- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Digital Remittance: Streamlining Electronic Funds Transfers with Digital Money Services

What is Digital Remittance and How Does It Work?

Definition & Market Impact

Digital remittance refers to the electronic transfer of funds, typically across international borders, without the need for physical cash or visits to bank branches. It replaces traditional money transfer methods like cash remittance, check deposits, or physical wire transfers.

According to Grand View Research, the global digital remittance market is projected to reach $60 billion by 2030, driven largely by migrant workers and small-to-medium enterprises (SMEs). Some compelling market insights include:

- Migrant workers: 70% utilize apps like BiyaPay to send earnings home, saving an estimated $12 billion annually in fees alone.

- Businesses: SMEs reduce international payroll costs by up to 30% by adopting digital money transfer services.

This shift is a testament to the growing preference for digital money transfer services that offer convenience, transparency, and speed.

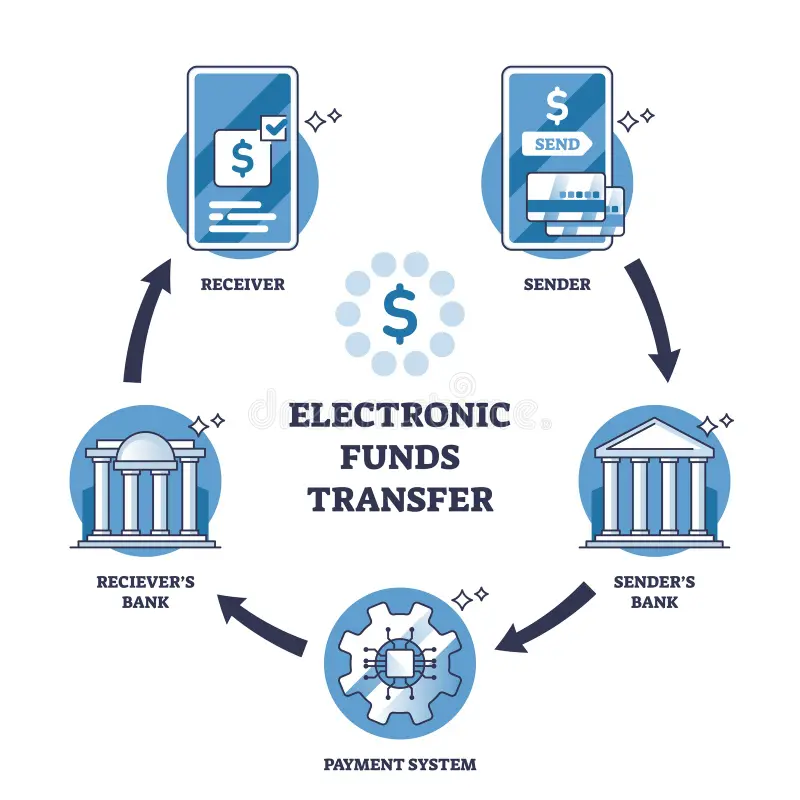

How Digital Remittance Works

Digital remittance platforms typically follow these steps:

- User Input: The sender enters recipient details such as phone number, email, or bank account number, along with the transfer amount.

- Secure Verification: To authorize the transaction, platforms like BiyaPay employ biometric authentication and two-factor authentication (2FA), enhancing security.

- Transfer Initiation: Funds are transferred using encrypted APIs that connect directly with banking and payment networks, ensuring swift and secure movement of money.

- Real-Time Tracking: Users can monitor transfer progress with instant app notifications—e.g., “Delivered in 37 seconds to Nigeria.”

Case Example: A Filipino nurse working in London uses BiyaPay to send £500 home monthly. Her family receives ₱35,000 in under 5 minutes, compared to several days and ₱1,750 higher fees through traditional banks.

Understanding Electronic Funds Transfers (EFT)

The main part of most current digital money transfer services is electronic funds transfers (EFT). With EFT, money can be sent electronically between bank accounts, so checks and cash are no longer needed. This method is very important for both domestic and international digital money transfers.

