- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Is Wise Remittance Reliable? Top Alternatives to Consider in 2025

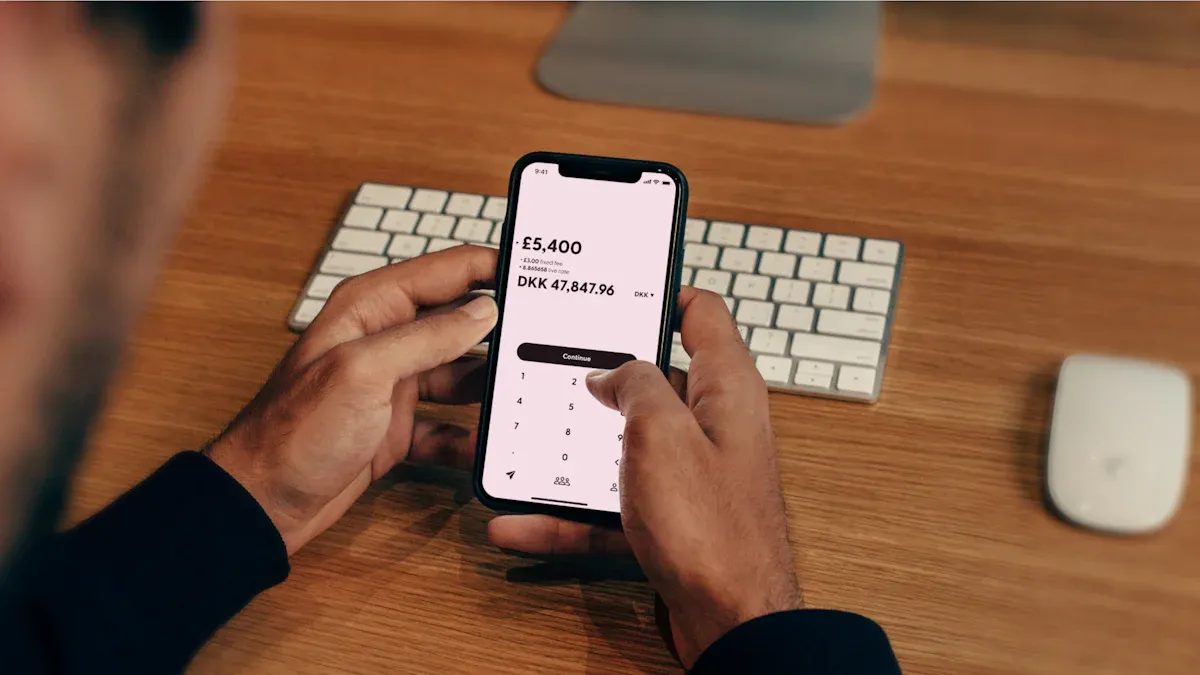

Image Source: unsplash

Is Wise a trustworthy choice for international remittance? As a globally recognized cross-border payment platform, Wise processed approximately USD 130 billion in transactions during fiscal year 2023, highlighting its wide usage and growth potential. Many users wonder if its fees are reasonable, whether transfers are fast enough, how secure their funds are, and if the user experience is smooth. Wise is known for transparent fees—for example, bank debit fees are $3.19, while credit card payments can cost up to $74.89. The platform is tightly regulated by the UK’s FCA and Hong Kong Customs, and user funds are held in low-risk institutions like Barclays Bank, offering strong security assurances.

If you’re exploring alternatives better suited to your needs, this article provides a range of options to help you find the best international remittance platform with ease.

Key Points

- Wise is popular for its transparent fees and speedy transfers, ideal for users who need efficient international payments.

- Strictly regulated, Wise employs advanced encryption to safeguard user funds and personal information.

- Credit card fees can be high for small transfers; more cost-effective payment methods are recommended.

- Alternatives like BiyaPay and Airwallex offer different strengths, allowing users to choose based on their specific needs.

- When selecting a remittance platform, it’s essential to weigh fees, speed, and security for the best experience.

Is Wise Remittance Reliable?

Image Source: pexels

Advantages of Wise Remittance

Wise is widely praised for its transparent fee structure and efficient transfer speed. Users can clearly see the cost breakdown of each transaction, avoiding hidden charges. Wise uses mid-market exchange rates, meaning users get competitive rates without extra markup.

In terms of speed, Wise performs well. Many transfers complete within hours, with some even arriving instantly. This quick service is especially beneficial for users needing rapid international payments.

Security is another strong point. Regulated by the UK Financial Conduct Authority (FCA) and other authorities, Wise uses advanced encryption to protect funds and personal data.

