- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Which Way to Invest in Silver Suits You Best? In-depth Analysis of Five Major Avenues

Image Source: unsplash

When considering investing in silver, you first need to clarify your goals. Some people prefer short-term trading to profit quickly from market fluctuations; others lean toward long-term holding for asset preservation; and some choose silver as a hedge against inflation.

- Short-term trading: Suitable for those who enjoy frequent operations.

- Long-term holding: Suitable for those seeking stable appreciation.

- Hedging inflation: Suitable for those concerned about economic changes.

The global silver investment market continues to expand, with projections estimating a market size of $28.43 billion by 2033, with an annual growth rate of 3.31%.

| Year | Market Size (USD Billion) | Annual Growth Rate (CAGR) |

|---|---|---|

| 2024 | 21.21 | N/A |

| 2025 | 21.91 | N/A |

| 2033 | 28.43 | 3.31% |

You should combine your capital, risk tolerance, and goals to choose the silver investment method that best suits you.

Key Points

- Clarify investment goals. Short-term trading suits those who enjoy frequent operations, while long-term holding suits those seeking stable appreciation.

- Physical silver investment allows you to directly own assets, suitable for those aiming for preservation. Pay attention to storage safety and liquidity risks.

- Silver ETFs offer high liquidity and convenient trading, ideal for investors with smaller capital. Focus on management fees and market prices.

- Silver futures are suitable for experienced investors, leveraging higher returns but with greater risks. Understand market volatility and margin requirements.

- Online platform silver investments are suitable for beginners, with low entry barriers and convenient operations. Choose regulated platforms to ensure capital safety.

Physical Silver Investment

Image Source: unsplash

Introduction

You can directly own physical silver by purchasing silver bars, coins, or bullion. This method allows you to truly hold precious metals, feeling the tangible presence of your assets. Many investors choose physical silver because of its potential for long-term preservation. You can buy physical silver from precious metal dealers in the U.S. market, auction houses, or certain licensed banks in Hong Kong. Compared to gold, silver is more affordable, with a lower entry barrier.

Advantages and Disadvantages

When investing in silver, physical silver has unique advantages and risks.

Key advantages include:

- You can directly own and control physical silver.

- Silver prices are lower than gold, suitable for investors with limited capital.

- After purchase, management fees are low, unless you opt for professional storage or insurance.

- Silver coins and bars have collectible value and aesthetic appeal.

Key risks and disadvantages include:

- You need secure storage; keeping it at home may pose risks of theft or damage.

- Physical silver has lower liquidity, and you may face delays or discounts when needing to liquidate urgently.

- Market fluctuations affect silver prices, leading to uncertainty in investment returns.

- Changes in regulations and tax policies may impact your returns.

You also need to consider transaction and storage costs. The table below shows common fee types:

| Fee Type | Description |

|---|---|

| Transaction Fees | Include broker or reseller commissions, account or platform management fees, delivery or withdrawal fees. |

| Storage Fees | Depend on storage method; insurance costs are related to investment value. |

Historically, physical silver has performed well during financial crises. For example, during the 2008 financial crisis and the 2011 silver squeeze, physical silver premiums surged significantly, with stronger liquidity. You can refer to the table below:

| Crisis Event | Physical Silver | Silver ETF | Winner |

|---|---|---|---|

| 2008 Financial Crisis | Premiums soared above 40% | Traded at net asset discount | Physical |

| 2011 Silver Squeeze | Severe shortage, high premiums | Normal operations | Physical |

| 2013 Taper Tantrum | Moderate premium increase | Overall liquidity | ETF |

| 2016 Brexit | Slight premium expansion | Excellent liquidity | ETF |

Suitable Investors

If you want to own tangible assets and pursue long-term preservation, physical silver is very suitable for you. You are not concerned about taking on storage and insurance responsibilities and are willing to accept lower liquidity. You value asset safety and independence over frequent trading or short-term profits. For investors looking to diversify their portfolio and hedge against inflation, physical silver is also a good choice.

