- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Dividend Doubling Strategy: Accelerate Your Investment Returns

Image Source: pexels

Do you want to accelerate your investment returns? The stock dividend multiplier technique can help you achieve this. Through scientific stock selection and dividend reinvestment, you can realize the compounding effect. Data shows that adopting a dividend reinvestment strategy yields an average annual return of 9.9%, compared to only 6.5% without reinvestment:

| Investment Strategy | Average Annual Return |

|---|---|

| Dividend Reinvestment | 9.9% |

| No Dividend Reinvestment | 6.5% |

Many U.S. companies offer Dividend Reinvestment Plans (DRIPs), allowing you to automatically purchase additional shares with each dividend, thereby boosting future returns. You can also use dividend reinvestment to increase your shareholding during market downturns, further expanding long-term return potential. You need to focus on practical operations and risk control to make your investments more efficient.

Key Points

- Through dividend reinvestment, you can achieve the compounding effect, significantly improving your investment returns.

- Select stocks with annualized dividend yields between 2% and 3% to ensure stable dividends and company growth.

- Regularly monitor and adjust your investment portfolio to adapt to market changes and maintain flexibility.

- Utilize Dividend Reinvestment Plans (DRIPs) to automatically purchase more stocks, maximizing compound growth.

- Focus on the company’s financial health and dividend history to ensure the selected stocks have sustainable dividend-paying capacity.

Overview of the Stock Dividend Multiplier Technique

Image Source: unsplash

Principles and Advantages

You can use the stock dividend multiplier technique to accelerate your investment returns. The core of this strategy lies in reinvesting dividends to continuously purchase more stocks, allowing both your principal and returns to generate compound interest.

The goal of the stock dividend multiplier technique is not only to obtain stable cash flow but also to help you achieve wealth growth in the long term, making it particularly suitable for those seeking passive income through investments.

When implementing the stock dividend multiplier technique, you can gain the following advantages:

- You can leverage the reliability of dividends to pursue sustained portfolio growth.

- Dividends from blue-chip stocks are typically stable, providing income sources similar to real estate or bonds.

- Through Dividend Reinvestment Plans (DRIPs), you can continuously amplify investment returns via compounding.

- Companies that pay dividends are generally more stable with lower stock price volatility, suitable for investors with lower risk tolerance.

- As company profits grow, dividend payments also increase, helping you combat inflation.

- In the U.S., qualified dividends are typically taxed at a lower rate than ordinary income, making your investments more tax-efficient.

- By holding dividend-paying stocks across different industries, you can enhance portfolio diversification and reduce overall risk.

Dividend Mechanism Explained

When investing in the U.S. market, you will encounter various dividend types and key dates. Understanding these mechanisms helps you better grasp the operational rhythm of the stock dividend multiplier technique.

- Cash Dividends: Companies pay you directly in dollars, typically distributed quarterly.

- Stock Dividends: Companies reward you with additional shares, increasing your shareholding proportion.

- Property Dividends: Companies distribute non-cash assets, such as equipment or real estate.

- Scrip Dividends: Companies promise to pay dividends at a future date.

- Liquidating Dividends: Cash or assets paid during company dissolution or restructuring.

You also need to pay attention to the following key dates:

- Declaration Date: The date the company officially announces it will pay a dividend.

- Ex-Dividend Date: Buying stocks on or after this date means you won’t receive the current dividend.

- Record Date: The date the company determines which shareholders are eligible for the dividend.

The dividend payment mechanism in the U.S. market is typically based on the company’s profitability and shareholder return expectations. By analyzing a company’s historical dividends and profitability, you can assess the sustainability of its future dividends.

Many U.S. companies offer Dividend Reinvestment Plans, allowing you to automatically use dividends to purchase more stocks, further enhancing the compounding effect.

Implementation Steps

Stock Selection Criteria

When implementing the stock dividend multiplier technique, you first need to learn scientific stock selection. Choosing suitable dividend-paying stocks is the foundation for achieving compound growth. You can focus on the following core criteria:

- Yield: Prioritize stocks with annualized dividend yields between 2% and 3%. This range typically indicates that the company can provide stable dividends without compromising growth due to excessive payouts.

- Payout Ratio: The ideal payout ratio should be below 50%. This allows the company to retain sufficient profits for reinvestment and market adaptability, making dividends more sustainable.

