- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Everything You Need to Know About Currency Exchange: Services, Rates, and How to Convert

What is currency exchange?

Definition of currency exchange and its role inglobal finance Currency exchange is the process of converting one nation’s currency into another, making global transactions possible. It’s essential for buying goods across borders, investing in foreign markets, or simply traveling abroad. In the vast landscape of global finance, over $7.5 trillion is traded daily in the foreign exchange market (as of 2024, BIS data), highlighting its massive impact on global liquidity and economic connectivity.

The role of currency exchange in trade, tourism, and investments Currency exchange international fuels global trade by allowing businesses to buy and sell goods in different currencies, reducing friction in cross-border deals. For tourists, it allows spending in foreign countries; for investors it allows access to international stocks, bonds, and real estate. As of 2023, global tourism expenditure exceeded $1.3 trillion (UNWTO report), much of which depended on efficient currency exchange systems.

Key factors that influence currency exchange rates Exchange rates are dynamic and influenced by several factors:

- Economic conditions like inflation, interest rates, and GDP growth shape a currency’s strength.

- Supply and demand in foreign exchange—increased demand for a currency increases its value.

- Wars, elections or agreements in trade can all lead to market shifts and weather events. As an example, the U.S. dollar rose by 5% in the middle of 2024 because of interest rate hikes by the Federal Reserve.

Types of currency exchange services

When it comes to handling money across borders, there’s no one-size-fits-all solution. Depending on your needs—whether you’re a traveler looking to buy some yen or a trader watching the currency exchange market—there are a variety of currency exchange services to choose from.

Currency exchange near me: If you’ve ever searched for “currency exchange near me” before heading to the airport or crossing a border, you’re not alone. Local options include banks and travel agencies, as well as exchange bureaus, and airport kiosks. These are convenient, but fees can vary accordingly. So, it’s always a good idea to call ahead or check their current currency exchange rate online first.

Foreign currency exchange: Traditional foreign currency exchange services are typically provided by a bank or a specialised money changer. All you do is walk into the establishment with your home currency, and walk out with your destination currency’s equivalent. This is an easy service, but used to be the least affordable option!

Online currency exchange: With the rise of digital banking, online currency exchange platforms have become a go-to for many. These services let you exchange money from the comfort of your home, often offering better rates than physical locations. Whether you’re paying tuition abroad or sending money to family overseas, online services can be a quick, cost-effective option.

Currency exchange market (Forex): Currency exchange market (Forex): Many people may simply look at exchanges, while others may look at currencies and consult the currency exchange market (Forex), where global currencies can be purchased or sold. Forex is the most liquid market in the world, trading over $7 trillion everyday. For example, traders are involved in currency exchange trading and speculate in price movements between currencies, such as the euro to dollar. It can be potentially profitable, but with that also comes a lot of risks and requires serious financial acumen. From a trip between two exchanges, to walking into a bank, to trading currencies in front of a computer screen, currency is a more extensive world than most realize. Knowing the different services and seeing what the costs are in finding a currency converter can help you make smarter decisions for your funds, whether traveling, investing or sending money abroad.

Currency exchange rates: Understanding the basics

Before exchanging your money—or diving into currency trading—it’s essential to understand how currency exchange rates work. These rates tell you how much one currency is worth compared to another, and even small changes can affect your travel budget, international business, or investment profits.

What determines currency exchange rates?

At its core, a currency exchange rate is determined by the balance of supply and demand in the currency exchange market. If more people want a particular currency, its value rises. Conversely, when demand falls, the rate drops.

For example, in 2024, the U.S. dollar strengthened significantly, with the dollar index rising by 6.6% over the year (Reuters). This surge was influenced by the Federal Reserve’s cautious stance on rate cuts and anticipated pro-growth policies from the incoming administration, including tax cuts and tariff hikes. These factors contributed to the dollar’s strength against other major currencies, such as the euro and the Japanese yen.

Key factors that affect exchange rates

Several economic and political forces play a role in pushing exchange rates up or down:

- Inflation: Countries with low inflation tend to have stronger, more stable currencies.

- Interest rates: Higher interest rates attract foreign investment, increasing demand for the currency.

- Political stability: Investors prefer stable nations, so geopolitical events like elections, wars, or sanctions can shake a currency’s value.

A prime example is that the British pound dropped significantly in 2022 due to unexpected political instability, demonstrating the high sensitivity of exchange rates to trajectory at a global level (BBC News).

