- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Understanding IBAN Numbers: How to Check, Verify, and Use

What is an IBAN number?

An IBAN number stands for International Bank Account Number, and it is used to identify specific bank accounts across countries. This number is essential for processing international payments, as it ensures that funds are sent to the right bank account in the correct country.

A domestic bank account number can be formatted in numerous different ways. Still, an IBAN has a particular structure with a standardized format accepted by banks internationally, enabling banks to process cross-border payments better. The IBAN itself contains country code, check digits, bank code, and the account number itself, ensuring that each international transaction goes through smoothly.

The IBAN number differs from other account identifiers, such as the SWIFT code. While SWIFT codes are used to identify banks or financial institutions globally, IBAN numbers are used for identifying individual accounts. This distinction is essential when making payments because you may need both codes to complete an international transaction.

How long is an IBAN number?

The length of an IBAN number varies depending on the country, but it generally ranges from 15 to 34 characters. Each IBAN is structured to include essential details such as the country code, check digits, bank code, and the account number. The IBAN number starts with a two-letter country code, followed by two check digits to validate the number. It then includes the bank-specific code and the account number, which can vary in length based on the country’s banking system.

Example of IBAN numbers and their lengths:

- Germany (DE): DE44 1234 1234 1234 1234 00 – 22 characters

- United Kingdom (GB): GB29 NWBK 6016 1331 9268 19 – 22 characters

- France (FR): FR14 1234 5678 9012 3456 7890 123 – 27 characters

- United States (US): The US does not use IBANs, instead relying on other identifiers like the SWIFT code for international transfers.

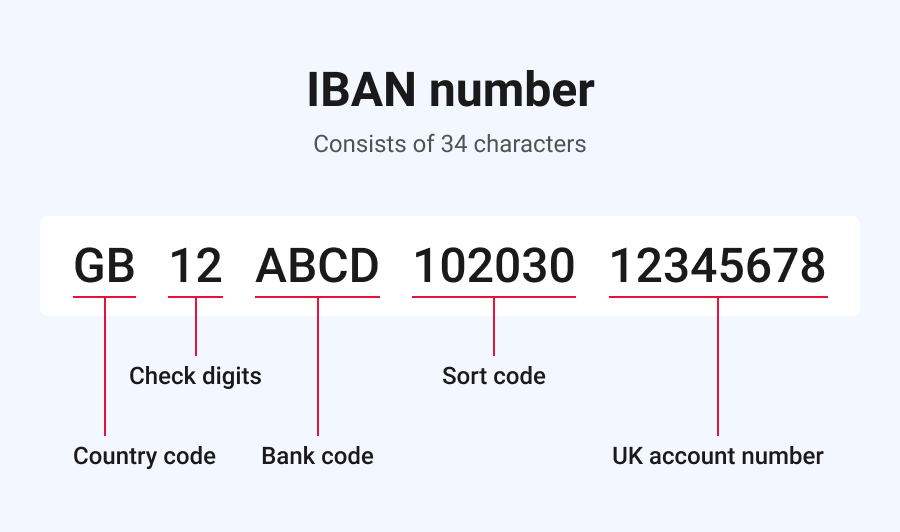

IBAN number format: Breaking down the structure

The IBAN number format is designed to standardize the structure of international bank account numbers, ensuring that transactions are processed accurately across borders. Here’s a detailed breakdown of the key components that make up an IBAN number:

- Country code (2 letters) The first two characters represent the country where the account is held. For example, “DE” stands for Germany, “GB” represents the United Kingdom, and “FR” is for France. This part of IBAN helps identify the country of the bank and account holders.

- Check digits (2 numbers) These two digits are calculated using an algorithm to validate the integrity of the IBAN number. They help ensure that the IBAN is correctly formatted and that the transaction can be processed without errors. You can check IBAN number validity by verifying these check digits.

- Bank code (varies by country) The bank code, which varies by country, identifies the specific financial institution or bank holding the account. It can be made up of letters or numbers, depending on the country’s banking system. For example, the bank code for a UK account is part of the “NWBK” in the IBAN number example “GB29 NWBK 6016 1331 9268 19”.

- Account number (variable length depending on the country) The final part of the IBAN number is the actual account number of the account holder. The length of this section varies based on the country’s banking standards. For instance, Germany’s IBAN includes a 10-digit account number, while France’s includes 15 digits.

The IBAN number format ensures that all relevant banking information is included, making international transfers more accurate and efficient. To find your IBAN number, you can refer to your bank statement, online banking portal, or contact your bank directly. It’s crucial to verify IBAN number details to avoid any potential errors when transferring funds internationally.

