- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How does the initial margin affect trading profits and losses? The core logic that experts are looking at

Image Source: pexels

Are you often confused about why initial margin affects your trading results? When you use leverage, initial margin determines the contract value you can control. U.S. market research shows that the procyclicality of margin requirements can lead to systemic liquidity risks, and investors tend to shift to riskier assets when leverage is restricted.

| Research Topic | Key Findings |

|---|---|

| Margin Requirements and Systemic Liquidity Risk | Examined the pressure spillover from the OTC derivatives market to the interbank market, highlighting that procyclical margin requirements may lead to systemic liquidity risks. |

| Leverage Constraints and Investor Choices | Studied how ESMA’s interventions affect retail investors’ leverage use, finding that investors shift to riskier assets when leverage is restricted. |

You need to understand the logic of how initial margin impacts trading outcomes to better manage risks and develop strategies.

Key Points

- Initial margin is the entry threshold to the market, affecting your leverage capacity and trading scale. Properly setting margins can help you manage risks more effectively.

- High initial margin requirements reduce leverage ratios, minimizing potential losses. When market volatility increases, exchanges often raise margin requirements to protect investors.

- Initial margin directly impacts profit and loss ranges. When using high leverage, price fluctuations amplify losses, requiring cautious position control.

- Properly setting initial margins can reduce liquidation risks and protect account funds. Regularly monitoring account changes and topping up margins promptly is crucial.

- Experts dynamically adjust margin ratios based on market conditions, flexibly controlling risks. Maintaining extra cash reserves and diversified portfolios are effective safeguards.

Definition of Initial Margin

Image Source: pexels

Nature of Margin

When trading futures or derivatives, initial margin is the first threshold to enter the market. It represents the funds you must deposit upfront to qualify for leveraged trading. U.S. regulators have strict definitions and requirements for initial margins. You can refer to the table below for specific regulatory provisions on initial margin models:

| Clause | Content |

|---|---|

| (vii) | The total sum of initial margin is used to determine the total initial margin from counterparties. |

| (viii) | The initial margin model must not allow any calculated initial margin to be offset or considered against any initial margin potentially owed or payable to counterparties. |

| (ix) | The initial margin model should include all significant risks arising from the non-linear price characteristics of option positions or positions with embedded options. |

| (x) | The omission of any risk factor must first be justified to the Commission or registered futures association as appropriate. |

| (xi) | No proxy or approximation methods may be used unless their appropriateness has been demonstrated. |

| (xii) | Rigorous processes must be in place to reassess and update internal margin models. |

| (xiii) | Data used to calibrate the initial margin model must be reviewed and revised at least annually. |

| (xiv) | The complexity of the initial margin model should be proportionate to the complexity of the swaps applied. |

| (xv) | The Commission or registered futures association may require margins exceeding the model’s calculations. |

You need to understand that initial margin is not just a funding requirement but also a core tool for risk management. It directly relates to your ability to withstand market fluctuations.