Disadvantages of Wise Remittance

While Wise excels in many areas, it’s not without limitations. Fees can be relatively high for small transfers, especially when paying by credit card. Also, although Wise covers many countries, users in some regions may face service restrictions.

Another point is that while Wise supports many currencies, less common currencies may take longer to process, impacting user experience.

Wise Fees and Speed

Wise’s fees and speed are core competitive advantages. Here’s a real-world example illustrating its costs and transfer times:

| Item | Original Amount |

|---|---|

| Transfer Fee | $18.28 USD |

| Exchange Rate | 1 CNY = 0.1392 USD |

| Total Fees | $18.28 USD |

| Amount Received | $2,764.88 USD |

| Processing Time | Instant - 2 days |

*Conversion calculated at provided exchange rate: 1 CNY = 0.1392 USD

This table shows Wise’s fees are transparent and reasonable, with transfer times typically short—important for users needing quick remittances.

Wise Security and User Experience

Wise excels in security. You can confidently use it knowing your funds and personal data are protected by advanced encryption. Two-factor authentication further secures accounts against unauthorized access. The platform is regulated globally by authorities like the UK FCA, ensuring compliance with financial standards.

User experience is another highlight. The interface is clean and intuitive, making registration, adding recipients, and sending money straightforward. Multilingual support broadens accessibility. You can manage your account, track transfers, and even schedule automatic payments via mobile app anytime, anywhere.

Wise’s customer support is responsive and professional, available via live chat and email to help resolve issues promptly.

In summary, is Wise reliable? From security to ease of use, Wise proves itself as a dependable international remittance platform that keeps your funds safe and makes transfers simple and efficient.

Best Alternatives in 2025

Reap: Ideal for Businesses

If you’re a business user, Reap is worth considering. It specializes in streamlining cross-border payments for enterprises. Supporting credit cards, bank transfers, and e-wallets, Reap caters to diverse corporate needs.

Reap stands out for flexibility and convenience. You can easily manage company finances without complexity. Detailed transaction records and reports help monitor cash flow. For large payments, Reap improves efficiency and reduces operational costs.

Security is a priority with advanced encryption safeguarding every transaction, giving you peace of mind.

Airwallex: Multi-Currency Support and Fast Transfers

Airwallex focuses on multi-currency capabilities and swift payments. Supporting over 60 currencies covering 80% of global GDP, it simplifies managing diverse international transactions.

Here are some highlights:

| Evidence Type | Details |

|---|---|

| Number of Licenses | Over 60 |

| Coverage | 80%+ of global GDP |

| Fees and Speed | Competitive fees and faster settlements |

Airwallex offers lower fees and quicker arrivals, ideal for users needing fast, multi-currency international transfers. It also provides integrations to optimize payment workflows.

TorFX: Best for Large Transfers

For large transactions, TorFX is trusted and well-known for zero transfer fees and transparent pricing. Here’s a sample case showing its performance:

| Item | Fee |

|---|---|

| Transfer Fee | $60.00 |

| Exchange Fee | $64.23 USD |

| Total Cost | $64.23 USD |

| Amount Received | $6,892.95 |

TorFX’s clear fees and competitive exchange rates help maximize your transfer amount. Personalized account managers ensure professional support throughout.

Whether individual or business, TorFX meets high-value transfer needs with wide currency support.

Payoneer: Perfect for Freelancers and Small Businesses

Payoneer caters to freelancers and small enterprises, offering convenient cross-border payments. Whether receiving client payments or paying suppliers, it covers your needs.

Key features include:

- Global Reach: Serving over 190 countries to connect you with clients worldwide.

- Multiple Payment Methods: Bank transfers, e-wallets, prepaid cards to fit preferences.

- Low Fees: More affordable than traditional banks, ideal for tight budgets.

Payoneer provides account management tools to track transactions, generate reports, and automate payments—boosting your productivity.

Security is solid, with encryption protecting funds and data.

BiyaPay: Multi-Asset Trading Wallet with Fast Remittance

BiyaPay is a leading multi-asset wallet, offering fast, secure remittance and investment services. Supporting 30+ fiat currencies and 200+ digital assets, it simplifies cross-border payments.

Advantages include:

- Fast Transfers: Local payment methods with no limits, ensuring same-day send and receive.

- Multi-Asset Support: Handles both fiat and digital currency trades for diverse needs.

- Transparent Fees: Low costs with clear rates help save money.

BiyaPay also offers investment tools, enabling direct trading of US and HK stocks with digital currency—no offshore accounts needed. Its wealth management features provide up to 5.48% annual returns, aiding asset growth.

Licensed under US MSB and New Zealand FSP, BiyaPay ensures global regulatory compliance.