Silver ETF Investment

Image Source: pexels

Introduction

You can conveniently invest in silver through silver ETFs in the stock market. ETFs (exchange-traded funds) directly track the spot price of silver, allowing you to trade them like stocks. You don’t need to physically hold silver; you only need to purchase ETF shares in a securities account. The total asset value of global silver ETFs has reached $493,068,673, with a one-year total return of up to 55.86%.

In 2023, the global silver market was estimated at $7B, projected to exceed $11B by 2028, primarily driven by industrial demand.

Advantages and Disadvantages

When choosing silver ETFs, you can enjoy high liquidity and low bid-ask spreads. ETFs typically have bid-ask spreads of 0.05% to 0.16%, much lower than the 5-7% for physical silver. You can buy or sell ETF shares anytime during market hours, making capital liquidation very convenient.

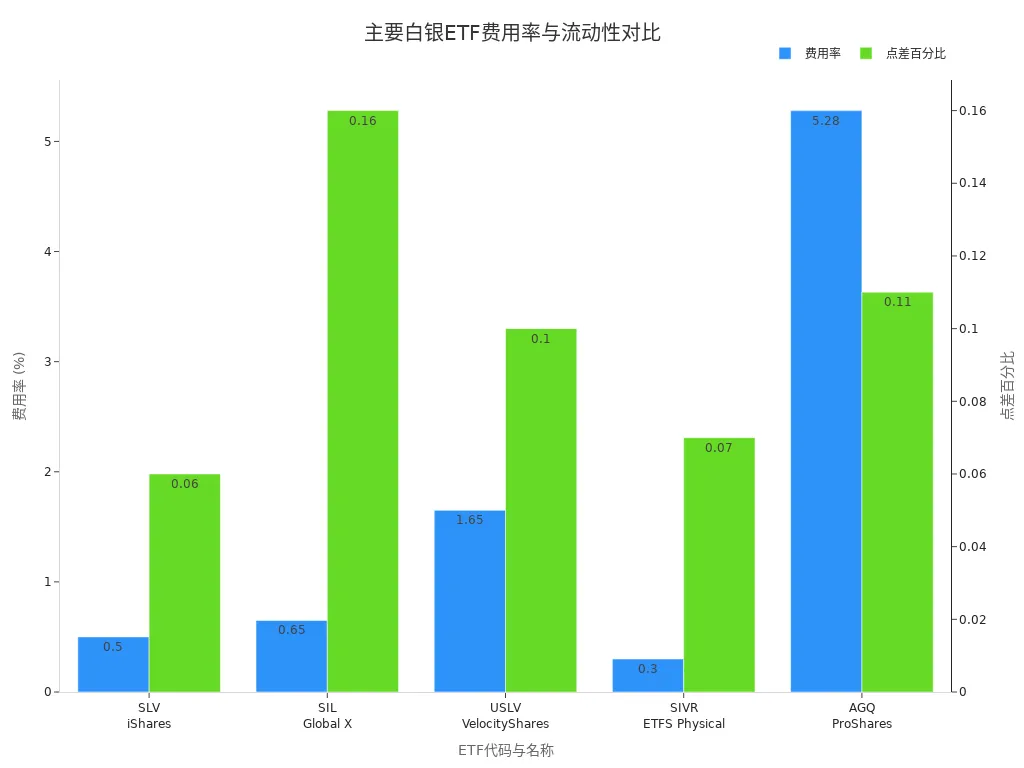

The table below shows the expense ratios and liquidity of major silver ETFs:

| TICKER | FUND NAME | EXPENSE RATIO | AUM (USD) | SPREAD % |

|---|---|---|---|---|

| SLV | iShares Silver Trust | 0.50% | $5.17B | 0.06% |

| SIL | Global X Silver Miners ETF | 0.65% | $411.10M | 0.16% |

| USLV | VelocityShares 3X Long Silver ETN | 1.65% | $361.21M | 0.10% |

| SIVR | ETFS Physical Silver Shares | 0.30% | $328.49M | 0.07% |

| AGQ | ProShares Ultra Silver | 5.28% | $208.46M | 0.11% |

You need to note that ETFs only track spot prices and cannot benefit from the premium gains of physical silver during supply shortages or market panics. For example, during supply shortages, physical silver may yield over 50% returns, while ETFs only reflect spot prices. Additionally, ETFs have management fees, which can accumulate over time for long-term holders.

