- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Understanding SWIFT Codes and Finding the Right One for Bank Transfers

What is a SWIFT Code?

SWIFT code meaning, which stands for the Society for Worldwide Interbank Financial Telecommunication, is essentially a unique international identifier for banks and financial institutions. Often used interchangeably with the term BIC (Bank Identifier Code), it acts like a postal code for banks, ensuring that when money is sent internationally, it reaches the correct destination. Without SWIFT codes, the process of international money transfers would be significantly more complex and prone to errors. These codes play a crucial role in accurately routing funds by identifying not only the specific bank but also, in many cases, a particular branch. This level of detail ensures that the transferred money ends up in the intended recipient’s account.

What is a SWIFT code for a bank?

A bank SWIFT code has a structured format, typically consisting of 8 to 11 characters. These characters are broken down into the following components:

Bank Identifier (4 letters): This is a unique code that identifies the specific bank.() It’s often an abbreviated version of the bank’s name.

Country Code (2 letters): These two letters indicate the country where the bank is located, following the ISO 3166-1 standard (ISO 3166).

Location Code (2 letters or numbers): This component identifies the geographical location or city of the bank’s head office.

Branch Code (3 letters or numbers - optional): This is an optional code used to identify a specific branch of the bank. If a bank has multiple branches, each may have a unique branch code. If this is not specified or the transfer is intended for the bank’s head office, this part is often represented by ‘XXX’.

Currently, there are over 40,000 live SWIFT codes (TreasuryXL, 2022) registered worldwide, highlighting the extensive network of financial institutions participating in international transactions. Understanding this structure is key to ensuring the accuracy and security of your international bank transfers.

How to find SWIFT Code?

Finding the correct SWIFT code for a bank is a crucial step in ensuring your international money transfers go smoothly. Here’s a step-by-step guide on how to locate one:

1. Check your bank statement or online banking portal

- Sending money: If you’re sending money to someone, the easiest way to get their bank’s SWIFT code is to ask the recipient directly. They can usually find it in their bank statements or within their online banking portal. Many banks display this information clearly for international transactions.

- Receiving Money: If you need to provide your bank’s SWIFT code to someone sending you money, it’s best to retrieve it directly from your own bank statement or online banking account. Log in to your online banking and look for account details or information related to international transfers. The SWIFT/BIC code is often listed there. Your bank statement, especially those detailing account information, should also contain this code.

2. Visit the bank’s official website

Most banks have a dedicated section on their website for international transfers or frequently asked questions (FAQs). Navigate to these sections and look for information regarding SWIFT/BIC codes. You can often find a search tool or a list of their SWIFT codes for different branches if applicable. Ensure you are on the official website of the bank to avoid any misinformation.

3. Use a SWIFT Code finder tool available online

Numerous reputable websites offer SWIFT code finder tools. These tools allow you to search for a bank’s SWIFT code by its name and location. However, while convenient, it’s always good practice to double-check the code obtained from these tools with the recipient or the bank directly, especially for critical transactions. Some popular and reliable SWIFT code finder websites include those provided by financial information services or banking aggregators.

By utilizing these methods, you can confidently find the correct SWIFT code needed for your international bank transfers, ensuring a smoother and more secure process.

SWIFT Code vs. BIC Code: what’s the difference?

You’ve likely encountered both terms when dealing with international bank transfers: SWIFT code and BIC code. The good news is that they essentially refer to the same thing.

- BIC stands for Bank Identifier Code. It’s an 8 to 11-character code that uniquely identifies a specific bank or financial institution.

- SWIFT stands for the Society for Worldwide Interbank Financial Telecommunication. This is the name of the global network that facilitates secure messaging between banks, including payment instructions. The SWIFT network assigns these unique identifiers to its member institutions.

Therefore, a BIC code is the identifier used on the SWIFT network. Banks and financial institutions are assigned a BIC by the SWIFT organization to enable smooth and accurate routing of international payments.

Why are they used interchangeably?

