- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Gold, Bonds, or Currency: Which is More Stable? The Ultimate Guide to Safe-Haven Investments

Image Source: unsplash

If you want stable investments, gold performs most steadily. The table below shows that gold prices typically rise during periods of high geopolitical risk and policy uncertainty, while bonds and currency assets fluctuate more significantly. Global market volatility is intensifying, making safe-haven assets an important tool for protecting wealth.

| Asset Class | Performance | Description |

|---|---|---|

| Gold | Stable | During periods of high geopolitical risk and policy uncertainty, gold prices typically rise. |

| Bonds | Unstable | When economic policy uncertainty increases, bond prices usually decline. |

| Currency Assets | Unstable | During extreme market volatility, currency assets perform less favorably than gold. |

Key Points

Gold performs steadily during economic uncertainty, and it is recommended to allocate 15% of your portfolio to gold or Bitcoin to hedge against currency devaluation risks.

Bond prices are inversely related to interest rates; when interest rates rise, bond prices typically fall, and investors need to pay attention to the impact of interest rate changes on bonds.

Cash has strong liquidity during market turmoil, enabling quick responses to unexpected situations, making it suitable for emergencies and daily payments.

Diversified investment is an effective strategy to reduce risk, combining gold, bonds, and cash to enhance overall risk resistance.

Regularly rebalance your portfolio to ensure the proportion of each asset aligns with your risk tolerance, avoiding risk concentration due to market fluctuations.

Gold as a Safe-Haven Asset

Image Source: unsplash

Gold’s Value Stability

When choosing safe-haven assets, gold is often the top choice. Gold demonstrates strong value stability during heightened economic uncertainty. Ray Dalio suggests allocating approximately 15% of your portfolio to gold or Bitcoin to effectively hedge against currency devaluation risks. Unlike currency, gold is less susceptible to inflation and is not influenced by a single country’s policies. You can diversify your investments with gold to enhance the overall safety of your assets. Gold is widely regarded as a recession-resistant investment. During economic recessions, gold prices typically rise, protecting your wealth from losses.

Gold’s Historical Performance

You can observe gold’s safe-haven attributes from historical data. Over the past 50 years, gold has performed exceptionally well during global financial crises. For example, during the 2008 U.S. financial crisis, spot gold prices rose significantly. Gold typically provides protection for portfolios during major economic crises. Although gold prices may briefly decline in the early stages of liquidity tightening, they often recover quickly and outperform other assets as monetary policies adjust. In the six major recessions we studied, gold prices generally rose.

Gold performs exceptionally well during periods of global market turmoil, making it the preferred safe-haven asset for many investors.

Risks of Gold Investment

When investing in gold, you should also be aware of related risks. The gold market can be volatile, with prices potentially fluctuating significantly in the short term. You also need to consider storage and insurance costs, especially for physical gold. Concerns about authenticity and potential fraud risks should not be overlooked. Some investors encounter issues with counterfeit products, online stores failing to deliver, or hidden fees. Additionally, gold faces risks of theft and loss, and holding costs cannot be ignored. Market volatility may affect your investment returns.

Storage and insurance costs increase your holding expenses.Authenticity and fraud risks require extra vigilance.

Bond Risk Analysis

Image Source: unsplash

Government Bonds vs. Corporate Bonds

When choosing bonds, you often hesitate between government bonds and corporate bonds. Government bonds, fully backed by the U.S. government, have extremely low credit risk and are a key component of safe-haven assets. Corporate bonds, issued by companies, carry higher credit and market risks but typically offer higher returns. The table below provides a quick overview of their main differences:

| Type | Risk Characteristics | Return Potential |

|---|---|---|

| Corporate Bonds | Higher credit risk, interest rate risk, and market risk; may be called early. | Usually higher than government bonds |

| Government Bonds | Lowest credit risk, with market and inflation risks present. | Usually lower than corporate bonds |

When allocating safe-haven assets, you typically prioritize government bonds because they offer greater safety during market turmoil.

Impact of Interest Rates

You need to pay attention to the impact of interest rate changes on bond prices. Bond prices are inversely related to interest rates. When interest rates rise, bond prices fall; when interest rates fall, bond prices rise. Bonds with longer durations are more sensitive to interest rate changes. If you hold long-term bonds, rising interest rates will reduce your bond’s value. You should also note that interest rate changes have a greater impact on bonds in the secondary market, especially in high-interest-rate environments, where older bonds become less attractive. There is an inverse relationship between bond prices and interest rates.

Longer-duration bonds are more sensitive to interest rate changes.

