- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Detailed Explanation of the Martingale Strategy: The Game of Balancing Profit and Risk in Investments

Image Source: pexels

You may have heard of the Martingale strategy in investing. This method involves doubling your investment after each loss, attempting to recover all losses when the market rebounds. However, in the U.S. stock market, companies may go bankrupt, leading to a total loss of capital. The forex and cryptocurrency markets are highly volatile, and doubling down can quickly deplete your funds. While commodity markets are less likely to go to zero, prices are influenced by global economic and political factors, making risks still significant.

Key Points

- The Martingale strategy attempts to recover losses by doubling investments after each loss, but it carries extremely high risks.

- This strategy assumes you have unlimited funds and time, but in reality, funds are limited, and consecutive losses can wipe out your account.

- Successfully applying the Martingale strategy requires frequent market reversals and strict risk management; without these, significant losses are possible.

- In range-bound markets, the Martingale strategy may be effective, but in trending markets, the risks are higher, requiring cautious use.

- Ordinary investors should prioritize less risky alternatives, such as the Anti-Martingale or fixed-ratio position sizing, avoiding blindly chasing short-term recovery.

Introduction to the Martingale Strategy

Image Source: pexels

Principle Overview

When learning investment strategies, you may come across the Martingale strategy. This method requires you to double your bet after each loss, aiming to recover all previous losses with a single win. The core idea of the Martingale strategy is that as long as you have enough funds and time, you will eventually recover losses and achieve your initial profit through a market rebound.

In probability theory, a Martingale is a stochastic process. The expected value of each bet equals the result of the previous one, regardless of what happened before. Mathematical models show that future returns cannot be predicted based on past results. In practice, you’ll find that the expected value of a single bet in casinos or markets is usually negative. As the number of bets increases, your average losses also increase.

- The Martingale strategy assumes you have unlimited wealth and time, but in reality, your funds and betting opportunities are limited.

- This strategy cannot guarantee long-term success, as doubling bets may encounter extreme consecutive losses.

- You cannot predict future market movements based on past results.

Historical Origins

The Martingale strategy first appeared in 18th-century France. You can see its application in coin-tossing games and roulette during that time. As gambling games grew in popularity, the Martingale strategy was adopted by more people.

- Roulette became very popular in 18th-century France, driving the development of the Martingale strategy.

- You can also see similar doubling-down methods in American casinos, but in practice, casinos set betting limits, restricting the number of times you can double.

- The history of the Martingale system proves that in fair games, relying on doubling bets does not ensure eventual profits.

Profit Mechanism

Doubling Down

When using the Martingale strategy, the core action is to double your position after each loss. The purpose is to recover all previous losses and achieve the initial target profit in the next win. You can refer to the table below to understand the main profit mechanism of the Martingale strategy:

| Mechanism | Explanation |

|---|---|

| Gradually doubling trade size | Double the trade size after each loss to recover all losses and gain a small profit in the next win. |

| Combining reliable trading strategies | You need to pair it with effective trading strategies to better manage funds and handle market fluctuations. |

| Adaptive position adjustment | Continuously increase position size during consecutive losses, then revert to the initial size after a win. |

Each time you double your bet, the risk increases. Please note the following:

- Doubling your bet after each loss increases the capital invested and the associated risks.

- If the market does not rebound in time, you may face significant financial losses.

- You need strong risk tolerance and sufficient capital reserves to handle consecutive losses.

- The higher the market volatility, the greater the strategy’s risks and psychological pressure.

Market Rebound

To profit from the Martingale strategy, you must rely on market rebounds. Only when the market price reverses can you achieve profits by doubling down. The table below shows market conditions favorable for the strategy’s profitability:

| Market Condition | Reason |

|---|---|

| Markets with frequent price reversals | You have more opportunities to recover losses and ultimately profit. |

| Sufficient capital reserves | You can sustain multiple doubling trades, reducing the risk of blowing up your account. |

| Clear risk management rules | You can stop losses in time to avoid catastrophic losses. |

In practice, you can increase the probability of profit only if the market frequently reverses, and you have sufficient funds and strict risk control. Otherwise, consecutive losses will quickly deplete your funds.

