- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Iron Condor Strategy: A Comprehensive Analysis of a Low-Volatility, Market-Neutral Options Trading Tool

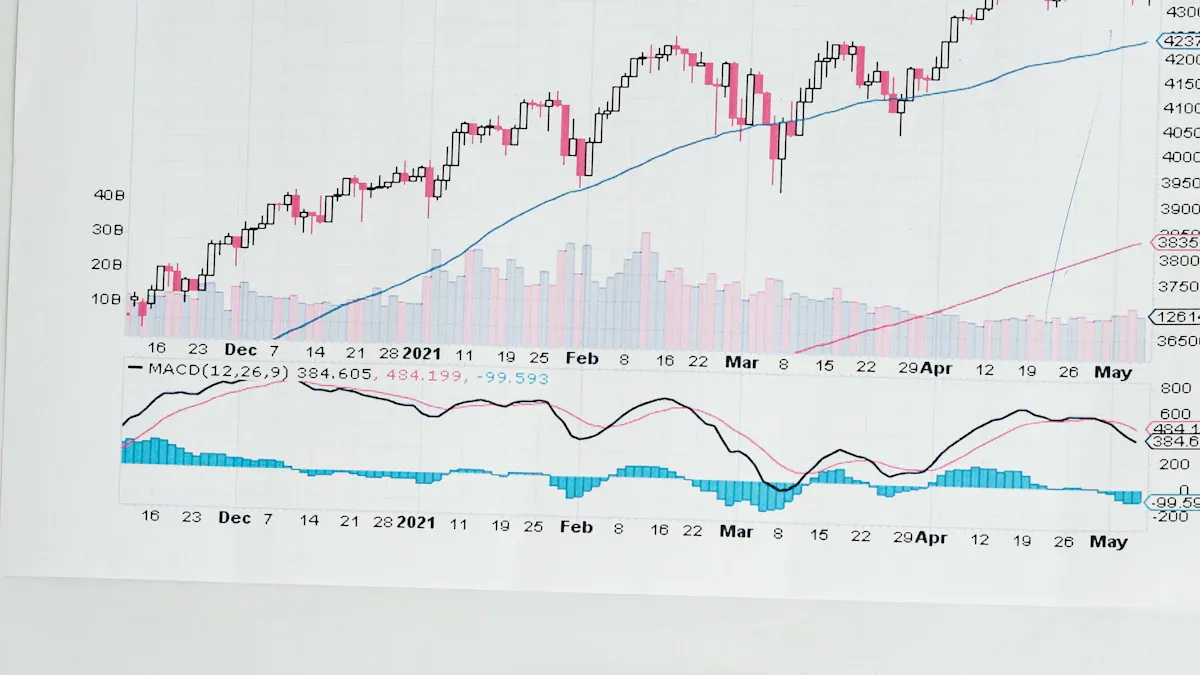

Image Source: pexels

The Iron Condor Strategy Analysis highlights the unique advantages of this strategy in low-volatility markets. The Iron Condor Strategy combines out-of-the-money call and put options to form a profit structure for range-bound markets. Many traders in the U.S. market adopt this strategy because the underlying asset price typically fluctuates within a predefined range.

- In low-volatility environments, the Iron Condor Strategy can be effectively implemented, with the expectation that the asset price will remain within a defined range.

- Historical backtesting shows that the strategy performs steadily during low-volatility periods, with parameter settings impacting the profit potential.

- The strategy is suitable for range-bound markets, tolerating moderate price fluctuations, with time value decay contributing to profit accumulation.

Traders should focus on the strategy’s structure, specific operational processes, risk-reward profiles, and applicable scenarios to achieve stable neutral returns.

Key Takeaways

- The Iron Condor Strategy is suitable for low-volatility markets, enabling stable returns when prices remain within a specific range.

- Traders need to focus on the strategy’s structure and operational processes to effectively manage risk and reward.

- By leveraging time value decay, traders can profit from collecting option premiums, especially in low-volatility environments.

- Understanding breakeven points helps in timely position adjustments to prevent loss escalation.

- Selecting appropriate strike prices and managing volatility expectations are critical to successfully implementing the Iron Condor Strategy.

