- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

2025 Top 5 Investment Guide for Chinese Concept Stocks by Market Value

Image Source: unsplash

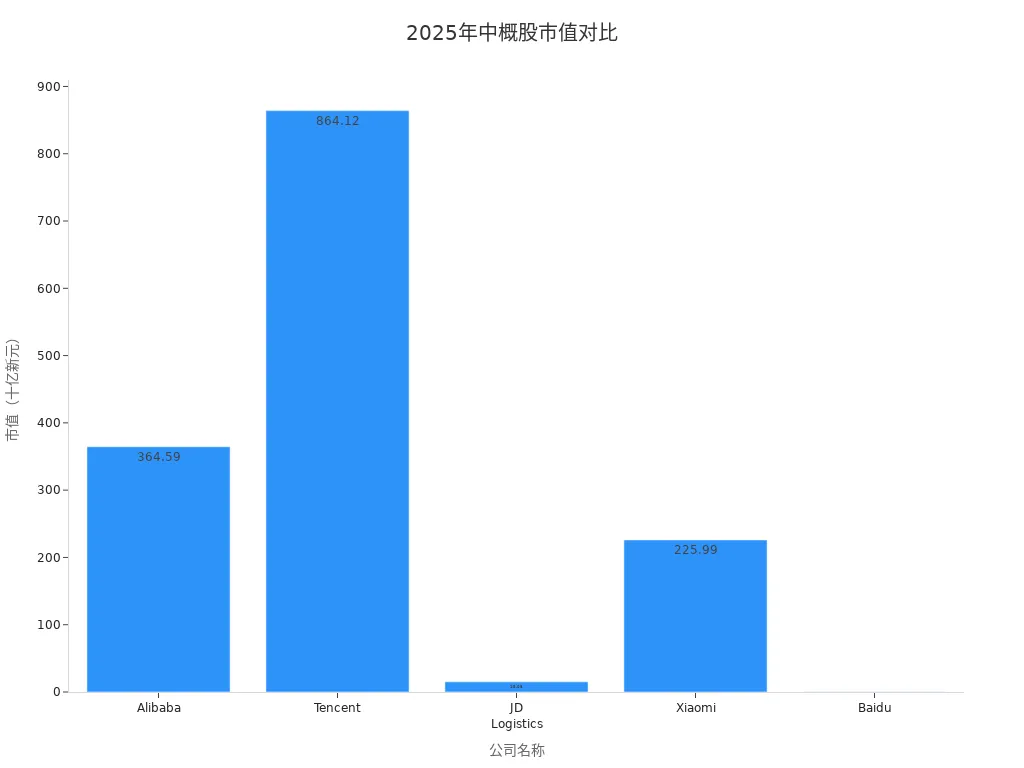

You can quickly grasp global investment trends by focusing on the top 5 China concept stocks by market capitalization in 2025. These companies include Alibaba, Tencent, JD Logistics, Xiaomi, and Baidu. The table below shows their market capitalization changes:

| Company Name | Market Capitalization (USD) | 2025 Market Cap Change |

|---|---|---|

| Alibaba | $36.459 billion | +42.43% |

| Tencent | $86.412 billion | +42.23% |

| JD Logistics | $1.508 billion | +2.44% |

| Xiaomi | $22.599 billion | +54.56% |

| Baidu | $385,000 | +6.00% |

You can focus on these investment themes:

- Contrarian tactical opportunities are gradually emerging

- Market sentiment toward Chinese companies may be overly pessimistic

- Current valuations show a clear discount compared to global peers

- E-commerce, gaming, home appliances, and industrial sectors benefit from supply chain changes

You will understand the investment logic of major leading companies by analyzing the market capitalization of China concept stocks.

Key Points

- Focus on the top 5 China concept stocks by market capitalization in 2025 to grasp global investment trends and understand market changes.

- Diversify investments across different types of China concept stocks to reduce risks from a single industry or company, enhancing investment safety.

- Regularly review your investment portfolio and dynamically optimize allocations based on market changes to ensure the effectiveness of your investment strategy.

- Monitor companies’ developments in technological innovation, market expansion, and regulatory policies, adjusting investment decisions promptly.

- Use ETFs to achieve diversified investments, reduce risks, and seize growth opportunities in China concept stocks.