Practical Operations

Image Source: unsplash

Operational Process

When applying the Martingale strategy in practice, you need to follow a clear set of steps. Below is a common process:

- Identify trading setups: You can use technical analysis tools, such as moving averages or candlestick patterns, to find potential entry points.

- Enter trades with an initial position size: It’s recommended to start with a smaller position to leave room for subsequent doubling.

- Set stop-loss: You should set reasonable stop-loss levels based on risk management rules to avoid excessive losses in a single trade.

- If the trade is favorable: You can take partial profits at the target price and adjust the stop-loss to the breakeven point.

- If the trade is unfavorable: You need to double the position size, reset the stop-loss, and continue executing the strategy.

- Repeat the process: Continue doubling after each loss until the market rebounds, recovering previous losses.

- Monitor overall risk exposure: You should regularly assess total risk and adjust positions to ensure risks remain within a controllable range.

At every step, you must stay calm, strictly follow the trading plan, and avoid impulsive position increases due to emotional fluctuations.

Investment Scenarios

In the U.S. market, the Martingale strategy is commonly used in range-bound conditions. Below are typical application scenarios and considerations:

- Range-bound markets: Prices fluctuate up and down without a clear trend, allowing you to use repeated doubling to wait for a price rebound.

- Futures or cryptocurrency markets: These markets are highly volatile, suitable for flexible position adjustments, but the risks are also higher.

- Risk management principles: It’s recommended to adopt a 1:1 risk-reward ratio, with each trade risking no more than 1% of your account balance. Avoid overtrading during consecutive losses and maintain psychological stability.

- Sufficient account balance: You need to ensure enough USD funds to support multiple doublings to prevent blowing up your account.

- Market factors: You must pay attention to macroeconomic and policy changes to avoid ignoring fundamental influences.

In practice, you can effectively apply the Martingale strategy in range-bound markets only by combining strict capital management and risk control. Otherwise, consecutive losses will quickly deplete your funds.

Pros and Cons of the Martingale Strategy

Profit Analysis

When investing, you may be attracted to the high-profit potential of the Martingale strategy. By doubling investments after each loss, the strategy theoretically allows you to recover all losses and achieve the initial profit during a market rebound. You can see its profit opportunities in both bull and bear markets, especially in environments with frequent price fluctuations. You can refer to the table below to compare the pros and cons of the Martingale and Anti-Martingale strategies:

| Strategy Type | Advantages | Disadvantages |

|---|---|---|

| Martingale Strategy | Potential for significant short-term profits | High risk, potentially leading to total capital loss |

| Anti-Martingale Strategy | Reduces risk, protects capital | Slower returns |

In practice, if your first bet is USD 100 and you lose, the next bet would be USD 200. Consecutive losses will rapidly increase your investment amount, potentially exceeding your financial capacity. The Anti-Martingale strategy, in contrast, reduces bet sizes after losses, helping to protect your capital but offering slower profits.

In the U.S. market, the Martingale strategy performs better in range-bound conditions. You can capitalize on short-term rebound opportunities for profits. However, statistics show that the Martingale strategy underperforms in flat markets compared to bull or bear markets. You need to note that past trading results do not affect future outcomes, and the market’s randomness makes it difficult to predict the next move.

Risk Analysis

When using the Martingale strategy, you must pay close attention to risks. The biggest risk is capital depletion. You need substantial capital reserves to handle consecutive losses. If you lose more than 3 to 5 times consecutively, the risk of capital depletion increases significantly. You can reduce the risk of wiping out your account by setting a loss threshold in advance, but the possibility of blowing up your account cannot be completely eliminated.

