- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Your 2025 Guide to Solana ETF Investing

Image Source: pexels

A Solana ETF combines the innovation of cryptocurrency with the accessibility of exchange-traded funds. It allows you to invest in Solana, a leading blockchain platform, through a regulated investment fund. This approach simplifies cryptocurrency investments, making them more approachable for both new and experienced investors. Solana ETFs, such as the Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT), appeal to those seeking to diversify their portfolios while participating in the growing crypto market. Before investing, you must understand the benefits, risks, and strategies involved. A thoughtful approach will help you make informed decisions and maximize your investment potential. Additionally, you can purchase these Solana ETFs through BiyaPay, enhancing your investment options in the crypto space.

Why Solana Stands Out in Blockchain Innovation

Solana has emerged as the fastest-growing Layer 1 blockchain, processing over 65,000 transactions per second (TPS) with sub-second finality - 46x faster than Ethereum. According to CoinDesk Q2 2025 State of Crypto Report, Solana now commands 34% of all decentralized exchange (DEX) volume, surpassing Ethereum in NFT trading volume for three consecutive quarters.

Key Technological Advantages:

- Sealevel Parallel Execution: Enables simultaneous smart contract processing

- Proof-of-History (PoH): 78% more energy-efficient than Bitcoin’s Proof-of-Work

- Low-Cost Infrastructure: Average transaction fee of $0.00025 vs Ethereum’s $2.15

Grayscale Research notes: “Solana’s institutional-grade throughput positions it as prime ETF underlying collateral - we’ve seen $2.3B in SOL futures open interest since March 2025 CME listing.”

Key Takeaways

- Solana ETFs make crypto investing easier. You can invest in Solana through safe, regulated funds without handling digital wallets.

- Begin with small amounts when buying Solana ETFs. This lowers risk and helps you learn how the market works.

- Add Solana ETFs to your portfolio with other investments. This spreads out risk and can increase your chances of earning more.

- Keep up with market news and Solana updates. Knowing what’s happening helps you make smarter choices and adjust your plan.

- Pick a trusted brokerage platform with learning tools and Solana ETF options. A good platform makes investing simpler and better.

What is a Solana ETF?

Image Source: pexels

The Blockchain Advantage

Solana’s architecture provides three critical ETF advantages:

- Real-Time Settlement:

- Traditional ETFs: T+2 settlement (e.g., BlackRock’s IBIT)

- Solana ETFs: T+0 settlement via on-chain verification

- Source: Fidelity Digital Assets 2025 Settlement Report]