When interest rates rise, the market value of existing bonds is usually below their face value.

Changes in U.S. Treasury Stability

You may think U.S. Treasuries have always been stable, but recent changes have occurred. The liquidity of the U.S. Treasury market has significantly deteriorated, mainly due to restrictions on bank leverage requirements and increased volatility in monetary policy. Economists at the Federal Reserve Bank of New York point out that the liquidity and functionality of the Treasury market have faced challenges in recent years. Banks need to hold the same capital for low-risk Treasuries as for high-risk securities, reducing their willingness to participate in the Treasury market. Bank of America analysts believe that declining liquidity in the Treasury market could be one of the greatest threats to global financial stability. The health and liquidity of the Treasury market directly affect the U.S. government’s financing costs, especially when interest rates and debt levels rise.

A November 2022 Federal Reserve report showed that Treasury market liquidity was at its worst level since March 2020.

The U.S. Treasury market, valued at up to $24 trillion, is the foundation of the global financial system, but declining liquidity has raised concerns about market stability.

You will find that corporate bond liquidity is highly sensitive to economic policy uncertainty in different economic cycles. When economic uncertainty intensifies, corporate bond liquidity and credit spreads fluctuate more significantly. When allocating safe-haven assets, you need to closely monitor market environment changes and adjust bond allocations in a timely manner.

Currency Asset Performance

Cash Liquidity

During market turmoil, the liquidity advantage of cash is very evident. Cash allows you to quickly respond to unexpected situations, meeting daily payment and emergency needs. Compared to other assets, cash is easier to access and use during crises. The table below shows the liquidity differences between cash and other assets:

| Asset Class | Liquidity Characteristics |

|---|---|

| Cash | Can be quickly accessed and used to meet obligations |

| Other Assets | Increased difficulty in buying and selling, reduced liquidity |

You will find that during financial crises, market liquidity typically drops significantly. Many assets become difficult to buy or sell, and price volatility intensifies. Cash helps you maintain financial safety and flexibility in extreme situations.

Digital Currency Risks

You may be interested in digital currencies like Bitcoin. Digital currencies have high volatility, with dramatic price changes. Bitcoin’s annual volatility has exceeded 200%, far higher than traditional currencies. The digital currency market also faces risks such as immature technology, cybersecurity issues, and regulatory uncertainty. You should also note that digital currencies rely on the internet and digital wallets, and losing keys could result in unrecoverable assets. Market liquidity is limited, and in extreme cases, you may not be able to liquidate assets quickly. Investing in digital currencies is a high-risk activity.

Changes in technology and regulatory environments directly affect your investment safety.

High market volatility can lead to significant losses in the short term.