Revolut: Digital Card and Multi-Payment Features

Revolut is a versatile digital payment platform offering multi-currency support. Its digital card and payment options make it a leader in international payments.

Highlights:

- Metal membership offers up to 3% cashback.

- Supports multi-currency transfers and foreign exchange.

- Features receipt upload and photo tools for easy expense tracking.

Plans to add multi-currency accounts will enhance experience further.

Revolut’s virtual card secures online and in-store payments with flexible spending. The clean app interface includes budgeting and transaction tracking.

Paysend: Emerging Low-Cost Remittance Platform

Paysend has rapidly grown as a low-cost, convenient remittance platform, covering over 170 countries and supporting multiple currencies—great for frequent small transfers.

Key features:

- Fixed Fees: Only $1.99 per transfer, regardless of amount.

- Fast Delivery: Most transfers complete within minutes.

- Multiple Payment Options: Cards, bank accounts, and e-wallets.

Tip: For regular family or friend remittances, Paysend’s low fees and speed are ideal.

Paysend’s interface is straightforward—just enter recipient details and amount, and see fees and estimated delivery. The app boosts convenience, plus 24/7 support ensures help when needed.

Western Union: Traditional In-Person Service

Western Union is one of the oldest global remittance providers, with over 500,000 physical locations in 200+ countries. It’s reliable for users preferring face-to-face service.

Advantages:

- Extensive network for easy local access.

- Multiple methods: cash, bank transfer, mobile payment.

- Instant transfers available for urgent needs.

Drawbacks include higher fees, especially for cash payouts, and less competitive exchange rates.

Advice: Ideal for recipients without bank accounts who need cash pick-up.

PayPal: Widely Accepted International Payment Platform

PayPal is a leading online payment service in over 200 countries, popular with individuals, freelancers, and businesses.

Key strengths:

- Globally accepted by many e-commerce and service platforms.

- Strong security with encryption and buyer protection.

- Supports remittance, invoicing, subscriptions, and bulk payments.

Fee structure example:

| Service Type | Fee Rate | Additional Fees |

|---|---|---|

| International Transfers | 5% (max $4.99) | Exchange rate margin |

| Business Payments | 2.9% + $0.30 | None |

Though fees can be high, PayPal’s convenience and acceptance make it a popular choice.

Tip: Great if you frequently shop online internationally or need multi-purpose payment services.

Currencies Direct: Safe and Convenient Currency Exchange

Currencies Direct specializes in currency exchange and international payments with efficient, secure service.

Highlights:

- No Transfer Fees: Save on costs with zero fees.

- Competitive Rates: Better than banks for exchange value.

- Multiple Payment Methods: Bank transfer, e-wallets, etc.

- Dedicated Account Managers: Personalized support for smooth transactions.

Supports over 40 currencies worldwide.

| Benefit Type | Details |

|---|---|

| Transparent Fees | No hidden charges |

| Fast Arrival | Most transfers within 24 hrs |

| High Security | Advanced encryption |

The platform’s simple interface and excellent customer support make managing international payments easy.

Tip: Ideal for frequent currency exchanges and cross-border payments.

Comparative Analysis of Alternatives

Fee Comparison: Which Platform Is Most Cost-Effective?

Fees heavily influence platform choice. Structures and rates vary widely, impacting your costs.

| Payment Method | Fee Formula | Fee to Send $1000 USD |

|---|---|---|

| Bank Debit (ACH) | $0.94 + 1.22% | $13.03 |

| Wire Transfer | $4.46 + 1.02% | $14.54 |

| Wise Using Foreign Currency Balance | $0.60 + 0.98% | $10.32 |

Using Wise’s foreign currency balance is cheapest at $10.32, while ACH and wire transfers cost more.

Platforms like PingPong (1% fees) and Onlypay (no hidden fees) offer competitive alternatives.

Tip: Consider fee formulas and exchange margins; low fees alone may not mean overall savings.

Transfer Speed Comparison: Which Platform Is Fastest?

Speed affects fund availability, crucial for urgent needs.

| Platform | Arrival Time |

|---|---|

| Wise | Instant to within 24 hours |

| Banks | SWIFT wire: 1-5 business days |

Wise excels in speed; traditional SWIFT transfers take longer.

Innovative platforms like BiyaPay use local transfers for same-day send and receive, boosting efficiency.

Suggestion: Prioritize instant or local transfer platforms for urgent funds.

Security Comparison: Which Platform Is Most Reliable?

