- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Understanding Global Remittance: Mobile Transfers, Cash Pickup & More

What is global remittance?

Global remittance meaning is defined by the cross-border transfer of funds by individuals, plays a vital role in the global economy, providing crucial financial support to families and communities worldwide. In 2023, global remittances were estimated to be $857 billion, a 1.6% increase from the previous year (Migration Data Portal, 2023). Of this, an estimated $656 billion flowed to low- and middle-income countries, surpassing both Foreign Direct Investment (FDI) and Official Development Assistance in many of these nations.

This essential system enables individuals working or living abroad to send money back home, fostering economic growth and improving livelihoods. For many developing countries, remittances represent a significant portion of their Gross Domestic Product (GDP); in 2023, remittances accounted for over 20% of GDP in countries like Tonga, Tajikistan, Lebanon, Samoa, and Nicaragua. In fact, for low-income countries, remittance flows can represent nearly 6% of their GDP, compared to about 2% for middle-income countries (World Bank, 2023).

Increasingly, mobile money transfers and convenient cash pickup services have become indispensable tools within this landscape, offering accessible and efficient ways to send and receive funds across geographical boundaries. The amount of money sent via mobile transfer increased by 65% in 2020, reaching $12.7 billion, and further grew to $16 billion in 2021 (GSMA, 2021), highlighting the growing adoption of digital channels.

How do mobile money transfers work in global remittance?

Mobile money transfers have revolutionized global remittance by enabling individuals to send and receive funds internationally directly through their mobile phones. This process typically involves the following steps:

- Account registration: Users in both the sending and receiving countries need to register for a mobile money service with a provider. This often involves providing identification and linking their mobile phone number to a digital wallet.

- Funding the account: The sender needs to load funds into their mobile money account. This can be done through various methods such as bank transfers, debit/credit card payments, or cash deposits at authorized agents.

- Initiating the transfer: Using the mobile money platform’s app or USSD (Unstructured Supplementary Service Data) codes, the sender initiates the international transfer. They will need to provide the recipient’s mobile phone number (linked to their mobile money account) and the amount they wish to send.

- Authorization and processing: For security, the sender usually needs to authorize the transaction using a PIN or other authentication methods. The mobile money service provider then processes the transfer, often coordinating with partner mobile money operators or financial institutions in the receiving country. Currency conversion, if necessary, is typically handled at this stage, with the exchange rate and any fees clearly displayed to the sender before confirmation.

- Recipient notification and access: Once the transfer is complete, both the sender and the recipient usually receive SMS or in-app notifications confirming the transaction. The recipient can then access the funds in their mobile money wallet.

There are several mobile money platforms that facilitate global remittances, including:

- BiyaPay: A platform specifically designed for cross-border mobile money transfers, focusing on certain corridors.

- M-Pesa: Popular in East Africa, it allows users to send, receive, and store money on their mobile phones.

- WorldRemit: An online service that partners with various mobile money operators globally, enabling transfers to mobile wallets.

- Remitly: Focuses on international money transfers, often with mobile money as a payout option in many countries.

- Wise (formerly TransferWise): Offers transparent international transfers with options to send directly to mobile money accounts in some regions.

- Xoom (a PayPal service): Integrates with PayPal accounts and allows sending money to mobile wallets in select countries.

In addition to that, the benefits of using mobile money transfers for global remittances are numerous, such as:

- Ease of use: Sending money can be done conveniently from anywhere with a mobile phone, eliminating the need to visit physical money transfer locations or banks.

- Accessibility: Mobile money reaches individuals who may not have access to traditional banking services, particularly in remote or underserved areas.

- Speed: Transfers are often processed quickly, with recipients receiving funds within minutes in many cases.

- Lower costs: Mobile money transfers can often have lower fees and more competitive exchange rates compared to traditional methods like banks or some money transfer operators. It is estimated that using mobile money for international remittances can be significantly cheaper than the global average cost (GSMA, 2023).