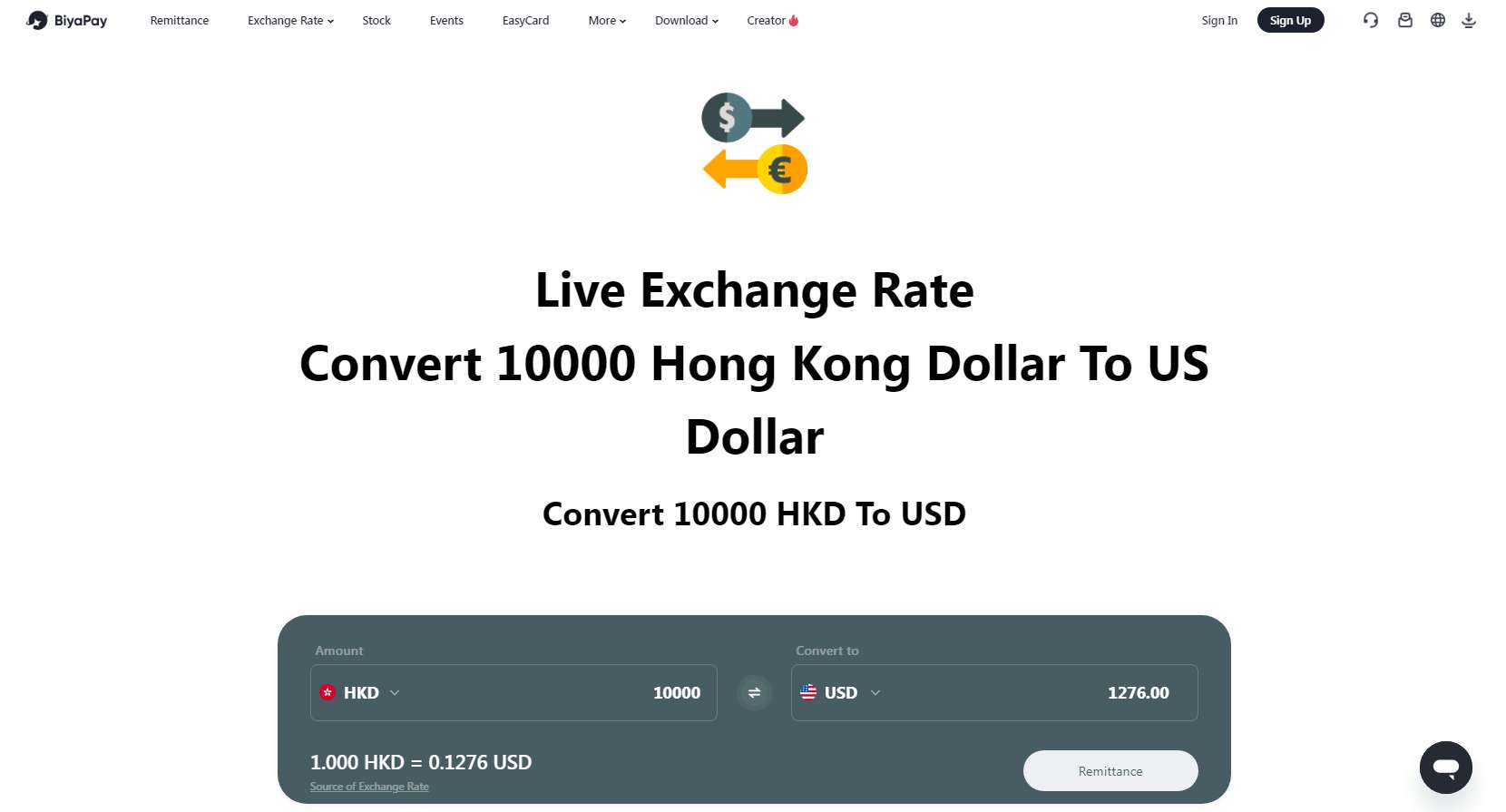

How to check currency exchange rates easily?

You don’t need to be a financial analyst to monitor exchange rates. There are plenty of online tools and apps that let you track live rates in real time:

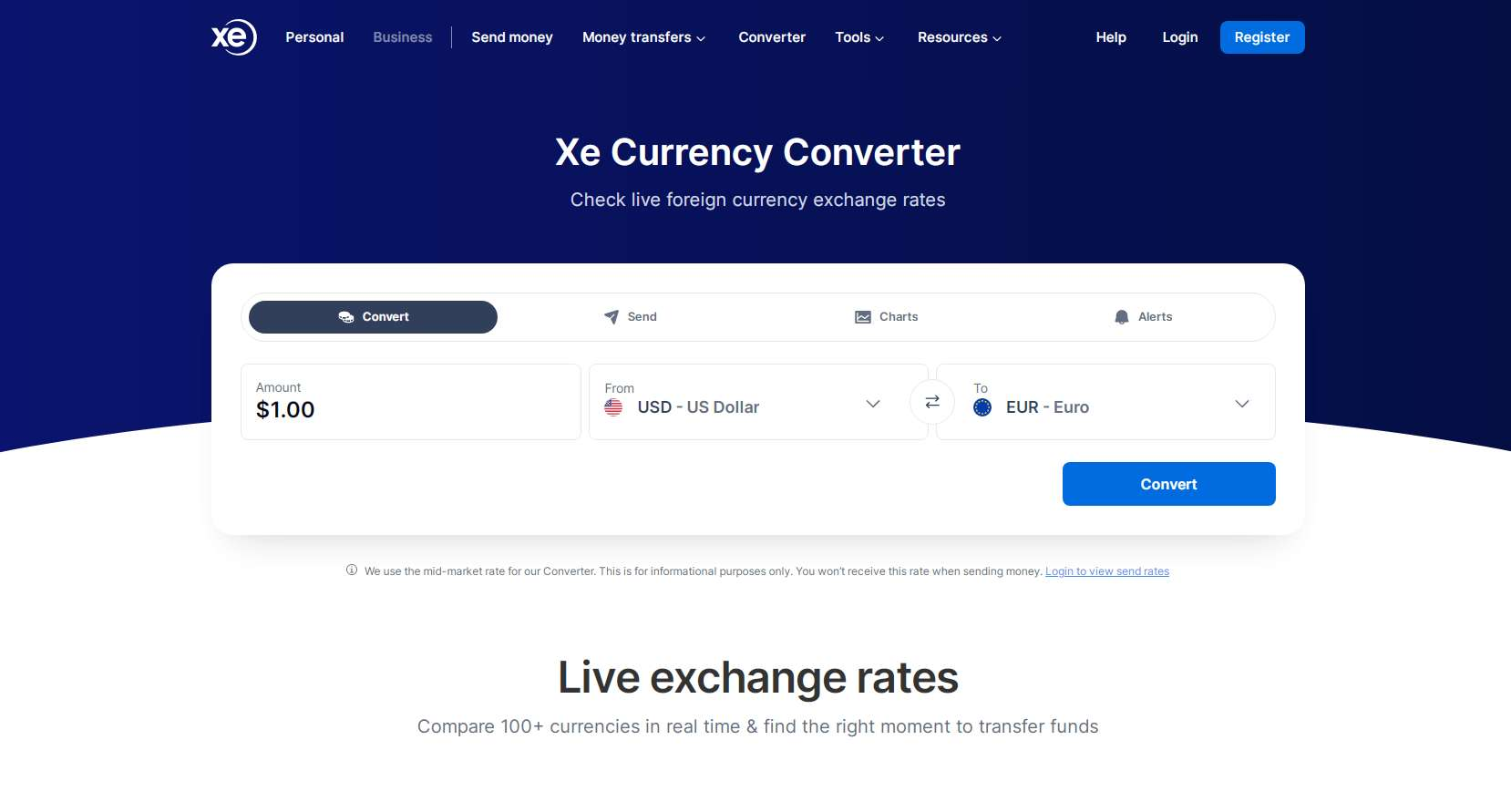

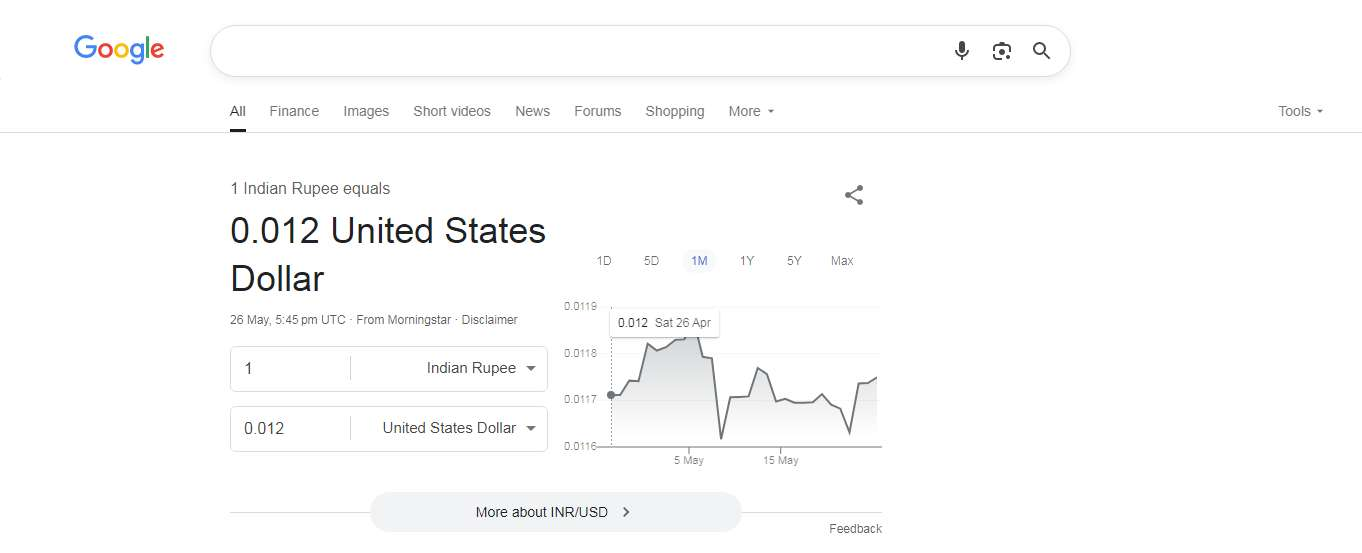

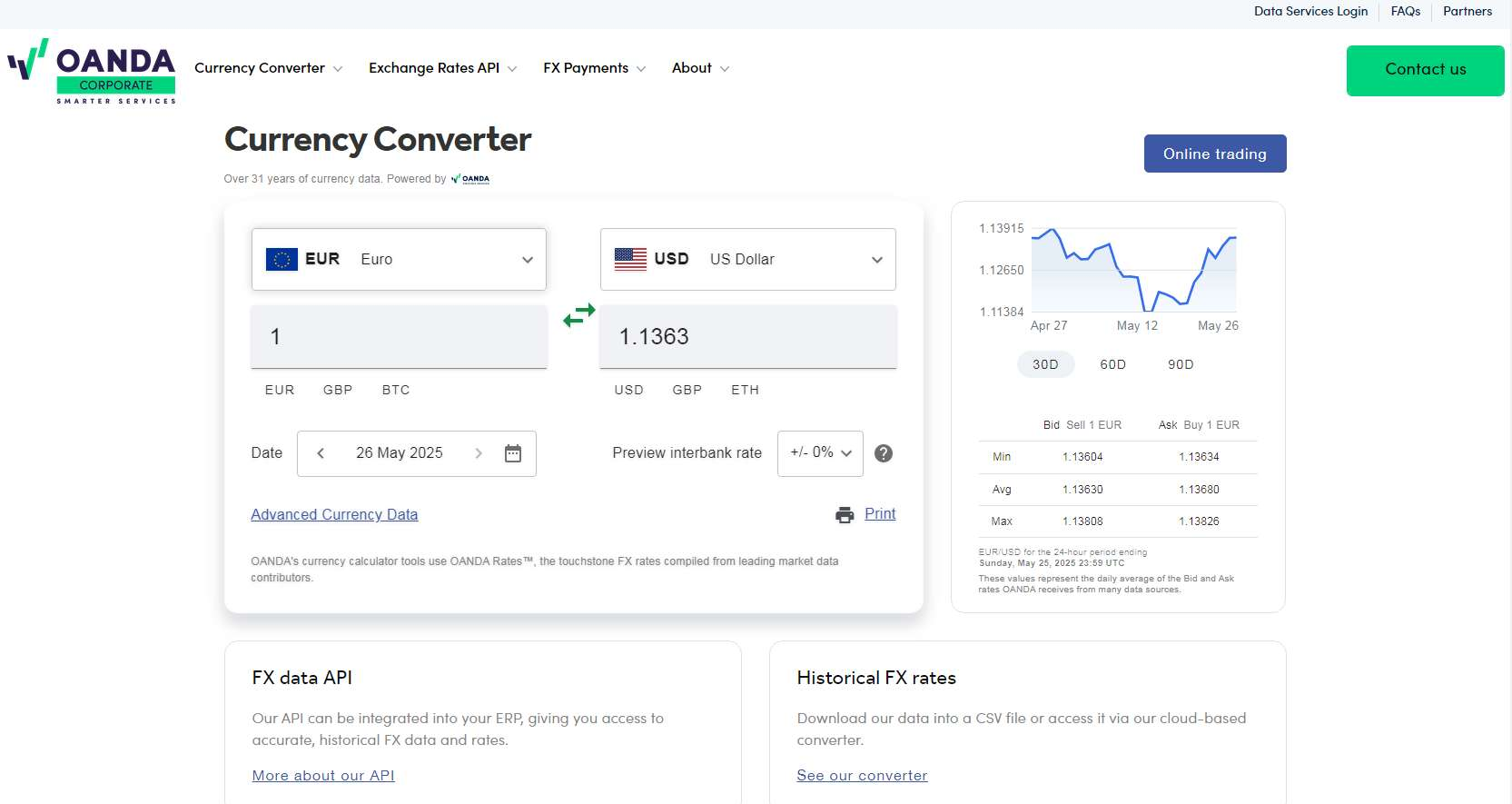

- Currency converter websites like XE, OANDA, and Google currency converter provide instant conversions.

- Many online currency exchange platforms also show historical rate charts, i.e., to better gauge and plan your next move.

- For those of you who may be traveling soon, if you are checking the currency exchange euro to dollar rate (or any other relevant pair) a few days before your planned trip, it may help you plan accordingly.

Knowing how to find and interpret these rates gives you a major advantage—whether you’re exchanging a few hundred dollars or managing cross-border deals.

How to use a currency converter

Whether you’re preparing for a trip abroad, shopping on international websites, or managing overseas business expenses, a currency converter is your go-to tool for quick and accurate currency conversions. Using one is simple, but knowing how to do it right ensures you avoid errors and get the most accurate exchange value.

Step-by-Step: Using an online currency converter

- Choose a trusted tool Start by picking a reliable platform. Popular options include XE and Google currency converter, both of which provide fast and up-to-date conversions.

- Select your currencies Input your home currency and the foreign currency you want to convert to. For example, if you’re converting from U.S. dollars to euros, choose “USD” and “EUR.”

- Select your currencies Type the amount of money you wish to convert. The tool will instantly show you the equivalent value in the target currency based on the latest currency exchange rate.

- Select your currencies Make sure the converter uses real-time exchange rates. Since rates can fluctuate by the minute—especially in active markets—it’s important to have the most current data.

- Select your currencies Many converters also offer historical charts, rate trends, and even fee estimators, which are especially helpful if you’re transferring money or doing foreign currency exchange for business—and wondering where to exchange foreign currency at the best rate.

Popular currency converter tools

Looking to convert currencies quickly and accurately? Here are some of the most popular currency converter tools trusted by travelers, businesses, and everyday users.

1. XE Currency Converter

A globally trusted tool offering real-time rates, historical charts, rate alerts, and multi-currency tracking—all in one sleek interface.

2. Google Currency Converter