You can refer to the table below to understand capital requirements and risk assessment:

| Evidence Type | Content |

|---|---|

| Capital Requirements | To sustain the Martingale strategy, traders need sufficient capital. Doubling investments after losses requires a large capital pool. Traders without enough funds are at a significant disadvantage and may be forced to exit the market early. |

| Risk Assessment | During prolonged losing streaks, there is a high risk of losing all capital. If the market continues to move against you, consecutive unsuccessful trades can quickly deplete your capital. |

In practice, you will also be affected by psychological factors. You may hold losing investments too long due to the disposition effect or keep increasing bets due to sunk cost fallacy, hoping to recover losses. You may also engage in self-justification during decision-making, continuing to invest in losing strategies to prove your choices were correct. Multiple studies show that these psychological factors can exacerbate your risk exposure.

When deciding whether to adopt the Martingale strategy, you need to consider the following limitations:

- You must have sufficient USD funds to withstand multiple doubling investments.

- You need strong risk control skills to set reasonable stop-loss points.

- You need high psychological resilience to handle the stress of consecutive losses.

- This strategy is not suitable for highly volatile or strongly trending markets; it’s better to try it cautiously in range-bound conditions.

When investing, you must rationally assess your financial situation and risk tolerance to avoid wiping out your account due to blind position increases.

Case Studies

Real-World Cases

In actual investments, you may encounter the Martingale strategy being applied in different fields.

- In the forex market, many traders double their positions after losses, attempting to recover losses in a single rebound. If you don’t have enough USD funds, consecutive losses can lead to significant losses.

- In sports betting, gamblers often double their bets after losing an initial wager. While this can theoretically recover all losses, betting companies typically set wager limits, and gamblers’ funds are limited, making the strategy highly risky.

- In business investments, entrepreneurs sometimes increase investments after project failures, hoping to turn things around. This approach occasionally works but may also lead to resource waste and larger losses.

- In personal finance management, you might double payments on new debts after paying off small debts. If your income is stable and debts are manageable, this can sometimes work, but if debts are too large or income is unstable, risks accumulate quickly.