Suitable Investors

If you want to invest in silver conveniently through the stock market, silver ETFs are very suitable for you. You have a smaller capital base and seek liquidity and ease of operation. Many investors choose ETFs because traditional stocks or bonds have high volatility, and they want to allocate part of their assets to precious metals for greater stability. Demand for precious metal investments rises during economic uncertainty. You don’t need to deal with the storage and insurance responsibilities of physical silver; you only need to focus on market prices and fund fees.

Silver Futures Investment

Introduction

You can participate in the silver market through silver futures contracts. Silver futures allow you to control a larger silver position with less capital. Silver futures contracts in the U.S. market are actively traded, with average open interest continuing to grow. The table below shows recent changes in open interest for major silver futures:

| Time | Open Interest |

|---|---|

| Current | 151013.0 |

| Last Week | 145618.0 |

| One Year Ago | 131408.0 |

| Change (Last Week) | +3.70% |

| Change (Last Year) | +14.92% |

You can trade silver futures through brokers on exchanges, with transparent contract specifications and margin requirements.

Advantages and Disadvantages

Silver futures investments have clear advantages and risks.

Advantages include:

- Leverage allows you to achieve greater return opportunities with less capital.

- High market liquidity makes buying and selling convenient, suitable for short-term operations.

- You can use futures to hedge and manage risks in other assets.

Disadvantages include:

- Leverage tools always carry the risk of losses exceeding the actual position value.

- You may achieve substantial profits but also face substantial losses.

- Key risks include margin calls and market volatility, which can lead to significant financial losses.

- Historically, excessive leverage and inability to meet margin calls have triggered market crises.

In silver futures trading, leverage allows you to control large positions with smaller capital. Small price fluctuations may lead to margin calls. If your margin account value falls below requirements, you need to add funds, or your position may be forcibly closed.

Suitable Investors

Silver futures are suitable for experienced investors who can tolerate high risks and seek short-term capital appreciation. You need to understand silver’s characteristics, supply and demand factors, and futures contract specifications. You should study how contracts operate, familiarize yourself with margin requirements, and develop trading strategies before trading. Misunderstanding these mechanisms can lead to high costs. You should carefully assess your risk tolerance and investment goals to decide whether to participate in silver futures trading. If you aim for higher returns through leverage and can handle the pressure of market volatility, this silver investment method may suit you.

Silver Stocks and Funds

Introduction

You can indirectly participate in the silver market by purchasing stocks of silver mining companies or investing in silver-related funds. These stocks and funds are typically listed on major U.S. stock exchanges, with trading methods similar to ordinary stocks. Silver mining stock prices are highly correlated with silver spot prices but have greater volatility. You can also invest in mutual funds or ETFs focused on the silver industry, which hold stocks of multiple silver mining companies to help diversify risk.

Advantages and Disadvantages

Investing in silver stocks and funds offers many advantages.

- You can achieve higher liquidity than physical silver, trading anytime during market hours.

- Silver mining stocks have a leverage effect on silver prices. A 10% rise in silver prices may lead to a 20% or greater increase in mining stocks; declines may also be larger.

- You don’t need to worry about storage, insurance, or transportation issues for physical silver, reducing investment costs.

- Silver funds typically hold stocks of multiple companies, helping you diversify the operational risks of a single company.

However, you also need to be aware of some risks.

- Silver mining stocks are more volatile than silver prices, and losses may be greater during market downturns.

- Individual company events (such as management changes or mine accidents) can affect stock performance, and the correlation is not always perfect.

- When investing in funds, you need to pay management fees, which can impact returns over the long term.

Silver stocks and funds are suitable for those who want to indirectly invest in silver through financial markets, especially for investors seeking high liquidity and greater return potential.