Ultra-fast and effortless. Just type “100 USD to EUR” into Google and get instant results—no app, no fuss.

3. OANDA Currency Converter

Precision meets power. Used by serious travelers and businesses alike, it supports hundreds of currencies and offers deep historical data for smarter decisions.

Why does real-time data matter?

Using outdated rates can lead to incorrect budgeting or even financial loss. For instance, a rate that’s even 1–2% off during a currency exchange euro to dollar transaction could cost you significantly if you’re converting a large amount. That’s why it’s crucial to use tools that update rates frequently—often every few seconds.

Where to eexchange fforeign ccurrency

When exchanging foreign currency, knowing where to exchange it will affect how much you lose and how much you get. Whether it is cash exchange for a vacation or exchanging cash for global payments, it matters who you choose to convert your cash to local currency.

Local currency exchange providers

Traditional currency exchange near me options come in the form of banks, and currency exchange providers like exchange bureaus, and sometimes local post offices. Generally, banks offer the most secure (with minimal fees) and best exchange rates, but can charge fees for each transaction.

Currency exchange providers or ‘currency exchange bureaus’ typically conveniently located in city centre and tourist areas, but you must always consider and compare values between currency exchange bureaus, especially in tourist areas, where exchange rates may fluctuate. They can change values multiple times per day.

Some post offices in some countries offer currency exchange services (i.e. UK or Japan) with fixed fee rates based on the currency exchanged, and they can also get you close to the current foreign exchange rates which range from very close to mid-range.

Thus, wherever you are exchanging cash locally, always consider at least a few providers prior to committing or exchanging your cash. Even if you are exchanging cash at the airport for convenience, be extremely cautious, as airport exchange counters can. The worst case scenario represents the worst transactional cash exchange rates in comparison to standard or normal cash exchange providers.

Here are some trusted online currency exchange platforms:

In today’s digital world, online currency exchange platforms are becoming the go-to choice for travelers, freelancers, and international shoppers. Services like PayPal, Revolut, and BiyaPay allow users to convert currencies quickly and securely right from their phone or computer.

