- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Currency Exchange Calculator: Understanding and Using Rate Calculators

What is a currency exchange rate calculator?

A currency exchange rate calculator is a digital tool or application designed to determine the equivalent value of one currency when converted into another, based on current market exchange rates. Its primary purpose is to simplify the process of currency conversion for various needs, such as:

- Travel: Calculating how much your home currency is worth in the local currency of your destination.

- International business: Determining the cost of goods or services in different currencies or calculating revenue from international sales.

- Online shopping: Understanding the price of items listed in foreign currencies.

- Financial planning: Assessing the value of international investments or remittances.

These calculators work by taking a specified amount in one currency and multiplying or dividing it by the real-time exchange rate between that currency and the desired target currency. The exchange rate represents the current price at which one currency can be bought or sold for another in the foreign exchange market. Major currency pairs, like EUR/USD, tend to have tighter spreads (the difference between the buying and selling price) due to their high liquidity.

Users input the amount they wish to convert and select the original and target currencies. The calculator then retrieves the latest exchange rate for that currency pair from a data feed, often provided by financial institutions or specialized data providers. This rate is then applied to the input amount to determine the equivalent value in the foreign currency.

The role of real-time data is crucial for ensuring the accuracy of the conversion. Exchange rates are constantly fluctuating; for example, major currency pairs can experience an average daily range of 50 to 150 pips (a pip is a unit of movement in the exchange rate) (Math Mind Money, 2025). These fluctuations are due to various economic, political, and social factors that influence the supply and demand of currencies. By using real-time data, currency exchange rate calculators provide the most up-to-date and relevant conversion values, allowing users to make informed financial decisions based on the current market conditions. Without real-time data, the calculated amounts would quickly become outdated and potentially inaccurate.

How to use a currency exchange rate calculator

If you are wondering how to calculate exchange rates, then keep in mind that using a currency exchange rate calculator is a straightforward process that allows you to quickly determine the value of one currency in another. Here’s a step-by-step guide:

- Select the base currency

The “base currency” is the currency you currently have or want to convert from. Typically, you’ll see a dropdown menu or a selection of currency symbols. For example, if you have United States Dollars and want to convert them, you would select USD as the base currency. - Select the target currency

The “target currency” is the currency you want to convert to. Similar to selecting the base currency, you’ll choose the desired currency from a list. For instance, if you want to know how many Euros your USD will buy, you would select EUR as the target currency. So, in this case, you’re performing a USD to EUR conversion. Conversely, if you wanted to convert Euros to US Dollars, you would select EUR as the base currency and USD as the target currency (EUR to USD). - Enter the amount to convert

Once you’ve selected your base and target currencies, you’ll see a field where you can enter the specific amount you want to convert. For example, you might enter “100” if you want to see the Euro equivalent of 100 US Dollars. - View the conversion result

After entering the amount, the calculator will instantly display the converted value in the target currency. Based on the real-time exchange rate, if 1 USD is currently trading at approximately 0.93 EUR, then entering “100” USD would show a result of around 93 EUR (this rate fluctuates constantly).

Understanding exchange rate fluctuations

It’s crucial to remember that exchange rates are dynamic and constantly change due to a multitude of global economic factors, including interest rates, inflation, political stability, and market sentiment. This means that the conversion value you see on the calculator at one moment might be slightly different just a few minutes later. For example, a significant economic announcement in the Eurozone could cause the EUR/USD exchange rate to shift noticeably within a short period. Therefore, the value you see is an indication at that specific point in time. If you’re planning a transaction for the future, the actual exchange rate you receive might vary.

The importance of reliable and up-to-date calculators

For accurate conversions, it’s vital to use reliable and up-to-date currency exchange rate calculators. These calculators source their data from reputable financial data providers, ensuring they reflect the current market conditions. Using outdated or unreliable sources can lead to inaccurate calculations, which could negatively impact financial decisions, especially for businesses dealing with international payments or individuals making significant currency exchanges. Look for calculators provided by reputable financial institutions, established financial websites, or well-known currency data providers to ensure you’re getting the most accurate information available.

Types of rate calculators

If you were wondering regarding the various types of currency rate calculators, then the following breakdown should help you learn more about their individual differences.