Suitable Investors

If you are an active trader who enjoys capitalizing on market fluctuations for higher returns, silver stocks and funds are a good choice. You can refer to the table below for portfolio allocation suggestions for different investor types:

| Investor Type | Physical Silver Proportion | ETF Proportion | Description |

|---|---|---|---|

| Conservative Wealth Protector | 80% | 20% | Primarily holds physical silver, with a small ETF portion for liquidity needs. |

| Balanced Investor | 50% | 50% | Balanced allocation, combining flexibility and tangible asset protection. |

| Active Trader | 25% | 75% | Focuses on ETFs and stocks, with moderate physical silver holdings as insurance. |

When investing in silver, you can flexibly choose the proportion of stocks, funds, or ETFs based on your risk tolerance and investment goals. If you seek higher returns and can accept larger price fluctuations, silver stocks and funds will provide you with more opportunities.

Online Platform Silver Investment

Introduction

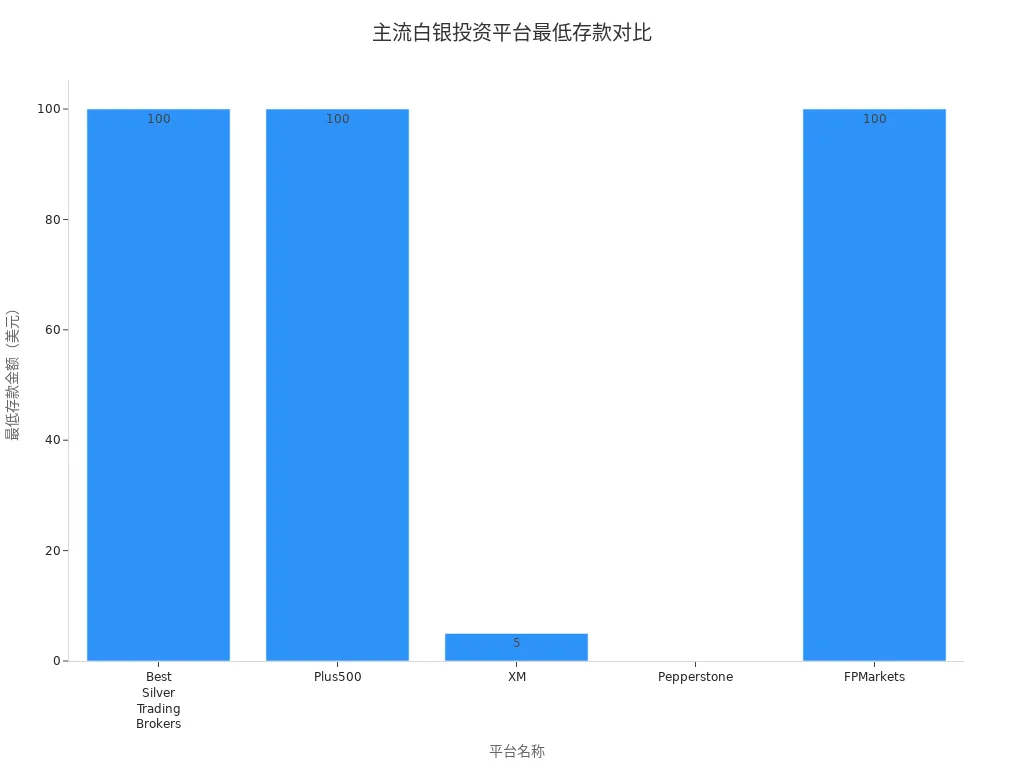

You can easily participate in silver investment through online platforms. Many mainstream platforms offer convenient account opening processes and diverse trading tools. You only need to register an account on a computer or phone to buy and sell silver contracts or related products anytime, anywhere. Mainstream platforms typically have low minimum deposit thresholds, with some requiring as little as $5 to start. The table below shows basic information for several common platforms:

| Platform Name | Minimum Deposit | License | Customer Support | Trading Platform |