Role in Trading

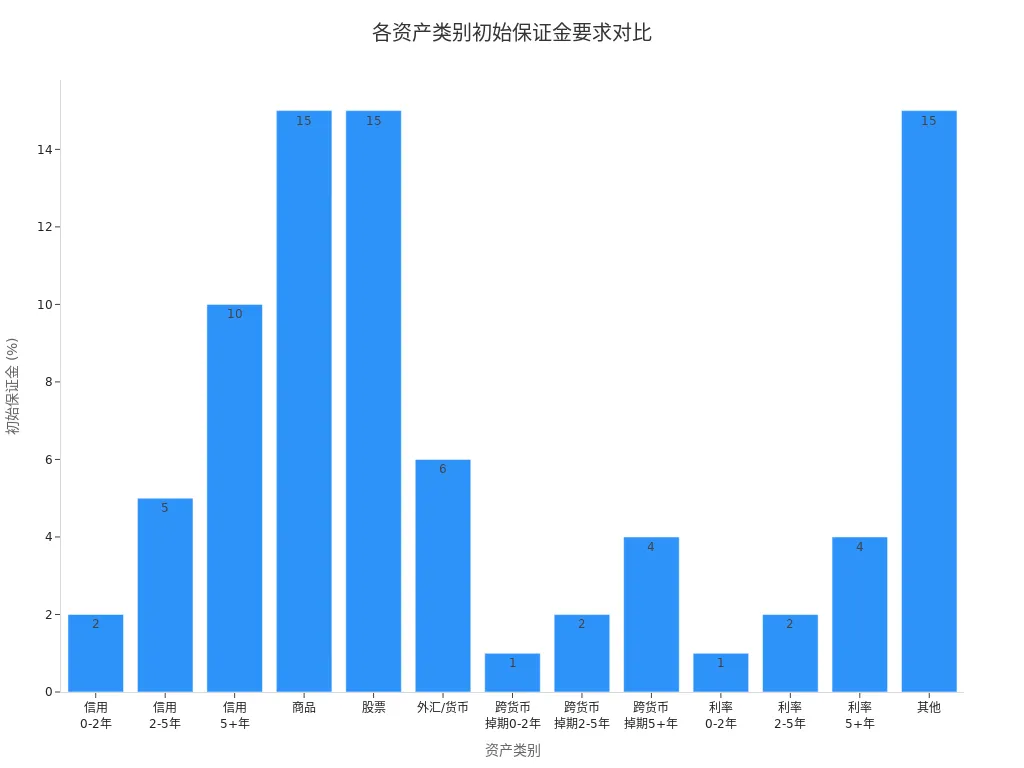

Initial margin affects your trading scale and risk tolerance. The more initial margin you deposit, the larger the contract value you can control. Margin requirements vary across exchanges and asset classes. You can refer to the table below for initial margin ratios for major asset classes (as a percentage of notional exposure):

| Asset Class | Gross Initial Margin (% of Notional Exposure) |

|---|---|

| Credit: 0-2 Year Maturity | 2 |

| Credit: 2-5 Year Maturity | 5 |

| Credit: 5+ Year Maturity | 10 |

| Commodities | 15 |

| Equities | 15 |

| Forex/Currencies | 6 |

| Cross-Currency Swaps: 0-2 Year Maturity | 1 |

| Cross-Currency Swaps: 2-5 Year Maturity | 2 |

| Cross-Currency Swaps: 5+ Year Maturity | 4 |

| Interest Rates: 0-2 Year Maturity | 1 |

| Interest Rates: 2-5 Year Maturity | 2 |

| Interest Rates: 5+ Year Maturity | 4 |

| Others | 15 |

In practice, you should also focus on the historical data and stress testing of initial margin models. Models are typically based on at least one year of historical observation, covering significant financial stress periods. This ensures that initial margin reflects real market volatility when impacting your risk management and trading decisions.

How Initial Margin Affects Trading Profits and Losses

Leverage Effect

When using a margin account, initial margin determines your leverage capacity. Leverage allows you to control larger trading positions with less capital. For example, in the U.S. market, with a 2% initial margin requirement for stock trading, you can control a USD 100,000 stock position with USD 2,000. The leverage formula is:

Leverage = 1 / Margin Requirement

If the initial margin requirement increases to 10%, your leverage capacity decreases, allowing you to control a USD 100,000 position with USD 10,000. You need to note that initial margin affects your leverage ratio. Higher initial margins lower leverage and reduce risks. When market volatility increases, exchanges often raise initial margin requirements to limit leverage and protect traders’ funds.

Leverage trading can amplify your profits but also magnify losses. When formulating trading strategies, you must fully consider how initial margin affects leverage capacity and control positions reasonably.

