- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Asset Allocation: The Core Strategy for Building a Robust Investment Portfolio

Image Source: unsplash

When investing, asset allocation can help you scientifically diversify risks and achieve long-term stable returns. Financial research shows that by using mean-variance frameworks and machine learning models, investors can more effectively predict asset returns and volatility. Through minimum variance portfolios and maximum Sharpe ratio portfolios, you can optimize risk and return in different market environments. You need to clarify your risk tolerance, investment horizon, and goals, and develop a tailored allocation plan based on your actual needs.

Key Points

- A diversified investment portfolio is key to reducing risk. Choosing assets with low correlation can effectively mitigate the impact of volatility in a single asset.

- Maintain a long-term investment perspective. Holding assets over the long term can smooth out market fluctuations and help achieve financial goals.

- Assess your risk tolerance. Understanding your risk appetite and developing an appropriate asset allocation strategy can prevent emotional decision-making.

- Dynamically manage your portfolio. Regularly review and rebalance your asset allocation to ensure it aligns with your personal goals and market changes.

- Pay attention to changes in the market environment. Adjust asset allocation ratios flexibly based on macroeconomic trends and market volatility to enhance portfolio stability.

Core Concepts

Diversification

When allocating assets, you should prioritize the principle of diversification. Diversification can significantly reduce the overall risk of your portfolio. Modern portfolio theory suggests that only by spreading capital across different asset types can you effectively mitigate the impact of volatility in a single asset. Research shows that selecting assets with low or negative correlation significantly reduces portfolio risk. For example, Levy and Sarnat’s analysis indicates that when the return correlation between assets is zero, company-specific risks can be eliminated. Cross-border investments can further diversify risk, as economic cycles in different countries and regions are not fully synchronized.

Diversification is not just about holding a variety of assets; you need to focus on the correlation between assets. Highly correlated assets cannot help diversify risk, while low or negatively correlated assets can enhance the effectiveness of asset allocation.

- Portfolio diversification is key to reducing risk.

- Correlation analysis helps optimize asset selection.

- Cross-regional allocation can further diversify systemic risk.

Long-Term Perspective

When developing an asset allocation strategy, you should maintain a long-term perspective. Historical data shows that while stocks experience significant short-term volatility, they offer the highest long-term returns. For those years away from retirement, there is sufficient time to recover from short-term market downturns. Combining stocks with bonds and other assets can balance growth and volatility. Long-term investing not only helps you weather market sentiment fluctuations but also enables you to better achieve financial goals.

- Long-term holding helps smooth market fluctuations.

- Asset allocation should align with your investment horizon.

- The compounding effect is more pronounced in long-term investing.

Risk Diversification

In the asset allocation process, you must prioritize risk diversification. The correlation between different assets determines the effectiveness of risk diversification. Highly correlated assets cannot reduce overall risk, while low or negatively correlated assets can effectively diversify risk. For example, when Stock A and Stock B have a correlation of 1, risk cannot be reduced; when Stock A and Stock E have a correlation of -0.50, portfolio risk decreases significantly. By reasonably pairing assets with different correlations, you can optimize the volatility and risk characteristics of your portfolio.

- Low-correlation asset combinations enhance risk diversification.

- Risk diversification is the core objective of asset allocation.

- Asset correlation analysis aids in scientific portfolio allocation.

Asset Allocation Principles

Image Source: pexels

Risk Tolerance

When developing an asset allocation strategy, you must first assess your risk tolerance. Risk tolerance depends not only on your intuition but also on your comfort with market volatility and actual financial capacity. Understanding your risk tolerance is crucial for determining an appropriate investment portfolio.

- If you have a high risk tolerance, you may lean toward allocating more to stocks to pursue higher long-term returns.

- If you prefer stability and are risk-averse, you might favor low-volatility assets like bonds to ensure capital safety.

You can systematically assess your risk tolerance through questionnaires or scenario simulations. Only by clarifying this can you avoid emotional decisions during market volatility.

Common mistakes include lacking a clear investment plan and blindly chasing popular assets. You should set clear goals, assess your risk tolerance, and stick to your strategy.

Investment Horizon and Goals

When setting up asset allocation, the investment horizon and goals are equally critical. The range of investment returns varies over time. A longer investment horizon allows economic growth, monetary policy, and geopolitical factors to play a role. You need to reasonably assess markets and investment opportunities based on your investment perspective.

| Investment Horizon | Impact on Asset Allocation |

|---|---|

| Short-Term | Greater changes in risk and return, high market volatility |

| Medium-Term | Economic growth and market environment changes become evident |

| Long-Term | Increased portfolio stability, return drivers become more significant |

- The range of investment outcomes varies over time.