- Security: Mobile money platforms employ various security measures, including PINs, encryption, and transaction monitoring, to protect users’ funds and personal information.

- Transparency: Fees and exchange rates are usually displayed upfront before the transaction is completed, providing clarity to the sender.

- Convenient receiving options: Recipients can receive money directly on their phones and use it without needing to travel long distances to pick up cash.

What is cash pickup in global remittance?

Cash pickup in global remittance is a method that allows recipients to collect the money sent to them in physical cash from designated local agents or partner bank branches in their country. Instead of the funds being deposited into a bank account or mobile wallet, the recipient visits a physical location with proper identification to receive the transferred amount.

This service plays a crucial role, particularly in countries where banking infrastructure is limited, or where a significant portion of the population remains unbanked. For individuals without bank accounts or reliable access to digital financial services, cash pickup provides a tangible and immediate way to access the remittances sent by their loved ones abroad (Now Money, 2024). It bridges the gap in financial inclusion, ensuring that even those in remote areas or with limited technological access can benefit from international financial support.

Several companies facilitate global remittances through cash pickup services. Some prominent examples include:

- Western Union: A long-established global leader in money transfer services, Western Union has a vast network of agent locations worldwide, enabling senders to send money online or in person for recipients to pick up in cash at a nearby agent location.

- MoneyGram: Similar to Western Union, MoneyGram offers a wide network of agents globally, allowing for convenient cash pickup of international remittances.

- RIA Money Transfer: RIA provides international money transfer services with a strong focus on cash pickup options through its extensive network of agents and partners.

- Local banks and post offices: In many countries, local banks and postal services also partner with international money transfer companies to act as cash pickup locations, leveraging their existing branch networks.

Examples of global remittances

To help you understand better, we have listed some important remittances examples and case studies that you can go through.

Examples:

- Let’s say, if I’m sending10,000 Hong Kong Dollarsto someone in the United States, how much will the other party receive?

Answer: As of 28th May 2025, if we follow the exchange rate of 0.1276 per 1 Hong Kong Dollar (HKD), then it comes to 1276 US Dollars (USD). Additionally, a transfer fee (related to the remittance amount) of 6.38 US Dollars will be deducted from the amount, which means the recipient will get 1269.62 US Dollars.

- Again, if I send someone in Japan an amount of10,000 US Dollars, how much will he or she receive?

Answer: As of 28th May 2025, if we follow the exchange rate of 144.3535 per 1 US Dollar (USD), then it comes to 1443535 Japanese Yen (JPY). Additionally, a transfer fee (related to the remittance amount) of 7217.68 JPY will be charged from the amount, bringing the final amount to 1436317.32 Japanese Yen.

Case Studies:

United States to Mexico: When talking about remittances by country, the US is a major source of remittances to Mexico. In 2024, Mexico received a record $64.7 billion in remittances, with the vast majority (around 96.6%) originating from the United States (BBVA Research, 2024). These funds constitute a significant portion of Mexico’s GDP (around 4.5%) and are crucial for supporting families, especially in states like Michoacán, Guerrero, and Jalisco (Dallas Fed, 2023). The strong labor market for Mexican migrants in the US, particularly in sectors like food and beverage services, healthcare, and construction, contributes significantly to these flows.

United Kingdom to India: While the flow from the US to India is larger overall, the UK is also a significant source of remittances to India. In 2023-24, the share of remittances to India from the UK increased to 10.8%, up from 6.8% in 2020-21 (Economic Times, 2024). This reflects a growing skilled Indian diaspora in the UK working in various sectors. Overall, India is one of the top recipients of global remittances, reaching $118.7 billion in 2023-24 (Business Standard, 2025). The UK’s contribution, while smaller than that of the US or UAE, is still substantial and important for many families in India. Maharashtra, Kerala, and Tamil Nadu are key recipient states in India.