- Dividend Growth Rate: Choose companies with a dividend growth rate exceeding 6% over five years. Such companies typically have strong profitability and growth potential, helping you counter inflation.

- Financial Strength: Pay attention to the company’s balance sheet and cash flow to ensure it has a strong financial foundation.

- Dividend Safety: The company should have the ability to consistently pay dividends, avoiding interruptions due to performance fluctuations.

- Consistent Dividend Payment History: Prioritize companies with years of uninterrupted dividend payments, as they are more trustworthy.

By applying these criteria, you can select high-quality dividend stocks, laying a solid foundation for subsequent dividend reinvestment and compound growth.

Dividend History Analysis

Analyzing dividend history helps you assess the stability and growth potential of future dividends. You can start with the following aspects:

- Evaluate the scale and frequency of dividend payments. Check the company’s annual or quarterly dividend amounts to determine if they are steadily increasing.

- Understand the company’s financial health. Review annual reports and financial statements, focusing on metrics like net profit and free cash flow.

- Consider the stability and growth of dividend payments. Prioritize companies with uninterrupted and incrementally increasing dividends.

- Collect relevant data from annual reports and other financial documents. Use public information to calculate average dividends and assess risks based on historical payments.

You can also refer to statistical data to understand the relationship between dividend growth and long-term returns. Data shows that the S&P 500 index’s returns have an 83% correlation with dividend growth. For example, the Vanguard Dividend Appreciation ETF (VIG) has an annualized return of 8.92%, close to the SPY’s 8.65%, but with lower volatility and smaller maximum drawdowns. This indicates that companies with consistent dividend growth perform more steadily over the long term.

| Metric | Correlation |

|---|---|

| S&P 500 Returns | 58% |

| Earnings | 64% |

| Dividends | 83% |

Reinvestment Strategy

To fully harness the power of the stock dividend multiplier technique, you must prioritize dividend reinvestment. Reinvesting dividends allows you to continuously increase your shareholding, creating a compounding effect. Common reinvestment strategies include:

- Dividend Reinvestment Plans (DRIPs): You can automatically use received dividends to purchase more company stocks, saving on transaction fees and maximizing compound growth.

- The Power of Compounding: Each reinvested dividend increases your share count, leading to higher dividend payments in the next cycle, creating a snowball effect.

- Dollar-Cost Averaging: Regularly invest a fixed amount in target stocks, using market fluctuations to lower average costs.

- Diversified Investment: Spread investments across different industries to reduce risks from a single sector’s downturn.

You can also compare automatic versus manual reinvestment. Automatic reinvestment plans (DRIPs) typically have lower fees and enable immediate reinvestment, maximizing compounding effects. Manual reinvestment offers flexibility but may lose some compounding benefits due to delays.

| Feature | Automatic Reinvestment Plans (DRIPs) | Manual Reinvestment |

|---|---|---|

| Costs and Fees | Typically lower, many companies offer free services | May incur higher transaction fees |

| Compounding Impact | Immediate reinvestment maximizes compounding benefits | Potential delays in reinvestment may reduce compounding effects |

| Investment Control | Automatically purchases the same stock | Investors can choose which stocks to reinvest in |

| Flexibility | Lower | Higher, allows for portfolio diversification |

You can prioritize DRIPs for cost-efficiency and effectiveness. If you want to actively adjust your portfolio, you can also combine manual reinvestment strategies.

Portfolio Adjustment

The stock dividend multiplier technique is not a set-it-and-forget-it strategy. You need to regularly monitor and adjust your portfolio to adapt to market changes and personal goals. You can adopt the following practices:

- Pursue monthly dividend stocks, such as Realty Income Corp., Ellington Financial Inc., and SL Green Realty Corp., to allow compounding to occur more frequently.

- Seek Dividend Aristocrats, companies that have increased dividends for at least 25 consecutive years, for more stable returns.

- Consider special dividend stocks to boost overall returns with one-time dividends.

- Use DRIPs to automatically reinvest dividends, continuously expanding your holdings.

- Regularly monitor DRIP performance to ensure alignment with financial goals.

- Adjust your portfolio based on market changes, responding promptly to economic indicators and stock price fluctuations.

You don’t need to adjust your holdings frequently every month. Generally, rebalancing once a year is more reasonable. You can adjust your holdings based on market conditions and personal needs. In cases of extreme market volatility, set a 7-10% rebalancing range to avoid costs from excessive trading.