- Long-term investing allows you to address changes in economic and market forces.

- Different assets exhibit varying risk characteristics across time frames.

You should dynamically adjust your asset allocation based on your financial goals and timeline. For example, as you approach retirement or major financial goals, you should gradually reduce the proportion of risky assets and increase stable ones. You also need to review your portfolio regularly, at least annually, or adjust promptly after significant life events (e.g., buying a home or funding education) to ensure your portfolio remains aligned with your goals.

Core-Satellite Strategy

The core-satellite strategy is an asset allocation approach that balances stability and flexibility. You can allocate the majority of your capital to core assets for long-term stable returns while investing a smaller portion in satellite assets to seize market opportunities and enhance overall returns.

| Risk Tolerance | Core Asset Proportion | Satellite Asset Proportion |

|---|---|---|

| Conservative Investor | 80% | 20% |

| Balanced Investor | 70% | 30% |

| Aggressive Investor | 60% | 40% |

- Core assets typically include low-cost, diversified products like U.S. market index funds and bond funds.

- Satellite assets may include sector-specific funds, emerging market stocks, or REITs to enhance portfolio flexibility and potential returns.

- You should adjust the core-to-satellite asset ratio based on your risk tolerance to ensure the portfolio is both stable and growth-oriented.

It’s recommended to periodically review the core-satellite allocation to avoid deviating from your original intent due to market fluctuations or changes in personal goals. Maintaining diversified investments, controlling costs, and avoiding emotional decisions are key to achieving long-term stable growth.

Practical Steps

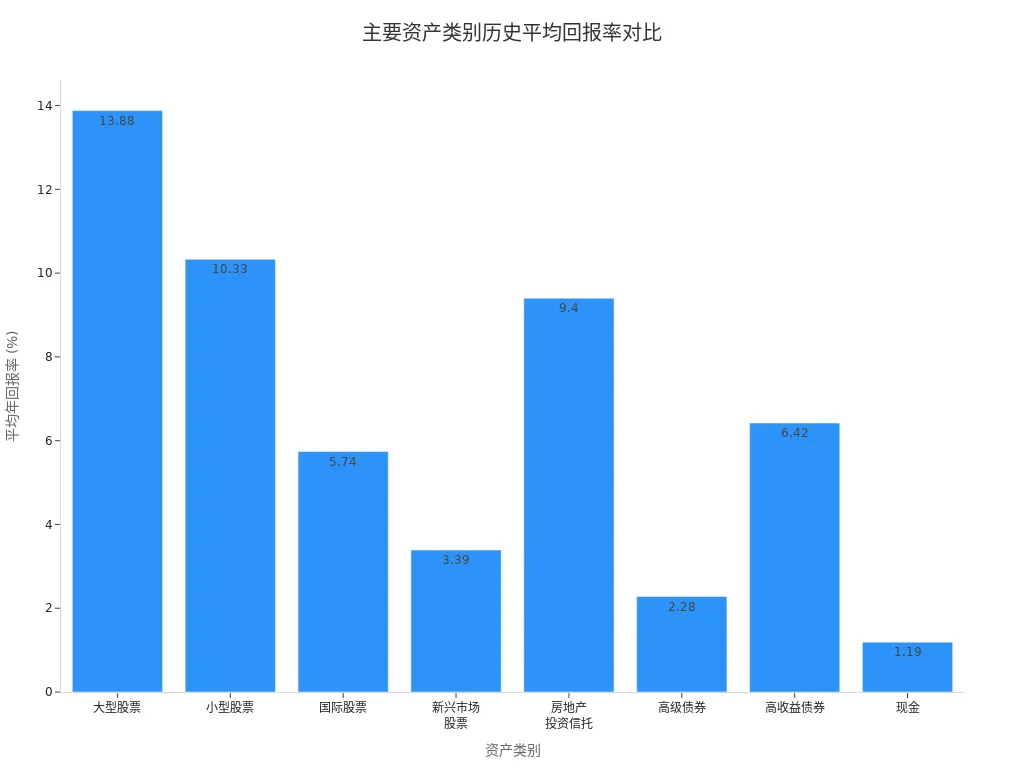

Asset Class Selection

When building a portfolio, you should first identify the main asset classes available. Each asset class has distinct risk and return characteristics. You can allocate capital based on your needs and goals. The table below shows the historical average annual returns and volatility of major asset classes in the U.S. market:

| Asset Class | Average Annual Return | Best Year Return | Worst Year Return |

|---|---|---|---|

| Large-Cap Stocks | 13.88% | 32.4% | -18.1% |

| Small-Cap Stocks | 10.33% | 38.8% | -20.4% |

| International Stocks | 5.74% | 25.6% | -14.0% |

| Emerging Market Stocks | 3.39% | 37.8% | -19.7% |

| Real Estate Investment Trusts | 9.40% | 41.3% | -25.0% |

| Investment-Grade Bonds | 2.28% | 8.7% | -13.0% |

| High-Yield Bonds | 6.42% | 17.5% | -11.2% |

| Cash | 1.19% | 5.3% | 0.0% |

You can choose asset classes such as stocks, bonds, real estate investment trusts (REITs), and cash. Stocks are typically suitable for investors seeking high returns, while bonds and cash are better for conservative investors. REITs provide additional diversification and potential returns. When selecting asset classes, consider combining your risk tolerance and investment horizon to avoid over-concentration in a single asset.

Tip: When opening an investment account with a licensed bank in Hong Kong, you can directly purchase U.S. market ETFs, bonds, or REITs to facilitate global asset allocation.

Proportion Setting

When determining asset allocation ratios, you need to consider your investment goals and risk appetite. Research shows that a balanced fixed-proportion portfolio of stocks, bonds, and commodities can achieve diversification benefits similar to optimized models. Simple heuristic allocation strategies also perform well in international equity markets and across different asset classes. The table below summarizes typical asset allocation ratio suggestions for different investor types:

| Investor Type | Stock Proportion | Bond Proportion | Real Estate Investment Trusts | Cash Proportion |

|---|---|---|---|---|

| Young Investor | 70% | 15% | 10% | 5% |

| Balanced Investor | 50% | 30% | 15% | 5% |

| Conservative Investor | 30% | 50% | 10% | 10% |

- Young investors typically have higher risk tolerance and can allocate more to high-risk assets like stocks to leverage time to manage market volatility.

- Conservative investors prioritize capital preservation and should increase the proportion of bonds and cash to reduce portfolio volatility.

- Balanced investors can adopt a balanced allocation of stocks, bonds, and REITs to achieve both growth and stability.

You can adjust the ratios based on your circumstances to ensure the portfolio meets your goals while withstanding market fluctuations.

Suggestion: When setting ratios, prioritize long-term goals and risk tolerance, and avoid frequent adjustments due to short-term market fluctuations.

Dynamic Management

In the asset allocation process, dynamic management is key to achieving long-term stable growth. Regularly rebalancing your portfolio helps maintain target ratios, preventing any single asset class from becoming over- or under-weighted due to market fluctuations. Financial experts suggest rebalancing your portfolio annually to achieve an optimal balance between risk and return. Overly frequent rebalancing increases transaction costs, while infrequent rebalancing may lead to uncontrolled risk.

| Rebalancing Frequency | Advantages | Disadvantages |

|---|---|---|

| Annually | Low transaction costs, good risk control | May miss short-term opportunities |

| Quarterly | Faster response to market changes | Increased transaction costs |

| Biennially | Minimal transaction costs | Risk may accumulate excessively |

When operating through a licensed bank in Hong Kong or a U.S. brokerage platform, you can set up automatic rebalancing services to ensure your portfolio aligns with your target ratios. Annual rebalancing not only helps capture equity risk premiums but also effectively controls transaction costs.

- Rebalancing helps prevent asset allocation from deviating from targets.

- You can use automated tools to simplify the process.

- Regularly assess portfolio performance and adjust strategies promptly.

Friendly Reminder: During dynamic management, it’s recommended to review your portfolio annually, adjusting asset allocation ratios as needed based on market changes and personal goals to ensure alignment with your needs.

Risk Management

Image Source: unsplash

Managing Market Volatility

You will encounter market volatility during investing. Asset allocation can help you diversify risk, reducing losses from a single asset’s decline. Professional investors often use diversified investments, tactical hedging, and regular rebalancing to manage downside risk. You can enhance your portfolio’s resilience through the following methods:

- Diversify investments across stocks, bonds, REITs, and other asset classes.

- Regularly review asset allocation to ensure actual ratios align with targets.

- Sell over-allocated positions and buy under-allocated ones to maintain diversification.

- Maintain some liquidity to address sudden market turmoil.

In the U.S. market, asset allocation funds effectively mitigate losses during stock market volatility by diversifying investments. Volatility not only affects expected asset returns but also alters correlations between assets, increasing the difficulty of building a diversified portfolio. You need to periodically reassess your portfolio to ensure its risk level matches your tolerance.