- Dollar rate calculator As the name suggests, this type of calculator is specifically focused on the United States Dollar (USD) as either the base or the target currency. For someone in the United States, they might primarily use this to see how much their USD is worth in other currencies like the Euro (EUR), Japanese Yen (JPY), Canadian Dollar (CAD), or British Pound (GBP). Conversely, someone in another country might use it to determine the cost in their local currency of goods or services priced in USD.

- Currency exchange rate calculator This is a more general and versatile tool. Unlike the dollar-specific calculator, a standard currency exchange rate calculator can handle a wide array of global currencies. You can typically select from a comprehensive list of currencies, allowing you to perform conversions between any two chosen currencies, such as USD to EUR, JPY to GBP, AUD to CAD, and so on. This is the most common type of currency converter found online and is useful for a broad audience with diverse international financial needs.

- Exchange rate Euro to USD calculator Euro to USD exchange rate calculator has a specific focus on the exchange rate between the Euro (EUR) and the United States Dollar (USD). Given that EUR/USD is one of the most heavily traded currency pairs globally, this type of calculator is particularly useful for individuals and businesses involved in transactions between the Eurozone and the United States. It often provides real-time rates and may include historical charts or analysis specific to this pair.

- Multi-currency calculators: Taking versatility a step further, multi-currency calculators allow you to convert multiple currencies simultaneously. This is incredibly convenient for managing international transactions, comparing costs in different markets, or consolidating financial reports involving various currencies.

- Crypto to fiat calculators: With the rise of digital currencies, crypto to fiat calculators have become increasingly important. These tools convert the value of cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), or others into traditional government-issued currencies (fiat) such as USD or EUR The exchange rates for cryptocurrencies are often highly volatile, so these calculators rely on real-time data from cryptocurrency exchanges to provide up-to-date conversion values. For individuals holding or trading cryptocurrencies, these calculators are essential for understanding their digital assets’ worth in real-world terms.

Benefits of using exchange rate calculators

Leveraging currency exchange rate calculators offers a multitude of significant benefits for individuals and businesses operating in an increasingly interconnected global landscape:

- Accuracy: One of the most crucial advantages is the accuracy provided by these tools. By tapping into real-time data feeds from financial markets, exchange rate calculators ensure that the conversion values you receive reflect the current trading prices of currencies. This immediacy is vital, as exchange rates can fluctuate even within minutes. Using an up-to-date calculator minimizes the risk of relying on outdated information, which could lead to financial miscalculations.

- Convenience: Currency exchange rate calculators are readily accessible through various online platforms and dedicated mobile applications. This means you can quickly perform conversions anytime, anywhere you have an internet connection.

- Transparency: By clearly displaying the exchange rate used and the resulting converted value, they provide users with a clear understanding of the transaction’s financial implications. This visibility is particularly helpful for businesses engaging in international trade, allowing them to accurately assess costs and revenues in different currencies. For travelers, it helps in understanding the true cost of goods and services in a foreign country, preventing surprises due to unfavorable exchange rates applied by local vendors or exchange services.

- Cost-effectiveness: Businesses can use this information to compare exchange rates offered by different financial institutions or services, potentially identifying more favorable options and avoiding hefty fees or unfavorable margins. For individuals exchanging currency for travel or other purposes, knowing the real-time rate empowers them to make informed decisions about when and where to exchange their money, potentially saving them from hidden charges or poor exchange rates offered at airports or tourist traps.

Best currency exchange rate calculators available

Stated below are some of the best currency exchange rate calculators available around the world, that you can utilize for international payments.

XE Currency Converter

This is a very popular and widely used tool known for its real-time exchange rates and user-friendly interface. Many users appreciate its reliability and the ability to track historical data and set rate alerts. XE also offers a mobile app for on-the-go conversions and money transfers to over 190 countries. However, be aware that XE’s send rates for money transfers include a markup on the mid-market rate, which acts as a fee.

