- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Stock Investment 101: How to Start Investing in the Stock Market

What is stock investment?

Stock investment means more than just buying shares. It’s also taking ownership, being part of that journey and having a say in the eventual success of the company that you helped to finance. When you own stocks, you’re not just a passive investor; you’re a partial owner of that business. This gives you the power to grow your money as the company grows and succeeds over time.

When you buy a share in a company, you’re not just owning a small piece of that business; you’re investing in its potential for growth and success. The shares you buy, usually referred to as “stocks,” give you a claim on the business’ future success. This means that if the business grows and does well, the value of your shares may go up. If you have common shares, you may also be eligible for dividends as the business might or might not choose to pay dividends. This is one of the reasons why stock investing is considered one of the best ways to create wealth.

Think of stock market investing as participating in a massive marketplace where everyone, including you, can come together to trade shares. It’s designed to be transparent and efficient, making it easier for everyday investors to buy and sell whenever they want. Major stock exchanges like the NYSE and NASDAQ are home to thousands of publicly listed companies, offering plenty of options for anyone looking to invest. The stock market is not just for the elite; it’s for everyone.

To understand just how significant this market is—consider this: the total value of U.S. stocks have topped $50 trillion, and the companies in the S&P 500 alone are valued at over $36 trillion, according to (MarketBeat, 2024) data. With so much happening in the market every day, investors have countless chances to grow their money and work toward financial independence.

At its core, stock investing isn’t just about numbers and charts—it’s about owning a real stake in companies you believe in and using that ownership to build a better financial future.

How to start investing in stocks

Beginning your path in investing in stocks may feel daunting at first, yet by dividing it into basic steps; the process can become manageable and even enjoyable. If you’re looking to create long-term wealth or merely improve your savings, stock market investing is a sensible approach to achieving this—particularly if you begin intelligently. Here are the steps for investing in stocks for beginners:

1. Choose a broker or investing platform

The first step is to select a trustworthy brokerage platform or mobile app. Many beginners opt for user-friendly options like Zerodha, Upstox, Robinhood, or Groww that offer low fees, real-time data, and easy-to-navigate dashboards. According to Statista, Robinhood alone had over 10 million monthly active users as of 2023—highlighting how accessible investing has become.

2. Research potential stocks and investment strategies

Before you leap, spend some time learning how the market operates. Familiarize yourself with the fundamentals of assessing businesses—review their books, current performance, and sector movements. You can pursue strategies such as value investing, growth investing, or dividend investing based on your risk tolerance and objectives. Resources such as stock screeners, market news apps, and YouTube finance channels can keep you up to speed.

3. Open a brokerage account and fund it

Once you’ve chosen a platform, set up your brokerage account by filling out the KYC (Know Your Customer) process. Then, deposit money into the account with an amount you feel comfortable beginning with. Don’t need a fortune—you can begin investing with as little as $10–$20 thanks to fractional shares and no-commission trades.

4. Make your first stock purchase and diversify your portfolio

Pick a stock you’ve researched thoroughly and go ahead with your first buy. Many beginners start with well-known companies that have a history of stable growth. From there, keep adding to your portfolio gradually and focus on diversification. Spread your investments across different sectors like tech, healthcare, energy, and consumer goods to reduce risk.

You don’t need to be an expert to start—start small. Even $10 is enough to begin your stock market investing journey. Use tools like a stock investment calculator to track progress and set realistic goals. Make it a habit to read financial news and follow market trends. As you learn how to invest in stocks, adjust your strategy with confidence. The key is staying consistent, informed, and patient. Over time, small steps lead to smart decisions and lasting financial growth.

Best stocks to invest in: What to look for

When choosing the best stock to invest in, it isn’t enough to identify just large brands. Understanding what makes a business thrive as well as setting it in the context of the market today is important for your investment. Good investing needs good research and a clear focus on several factors.

- Company performance and growth potential: Look at a company’s revenue growth and profit margin as well as their long-term vision. Ideally, a good candidate will have continual earnings and funding as well as clearly separated funding sources to encourage innovation. For instance, tech companies such as Apple and Microsoft have continued to outperform market expectations as a result of developed demand and position relative to the global market.

