit from temporary market imbalances.

- Institutional investors stay informed, monitoring market news and expert analysis to adjust portfolio structures promptly.

- Algorithmic trading systems are active on Triple Witching Day. Exchange auction trading accounts for up to 47% of trading volume on Triple Witching Day, far higher than regular trading days. Quantitative execution teams collaborate with research teams to develop more accurate trading volume prediction models. Trading volume on the day is typically about 170% higher than the average daily volume.

Traders should choose appropriate trading strategies based on their risk tolerance and technical expertise, avoiding blindly following trends.

Precautions

The market environment on Triple Witching Day is complex, and traders need to take the following precautions to ensure capital safety and trading efficiency.

- Adjust portfolios promptly to avoid holding high-risk or illiquid assets.

- Stay vigilant and closely monitor market dynamics and derivative expiration conditions.

- Create detailed trading plans to avoid operational errors from impromptu decisions.

- Monitor changes in market liquidity and arrange trading times rationally, avoiding blind entries or exits in the final hour.

- Institutional investors recommend continuously tracking market news and expert opinions before and after Triple Witching Day to ensure sufficient information.

- Traders should avoid overconfidence, rationally assess their capabilities, and strictly implement risk management measures.

While Triple Witching Day offers abundant market opportunities, the risks are equally significant. Traders need to approach it with a professional mindset to ensure scientific and rational investment decisions.

Case Studies

Historical Performance

Triple Witching Day has historically triggered significant market volatility multiple times. U.S. market data shows that on October 16, 1987, the simultaneous expiration of stock and futures options, combined with program trading, drove the Dow Jones Industrial Average down 4.6%, setting the stage for “Black Monday.” On December 19, 2008, during the global financial crisis, Triple Witching Day further exacerbated market tensions. In 1992, blue-chip stocks like IBM and General Motors faced heavy selling on Triple Witching Day, leading to an overall market decline.

| Date | Event Description | Market Impact |

|---|---|---|

| October 16, 1987 | Simultaneous expiration of stock and futures options, with significant market volatility | Dow Jones Industrial Average fell 4.6%, laying the groundwork for “Black Monday” |

| December 19, 2008 | Triple Witching Day triggered market volatility during the global financial crisis | Market faced further shocks in an already tense environment |

| 1992 | Heavy selling of blue-chip stocks on Triple Witching Day, with significant market decline | Caused a notable market drop |

Statistical data shows that the market’s average loss on Triple Witching Day is 0.52%, with an average loss of 0.53% for the Triple Witching week. Since 2021, the standard deviation on Triple Witching Days has reached 3.04%, indicating high uncertainty. The positive return probability is only 22%, far below the 61% for non-expiration weeks.

Strategy Review

Historically, professional institutions have adopted diversified strategies on Triple Witching Day to address high volatility.

- Many traders close or roll over derivative positions in advance to reduce risk exposure on expiration day.

- Institutional investors tend to use hedging tools, such as buying put options or employing pair trading, to mitigate losses from price anomalies in individual assets.

- Quantitative teams dynamically adjust algorithm parameters based on historical trading volume and volatility data to optimize trading execution efficiency.