Profit and Loss Amplification

Initial margin not only affects leverage capacity but also directly determines your profit and loss range. If you buy stocks with a 40% initial margin and the stock price drops by 20%, your loss ratio will reach 50%. This amplification effect is particularly pronounced during high market volatility. The table below shows the impact of margin trading on market prices and risks:

| Research Title | Key Findings |

|---|---|

| The Impact of Margin Trading on Share Price Evolution: A Cascading Failure Model Investigation | Increased margin trading leads to greater share price fragility, potentially exacerbating market crash risks. |

| Counter-cyclical Margins for Option Portfolios | Risk-sensitive margin requirements amplify market shocks procyclically, requiring traders to post additional collateral during volatile periods. |

When trading highly volatile assets, the impact of initial margin is particularly significant. A 10% increase in margin requirements causes about 1.75% of speculators to exit the market, reducing liquidity. You need to flexibly adjust initial margin ratios based on market conditions to avoid significant losses due to excessive leverage.

- Initial margin requirements directly affect the likelihood of margin calls.

- Leverage ratios are inversely related to initial margin requirements; higher margins mean lower leverage.

- In leveraged trading, price fluctuations amplify losses.

- Margin calls are issued when the account fails to maintain sufficient margin, potentially leading to automatic liquidation and significant losses.

- Using lower leverage can reduce potential losses and protect trading capital.

Margin Ratio and Risk

During trading, the initial margin ratio is a core parameter for risk management. Initial margin affects your risk tolerance and liquidation risk. Higher initial margin ratios typically mean lower maintenance margin ratios, reducing the risk of forced liquidation. Conversely, a low initial margin ratio with a high maintenance margin ratio makes it easier to trigger forced liquidation during market fluctuations.

Market volatility is the primary driver of margin adjustments. Higher volatility leads to increased initial margin requirements, limiting leverage and reducing systemic risks. When trading in the U.S. market, you need to closely monitor how initial margin affects market liquidity and speculative behavior. Increased margin requirements cause some speculators to exit, reducing liquidity and market risks.

- Changes in margin requirements affect the capital needed to open and maintain positions.

- When market conditions change, initial margin affects your leverage capacity and risk tolerance.

- Margin requirements determine speculation levels, thereby impacting market volatility.

- Margin rules may fail to effectively control market volatility due to small position sizes and financing methods not affecting underlying asset performance.

When formulating trading strategies, you must combine market volatility, contract value, and initial margin ratios to reasonably control risks. Initial margin affects your trading outcomes and capital safety, making it a must-learn lesson for becoming an expert.

Initial Margin and Risk Management

Liquidation Risk

When using leverage trading, liquidation risk is always present. Sudden sharp market price fluctuations can rapidly reduce the value of your positions. If account equity falls below the maintenance margin level, brokers will issue margin calls or even force liquidation.

Properly setting initial margins can effectively reduce liquidation risks. Higher initial margin requirements provide extra buffering for your account, helping you withstand losses from market fluctuations. U.S. market historical data shows that during the 1929 stock market crash, forced liquidations and margin calls were significant factors in market instability. Studies found that days with forced liquidations saw markets drop an average of 2.8%, while days without forced liquidations saw an average rise of 0.5%.

You need to focus on the following liquidation risk factors:

- Market Volatility: Sharp price fluctuations easily trigger margin calls.

- High Leverage: Excessive leverage amplifies losses, eroding account equity.

- Insufficient Monitoring: Failing to monitor account changes promptly may lead to unexpected liquidations.

- Broker Margin Requirements: Increased volatility may lead to changing margin requirements, increasing liquidation probability.

Initial margin requirements provide extra protection, reducing forced liquidation risks due to market fluctuations. Central clearing counterparties often set over-collateralization mechanisms to reduce counterparty risks in leveraged trading, minimizing forced liquidations during market crashes.

Capital Safety

During trading, capital safety is the top priority. Initial margin affects your capital preservation ability, especially during market downturns. Higher initial margin requirements may require you to invest more funds, affecting your liquidity and ability to maintain positions.

By understanding the drivers of margin changes, you can reduce risks related to capital preservation. Initial margin volatility directly impacts your capital safety during turbulent market periods.