- Market trends and economic indicators: Considering the market is not only important for the stock you are investing in, it is also crucial to realize how a stock is performing in real-time. Typically, stocks will tend to lag in what is happening with the market. Relaxed market conditions lead to better sector performance, while levels of inflation and interest rate increases lead to better defensive sectors such as healthcare and utilities. Statista states the global stock market totaled over $109 trillion in value in 2023 indicating the volume and opportunity available.

- Industry strength and company leadership: A company is only as good as the industry it is in. Pick industries that are growing in potential - for example, renewable energy, AI, fintech, etc. and companies that have great CEOs and management. Leaders who adapt quickly to change often drive innovation and investor returns.

- Valuation metrics like price-to-earnings ratio (P/E ratio): Finally, assess if a stock is fairly priced using valuation metrics like the price-to-earnings (P/E) ratio, price-to-book ratio, and earnings growth forecasts. A P/E ratio less than others in the industry may mean that the stock is undervalued, and you should understand a contextual reading of the average for its industry. Warren Buffett once said, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

Balancing growth stocks and dividend-paying stocks helps you build a strong, diversified portfolio. Growth stocks offer high potential returns by reinvesting profits, while dividend stocks provide steady income and stability. For example, many investors look to AI stock investing for future growth, while others rely on dividend payers for consistent payouts. Some companies have raised dividends for 25+ years (S&P Global, 2023). If you’re learning how to invest in stocks, this mix helps you manage risk and reward. Use a stock investment calculator to plan your ideal balance. Start with your goals, and build your portfolio around them.

Stock investment strategy: Building a successful portfolio

A solid stock investing strategy is a great foundation for long-time success. No matter if you are getting started or you’ve spent some time in the stock market, using a solid stock investment strategy can help you manage risk and return. Here are four common stock investment strategies and styles to consider while building your stock portfolio.

1. Long-term investing

You purchase shares of organizations that display consistent revenue, a reliable management team and special advantages and then keep holding these shares for years. If you invest in the long term, you’ll be able to handle market ups and downs and enjoy slow but steady growth. A long-term approach to investing, rather than attempting to predict the market, has usually given better results, based on Morningstar data.

2. Short-term investing

Some people call it active trading and these types of investors aim to make a profit by buying and selling stocks quickly. Investing in this way allows you to earn money faster, though it’s riskier and you often need to be very close to the market and have thorough knowledge of day-to-day stock investing apps.

3. Dividend investing

This strategy allows you to select stocks that pay dividends, which provides regular income and is suitable for investors looking for potential long-term appreciation. In addition, many investors may gravitate to dividend-paying stocks in cyclical industries like energy, as well as in utilities and consumer staples. In 2023, dividends paid by S&P 500 companies surpassed $500 billion, illustrating just how significant this passive income can be.

4. Index investing

Diversification is a basic principle of building a sustainable investment portfolio. Diversifying across asset classes, sectors, and geographic locations lessens the likelihood of losing a significant amount of your investment portfolio on an underperforming asset. Diversifying across various asset types can lower correlation, and limit the risk of adverse performance during declines in a market (BlackRock). Although diversification does not eliminate risk, it will help you manage risk better, typically allowing for a smoother investment journey over time. Whether you are attempting to do AI stock investing or using stock investment calculator, diversification can alleviate some stress, along with being a wise investment strategy for long-term financial success.

Stock market investing: A brief overview of how it works

Stock market investing allows nearly anyone to build wealth and being knowledgeable about how it operates helps you decide what to do with your money. The stock market works fundamentally as a supervised market for people to buy and sell the shares of companies traded publicly. These exchanges include the NYSE and NASDAQ , which help buyers and sellers meet and interact.

By buying a company’s stock, you own a part of the company, called a share. The costs of these shares are impacted by factors such as demand and supply, how well the company is performing, changes in economic information and what investors think. Most investors resort to using brokers or online platforms that help them trade. Such brokers frequently join forces with market makers, who maintain easy access to stocks by being willing to buy or sell.

More and more investors are buying shares on the global stock market which currently has a market capitalization of over $109 trillion (World Federation of Exchanges, 2024).

Whether you’re exploring how to invest in stocks, using a stock investment calculator, or researching the best stocks to invest in, understanding how the market functions is the first step toward smart and confident investing.

Stock investment calculator: How to estimate your returns

A stock investment calculator is a powerful tool that allows you to estimate how much money you could earn in the future based on time and returns on your investments. Whether you are a beginner dipping your toes in the water or a seasoned pro planning to retire, these calculators help paint a clear picture of what your money could look like over time in the stock market.