- Programmable Exposure:

```solidity

// Smart contract-automated rebalancing

function rebalancePortfolio() public {

require(msg.sender == authorizedAP, "Only APs");

adjustCollateralRatio(SOLPriceOracle.fetch());

}

Example: 21Shares’ Solana ETP uses Chainlink oracles for NAV calculation

- Cost Efficiency:

| Fee Component | Traditional ETF | Solana ETF |

|---|---|---|

| Custody | 15-25 bps | 5-8 bps |

| Transaction Settlement | $0.30/trade | $0.0001 |

| Regulatory Reporting | $50,000/month | On-chain |

Regulatory Milestones

The SEC’s approval of SOL futures ETFs in March 2025 set crucial precedents:

- Surveillance-Sharing Agreement: CME & Coinbase jointly monitor SOL markets

- Asset Protection: 95% cold storage mandate via SOC 2-certified custodians

- Transparency: Daily on-chain proof-of-reserves (View VanEck’s reserves)

As former CFTC Commissioner Brian Quintenz stated: “Solana ETFs represent the first truly 24/7 global ETF structure - a paradigm shift requiring new risk frameworks.”

How Solana ETFs Work

Solana ETFs operate by tracking the price of Solana or its related financial instruments, such as futures contracts. These ETFs are managed by professional fund managers who aim to replicate Solana’s performance as closely as possible.

However, operational differences set Solana ETFs apart from other types of ETFs:

Market Volatility: Solana ETFs experience significant price fluctuations, reflecting the volatility of the underlying cryptocurrency.

Tracking Errors: Management fees and operational costs can cause the ETF’s performance to deviate slightly from Solana’s actual price.

Regulatory Uncertainty: Changes in regulations may impact the availability and performance of Solana ETFs.

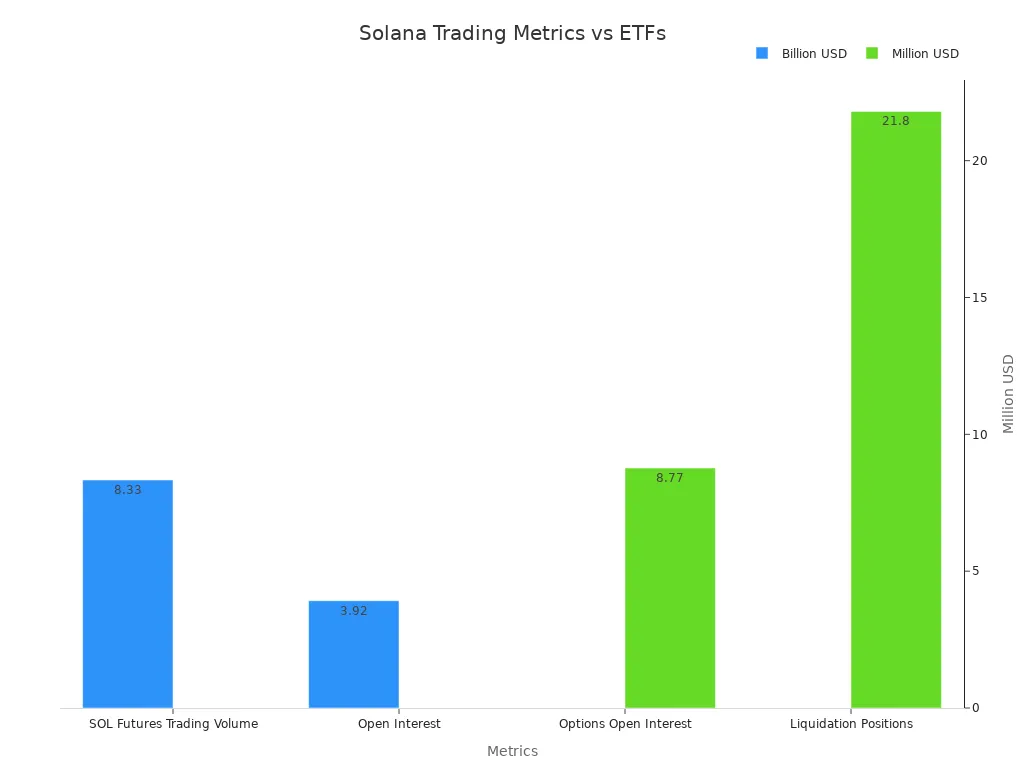

The table below highlights key data and trends that explain the relationship between Solana’s technology and the rise of ETFs in the market:

| Metric | Value | Change |

|---|---|---|

| SOL Futures Trading Volume | $8.33 billion | +38.94% |

| Open Interest | $3.92 billion | +1.32% |

| Options Open Interest | $8.77 million | +11.13% |

| Long/Short Ratio (Binance) | 2.29 | N/A |

| Liquidation Positions | $21.8 million | N/A |

Wall Street’s SOL ETF Playbook

Q2 2025 Institutional Activity:

Data: CoinShares Digital Asset Fund Flows Report

| Institution | SOL ETF Exposure | Strategy |

|---|---|---|

| Morgan Stanley | $420M | Treasury yield hedge |

| Citadel | $150M | Arbitrage basket |

| Vanguard | $900M | Tech sector rotation |

| MicroStrategy | 15% of BTC gains | DeFi yield enhancement |

Portfolio Allocation Strategies:

- Core-Satellite Approach:

- 5-7% in spot SOL ETF (e.g., SOLZ)

- 2-3% in 2x leveraged futures ETF (e.g., SOLT)

- Yield Stacking:

- 65% spot ETF + 35% SOL staking pool (平均APY 5.2%)

- Risk Parity:

- 40% SOL ETF / 30% BTC ETF / 20% Cash / 10% Short-term Bonds

Source: Goldman Sachs 2025 Digital Asset Allocation Model

Benefits of Investing in Solana ETFs

Investing in Solana ETFs offers several advantages:

- Accessibility: You can invest in Solana without needing to manage a cryptocurrency wallet or navigate complex exchanges.

- Diversification: Solana ETFs allow you to diversify your portfolio by adding exposure to the cryptocurrency market.

- Income Potential: Some Solana ETFs include staking capabilities, which can generate an additional yield of 2-3.5% on top of Solana’s returns. Up to 50% of the fund’s assets may be eligible for staking, enhancing your income potential.

- Regulated Environment: Solana ETFs operate within a regulated framework, providing a safer alternative to direct cryptocurrency investments.

Custody Security Standards

SEC’s custody requirements for Solana ETFs include:

- Multi-Party Computation (MPC) Wallets: Industry-standard solutions (e.g., 3/5 multi-signature mechanisms)

- Penetration Testing: Quarterly audits by SEC-recognized firms (e.g., CertiK or Halborn)

- Insurance Coverage: Most issuers opt for coverage from institutions like Lloyd’s of London (typical coverage: $250M–$500M)

Example: Coinbase Custody provides $500M insurance for SOL assets.

Case studies also highlight the potential growth of Solana ETFs. For example:

- In a bear case, Solana capturing 2% of Bitcoin’s ETF inflows could lead to a 1.4x price increase.

- In a base case, achieving 5% of Bitcoin’s ETF inflows could result in a 3.4x price increase.