Because the SWIFT network is the primary system that utilizes these Bank Identifier Codes for international financial transactions, the terms BIC or SWIFT code have become synonymous in everyday usage. When someone asks for a SWIFT code, they are generally looking for the BIC required to send or receive international funds. Similarly, if a bank asks for a BIC, they mean the SWIFT code.

Their role in global financial transactions

Both SWIFT codes and BIC codes are critical for:

- Identifying the correct bank: They pinpoint the specific financial institution involved in the transfer, ensuring the money goes to the right place.

- Facilitating cross-border transfers: They provide the necessary routing information for banks to send and receive money internationally through the SWIFT network.

- Ensuring accuracy: By providing a standardized and unique identifier, these codes minimize the risk of errors and delays in international payments.

SWIFT Code checker: how to verify your SWIFT Code

Before you hit that ‘send’ button for an international bank transfer, verifying the SWIFT code is paramount. Using an incorrect SWIFT code can lead to a host of problems, including significant delays in your transfer, additional fees levied by intermediary banks, or, in the worst-case scenario, your money being sent to the wrong financial institution altogether. Taking a few extra moments to confirm the code can save you considerable time, money, and stress.

Fortunately, there are several tools and methods available to check the accuracy of a SWIFT code:

SWIFT Code lookup tools: Numerous reputable websites offer SWIFT code checker or lookup tools. You can typically enter the bank’s name and sometimes its location to find the corresponding SWIFT code. If you already have a code, you can input it to verify the bank name, country, and sometimes even the branch. Keep in mind that while these tools are helpful, it’s always wise to cross-reference the information.

Bank verification: The most reliable way to verify a SWIFT code is directly with the bank involved.

- Contact the recipient’s bank: If you are sending money, ask the recipient to confirm their bank’s SWIFT code and ideally provide it in writing. You can then contact the recipient’s bank directly (if possible) to double-check the code they provided.

- Contact your own bank: If you are unsure about the SWIFT code you have, your bank’s customer service can assist you in verifying its accuracy. They have access to the SWIFT network database and can confirm if the code is correct for the intended recipient bank and location.

Why is verification so crucial?

- Minimize the risk of transfer delays: Accurate codes allow direct routing to the intended bank without the need for intermediary banks to investigate and redirect the funds.

- Avoid potential errors: A correct code significantly reduces the chances of your money ending up at the wrong destination.

- Save on additional fees: Incorrect routing can lead to intermediary banks charging fees for handling and potentially returning the funds.

To help you understand more, let’s take a SWIFT code example, which is CHASUS33XXX for JPMorgan Chase Bank in the United States. Here’s a breakdown of its components:

- CHAS - Bank Identifier: This four-letter code uniquely identifies JPMorgan Chase Bank. “CHAS” is a common abbreviation used for this bank in financial transactions.

- US - Country Code: These two letters indicate the country where the bank is located, in this case, “US” for the United States.

- 33 - Location Code: These two characters specify the location of the bank’s head office or a major branch. “33” in this context refers to New York.

- XXX - Branch Code: This optional three-character code identifies a specific branch. When “XXX” is used, it typically refers to the bank’s head office or is used when a specific branch isn’t being identified for the transaction.

Therefore, the Chase SWIFT code CHASUS33XXX points to the head office of JPMorgan Chase Bank in New York, USA. Keep in mind that larger banks like JPMorgan Chase may have different SWIFT codes for various branches or departments. For instance, a different branch in another city might have a SWIFT code like CHASUSNY followed by a specific three-character branch identifier (e.g., CHASUSNYABC).

How to use a SWIFT Code in international transfers

Using a SWIFT code for international transfers is straightforward, as you only need to go through the steps outlined below and you will be good to go.

To send money

- Obtain the recipient’s bank’s SWIFT code. Ask the recipient directly.

- Provide the SWIFT code to your bank or payment platform when initiating the transfer.

- Include other required details: Recipient’s full name, account number, bank name, and transfer amount.