Remember, building and optimizing a dividend portfolio is a continuous process. Only through constant learning and adjustment can the stock dividend multiplier technique consistently deliver results in your investment journey.

Screening Techniques

Dividend Sustainability

When screening dividend stocks, you should focus on dividend sustainability. A consistently growing dividend history is a strong positive signal. You can use financial data services to check a company’s dividend records over the past 5, 10, or 20 years. Companies that maintain dividend growth even during economic cycles are more reliable. You also need to compare the company’s debt-to-equity ratio, as excessive debt may indicate risks. Free cash flow (FCF) covering per-share dividends suggests the company has sufficient operational strength to support dividends. You can assess the company’s competitive advantages and management team to ensure they prioritize shareholder returns. Companies in stable industries typically offer more consistent dividends, helping you achieve the goals of the stock dividend multiplier technique.

- Consistently growing dividend history

- Reasonable debt-to-equity ratio

- Adequate free cash flow

- Clear competitive advantages

- Excellent management team

- Industry stability

Financial Report Data Application

You can use financial report data to assess dividend safety and growth potential. The payout ratio is a key indicator, reflecting how much of the company’s earnings are used for dividends. Generally, a payout ratio below 70% indicates the company can comfortably pay dividends while retaining enough earnings for reinvestment, making dividends safer. A ratio between 70% and 90% is generally considered safe but requires monitoring future earnings changes. A ratio above 90% poses higher risks, as the company may cut dividends. You can also focus on free cash flow, earnings stability, debt levels, return on equity (ROE), and five-year dividend growth rates. These metrics help you comprehensively evaluate dividend sustainability.

| Payout Ratio Range | Implication |

|---|---|

| Below 70% | The company can comfortably pay dividends and retain sufficient earnings for reinvestment. |

| 70% to 90% | Generally considered safe but may raise some concerns. |

| Above 90% | High risk of dividend cuts, as the company uses nearly all earnings for dividends. |

Avoiding High-Yield Traps

When screening high-dividend stocks, you need to beware of high-yield traps. High yields are sometimes a tactic used by financially distressed companies to attract investors, which is unsustainable in the long term. High debt levels can limit a company’s investment capacity, affecting dividend stability. If a company pays dividends using debt or declining cash flow, the dividends are likely unsustainable. When the dividend coverage ratio falls below 1.5, the company may face the risk of cutting dividends. You should combine financial report data and industry context to avoid being misled by high yields and select high-quality companies with sustainable dividends.

Risks and Considerations

Image Source: pexels

Dividend Traps

When selecting dividend stocks, you may encounter dividend traps. Some companies offer high dividends on the surface but have poor financial conditions, making dividends unsustainable. You can identify and mitigate risks through the following methods:

- Check the company’s financial statements and earnings reports to analyze dividend sustainability.

- Compare dividend yields within the industry and stay cautious of abnormally high yields.

- Review the company’s dividend history and current fundamentals, noting any records of dividend cuts.

Remember, stable dividends come from healthy business operations. High dividends don’t always mean high returns; only companies with solid fundamentals can deliver long-term gains.

Market Volatility

Market volatility can affect your portfolio’s value and may cause emotional stress. When implementing the stock dividend multiplier technique, you need to focus on the following:

- Dividends may be reduced without notice, affecting your income expectations.

- Stock prices are heavily influenced by market fluctuations, potentially experiencing significant short-term volatility.

- Focusing on portfolio value can be swayed by market sentiment, leading to decision-making errors.

You can address market volatility through the following methods:

- Hold companies that can maintain or grow dividends, as these typically perform better in less volatile conditions.

- Use a dividend investment strategy to secure a stable income stream regardless of market changes.

- Establish reliable income sources to reduce focus on short-term market fluctuations, emphasizing long-term returns.

As a dividend investor, you should focus on dividend growth and compounding effects. Dividends provide certainty amid uncertainty, helping you achieve both income and capital growth.

Diversified Investment

Diversification is an effective way to reduce risk. You can optimize your dividend portfolio through the following measures:

- Add reasonably priced dividend stocks to avoid concentrated holdings.

- Diversify across asset classes, such as holding stocks, bonds, and real estate investment trusts simultaneously.