To get the most out of a calculator, you typically have to input your initial investment amount, desired annual rate of return, duration of investment or for how long you expect to hold the investment, and any other additional contributions you intend to make. Then, the calculator provides information about how your investment may be appreciated, considering compounded interest and any earnings you may want to reinvest. The calculator can help you formulate realistic expectations and adapt your investment strategy in any way you see fit.

For example, if you invest ₹1,00,000 with an expected annual return of 10% over 20 years, your investment could grow to over ₹6.7 lakhs—without adding anything extra—thanks to compounding. According to historical data, the S&P 500 has averaged an annual return of about 10% over the last 50 years (Statista, 2024), making it a useful benchmark for such projections.

Using a stock investment calculator doesn’t just show you numbers—it empowers you to take control of your financial future. It’s an essential step in stock market investing, especially when evaluating different scenarios and planning long-term goals.

AI in stock investing: How technology is changing the game

Stock investing is being changed quickly by AI, making it smarter, quicker and open to more people. Thanks to AI, investors do not have to rely only on manual research or their instincts. Rather, today’s advanced programs can go through huge amounts of market records in a few seconds, detect similarities and perform trades on their own.

By employing machine learning, these platforms examine history, follow news, notice patterns in prices and try to predict market trends. With this information, both beginning and seasoned investors can make better choices. As a result, products such as Trade Ideas, Kavout and EquBot (found in the AI-Powered Equity ETF) are meant to screen through countless stocks and suggest reliable trades.

In fact, NVIDIA’s report showed that more than 60% of institutional investors are now using AI to support trading decisions and portfolio management strategies (NVIDIA, 2024). Overall, this indicates an increasing level of trust in AI’s ability to drive performance and reduce risk.

AI is here to say in the world of stock market investing, whether you’re interested in AI stock investing or simply want to improve your processing around stock market investing, you are at a competitive advantage using AI tools in today’s fast-paced markets.

AI is transforming the way people invest, offering faster, data-driven decisions. But like any tool, it comes with both benefits and risks worth weighing carefully.

Pros

- Data-driven insights: AI can process massive amounts of market data quickly, identifying trends and patterns humans might miss.

- Speed & efficiency: Automated systems can execute trades faster than manual methods, helping capitalize on market opportunities.

- Emotion-free decisions: AI removes emotional bias—like fear or greed—from investment choices.

- 24/7 monitoring: AI tools can track global markets in real time, around the clock.

- Personalized strategies: Many platforms use AI to tailor investment plans based on your goals and risk tolerance.

Cons

- Lack of context: AI might miss broader economic or political nuances that influence markets.

- Over-reliance risk: Depending solely on AI can be risky if the underlying algorithms are flawed or outdated.

- Black box problem: Many AI models don’t explain their logic, making it hard to trust or verify decisions.

- Market volatility: AI can react too quickly in volatile markets, triggering trades that might not align with long-term goals.

- Security & data concerns: Using AI-based tools involves sharing financial data, raising privacy and security issues.

Stock investing apps: Tools for Easy and Convenient Trading

In today’s digital-first society, stock investing apps have fundamentally changed the way in which we approach stock market investing. Whether you’re a newcomer to investing, or someone looking to amass a serious portfolio, these mobile apps are exponentially enhancing how accessible, user-friendly, and commission-free we can easily trade stocks through highly functional applications. With the right mobile stock investing app, you can stay up to date on market activity, look at your portfolio, and place trades all on your phone.

Let’s take a look at some of the most popular stock investing apps and what they bring to the table.