TSMC

Company Overview

You can view TSMC (Taiwan Semiconductor Manufacturing Company) as a global leader in semiconductor manufacturing. Headquartered in Taiwan, China, the company focuses on providing chip manufacturing services for global technology companies. TSMC adopts a pure-play foundry model, not competing with its clients, and focuses on producing high-quality chips. You will find that many smartphones, servers, and automotive electronics rely on TSMC’s technological support.

Market Capitalization

By 2025, TSMC’s market capitalization has reached $1345.027B, growing by 129% over five years. You can refer to the table below to understand TSMC’s market cap changes:

| Year | Market Capitalization | Percentage Change |

|---|---|---|

| 2025 | $1345.027B | 129% growth |

TSMC ranks among the top in China concept stock market capitalization, demonstrating strong market recognition.

Core Business

TSMC’s main revenue comes from smartphone, high-performance computing, IoT, and automotive chip manufacturing. You can refer to the table below to understand the revenue contributions of each business segment:

| Business Segment | Estimated Revenue Contribution (2024) |

|---|---|

| Smartphones | 40% |

| High-Performance Computing (HPC) | 30% |

| Internet of Things (IoT) | 15% |

| Automotive | 7% |

| Others | 8% |

Growth Potential

You can see that TSMC’s 2024 revenue reached $2.89 trillion, with a year-over-year growth of 33.89%; its net profit was $1.16 trillion, up 36%. This indicates the company’s sustained profitability and growth momentum.

Investment Highlights

TSMC possesses the world’s largest contract semiconductor manufacturing capacity. You can observe that the company has clear advantages in innovative packaging technology, pure-play foundry model, superior yield rates, and reliability. TSMC collaborates with global tech giants, forming a flexible ecosystem that can quickly adapt to market changes.

Risk Factors

You need to pay attention to the main risks TSMC faces. Geopolitical tensions may impact chip manufacturing security, and supply chain vulnerabilities could lead to production disruptions. TSMC’s semiconductor dominance is both an advantage and a potential burden. Economic or military conflicts could affect global chip supply.

Investment Recommendations

If you focus on the long-term growth of the tech industry, TSMC is a worthy investment target. You can allocate TSMC stocks through the U.S. market to diversify investment risks. It is recommended to continuously monitor global supply chains and geopolitical changes, reasonably control investment proportions, and avoid single-risk exposure.

Alibaba

Company Overview

You can view Alibaba as China’s leading digital economy platform. The company’s operations span e-commerce, cloud computing, artificial intelligence, and logistics. Alibaba serves hundreds of millions of users and businesses worldwide through innovative technology and a diversified ecosystem. You will find that Alibaba continuously promotes the integration of online and offline channels, enhancing user experience.

Market Capitalization

By 2025, Alibaba’s market capitalization has reached $376.82 billion, up 87.07% from 2024. You can refer to the table below to understand its market cap changes:

| Year | Market Capitalization (USD billion) | Growth Rate |

|---|---|---|

| 2023 | 198.56 | N/A |

| 2024 | 201.00 | N/A |

| 2025 | 376.82 | 87.07% |

Core Business

Alibaba’s core businesses include e-commerce platforms (such as Tmall and Taobao), cloud computing, artificial intelligence, and logistics services. You can see that Alibaba Cloud provides AI infrastructure for enterprises, its e-commerce platforms connect hundreds of millions of consumers, and its logistics network supports efficient delivery. The company also actively expands into overseas markets, promoting global development.

Growth Potential

You can observe from the data that Alibaba’s 2025 annual revenue reached $996.35 billion, with an annual growth rate of 5.86%. The quarterly growth rate was 1.82%, and the revenue growth rate was 5.32%. These figures indicate that the company maintains stable growth and sustained profitability.

| Metric | Value |

|---|---|

| Revenue Growth Rate | 5.32% |

| Quarterly Growth Rate | 1.82% |

| Annual Revenue | 996.35B USD |

| Annual Growth Rate | 5.86% |

Investment Highlights

You can focus on the following investment highlights:

| Investment Highlight | Description |

|---|---|

| Artificial Intelligence | Launched Qwen3, an open-source AI model with 235 billion parameters, supporting multiple languages, solidifying Alibaba’s dominance in the AI ecosystem. |

| Cloud Computing | Alibaba Cloud focuses on AI-native infrastructure and developer tools, driving innovation and improving customer retention and operational efficiency. |

| Capital Reallocation | Redirecting capital from non-core businesses to high-return AI and cloud computing projects, simplifying operational complexity. |

| Shareholder Returns | Repurchased $16.5 billion in shares in fiscal year 2025 while maintaining dividend yields, reflecting a commitment to capital efficiency. |

| Global Expansion | Established new data centers in Southeast Asia, supporting over 5,000 enterprises and 100,000 developers, advancing strategic international market layouts. |

Risk Factors

You need to pay attention to the following risks:

- Regulatory Impacts: The Chinese government previously halted Ant Group’s IPO and imposed hefty antitrust fines on Alibaba, with ongoing changes in fintech and platform regulations.