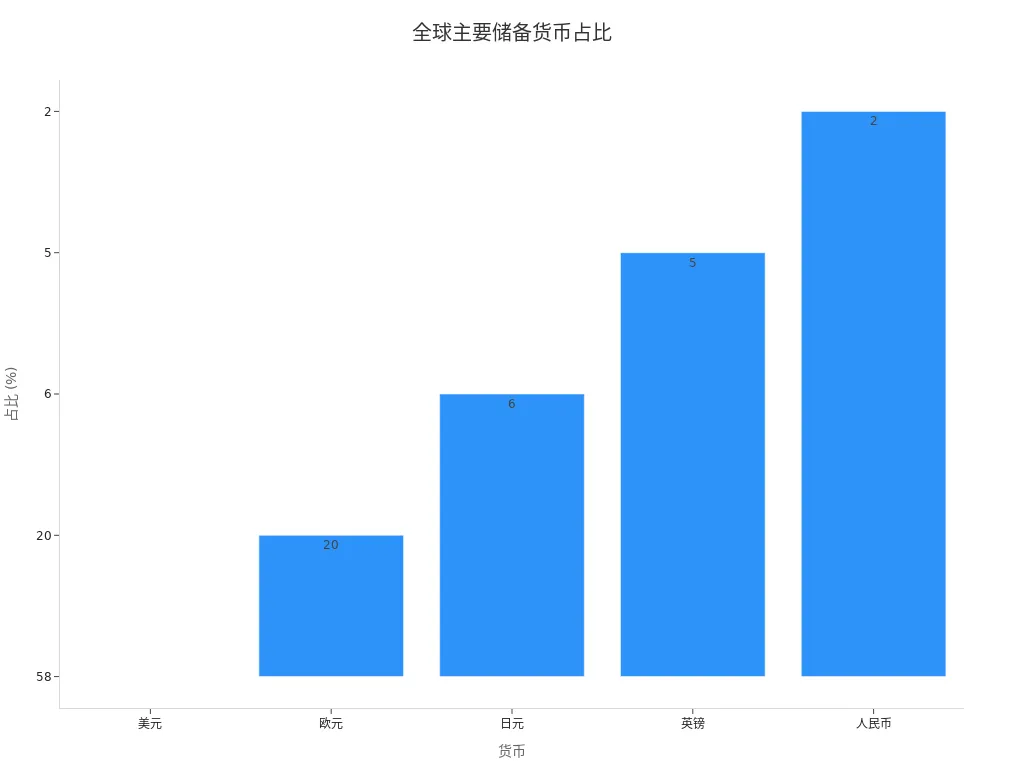

Currency Historical Data

When choosing safe-haven assets, the U.S. dollar has always been the dominant global currency. The dollar accounts for 58% of global official foreign exchange reserves, far surpassing other currencies. The depth and liquidity of U.S. financial markets make the dollar the preferred reserve asset for many countries. The table below shows the proportions of major reserve currencies:

| Currency | Proportion |

|---|---|

| U.S. Dollar | 58% |

| Euro | 20% |

| Japanese Yen | 6% |

| British Pound | 5% |

| Chinese Yuan | 2% |

You can also see that the dollar accounts for 88% of global foreign exchange transaction volume. Even during global economic shocks, the dollar continues to dominate global trade and finance. The chart below shows the proportions of major global reserve currencies:

You can see that the dollar’s stability and availability make it a key safe-haven asset. Emerging markets often choose the dollar as a reserve during crises, further solidifying its global influence.

Safe-Haven Asset Comparison

Stability Analysis

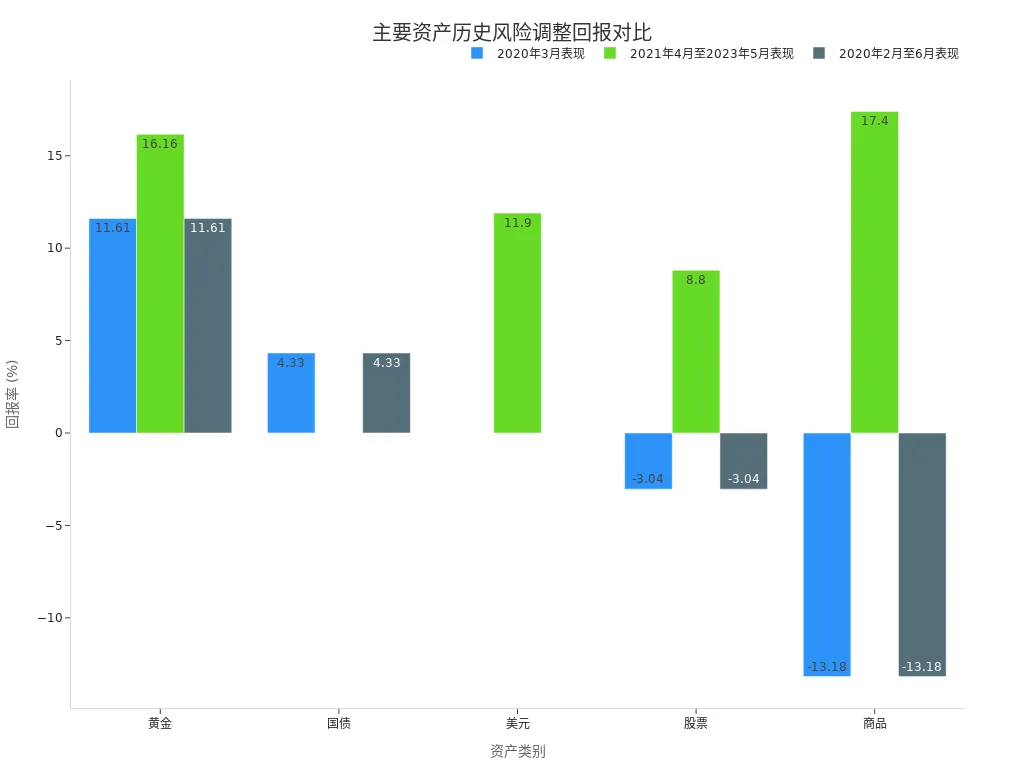

When choosing safe-haven assets, your primary concern is asset stability. Gold, bonds, and currency assets each have their pros and cons. Gold has performed exceptionally well over the past few decades, especially during high inflation and market volatility. Data shows that from 1970 to 2020, gold’s average annual return was approximately 8.6%, higher than bonds’ 2%-5%. During the high-inflation period from April 2021 to May 2023, gold’s return reached 16.16%, far surpassing Treasuries and the dollar. The table below provides a quick overview of the historical performance of different assets:

| Asset Class | Average Annual Return | March 2020 Performance | April 2021 to May 2023 Performance |

|---|---|---|---|

| Gold | 8.6% | 11.61% | 16.16% |

| Treasuries | 2%-5% | 4.33% | N/A |

| U.S. Dollar | N/A | 0.00% | 11.90% |

| Stocks | 7.2% | -3.04% | 8.80% |

| Commodities | N/A | -13.18% | 17.4% |

You can see that gold performs most steadily during market turmoil and high inflation. Although bonds have lower returns, they have less volatility, making them suitable for investors seeking stability. Dollar assets can provide some protection during specific periods but have weaker long-term inflation resistance compared to gold.

Tip: There is a negative correlation between gold and the dollar. When allocating assets, you can use this characteristic to hedge against currency devaluation risks.

Liquidity Comparison

When investing, liquidity is also a key consideration. Gold (such as 1-ounce gold bars) is considered a highly liquid asset, but it is not as quick to convert to cash as bonds or currency. Physical gold has higher transaction costs and takes time to sell. Paper gold investments (such as ETFs) offer better liquidity and lower transaction costs. Bond liquidity is affected by market conditions; Treasuries typically have strong liquidity, while corporate bond liquidity declines during economic uncertainty. Dollar assets have the highest liquidity, allowing you to convert and use them anytime. Gold generally maintains liquidity during market stress or economic uncertainty, while other assets may be harder to sell.

Physical gold has high transaction costs, while paper gold offers better liquidity.Treasuries have strong liquidity, while corporate bonds are more affected by market conditions.Dollar assets have the highest liquidity, suitable for emergencies and daily payments.

You can choose assets with higher liquidity based on your needs to enhance financial flexibility.

Suitable Investors

When choosing safe-haven assets, you need to consider your risk tolerance and investment goals. Different types of investors are suited to different asset allocations. The table below can help you quickly determine:

| Investor Type | Suitable Investment Method | Risk Tolerance |

|---|---|---|

| Conservative Investors | Physical Gold | Low Risk |

| Aggressive Investors | Gold ETFs or Mining Stocks | High Volatility |

If you seek long-term stability and capital preservation, you can choose gold and Treasuries as primary safe-haven assets. If you aim for higher returns and are willing to take on some risk, you can consider gold ETFs or corporate bonds. Dollar assets are suitable for investors needing high liquidity and emergency funds.

Reminder: When allocating safe-haven assets, it’s recommended to dynamically adjust proportions based on your needs and market conditions to avoid risks from single-asset allocations.

Safe-Haven Asset Allocation Suggestions

Diversification Principles

When allocating safe-haven assets, diversification is the most fundamental and effective principle. Diversification can help you reduce the risks from fluctuations in a single asset. Financial experts suggest that you choose safe assets based on the time horizon of your financial needs. If you have short-term financial needs, prioritize assets with high liquidity and capital preservation, such as cash or short-term Treasuries. If you focus on long-term wealth preservation, gold and certain high-rated bonds are more suitable. You need to understand the role of safe assets in your portfolio.

Reasonably allocate proportions to avoid being forced to sell high-risk assets during market downturns.

You can combine gold, Treasuries, and cash to enhance overall risk resistance.When choosing complex products like buffered ETFs, carefully evaluate their structure and fees to ensure they align with your investment goals.

Tip: Modern portfolio theory encourages wise diversification. Gold’s low correlation with the stock market can enhance portfolio diversification. You can use tools like gold ETFs or sovereign gold bonds to conveniently gain gold exposure.

Risk Management

When allocating safe-haven assets, risk management is equally important. Gold serves as a hedge against inflation and market volatility, providing protection for your portfolio. You can effectively manage risks through the following methods:

Regularly assess the proportion of each asset in your portfolio to ensure it aligns with your risk tolerance.

Pay attention to asset correlations to avoid redundant allocation in similar asset types. For example, multiple funds may hold similar bonds or gold, leading to risk concentration and unnecessary costs.

Do not overly rely on past performance. You need to understand the drivers behind assets and adjust strategies in time to adapt to market changes.

Choose products with reasonable fee structures to avoid high management fees eroding your investment returns.