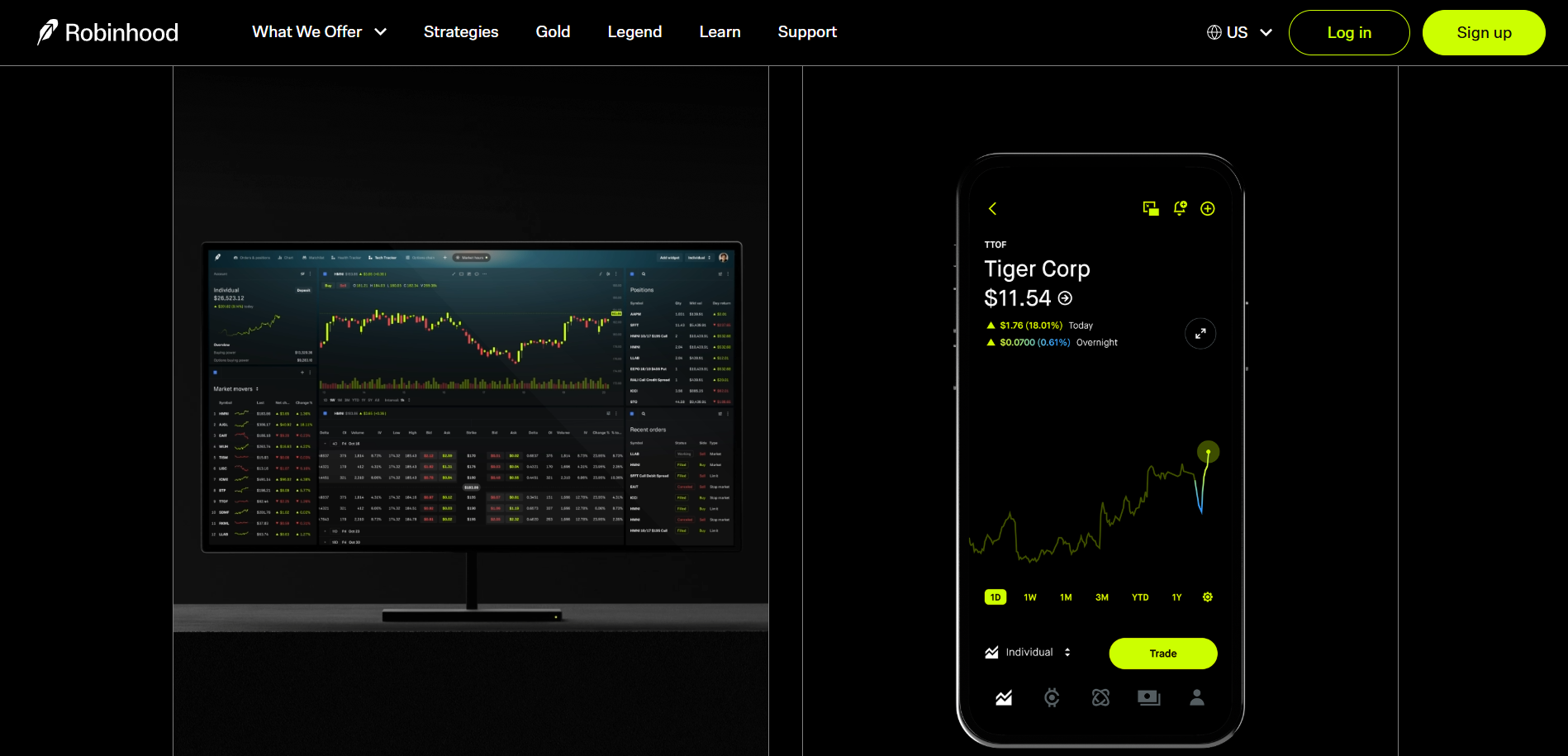

Robinhood: Simplified, commission-free investing

Robinhood has quickly become a hallmark app for beginning stock market investors with its simple interface and commission-free investing. Users are able to buy stocks, ETFs, and even cryptocurrency with minimal investment hold-ups. As of 2023, Robinhood brought in over 23 million users (Statista) and is singularly appealing to everyday investors.