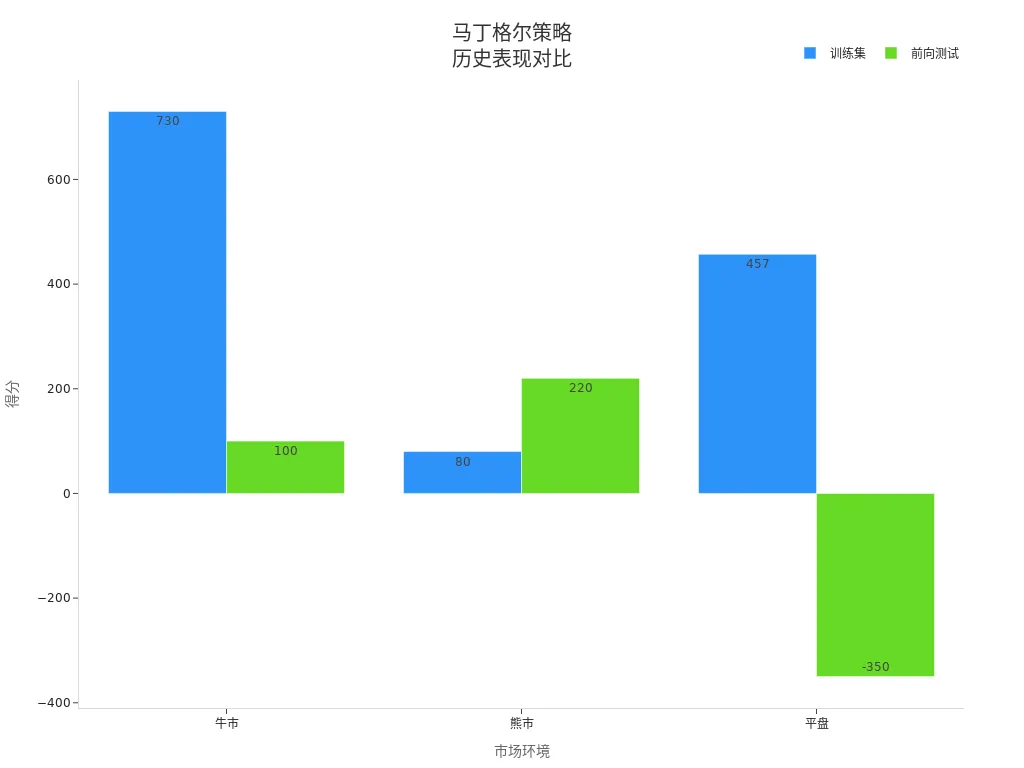

You can refer to the table below to understand the historical performance of the Martingale strategy in different market environments:

| Market | Training Set | Forward Test |

|---|---|---|

| Bull Market | 730 points | 100 points |

| Bear Market | 80 points | 220 points |

| Flat Market | 457 points | -350 points |

Applicability Discussion

When deciding whether to adopt the Martingale strategy, you need to consider market conditions and your own circumstances.

- The Martingale strategy performs better in short-term predictions, especially in flat or slightly volatile markets where profits are more achievable. However, in strongly trending markets like bull or bear markets, the strategy underperforms, with increased risks of consecutive losses.

- In practice, you must pay attention to market dynamics and volatility. During sharp market fluctuations, losses can escalate rapidly.

- Trading fees also increase rapidly with doubling actions, further amplifying your losses.

- You need to consider the platform’s maximum betting limits to avoid being forced to stop out due to an inability to continue doubling.

- During volatile market periods, you should closely monitor returns and adjust parameters based on market changes. It’s recommended to avoid using the Martingale strategy in strong uptrends or downtrends and focus on flat or retracement markets.

When investing, you must combine your financial strength and risk tolerance to rationally assess the strategy’s applicability and avoid blindly increasing positions.

Adoption Recommendations

Risk Warnings

When considering the Martingale strategy, you must prioritize risk management. Many investors overlook the following key issues in practice:

- You need substantial capital support. Consecutive losses can rapidly increase position sizes, potentially depleting account funds in a short time.

- Most brokers impose limits on trade sizes. If you hit the maximum allowable position during a losing streak, the strategy will be forced to terminate, potentially causing significant account losses.

- Doubling bets after losses creates significant psychological pressure. You may make irrational decisions due to fear, further exacerbating losses.

- In strongly trending markets, the Martingale strategy can lead to prolonged losses. The market may continue moving against you, making timely stop-losses impossible.

- In the forex market, especially in high-leverage environments, small fluctuations can cause significant losses. If your initial investment is USD 200, you could lose all capital after four consecutive losses.

- Common mistakes in practice include not setting capital limits, underestimating market volatility, and underestimating the potential for sustained losses. These errors can lead to uncontrollable risks.

Before investing, you should create a detailed capital management plan, set a maximum loss limit, and avoid account depletion due to continuous doubling. Rationally assess the market environment and avoid blindly chasing short-term recovery.

You also need to consider legal and regulatory factors. The table below shows regulations related to the Martingale strategy in different regions:

| Consideration Type | Description |

|---|---|

| Legal Considerations | The Martingale strategy is not explicitly banned in casinos or betting platforms, but casinos typically set table limits to prevent unlimited doubling. |

| Ethical Considerations | The strategy may encourage irresponsible gambling behavior, leading to significant financial losses. |

| Regulatory Requirements | Online gambling laws vary by region, with some requiring operators to detect and restrict the use of progressive betting strategies. |

When investing in the U.S. market, you must understand the platform’s trading rules and maximum position limits to avoid additional losses due to rule violations.

Investor Types

When deciding whether to adopt the Martingale strategy, you should make rational judgments based on your conditions and investment goals. Experts generally believe that ordinary investors should not easily adopt this strategy for the following reasons:

- The Martingale strategy may seem clever in theory but can lead to significant losses in practice.