|---|---|---|---|---|

| Best Silver Trading Brokers | $100 | ASIC, CySEC, CMA, STV, FSCA, FSA | 24/7 (Multilingual) | MT4, MT5, WebTrader |

| Plus500 | $100 | FCA, CySEC, ASIC, CFTC | 24/7 | WebTrader, Windows 10, Mobile Apps |

| XM | $5 | CySEC, ASIC, IFSC | 24/7 | MT4, MT5, WebTrader |

| Pepperstone | $0 | CySEC, BaFin, FCA, SCB, CMA | 24/5 | MT4, MT5, cTrader |

| FPMarkets | $100 | ASIC, CySEC, CMA, STV, FSCA, FSA | 24/7 (Multilingual) | MT4, MT5, WebTrader |

Advantages and Disadvantages

When investing in silver through online platforms, you can experience high liquidity and great trading convenience. You can buy and sell anytime without worrying about physical storage or transportation. Platforms typically offer various trading tools to help you flexibly manage funds.

However, you also need to be aware of some risks and costs:

- Price volatility can be significant, potentially leading to large losses in the short term.

- Platforms do not generate interest or dividends, and returns depend entirely on silver price movements.

- While physical storage is not required, some platforms may charge management fees or spreads.

- Traditional physical investments may face theft risks, while online platforms require attention to account security and platform compliance.

When choosing a platform, prioritize its regulatory qualifications and customer support services to ensure capital safety.

Suitable Investors

If you seek operational convenience and capital flexibility, online platform silver investment is very suitable for you. You can enter the market quickly with small capital, making it ideal for beginners and younger investors. Data shows that the proportion of millennials choosing self-directed investments increased from 13% in 2018 to 22% in 2023. Among all investors, 31% chose self-directed investment methods in 2023. The table below shows the proportion of self-directed investments by age group:

| Age Group | 2018 Self-Directed Investment Proportion | 2023 Self-Directed Investment Proportion |

|---|---|---|

| Millennials | 13% | 22% |

| All Investors | 19% | 31% |

If you enjoy using technological tools to manage assets or want to try silver investment with small capital, online platforms are an ideal choice for you.

Silver Investment Selection Suggestions

Conservative Suggestions

If you are a conservative investor, it is recommended to allocate 5-8% of your total assets to precious metals, with 60% in gold and 40% in silver, focusing on physical holdings. You can adjust the asset proportion annually to ensure manageable risks. The table below shows a typical conservative allocation:

| Investment Type | Allocation Proportion |

|---|---|

| Total Precious Metals | 5-8% |

| Gold | 60% |

| Silver | 40% |

| Focus | Physical Holdings |

| Adjustment Frequency | Annually |

You can also opt for 8-10% in gold and 2-3% in silver, with the primary goal of preservation and reducing volatility. You should prioritize physical silver or silver ETFs and reduce the proportion of high-volatility products.

Aggressive Suggestions

If you seek higher returns, you can focus on structural opportunities in the silver market. Silver prices reached $35.76 per ounce in June 2025, with a year-to-date return of 24.54%, significantly outperforming commodity indices. Over the past three years, the market has seen a supply-demand deficit exceeding 500 million ounces, with major silver mines stagnating and declining ore grades, making supply increases challenging. You can use silver futures, mining stocks, or leveraged ETFs to capitalize on market fluctuations. Silver’s low correlation with traditional assets also helps enhance portfolio diversification.

Structural supply-demand imbalances and growing green energy demand create more silver investment opportunities for aggressive investors.

Small Capital Suggestions

If you have limited capital, you can choose silver ETFs or online platforms for investment. You can gain exposure to large, established producers through the Global X Silver Miners ETF (SIL) or participate in the growth potential of smaller developers through the Amplify Junior Silver Miners ETF (SILJ). You can also combine diversified approaches to optimize risk-adjusted returns. Understand the risk and return characteristics of different products to choose the most suitable method.

- Choose established producer ETFs for lower risk.

- Choose developer ETFs for higher volatility and greater potential returns.

- Online platforms have low entry barriers, suitable for beginners to try.