- China’s Economic Slowdown: Insufficient consumer confidence and uneven recovery impact retail spending.

- Competitive Pressure: Emerging platforms like Pinduoduo and Douyin continue to erode market share, pressuring profit margins and customer loyalty.

- Geopolitical Risks: Tensions in U.S.-China relations, delisting risks, and export restrictions affect AI and cloud computing businesses, while fluctuations in foreign investor sentiment impact valuations.

Investment Recommendations

You can consider Alibaba as part of a diversified investment portfolio. It is recommended to focus on the company’s innovation progress in AI and cloud computing while closely monitoring regulatory policies and international developments. You can allocate Alibaba stocks through the U.S. market, reasonably diversifying risks to avoid over-concentration.

Pinduoduo

Company Overview

You can view Pinduoduo as a leading social e-commerce platform in mainland China. The company attracts a large number of users to participate in interactive shopping through its innovative group-buying model. Pinduoduo is committed to providing cost-effective products and continuously optimizing the shopping experience. You will find that Pinduoduo not only serves the mainland China market but also actively expands its international business, enhancing its global influence.

Market Capitalization

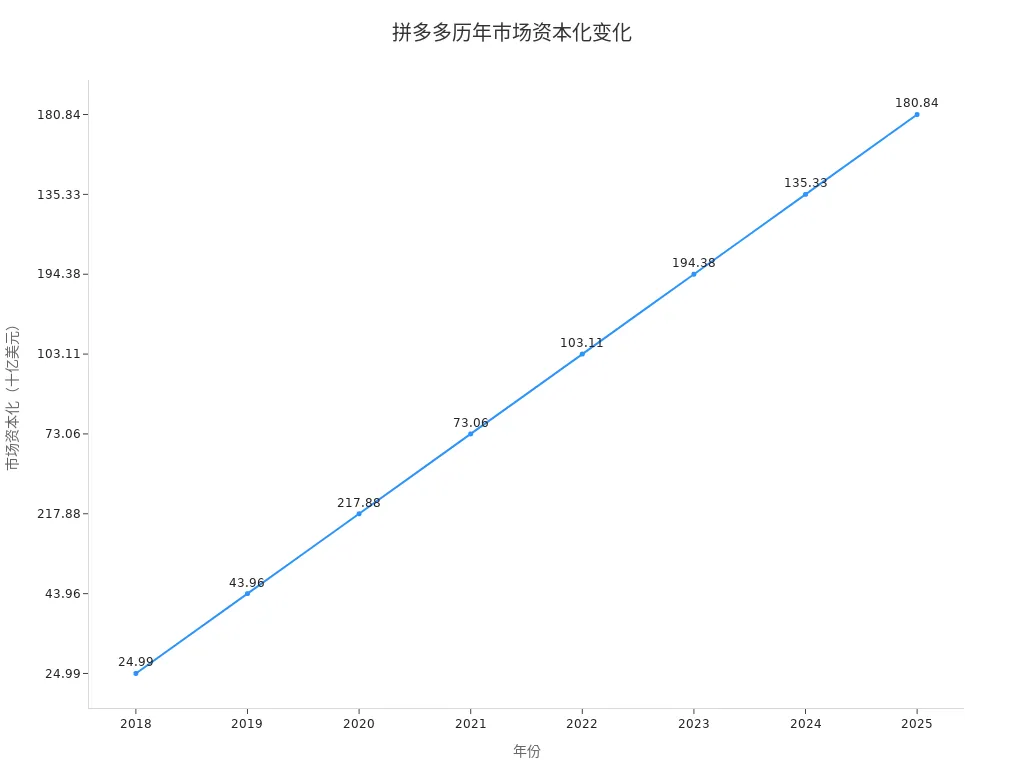

Pinduoduo’s market capitalization has experienced significant fluctuations in recent years. You can refer to the table below to understand Pinduoduo’s market cap changes from 2018 to 2025:

| Year | Market Capitalization | Change |

|---|---|---|

| 2025 | $180.84 B | 33.63% |

| 2024 | $135.33 B | -30.38% |

| 2023 | $194.38 B | 88.52% |

| 2022 | $103.11 B | 41.12% |

| 2021 | $73.06 B | -66.46% |

| 2020 | $217.88 B | 395.63% |

| 2019 | $43.96 B | 75.87% |

| 2018 | $24.99 B |

Core Business

Pinduoduo’s core business revolves around its e-commerce platform. You can see that the company enhances user experience and platform efficiency by strengthening platform construction, supporting small and medium enterprises, improving supply chain capabilities, and investing in technical infrastructure. The table below shows Pinduoduo’s key business operations and revenue drivers in 2025:

| Business Operation | Revenue Driver |

|---|---|

| Strengthening E-commerce Platform | Online marketing services |

| Supporting SMEs | Contributed $7.8 billion, up 13% year-over-year |

| Improving Supply Chain Capabilities | Increased engagement from merchants and advertisers |

| Investing in Technical Infrastructure | Profit pressure due to competitive marketing activities |

| Enhancing User Experience and Platform Efficiency |

Growth Potential

You can observe that Pinduoduo’s unique e-commerce model focuses on cost-effectiveness and interactive shopping experiences, giving the company sustained growth potential. In 2024, Pinduoduo’s revenue grew by 55%. This growth primarily comes from increased user engagement, higher consumer spending, and successful expansion into new product categories and markets.

- Increased user engagement

- Higher consumer spending

- Successful expansion into new product categories and markets

Investment Highlights

You can focus on Pinduoduo’s continued investment in technological innovation and supply chain optimization. The company enhances user stickiness and platform efficiency through social group buying and efficient logistics. Pinduoduo actively expands into international markets, particularly through the Temu platform in the U.S. and other regions, strengthening global competitiveness. You can also see that Pinduoduo supports SME growth, promoting platform diversification.

Risk Factors

You need to pay attention to the risks Pinduoduo faces during international expansion:

- Changes in international trade policies and tariffs, especially in European and North American markets

- EU compliance challenges may increase operational costs

- Changes in legal and regulatory environments, with potential future legal challenges affecting the company’s credit profile

Investment Recommendations

If you focus on innovation and growth in the e-commerce sector, Pinduoduo is worth including in your investment portfolio. You can allocate Pinduoduo stocks through the U.S. market to diversify investment risks. It is recommended to continuously monitor the company’s compliance progress in international markets and changes in global trade policies, reasonably control investment proportions, and avoid single-market risks.

NetEase

Company Overview

You can view NetEase as a leading internet technology company in mainland China. Founded in 1997, NetEase focuses on game development, online education, music, and innovative businesses. The company centers on technological innovation, continuously launching popular game products while actively expanding its AI education and music ecosystems. NetEase has a large global user base, particularly excelling in the gaming sector.

Market Capitalization

You can refer to the table below to understand NetEase’s market capitalization changes over the past five years. In 2025, NetEase’s market cap reached $98.03 billion, up 66.28% year-over-year. After a decline in 2022, the company’s market cap rebounded strongly in 2025.

| Year | Market Capitalization (USD) | Change |

|---|---|---|

| 2025 | $98.03 B | 66.28% |

| 2024 | $58.95 B | -3% |

| 2023 | $60.77 B | 27.41% |

| 2022 | $47.70 B | -29.6% |

| 2021 | $67.76 B | 3.98% |

Core Business

NetEase’s main businesses include gaming, innovative businesses, and cloud music. You will find that the gaming segment is the company’s primary revenue source, performing particularly strongly in 2025. Innovative businesses and cloud music face certain challenges, with declining revenues. The table below shows the revenue changes for each business segment:

| Business Segment | Revenue Change | Remarks |

|---|---|---|

| Gaming | Up 14% | New game releases and record-high player numbers |

| Innovative Businesses & Others | Down 18% | Facing challenges, overall performance weak |

| NetEase Cloud Music | Down 4% | Down compared to last year but up 6% from the previous quarter |

Growth Potential

You can see that NetEase’s 2025 revenue reached $38.94 billion, up 11.02% year-over-year. The company’s Q2 gross profit was RMB 18.1 billion, up 13% year-over-year. Non-GAAP net income was RMB 9.5 billion, up 22% year-over-year. These figures indicate that NetEase has strong profitability and growth momentum.