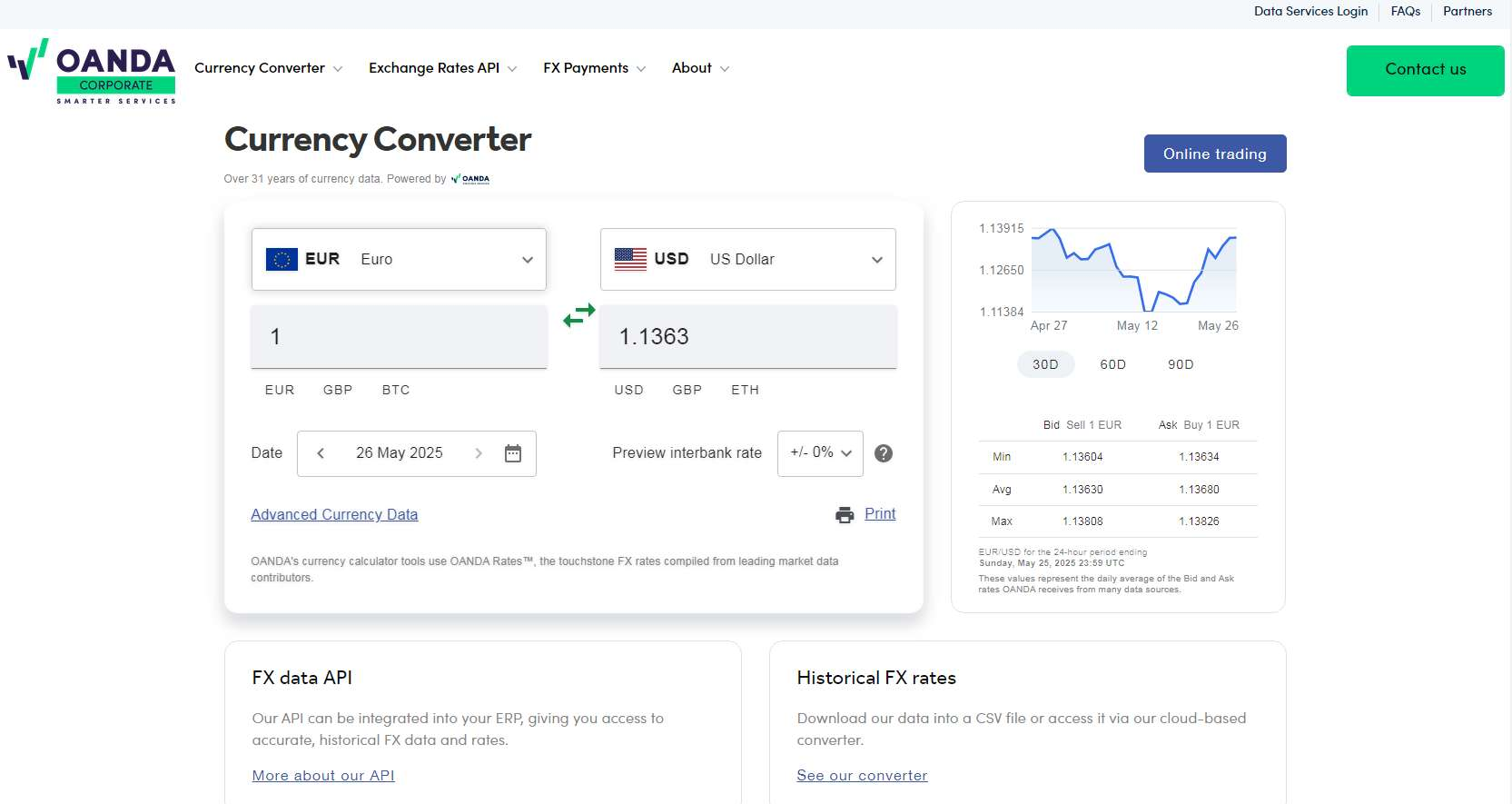

OANDA Exchange Rate Calculator

OANDA is a trusted provider, particularly favored for business and financial purposes due to its access to OANDA Rates, which are compiled from leading market data contributors. They offer over 38,000 currency pairs (ONADA) with historical data going back over 31 years. OANDA is also a globally recognized forex broker with various trading platforms and tools. Their currency converter is considered credible and accurate, used by major corporations and financial institutions.

Google Currency Converter

This is a simple and effective tool that’s easily accessible through a Google search. Just type in the currencies you want to convert (e.g., “USD to EUR”), and it will display the current exchange rate and allow you to input amounts. It provides a quick and convenient way to get an indicative exchange rate. Google typically uses the mid-market rate, but it’s important to remember that actual transaction rates from banks or other services will likely include fees or markups.