IBAN number example

Let’s look at a concrete example of an IBAN number from the United Kingdom to understand better how it’s structured and what each part represents:

Example IBAN: GB29 NWBK 6016 1331 9268 19

Walkthrough of the example:

- Country code (GB)

- GB stands for the United Kingdom. This is the first part of the IBAN, indicating the country where the account is located. Each country has its unique two-letter code, which is part of the IBAN number format.

- Check digits (29)

- The check digits are the next two digits of the IBAN. In this example, 29 is the check digit. These digits are calculated using an algorithm that helps verify the validity of the IBAN. They provide a safeguard against errors in the IBAN number.

- Bank code (NWBK)

- NWBK is the bank code that identifies the specific financial institution where the account is held. In this case, “NWBK” represents the National Westminster Bank (commonly known as NatWest) in the UK. The bank code may vary depending on the country and the bank and is a critical component of IBAN.

- Account number (6016 1331 9268 19)

- The final part of the IBAN is the account number, which is specific to the account holder. This part can vary in length depending on the country’s banking system. In the UK, the account number here is 6016 1331 9268 19. This sequence of digits is the actual bank account number associated with the account holder.

How to check and verify an IBAN number

Ensuring the accuracy of an IBAN is crucial when making international payments. To avoid costly errors or delays, always check IBAN account number details carefully. Knowing how to check IBAN number information ensures your transfer reaches the right destination. An incorrect IBAN can lead to delays, errors, or even the transfer being sent to the wrong account. Here’s a step-by-step guide on how to check and verify an IBAN:

Step 1: Use an IBAN checker tool

The simplest way to verify an IBAN is to use an online IBAN checker tool. These tools are widely available on banking websites or third-party platforms. By inputting the IBAN, the tool will validate the number’s format, ensuring it conforms to the standards required for that country. Many banks offer an IBAN checker on their websites, allowing you to check IBAN account number details before processing payments.

Step 2: Confirm the IBAN’s format and check the digits

Each IBAN follows a specific format based on the country of the account holder. Check the IBAN’s structure, ensuring that the length, country code, and bank code match the expected format for that country. The check digits, which come after the country code, are essential for verifying the validity of the IBAN. These digits are calculated using a mathematical algorithm to confirm that the IBAN has been correctly generated.

If the IBAN number example includes incorrect check digits, the tool will flag it as invalid, preventing errors in international transfers. Always verify IBAN number details before proceeding with a transaction.

Step 3: Use IBAN verification to avoid errors in international payments

When sending money internationally, it’s essential to check IBAN number accuracy to avoid mistakes that could result in delays or incorrect payments. If the IBAN contains errors, your payment may be rejected by the recipient’s bank or sent to the wrong account. IBAN verification ensures that the bank account details are accurate, which helps prevent issues in the transfer process.

Before initiating any international payment, it’s wise to confirm the IBAN by checking its format and confirming that the check digits match. This step is crucial for business payments or larger transactions, where mistakes can be costly.

How to find your IBAN number

Finding your IBAN is essential for making international payments. Your bank typically provides it, and it can be accessed in several ways. Here’s how to locate your IBAN number:

Where to find your IBAN

Bank statements: Most banks include the IBAN on your monthly bank statements. You can find it on both paper and electronic statements, usually in the section detailing your account information.

Online banking portals: Many banks allow customers to access their IBAN through their online banking platforms. Log into your online banking account and look for IBAN under the account details or transfer section. This is a quick and easy way to find your IBAN without needing to visit a branch.

Contact your bank: If you’re unable to find your IBAN on your statement or online, you can contact your bank’s customer service. They can provide you with your IBAN directly or guide you on how to find it in your banking app or website.