- Consider global investments, selecting high-quality dividend-paying companies outside the U.S. to enhance return stability.

- Regularly rebalance your portfolio to ensure asset allocation aligns with your risk tolerance and financial goals.

| Diversification Method | Advantage |

|---|---|

| Adding Dividend Stocks | Reduces single-company risk |

| Cross-Asset Class Investment | Mitigates market volatility |

| Global Asset Allocation | Enhances return stability |

| Regular Rebalancing | Maintains portfolio health |

Through diversification, you can effectively reduce concentration and volatility risks, enabling the stock dividend multiplier technique to perform well in various market environments.

Case Studies

Success Stories

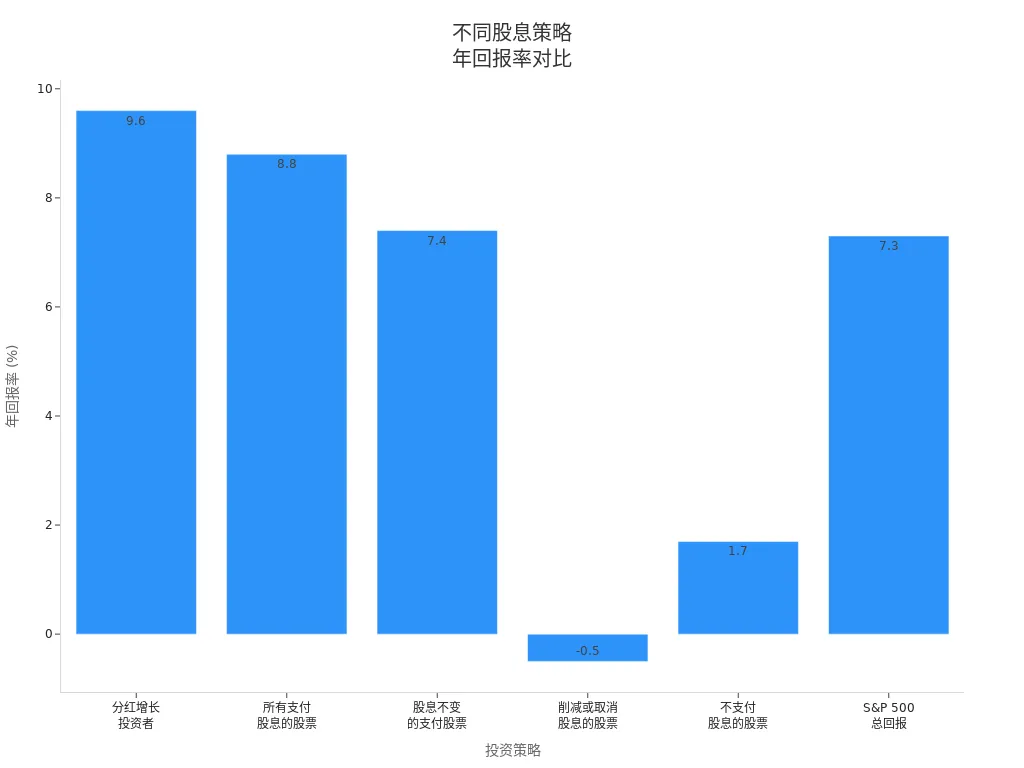

You can understand the power of the stock dividend multiplier technique through real-world cases. Many U.S. investors have used dividend reinvestment strategies to achieve long-term returns far exceeding the market. The table below shows the annual returns of different investment strategies:

| Investment Strategy | Annual Return |

|---|---|

| Dividend Growth Investors | 9.6% |

| All Dividend-Paying Stocks | 8.8% |

| Stocks with Unchanged Dividends | 7.4% |

| Stocks that Cut or Eliminated Dividends | -0.5% |

| Non-Dividend-Paying Stocks | 1.7% |

| S&P 500 Total Return | 7.3% |

You can see that dividend growth investors’ annual returns significantly outperform other strategies. The chart below visually illustrates the annual return differences among six investment strategies:

During the 2022 U.S. stock bear market, some well-managed dividend growth portfolios still achieved 6-7% positive returns, while the S&P 500 index fell nearly 20%. If you persist with dividend reinvestment, the annualized return over 40 years can increase from 8.6% to 11.6%, with the extra 3% accounting for 25% of the total return.