Types & Timelines

Understanding electronic funds transfers is key to grasping how digital remittance functions. Here’s a breakdown of common EFT types, including speed, cost, and best use cases:

| Transfer Type | Domestic Time | International Time | Best For |

|---|---|---|---|

| Real-Time Payments (RTP) | Seconds | N/A | Urgent payments |

| Wire Transfers | 1–24 hours | 1–3 business days | High-value transactions |

| ACH Transfers | 1–3 days | 3–5 days | Payroll, recurring bills |

| Digital Wallets (e.g., BiyaPay) | Minutes | Minutes–24 hours | Low-cost remittances |

Factors That Influence Electronic Fund Transfers Duration

Time Zones and Working Hours of the Banks Involved

- Time Zones: If the sender and recipient are in different time zones, the transfer might be delayed if the recipient bank is not open to process the transaction.

- Working Hours: Banks typically process transactions during their business hours. Transfers initiated outside these hours may be held until the next business day.

National Holidays

- Bank Holidays: Many banks do not process transactions on national holidays. This can extend the processing time for both domestic and international transfers. Avoid initiating transfers on weekends or holidays; delays increase by up to 40% due to bank closures.

- Recipient Country Holidays: If the recipient bank is in a country observing a holiday, the transfer might be delayed until the next business day.

Verification Requirements

- Identity Verification: Some transfers, especially international ones, may require additional identity verification to comply with anti-money laundering (AML) and know your customer (KYC) regulations. This can add extra time to the process.

- Account Verification: Ensuring that the recipient’s account details are correct can prevent delays. Incorrect information can lead to the transfer being rejected or held for further review.

Why Choose Digital Money Transfer Service Over Traditional?

Digital money transfer services have changed the way money is sent around the world because they offer features that older methods often can’t match. Here’s a closer look at these important features and what they can do for you:

- Cost Savings: Traditional banks charge an average fee of 5–10% on remittances, whereas digital platforms like BiyaPay maintain fees between 1–3%, significantly increasing money received by beneficiaries.

- Faster Delivery: Data shows that 90% of BiyaPay transactions finalize within 24 hours, a major improvement over traditional 3–5 day international wire transfers.

- Enhanced Security: BiyaPay partners with FDIC-insured custodians and encrypts data end-to-end, adhering to strict compliance frameworks, which reduces fraud risk dramatically.

Case example: In Kenya, a farmer leverages digital remittance through BiyaPay integrated with M-Pesa, a mobile wallet widely used in East Africa. This system significantly reduces the farmer’s dependence on cash, saving approximately $5 per transaction in fees and minimizing risks associated with carrying physical money.

BiyaPay Deep Dive: Features & Benefits

Among the growing list of digital remittance providers, BiyaPay stands out for its focus on user experience, speed, and affordability.

BiyaPay is a comprehensive platform designed for both individuals and businesses to carry out secure electronic funds transfers globally. It leverages modern encryption standards and a highly intuitive interface to ensure each transaction is seamless and safe.

Top Features of BiyaPay:

Fast Transfers:

- Instant Transactions: BiyaPay supports real-time payments, allowing users to send and receive money almost immediately, especially within supported regions.

- Same-Day Transfers: For regions where real-time payments are not yet available, BiyaPay ensures that most transactions are completed within the same business day, significantly reducing the waiting time compared to traditional methods.

Global Reach:

- Wide Availability: BiyaPay is available in dozens of countries, making it a versatile choice for international transactions.

- Multiple Currencies: The platform supports a wide range of currencies, allowing users to send and receive money in their preferred currency without the need for manual conversions.

Transparent Pricing:

- Clear Fee Structure: BiyaPay provides a straightforward and transparent fee structure, ensuring that users know exactly what they will pay for each transaction.