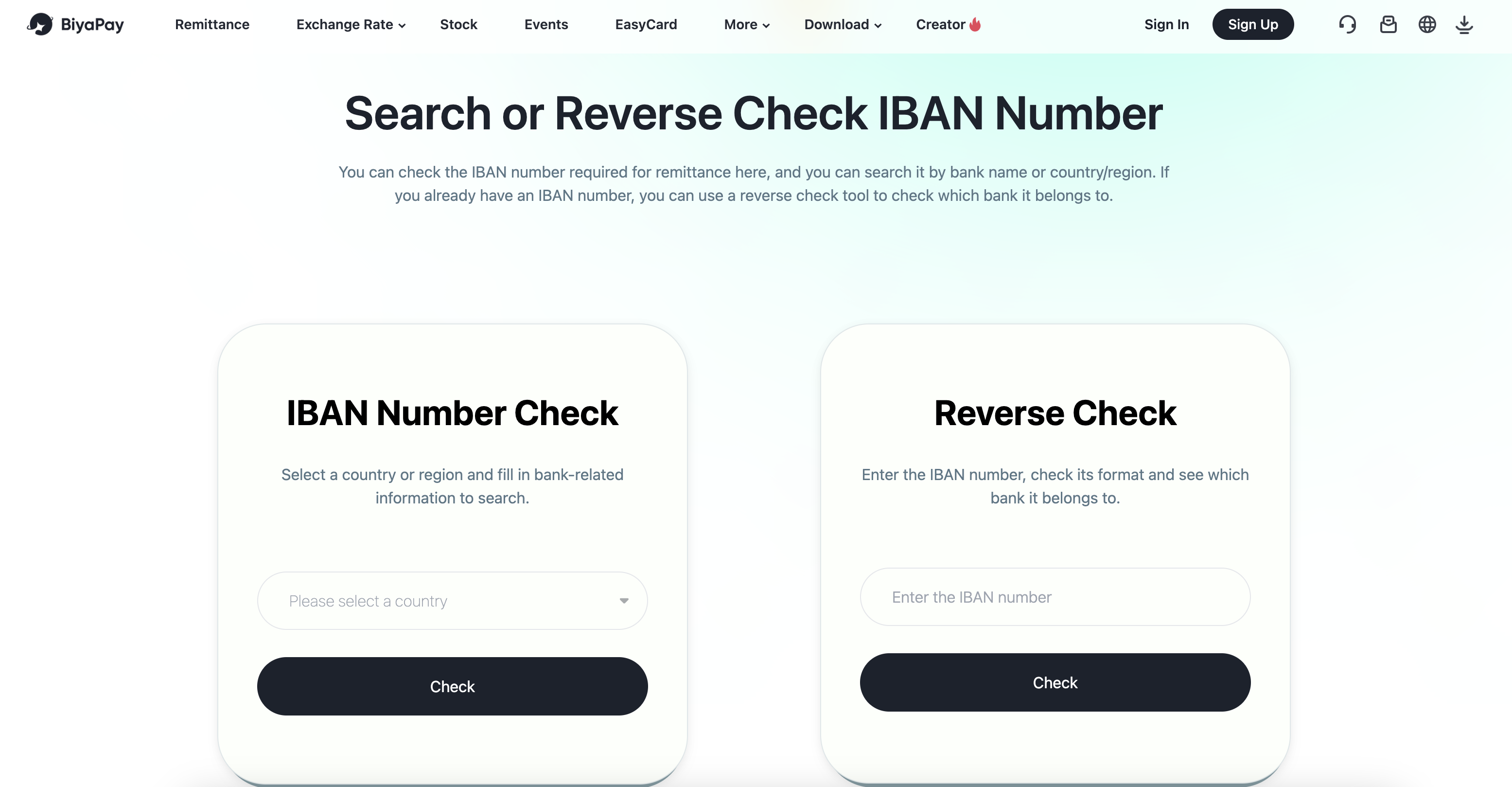

BiyaPay: Simplifying international transfers with IBAN

BiyaPay is a leading digital platform that simplifies international payments and transfers, utilizing IBAN numbers to ensure secure and accurate cross-border transactions. Whether you’re a business or an individual, BiyaPay provides an easy-to-use system for sending money internationally, with the added benefit of IBAN verification tools to ensure that your payment details are accurate before you initiate the transfer.

How BiyaPay integrates IBAN verification tools

One of the standout features of BiyaPay is its IBAN verification tool. This built-in feature allows users to s easily, ensuring that every transaction is routed to the correct account. By checking the IBAN account number before making any payments, BiyaPay helps prevent errors and delays, ensuring smooth international transfers. Users can confirm IBAN numbers in real time, giving them peace of mind that their payments are processed accurately.

How to check your IBAN using BiyaPay: 4 simple steps

Step 1: Download the BiyaPay app.

Get the BiyaPay app from the App Store or Google Play. Install it on your device and sign up using your phone number or email.

Step 2: Log in and go to the “Accounts” section.

Once logged in, navigate to the “Accounts” tab on the dashboard. Here, you’ll find all your linked bank details and international payment info.

Step 3: Select your linked bank account.

Choose the bank account you want to check. BiyaPay will display the full IBAN number associated with it, formatted for accuracy.

Step 4: Verify your IBAN details instantly.

Review the displayed IBAN number carefully. BiyaPay ensures it follows international standards and helps confirm its validity before you make any transfers.