The table below shows the role of initial margin in risk management:

| Risk Factor Construction | Description |

|---|---|

| Risk Factors | Represent factors driving valuation changes, such as prices, returns, or interest rates. |

| Scaling and Scenarios | Risk factors are scaled to produce scenarios reflecting current market volatility, combined with various risk and regulatory requirements. |

| Instrument P&L Scenarios | Use peak-day risk factors to generate instrument P&L simulations, converted based on observable instrument prices. |

| Initial Margin | Instrument P&L simulations are aggregated at the portfolio level and combined with other components to meet regulatory and risk requirements, generating the final initial margin. |

When market volatility intensifies, initial margin requirements typically rise. This helps protect your account funds during extreme market conditions, reducing the probability of forced liquidation and liquidation risks. Properly setting initial margins helps you preserve capital during market downturns, avoiding forced liquidations due to insufficient liquidity.

Maintenance Margin

After purchasing margin securities, you must maintain account funds above the maintenance margin level. Maintenance margins are typically lower than initial margins, with initial margins requiring higher deposits when purchasing securities. If the securities’ value falls below the maintenance margin, you may receive a margin call.

Properly setting initial margins can reduce the likelihood of margin calls. Initial margin affects your risk tolerance and account safety. You need to regularly monitor account equity and top up margins promptly to prevent forced liquidations due to market fluctuations.

Maintenance margins, together with initial margins, form the core mechanism of risk management. In practice, you need to flexibly adjust margin ratios based on market volatility and contract value. This effectively reduces liquidation risks and protects your capital safety.

Initial margin affects market liquidity and volatility. When margin requirements increase, some speculators exit the market, reducing liquidity and systemic risks. When formulating trading strategies, you need to combine market conditions and margin changes to reasonably control positions and risks.

Expert Practical Techniques

Image Source: pexels

Margin Setting

When setting initial margins, you need to consider trading instruments, market volatility, and your risk tolerance. Experts typically use multiple methods to optimize margin settings:

- Understand exchange and broker margin requirements; initial margins are typically 10% to 50% of the transaction value, with maintenance margins at 25%-30%.

- Use fixed amounts or percentages of account capital to allocate funds for each trade. For example, you can set the initial margin for each trade at 5% of total account capital.

- Combine risk parameters and market volatility, using indicators like ATR (Average True Range) to dynamically adjust position sizes.

- Apply the Kelly Criterion to calculate optimal position sizes based on win rates and risk-reward ratios, improving capital efficiency.

- Always use stop-loss strategies to avoid excessive leverage and prevent single trades from significantly impacting the overall account.

You can refer to the table below to understand how to optimize margin models using historical volatility data:

| Model Name | Description |

|---|---|

| PAIRS | Based on ten years of historical market data, combined with volatility scaling, simulates portfolio value changes to estimate potential loss distributions. |

Dynamic Adjustment

Experts do not set initial margins as static parameters. You need to flexibly adjust margin ratios based on market conditions:

- When market volatility rises, exchanges and brokers increase margin requirements to protect traders from rapid price changes.

- Brokers may require margins above regulatory standards based on their risk assessments.

- When your positions face adverse movements, you need to promptly top up variation margins to ensure sufficient account funds.

- By monitoring margin thresholds in real-time, conducting pre-trade risk analysis, and managing credit limits, you can identify risks and adjust margin settings promptly.

| Monitoring and Adjustment Methods | Description |

|---|---|

| Real-Time Margin Monitoring | Check current margin requirements to understand the margin impact of each trade. |

| Margin Alerts | Account pop-up notifications warn of approaching margin insufficiency. |

Position and Risk Control

In actual trading, position management and risk control are equally important. Experts allocate funds for each trade based on risk tolerance and market conditions:

- Position size directly determines potential profits and losses. Proper allocation avoids excessive exposure.

- Initial margin is related to leverage; leverage amplifies profits but also risks.

- Use percentage-based, volatility-based, or fixed-amount position sizing methods to ensure single trades do not impact the overall portfolio.

- By dynamically adjusting positions and margin ratios, you can maintain account fund safety during market fluctuations, reducing forced liquidation risks.