The SWIFT code acts as the destination address for the receiving bank, ensuring your funds are routed correctly across international banking networks.

To receive money

- Provide your bank’s SWIFT code to the sender. You can find this in your bank statement or online banking.

- Share other necessary information: Your full name, account number, and bank name.

The sender’s bank uses your bank’s SWIFT code to direct the funds to the correct financial institution, ensuring the money reaches your account. The SWIFT code is crucial for accurate and efficient cross-border payments.

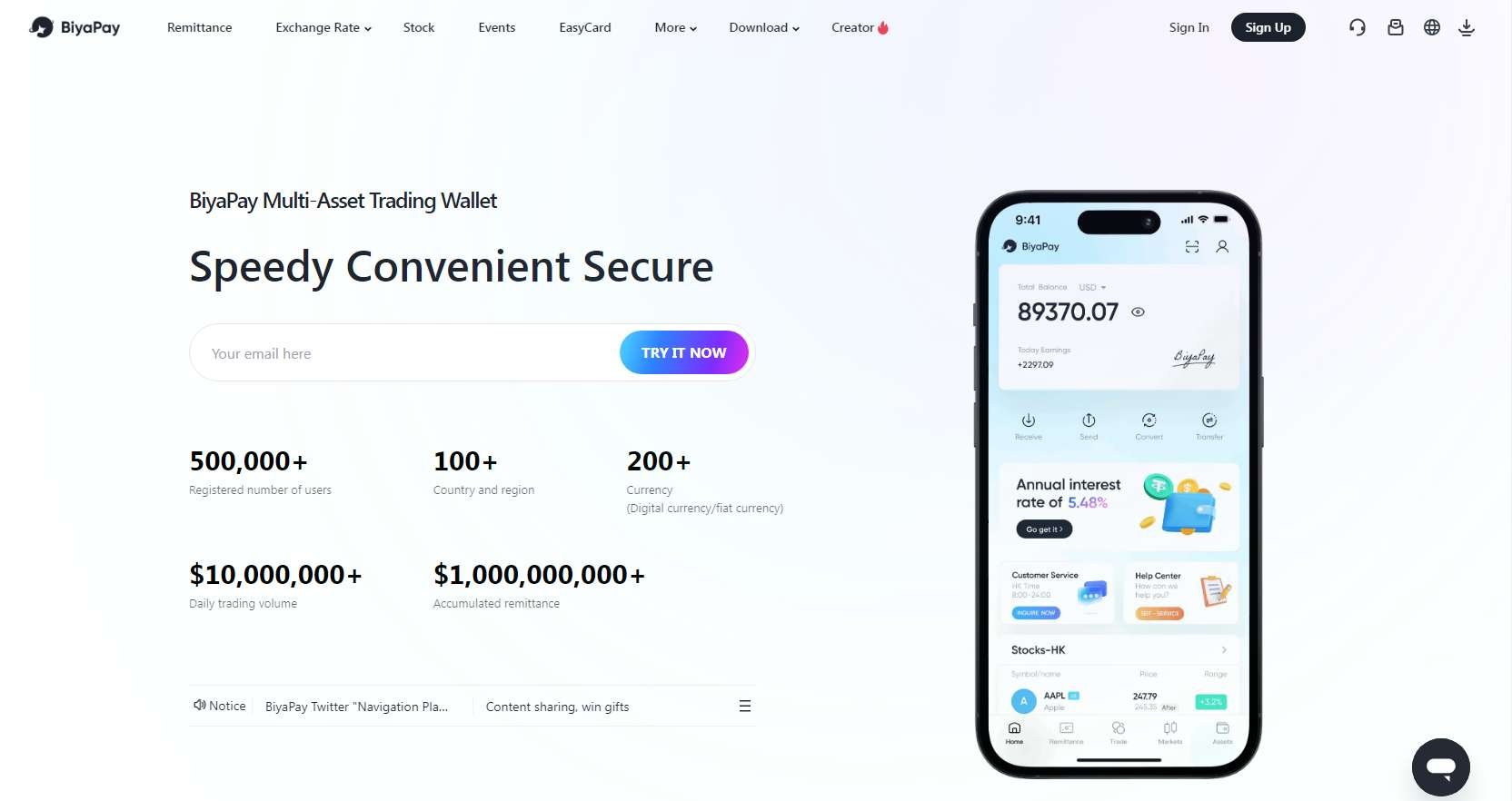

BiyaPay: simplifying international payments with SWIFT Codes

BiyaPay offers a sophisticated platform meticulously engineered for frictionless international financial transactions, with a deep integration of the ISO 9362 standard governing SWIFT/BIC codes. This robust integration ensures the precise routing of funds across a comprehensive network encompassing over 11,000 financial institutions worldwide. Their system employs advanced algorithms to perform real-time validation of SWIFT codes, cross-referencing against the official SWIFT directory to significantly mitigate transactional errors and exceptions that can typically result in delays and elevated costs.

The platform is architected to abstract the inherent complexities of cross-border payments, offering users in the United States an intuitive interface that automates the often intricate process of SWIFT code retrieval and verification. BiyaPay’s infrastructure incorporates sophisticated API integrations with prominent foreign exchange providers, facilitating the provision of competitive, interbank-level exchange rates coupled with transparent and low fee structures. By optimizing the entire payment workflow and adhering to rigorous security protocols, including end-to-end encryption and multi-factor authentication, BiyaPay delivers a highly efficient, secure, and professional solution tailored to meet the diverse international payment requirements of both individuals and corporations in the United States.

Key Features

- Automated verification: The platform automatically validates SWIFT codes in real-time against the SWIFT directory, reducing the risk of errors and ensuring accurate routing of international payments.

- Intelligent lookup: BiyaPay offers an intuitive search functionality that helps users easily find the correct SWIFT/BIC code for beneficiary banks worldwide, simplifying the payment initiation process.