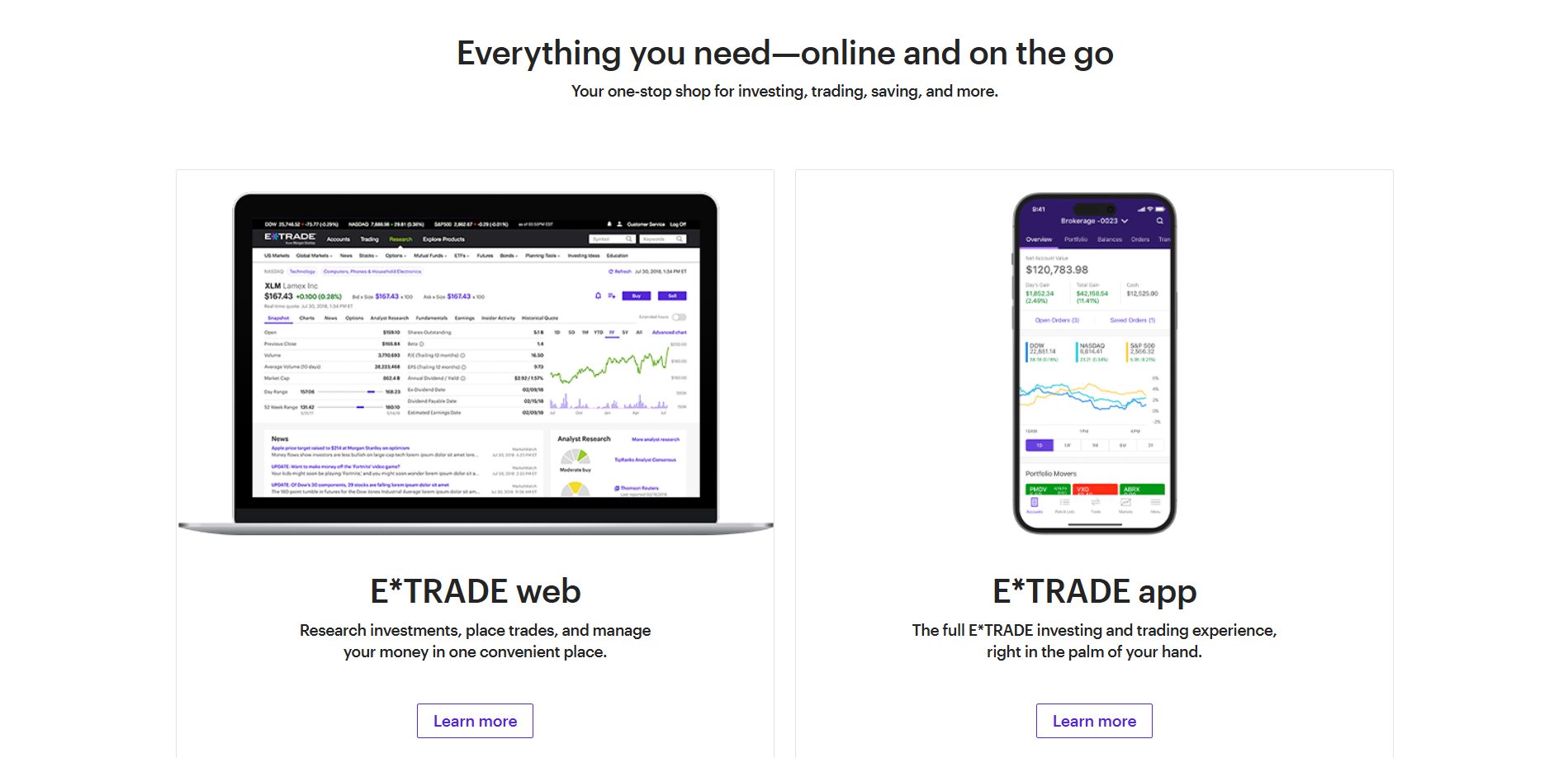

E*TRADE: Comprehensive tools for all levels

E*TRADE is a user-friendly platform that also features powerful tools and is perfect for both new and active traders, as it offers powerful charting, technical analysis capabilities, and a wealth of educational material. With thousands of mutual funds, bonds, and retirement options available, it is a good platform for anyone that is learning to develop a long-term stock investing strategy.