- 2025 revenue growth rate: 11.02%

- Q2 gross profit growth rate: 13%

- Non-GAAP net income growth rate: 22%

Investment Highlights

You can focus on NetEase’s continued innovation in gaming and AI education. In 2025, gaming revenue accounted for 81% of total revenue, up 13.7% year-over-year. The AI education business (Youdao) saw revenue growth of 7.2%, with AI tutoring accuracy reaching 92%. Although NetEase Cloud Music revenue fell 3.5%, it maintained high engagement with Gen Z users. The company supports AI research with gaming revenue, reducing R&D and marketing expenses by 21%, achieving strategic diversification.

| Investment Highlight | Specific Data or Growth |

|---|---|

| Gaming Revenue | Accounts for 81% of total revenue, up 13.7% year-over-year |

| AI Education (Youdao) | Revenue up 7.2%, AI tutoring accuracy at 92% |

| Music Ecosystem | Revenue down 3.5%, but maintains engagement with Gen Z |

| Strategic Diversification | Supports AI research with gaming revenue, R&D/marketing expenses down 21% |

Risk Factors

You need to pay attention to the multiple risks NetEase faces. The company faces uncertainties in legal and regulatory issues, production costs, technological innovation, sales capabilities, and international operations. The following risks deserve your focus:

- Legal and regulatory risks, including litigation and compliance issues

- Production costs and supply chain risks

- Technology dependence and innovation risks

- Macroeconomic and political environment changes

- Uncertainties from international business expansion

- Capital market volatility and exchange rate risks

Investment Recommendations

If you focus on long-term growth in the technology and entertainment sectors, NetEase is worth including in your investment portfolio. You can allocate NetEase stocks through the U.S. market to diversify investment risks. It is recommended to continuously monitor the company’s innovation progress in gaming and AI education while closely tracking global regulatory policies and economic environment changes, reasonably controlling investment proportions to reduce single-market risks.

JD.com

Company Overview

You can view JD.com as a leading comprehensive e-commerce and supply chain company in mainland China. The company is renowned for its self-operated logistics and efficient delivery, committed to providing high-quality products and services to consumers and business clients. JD.com continuously promotes technological innovation, enhances supply chain efficiency, and actively expands diversified businesses such as retail, logistics, and healthcare. You will find that JD.com has a broad user base and strong brand influence in the mainland China e-commerce market.

Market Capitalization

As of September 15, 2025, JD.com’s market capitalization is $47.03 billion, down 4.99% from the previous year. You can refer to the table below to understand JD.com’s market cap trends:

| Date | Market Capitalization (USD) | Percentage Change |

|---|---|---|

| September 15, 2025 | $47.03B | -4.99% |

| Change Record | -48.27% | |

| 164.83% |

JD.com’s market capitalization has experienced significant fluctuations, reflecting varying market expectations for its future growth and profitability.