Additionally, remittances are utilized in the following ways:

- Supporting families: The majority of remittances are used for basic household needs, including food, clothing, and shelter, directly alleviating poverty and improving living standards.

- Funding education: Remittances enable families to afford school fees, uniforms, and educational materials, investing in the human capital of the next generation.

- Healthcare: Remitted funds often cover medical expenses, access to healthcare services, and medication, improving the health and well-being of recipients.

- Housing: Families may use remittances to build, repair, or improve their homes, providing more stable and secure living environments.

- Investment and entrepreneurship: In some cases, remittances can provide capital for small businesses and entrepreneurial activities, fostering local economic development and job creation.

- Debt repayment: Families might use remittances to pay off existing debts, reducing financial burdens.

The benefits and challenges of global remittance

Global remittances offer a multitude of significant benefits, yet they also come with their own set of challenges.

Benefits of global remittance

- Financial support for families: The most direct benefit is the financial lifeline remittances provide to families in recipient countries. These funds often cover essential needs like food, shelter, clothing, education, and healthcare, directly improving living standards and overall well-being. As we discussed earlier, in many low- and middle-income countries, these funds are a crucial source of income.

- Poverty alleviation: By supplementing household incomes, remittances play a significant role in reducing poverty levels in receiving countries. The consistent inflow of funds can lift families above the poverty line and provide opportunities for economic advancement.

- Contribution to GDP: For many developing nations, remittances represent a substantial portion of their Gross Domestic Product (GDP), as highlighted by the examples of Tonga, Tajikistan, and Nepal. This inflow of foreign currency can boost a country’s economy, support its balance of payments, and contribute to overall economic stability.

- Investment in human capital: Remittances often fund investments in education and healthcare, leading to a more skilled and healthier population in the long run. This can have positive ripple effects on a country’s future development.

- Economic multiplier effects: The money received through remittances circulates within the local economy as families spend it on goods and services, creating demand and supporting local businesses.

- Resilience to economic shocks: Remittance flows can act as a buffer during economic downturns or crises in the recipient country, providing a stable source of income when other sources may be affected.

Challenges associated with remittances

- High transaction fees: One of the most significant challenges is the high cost associated with sending money internationally. Traditional channels like banks and some money transfer operators can charge substantial fees and offer unfavorable exchange rates, reducing the amount of money that ultimately reaches the recipient.

- Slow processing times: Traditional methods can sometimes involve lengthy processing times, delaying the arrival of much-needed funds. This can be particularly problematic in emergency situations.

- Limited accessibility: In some remote or underserved areas, access to formal remittance channels like banks or money transfer agent locations can be limited, forcing people to rely on informal and potentially riskier methods.

- Lack of transparency: Sometimes, the fees and exchange rates involved in the transfer process are not fully transparent, making it difficult for senders to understand the true cost.

- Potential fraud risks: Both senders and recipients can be vulnerable to fraud and scams in the remittance process, leading to financial losses. This can include unauthorized transactions or deceptive practices by illegitimate operators.

- Regulatory hurdles: Varying regulations across different countries can sometimes complicate the remittance process, leading to delays or increased costs.