When formulating trading strategies, you need to combine market volatility, margin requirements, and personal risk preferences to flexibly adjust positions and margin settings, enhancing trading stability and capital safety.

Common Mistakes and Prevention

Misuse

In actual trading, you often make typical mistakes due to insufficient understanding of initial margins. Many mistakenly believe that depositing the minimum initial margin allows unlimited position expansion. This exposes you to high risks during market fluctuations. Some traders overlook the double-edged nature of leverage, focusing only on potential profits while ignoring amplified losses. If you do not reserve extra cash in your account, adverse market movements can easily lead to forced liquidation due to insufficient margins. Additionally, some traders habitually operate at full capacity, neglecting asset allocation and risk diversification. Failing to regularly check your account may prevent timely detection of risk signals, leading to further losses.

Expert Advice

To effectively prevent initial margin mismanagement, you can adopt professional traders’ practices. Experts typically maintain extra cash reserves to address sudden market fluctuations and margin call demands. They diversify portfolios to reduce risks from single assets. You need to actively monitor your trading account, regularly check positions and capital changes, and adjust strategies promptly. Experts also use leverage correctly, ensuring each trade stays within controllable risk ranges. You can use stop-loss and limit orders to preset loss and profit targets, preventing emotional decisions. The table below summarizes common preventive measures:

| Preventive Measure | Description |

|---|---|

| Maintain Extra Cash | Keep cash reserves in the account to prevent sudden margin calls. |

| Diversify Portfolio | Spread investments to reduce single-market risks. |

| Actively Monitor Account | Regularly check account and positions to identify risks promptly. |

| Use Leverage Correctly | Control leverage multiples to avoid excessive risk amplification. |

| Use Stop-Loss and Limit Orders | Set stop-loss points and target prices to automatically manage risks. |

If you adhere to these practices, you will significantly enhance account safety and trading stability.

You now understand how initial margin affects trading profits, losses, and risk management. Properly setting initial margins can help you optimize trading structures and reduce liquidation risks. Experts dynamically adjust margin ratios and flexibly control positions. You can draw on U.S. market experiences and combine them with your situation to develop suitable margin strategies.

Properly utilizing initial margins is key to enhancing trading stability and capital safety.

FAQ

What is Initial Margin?

When trading, initial margin is the minimum capital you must deposit to enter the market. It helps you qualify for leveraged trading and protects account safety.

How Does Initial Margin Affect Leverage?

The lower the initial margin you deposit, the higher the leverage multiple. High leverage can amplify profits but also increases loss risks.

When Do You Need to Top Up Margins?

When market fluctuations cause your account funds to fall below the maintenance margin, brokers will require you to top up margins, or you may face forced liquidation.

How to Determine Initial Margin Ratios?

You can choose initial margin ratios based on exchange regulations, market volatility, and your risk tolerance. The U.S. market typically has clear standards.

How Does Initial Margin Relate to Capital Safety?

Setting reasonable initial margins can reduce liquidation risks and protect account funds. High margin requirements help address extreme market conditions.

By understanding how initial margin impacts trading profits and losses, you’ve learned to optimize leverage and minimize blow-up risks, but high cross-border fees, currency volatility, and complex account setups can limit swift responses to U.S. futures or derivatives markets, especially during volatility spikes or margin requirement shifts. Imagine a platform with 0.5% remittance fees, same-day global transfers, and zero-fee limit orders, enabling seamless leverage strategies via one account?

BiyaPay is tailored for leveraged traders, offering instant fiat-to-digital conversions to act on market signals nimbly. With real-time exchange rate query, monitor USD trends and transfer at optimal moments to cut costs. Covering most regions with instant arrivals, it powers rapid allocations to S&P 500 futures or stock options. Crucially, trade U.S. and Hong Kong markets through a single account, leveraging zero-fee limit orders for volatility and margin-based strategies.

Whether optimizing position sizing or guarding against forced liquidations, BiyaPay fuels your edge. Sign up now, visit stocks for leveraged prospects—quick setup unlocks cost-effective, data-driven trading. Join global investors and thrive in 2025’s markets!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.