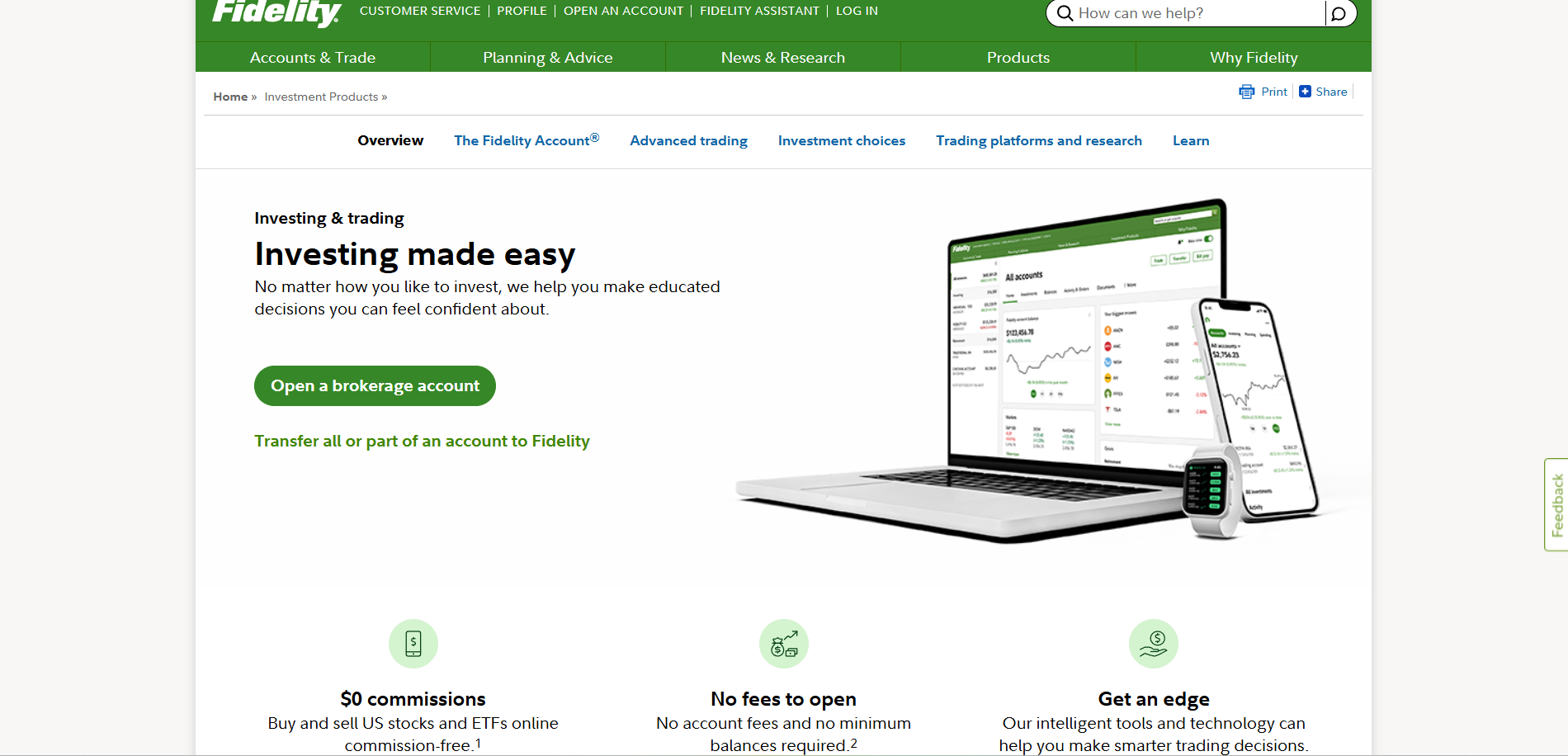

Fidelity: Trusted platform with in-depth research

Fidelity is known for offering low-cost transparency, and it provides strong research tools. Fidelity is excellent for long-term investors that desire detailed company reports, real-time data, and a variety of retirement accounts. In fact, J.D. Power rated Fidelity as #1 in investor satisfaction in 2022, which is a great indicator of its trustworthiness.

TD Ameritrade: Educational and technical powerhouse

TD Ameritrade offers one of the most powerful platforms (particularly with its Thinkorswim interface). The platform is loaded with features including real-time data, backtesting, paper trading, and lots of educational material. For users who want to focus on technical analysis, TD Ameritrade is solid, and they are also starting to add AI stock investing features that other platforms offer.

Why does picking the right investing app really matter?

- Not all apps match all goals: Some are built for long-haul wealth builders; others cater to thrill-chasing day traders. Choose one that aligns with your risk appetite, time horizon, and strategy—or risk investing blindfolded.

- Features can make or break you: Advanced charting, real-time data, fractional shares, auto-investing, stop-loss tools—your app should offer what you need, not just what looks sleek on the homepage.

- Zero fees ≠ Zero cost: “Commission-free” often hides in spreads, limited access, or missing features. Look deeper. If you save on fees, you might lose flexibility or transparency.

- Security is non-negotiable: You’re handing over your money and data. Make sure the app has top-tier encryption, 2FA, and a proven track record. Shiny UX means nothing if your funds aren’t safe.

- Your goals evolve—so should your app: Today you’re learning the ropes, tomorrow you’re optimizing a diversified portfolio. Pick an app that grows with you, not one that boxes you in.