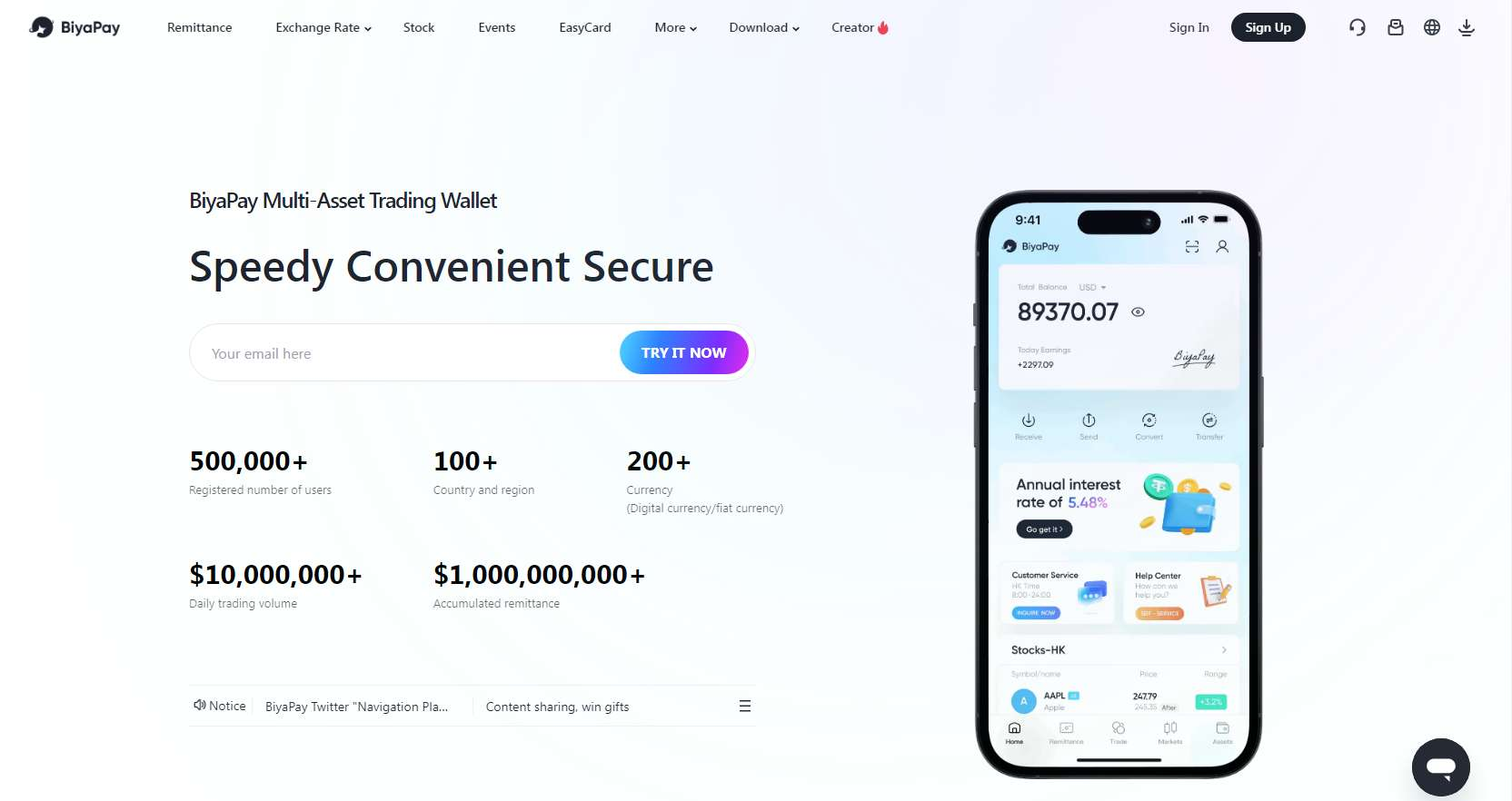

BiyaPay

BiyaPay presents itself as a comprehensive tool that simplifies currency conversion and international payments. It supports real-time exchange of over 30 legal currencies and more than 200 digital currencies (BiyaPay). BiyaPay highlights its use of mid-market rates with transparent, low handling fees and aims for fast, same-day global remittances in many regions. It also offers features for trading US and Hong Kong stocks using digital currency.