Iron Condor Strategy Analysis and Structure

Image Source: pexels

Strategy Definition

The Iron Condor Strategy Analysis holds significant importance in the field of options trading. This strategy is a four-leg option combination, where traders simultaneously manage two call options and two put options, buying and selling at different strike prices. All option contracts share the same expiration date.

- The Iron Condor Strategy Analysis emphasizes that its structure consists of two vertical spreads: a bearish call spread and a bullish put spread.

- Traders build a profit range by selling out-of-the-money call and put options while buying further out-of-the-money call and put options.

- The strategy’s name derives from its profit/loss graph, resembling a condor, reflecting its neutral return characteristics.

The Iron Condor Strategy Analysis is suitable for market environments where the underlying asset price fluctuates within a predefined range. Traders can choose a long Iron Condor (net debit) or a short Iron Condor (net credit) approach, flexibly addressing different risk preferences.

Structure Analysis

The structure of the Iron Condor Strategy Analysis balances risk control and return stability.

- Bearish Call Spread: Sell one out-of-the-money call option while buying a further out-of-the-money call option.

- Bullish Put Spread: Sell one out-of-the-money put option while buying a further out-of-the-money put option.

- The four option contracts together form a range, and as long as the underlying asset price fluctuates within this range, traders can achieve maximum profits.

The table below shows the average profit performance of the Iron Condor Strategy in different volatility environments:

| Volatility Environment | Average Profit/Loss | Remarks |

|---|---|---|

| Low Volatility | Higher average profit | Closing profitable trades early performs best |

| High Volatility | Larger losses | Loss management needed to improve overall profitability |

The Iron Condor Strategy Analysis is commonly applied to high-liquidity assets, such as mainstream U.S. market ETFs (e.g., SPY, QQQ) or large-cap tech and financial stocks. These assets typically trade within narrow ranges, contributing to higher strategy success rates.

Low-Volatility Advantage

The Iron Condor Strategy Analysis demonstrates significant advantages in low-volatility market environments.

- During low-volatility periods, the underlying asset price is more likely to remain within the strategy’s profit range, increasing the probability of profitability.

- The strategy leverages the time value decay principle of option premiums, allowing sellers to profit by collecting premiums. As time progresses, option values gradually decrease, enabling sellers to retain more of the premium.

- Traders implementing the Iron Condor Strategy Analysis in low-volatility environments typically achieve higher average profits with limited risk exposure.

Note that the Iron Condor Strategy involves a four-leg trade, with higher transaction costs. Traders should fully consider the impact of fees and commissions on net profits when evaluating overall profitability.

The Iron Condor Strategy Analysis is not only suitable for low-volatility markets but also for investors with high risk control requirements. Mature blue-chip companies and high-liquidity ETFs in the U.S. market are ideal underlyings, effectively enhancing the strategy’s stability and operability.

Operational Process

Position Establishment Steps

Professional traders in the U.S. market typically follow these steps when implementing the Iron Condor Strategy Analysis:

- Sell one out-of-the-money (OTM) call option. For example, sell a call option with a $55 strike price, receiving a $2.00 premium.

- Buy a further OTM call option. For example, buy a call option with a $60 strike price, paying a $1.00 premium.

- Sell one OTM put option. For example, sell a put option with a $45 strike price, receiving a $2.00 premium.

- Buy a further OTM put option. For example, buy a put option with a $40 strike price, paying a $1.00 premium.

Traders must ensure that all option contracts have the same expiration date to form a complete Iron Condor Strategy Analysis structure.

Expiration and Closing

Expiration and closing significantly impact the strategy’s returns. Traders should note the following:

- Consider the expiration date and select sufficient time to ensure the asset price remains within the expected range.

- Monitor economic events and avoid establishing or holding an Iron Condor Strategy before major announcements.

- Use trading platform analytics tools to evaluate strategy performance and potential risks in real time.

Timely closing helps lock in profits and avoid risks from sharp market fluctuations near expiration.

Management Techniques

During market fluctuations, traders can employ various management techniques to optimize the Iron Condor Strategy Analysis:

| Management Technique | Application Scenario |

|---|---|

| Rolling Up Put Spread | When the stock price rises, collect profits and create a narrower Iron Condor structure. |

| Rolling Forward Call Spread | When the stock price remains high and approaches expiration, convert to a Call Spread and roll forward. |

| Rolling Down Call Spread | When the stock price falls, collect profits and create a narrower Iron Condor structure. |

Traders can flexibly adjust the positions of each option leg based on market movements to reduce risk exposure and enhance overall strategy stability.