1. PayPal

Offers international payments with automatic currency conversion, although exchange rates may include a margin above the mid-market rate.

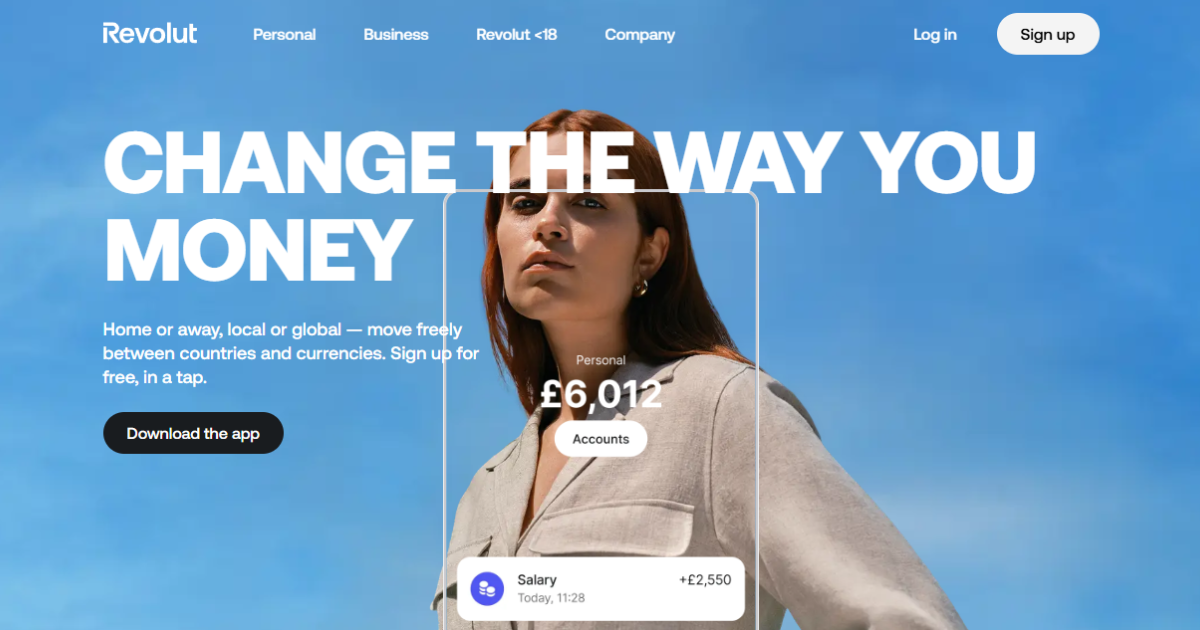

2. Revolut

Known for real-time exchange rates with low or no fees for standard users—especially useful for travel and international shopping.