Core Business

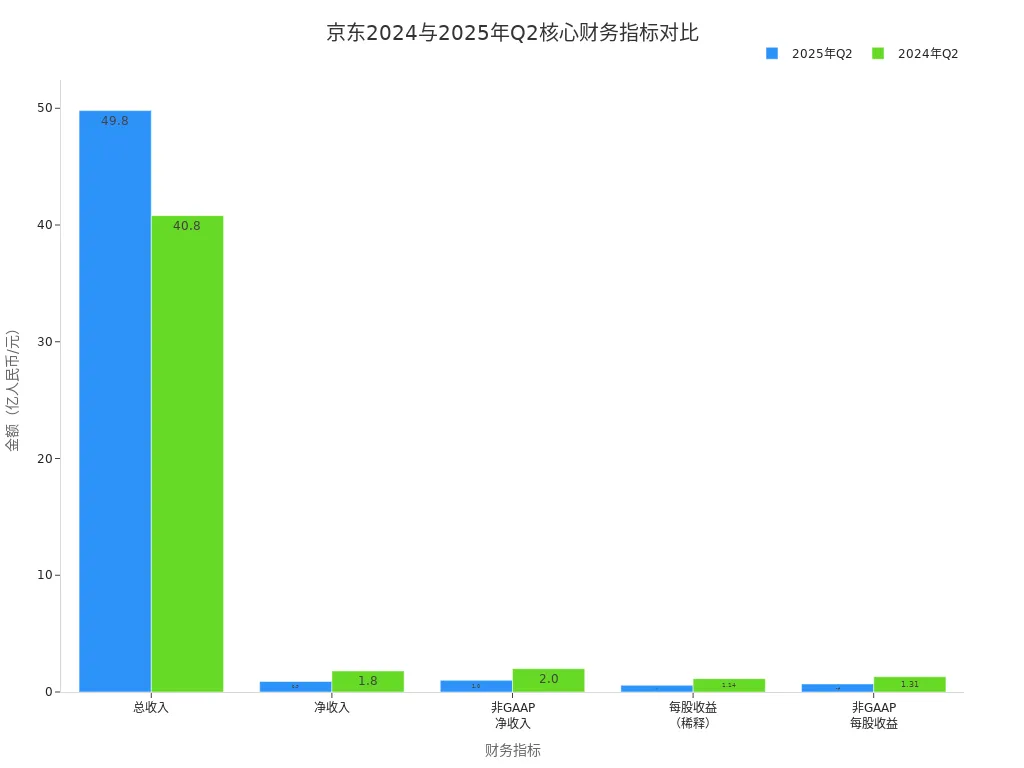

JD.com’s core businesses include retail, logistics, and services. You can see that in Q2 2025, JD.com’s total revenue was $49.8 billion, up 22.4% year-over-year. Retail business revenue reached RMB 310.1 billion, with net product revenue up 20.7% and net service revenue up 29.1%. The table below shows key financial metrics:

| Metric | Q2 2025 (USD) | Q2 2024 (USD) | Growth Rate |

|---|---|---|---|

| Total Revenue | $49.8B | $40.8B | +22.4% |

| Net Income | $0.9B | $1.8B | -50% |

| Non-GAAP Net Income | $1.0B | $2.0B | -50% |

Growth Potential

You can observe that JD.com’s 2025 revenue was RMB 356.66 billion (approximately $49.4 billion), with a year-over-year growth rate of 22.4%. However, net profit was RMB 6.2 billion (approximately $860 million), down 50.8% year-over-year. Non-GAAP net profit also fell by 49%. Revenue growth mainly came from the expansion of retail and service businesses, but profits were pressured, reflecting intensified market competition and rising costs.

Investment Highlights

You can focus on JD.com’s continued investment in supply chain and social responsibility. The company employs 900,000 people, plans to add 35,000 jobs through campus recruitment, and provides employment opportunities for people with disabilities through the “Sunshine Angel” program. The table below summarizes key investment highlights:

| Investment Highlight | Description |

|---|---|

| Consumer Revival | Driving the recovery of the mainland China consumer market |

| User Experience | Continuously optimizing the shopping experience, improving efficiency, and reducing costs |

| Supply Chain Capabilities | Strengthening the supply chain to support business growth |

| Food Delivery | Rapid growth in food delivery business, creating more cross-selling opportunities |

| Global Expansion | Leveraging supply chain technological advantages to actively expand into international markets |

| Low-Tier Markets | Penetrating low-tier markets through the Jingxi business, offering cost-effective products |

| Social Responsibility | Focusing on employee and community value, promoting inclusive employment |

You can also see that JD.com is confident in the long-term healthy growth of its core businesses, with new businesses expected to become new growth drivers, targeting high single-digit profit margins in the long term.

Risk Factors

You need to pay attention to the multiple risks JD.com faces:

- The e-commerce sector faces intense competition, with established competitors like Alibaba and Pinduoduo exerting continuous pressure.

- Meituan dominates the food delivery sector, increasing market pressure.

- Mainland China’s regulatory environment changes frequently, involving e-commerce operations, data privacy, and antitrust issues.

- Stricter regulation of price wars increases market uncertainty.

- Consumer behavior changes and the retail market’s vast potential make it difficult for any company to dominate long-term.

- Policy changes may impact business operations, with recent tightened regulations on the tech and real estate sectors.

- Cultural and governance differences affect foreign investor confidence.

Investment Recommendations

If you focus on e-commerce and supply chain innovation, JD.com is worth including in your U.S. market investment portfolio. You can focus on the company’s developments in supply chain, food delivery, and low-tier markets while closely monitoring market competition and regulatory policy changes. It is recommended to reasonably diversify investment proportions to reduce single-market and industry risks.

China Concept Stocks Market Cap Comparison

Image Source: unsplash

Industry Distribution

You can quickly understand the industry distribution of mainland Chinese companies in the global market by analyzing the top 5 China concept stocks by market capitalization. TSMC belongs to the semiconductor manufacturing industry, Alibaba, Pinduoduo, and JD.com primarily focus on e-commerce and internet services, while NetEase focuses on gaming and digital content.