BiyaPay: simplifying currency calculations and international payments

BiyaPay emerges as a powerful solution, streamlining the often-complex world of currency calculations and international payments. By embedding real-time exchange rate calculators directly into its platform, BiyaPay empowers users with the immediate ability to calculate and convert currencies with effortless ease. Additionally, it ensures truly seamless international payments by prioritizing accuracy in exchange rates and maintaining remarkably low conversion fees. This commitment to transparency and affordability removes significant hurdles often associated with cross-border transactions, making global commerce and personal remittances more accessible and cost-effective.

Further enhancing its utility, BiyaPay’s integrated multi-currency wallet supports a diverse range of currencies. This feature provides users with a centralized hub to manage their international funds and transactions efficiently. Whether you’re a frequent traveler, an international student, or a global entrepreneur, BiyaPay’s multi-currency wallet simplifies the process of holding, sending, and receiving funds in various currencies, all within a single, intuitive platform. In essence, BiyaPay is not just a payment platform; it’s a comprehensive solution designed to simplify the intricacies of global finance, making international transactions more transparent, affordable, and ultimately, hassle-free.

Key Features

- End-to-end encryption: To safeguard sensitive data transmitted during transactions, BiyaPay would likely use robust end-to-end encryption. This ensures that information remains scrambled and unreadable to unauthorized parties from the moment it leaves the user’s device until it reaches BiyaPay’s secure servers.

- Two-factor authentication (2FA): Adding an extra layer of security, 2FA requires users to provide two forms of identification before accessing their accounts or completing transactions. This could involve a password and a one-time code sent to their mobile device, significantly reducing the risk of unauthorized access.

- Biometric authentication: For added convenience and security, BiyaPay might integrate biometric authentication methods such as fingerprint or facial recognition. These technologies provide a unique and secure way for users to verify their identity.

- Secure data storage: Ensuring the confidentiality and integrity of user data and financial information is crucial. BiyaPay would utilize secure servers and advanced data encryption techniques to protect stored information from cyber threats and unauthorized access.

- Compliance with regulatory standards: BiyaPay would need to adhere to international and local financial regulations and security standards to ensure the safety and legality of its operations. This includes measures like KYC (Know Your Customer) and AML (Anti-Money Laundering) procedures.

Steps to use BiyaPay for currency calculations

Step 1: Download the BiyaPay app

The foremost step involves downloading the BiyaPay app on your smartphone. The app is available for both Android and iOS devices, as of the present day.

Step 2: Register and verify your identity

After successfully downloading and installing the app, launch it and sign-up using your email address. Once done, complete the identity verification process and fill out your user profile to activate all features securely.

Step 3: Head over to the Convert section

In the next step, select the “Convert” option from the homepage and choose the currency that you want to convert. There will be options to select your source currency and your target currency. For instance, if you want to convert from USD to EUR, then select USD as your source currency and EUR as your target currency.

Step 4: Enter the requisite amount

After that, enter the necessary amount (the numerical value) that you want to convert. Once you do that, BiyaPay will automatically display the current real-time exchange rate for the selected currency pair.

Steps to use BiyaPay for international transactions

Step 1: Navigate to the Send section from the homepage

Proceed to first launch the BiyaPay app and then from the homepage, select the “Send” option

Step 2: Fill up the recipient details, amount, and currency

In the subsequent step, you will be prompted to fill out the details of the recipient, such as the person’s full name, bank name and address, bank account number or IBAN details, and the necessary SWIFT/BIC code. Additionally, you will need to disclose the recipient’s country, the amount you will be sending, and its currency (based on which the conversion fees will be charged).

Step 3: Select your payment method

Moving on, you will be asked to provide the source through which the payment will be funded. If you have sufficient funds in your BiyaPay Wallet, you will be allowed to use that. Otherwise, you will need to use your bank account, debit/credit cards, or any other payment method, as supported by BiyaPay in your specific region.

Step: Confirm and send payment

Finally, confirm your payment and the transaction will be completed in a matter of just seconds. In addition to that, you can track your payment status.

User Reviews

“I regularly send money to my family back home, and BiyaPay has made the process so much easier and more affordable. The exchange rates are transparent, and the fees are much lower than traditional money transfer services I’ve used before. Knowing exactly how much my family will receive without worrying about hidden charges is a huge relief. The app is also very user-friendly.”