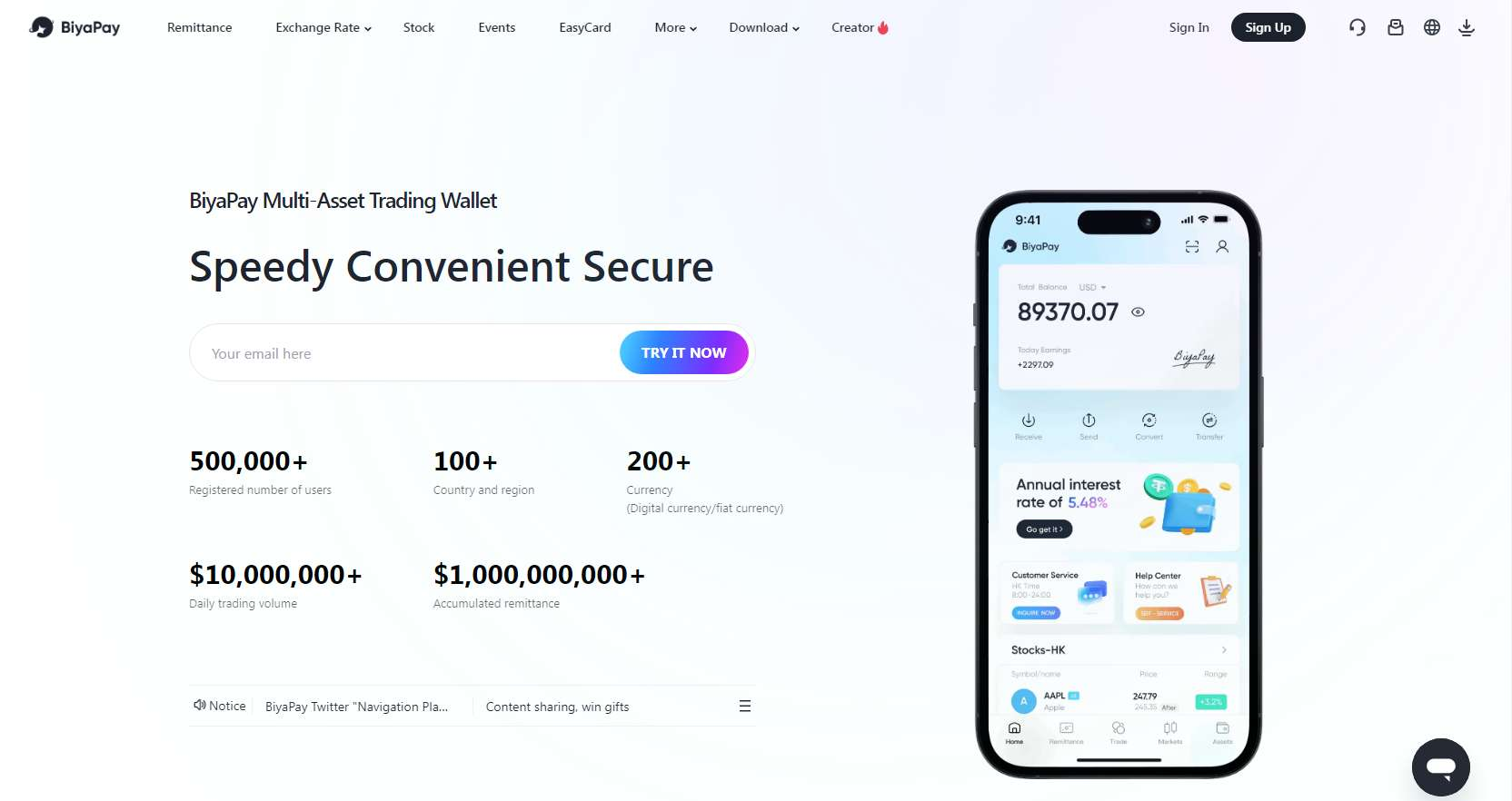

BiyaPay: a convenient solution for global remittance

BiyaPay offers a convenient and trusted solution for global remittance, ensuring secure and fast international money transfers. The platform leverages innovative blockchain technology to provide secure and transparent transactions, often boasting real-time or same-day remittance with significantly reduced fees compared to traditional methods. BiyaPay supports the exchange of numerous fiat and cryptocurrencies, facilitating localized transfers across over 50 countries. Security is a paramount concern, with the platform employing measures such as bank-level encryption, biometric verification, and smart contracts to safeguard user funds.