- No Hidden Charges: There are no surprise fees or hidden costs, making it easier for users to budget and manage their finances.

Real-Time Tracking:

- Step-by-Step Status Updates: Users can track the status of their remittance from the moment it is initiated to the moment it is received, providing peace of mind and transparency.

- Notification Alerts: BiyaPay sends real-time notifications to both the sender and the recipient, keeping them informed of the transaction’s progress.

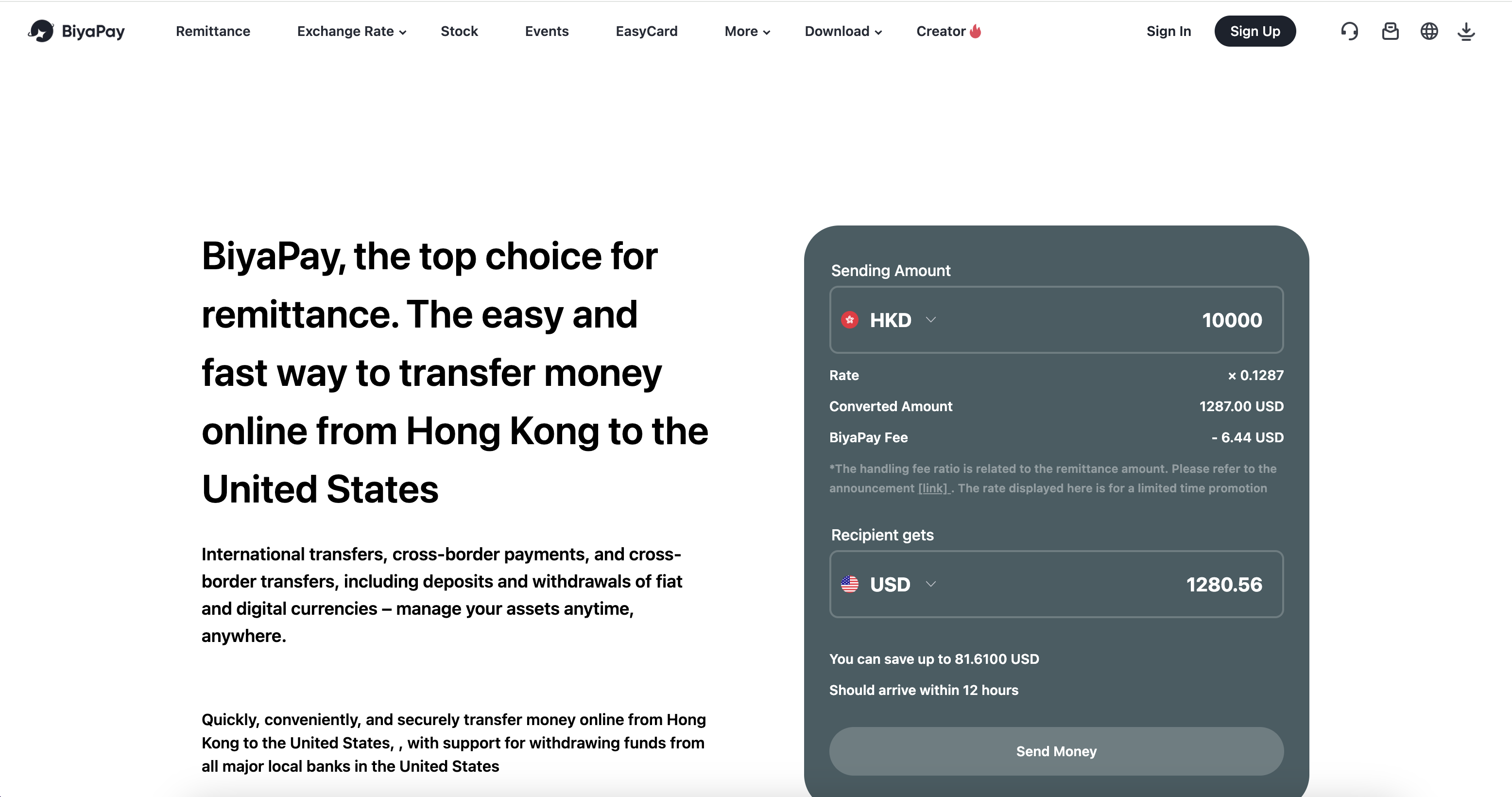

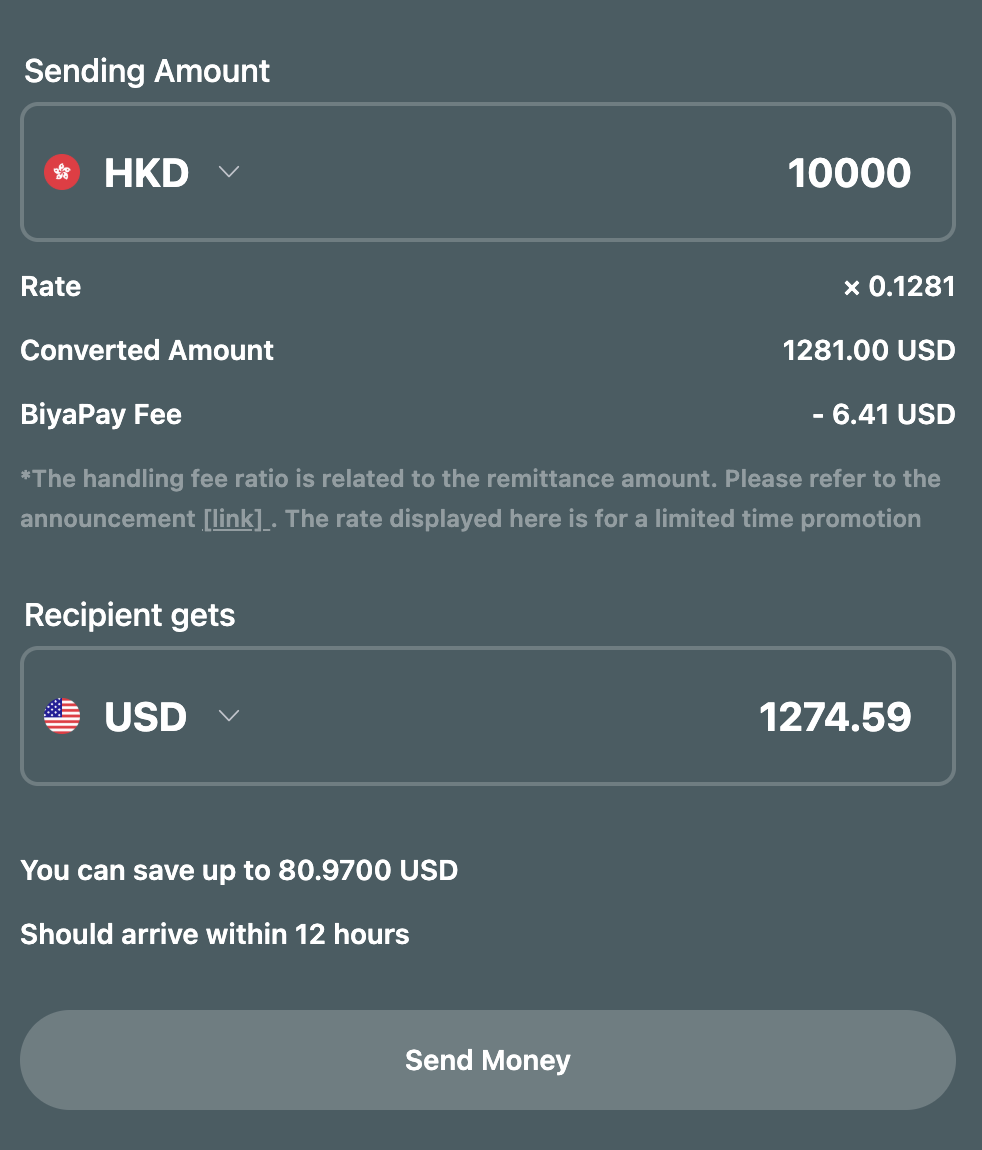

For example, using BiyaPay’s Hong Kong to USA remittance calculator, you can instantly see how much a recipient would receive in USD when sending HKD 10,000. You can explore even more scenarios, such as sending USD 10,000 from the USA to Japan, to understand cross-border conversions in real time.