You can refer to the table below to understand the roles of different assets in a portfolio:

| Asset Class | Characteristics | Role |

|---|---|---|

| Gold | High Stability | Mitigate Market Volatility |

| Liquidity Alternatives | Diversification | Provide Additional Protection |

| Cash | High Liquidity | Address Uncertainty |

Note: Holding more funds does not always reduce risk, especially when they invest in similar styles or regions. Focus on true strategic diversification.

Rebalancing Strategies

During long-term investing, asset proportions may shift due to market fluctuations. Rebalancing strategies can help you maintain your portfolio’s target structure, reducing risk and improving long-term efficiency. You need to periodically (e.g., every six months or annually) check the actual proportions of each asset and adjust them based on your preset goals. If gold prices rise significantly, your gold allocation may exceed the target. You can sell some gold and add bonds or cash to restore balance.

If the proportion of bonds or cash decreases, you can increase holdings in these assets to maintain overall structural stability.

You can adopt momentum or trend-following methods, observing the historical performance of asset classes and adjusting allocations accordingly. Studies show that cross-asset momentum strategies achieved nearly 8% annual returns from 1986 to 2007, with stable returns.

Common mistakes during rebalancing include:

Ignoring active rebalancing, leading to portfolios deviating from the expected structure and increasing risk.Over-relying on recent performance and ignoring market environment changes.

Redundant allocation, hiding concentrated risks.

Inefficient fee structures eroding long-term returns.

Suggestion: Dynamically adjust asset proportions based on market conditions. During crises, gold and cash offer stronger protection. You can flexibly apply rebalancing strategies based on your needs to enhance portfolio stability.

When choosing safe-haven assets, gold, bonds, and currency each have their advantages. Gold can counter inflation, is globally recognized, but has significant price volatility and storage costs. Bonds offer strong stability, suitable for those seeking stable cash flow, but returns are limited. Currency has high liquidity, convenient for emergencies, but is susceptible to inflation.

| Advantages | Disadvantages |

|---|---|

| Counters Inflation | No Income Generation |

| Diversification | Storage Costs |

| Safe Haven | Price Volatility |

You can diversify your investments across asset classes, industries, and regions. Regularly rebalance your portfolio to maintain long-term stability. Asset allocation should be dynamically adjusted to ensure your investment goals and risk tolerance are always aligned.

FAQ

How Much is the Minimum Investment for Gold?

You can buy gold ETFs with USD 100. Physical gold prices vary based on weight and purity, typically around USD 2,300 per ounce. You can choose flexibly based on your budget.

Tip: Gold ETFs have a low entry threshold, suitable for beginners.

Are Bond Investments Safe?

When you buy U.S. Treasuries, credit risk is extremely low. Corporate bonds have higher risks but also higher returns. Choose the appropriate bond type based on your risk tolerance.

| Type | Risk | Return |

|---|---|---|

| U.S. Treasuries | Low | Low |

| Corporate Bonds | High | High |

How Do Currency Assets Address Inflation?

When you hold cash, it is easily affected by inflation. The dollar’s long-term ability to resist inflation is weaker than gold. You can enhance your assets’ inflation resistance by diversifying into gold and bonds.

Are Digital Currencies Suitable for Safe-Haven Investments?

When investing in digital currencies like Bitcoin, you face high volatility and technical risks. Digital currencies are not suitable for long-term safe-haven investments. Monitor market changes and allocate cautiously.

How to Choose Bank Services for Safe-Haven Assets?

You can choose a licensed bank in Hong Kong to open a multi-currency account. This facilitates managing USD and gold assets. Pay attention to account management fees and transaction fees.

Note: Bank service fees vary significantly; consult in advance.

You’ve explored the hedging characteristics and allocation strategies of gold, bonds, and currency assets. Whether you choose gold to hedge against inflation or bonds to lock in yield, efficient fund management is the key to your strategy’s success.

When engaging in global asset allocation, particularly involving US/HK stocks and digital currencies, high remittance costs and non-transparent exchange rates can significantly diminish your hedging returns. You need an integrated platform that handles fiat currency exchange, digital asset management, and global investment seamlessly.

BiyaPay is the ideal platform for your needs. We offer real-time exchange rate inquiry and conversion for fiat currencies, with remittance fees as low as 0.5%. Plus, our zero commission for contract limit orders helps you keep trading costs minimal. Furthermore, BiyaPay supports the conversion between various fiat and cryptocurrencies, enabling you to participate in global asset allocation, including Stocks, all within one platform. There is no need for a complex overseas account, and you can enjoy same-day remittance and arrival. Click the Real-time Exchange Rate Inquiry now, BiyaPay for quick registration, and make your safe-haven investments more secure and efficient!

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.