- Community, education, and support matters: The best apps teach, guide, and back you up. Whether it’s in-app tutorials or responsive customer support, make sure you’re not going it alone.

Stock investment today: How to stay updated on market trends

In today’s fast-paced financial world, staying informed is not just helpful—it’s essential for smart stock investment decisions. The market can shift quickly due to economic updates, global events, or even breaking company news. That’s why tracking current trends, monitoring company performance, and understanding broader economic signals can give you a major edge as an investor.

Thankfully, there are a wide range of tools that make this easier than ever. From stock market apps like Yahoo Finance, Bloomberg, and Moneycontrol to financial news platforms like CNBC and Reuters, investors can track real-time stock prices, earnings reports, sector movements, and even global indices all from their phones or desktops. Many platforms also offer customizable alerts, AI-driven news summaries, and insights tailored to your watchlist.

For example, according to a report by Statista, over 131 million people worldwide used stock market apps in 2023 alone—a number expected to grow as digital investing becomes the norm (Statista, 2024).

Whether you’re a beginner learning how to invest in stocks or a seasoned trader looking for the best stocks to invest in, staying consistently updated ensures you’re never caught off guard. By using these tools regularly, you’ll be better equipped to react wisely to market changes and manage your portfolio with confidence.

BiyaPay: Simplifying financial transactions for stock investors

For anyone involved in stock market investing, managing funds efficiently is just as crucial as choosing the right stocks. That’s where BiyaPay steps in—a next-generation financial platform designed to simplify transactions for both domestic and international stock investors. Whether you’re funding your brokerage account, withdrawing profits, or managing global investments, BiyaPay streamlines every step with ease and security.

4 Power Moves to Use BiyaPay for Stock Trading Like a Pro

Ready to power your global stock investing? BiyaPay cuts through red tape with speed, security, and smart currency moves. Follow these steps to take control and trade like a boss.

Step 1: Download & Lock It Down

Snag the BiyaPay app, slam in your details, and verify like a boss. This is your launchpad—security tight, access instant.

Step 2: Plug In Your Brokerage & Cash Source

Fuse your trading platform—eToro, Robinhood Intl., wherever you play—and hook your bank or card. One click, zero hassle, funds flow like lightning.

Step 3: Flip Currency & Fire Funds

Cross-border investing? Swap currencies live with razor-thin fees. Then blast your cash to your brokerage—usually before you can blink.

Step 4: Scoop Profits & Spy on Moves

Pull profits back to BiyaPay, flip currencies if you want, then jet-set them home to your bank. Track every dime, every deal in real time—stay sharp, stay ahead.

According to a 2024 report by FXC Intelligence, over 70% of digital investors said high transfer fees and slow processing were the top barriers to investing across borders (FXC Intelligence, 2024). BiyaPay directly addresses these challenges, making it easier for investors to focus on building wealth rather than navigating financial roadblocks.

Key features of BiyaPay: Where money moves like you think

- One-tap trading transfers: Jump from stock app to cash-out in seconds—no more juggling banks, cards, or clunky delays. Just tap, move, done.

- Cross-border? No borders.: BiyaPay speaks fluent dollar, yen, euro, and beyond—because your money shouldn’t need a visa to travel.

- Fees that don’t bite; No wallet-draining fees lurking in the fine print. You invest, BiyaPay clears the way—clean, cheap, and transparent.

- Blink-and-it’s-done speed: Missed that dip because your transfer was “processing”? Not with BiyaPay. Your funds move as fast as your instinct.

- Live rates, real results: Why guess the forex rate? Get real-time currency conversion that updates with every heartbeat of the market.

- Ironclad security, no drama: Military-grade encryption, fraud detection, zero-stress. Your money’s locked down, even when the market isn’t.

- Smashes barriers, not dreams: FXC says 70% of investors fear fees and delays—BiyaPay eats those fears for breakfast and lets you invest without baggage.

BiyaPay also shines when it comes to international stock investments. With low transaction fees, end-to-end encryption, and quick processing times, it eliminates the usual headaches associated with cross-border payments. Plus, its real-time currency exchange feature ensures that investors can manage their funds in multiple currencies—without worrying about delayed conversions or fluctuating forex rates.

Whether you’re exploring AI stock investing, diversifying your portfolio globally, or just getting started with how to invest in stocks, BiyaPay offers a smarter, faster, and more reliable way to manage your investment funds.