- Seamless integration with SWIFT network: BiyaPay’s infrastructure is directly integrated with the SWIFT network, facilitating efficient and secure transmission of payment instructions to recipient banks globally.

- Transparency in SWIFT fees: BiyaPay provides clear visibility into any SWIFT-related fees associated with international transfers, ensuring users have a comprehensive understanding of the transaction costs upfront.

- Real-time tracking of transfers: Users can monitor the status of their international payments processed through the SWIFT network within the BiyaPay platform, providing enhanced transparency and peace of mind.

- Enhanced security for transactions: BiyaPay employs robust security measures, including encryption and multi-factor authentication, to safeguard all SWIFT-based international payment transactions.

Steps to use BiyaPay for international SWIFT Code payments

Step 1: Download the BiyaPay app

The primary step involves downloading the BiyaPay app on your smartphone. The app is available for both Android and iOS devices.

Step 2: Register and verify your identity

After successfully downloading and installing the app, launch it and sign-up using your email address. After that, complete the identity verification process and fill out your user profile to activate all features securely.

Step 3: Navigate to the Send or Transfer section

Once verified, look for an option within the app that allows you to send money or initiate a transfer. This might be labeled as “Send” or similar.

Step 4: Select International Transfer and specify the destination country

Within the transfer section, you will likely need to specify that you are making an international transfer. Choose the country where the recipient’s bank is located.

Step 5: Enter recipient’s bank details

Next, you will be prompted to enter the beneficiary’s bank details. This is where the SWIFT code becomes crucial. Typically, you will need to provide the following information: recipient’s full name and bank account, the respective SWIFT/BIC Code (or IBAN details if the recipient is in a European country), and the recipient’s address.

Step 6: Enter transfer amount and currency

After that, specify the amount you wish to send and the currency you want to send it in. BiyaPay will likely display the exchange rate if you are sending in a different currency than the recipient’s bank account currency.