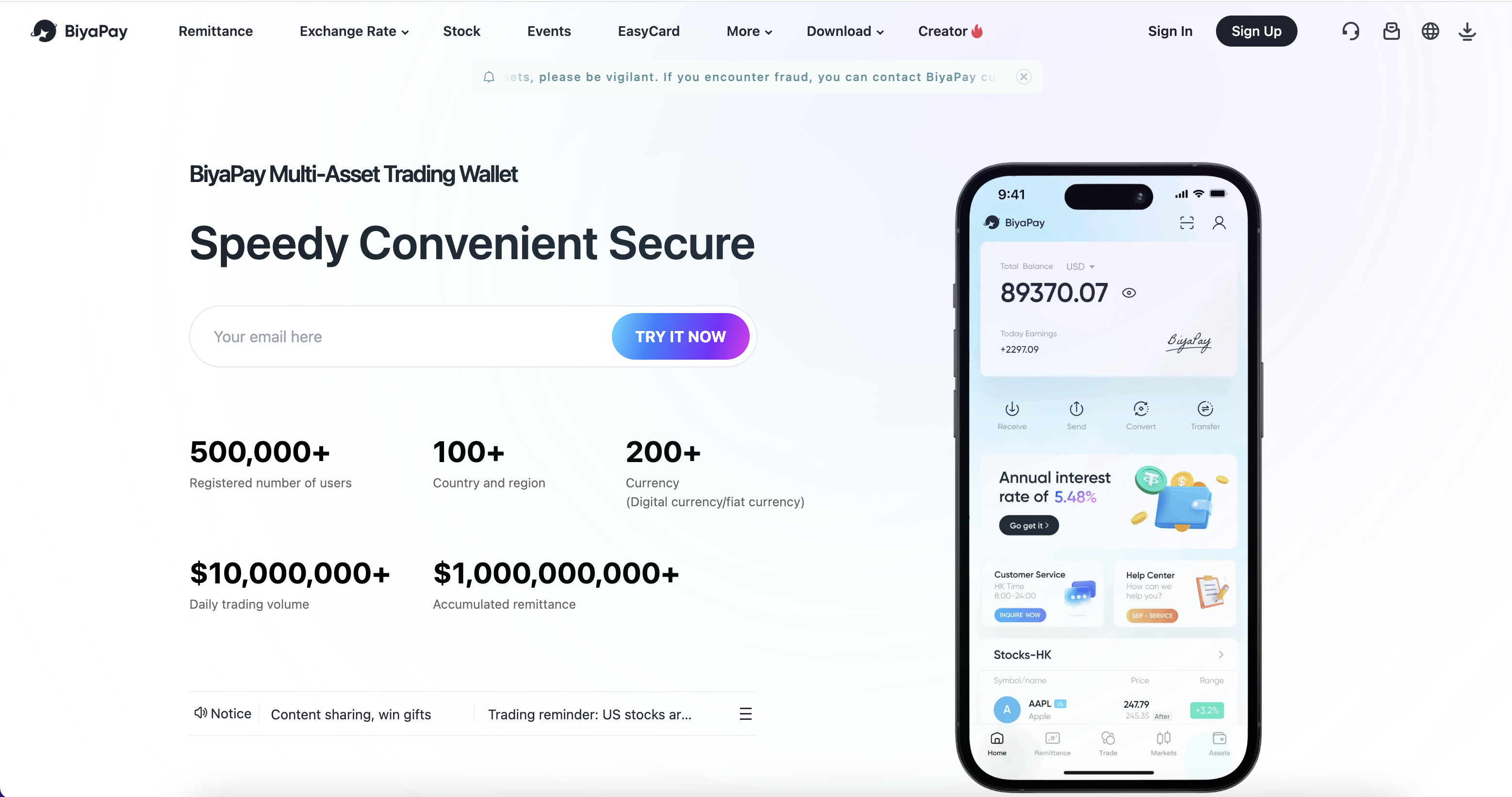

3. BiyaPay

A growing platform that supports cross-border payments with transparent fees and mid-market rates, appealing to global freelancers and remote workers.

These platforms are ideal for managing everyday global transactions and avoiding the hassle of cash handling. Just make sure to read the fine print—some providers include hidden margins or fees.

Tips for getting the best exchange rates

Get the most bang for your buck when exchanging currency:

- Compare exchange rates: Check direct conversion rates using a currency converter or a live exchange rate service like XE or OANDA. Knowing the converted value in your mind can help you identify overpriced offers and what the true mid-market exchange rate is.

- Don’t get hit with hidden fees: Only use services that display their fees and margins clearly for you to see. Some currency exchange services will advertise their rates as “zero commission” but really make up for their rates elsewhere in fees or margins.

- Do as much exchange as possible before you’re traveling: Exchange your money before travelling so that you do not get caught out in airports or hotels paying additional fees.

- Use digital wallets as much as possible when using small transfers: If all you are doing is sending small amounts, digital wallets/platforms are a much cheaper option than bank wire transfers.

- Keep an eye on the currency exchange market: If you need to convert large amounts of currency, it pays to monitor trends in the currency exchange market. Economic events, inflation or increases in interest rates can significantly change the currency exchange rates.

currency exchange trading: How it works

Currency exchange trading, often referred to as Forex (foreign exchange) trading, is the world’s largest and most liquid financial market. Trillions of dollars are traded daily, and it operates 24 hours a day, five days a week. But how exactly does it work, and can anyone get involved?

What is currency exchange trading in the forex market?

At its core, currency exchange trading involves buying one currency while simultaneously selling another. These transactions take place in the Forex market, a global decentralized marketplace where banks, financial institutions, corporations, and individual traders exchange currencies.

Unlike stock markets, the Forex market has no central exchange. Instead, it’s powered by electronic trading networks, with major financial hubs like London, New York, Tokyo, and Sydney leading the activity.

In this market, traders and investors aim to profit from changes in currency exchange rates. For example, if a trader expects the euro to strengthen against the U.S. dollar, they’ll buy the EUR/USD currency pair. If the euro rises in value, they can sell it at a higher rate and pocket the difference.

There are two main types of participants:

- Retail traders: Everyday individuals using online platforms like MetaTrader or eToro to speculate on price movements.

- Institutional traders: Banks, hedge funds, and multinational companies trading large volumes to hedge risk or seek profit.

Understanding currency pairs: EUR/USD, GBP/USD, and more

All Forex trades are made in currency pairs. The first currency is the “base,” and the second is the “quote.” Common examples include:

- EUR/USD – Euro vs. U.S. Dollar

- GBP/USD – British Pound vs. U.S. Dollar

- USD/JPY – U.S. Dollar vs. Japanese Yen

If EUR/USD is trading at 1.10, it means 1 euro equals 1.10 U.S. dollars. Traders predict whether the base currency will rise or fall against the quote, and they open “buy” or “sell” positions accordingly.

Risks and rewards of currency trading for beginners

Forex trading offers high reward potential—but it comes with significant risk. Since trades are often made with leverage (borrowed money), small market moves can lead to large gains—or devastating losses.

Pros

- Frictionless nntry, scalable growth: With minimal capital barriers, stock investing democratizes wealth-building — turning a few hundred dollars into a gateway to global equity markets.

- Global markets on demand: Trade Tokyo at dawn, London by noon, and Wall Street by close. With 24/5 market access, your portfolio never sleeps, only strategizes.

- Tactical to transformational: From micro-moves to macro-plays, stock markets serve both day-trading tactician and long-term wealth architects.

Cons

- Volatility with teeth: Markets don’t whisper; they roar. Sharp swings, flash crashes, and sentiment spirals can obliterate gains in minutes.

- Chaos in the fundamentals: inflation prints, rate hikes, oil shocks, political turbulence — one headline can send your portfolio into a tailspin.

- Emotions vs. Execution: FOMO, panic, greed, regret — the psychological warfare of trading often punishes reaction over reason.

Tip: Beginners should start with a demo account to practice, use stop-loss orders to manage risk, and never trade more than they can afford to lose.

- Overview of currency exchange trading in the Forex market.

- The role of traders and investors in the global exchange market.

- Basic principles of currency pair trading, including EUR/USD, GBP/USD, and others.

- Risks and rewards of currency trading for beginners.

Currency exchange Euro to Dollar: A case study

The exchange rate between the Euro (EUR) and the U.S. Dollar (USD) is one of the most closely watched currency pairs worldwide. It affects everything from international trade to travel expenses and investment returns. Let’s explore how to convert Euros to Dollars, look at historical trends, and understand the key factors driving this important exchange rate.