- In a blue sky case, capturing 14% of Bitcoin’s ETF inflows could yield nearly 9x growth.

These benefits make Solana ETFs an attractive option for those looking to participate in the crypto market through a structured and regulated investment vehicle.

How to Start Investing in Solana ETFs

Choose a Brokerage Platform

The first step in investing in Solana ETFs is selecting a reliable brokerage platform. A brokerage acts as your gateway to the financial markets, allowing you to buy and sell ETFs with ease. When choosing a platform, prioritize features like user-friendly interfaces, low fees, and access to a wide range of ETFs. Look for platforms that support cryptocurrency-related ETFs, including Solana ETFs, to ensure you have the right options available.

Some platforms also offer educational resources to help you understand the nuances of ETF investing. These resources can be valuable, especially if you’re new to the world of crypto ETFs. Additionally, check for security measures like two-factor authentication and encryption to protect your investments. A well-chosen brokerage platform sets the foundation for a smooth investing experience.

Research Available Solana ETFs

Once you’ve selected a brokerage platform, the next step is to research the available Solana ETFs. Not all ETFs are created equal, so it’s essential to evaluate their features, fees, and investment focus. For example, the CI Galaxy Solana ETF (SOLX) offers direct exposure to Solana tokens and has a management fee of 0% for the first three months, increasing to 0.35% afterward. This ETF trades on the Toronto Stock Exchange and provides options for both U.S. dollar-denominated (SOLX.U) and Canadian dollar-denominated (SOLX.B) investments. Its focus on decentralized finance and staking rewards highlights its growth potential.

To make informed decisions, consult market analyses and research reports. Sources like the GSR Report emphasize Solana’s technological advantages and its potential for a spot ETF. Token Metrics provides detailed market analysis and trend reports, offering insights into Solana’s position in the cryptocurrency market. Comparing these resources can help you identify the ETF that aligns with your investment goals.

| Feature | Details |

|---|---|

| ETF Name | CI Galaxy Solana ETF (SOLX) |

| Management Fee | 0% for the first three months, then 0.35% |

| Investment Focus | Direct investment in Solana tokens (SOL) |

| Trading Venue | Toronto Stock Exchange |

| Launch Date | April 16, 2025 |

| Series Available | U.S. dollar-denominated (SOLX.U) and Canadian dollar-denominated (SOLX.B) |

| Growth Potential | Exposure to decentralized finance and staking rewards |

| Source | Description |

|---|---|

| GSR Report | Highlights Solana’s position in the crypto market and its potential for a spot ETF. |

| Token Metrics | Provides comprehensive research reports on cryptocurrencies, including market analysis and trend reports relevant to Solana. |

Open and Fund Your Account

After selecting a brokerage platform and identifying the right Solana ETF, it’s time to open and fund your account. Most platforms require you to provide basic personal information, such as your name, address, and identification documents, to comply with regulatory requirements. The process is straightforward and typically takes only a few minutes.

Once your account is set up, deposit funds to start investing. Many platforms accept various payment methods, including bank transfers, credit cards, and even cryptocurrency deposits. Choose the method that works best for you and ensure you have enough funds to cover your initial investment and any associated fees. Starting with a small amount can help you get comfortable with the process before committing more significant sums.

Place Your First Trade

Placing your first trade in Solana ETFs marks an important step in your investing journey. This process may seem complex at first, but breaking it into manageable steps can make it straightforward. Here’s how you can confidently execute your first trade.

- Log in to Your Brokerage Account

Start by logging into the brokerage platform where you’ve opened and funded your account. Navigate to the trading section, which is typically labeled as “Trade” or “Invest.” Ensure you have access to the list of available ETFs, including Solana ETFs. - Search for the Solana ETF