The convenience of BiyaPay for businesses and individuals

BiyaPay makes it simple for both businesses and individuals to perform international transactions. Whether you need to find IBAN number details for an international transfer or check IBAN number accuracy, BiyaPay provides a seamless platform. Its easy-to-navigate interface helps users enter their IBAN number format correctly, reducing the risk of mistakes. By using IBANs, businesses and individuals can confidently transfer funds across borders without worrying about errors or delays.

How BiyaPay supports multiple currencies and real-time exchange rates

Another key advantage of BiyaPay is its support for a wide range of currencies. The platform allows users to make payments in multiple currencies, simplifying international transactions for people and businesses involved in global trade. Additionally, BiyaPay provides real-time exchange rates, ensuring that users are getting the best rates when converting currencies for their payments. This feature is particularly beneficial for businesses that need to manage payments in various currencies, ensuring efficiency and cost-effectiveness.

With BiyaPay, making cross-border payments becomes straightforward and secure, whether you need to verify IBAN number details or confirm your IBAN number before sending money. The integration of IBAN verification tools, multi-currency support, and real-time exchange rates make BiyaPay a reliable and efficient solution for international transactions.

Why confirming your IBAN number is crucial for international transactions

Confirming the IBAN number before sending international payments is essential to ensure the accuracy and security of the transaction. An incorrect IBAN can lead to several risks, delays, and even financial loss, making it crucial to verify the number before initiating any cross-border transfer.

The potential risks and delays from incorrect IBAN’s

If an IBAN is incorrect, the transaction may be routed to the wrong account or rejected entirely. This can cause significant delays in processing, resulting in the funds being temporarily unavailable or, in some cases, lost. The payment may require manual intervention from the bank, which could take days or even weeks to resolve. IBAN verification helps mitigate these risks by ensuring that the IBAN number format is correct, the check digits are accurate, and the account information is valid before the payment is sent.

How confirming the IBAN prevents transaction errors

By confirming your IBAN before initiating a payment, you can prevent costly errors and ensure that the funds reach the correct recipient. IBAN verification tools check the validity of the IBAN and confirm its accuracy, significantly reducing the risk of errors. This process helps to streamline international payments, making them faster, more reliable, and less prone to mistakes. If the IBAN number example is validated, you can be confident that the payment will reach the intended recipient without complications.

Why IBAN number verification is standard in global payments

For businesses, freelancers, and individuals working with international clients, verifying the IBAN has become a standard process. With globalization making cross-border transactions more frequent, ensuring the IBAN number is correct is critical for timely and accurate payments. For example, businesses that frequently engage in international trade must verify IBAN numbers to avoid delays and maintain smooth operations. Freelancers working with clients across different countries must also ensure their IBAN is correct to receive payments promptly.

IBAN verification helps prevent transaction failures, improves the efficiency of global payments, and fosters trust in the payment process, especially when dealing with clients or partners overseas. Ensuring the IBAN number is accurate is a small but essential step to avoid bigger complications in international transactions.

Conclusion

Understanding IBAN numbers is crucial for anyone involved in international transactions. Whether you’re making a personal payment or running a business with global clients, ensuring the accuracy of your IBAN number helps avoid delays, errors, and potential financial loss. By properly checking IBAN numbers and verifying IBAN details, you can ensure that your payments are routed accurately, ensuring smooth and efficient cross-border transfers.

To simplify and secure your international payments, consider using BiyaPay. With its IBAN verification tools and fast processing features, BiyaPay ensures your payments are accurate and processed without hassle. Take advantage of BiyaPay’s seamless international transfer platform today to ensure secure, efficient, and reliable transactions.

FAQs

Q1. What is the difference between IBAN and SWIFT codes?

IBAN (International Bank Account Number) is used to identify a specific bank account in international transactions, while SWIFT codes (or BIC) identify the bank or financial institution itself. While IBANs ensure that the payment reaches the correct account, SWIFT codes are used to identify the bank or financial institution where the payment is being sent.

Q2. How do I know if my IBAN number is correct?

To ensure your IBAN number is correct, use an IBAN checker tool available online or through your bank. The tool will verify the number’s format and check the digits and structure to ensure its accuracy. You can also check the number against the bank’s records or customer service if needed.

Q3. Can I use my IBAN number for domestic payments?

No, IBANs are used explicitly for international transactions. For domestic payments within the same country, a local account number or other identifiers are typically used instead of an IBAN.

Q4. How do I find the IBAN for my account?

You can find your IBAN on your bank statement, in your online banking portal, or by contacting your bank’s customer service. Many digital banking services also provide your IBAN automatically for international transfers.

Q5. Are IBAN numbers used for every international transaction?

While most international transactions require an IBAN, some countries and banks may use other systems, such as the SWIFT code or national account numbers. However, IBANs are the standard in most countries for ensuring accurate cross-border payments.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.