- If the market trend persists beyond your endurance, your account may collapse.

- Increasing losing investments without a plan creates bigger problems.

You are better suited to choosing less risky alternative strategies, such as:

- Anti-Martingale: You increase position sizes only after profits, avoiding increased risks during losses.

- Fixed-ratio position sizing: Each trade risks a fixed percentage of capital, regardless of previous outcomes.

- Partial Martingale: You can limit the number of doublings or set a maximum trade count, combining flexibility and safety measures to protect your account from total loss.

You may cautiously try the Martingale strategy if you meet the following conditions:

- You have sufficient USD funds to withstand multiple doubling investments.

- You have strong risk control skills to set reasonable stop-loss points.

- You have high psychological resilience to handle the stress of consecutive losses.

- You are familiar with market rules and understand the platform’s maximum position limits and relevant regulations.

When investing, rationality should come first, prioritizing risk control. Only by fully understanding the strategy’s principles and risks and combining them with your situation can you make informed choices.

You can understand the essence and risks of the Martingale strategy from the following points:

- Doubling bets after each loss theoretically aims for eventual profits.

- Prolonged losses can lead to significant financial losses, with extremely high risks.

- The method is often seen as gambling, lacking true risk control.

| Strategy | Risk Management Features | Long-Term Sustainability |

|---|---|---|

| Martingale | High risk, relies on continuous capital support, prone to account depletion during consecutive losses | Unsustainable, likely to lead to rapid losses |

| Anti-Martingale | Capital protection, reduces investment during losses, increases investment during profits | More sustainable, suitable for conservative traders |

When investing, you should prioritize rationality and risk control. The Martingale strategy is not suitable for most investors. You need to choose more sustainable investment methods based on your situation to remain invincible in the path of investment.

FAQ

Is the Martingale Strategy Suitable for Beginner Investors?

As a beginner investor, you are not recommended to directly use the Martingale strategy. This method is extremely risky and can easily lead to total capital loss. You should first learn basic capital management and risk control.

What Happens to Funds During Consecutive Losses?

Each time you lose, you must double your investment. During consecutive losses, your funds will be depleted very quickly. You can easily exhaust all USD funds in a short time.

What Are the Limitations of the Martingale Strategy in the U.S. Market?

When operating in the U.S. market, brokers typically set maximum position limits. You cannot double bets indefinitely. You also face high trading fees and strict regulatory requirements.

How Can the Risks of the Martingale Strategy Be Reduced?

You can set a maximum loss limit in advance. You must strictly enforce stop-loss rules. You can also limit the number of doublings to avoid account depletion due to consecutive losses.

What Is the Difference Between the Martingale and Anti-Martingale Strategies?

In the Martingale strategy, you double investments during losses. In the Anti-Martingale strategy, you increase investments only during profits. The Anti-Martingale focuses more on capital protection, with lower risks.

Grasping the Martingale strategy’s profit mechanics and risks enables more rational decision-making in investments, but practical use often encounters rapid capital depletion, amplified losses from consecutive setbacks, and uncertainties in cross-border exchange rates along with high fees. These challenges can prevent timely position adjustments or stop-losses during market volatility, missing rebound chances. As a risk-conscious investor, you need an efficient platform to optimize fund flows and trade execution.

BiyaPay offers a comprehensive solution with real-time exchange rate queries, enabling seamless fiat-to-crypto conversions for transparent and up-to-date rates. Remittance fees start as low as 0.5%, with zero fees for contract orders, covering same-day transfers to most countries and regions globally. Crucially, no overseas account setup is required to invest in US and Hong Kong stocks directly on the platform, allowing agile strategy adaptations.

Sign up for BiyaPay now to leverage these key benefits. Whether in ranging or trending markets, this platform helps you manage capital more effectively, mitigating the Martingale strategy’s inherent dangers. Don’t let transfer hurdles impede your investment performance—join BiyaPay today for a more secure gaming path in finance!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.