Leveraging mobile technology, BiyaPay provides seamless money transfer capabilities, allowing users to send funds directly to bank accounts or for cash pickup at partner locations. The platform integrates various technologies to enhance user experience, including real-time market analysis and intelligent monitoring systems. BiyaPay also supports direct withdrawals of stablecoins to fiat currencies, aiming to minimize the risk of fund freezes. Overall, BiyaPay combines blockchain, mobile accessibility, and robust security features to offer a modern and efficient global remittance solution.

Key Features

- Low fees and competitive exchange rates: BiyaPay aims to minimize transaction costs, ensuring more of the sender’s money reaches the recipient by offering competitive exchange rates compared to traditional remittance services.

- Fast and secure transfers: Utilizing blockchain technology, BiyaPay facilitates rapid and secure international money transfers, often with real-time or same-day processing, while employing robust security measures like encryption and biometric verification.

- Mobile money transfer capabilities: Users can conveniently send money directly from their smartphones to overseas bank accounts or for cash pickup at BiyaPay’s partner locations, offering flexibility and accessibility for recipients.

- Real-time transfer tracking: BiyaPay provides users with the ability to track their transfers in real-time, offering transparency and peace of mind throughout the remittance process.

- Support for multiple currencies (fiat and crypto): The platform supports a wide range of fiat currencies and cryptocurrencies, enabling users to send and receive money across over 50 countries with the option of stablecoin withdrawals to fiat, mitigating potential fund freeze risks.

Steps to follow when using BiyaPay for global remittance

Step 1: Download the BiyaPay app Before you can start sending money, you need to first download the BiyaPay app on your smartphone. It’s currently available for both Android and iOS devices.

Step 2: Register and verify your identity After installing, launch the app and then sign up using your email address. Once done, you need to complete the identity verification process. Additionally, don’t forget to fill out your profile details.

Step 3: Select the send or transfer option

In the next step, select the “Send” or “Transfer” option from the homescreen and then proceed to fill out the details of the recipient, such as the name, bank account, bank branch ID, SWIFT/BIC codes, etc.

Step 4: Enter the requisite amount

Once done, you will need to enter the respective amount that you are planning to send and the currency in which you will be sending it. Additionally, you will need to add your bank account or bank card (debit or credit card), which will act as the main source of funds. Alternatively, if you have sufficient funds in your BiyaPay Wallet, you can use that as well.

Step 5: Confirm, verify, and complete the payment

Finally, confirm your transaction and then verify the same with the respective authorization process. Once done, your funds will be transferred to the recipient’s account safely.

User Reviews

“This deposit and withdrawal tool is a total game-changer, super convenient! The interface is super clear and user-friendly; there’s always a bunch of cool perks and events. You can handle US stocks, HK stocks, and crypto all in one go. Plus, depositing and withdrawing cash is a breeze.”

“The exchange rate is clear at a glance, and you can grasp the market in real time.”

“I’ve been using BiyaPay since the moment it went online, and the experience has nothing sort of amazing. The app user-interface is spot-on and the overall process you need to follow for sending/receiving payments is pretty seamless and straightforward. Also, the conversion charges and transactions fees are industry leading, to say the least”

The future of global remittance: trends and innovations

The future of global remittance is poised for significant transformation, driven by emerging trends and technological innovations that aim to make the process faster, cheaper, more transparent, and accessible to a wider population.

Emerging trends

- Blockchain technology and cryptocurrencies: Blockchain, the underlying technology of cryptocurrencies, offers the potential to revolutionize cross-border payments by eliminating intermediaries, reducing transaction costs, and increasing speed and security (Global Payments). Cryptocurrencies can facilitate near-instant transfers across borders, potentially bypassing traditional banking systems.

- Rise of digital wallets: Digital wallets are becoming increasingly popular for both domestic and international money transfers. They offer convenience, speed, and security, allowing users to send and receive funds directly from their mobile devices. The interoperability of digital wallets across different platforms and countries is a key area of development that promises to streamline international transfers. Studies indicate a growing preference for digital wallets for cross-border payments, especially for peer-to-peer remittances.