Returns and Risks

Image Source: pexels

Return Sources

The returns of the Iron Condor Strategy Analysis primarily come from option premiums. Traders collect two premiums by simultaneously selling out-of-the-money call and put options. As long as the underlying asset price remains between the strike prices of the sold options at expiration, all options expire worthless, allowing traders to retain the full net premium as profit.

Additionally, time value decay is a core source of profitability for this strategy. As the expiration date approaches, option values gradually decrease, enabling sellers to benefit from the passage of time.

Traders typically select low-volatility, range-bound U.S. ETFs or large-cap blue-chip stocks as underlyings to increase the strategy’s success rate.

Maximum Returns

The maximum return equals the net premium income from the four-leg option combination. The specific calculation is as follows:

- Sell a call option to receive premium A

- Buy a higher strike call option, paying premium B

- Sell a put option to receive premium C

- Buy a lower strike put option, paying premium D

Maximum Return = (A - B) + (C - D)

As long as the underlying asset price fluctuates between the strike prices of the sold options, traders can achieve the full net premium.

For example, if the net income is $2.00, the maximum return is $2.00 per contract.

Risk Exposure

The risk exposure of the Iron Condor Strategy primarily lies in potential losses during extreme market movements.

- The maximum potential loss is significantly greater than the maximum potential profit.

- The strategy profits in range-bound markets but can lead to significant losses during sharp price fluctuations.

- Due to the negative gamma effect, rapid and significant price movements accelerate losses, potentially wiping out the initial option premium and leading to maximum losses.

- The Iron Condor Strategy is particularly sensitive during market volatility, especially during unexpected market fluctuations.

- If the underlying asset price approaches the breakeven point before expiration, it may lead to significant losses.

- The strategy relies on market stability, and unstable market conditions (e.g., unexpected news) may affect its effectiveness.

Professional traders typically adopt the following risk management methods:

- Identify the profit window, i.e., breakeven points, to help traders anticipate potential returns and manage risks effectively.

- Set profit targets and maximum loss levels to close positions promptly when these thresholds are reached.

- Understand transaction costs to avoid profit erosion from frequent adjustments.

- Know when to close positions to avoid larger losses when the market undergoes fundamental changes.

Beginners should learn basic adjustment techniques, such as rolling spreads or closing positions early when losses expand. Complex multi-step adjustments may increase risk, so novices are advised to keep it simple and focus on risk control.

Breakeven Points

Breakeven points are critical for risk management in the Iron Condor Strategy. Traders must accurately calculate the upper and lower breakeven points to adjust positions promptly.

The table below shows the calculation method for breakeven points in a standard Iron Condor Strategy:

| Calculation Type | Formula | Explanation |

|---|---|---|

| Upper Breakeven Point | Short call option strike price + Net credit received | The asset must stay below this level to avoid upside losses. |

| Lower Breakeven Point | Short put option strike price - Net credit received | The asset must stay above this level to avoid downside losses. |

For example, if a trader establishes an Iron Condor Strategy with a $2.00 credit received, the breakeven points are $2.00 above the short call option strike price and $2.00 below the short put option strike price.

Clear breakeven points help traders take timely action when prices approach critical ranges, preventing loss escalation.

Applicable Scenarios and Recommendations

Market Environment

The Iron Condor Strategy performs exceptionally well in specific U.S. market environments. Historical data indicates that the following market conditions are more suitable for implementing the strategy:

- When implied volatility is above the 75th percentile, the Iron Condor Strategy offers higher premiums and greater profit potential.

- During earnings seasons, volatility is often overestimated, allowing traders to sell options and collect higher premiums.

- After major economic announcements, markets typically enter a consolidation phase with stable price fluctuations, suitable for range-bound strategies.

- During seasonal low-volatility periods, such as summer, lower market volatility favors stable profits from the Iron Condor Strategy.

The Iron Condor Strategy performs well in low to moderate volatility environments, providing stable income for portfolios.

Investor Types

The Iron Condor Strategy is suitable for investors with the following characteristics:

- Expect the market to remain range-bound within the option’s lifecycle, seeking stable returns.