How to convert Euros to US Dollars using the current exchange rate?

Converting Euros to US Dollars is straightforward with a reliable currency converter or through your bank or currency exchange service. Suppose the current exchange rate is 1 EUR = 1.10 USD. This means for every 1 Euro, you get 1.10 US Dollars. To convert, simply multiply the amount in Euros by the exchange rate:

Example: If you want to convert €500 to USD: 500 × 1.10 = $550

Using online tools like XE.com or Google Currency Converter ensures you get the most accurate, real-time rate. Remember that the final amount you receive may be affected by fees or margins charged by the currency exchange service.

Historical trends in the Euro to USD exchange rate

The EUR/USD pair has experienced significant fluctuations over the past two decades. It reached a peak of about 1.60 USD per Euro in 2008 before sharply declining during the global financial crisis. Since then, the rate has oscillated between roughly 1.05 and 1.25 USD.

More recently, the Euro faced downward pressure in 2022 and 2023 due to inflation concerns and energy supply challenges in Europe, while the US Dollar strengthened thanks to higher interest rates set by the Federal Reserve.

These historical trends reflect broader economic cycles and market sentiment, making the EUR/USD pair a barometer for global financial health.

Several factors impact the Euro to Dollar exchange rate, including:

- Economic reports: Data on GDP growth, employment, inflation, and trade balances from both the Eurozone and the U.S. can shift market expectations. For instance, stronger US economic data tends to boost the dollar against the Euro.

- Central bank policies: The European Central Bank (ECB) and the U.S. Federal Reserve influence the rate through interest rate decisions and monetary policy. When the Fed raises rates faster than the ECB, the dollar typically strengthens against the Euro.

- Global events: Political instability, trade tensions, or crises like the COVID-19 pandemic create uncertainty that can cause rapid currency fluctuations. For example, geopolitical tensions in Europe may weaken the Euro as investors seek safer assets like the dollar.

Understanding these factors can help traders, businesses, and travelers anticipate changes in the EUR/USD rate and make informed financial decisions.

How currency exchange affects international travel

When traveling internationally—whether for business or leisure—understanding the ins and outs of currency exchange can make a big difference in your travel budget and convenience. Exchanging your home currency into the local currency is essential because it allows you to pay for essentials like hotels, transportation, meals, and shopping without hassles or surprises.

Exchanging currency at airports vs. local exchange services

Airport currency exchange kiosks are convenient for last-minute needs, but they usually come with high fees and less favorable rates. Local exchange services, whether in the city or online, often offer better value but may require more time and planning.

Here’s how the two options compare:

Airport exchange services

Pros

- Ultra-convenient: Perfect for last-minute swaps when you’ve got seconds, not hours.

- Always on: Most major airports run 24/7—no worrying about opening hours when you land at midnight.

Cons

- Brutal rates: Often, the worst exchange rates in town—convenience comes at a cost.

- Sneaky fees: Hidden margins and transaction charges quietly eat into your cash.

- Slim pickings: Limited selection of currencies, especially if you’re not trading USD, EUR, or GBP.

Local exchange services

Pros

- Better bang for your buck: Usually offer stronger, more competitive exchange rates.

- Transparent pricing: Lower fees and fewer hidden surprises—what you see is (usually) what you get.

- Room to shop: Multiple providers means you can compare and choose the best deal.

Cons

- Less walk-up friendly: Requires effort—finding, comparing, and getting there takes time.

- Time-sensitive: Limited hours, and forget late nights or holiday weekends.

- Trust factor: Need to vet providers to avoid scams or shady operations.

Managing exchange rates and avoiding excessive fees

Currency exchange rates fluctuate constantly based on economic factors, political events, and market demand. Using online currency converters and financial apps before and during your trip allows you to track current exchange rates, helping you decide the best time to exchange money.

Another smart strategy is to exchange some currency before your trip to cover immediate expenses upon arrival, avoiding the rush to use airport services. Additionally, consider using credit or debit cards that waive foreign transaction fees. These cards often provide exchange rates closer to the market rate, meaning better value than cash exchanges.

Be cautious of hidden charges such as transaction fees, poor exchange margins, or ATM withdrawal fees, which can erode your budget. Always read the fine print or ask your provider for a full breakdown of costs. Planning your currency needs and using a combination of cash and cards can help you avoid surprises and keep more money in your pocket.

Carrying some cash is necessary, especially for small vendors, taxis, or rural areas where card payments aren’t accepted. However, relying solely on cash isn’t always safe or convenient. Using credit and debit cards abroad offers many advantages:

- Cards usually offer better exchange rates than cash exchanges.

- Many travel cards waive foreign transaction fees, reducing costs.

- Electronic payments provide added security and the ability to track spending.

- Alerts from your bank can help prevent fraud.

Before traveling, inform your bank or card issuer about your plans to avoid fraud alerts that may freeze your card. Also, check for any ATM withdrawal fees at your destination to avoid unexpected costs. Having multiple payment options ensures you’re prepared for various situations and helps you manage your money more efficiently.

BiyaPay: A convenient platform for online currency exchange

In today’s fast-paced, global economy, finding a reliable and efficient way to exchange money online is more important than ever. BiyaPay has emerged as a leading platform for online currency exchange services, offering individuals and businesses a secure, user-friendly, and cost-effective solution for managing cross-border transactions.

BiyaPay offers a fast, secure, and user-friendly platform for exchanging currency online. Just follow these four easy steps to get started.

4 Easy steps to using BiyaPay for online currency exchange:

Step 1: Download and install the BiyaPay app Go to the App Store or Google Play Store, search for “BiyaPay,” and install the app on your device.