Inflation and Interest Rate Risk

When facing inflation and interest rate changes, asset allocation plays a critical role. A diversified portfolio can mitigate the impact of inflation and interest rate fluctuations. You can consider the following strategies:

- Allocate to stocks and bonds to leverage their negative correlation for risk management.

- Invest in inflation-linked bonds (e.g., TIPS) to hedge against rising inflation.

- Hold REITs to counter inflation through rising rents.

- Increase commodity investments, as commodity prices typically rise with inflation.

- Avoid over-investing in bonds, as bond prices may fall when interest rates rise.

In a high-inflation environment, holding too much cash leads to a decline in purchasing power. You should regularly review your portfolio to ensure it keeps pace with rising living costs and adjust asset ratios based on market changes.

Psychological Biases

Your investment decisions can be influenced by psychological biases. Common biases and coping strategies are as follows:

| Psychological Bias | Description | Coping Strategy |

|---|---|---|

| Loss Aversion | Stronger emotional reaction to losses than equivalent gains | Set predetermined exit strategies, evaluate investments based on market value, avoid emotional attachment |

| Herd Mentality | Blindly following group behavior, leading to bubbles or panic selling | Develop a personal investment plan, diversify portfolio, set exit strategies |

| Anchoring Bias | Over-reliance on initial information, affecting subsequent decisions | Regularly review investment performance, focus on current market conditions, avoid relying solely on historical data |

| Confirmation Bias | Focusing only on information supporting your views, ignoring contrary evidence | Actively seek diverse perspectives, challenge assumptions, conduct thorough research |

You can avoid psychological biases by developing a clear investment plan, regularly reviewing portfolio performance, and actively learning about market changes, thereby improving the rationality of your investment decisions.

Market Environment

Macro Trends

When formulating investment strategies, you need to closely monitor the global macroeconomic environment in 2024. Currently, the risk of economic recession remains high, with tight monetary policies and a slowing labor market increasing the likelihood of policy errors. Although inflation has cooled, it remains above the Federal Reserve’s target, and recent upticks have raised market concerns about the inflation outlook. U.S. unemployment remains low, with the labor market showing strong resilience. The Federal Reserve is expected to gradually lower interest rates in 2024, impacting the performance of various asset classes.

You also need to monitor global trade policies and geopolitical risks. 75% of North American institutional investors believe central bank policies significantly impact portfolios, 71% are concerned about high interest rates, 62% worry about economic recession, and 63% of pension funds view inflation risk as a key factor.

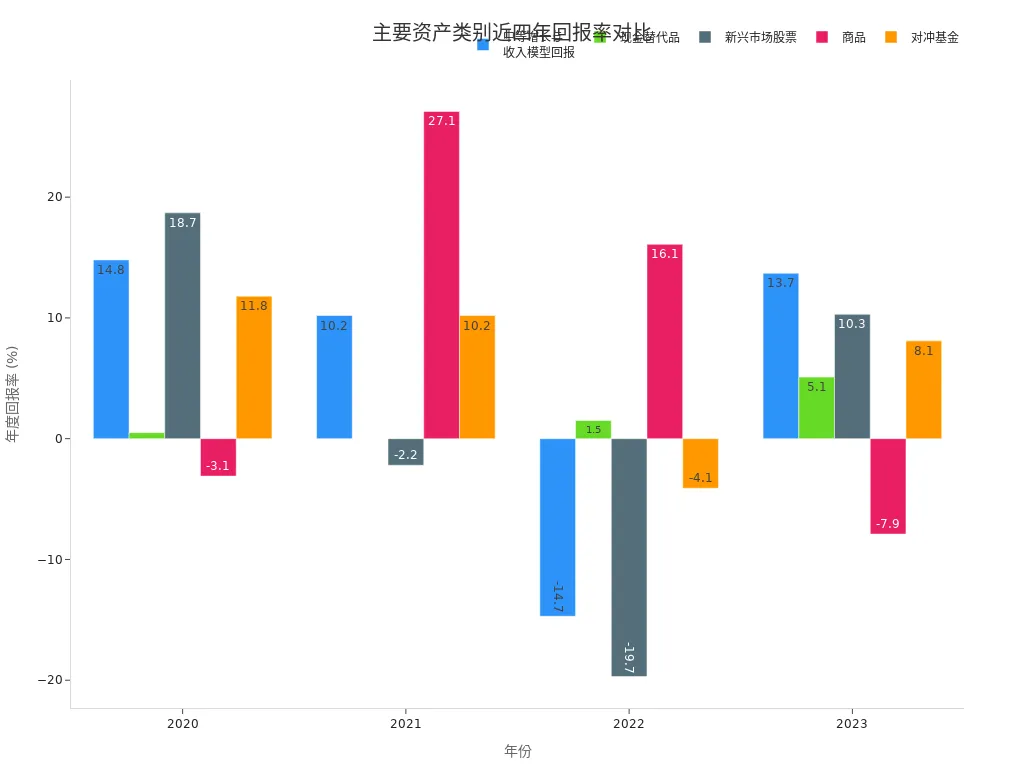

Asset Performance

Over the past five years, major asset classes have shown significant performance volatility. U.S. large-cap stocks performed strongly in 2023, while fixed-income markets experienced sharp declines in 2022. The table below summarizes annual returns for different asset classes:

| Year | Moderate Growth & Income Model Return (%) | Cash Alternatives (%) | Developed Market ex-U.S. Stocks (%) | Emerging Market Stocks (%) | Commodities (%) | Hedge Funds (%) |

|---|---|---|---|---|---|---|

| 2020 | 14.8 | 0.5 | -14.0 | 18.7 | -3.1 | 11.8 |

| 2021 | 10.2 | 0.0 | 18.9 | -2.2 | 27.1 | 10.2 |

| 2022 | -14.7 | 1.5 | N/A | -19.7 | 16.1 | -4.1 |

| 2023 | 13.7 | 5.1 | N/A | 10.3 | -7.9 | 8.1 |

You can see that asset performance volatility underscores the importance of diversified asset allocation. By reasonably diversifying investments, you can better manage risk and smooth long-term returns.

Strategic Recommendations

When allocating assets in the current market environment, you should focus on the following strategies:

- Adopt a core diversified portfolio combining growth, value, and quality stocks.

- Dynamically adjust the proportions of stocks, bonds, commodities, and cash to adapt to economic cycle changes.

- Use statistical tools like dynamic models and regression models to track market changes in real-time and optimize investment decisions.

- Monitor global trade environments and geopolitical risks, adjusting asset structures promptly.

- Reference successful cases, such as increasing fixed-income and cash allocations during market downturns and gradually returning to stocks during recovery to enhance overall returns.

You need to flexibly adjust your portfolio based on your risk tolerance and investment goals. Diversification and dynamic management are key to navigating uncertain market environments. Asset allocation not only helps you diversify risk but also enhances the stability of long-term returns.

In the investment process, asset allocation remains the core of achieving stable growth. Continuous learning enables you to identify risks, seize market opportunities, and avoid being constrained by outdated strategies. You can enhance professional skills through systematic course modules and regularly review and adjust your portfolio to ensure alignment with market changes. This way, you can better manage risks and focus on long-term wealth accumulation.

FAQ

Which is more important: asset allocation or stock selection?

You should prioritize asset allocation. Research shows that asset allocation has a far greater impact on long-term returns than individual stock selection. Diversifying assets effectively reduces risk.

How often should I adjust my asset allocation?

It’s recommended to review your portfolio annually. Adjust promptly when market fluctuations or personal goals change to ensure the allocation meets your needs.

Is asset allocation suitable for all investors?

Regardless of risk appetite, you can achieve risk diversification through asset allocation. Different investors can flexibly adjust ratios based on their goals and tolerance.

How do I choose the right asset classes for myself?

You should consider your risk tolerance, investment horizon, and goals. Young investors can allocate more to stocks, while conservative investors can increase bonds and cash.

What are common asset allocation tools in the U.S. market?

You can choose ETFs, index funds, bond funds, and REITs. These tools are low-cost and highly diversified, ideal for building a diversified portfolio.

You have mastered the core strategies of asset allocation, recognizing that dynamic management and efficient rebalancing are vital for achieving stable long-term returns in the current global macro environment. Whether you are adjusting the allocation between stocks, bonds, or REITs, traditional cross-border remittance and trading methods can hinder timely, effective execution due to high costs and delayed fund arrivals.

To ensure your portfolio consistently adheres to its risk targets, you need a financial platform that supports rapid global capital movement and low-cost dynamic management.

BiyaPay is your essential asset allocation execution tool. We offer real-time exchange rate inquiry and conversion for fiat currencies, with remittance fees as low as 0.5%, and zero commission for contract limit orders, helping you maximize the net returns from every rebalancing action. BiyaPay allows you to seamlessly convert between various fiat and digital currencies, and trade global markets, including Stocks, all on one platform. There is no need for a complex overseas account, and you can enjoy same-day remittance and arrival. Click the Real-time Exchange Rate Inquiry now, and BiyaPay for quick registration, and use peak capital efficiency to build and maintain your stable, diversified long-term investment portfolio!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.