Whether you’re paying tuition abroad, sending money to family, or managing business payments, BiyaPay offers a simplified and efficient experience. Its integration with global banking systems and real-time capabilities make it one of the top contenders in the digital remittance space.

How to Use BiyaPay for Cross-Border Transfers

Step 1: Download the BiyaPay App

Visit the app to download and install the BiyaPay on your device.

Step 2: Register and verify Your Identity

Open the app and sign up using your email. Complete the identity verification process, add your bank card, and provide the necessary personal information to set up your account.

Step 3: Deposit USDT

On the homepage, tap on the Deposit option. Select the on-chain deposit method and deposit USDT into your account.

Step 4: Remit Fiat Currency

Go to the Transfer page, select USDT for remittance (actual transfer in USD), choose the recipient’s account, and enter the verification code sent via email or Biya Authenticator to complete the transfer.

How to Pick a Remittance Service: Your Checklist

Speed: Real-time payments (RTP) are essential for urgent transfers, a service BiyaPay offers extensively.

Fees: Avoid hidden costs and unfavorable exchange rate markups common in many platforms.

Payout Options: Consider recipient preferences—mobile wallets like M-Pesa are vital in regions with low banking penetration.

Licensing: Validate regulatory credentials—BiyaPay’s VFAA license is an example of robust compliance.

Red Flags to Avoid

Opaque fee structures

Poor or inconsistent customer reviews (Trustpilot ratings below 3.5 stars)

Trends to Watch in Digital remittance space

Innovations like blockchain and CBDCs promise to further revolutionize digital remittance:

- Ripple (XRP): Slashes transactions cost approximately $0.01, utilized by banks such as Santander.

- eNaira (Nigeria): Enables instant, cost-efficient remittances across West Africa, including Ghana and Kenya.

- DeFi Platforms: Services like Stellar offer microloans at 2% interest rates, compared to 15% in traditional lending, improving financial inclusion.

Expert Insight: “By 2030, blockchain and CBDCs will handle 50% of global remittance volumes,” predicts the IMF’s 2024 Fintech Report.

Conclusion

Digital remittance and electronic funds transfers have redefined how we send money around the world. With the rise of user-friendly and secure platforms like BiyaPay, individuals and businesses can now enjoy faster, safer, and more affordable global transactions. If you’re looking to upgrade how you manage international payments, now is the perfect time to explore what digital money transfer services have to offer.

Try BiyaPay today and experience the future of digital remittance.

FAQs:

What is the difference between digital remittance and traditional money transfer? For traditional money transfers, you usually have to go to a real office, wait longer for processing, and pay more. Digital remittance uses the internet to make choices faster, cheaper, and easier to get to.

How long does it take for electronic funds transfers to process? Different types of EFT have different times: real-time payments (seconds), wire transfers (a few hours), and ACH (1–3 days). The time may also change because of different time zones, breaks, or bank processes.

What are the advantages of using a digital money transfer service? You can use digital services from your phone or computer. They have low prices, fast delivery, strong security features, and a wide international reach.

Is BiyaPay secure for digital money transfers? Yes. To make sure every transaction is safe, BiyaPay uses encryption, two-factor login, and follows all international security standards.

How can I track my digital remittance on BiyaPay? Through your account dashboard, BiyaPay lets you watch your transfer in real time, so you can see every step of the way until it’s done.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.