Step 2: Sign up and complete KYC verification Create your BiyaPay account and complete the simple KYC process to activate currency exchange features.

Step 3: Choose currency & enter amount Select the currency pair (e.g., USD to INR) and type in the amount you wish to exchange.

Step 4: Confirm exchange & receive funds Review the live exchange rate, choose your payment method, and confirm the transaction. The converted funds will be credited to your account securely and instantly.

Discover BiyaPay’s powerful features:

- Real-time exchange rates & seamless currency conversion: One of BiyaPay’s standout features is its ability to provide real-time currency exchange rate tracking, giving users the most accurate and up-to-date information available. This helps you make smarter financial decisions—whether you’re sending money overseas, paying an international invoice, or simply converting funds for personal use. BiyaPay ensures smooth and fast conversions between multiple currencies, making the process seamless from start to finish.

- Low fees & multi-currency support: Unlike many traditional banks and exchange bureaus that often charge steep service fees or use poor exchange rates, BiyaPay keeps its costs transparent and competitive. With low transaction fees and better rates than many offline options, users can exchange money without losing value. It also supports a wide range of global currencies, allowing both individuals and businesses to manage international payments in the currencies they need.

- Ideal for both businesses and individuals: Whether you’re a freelancer working with international clients, a digital nomad traveling across countries, or a company paying overseas suppliers, BiyaPay offers the tools you need. With instant conversions, real-time notifications, and multi-currency digital wallets, it’s designed to keep your finances organized and globally connected. Businesses benefit from faster settlements and cost savings, while individual users enjoy flexibility and peace of mind.

- Secure and efficient cross-border transactions: Security is a top priority with BiyaPay. The platform uses bank-level encryption and regulatory compliance to protect users’ data and funds. Whether you’re transferring money for a purchase or managing recurring payments, BiyaPay ensures each transaction is completed safely, quickly, and reliably, giving users the confidence to handle international currency exchange without hassle.

Why currency exchange services are important for global business

In an increasingly interconnected world, businesses of all sizes are operating across borders—and that means dealing with different currencies. Currency exchange services play a vital role in facilitating international trade and payments, making it easier for companies to expand into new markets and manage global operations smoothly.

For businesses operating globally, currency exchange is more than a financial formality—it’s a critical part of daily operations. From making international payments to managing multi-currency cash flows and protecting against rate volatility, here’s how currency exchange powers global business success:

- Enabling international trade and payments: When a business buys raw materials from another country, pays overseas employees, or sells products internationally, currency exchange becomes a daily necessity. Without a reliable way to convert money, even simple transactions can become complicated. Currency exchange services make these cross-border payments seamless, ensuring funds arrive on time and in the correct currency.

- Whether it’s settling an invoice in euros or receiving payment in yen, having access to a trusted currency exchange provider ensures smooth transactions with global partners, suppliers, and customers.

- Managing foreign expenses and sales: Global businesses face the challenge of juggling income and expenses in multiple currencies. This includes paying international vendors, handling employee salaries abroad, and receiving revenue from different markets. Effective currency exchange tools help businesses convert currencies at the best possible rates, often reducing costs in the process.

- Some platforms even offer multi-currency wallets, allowing companies to hold and manage different currencies without immediate conversion, which gives them flexibility and more control over when and how they exchange funds.

- Mitigating risks from exchange rate fluctuations: Exchange rates can shift daily—or even hourly—based on economic data, interest rate changes, and geopolitical events. These fluctuations can have a direct impact on a company’s profit margins and overall cost structure. For example, a sudden drop in a currency’s value might increase the cost of imports, while a stronger domestic currency could make exports less competitive.

- To manage these risks, businesses often use strategies like hedging or rely on real-time exchange tracking offered by professional currency exchange services. This helps them avoid surprises and make more accurate financial forecasts.

Currency exchange services aren’t just about swapping one currency for another—they’re a key part of running a successful global business. With the right tools and strategies, companies can save money, reduce risk, and stay competitive in international markets.

Conclusion

In conclusion, understanding the fundamentals of stock investment is crucial for making informed financial decisions that can help grow your wealth over time. Whether you’re an individual investor or a business navigating the stock market, having a solid strategy and staying updated with market trends are key to success. Leveraging the right tools—such as stock investment calculators, AI-powered platforms, and trusted investing apps—can enhance your decision-making and portfolio management.

To simplify your investment-related transactions, BiyaPay offers competitive rates, secure payments, and multi-currency support, making it easier to manage international stock investments. With BiyaPay, you can enjoy fast, cost-effective, and reliable currency conversions and global payments, giving you greater control and peace of mind. Explore BiyaPay today and take the next step toward seamless, efficient stock investing in today’s global market.

FAQs:

- How do currency exchange rates change? Exchange rates move based on supply and demand, influenced by interest rates, inflation, economic news, and global events. BiyaPay helps you stay ahead with real-time rate tracking and instant conversion options.

- What’s the best time to exchange currency? Midweek (Tuesday–Thursday) often offers better rates than weekends. Avoid market uncertainty. BiyaPay’s rate alerts notify you when it’s the right time to exchange.

- Can I exchange currency online? Absolutely. Online exchange is faster and usually cheaper. BiyaPay lets you convert funds instantly, securely, and with better rates than banks or airport kiosks.

- How do I avoid high currency exchange fees? Compare platforms, avoid airport kiosks, and check for hidden fees. BiyaPay offers low-cost, transparent currency conversion with no surprise charges.

- How does BiyaPay simplify international currency conversion? BiyaPay makes global transactions easy with live rates, multi-currency wallets, and secure, fast conversions—perfect for freelancers, travelers, and businesses managing money across borders.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.