Tips for Investing in Stocks for Beginners

If you’re new to stock market investing, getting started can feel overwhelming—but it doesn’t have to be. With the right approach and mindset, beginners can build a solid foundation for long-term financial growth. One of the best tips is to start with a long-term perspective. Avoid chasing quick profits or following hype; instead, focus on companies with strong fundamentals and growth potential over time.

According to a NerdWallet survey (2023), over 60% of first-time investors said they felt more confident after creating a diversified portfolio and committing to a long-term strategy.

- Research like a detective, not a dreamer: Before you throw money at a ticker symbol, know the story. What does the company actually do? Is its industry hot—or headed for winter? Dig into the economic winds behind it. Emotional investing burns; informed investing builds.

- Only bet what you can afford to burn: Golden rule: if losing the money would keep you up at night, don’t invest it. Stocks can skyrocket—or nosedive. Play with capital that won’t wreck your financial life.

- Diversify or die trying (financially): Putting everything into one “sure thing”? That’s not confidence—it’s roulette. Spread your investments across different sectors, companies, and industries to soften the blow when things go sideways.

- Check your portfolio like you check the weather: Markets change. So should your portfolio. Don’t just “set and forget”—review it, rebalance it, and make sure it still matches your goals, not last year’s.

- Be patient—this isn’t a casino: Stocks aren’t a shortcut to overnight millions. They’re a long game. Let compound growth do its magic and don’t panic over every market twitch.

If you’re still wondering how to invest in stocks, remember: start small, stay consistent, and keep learning as you go. Tools like stock investing apps and a reliable stock investment calculator can help you plan your journey with clarity and confidence.

Conclusion

Stock investment is one of the most powerful ways to grow your wealth, but success starts with a strong understanding of the basics. From learning how the stock market works to selecting the best stocks to invest in, every step matters. Whether you’re exploring long-term strategies, using a stock investment calculator to estimate returns, or discovering how AI stock investing is changing the game—having a clear plan is key.

Start by setting realistic goals, doing your research, and choosing an investment strategy that aligns with your risk tolerance. Leverage the right tools like stock investing apps to stay informed and organized. And remember, consistency beats speed—investing is a marathon, not a sprint.

For those looking to expand into international markets or manage global stock portfolios, BiyaPay offers a smart solution. Its fast, secure, and low-cost financial services simplify transactions and remove the usual friction that comes with cross-border investing.

Begin your journey with patience, curiosity, and the right resources—and you’ll be well on your way to building a strong financial future through stock market investing.

FAQs:

- How much money do I need to start investing in stocks? You can begin with as little as ₹100 or $10, thanks to fractional shares on many apps. BiyaPay makes small international investments easier with low fees and fast currency conversions.

- What are the risks of stock market investing**?** Market volatility, economic downturns, and company performance can affect stock prices. BiyaPay supports global investors with secure and efficient cross-border transactions to manage risk with ease.

- Can I use AI to pick stocks for me? Yes, AI tools analyze data trends to recommend stocks, helping improve decisions. BiyaPay complements this tech-forward approach by simplifying how you fund and withdraw from your investment platforms globally.

- What is the best way to track my stock investments**?** Use stock apps offering real-time data, portfolio overviews, and alerts. BiyaPay helps you act on insights quickly by enabling smooth fund transfers across currencies and platforms.

- How does BiyaPay help investors with stock trading? BiyaPay offers low-cost, fast, and secure currency exchange, ideal for international investors. It enables seamless deposits, withdrawals, and fund management for cross-border stock trading.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

BIYA GLOBAL LLC is a licensed entity registered with the U.S. Securities and Exchange Commission (SEC No.: 802-127417); a certified member of the Financial Industry Regulatory Authority (FINRA) (Central Registration Depository CRD No.: 325027); regulated by the Financial Industry Regulatory Authority (FINRA) and the U.S. Securities and Exchange Commission (SEC).

BIYA GLOBAL LLC is registered with the Financial Crimes Enforcement Network (FinCEN), an agency under the U.S. Department of the Treasury, as a Money Services Business (MSB), with registration number 31000218637349, and regulated by the Financial Crimes Enforcement Network (FinCEN).

BIYA GLOBAL LIMITED is a registered Financial Service Provider (FSP) in New Zealand, with registration number FSP1007221, and is also a registered member of the Financial Services Complaints Limited (FSCL), an independent dispute resolution scheme in New Zealand.