Use the platform’s search bar to find the specific Solana ETF you want to invest in. For example, you might look for the Volatility Shares Solana ETF (SOLZ) or the Volatility Shares 2X Solana ETF (SOLT). Confirm the ETF’s ticker symbol to avoid selecting the wrong fund. - Analyze Market Trends

Before placing your trade, review the current market trends and trading volume. Solana’s transfer volume recently reached $318 billion, reflecting significant market activity. However, a decline in decentralized exchange (DEX) trading volume suggests waning demand, which could signal caution. Additionally, much of the recent transfer volume stems from bot activity, raising questions about market stability.

Use this data to decide whether the timing is right for your investment. If the market shows high volatility, consider starting with a smaller trade to minimize risk.Evidence Type Description Record Transfer Volume Solana’s transfer volume reached $318 billion, indicating significant market activity. DEX Trading Volume A decline in DEX trading volume suggests waning demand, signaling caution for investors. Bot Activity Most of the recent transfer volume is attributed to bot activity, raising questions about market stability. - Set Your Trade Parameters

Once you’ve selected the ETF, decide how many shares you want to purchase. You can also set a limit order to specify the maximum price you’re willing to pay. This approach helps you avoid overpaying during periods of high price fluctuation. For example, if the ETF is trading at $50 per share, you might set a limit order at $48 to ensure you buy at a favorable price.

5 Review and Confirm Your Trade

Double-check all the details before finalizing your trade. Verify the ETF ticker symbol, the number of shares, and the order type (market or limit). Once you’re satisfied, click “Submit” or “Place Order” to execute your trade. Most platforms will provide a confirmation screen or email to verify your transaction. - Monitor Your Investment

After placing your trade, monitor the performance of your Solana ETF. Use the brokerage platform’s tools to track price changes, trading volume, and other key metrics. Staying informed about market trends and Solana’s developments will help you make better decisions for future trades.

Tip: Start small with your first trade to gain confidence and minimize risk. As you become more familiar with the process, you can gradually increase your investment in Solana ETFs.

By following these steps, you can place your first trade with confidence. Remember, investing in ETFs like Solana ETFs requires patience and a willingness to learn. Each trade brings you closer to mastering the art of crypto investing.

Tips for Investing in Solana ETFs

Start Small

Starting small is a smart strategy when investing in Solana ETFs. This approach allows you to test the waters without exposing yourself to significant risk. Solana’s market valuation has risen to 33% of Ethereum’s, marking an 18-fold increase from its bear market low. This rapid growth highlights the potential of Solana’s ecosystem, driven by its transaction speed, cost efficiency, and mobile accessibility. By beginning with smaller positions, you can gradually build confidence while observing how Solana ETFs perform in the volatile cryptocurrency market.

Financial studies also support this strategy. Over half of institutions plan to increase their digital asset allocations within the next few years. Many have already allocated between 1%-5% of their funds to digital assets. Allocating small percentages to ETFs like Solana ETFs can enhance portfolio performance while keeping risk manageable. This method provides a balanced entry into the crypto market, allowing you to adjust your investments as you gain experience.

Diversify Your Portfolio

Diversification is key to reducing risk and maximizing returns. Spreading your investments across multiple ETFs, industries, and asset classes ensures that your portfolio remains resilient during market fluctuations. Solana ETFs can play a vital role in a diversified portfolio, offering exposure to the growing cryptocurrency sector.

Proper asset allocation produces evidence-driven results. By diversifying according to your risk tolerance, you can minimize the chances of large losses while optimizing long-term returns. A globally diversified portfolio smooths the investment journey, reducing periods of underperformance that might lead to discouragement. For example, portfolios diversified across U.S., international, and emerging markets have shown zero negative returns over extended periods. Including Solana ETFs alongside other crypto ETFs and traditional assets can help you achieve a balanced and robust investment strategy.