The table below helps you intuitively compare the industries of each company:

| Company Name | Industry Type | Main Business Direction |

|---|---|---|

| TSMC | Semiconductor Manufacturing | Chip foundry, technological R&D |

| Alibaba | E-commerce/Cloud Computing | E-commerce, cloud services, AI |

| Pinduoduo | E-commerce | Social e-commerce, overseas expansion |

| NetEase | Gaming/Digital Content | Gaming, music, AI education |

| JD.com | E-commerce/Logistics | Retail, logistics, supply chain |

You will find that the top 5 China concept stocks cover multiple sectors, including semiconductors, internet, retail, logistics, and digital content. This diversified distribution helps you diversify investment risks.

Growth Comparison

You can assess the growth potential of these companies by comparing their revenue and profit growth over the past three years. TSMC and Pinduoduo demonstrate strong revenue and profit growth momentum. Alibaba and NetEase maintain stable growth, while JD.com faces profit pressure despite revenue growth.

The table below shows the key growth metrics for each company in 2025:

| Company Name | Revenue Growth Rate | Net Profit Growth Rate | Main Growth Drivers |

|---|---|---|---|

| TSMC | 33.89% | 36% | Technological innovation, global demand |

| Alibaba | 5.32% | Stable | Cloud computing, AI, international expansion |

| Pinduoduo | 55% | High growth | User engagement, overseas markets |

| NetEase | 11.02% | 22% | Gaming innovation, AI education |

| JD.com | 22.4% | -50.8% | Retail expansion, supply chain upgrades |

You can see that Pinduoduo and TSMC exhibit the most prominent growth potential. NetEase also shows vitality in gaming and AI education. Alibaba and JD.com face growth pressures but still maintain industry-leading positions.

Risk Comparison

When investing in the top 5 China concept stocks by market capitalization, you need to pay attention to the different types of risks each company faces. TSMC faces geopolitical and supply chain risks. Alibaba and JD.com are primarily affected by regulatory policies and market competition. Pinduoduo encounters compliance and trade barriers in international expansion. NetEase needs to address legal, innovation, and international market uncertainties.

You can refer to the table below to quickly understand the main risks for each company:

| Company Name | Main Risk Types | Risk Description |

|---|---|---|

| TSMC | Geopolitical, Supply Chain | Chip manufacturing security, global situation changes |

| Alibaba | Regulatory, Competition, Economic | Policy changes, market share pressure |

| Pinduoduo | International Compliance, Trade Barriers | Overseas market policies, legal challenges |

| NetEase | Legal, Innovation, Internationalization | Litigation risks, technological updates, overseas expansion |

| JD.com | Competition, Regulatory, Profit Pressure | Intense e-commerce competition, policy adjustments, rising costs |

You need to choose investment targets reasonably based on your risk tolerance.

Tip: You can reduce risks from a single industry or company by diversifying investments across different types of leading China concept stocks.

Investor Suitability

When selecting the top 5 China concept stocks, you can find the most suitable targets by combining your investment goals and risk preferences.

- If you pursue long-term stable growth, you can focus on TSMC and Alibaba. These two companies have strong competitiveness in the global market and mature business models.

- If you prefer high growth and innovation, consider Pinduoduo and NetEase. Pinduoduo excels in e-commerce innovation and international expansion, while NetEase continues to break through in gaming and AI education.

- If you value supply chain and retail efficiency, JD.com is a good choice. The company has unique advantages in logistics and low-tier markets.

You can allocate these leading China concept stocks through the U.S. market and use tools like ETFs to achieve diversified investments. This approach allows you to seize growth opportunities in mainland Chinese companies while effectively managing overall risks.

Investment Strategies

Image Source: pexels

Portfolio Allocation

You can effectively seize the growth opportunities of the top 5 China concept stocks by scientifically allocating your investment portfolio. You can allocate funds to different types of companies to reduce risks from fluctuations in a single industry.

For example, you can refer to the following allocation approach:

- Semiconductor Manufacturing (e.g., TSMC): 30%

- E-commerce and Cloud Computing (e.g., Alibaba, JD.com, Pinduoduo): 50%

- Gaming and Digital Content (e.g., NetEase): 20%

You can adjust the proportions of each segment based on your risk tolerance. If you prioritize stable growth, you can increase allocations to TSMC and Alibaba. If you pursue high growth, you can appropriately increase the proportions for Pinduoduo and NetEase.

You can also regularly review your investment portfolio and dynamically optimize allocations based on changes in China concept stock market capitalizations.