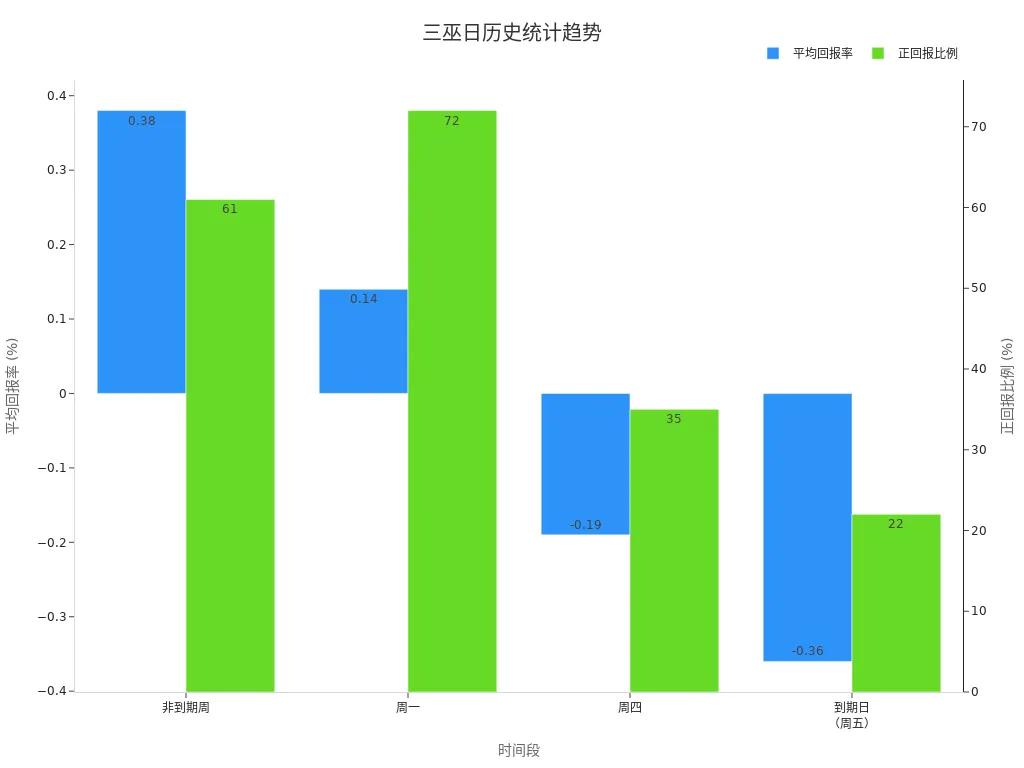

The table below summarizes statistical trends related to Triple Witching Day:

| Time Period | Average Return | Positive Return Probability |

|---|---|---|

| Non-Expiration Weeks | 0.38% | 61% |

| Monday | 0.14% | 72% |

| Thursday | -0.19% | 35% |

| Expiration Day (Friday) | -0.36% | 22% |

Experience shows that market volatility intensifies on Triple Witching Day, with a significantly lower probability of positive returns. Traders need to combine historical data and flexibly adjust strategies to avoid blindly chasing short-term fluctuations.

Triple Witching Day has a profound impact on market structure and participant behavior. Trading volume surges, liquidity fluctuates briefly, and this is common for specific stocks or sectors. Historical data indicates that Triple Witching Day often serves as a catalyst for accelerating market trends. The rise of passive investing and algorithmic trading has also altered trading patterns for assets like ETFs. Traders should develop strategies in advance and respond flexibly to thrive in an environment where risks and opportunities coexist.

FAQ

How does Triple Witching Day differ from regular trading days?

On Triple Witching Day, stock options, stock index options, and stock index futures contracts expire simultaneously. Market trading volume and volatility are significantly higher than on regular trading days. Traders typically adjust positions in the final hour, leading to price anomalies.

How does Triple Witching Day affect individual investors?

Individual investors face higher price volatility and liquidity changes on Triple Witching Day. Failure to adjust positions promptly may result in losses due to significant market volatility. Professional institutions recommend that investors develop risk management strategies in advance.

How can traders identify high market risks on Triple Witching Day?

Market risks on Triple Witching Day are primarily reflected in surging trading volume and increased price volatility. Investors can monitor contract expiration dates, trading volume changes, and market news. U.S. market data shows an increased probability of market pullbacks after Triple Witching Day.

What strategies should traders adopt on Triple Witching Day?

Traders can close or roll over contracts in advance and use hedging tools like buying put options. Institutional investors often use quantitative models to predict volatility and dynamically adjust trading strategies. Staying vigilant and strictly implementing stop-loss measures help reduce risks.

What are the main market opportunities on Triple Witching Day?

Triple Witching Day offers opportunities for momentum trading, arbitrage, and high-frequency trading. High trading volume and price anomalies facilitate capturing short-term trends. Some traders leverage market imbalances for pair trading to increase profitability.

By dissecting Triple Witching’s market impacts, you’ve learned to navigate contract expirations’ volatility and liquidity surges, but high cross-border fees, currency volatility, and offshore account complexities can hinder swift U.S. position adjustments, especially during the final hour’s volume spikes or price swings. Imagine a platform with 0.5% remittance fees, same-day global transfers, and zero-fee contract limit orders, enabling seamless Triple Witching strategies via one account?

BiyaPay is tailored for Triple Witching traders, offering instant fiat-to-digital conversions to act on expiration signals nimbly. With real-time exchange rate query, monitor USD trends and transfer at optimal moments to cut costs. Covering most regions with instant arrivals, it powers rapid allocations to S&P 500 index options (like SPX) or futures contracts. Crucially, trade U.S. and Hong Kong derivatives through a single account, leveraging zero-fee contract limit orders for volume-surge-based limit strategies.

Whether seizing arbitrage plays or mitigating price dislocation risks, BiyaPay fuels your edge. Sign up now, visit stocks for U.S. prospects—quick setup unlocks cost-effective, data-driven trading. Join global traders and triumph in 2025’s “storm days”!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.