Stay Informed About Solana and Market Trends

Staying informed is crucial for successful investing in Solana ETFs. Market trend reports and statistical analyses provide valuable insights into Solana’s performance and the broader crypto market. Solana’s market capitalization currently stands at $66.15 billion, reflecting its significant role in the cryptocurrency landscape. Factors such as supply and demand, network upgrades, and macroeconomic conditions influence its price movements.

Understanding historical price trends and technical analysis can help you identify buy and sell opportunities. These tools predict future price movements based on past performance and market sentiment. For instance, Solana’s transfer volume recently reached $318 billion, showcasing its active market presence. However, fluctuations in decentralized exchange trading volumes and bot activity highlight the importance of monitoring market stability. Staying updated on these trends ensures that you make informed decisions and adapt your investment strategy as needed.

Tip: Use reliable sources like market reports and analytics platforms to track Solana’s developments and the performance of your ETFs. Knowledge is your best tool for navigating the dynamic crypto market.

Risks and Considerations of Solana ETFs

Volatility in Solana ETFs

Solana ETFs often experience significant price fluctuations due to the volatile nature of the cryptocurrency market. You should understand how this volatility impacts your investment decisions. Several factors contribute to these risks:

- Solana’s fee concentration is heavily skewed, with 95% of fees originating from just 1.26% of wallet addresses. This imbalance increases the risk of market manipulation.

- Solana has faced five major outages between 2023 and 2024. These outages highlight the platform’s decentralization challenges, which are critical for institutional investors.

- The architecture of Solana allows metrics like transaction volume or user activity to be artificially inflated. This complicates market surveillance and adds uncertainty for ETF investors.

When investing in Solana ETFs, you should monitor these risks closely. Volatility can create opportunities for high returns, but it also increases the likelihood of losses.

Regulatory Risks for Solana Spot ETFs

Regulatory uncertainty poses another challenge for Solana ETFs, especially spot Solana ETFs. Governments and financial institutions continue to debate the classification and oversight of cryptocurrency-related funds. You may encounter sudden changes in regulations that affect the availability or performance of these ETFs.

For example, the SEC has expressed concerns about the transparency of Solana’s ecosystem. Issues like fee concentration and decentralization could lead to stricter rules for Solana ETFs. These changes might impact your ability to trade or hold these funds. Staying informed about regulatory developments ensures you can adapt your investment strategy effectively.

Fees and Costs of Solana ETFs

Fees and costs are important considerations when investing in Solana ETFs. Management fees, operational expenses, and trading costs can reduce your overall returns. You should evaluate these expenses before committing to an ETF.

Some Solana ETFs offer competitive fee structures, but others may charge higher rates due to the complexity of managing cryptocurrency-related funds. For instance, ETFs that include staking capabilities might have additional costs tied to their operations. Comparing fees across different ETFs helps you identify the most cost-effective options for your portfolio.

Tip: Look for ETFs with transparent fee structures and low management costs. This approach maximizes your returns while minimizing unnecessary expenses.

Where to Buy Solana ETFs

Image Source: unsplash

BiyaPay Overview

BiyaPay provides a seamless way for you to invest in Solana ETFs. This platform specializes in cryptocurrency-related financial products, making it an excellent choice for accessing Solana ETFs like the Volatility Shares Solana ETF (SOLZ) and the Volatility Shares 2X Solana ETF (SOLT). BiyaPay simplifies the investment process by offering a user-friendly interface and secure trading environment.