- Peer-to-Peer (P2P) payment systems: P2P payment platforms are also playing a growing role in facilitating international transfers, offering user-friendly interfaces and often lower fees compared to traditional methods (SDK Finance). Services like PayPal, Wise, and others are expanding their international reach and capabilities, making it easier for individuals to send money directly to each other across borders.

- Mobile money dominance: The trend of mobile money as a key enabler of remittances, particularly to and within developing countries, is expected to continue. The high mobile phone penetration rates in many regions make mobile money a highly accessible and convenient option for receiving funds, especially for the unbanked population.

How companies like BiyaPay are integrating cutting-edge technology

Companies like BiyaPay are at the forefront of integrating these technological advancements to improve the remittance process.

- Blockchain and cryptocurrency integration: BiyaPay leverages blockchain technology and the use of stablecoins like USDT to facilitate instant and low-cost cross-border remittances. This approach aims to bypass traditional banking delays and high fees.

- Multi-asset digital wallet: BiyaPay operates as a multi-asset trading wallet, supporting not only fiat currencies but also a wide range of cryptocurrencies. This allows users to seamlessly convert between different asset types for remittances and other financial activities.

- Real-time exchange and low fees: The platform supports real-time exchange of numerous fiat and cryptocurrencies with transparent fees, often significantly lower than traditional remittance services. This increases the amount of money that reaches the recipient.

- Global reach and accessibility: BiyaPay facilitates localized transfers in over 50 countries, aiming for same-day remittance and receipt. This broadens accessibility and speeds up the transfer process.

- Focus on compliance and security: BiyaPay emphasizes regulatory compliance by holding licenses in various jurisdictions, including the US and Canada, and employs security measures like encryption and multi-layered identity verification to build user trust.

- Unified platform: By integrating remittance services with other financial tools like cryptocurrency trading and investment in international stocks, BiyaPay aims to provide a comprehensive and convenient platform for users involved in global finance.

Conclusion

With that being said, global remittance stands as a vital artery in the global economy, channeling crucial financial support to millions of families and significantly contributing to the economic well-being of numerous nations worldwide. These cross-border transfers empower individuals, fund essential needs, and fuel development in recipient countries.

As technology continues to evolve, the landscape of global remittance is being reshaped for the better. For your next international money transfer, consider BiyaPay, a platform designed to offer a secure, fast, and affordable solution for sending funds across borders, connecting you with your loved ones and supporting communities globally with ease and efficiency!

FAQs:

- What is the difference between mobile money transfers and traditional bank remittances?

Mobile money transfers use mobile phone networks and digital wallets, offering greater accessibility for the unbanked with potentially lower fees and faster processing compared to traditional bank remittances. Choose BiyaPay for instant, low-cost global transfers leveraging blockchain and stablecoins.

- How can I track my global remittance transfer?

You can typically track your global remittance transfer using a unique transaction ID or reference number provided by the service provider on their website or mobile app. With BiyaPay, enjoy transparent tracking and real-time updates on your international transfers.

- What are the fees associated with sending money internationally?

Fees for international money transfers vary widely depending on the provider, sending/receiving countries, transfer amount, and chosen method; it’s crucial to compare fees and exchange rates before sending. BiyaPay offers real-time exchange with transparent and often significantly lower fees for global remittances.

- Can I use BiyaPay for both sending and receiving remittances?

Yes, BiyaPay is designed for both sending and receiving remittances, offering a multi-asset digital wallet for managing funds internationally. Use BiyaPay’s unified platform to seamlessly send, receive, and manage your global finances across fiat and crypto.

- How fast are remittances sent through mobile money services like BiyaPay?

Remittances sent through mobile money services like BiyaPay are often very fast, with many transfers being completed within minutes or hours, aiming for same-day receipts in many corridors. Experience the speed of BiyaPay with its aim for same-day remittance and receipt in over 50 countries.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.