You can also refer to this example: Investing $100 in the S&P 500 index in 2001 and reinvesting all dividends would be worth over $350 today.

These data demonstrate that long-term adherence to dividend reinvestment can lead to higher compounding returns and stronger risk resistance.

Lessons Learned

When practicing the stock dividend multiplier technique, you can summarize the following success lessons:

- You need to deeply understand the business models and competitive environments of the companies you invest in.

- You must remain patient, holding high-quality dividend stocks long-term to enjoy compound growth.

- You should focus on the company management’s capital allocation capabilities, choosing companies that excel at creating value for shareholders.

- You can diversify risk and enhance return stability through global asset allocation.

- You should prioritize companies with consistently growing dividends and persist in reinvesting dividends.

The table below summarizes key practices of successful investors:

| Success Factor | Description |

|---|---|

| Identifying Quality Stocks | Choose companies with strong brands and good management |

| Consistently Growing Dividends | Invest in companies that continuously increase dividends |

| Dividend Reinvestment | Use dividend reinvestment to achieve compound growth |

| Diversified Portfolio | Reduce individual stock risk through diversification |

Through global asset allocation, you can achieve stable cash flow and enjoy the dual potential of capital appreciation. Dividends provide consistent income, while capital appreciation drives wealth growth. By adhering to scientific stock selection and dividend reinvestment, you can achieve stable long-term returns in various market environments.

When practicing the stock dividend multiplier technique, you can follow these core principles:

- Dividend reinvestment accelerates compound growth.

- Select high-quality dividend growth stocks and maintain a diversified portfolio.

- Continuously learn and optimize strategies to adapt to market changes and improve decision-making.

- Focus on payout ratios and dividend coverage ratios and regularly review portfolio performance. Long-term adherence to risk management can yield higher annualized returns and lower volatility.

| Metric | Annualized Total Return | Annualized Standard Deviation |

|---|---|---|

| Dividend Growers (Russell 1000) | 11.41% | 14.35% |

| Russell 1000 Index | 11.07% | 15.87% |

FAQ

Is the Stock Dividend Multiplier Technique Suitable for Beginner Investors?

You can start with small amounts and choose high-quality dividend stocks in the U.S. market. Dividend Reinvestment Plans (DRIPs) are simple to operate, making them suitable for beginners to gradually accumulate experience and wealth.

How Much Capital Do I Need to Start?

You can begin with as little as $100. Many U.S. brokers support fractional share purchases and automatic dividend reinvestment, lowering the investment threshold.

Does Dividend Reinvestment Create a Tax Burden?

Cash dividends you receive are typically subject to taxes. Even if you opt for automatic reinvestment, tax obligations remain. You should understand U.S. tax policies in advance.

How Can I Determine If a Stock’s Dividend Is Sustainable?

You can review the company’s payout ratio, free cash flow, and dividend history. Consistently growing dividends and healthy financial conditions indicate more reliable dividends.

Is the Stock Dividend Multiplier Technique Effective During Market Downturns?

When you persist with dividend reinvestment, market downturns allow you to buy more stocks with the same dividends. In the long term, this helps enhance your overall returns.

By mastering the stock dividend doubling strategy through smart stock selection and dividend reinvestment, you’ve unlocked the power of compounding returns, but high cross-border fees, currency volatility, and complex offshore account setups can limit swift responses to U.S. dividend opportunities or portfolio adjustments, especially when leveraging DRIPs or buying undervalued stocks. Imagine a platform with 0.5% remittance fees, same-day global transfers, and zero-fee contract limit orders, enabling seamless dividend strategies via one account?

BiyaPay is tailored for dividend investors, offering instant fiat-to-digital conversions to act on market signals nimbly. With real-time exchange rate query, monitor USD trends and transfer at optimal moments to cut costs. Covering most regions with instant arrivals, it powers rapid allocations to S&P 500 Dividend Aristocrat ETFs (like VIG) or stable blue-chip stocks. Crucially, trade U.S. and Hong Kong markets through a single account, leveraging zero-fee contract limit orders for long-term reinvestment strategies.

Whether amplifying compounding via DRIPs or buying more shares during dips, BiyaPay fuels your edge. Sign up now, visit stocks for U.S. prospects—quick setup unlocks cost-effective, data-driven investing. Join global investors and thrive in 2025’s markets!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.