ETFs and Diversified Investments

You can achieve diversified investments through ETFs (Exchange-Traded Funds). ETFs typically include multiple high-market-cap China concept stock leaders. By purchasing a single ETF, you can hold stocks of multiple companies, reducing risks from a single company.

For example, in the U.S. market, you can choose ETFs that track mainland China’s technology or internet sectors. These ETFs automatically adjust the weights of their constituent stocks based on market capitalization. You can focus on the ETF’s price-to-earnings ratio and valuation levels to avoid concentrated buying at high valuations.

The table below shows the main advantages of ETF investments:

| Advantage | Description |

|---|---|

| Risk Diversification | Holds multiple companies simultaneously, reducing volatility |

| Trading Convenience | Can be bought and sold like regular stocks |

| Low Fees | Management fees are typically lower than active funds |

| High Transparency | Constituent stocks and weights are publicly disclosed, easy to track |

You can combine ETFs with individual leading stock investments to further optimize the risk-return ratio.

Risk Management

When investing in the top 5 China concept stocks by market capitalization, you need to prioritize risk management. You can take the following measures:

- Diversified Investments: Avoid investing all funds in a single company or industry. You can diversify risks through portfolio allocation and ETFs.

- Monitor Valuations: You can regularly check valuation metrics like price-to-earnings and price-to-book ratios to avoid blindly chasing highs during market exuberance.

- Dynamic Adjustments: You can adjust investment proportions in a timely manner based on market conditions and company fundamentals. For example, when a company faces significant policy risks, you can appropriately reduce holdings.

- Set Stop-Loss: You can set stop-loss lines for each stock or ETF to prevent further expansion of losses.

- Monitor External Environment: You need to closely monitor global economic, geopolitical, and regulatory policy changes and promptly assess their impact on China concept stock market capitalizations.

You can enhance investment safety and long-term returns through scientific risk management methods.

You can see that the five major China concept stocks each have their own investment highlights and risks. TSMC leads in technology, Alibaba and Pinduoduo have strong innovation capabilities, and NetEase and JD.com excel in content and supply chain sectors. You should rationally analyze each company, diversify fund allocations, and reduce single risks. It is recommended to continuously monitor market changes and scientifically formulate investment plans based on your risk preferences and goals.

FAQ

How can you invest in the top 5 China concept stocks by market capitalization in the U.S. market?

You can purchase these companies’ ADRs or directly listed stocks through U.S. stock exchanges. You can also choose related ETFs for diversified investments.

What are the main risks to focus on when investing in leading China concept stocks?

You need to focus on risks such as geopolitics, regulatory policies, international trade barriers, and corporate governance. You can regularly assess the market environment and adjust investment strategies in a timely manner.

How can you diversify investment risks?

You can allocate stocks from multiple companies or choose ETFs that include leading China concept stocks. You can also set stop-loss lines to reduce single-company risks.

How can you determine whether the valuation of leading China concept stocks is reasonable?

You can refer to metrics like price-to-earnings and price-to-book ratios, combined with the company’s growth potential and industry outlook. You can also compare valuations with global peers.

How can you obtain the latest information when investing in leading China concept stocks?

You can follow announcements from U.S. stock exchanges, company financial reports, and international financial media. You can also regularly review professional investment research reports.

Having analyzed the top five Chinese concept stocks by market cap in 2025, you’re equipped with insights into TSMC, Alibaba, Pinduoduo, NetEase, and JD’s growth highlights and risks, but high cross-border fees, currency volatility, and offshore account complexities can hinder allocating to these stocks, especially when responding to regulatory shifts or earnings releases. Imagine a platform with 0.5% remittance fees, same-day global transfers, and contract limit orders with zero fees, enabling seamless Chinese stock plays via one account?

BiyaPay is tailored for Chinese concept stock investors, offering instant fiat-to-digital conversions to act on cap changes nimbly. With real-time exchange rate query, monitor USD trends and transfer at optimal moments to cut costs. Covering most regions with instant arrivals, it powers rapid allocations to Alibaba ADRs or Pinduoduo ETFs. Crucially, trade U.S. and Hong Kong markets through a single account, leveraging contract limit orders with zero fees for P/E or growth-rate-based limit strategies.

Whether chasing tech leaders’ growth or diversifying regulatory risks, BiyaPay fuels your edge. Sign up now, visit stocks for U.S. prospects—quick setup unlocks cost-effective, data-driven investing. Join global investors and lead in 2025’s Chinese stock wave!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.