Step 7: Review, confirm, and complete the payment

Before confirming the payment, review the amount and receiver details. If the details provided are free of any misstatements, be sure to authorize the transaction by choosing a payment method (e.g., bank transfer from your linked account, BiyaPay balance).

Step 8: Track your transfer

Finally, once the transfer is initiated, BiyaPay should provide you with a transaction reference number or tracking information. You can use this to monitor the progress of your SWIFT payment.

User Reviews

“Sending money to my family in the US has become so much easier with BiyaPay. The SWIFT transfer went through quickly, and the fees were much lower than my traditional bank. I was also impressed with how clearly they explained the process and the real-time tracking was a great feature!”

“As a small business owner in New York, United States, I frequently make payments to suppliers overseas. BiyaPay has significantly simplified this process. The automatic SWIFT code verification gives me confidence that my payments will reach the correct destination without any hassles. The exchange rates are competitive, and the transfers are processed efficiently.”

“I’ve used other international money transfer services before, but BiyaPay stands out for its transparency and speed. Knowing that they utilize the SWIFT network gives me confidence in the security of my transactions. The entire process, from entering the recipient’s SWIFT code to the confirmation, is seamless.”

Why SWIFT Codes are crucial for international payments

SWIFT codes are absolutely vital for international payments because they act as the precise addressing system for global banking. Without them, sending money across borders would be a far more error-prone and unreliable process. The following are some of the major reasons why they are crucial.

- Ensuring the correct destination: SWIFT codes guarantee that your payment is routed to the intended bank and, in many cases, the specific branch in another country. This eliminates ambiguity and ensures the funds reach the right financial institution. Imagine trying to send a letter without a proper address – the SWIFT code serves as that essential address for international money transfers.

- Minimizing errors and preventing fraud: By providing a standardized and unique identifier for each bank, SWIFT codes significantly reduce the chances of manual errors during payment processing. This also makes it harder for fraudulent activities to succeed, as precise identification makes it easier to track and verify transactions.

- Reducing payment delays: When the correct SWIFT code is used, the payment instructions are sent directly to the recipient’s bank through the SWIFT network. This streamlined process avoids the need for intermediary banks to guess or investigate the destination, leading to faster and more efficient transfers.

- Enhancing efficiency and reliability: The SWIFT system, underpinned by these codes, creates a standardized and trusted framework for international financial communication. This makes the entire process of sending and receiving money across borders more efficient and reliable for both individuals and businesses around the world.

Conclusion

In conclusion, SWIFT codes stand as the cornerstone of secure and accurate international financial transactions. These unique identifiers act as digital addresses for banks worldwide, ensuring that cross-border payments are routed precisely to the intended financial institution. By providing a standardized system for identifying banks and their branches, SWIFT codes play a vital role in minimizing errors, preventing fraud, and ultimately making the process of sending money internationally reliable and efficient.

For your next international money transfer, be sure to experience the ease and efficiency of BiyaPay. By leveraging the power of SWIFT code integration, it ensures a seamless payment experience, guiding your funds accurately to their destination. Choose BiyaPay and experience the future of international payments today!

FAQs

- What is the difference between SWIFT and IBAN codes?

SWIFT codes pinpoint banks and branches globally, while IBANs identify specific accounts, mainly in Europe. BiyaPay leverages the accuracy of SWIFT codes for reliable international transfers. - How can I find the SWIFT code for my bank?

You can usually find your bank’s SWIFT code on statements or online. BiyaPay ensures you use the correct SWIFT code for efficient transactions. - Can I use a SWIFT code to send money internationally?

Yes, SWIFT codes are essential for international money transfers with BiyaPay, ensuring your funds reach the right bank securely. - Are SWIFT codes the same for all banks in a country?

No, each bank and often each branch has a unique SWIFT code. BiyaPay requires the correct SWIFT code for precise routing. - How long does it take to send money using SWIFT?

SWIFT transfers can take 1-5 business days depending on various factors. BiyaPay aims for swift processing within the SWIFT network.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.