Long-Term and Short-Term Goal Suggestions

If you focus on long-term investment, silver’s historical performance shows strong appreciation potential. Long-term holding typically yields more significant returns amidst market fluctuations. For example, silver investments made five years ago have nearly doubled. Short-term investments are more susceptible to price volatility and carry higher risks. You can flexibly choose the holding period based on your goals.

| Investment Horizon | Return Characteristics |

|---|---|

| Long-Term | Resilient to volatility, significant returns |

| Short-Term | Susceptible to volatility |

You should combine your capital, risk tolerance, and investment goals to choose the silver investment method that best suits you.

When choosing a silver investment method, you can refer to the table below for a quick overview of the thresholds, liquidity, and suitable investors for different methods:

| Investment Type | Minimum Investment | Liquidity | Storage Requirements | Fees/Premium | Suitable Investors |

|---|---|---|---|---|---|

| Physical Silver | ~$30 | High | Required | 5-20% | Long-term holders |

| Silver ETF | ~$25 | Instant | Not required | 0.50% annual fee | Traders |

| Mining Stocks | Varies | Instant | Not required | Brokerage fees | Risk seekers |

| Silver Futures | $6,000+ | High | Not required | Commission only | Professionals |

| Silver Mutual Funds | $1,000+ | Daily | Not required | 1-2% annual fee | Diversified investors |

You should first clarify your investment goals and assess your risk tolerance, then consider factors like storage, costs, and liquidity. Many investors often make mistakes due to lack of research, emotional decisions, or misunderstanding liquidity. Silver’s industrial demand continues to grow, with favorable long-term trends. Rationally analyze your situation and choose the silver investment method that best suits you to achieve asset appreciation and risk management.

FAQ

What are the main risks of silver investment?

When investing in silver, you may face price volatility, insufficient liquidity, and changes in market regulations. You also need to consider storage safety and platform compliance.

You should assess your risk tolerance in advance and diversify investments appropriately.

How to safely store physical silver?

You can choose a home safe or precious metal storage services from licensed banks in Hong Kong. Bank storage is safer but requires certain fees.

You should avoid storing large amounts of physical silver at home to reduce theft risks.

What is the difference between silver ETFs and physical silver?

When you invest in silver through ETFs, you don’t need to hold physical assets, and trading is more flexible. Physical silver requires storage and has lower liquidity.

| Method | Liquidity | Storage Requirement |

|---|---|---|

| ETF | High | Not required |

| Physical Silver | Low | Required |

Can small capital be used to invest in silver?

You can invest in silver with small capital through ETFs or online platforms. Some platforms require a minimum investment of just USD 5.

You should choose regulated platforms and pay attention to transaction fees and account security.

Is silver investment suitable for long-term or short-term?

You can choose long-term or short-term investment based on your goals. Long-term holding is more resilient to volatility, while short-term trading carries higher risks.

You should combine your needs and risk tolerance to develop an investment plan.

By delving into the five silver investment avenues, you’ve learned to tailor choices to goals and risks—physical silver for preservation, ETFs for ease, futures for leverage, mining stocks for indirect exposure, or online platforms for entry—but high cross-border fees, currency volatility, and complex account setups can hinder swift responses to silver market opportunities, especially during supply shortages or key price breaks. Imagine a platform with 0.5% remittance fees, same-day global transfers, and zero-fee limit orders, enabling seamless silver strategies via one account?

BiyaPay is tailored for silver investors, offering instant fiat-to-digital conversions to act on market signals nimbly. With real-time exchange rate query, monitor USD trends and transfer at optimal moments to cut costs. Covering most regions with instant arrivals, it powers rapid allocations to silver ETFs (like SLV) or mining stocks. Crucially, trade U.S. and Hong Kong markets through a single account, leveraging zero-fee limit orders for supply-deficit-based limit strategies.

Whether opting for physical silver stability or ETF liquidity, BiyaPay fuels your edge. Sign up now, visit stocks for silver prospects—quick setup unlocks cost-effective, data-driven investing. Join global investors and lead in 2025’s silver swings!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.