You can open an account on BiyaPay in minutes. The platform supports multiple payment methods, including bank transfers and cryptocurrency deposits, ensuring flexibility. Once your account is funded, you can explore a wide range of ETFs, including Solana ETFs, to diversify your portfolio.

BiyaPay also provides educational resources to help you understand the nuances of ETF investing. These tools empower you to make informed decisions, whether you’re a beginner or an experienced investor. By choosing BiyaPay, you gain access to a regulated platform that prioritizes security and transparency.

Volatility Shares Solana ETFs (SOLZ and SOLT)

The Volatility Shares Solana ETFs offer unique opportunities to invest in Solana’s ecosystem. SOLZ and SOLT are futures-based ETFs designed to track Solana’s performance through regulated financial instruments. These ETFs launched after the first Solana futures began trading on March 17, marking a significant milestone for the cryptocurrency market.

Key metrics for these ETFs include:

| Metric | Value |

|---|---|

| Current Price | $20.180 |

| 24H Rise and Fall | +3.97% |

| Previous Close | $19.41 |

| 52 Week High | $20.88 |

| 52 Week Low | $11.55 |

| Market Capitalization | $0.01 billion |

| Expense Ratio | 0.95% (SOLZ), 1.85% (SOLT) |

| Dividend Yield | 0.05% |

These ETFs cater to different risk appetites. SOLZ offers standard exposure to Solana futures, while SOLT provides leveraged exposure for those seeking higher returns. On launch day, SOL futures recorded $12.3 million in trading volume, showcasing strong investor interest. Analysts view these futures-based ETFs as a precursor to spot ETFs, similar to the paths taken by Bitcoin and Ethereum.

By investing in SOLZ or SOLT through BiyaPay, you can participate in Solana’s growth while benefiting from the platform’s secure and efficient trading environment.

Tip: Always review the expense ratios and performance metrics of ETFs before investing. This ensures you choose the right product for your financial goals.

Investing in Solana ETFs can be a rewarding way to enter the cryptocurrency market. Start by choosing a reliable platform, researching available ETFs, and funding your account. Place your first trade with confidence, keeping your goals in mind. Research plays a vital role in understanding the market and the fund you select. Diversify your portfolio to reduce risks and maximize returns. Stay informed about Solana’s developments and crypto trends to make smarter decisions. Take the first step today and explore the potential of Solana ETFs as part of your investment journey.

FAQ

What is the minimum amount I need to start investing in Solana ETFs?

You can start with as little as $50, depending on the brokerage platform. Some platforms allow fractional ETF shares, making it easier to begin with a small amount. Always check the platform’s minimum investment requirements before funding your account.

Can I invest in Solana ETFs if I don’t live in the United States?

Yes, many brokerage platforms offer access to Solana ETFs globally. However, availability depends on your country’s regulations. Platforms like BiyaPay provide international access to Solana ETFs, ensuring you can invest regardless of your location.

How do Solana ETFs differ from directly buying Solana tokens?

Solana ETFs simplify the process by eliminating the need for wallets or private keys. They operate in a regulated environment, offering added security. ETFs also allow you to invest in Solana’s performance without directly owning the cryptocurrency.

Are Solana ETFs suitable for beginners?

Yes, Solana ETFs are beginner-friendly. They provide a regulated way to gain exposure to cryptocurrency without the complexities of managing digital wallets. Start small, research thoroughly, and use platforms like BiyaPay to simplify your investment journey.

How often should I monitor my Solana ETF investments?

You should review your investments weekly or monthly. Keep an eye on market trends, Solana’s performance, and ETF updates. Staying informed helps you make timely decisions and adjust your strategy as needed.

Tip: Use alerts or notifications from your brokerage platform to track price changes and market news.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.