- Prefer strategies with defined risk and reward, accepting limited profits and limited risks.

- Are willing to manage multiple option positions and have the ability to adjust positions.

- Aim to balance portfolios with diversified strategies, enhancing performance in range-bound markets.

| Investor Characteristic | Applicability Explanation |

|---|---|

| Neutral Risk Preference | Suitable for investors seeking stable returns |

| Basic Options Knowledge | Able to understand and manage multi-leg strategies |

| Portfolio Diversification Needs | Can enhance performance alongside other strategies |

Operational Recommendations

Professional traders in the U.S. market typically follow these recommendations when implementing the Iron Condor Strategy:

- Choose appropriate strike prices. Selling strike prices closer to the current price yields higher premiums but lower success probabilities; further strike prices offer smaller premiums but higher success probabilities. Traders should balance based on their risk tolerance and market expectations.

- Manage volatility expectations. The Iron Condor Strategy performs best in low-volatility environments. Traders can use implied and historical volatility tools to assess market conditions, avoiding reckless position establishment during high-volatility periods.

- Use delta indicators to assess probabilities. Lower delta values indicate a higher probability of options expiring out-of-the-money. Traders can combine delta with overall strategy goals to optimize position structures.

- Incorporate the Iron Condor Strategy into a diversified portfolio. The strategy generates income in range-bound markets, balancing more directional strategies and enhancing overall performance.

Traders should closely monitor market dynamics, adjust positions promptly, and ensure risks remain manageable while achieving expected returns.

The Iron Condor Strategy demonstrates stable returns and limited risk advantages in low-volatility markets. Academic research indicates that the strategy limits losses with low margin requirements, making it suitable for risk-conscious investors. Traders should avoid the following common pitfalls:

- Lack of a trading plan can lead to impulsive decisions.

- Failure to adjust positions promptly can impact profitability.

- Ignoring implied volatility may increase costs.

Understanding Greek letters and balancing delta and gamma help maintain neutral positions. Investors can flexibly apply the Iron Condor Strategy based on their style and market environment to enhance overall performance.

FAQ

Is the Iron Condor Strategy suitable for beginner investors?

The Iron Condor Strategy is complex, involving four-leg option operations. Beginners should first master basic options knowledge before attempting it. Starting with simulated trading is recommended to gain experience before investing real funds.

Can positions be closed early before expiration?

Investors can close positions early at any time. Early closure helps lock in realized profits and mitigate risks from market fluctuations near expiration. Most U.S. market brokers support early closure operations.

Does the Iron Condor Strategy require high margin?

The strategy is a limited-risk structure with relatively low margin requirements. Margin depends on the maximum risk of the two spreads. Investors should understand their broker’s specific margin policies in advance.

Can the Iron Condor Strategy remain profitable in high-volatility markets?

In high-volatility markets, the Iron Condor Strategy’s risk increases. The probability of prices breaking out of the range rises, potentially leading to losses. Investors are advised to use the strategy in low-volatility environments.

Which underlyings are suitable for implementing the Iron Condor Strategy?

Investors commonly use high-liquidity U.S. ETFs (e.g., SPY, QQQ) or large-cap blue-chip stocks. Underlyings should have sufficient liquidity and stable price ranges to enhance the strategy’s success rate.

You have now mastered the Iron Condor, a powerful range-bound options strategy, and understand that its success hinges on precise transaction cost control and extreme capital liquidity. As a four-legged strategy, high trading fees and non-transparent cross-border exchange costs can quickly become invisible liabilities, consuming the premium you worked hard to collect.

You need a global financial management platform that helps you maximize net returns and minimize trading friction.

BiyaPay is your professional options trading support system. We offer real-time exchange rate inquiry and conversion for fiat currencies, with remittance fees as low as 0.5%, and zero commission for contract limit orders, helping you significantly reduce the costs of executing your Iron Condor strategy. BiyaPay supports the conversion between various fiat and cryptocurrencies, enabling you to participate in global financial markets, including Stocks and options, all within one platform. There is no need for a complex overseas account, and you can enjoy same-day remittance and arrival, ensuring you capitalize on every opportunity to open or close your positions. Click the Real-time Exchange Rate Inquiry now, BiyaPay for quick registration, and use ultra-low costs and peak efficiency to make your Iron Condor strategy profitable in a neutral market!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.