“As someone who travels frequently, BiyaPay’s multi-currency wallet is fantastic. I can easily convert currencies at good rates and hold different currencies in one place. It’s so convenient for making payments while abroad without getting hit with hefty bank fees. The real-time calculator helps me stay on budget, and the security features give me peace of mind.”

“I recently used BiyaPay to make a purchase from an international online store. The currency conversion was straightforward, and I could see the exact amount in my local currency before I paid. The fees were clearly stated, and the whole process was very transparent. It was much simpler and felt more secure than using my regular credit card for international transactions.”

Why use a currency rate calculator for business and travel?

Currency rate calculators are indispensable tools for both businesses and travelers, offering distinct advantages tailored to their specific needs in navigating the complexities of international finance.

For businesses

Businesses operating globally benefit significantly from using rate calculators in several key ways. Firstly, these tools streamline international transactions by providing an immediate and accurate understanding of the value of payments and receipts in different currencies.

Secondly, rate calculators are crucial for managing multi-currency operations. Companies dealing with international suppliers, customers in various countries, or maintaining overseas accounts need to constantly monitor and convert funds across different currencies. A reliable rate calculator enables them to assess the financial impact of exchange rate fluctuations on their profit margins, helping them make informed decisions about pricing strategies, hedging risks, and managing their international cash flow.

Furthermore, using a currency rate calculator reduces risks and ensures transparency in global transactions. By knowing the precise exchange rate at the time of a transaction, businesses can avoid unexpected costs or discrepancies that might arise from relying on outdated or less favorable rates offered by intermediaries. This transparency builds trust with international partners and allows for more accurate financial forecasting and reporting.

For travelers

For individuals planning international trips, currency converters play a vital role in budgeting accurately. By checking the current EUR to USD exchange rate, travelers can estimate the cost of accommodation, food, activities, and souvenirs in US dollars and then determine how much this equates to in their local currency. This proactive approach helps avoid overspending and allows for better financial planning before and during the trip.

Understanding exchange rates beforehand also reduces risks and ensures transparency for travelers. By knowing the approximate exchange rate, they can be more vigilant when exchanging money at foreign exchange bureaus or using their debit/credit cards abroad, helping them identify and avoid unfavorable exchange rates or hidden fees.

Conclusion

Conclusively speaking, the significance of employing accurate and reliable currency exchange rate calculators cannot be overstated in today’s globalized financial landscape. These indispensable tools empower individuals and businesses across the world, to make informed financial decisions by providing crucial transparency and up-to-the-minute exchange rate data. Whether planning international travel, managing overseas business operations, or simply understanding the value of foreign currencies, these calculators offer clarity and prevent costly errors.

To enhance your experience with currency exchange calculations and potentially streamline international payments, we encourage you to explore the services offered by platforms like BiyaPay. While specific features and supported currencies should be verified, such platforms often aim to provide a seamless and efficient way to navigate the complexities of foreign exchange. By leveraging these resources, you can approach international financial dealings with greater confidence and control, ensuring your transactions are both transparent and cost-effective. Remember to always prioritize up-to-date information from reputable sources for the most accurate results.

FAQs

- How do exchange rate calculators determine the value of a currency?

They use real-time or historical exchange rates reflecting market values. BiyaPay ensures accuracy by sourcing rates directly from global exchanges, providing users with up-to-the-minute conversion values. This transparency allows for informed financial decisions. - Can I rely on free online rate calculators for accurate conversions?

Reputable free online calculators are generally reliable as they often use real-time data, similar to BiyaPay’s approach to rate accuracy. However, always cross-verify with your chosen payment platform, especially for actual transaction costs which might include fees. - How do I use a rate calculator for business payments?

Enter the payment amount and the sending and receiving currencies into the calculator. BiyaPay can then potentially facilitate the payment at the displayed rate, offering a streamlined process for international business transactions. This helps in managing costs effectively. - What is the best tool for converting Euro to USD?

A reliable online currency exchange rate calculator from a well-known financial website is a good starting point. For actual transactions, a platform like BiyaPay, if it handles EUR/USD, would offer a rate for executing the exchange. - Does BiyaPay offer real-time currency exchange rates for payments?

Yes, absolutely. Modern payment platforms like BiyaPay typically provide real-time exchange rates to ensure users see the most current conversion value before completing a transaction. This is a standard feature for maintaining transparency.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.