Security involves regulation and technology protecting funds and data.

| Platform | Security Level | User Experience |

|---|---|---|

| Amazon Official | High | Amazon sellers only |

| Onlypay | High | Easy to use |

| Stripe | High | Requires offshore setup |

| WF Card & CD Card | High | Limited service fit |

| PingPong | High | Strict reviews |

Wise, BiyaPay, and others hold reputable licenses and use strong encryption.

Note: Choose platforms with authoritative licenses to safeguard your funds and avoid legal risks.

User Experience Comparison: Which Platform Is Most User-Friendly?

Ease of use improves efficiency and reduces hassle.

1. Wise

Clean, intuitive UI ideal for newcomers. Supports multiple languages and mobile app with status tracking and auto-pay.

Tip: Wise is great if you value simplicity and clarity.

2. BiyaPay

Strong multi-asset support with real-time rates and transparent fees. Mobile app supports fast remittance and investment.

Highlight: Local transfers ensure same-day arrival for better cash flow.

3. Payoneer

Simple interface with clear features for payments and reports. Helpful guides aid quick adoption. Auto-payment tools ideal for freelancers.

4. Revolut

Digital card and multi-currency support. Virtual cards protect info, budgeting and transaction tracking available.

5. Paysend

Very simple flow—enter recipient and amount, see fees and arrival time. Great for frequent small transfers.

| Platform | UI Design | Mobile Support | Feature Richness | Ease of Use |

|---|---|---|---|---|

| Wise | Clean & Clear | Yes | Moderate | High |

| BiyaPay | Friendly & Rich | Yes | High | High |

| Payoneer | Simple | Yes | Moderate | High |

| Revolut | Modern & Clean | Yes | High | Moderate |

| Paysend | Simple & Clear | Yes | Moderate | High |

How to Choose the Best International Remittance Platform

Image Source: pexels

Choose Based on Fees

Fees are a key factor. Consider transfer fees, exchange rates, and extra charges. Fee differences affect your actual costs.

- Fee Comparison: Wise charges 316.23 CNY, lower than TorFX’s 458.8 CNY. For small transfers, lower fees mean better value.

- Rate Transparency: Wise uses mid-market rates (e.g., RMB to USD at 0.1391), avoiding hidden markups.

- Additional Charges: Businesses should watch for hidden fees like account maintenance or failed transfer costs.

Compare fees and rates for cost-effective solutions.

Choose Based on Speed

Speed impacts fund availability, crucial when time matters.

- Fastest: Wise transfers are instant to 2 days.

- Traditional Banks: SWIFT takes 1–5 days, slower for urgent needs.

- Local Transfers: Platforms like BiyaPay offer same-day send and receive, boosting cash flow.

Pick instant or local transfer platforms if you need speed.

Choose Based on Security

Security cannot be overlooked.

- Regulation: Wise and BiyaPay hold global licenses ensuring legality.

- Technology: Encryption and two-factor authentication protect accounts.

- User Ratings: TorFX offers dedicated managers for extra trust.

Pick licensed, secure platforms to protect funds and comply with laws.

Choose Based on User Experience

User experience shapes your efficiency and satisfaction.

- Interface: Clear, simple UI helps you find features fast. Wise is user-friendly, BiyaPay shows real-time rates and fees.

- Mobile Support: Mobile apps let you manage transfers anytime. Revolut includes budgeting features.

- Functionality: BiyaPay supports fiat and crypto trading, investments, and wealth management.

- Ease: Paysend’s straightforward process suits frequent small transfers.

Tip: Prioritize platforms with simple design, mobile apps, and smooth workflows for a hassle-free experience.

Wise proves reliable from fees to security and usability, but everyone’s needs differ. Alternatives like BiyaPay, Reap, and Airwallex excel in specific areas. Choose based on what matters most to you—cost, speed, security, or features—to make remittance easier and more efficient.

Reminder: Always align platform choice with your needs, balancing fees, speed, and security

for the best fit.

FAQ

Is Wise suitable for small transfers?

Yes. Wise’s transparent fees and mid-market rates help save costs. Avoid credit card payments when possible due to higher fees.

Which currencies and assets does BiyaPay support?

BiyaPay supports over 30 fiat currencies and 200 digital assets, allowing real-time exchange and diverse payment and investment options.

How to pick the best remittance platform?

Consider fees, speed, security, and user experience. Wise and BiyaPay suit cost and speed; businesses might prefer Reap or Airwallex.

How is remittance platform security ensured?

Most platforms use encryption and two-factor authentication. Choose platforms with reputable licenses like Wise and BiyaPay.

Can I invest through BiyaPay?

Yes. BiyaPay lets you trade US and HK stocks directly with digital currency—no offshore accounts required. Wealth management offers annual returns as high as 5.48%.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.